British Land Company Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

British Land Company Bundle

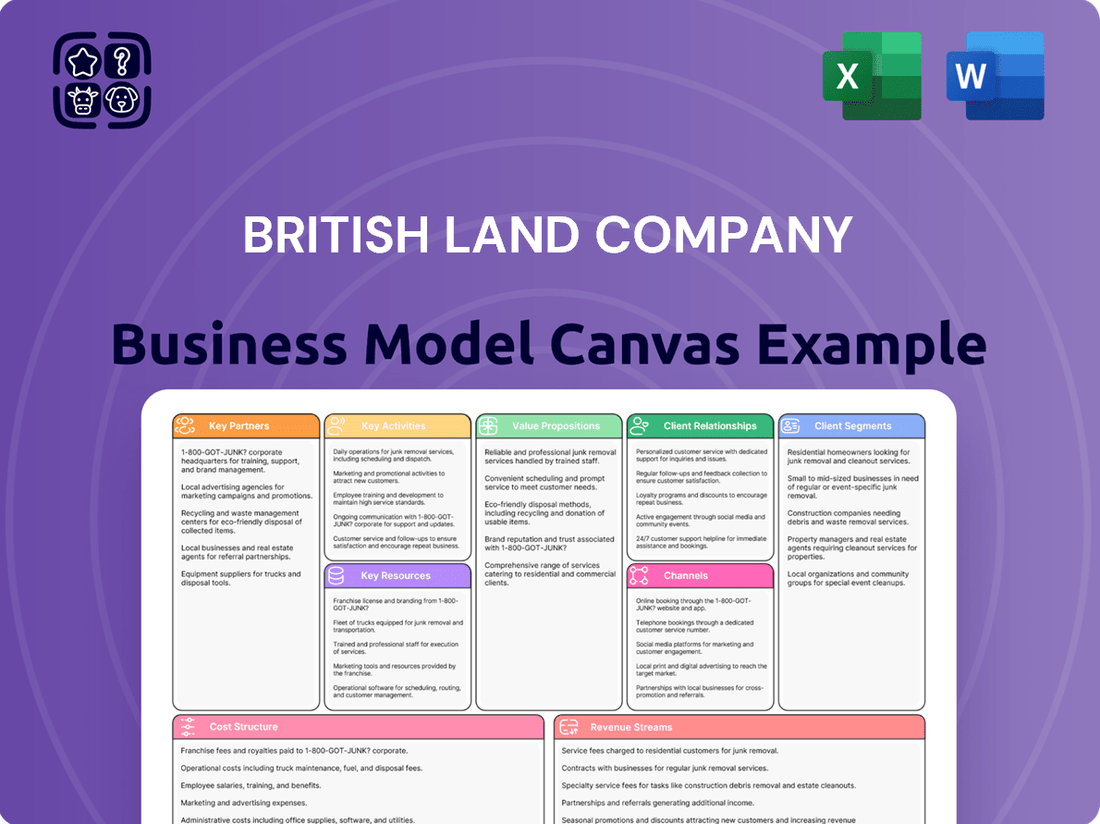

Discover the intricate workings of British Land Company's business model. This comprehensive canvas outlines their customer segments, value propositions, and key resources, offering a strategic roadmap to their success in the competitive real estate market.

Want to fully grasp how British Land Company creates and captures value? The complete Business Model Canvas dives deep into their revenue streams, cost structure, and customer relationships, providing actionable insights for your own strategic planning.

Unlock the strategic blueprint behind British Land Company's operations with our detailed Business Model Canvas. This resource reveals their core activities, partnerships, and channels, offering invaluable lessons for aspiring real estate professionals and investors.

Partnerships

British Land's financial stability hinges on robust connections with financial institutions and investors. These partnerships are crucial for securing the necessary debt facilities to fund its extensive acquisition and development pipeline, as well as for general operational needs.

The company actively engages with equity investors through capital raises, such as share placings, to bolster its financial position. For instance, in the fiscal year ending March 2024, British Land successfully raised capital to support its strategic objectives, demonstrating ongoing investor confidence.

Furthermore, British Land leverages joint ventures with entities like sovereign wealth funds and pension funds. These collaborations allow for co-investment in significant projects, sharing risk and capital requirements, and providing access to substantial, long-term funding sources.

Retailers and commercial tenants are the bedrock of British Land's business model. These entities occupy the company's diverse property portfolio, directly fueling its rental income streams. British Land actively cultivates relationships with these key partners.

The company prioritizes attracting and retaining high-caliber, omnichannel retailers for its retail parks. Simultaneously, for its prominent London campuses, British Land targets blue-chip companies, including those in technology, professional services, and financial sectors, ensuring a stable and valuable tenant base.

British Land Company heavily relies on its development and construction partners to bring its ambitious projects to life. These collaborations are essential for both new builds and the revitalization of existing properties, including significant urban regeneration efforts like the Canada Water development.

Working closely with contractors, architects, and urban planners ensures that British Land delivers not just buildings, but high-quality, sustainable spaces that meet modern demands. For instance, in 2024, the company continued to advance its major projects, underscoring the critical role these partnerships play in project execution and value creation.

Local Authorities and Government Bodies

British Land actively collaborates with local authorities and government bodies to navigate the complexities of urban development. This engagement is crucial for obtaining necessary planning permissions and ensuring all projects align with current regulations and broader urban planning strategies. For instance, in 2024, the company continued its work on significant urban regeneration projects, which inherently require close consultation with local councils to meet sustainability targets and community needs.

These partnerships are vital for integrating development plans with wider public infrastructure improvements and environmental objectives. By working hand-in-hand with government entities, British Land can effectively contribute to the creation of sustainable urban environments and logistics hubs, such as those being developed in key growth areas. Their commitment to these relationships helps foster confidence and support for large-scale campus and logistics ventures.

- Planning Permission: Securing approvals for new developments, like the ongoing work at the Canada Water regeneration scheme, relies heavily on positive relationships with Southwark Council.

- Regulatory Compliance: Ensuring adherence to building codes, environmental standards, and local planning policies is managed through ongoing dialogue with relevant government agencies.

- Urban Planning Alignment: Integrating British Land's projects with local authority visions for transport, housing, and green spaces is a key aspect of these partnerships.

- Sustainability Goals: Collaborating on initiatives that support net-zero targets and biodiversity net gain, as mandated by government policy, is integral to their development approach.

Service Providers and Property Management Firms

British Land relies on a network of key partners, including facilities management, security, and cleaning service providers, to ensure the smooth operation and upkeep of its vast property holdings. These collaborations are crucial for maintaining high standards and tenant satisfaction across its diverse portfolio.

Digital infrastructure providers are also essential partners, enabling the integration of smart building technologies and enhancing the overall tenant experience. In 2024, British Land continued to invest in upgrading its digital capabilities, aiming to create more connected and efficient spaces.

- Facilities Management: Partners ensure the operational efficiency and maintenance of buildings.

- Security Services: Essential for maintaining a safe environment for tenants and visitors.

- Cleaning and Maintenance: Crucial for presenting high-quality, well-maintained properties.

- Digital Infrastructure Providers: Enable smart building technologies and connectivity.

British Land's success is intrinsically linked to its strategic alliances with financial institutions and a broad base of investors, including equity and debt providers. These relationships are fundamental for capital acquisition, enabling the company to fund its development pipeline and maintain operational fluidity. For instance, in the fiscal year ending March 2024, British Land actively managed its capital structure through various means to support its strategic growth initiatives.

The company also forms crucial joint ventures, often with substantial entities like sovereign wealth funds and pension funds. These collaborations are instrumental in co-investing in large-scale projects, thereby sharing capital burdens and associated risks. Such partnerships provide access to significant, long-term capital, which is vital for the extensive nature of British Land's development portfolio.

Furthermore, British Land relies heavily on its development and construction partners, including architects and urban planners, to realize its ambitious projects. These collaborations are essential for both new constructions and the regeneration of existing properties, such as the ongoing Canada Water development. In 2024, the company continued to advance these major schemes, highlighting the critical role of these partners in project execution and value creation.

The company also collaborates closely with local authorities and government bodies to navigate the complexities of urban development and secure necessary planning permissions. These engagements ensure projects align with regulations and broader urban planning strategies, as seen in 2024 with continued work on urban regeneration projects requiring close consultation with local councils to meet sustainability targets and community needs.

| Partnership Type | Key Role | Examples/Impact |

|---|---|---|

| Financial Institutions & Investors | Capital acquisition, debt facilities, equity raises | Secured funding for development pipeline; supported operational needs. Fiscal year ending March 2024 saw active capital management. |

| Joint Venture Partners (e.g., Pension Funds, Sovereign Wealth Funds) | Co-investment, risk sharing, long-term funding | Enabled significant project funding and risk mitigation. |

| Development & Construction Partners (Architects, Contractors) | Project execution, new builds, property regeneration | Crucial for delivering high-quality, sustainable spaces; advanced major projects in 2024. |

| Local Authorities & Government Bodies | Planning permissions, regulatory compliance, urban planning alignment | Facilitated urban regeneration like Canada Water; ensured alignment with sustainability goals and community needs in 2024. |

What is included in the product

A detailed breakdown of British Land's strategy, outlining its focus on key customer segments like office occupiers and retail shoppers, its diverse property portfolio as a core asset, and its revenue streams derived from rent and asset management.

British Land's Business Model Canvas acts as a pain point reliever by offering a clear, visual map of their operations, enabling swift identification of inefficiencies and strategic alignment.

It simplifies complex property development and management, providing a structured framework to address challenges in asset utilization and tenant relationships.

Activities

British Land's core activity involves strategically acquiring prime real estate. Their current focus areas are retail parks, urban logistics in London, and top-tier campuses.

This proactive acquisition strategy is crucial for their growth. For instance, they invested £711 million in retail parks between April 2024 and the end of the reporting period, highlighting their commitment to this sector.

British Land Company's key activity of property development and redevelopment involves the strategic planning, design, and construction of new buildings or the revitalization of existing ones. This process aims to increase property value and align offerings with current market needs.

In 2024, the company is actively engaged in significant development projects, with a particular focus on its London campuses and urban logistics portfolio. This includes ongoing work at sites like Mandela Way and Verney Road, demonstrating a commitment to expanding and enhancing its real estate assets.

British Land actively manages its assets to maximize returns. This involves strategic leasing, ensuring properties are occupied and generating income. For instance, in the year ending March 2024, they reported a 97% occupancy rate across their office portfolio, demonstrating successful tenant acquisition and retention.

The company also focuses on rent reviews and property enhancements to boost performance. These activities are crucial for increasing the value of their existing holdings. Their commitment to proactive management is evident in their ongoing development projects and refurbishment programs aimed at attracting and retaining high-quality tenants.

Portfolio Curation and Capital Recycling

British Land actively manages its property portfolio by selling off assets that have reached maturity or no longer align with its core strategy. This process, known as capital recycling, allows the company to free up capital. This capital is then strategically redeployed into new investments expected to generate stronger returns, particularly within its focus sectors.

In the fiscal year 2025, British Land demonstrated this strategy by disposing of £597 million worth of assets. A notable example was the sale of Meadowhall, a significant retail destination. The proceeds from these sales are earmarked for funding acquisitions in areas with higher growth potential, such as retail parks.

- Strategic Asset Disposal: British Land sells mature or non-core properties to optimize its portfolio.

- Capital Reinvestment: Funds generated from disposals are reinvested into higher-return opportunities.

- FY25 Disposals: £597 million in assets were sold in FY25, including Meadowhall.

- Focus on Growth Sectors: Reinvestment targets sectors like retail parks, as seen with the Meadowhall sale funding retail park acquisitions.

Sustainability and Community Engagement

British Land actively integrates sustainability into its operations, aiming to build thriving, environmentally responsible places. This commitment is evident in their focus on achieving high BREEAM ratings for new developments, with a significant portion of their portfolio already certified. For instance, in 2024, they continued to prioritize low-carbon construction methods and energy efficiency across their projects.

Community engagement is a cornerstone of their approach, ensuring their developments benefit local residents and businesses. British Land actively works with stakeholders to understand and address community needs. This includes investing in local initiatives and fostering positive relationships, contributing to the social fabric of the areas where they operate.

Key activities in this area include:

- Targeting BREEAM Excellent or Outstanding ratings for new developments.

- Implementing strategies to reduce carbon emissions and improve energy efficiency.

- Engaging with local communities through various programs and partnerships.

- Investing in social infrastructure and amenities within their developments.

British Land's key activities revolve around acquiring, developing, and managing diverse real estate assets. They strategically invest in retail parks and urban logistics, particularly in London, while also focusing on high-quality office campuses. This approach aims to create value and meet evolving market demands.

Their development pipeline is active, with significant projects underway in 2024, like the ongoing work at Mandela Way and Verney Road, reinforcing their commitment to expanding their portfolio.

Effective asset management is paramount, evidenced by a 97% office portfolio occupancy rate in the year ending March 2024. This includes proactive leasing, rent reviews, and property enhancements to maximize income and asset value.

Capital recycling, involving the sale of mature assets like Meadowhall in FY25 for £597 million, fuels reinvestment into growth sectors such as retail parks.

| Key Activity | Description | FY24/25 Data Point |

| Acquisition | Strategic purchase of prime real estate in focus sectors | £711 million invested in retail parks (Apr 2024 - end of reporting period) |

| Development | Planning, design, and construction of new or revitalized properties | Ongoing projects at Mandela Way and Verney Road |

| Asset Management | Maximizing returns through leasing, rent reviews, and enhancements | 97% occupancy in office portfolio (Year ending March 2024) |

| Capital Recycling | Disposal of mature assets to fund new investments | £597 million in asset disposals in FY25, including Meadowhall |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details British Land's strategic approach, including their key partners, activities, and value propositions. You'll gain full access to this professionally structured analysis, ready for immediate use.

Resources

British Land's most crucial asset is its extensive portfolio of prime real estate, strategically located across the United Kingdom. This collection is predominantly made up of modern campuses, essential retail parks, and vital urban logistics facilities, forming the backbone of its operations.

As of March 31, 2025, the company's impressive real estate holdings were valued at approximately £14.6 billion. This substantial valuation underscores the quality and strategic importance of these assets within the competitive UK property market.

British Land's access to substantial financial capital, encompassing equity, debt facilities, and cash reserves, is a cornerstone of its business model. This financial muscle enables strategic acquisitions, ambitious development projects, and ensures robust operational liquidity. As of early 2024, the company reported a strong balance sheet, bolstered by significant undrawn facilities, providing flexibility for future growth initiatives.

British Land Company leverages deep in-house expertise across property development, asset management, planning, and leasing. This integrated skill set is crucial for identifying prime development opportunities and navigating complex urban regeneration projects.

Their specialized knowledge enables them to effectively manage the entire property lifecycle, from initial concept to ongoing optimization. This hands-on approach ensures properties are developed and managed to maximize performance and tenant satisfaction.

In 2024, British Land continued to focus on its mixed-use portfolio, particularly in London, where demand for well-located and sustainable spaces remains strong. Their ability to execute large-scale developments, such as the Canada Water regeneration, underscores this expertise.

Strong Tenant and Customer Relationships

British Land's established relationships with a diverse array of blue-chip retailers and commercial tenants are a cornerstone of its business model. These strong connections ensure consistent occupancy rates and a reliable stream of rental income, providing a stable foundation for the company's operations.

The company actively cultivates these tenant relationships to foster satisfaction and drive incremental rental growth. This proactive approach allows British Land to adapt to market demands and maintain high occupancy across its portfolio.

- Tenant Diversification: British Land boasts a wide range of tenants, reducing reliance on any single entity.

- Long-Term Leases: Many of these relationships are underpinned by long-term lease agreements, offering predictable revenue.

- Tenant Engagement: The company focuses on understanding and meeting tenant needs, leading to higher retention rates.

- Strategic Partnerships: In 2024, British Land continued to strengthen ties with key occupiers through collaborative initiatives aimed at enhancing the retail and office environments.

Brand Reputation and Market Position

British Land's strong brand reputation as a premier UK property developer and investor is a cornerstone of its business model. This established trust and recognition attract high-quality tenants and strategic partners, solidifying its market-leading presence, particularly in sectors like retail parks.

This market leadership translates into tangible benefits. For instance, in 2024, British Land continued to demonstrate resilience in its retail portfolio, with occupancy rates remaining robust. Their ability to secure anchor tenants in key retail parks underscores the value placed on their brand and operational expertise by businesses seeking prominent locations.

- Brand Strength: British Land is recognized for its long-standing presence and reliability in the UK property market.

- Market Leadership: Dominance in specific segments, such as retail parks, offers a distinct competitive edge.

- Tenant Attraction: A strong reputation draws desirable tenants, enhancing portfolio value and stability.

- Partnership Appeal: The brand's credibility fosters attractive collaborations with joint venture partners and investors.

British Land's key resources include its substantial real estate portfolio, valued at approximately £14.6 billion as of March 31, 2025, and its robust financial capital, including significant undrawn facilities as of early 2024. Furthermore, the company leverages deep in-house expertise in property development and management, alongside strong, long-term relationships with blue-chip tenants and a formidable brand reputation in the UK property market.

| Key Resource | Description | 2024/2025 Data Point |

|---|---|---|

| Real Estate Portfolio | Prime UK properties including campuses, retail parks, and urban logistics. | Valued at approx. £14.6 billion (as of March 31, 2025). |

| Financial Capital | Equity, debt facilities, and cash reserves for acquisitions and development. | Strong balance sheet with significant undrawn facilities (early 2024). |

| In-house Expertise | Development, asset management, planning, and leasing capabilities. | Execution of large-scale projects like Canada Water regeneration. |

| Tenant Relationships | Partnerships with blue-chip retailers and commercial tenants. | High occupancy rates maintained in retail parks throughout 2024. |

| Brand Reputation | Established trust and recognition as a premier UK property developer. | Attracts quality tenants and partners, demonstrating market leadership. |

Value Propositions

British Land provides premium, meticulously maintained properties situated in sought-after UK locales, specifically tailored to adapt to changing business and consumer demands. Their commitment lies in crafting attractive and practical settings that enhance tenant experiences.

For instance, during the fiscal year ending March 2024, British Land reported a portfolio value of £9.7 billion, with a significant portion dedicated to these high-quality assets. This emphasis ensures tenant retention and attracts new businesses seeking reliable and appealing workspaces.

British Land strategically positions its properties in prime urban centers and key transport hubs, offering unparalleled accessibility. For instance, its central London campuses are situated in areas with excellent public transport links, facilitating easy commutes for employees and access for clients.

This strategic placement extends to its retail portfolio, with many retail parks located alongside major road networks, enhancing convenience for shoppers and enabling efficient last-mile delivery for businesses. This focus on accessibility is a cornerstone of their value proposition, supporting both customer engagement and operational effectiveness.

In 2024, British Land continued to emphasize the importance of location, with its London portfolio, which includes significant office space, demonstrating resilience and continued demand due to its central and well-connected nature.

British Land is dedicated to building sustainable environments, utilizing low-carbon materials and aiming for top-tier environmental certifications like BREEAM Outstanding or Excellent in their new projects. This focus strongly resonates with tenants and investors who prioritize environmental responsibility.

For instance, in 2024, British Land continued to advance its sustainability agenda across its portfolio, with several key developments progressing towards high BREEAM ratings, reflecting a commitment to future-proofing assets against evolving environmental standards and tenant expectations.

Partnership for Business Growth and Success

British Land positions itself as a growth partner for its tenants, understanding that their success directly fuels British Land's own. They provide adaptable spaces designed to accommodate evolving business needs, such as the increasing demand for multi-channel retail operations and efficient last-mile delivery logistics.

This partnership approach is evident in their commitment to offering flexible leasing solutions and actively managing their assets to create environments where businesses can thrive. For instance, in 2024, British Land continued its focus on mixed-use development, integrating retail, residential, and office spaces to create vibrant ecosystems that benefit all stakeholders.

- Strategic Space Adaptation: Offering flexible layouts and amenities to support diverse tenant operations, from traditional retail to e-commerce fulfillment.

- Active Asset Management: Proactively managing properties to enhance their appeal and functionality, thereby supporting tenant business objectives.

- Focus on Mixed-Use Environments: Creating integrated developments that foster synergy and convenience for businesses and their customers.

Long-Term Value Creation for Shareholders

British Land is committed to generating sustained value for its shareholders. This is achieved through a disciplined approach to acquiring and developing high-quality assets in prime locations, coupled with proactive management to optimize income and capital growth.

The company focuses on sectors with strong underlying demand, such as urban logistics and residential properties. For instance, as of their latest reporting, British Land has a significant portfolio in these growth areas, demonstrating their strategic allocation of capital.

- Strategic Acquisitions & Development: British Land targets opportunities that enhance its portfolio's long-term income potential and capital appreciation.

- Active Asset Management: The company actively manages its properties to maximize rental income, occupancy rates, and overall asset value.

- Attractive Returns & Dividends: The core proposition for investors is the delivery of consistent, attractive total returns, including regular dividend payments.

British Land's value proposition centers on providing high-quality, strategically located properties that adapt to evolving tenant needs, fostering thriving business environments. Their commitment to sustainability and active asset management further enhances property appeal and tenant satisfaction.

This approach is supported by a robust portfolio, as evidenced by their £9.7 billion portfolio value in fiscal year ending March 2024, with a focus on prime urban and accessible retail locations. For 2024, continued investment in mixed-use developments underscores their strategy of creating synergistic ecosystems.

British Land aims to be a growth partner for tenants by offering flexible spaces and solutions, recognizing that tenant success drives their own. This is reflected in their ongoing efforts to integrate diverse uses within their developments, enhancing convenience and commercial viability.

For shareholders, the value lies in sustained returns through disciplined investment in high-demand sectors and proactive portfolio management, targeting capital growth and attractive dividends.

| Value Proposition Aspect | Description | 2024 Data/Focus |

|---|---|---|

| Premium, Adaptable Properties | High-quality, well-maintained spaces in prime UK locations, designed for evolving business and consumer needs. | Portfolio value of £9.7 billion (FY ending March 2024), with ongoing development of flexible spaces. |

| Strategic Location & Accessibility | Properties situated in sought-after urban centers and transport hubs, ensuring easy access for employees and customers. | Emphasis on well-connected London campuses and major road-accessible retail parks. |

| Sustainability Focus | Commitment to low-carbon materials and high environmental certifications (e.g., BREEAM) for future-proofed assets. | Continued advancement of sustainability agenda across portfolio, progressing key developments towards high BREEAM ratings. |

| Tenant Growth Partnership | Providing flexible solutions and actively managing assets to support tenant success and evolving operational requirements. | Focus on mixed-use developments creating vibrant ecosystems and adaptable spaces for diverse business models. |

| Shareholder Value Creation | Disciplined investment in high-quality assets and sectors with strong demand, aiming for income optimization and capital growth. | Targeting growth sectors like urban logistics and residential, delivering attractive total returns and dividends. |

Customer Relationships

British Land Company employs specialized asset management and leasing teams. These dedicated groups engage directly with tenants, offering personalized solutions and prompt support. This hands-on approach ensures tenant needs are met efficiently, fostering stronger relationships.

British Land actively cultivates strategic partnerships with its key occupiers, working closely to tailor spaces that meet their dynamic requirements. This collaborative approach is a cornerstone of their strategy, especially in developing large-scale campus environments for major corporate clients and prominent retailers.

For instance, in 2024, their focus on understanding occupier needs was reflected in ongoing discussions and lease renewals with anchor tenants at their key London campuses. These relationships are vital for ensuring long-term value and adaptability within their portfolio.

British Land actively engages with local communities to foster vibrant environments, going beyond just serving individual tenants. This commitment to place-making is crucial for building long-term value and appeal in their developments.

In 2024, British Land continued its focus on community engagement, exemplified by initiatives at key sites like Regent's Place in London, which hosted over 50 community events. These activities aim to strengthen local ties and enhance the social fabric of their properties.

This strategic approach not only benefits residents and visitors but also bolsters the overall attractiveness and economic resilience of British Land's portfolio, contributing to sustained rental growth and asset appreciation.

Digital Platforms and Communication

British Land leverages digital platforms to foster robust tenant relationships. These platforms serve as crucial channels for disseminating timely updates, collecting valuable feedback, and delivering essential services, thereby ensuring a seamless and responsive experience for their customers.

The company actively utilizes its digital infrastructure to maintain an efficient flow of information. This proactive approach allows them to stay attuned to tenant needs and promptly address any emerging requirements, enhancing overall satisfaction and operational efficiency.

- Digital Engagement: British Land utilizes its online portal and communication tools to provide tenants with easy access to information and services.

- Feedback Mechanisms: Digital platforms facilitate structured feedback collection, enabling the company to gauge tenant sentiment and identify areas for improvement.

- Service Delivery: Online channels streamline the delivery of services, from maintenance requests to community updates, enhancing convenience for tenants.

- Data-Driven Insights: In 2024, British Land continued to analyze digital engagement data to refine its customer relationship strategies, aiming for greater personalization and responsiveness.

Long-Term Relationship Building

British Land prioritizes cultivating enduring connections with its clientele, focusing on tenant retention and loyalty. This is achieved through unwavering service quality, flexible property solutions, and a supportive ecosystem designed for tenant success and expansion.

- Tenant Retention: British Land reported a strong 97.2% rent collection for the year ended March 31, 2024, highlighting tenant stability and the company's ability to maintain relationships even in challenging economic conditions.

- Adaptable Spaces: The company actively invests in modernizing its portfolio, offering versatile office and retail environments that cater to evolving business needs, a key factor in retaining long-term occupants.

- Customer Support: British Land provides dedicated support services, aiming to foster a collaborative partnership that extends beyond simple lease agreements, encouraging sustained occupancy and mutual growth.

British Land focuses on building long-term relationships through dedicated asset management and strategic partnerships with key occupiers, tailoring spaces to evolving business needs.

Their 2024 strategy emphasized understanding occupier requirements, evident in ongoing lease discussions with anchor tenants at major London campuses, crucial for sustained portfolio value.

Community engagement, such as over 50 events at Regent's Place in 2024, strengthens local ties and enhances property appeal, contributing to resilience and rental growth.

Digital platforms are key for communication, feedback, and service delivery, with data analysis in 2024 refining personalized tenant strategies.

| Customer Relationship Aspect | Description | 2024 Data/Initiative |

|---|---|---|

| Dedicated Teams | Specialized asset management and leasing teams engage directly with tenants. | Personalized solutions and prompt support provided. |

| Strategic Partnerships | Collaborating with key occupiers to tailor spaces. | Focus on campus environments for major corporate clients and retailers. |

| Community Engagement | Fostering vibrant environments and local ties. | Over 50 community events at Regent's Place. |

| Digital Platforms | Utilizing online portals for updates, feedback, and services. | Analyzing digital engagement data for strategy refinement. |

| Tenant Retention | Prioritizing enduring connections and loyalty. | Strong 97.2% rent collection for year ended March 31, 2024. |

Channels

British Land’s direct sales and leasing teams are crucial for building tenant relationships. These in-house specialists actively market available office and retail spaces, ensuring a deep understanding of market dynamics and tenant needs. This direct engagement fosters personalized service and efficient property transactions.

In 2024, British Land continued to leverage these teams to secure key lettings across its portfolio. For instance, their efforts contributed to a significant portion of the 1.1 million sq ft of leasing activity reported in the first half of the fiscal year, demonstrating the teams' effectiveness in driving occupancy and rental income.

British Land Company actively partners with commercial property agents and brokers to connect with a broad spectrum of prospective tenants. These collaborations are crucial for effectively marketing available spaces and navigating the complexities of lease negotiations.

These external specialists significantly amplify British Land's market presence, bringing valuable local knowledge and established networks. For instance, in 2024, the company continued to leverage these relationships to fill its diverse portfolio of office and retail spaces across the UK.

British Land's corporate website is a crucial platform for engaging stakeholders, offering detailed insights into their diverse real estate portfolio, including office spaces and retail destinations. It acts as a central hub for investor relations, providing access to financial reports, annual statements, and up-to-date market commentary, ensuring transparency and accessibility for shareholders.

The website prominently features company news, press releases, and strategic updates, allowing for direct communication of British Land's vision and operational progress. Furthermore, it highlights their commitment to sustainability, detailing environmental, social, and governance (ESG) initiatives and performance metrics, which is increasingly important for investors and the broader public.

Investor Relations and Shareholder Communications

British Land maintains robust investor relations and shareholder communications through various channels to ensure transparency and provide crucial updates. These include detailed annual reports, interim financial results presentations, and dedicated investor events. For instance, in its 2024 fiscal year, the company actively engaged with stakeholders, highlighting its strategic progress and financial performance.

The company's communication strategy aims to keep investors well-informed about its financial health and strategic direction. Key updates are disseminated via press releases, ensuring timely access to important information. This commitment to open dialogue is fundamental to building and maintaining investor confidence.

- Annual Reports: Comprehensive overview of financial performance and strategic initiatives.

- Financial Results Presentations: Detailed analysis of earnings and operational highlights.

- Investor Events: Opportunities for direct engagement and Q&A with management.

- Press Releases: Timely dissemination of significant company news and updates.

Industry Events and Conferences

British Land actively participates in major real estate industry events and conferences, which is a crucial part of its business model. These gatherings offer a prime opportunity for networking with key stakeholders, including investors, potential tenants, and industry experts. For instance, in 2024, the company likely leveraged events like MIPIM or UKREiiF to present its portfolio and strategic vision.

These conferences are vital for showcasing current and future development projects, attracting new business opportunities, and fostering collaborations. By presenting at these forums, British Land can highlight its strengths in areas like urban regeneration and sustainable development, thereby enhancing its brand visibility and market position. The company's engagement in such events directly supports its goal of securing new leasing agreements and investment partnerships.

- Showcasing Developments: Presenting flagship projects like Canada Water to a broad audience of potential occupiers and investors.

- Networking: Engaging with peers, potential partners, and financial institutions to build relationships and explore joint ventures.

- Investor Relations: Participating in investor roadshows and conferences to communicate financial performance and strategic outlook, crucial for maintaining investor confidence and access to capital.

- Market Intelligence: Gathering insights into market trends, competitor activities, and emerging opportunities by attending industry-specific forums.

British Land's direct sales and leasing teams are vital for cultivating tenant relationships and efficiently marketing its property portfolio. These internal experts ensure a deep understanding of market needs, facilitating personalized service and smooth transactions. In the first half of fiscal year 2024, these teams were instrumental in driving 1.1 million sq ft of leasing activity, underscoring their effectiveness in boosting occupancy and rental income.

Customer Segments

British Land's large corporate tenants are primarily major players in technology, professional services, and finance. These businesses are drawn to British Land's prime London campus locations, seeking premium office environments.

These large occupiers often have specific needs, demanding flexible lease terms and substantial square footage. Sustainability is also a key consideration, aligning with corporate ESG goals. For instance, British Land's portfolio, including assets like the Regent's Place campus, is designed to meet these sophisticated tenant requirements.

Multi-channel retailers, including value-focused brands and those with robust online sales, represent a key customer segment for British Land's retail parks. These businesses seek cost-effective, flexible, and easily accessible locations for their physical stores, often leveraging them for click-and-collect services and last-mile delivery operations.

In 2024, the UK retail park sector continued to demonstrate resilience, with occupancy rates holding steady. British Land's portfolio, for instance, benefits from retailers prioritizing these locations for their operational efficiencies and direct customer reach, particularly as e-commerce integration becomes paramount.

Urban Logistics Operators are a key customer segment for British Land, particularly those focused on last-mile delivery and urban distribution. This group includes businesses heavily reliant on efficient operations within high-demand areas, especially in inner London.

The burgeoning e-commerce sector is a primary driver for this segment's growth. In 2024, online retail sales in the UK continued their upward trajectory, underscoring the need for strategically located logistics hubs to facilitate timely deliveries. British Land's portfolio, with its emphasis on well-connected urban sites, directly addresses this critical requirement.

Institutional Investors

Institutional investors, including significant players like pension funds and sovereign wealth funds, represent a crucial customer segment for British Land. These entities are primarily driven by the pursuit of stable, long-term returns, making high-quality real estate a natural fit for their portfolios. In 2024, British Land continued to attract this segment by offering attractive co-investment opportunities, allowing these large institutions to participate directly in their development projects.

British Land's strategy to cater to institutional investors in 2024 focused on its prime assets, particularly in the office and retail sectors, which are known for generating consistent income streams. The company's commitment to sustainability and ESG (Environmental, Social, and Governance) principles also resonates strongly with these investors, as many are increasingly prioritizing responsible investment practices. For instance, their focus on net-zero carbon buildings aligns with the long-term objectives of many pension funds managing assets for future generations.

- Targeted Real Estate Assets: Focus on prime office spaces and retail destinations known for stable income generation.

- Co-Investment Opportunities: Providing direct stakes in development projects to attract large-scale capital.

- ESG Alignment: Emphasizing sustainability and net-zero commitments to meet investor mandates.

- Long-Term Return Focus: Appealing to the core objective of pension funds and sovereign wealth funds seeking enduring value.

Local Communities and Public Sector

British Land views local communities and public sector entities as crucial stakeholders, even if they aren't direct revenue generators. Their approach focuses on creating positive social and economic impacts within the areas where they operate. This strategy is designed to build strong community relationships, which in turn can smooth the path for planning and development. For instance, in 2024, British Land continued its commitment to urban regeneration projects, aiming to enhance local amenities and employment opportunities.

The company's place-making initiatives are central to its business model, fostering goodwill and ensuring smoother progress on development projects. By investing in local infrastructure and community programs, British Land seeks to create environments that are attractive to both residents and businesses. This collaborative approach helps to secure necessary approvals and support from local authorities and residents alike.

- Stakeholder Engagement: British Land actively engages with local communities and public sector bodies to understand and address their needs, fostering collaborative development.

- Social Impact: The company prioritizes delivering tangible social benefits, such as job creation and improved public spaces, as part of its development strategy.

- Regulatory Facilitation: By demonstrating a commitment to community well-being, British Land aims to streamline the planning and approval processes for its projects.

- Long-Term Value: Building strong relationships with these groups is seen as essential for the long-term success and sustainability of its property portfolio.

British Land's customer segments are diverse, reflecting its broad real estate portfolio. Key groups include large corporate tenants in tech, finance, and professional services seeking prime London office space, often with specific demands for flexibility and sustainability. Retailers, particularly those in value-focused brands and those integrating online sales, are drawn to retail parks for their cost-effectiveness and accessibility.

Urban logistics operators, crucial for e-commerce last-mile delivery, are another vital segment, benefiting from British Land's strategically located urban sites. Institutional investors, such as pension funds and sovereign wealth funds, are attracted by the prospect of stable, long-term returns from high-quality assets and co-investment opportunities, with ESG alignment being a significant draw. Finally, local communities and public sector entities are engaged to foster positive social impact and facilitate development, underscoring a commitment to place-making.

| Customer Segment | Key Needs/Drivers | 2024 Relevance/Data Point |

|---|---|---|

| Large Corporate Tenants | Prime locations, flexibility, ESG | Continued demand for high-quality, sustainable office space in London. |

| Multi-channel Retailers | Cost-effectiveness, accessibility, online integration | Retail parks remain resilient, supporting omnichannel strategies. |

| Urban Logistics Operators | Last-mile efficiency, urban access | Growth driven by e-commerce, requiring strategically located hubs. |

| Institutional Investors | Stable returns, co-investment, ESG | Attracted to long-term income streams and sustainable development. |

| Local Communities/Public Sector | Social impact, regeneration | Engagement vital for smooth planning and community buy-in. |

Cost Structure

British Land Company's cost structure is significantly impacted by property acquisition costs. These are substantial outlays for securing new land and existing properties, particularly in sought-after UK markets. For instance, in the fiscal year ending March 31, 2024, the company's capital expenditure on acquisitions and developments was £740 million, reflecting the high price of prime real estate.

Development and construction costs represent a significant portion of British Land's expenses, encompassing everything from initial planning and design to the physical building of new properties or the extensive refurbishment of existing ones. These outlays cover essential elements like raw materials, skilled labor, necessary permits and approvals, and the fees for experienced project management teams overseeing these large-scale endeavors.

For instance, in the fiscal year ending March 31, 2024, British Land reported capital expenditure of £368 million, a substantial figure reflecting ongoing development and construction activities across its portfolio. This investment underpins the company's strategy to enhance its property assets and create value through strategic development projects.

Property operating and maintenance costs are the ongoing expenses British Land incurs to keep its vast portfolio in top shape. These include essential outlays like property taxes, insurance premiums, and utility bills, which are critical for day-to-day operations.

Furthermore, these costs encompass regular repairs, preventative maintenance, and comprehensive facilities management services. For instance, in the fiscal year ending March 31, 2024, British Land's total operating expenses, which include these property-related costs, were £718 million. This figure reflects the significant investment required to maintain their high-quality assets.

Financing and Interest Costs

British Land's cost structure includes significant financing and interest costs, primarily stemming from its substantial debt levels used to fund its extensive property portfolio. These costs encompass interest payments on various loans and credit facilities, which are crucial for maintaining liquidity and operational capacity.

The company actively manages its debt profile and employs hedging strategies to mitigate the impact of interest rate fluctuations on these expenses. This proactive approach aims to control borrowing costs and ensure financial stability.

For instance, as of their fiscal year end in March 2024, British Land reported interest costs of £279 million. This figure highlights the material nature of financing expenses within their overall cost base.

- Debt Financing Interest: Interest payments on secured and unsecured borrowings form a core component of financing costs.

- Hedging Strategies: Costs associated with interest rate swaps and other derivatives used to manage interest rate risk.

- Debt Management: Expenses related to the administration and servicing of the company's debt facilities.

- Fiscal Year 2024 Impact: In the fiscal year ending March 2024, interest expenses amounted to £279 million, reflecting the cost of servicing their debt.

Administrative and Staff Costs

British Land Company's administrative and staff costs are a significant component of its overall expense structure. These costs encompass salaries, benefits, and other compensation for its workforce, which is crucial for managing its extensive property portfolio and executing its strategic objectives. In 2024, the company continued to invest in its talent and operational infrastructure to support its growth and development initiatives.

These expenses also cover essential functions like marketing to promote its properties and brand, legal services for compliance and transactions, and general overheads required to maintain day-to-day operations. These administrative outlays are fundamental to ensuring the company can effectively manage its assets and pursue new opportunities in the dynamic real estate market.

- General Administrative Expenses: These include salaries, benefits, and associated costs for employees across various departments, from property management to finance and corporate strategy.

- Marketing and Sales: Costs incurred to promote the company's portfolio, attract tenants, and support leasing activities.

- Legal and Professional Fees: Expenses related to legal counsel, regulatory compliance, and other professional services essential for business operations.

- Overheads: General operating costs not directly tied to specific properties, such as office rent, utilities, and IT infrastructure.

British Land's cost structure is heavily influenced by property acquisition and development, with significant capital expenditures in these areas. Operating and maintenance costs are also substantial, covering property taxes, insurance, and upkeep for their extensive portfolio. Financing costs, driven by debt used to fund assets, represent another key expense, alongside administrative and staff costs necessary for managing operations and strategic initiatives.

| Cost Category | FY 2024 (Millions £) | Key Components |

|---|---|---|

| Acquisitions & Developments | 740 | Land purchase, construction materials, labor |

| Operating Expenses | 718 | Property taxes, insurance, utilities, repairs |

| Interest Costs | 279 | Interest on borrowings, hedging costs |

| Administrative & Staff | N/A* | Salaries, benefits, marketing, legal fees |

*Specific figures for administrative and staff costs for FY 2024 were not explicitly itemized in the provided data but are understood to be a necessary component of operations.

Revenue Streams

British Land's core revenue generation comes from rental income derived from its diverse property portfolio. This includes substantial income from its campus developments, which are designed for long-term occupation by major businesses.

The company also generates significant rental income from its network of retail parks, catering to a wide range of consumer needs. Furthermore, their urban logistics properties contribute to this primary revenue stream, reflecting the growing demand for efficient supply chain solutions.

For the year ended March 31, 2024, British Land reported total revenue of £734 million, with a substantial portion attributable to these rental activities. This consistent income forms the bedrock of their financial stability.

British Land Company generates revenue through the sale of properties it has developed or redeveloped. This often involves enhancing the value of existing assets before divesting them.

The company strategically disposes of mature assets, realizing profits from their sale. Additionally, revenue comes from selling individual units within larger development projects, capitalizing on completed phases.

For the year ending March 31, 2024, British Land reported £75 million in profit from property sales, demonstrating the significance of this revenue stream.

British Land generates income from its stakes in joint ventures, reflecting its share of profits from these collaborative projects. For instance, in the fiscal year ending March 31, 2024, their portfolio included significant joint ventures that contributed to their overall financial performance.

Beyond profit sharing, British Land may also earn fees for managing or developing properties within these joint ventures. This dual revenue stream from joint ventures allows them to undertake more substantial development opportunities by pooling resources and expertise, thereby accessing greater capital than they might on their own.

Service Charge and Other Property-Related Income

British Land Company generates additional revenue through service charges, which cover the costs of maintaining shared amenities and services for its tenants. This ensures a consistent income stream beyond base rent, reflecting the value provided in managing the properties effectively.

Other property-related income can include fees from parking, advertising space within their developments, and potentially income from vacant units if they are utilized for temporary events or pop-up shops. These diverse revenue sources contribute to the overall financial health and flexibility of the company's portfolio.

- Service Charges: Levied on tenants for upkeep of common areas and shared facilities.

- Other Property Income: Includes revenue from parking, advertising, and temporary site usage.

- Contribution to Revenue: These ancillary income streams supplement rental income, enhancing overall portfolio profitability.

Capital Gains from Asset Appreciation

British Land aims to achieve capital gains through the long-term appreciation of its property portfolio. This growth in asset value, while not a direct operational income stream, significantly bolsters the company's overall financial health and enhances shareholder returns. For instance, as of their fiscal year-end 2024, British Land's total property portfolio was valued at £10.4 billion, reflecting the accumulated growth and intrinsic value of their holdings.

These capital gains are realized when properties are sold at a price higher than their acquisition or development cost. This strategy is fundamental to maximizing shareholder value and contributes to the company's total accounting returns. The company actively manages its assets to foster this appreciation, making it a key, albeit indirect, revenue driver.

- Asset Appreciation: British Land seeks to increase the market value of its real estate assets over time.

- Shareholder Value: Capital gains contribute directly to the overall returns and value delivered to shareholders.

- Accounting Returns: These gains are reflected in the company's financial statements, improving total accounting returns.

- Portfolio Growth: The strategy relies on the inherent growth potential of prime urban real estate.

British Land's revenue streams are primarily anchored in rental income from its diverse property portfolio, including modern campuses and retail parks. For the year ended March 31, 2024, total revenue reached £734 million, with rental income forming the largest component.

Property sales also contribute significantly, with the company realizing £75 million in profit from property sales in the same fiscal year, often by enhancing and then divesting mature assets.

Additional income is generated through joint ventures, where British Land shares in profits and may earn management fees, alongside ancillary revenue from service charges, parking, and advertising within its developments.

| Revenue Stream | Description | FY24 Contribution |

| Rental Income | Income from leasing properties (campuses, retail, urban logistics) | Largest component of £734M total revenue |

| Property Sales | Profits from selling developed or redeveloped properties | £75M profit |

| Joint Ventures | Share of profits and fees from collaborative projects | Contributed to overall financial performance |

| Ancillary Income | Service charges, parking, advertising, temporary site usage | Supplements rental income |

Business Model Canvas Data Sources

The British Land Company Business Model Canvas is informed by a blend of internal financial disclosures, comprehensive market research reports, and strategic insights derived from industry analysis. These data sources ensure that each component of the canvas accurately reflects the company's current operations and future trajectory.