British Land Company Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

British Land Company Bundle

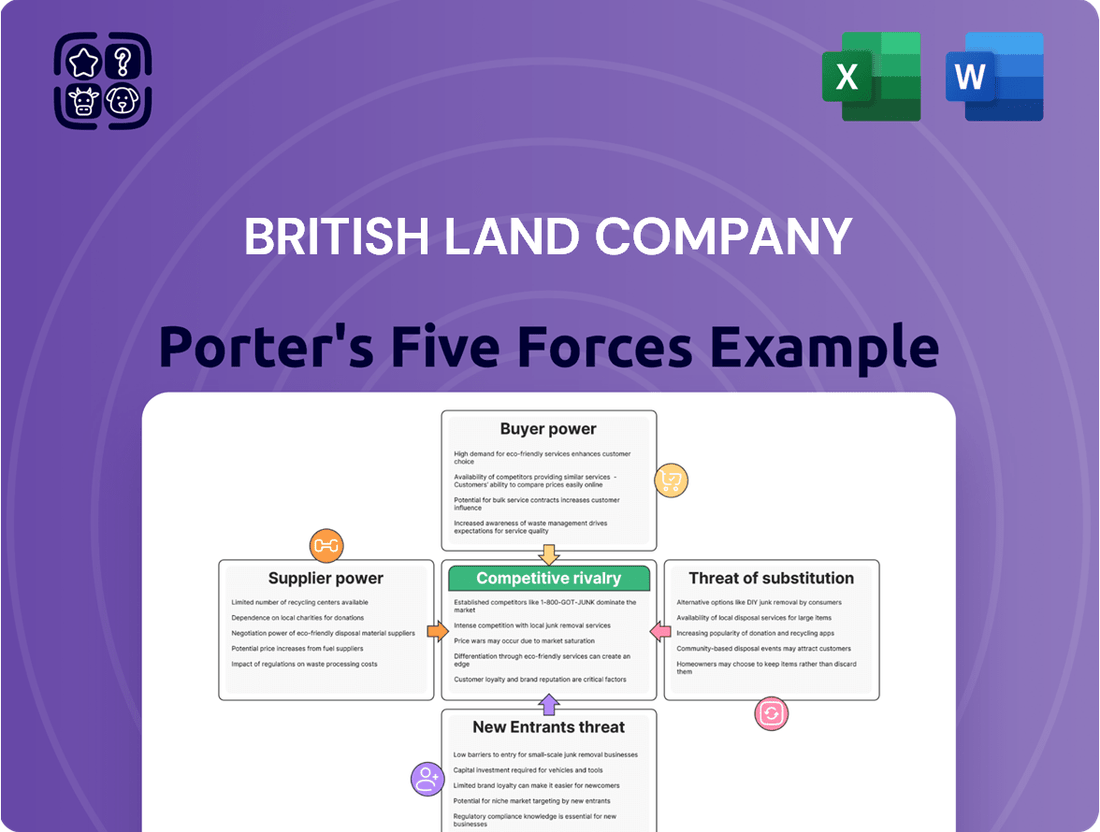

British Land Company navigates a complex real estate landscape, facing intense competition and evolving buyer demands. Understanding the bargaining power of suppliers and the threat of substitutes is crucial for its strategic positioning.

The full Porter's Five Forces Analysis reveals the real forces shaping British Land Company’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The rising cost of essential building materials like steel, concrete, and timber presents a significant challenge for British Land Company. Projections indicate these costs will continue their upward trend through 2025, driven by persistent supply chain issues, robust demand, and the implementation of stricter environmental regulations. This directly translates to higher capital expenditures for British Land's development pipeline, impacting project profitability and potentially delaying timelines.

A persistent shortage of skilled labour in the UK construction sector is projected to worsen by 2025. This scarcity stems from an aging workforce, a decline in new entrants, and ongoing effects of Brexit, potentially increasing wage demands and causing project timelines to stretch for developers such as British Land.

The Office for National Statistics reported in early 2024 that construction output saw a modest 1.5% increase in the final quarter of 2023, but labor availability remains a significant constraint. For British Land, this translates to a direct increase in the cost of projects and a heightened risk of delays, impacting their ability to deliver new developments on schedule and within budget.

While interest rates are showing signs of easing, securing development finance remains a hurdle for many in the property sector, with high street banks adopting a cautious lending approach. This can narrow the selection of potential contractors or inflate financing costs for British Land’s partners, potentially impacting project feasibility and profitability.

Limited Prime Land Availability

The scarcity of prime development land, especially in sought-after urban areas for campuses and logistics facilities, significantly enhances the bargaining power of landowners. British Land's strategy hinges on strategic land acquisitions, making land a crucial and potentially expensive input for its projects.

This limited availability means that landowners can command higher prices and more favorable terms, directly impacting British Land's development costs and profitability. For instance, in 2024, prime urban land values continued to see upward pressure due to sustained demand from various sectors, including technology and e-commerce, which rely heavily on well-located logistics hubs.

- Limited Supply: Prime development land in key urban centers is a finite resource.

- High Demand: Sectors like technology and logistics actively compete for these locations.

- Cost Impact: Scarcity drives up acquisition costs for British Land, affecting project economics.

- Strategic Importance: Access to desirable land is critical for British Land's portfolio growth and tenant attraction.

Increasing Sustainability Requirements

Suppliers offering green building materials, energy-efficient systems, and sustainability consultancy are gaining leverage as British Land Company increasingly focuses on sustainable development and achieving higher Energy Performance Certificate (EPC) ratings. For instance, in 2024, the demand for certified sustainable materials saw a significant uptick, with many suppliers able to command premium pricing due to their specialized offerings and the growing regulatory push. This trend is expected to continue as environmental, social, and governance (ESG) criteria become more embedded in investment decisions and operational mandates.

Compliance with evolving environmental regulations, such as those aimed at reducing embodied carbon and improving building lifecycle performance, adds both complexity and cost to projects. This necessitates closer collaboration with suppliers who can meet these stringent requirements, thereby enhancing their bargaining power. For example, new regulations in the UK by late 2024 mandated stricter standards for new commercial developments, directly impacting the types of materials and systems that can be specified, and giving suppliers of compliant products a stronger negotiating position.

- Increased Demand for Sustainable Materials: Suppliers of certified green building materials, such as low-carbon concrete or recycled steel, benefit from heightened demand driven by corporate sustainability goals.

- Expertise in Energy Efficiency: Companies specializing in advanced energy-efficient systems, like smart HVAC or solar integration, can exert greater influence due to the critical role these play in achieving higher EPC ratings.

- Regulatory Compliance Costs: The need to meet stringent environmental regulations, which often require specialized products or services, empowers suppliers who can provide compliant solutions, potentially at higher price points.

- Consultancy Services for ESG: Sustainability consultants are increasingly sought after to navigate complex ESG frameworks, giving them more bargaining power in project planning and execution.

Suppliers of specialized green building materials and energy-efficient systems are seeing their bargaining power increase. This is due to British Land's growing emphasis on sustainability and achieving higher Energy Performance Certificate (EPC) ratings. In 2024, demand for certified sustainable materials rose significantly, allowing suppliers to charge premium prices. This trend is expected to persist as ESG factors become more integral to investment and operational strategies.

The need to comply with new environmental regulations, such as those targeting embodied carbon reduction, also strengthens supplier leverage. These regulations often require specific materials and systems, giving suppliers of compliant products a more advantageous negotiating position. For example, UK regulations introduced by late 2024 mandated stricter standards for new commercial developments, directly influencing material choices.

| Supplier Type | 2024 Market Trend | Impact on British Land | Projected 2025 Outlook |

|---|---|---|---|

| Green Building Materials | +10% demand for certified materials | Increased procurement costs | Continued price premiums |

| Energy-Efficient Systems | +8% demand for smart HVAC/solar | Higher upfront investment for projects | Growing importance for EPC compliance |

| Sustainability Consultancy | +15% demand for ESG advisory | Increased project planning costs | Essential for regulatory navigation |

What is included in the product

This analysis of British Land Company's competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all to inform strategic decision-making.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each Porter's Five Forces, turning complex market dynamics into actionable insights.

Customers Bargaining Power

The ongoing shift towards hybrid and remote work significantly impacts the bargaining power of customers for British Land Company. With a substantial portion of London's workforce now operating remotely at least part-time, the overall demand for traditional, large-scale office spaces has softened. This trend empowers tenants, giving them more leverage to negotiate favorable lease terms, including rent reductions or shorter lease durations, especially for properties situated in secondary or less desirable locations.

The relentless expansion of e-commerce, now accounting for over 40% of UK retail sales, significantly amplifies customer bargaining power. This shift pressures landlords like British Land, as tenants in physical stores, especially those in less prime locations, can negotiate more favorable lease terms or seek better value to remain competitive against online alternatives.

Customers, especially significant corporate tenants and prominent retail chains, benefit from a robust market with numerous developers offering comparable, high-quality, and environmentally conscious properties. This abundance of choice, particularly evident in the 2024 commercial real estate market, allows them to negotiate favorable lease terms and select locations that precisely match their operational needs and environmental, social, and governance (ESG) objectives. For instance, a major corporation seeking a new headquarters in London in 2024 could easily compare offerings from multiple developers, influencing their bargaining position significantly.

Flight to Quality in Offices

Despite a general softening in office leasing, a notable trend is the 'flight to quality'. Tenants are increasingly prioritizing modern, sustainable, and well-located office spaces, often referred to as 'best-in-class' assets. This selective demand means that landlords with high-quality, energy-efficient buildings, like British Land's newer campus developments, can command premium rents and retain strong tenant relationships. Conversely, older, less amenity-rich properties face greater pressure on occupancy and rental rates.

This dynamic significantly influences the bargaining power of customers. For British Land's prime assets, tenant bargaining power is somewhat diminished because of the limited supply of comparable high-quality alternatives. However, for their portfolio of older, less desirable buildings, tenants have more leverage, as they can easily find more attractive options elsewhere. For instance, in 2024, reports indicated that prime office rents in London remained relatively stable or saw modest increases, while secondary office rents experienced more significant downward pressure.

- Flight to Quality: Tenants increasingly seek premium, sustainable office spaces.

- British Land's Advantage: High-quality campus developments benefit from this trend, allowing for premium rents.

- Challenge for Older Assets: Less efficient buildings face reduced tenant bargaining power and rental pressure.

- Market Data: Prime office rents in 2024 showed resilience compared to secondary market declines.

Logistics Occupier Demand Stability

While overall occupier demand for industrial and logistics property is projected to stay relatively stable through 2025, a potential uptick in vacancy rates during 2024 might grant larger tenants a degree of increased bargaining power. This could translate into more favorable lease terms for those with significant space requirements.

Despite this potential shift, the market fundamentals remain robust. Strong demand for prime, modern logistics facilities, particularly those catering to the ever-growing e-commerce sector, continues to underpin the sector. This sustained demand is expected to support moderate growth in prime rental rates.

- Vacancy Rates: A rise in vacancy in 2024 could empower larger occupiers.

- Occupier Demand: Expected to remain broadly consistent in 2025.

- Prime Asset Demand: Continues to support rental growth.

- E-commerce Logistics: A key driver for sustained demand.

The bargaining power of customers for British Land is a mixed bag, heavily influenced by the type of property and tenant. For their prime, modern office spaces, tenant power is somewhat constrained due to the scarcity of truly comparable alternatives, especially those meeting ESG standards. This was evident in 2024, where prime London office rents showed resilience, unlike secondary locations.

Conversely, tenants in older, less desirable buildings, or those in retail locations facing e-commerce competition, possess greater leverage. This is amplified by the general softening in demand for traditional office space due to hybrid work, empowering tenants to negotiate better terms.

| Property Type | Tenant Bargaining Power | Key Influencing Factors |

|---|---|---|

| Prime Office Space | Moderate to Low | Flight to quality, ESG focus, limited comparable supply |

| Secondary Office Space | High | Hybrid work impact, availability of better alternatives |

| Retail Space | High | E-commerce growth, competition from online retailers |

| Logistics Space | Moderate | Potential vacancy increase in 2024, strong e-commerce demand |

Preview Before You Purchase

British Land Company Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces Analysis of British Land Company you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual document, detailing the competitive landscape, industry rivalry, buyer and supplier power, and threat of new entrants and substitutes for British Land. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic decision-making.

Rivalry Among Competitors

The UK property market's fragmentation, with over 2,500 housebuilders and developers, intensifies competitive rivalry for British Land. This vast number includes national giants and specialized boutique firms, creating a diverse competitive environment across different market segments and project types.

British Land faces intense competition, especially in its core London campus, retail park, and urban logistics segments. Major real estate investment trusts (REITs) and developers with similar strategic focuses are constantly vying for prime assets and development opportunities. For instance, in 2024, the London office market saw significant activity, with companies like Derwent London and Great Portland Estates actively developing and leasing space, directly challenging British Land's campus strategy.

The UK commercial real estate market is poised for a significant rebound, with investment anticipated to climb by 15% in 2025 after a subdued 2024. This recovery is largely attributed to the projected decrease in interest rates, which is expected to reignite investor appetite.

This heightened investor confidence is a double-edged sword for companies like British Land. While it signals a healthier market, it also means increased competition for prime acquisition and development projects. More players vying for the same assets will likely drive up prices and reduce margins.

Sustainability as a Competitive Differentiator

Sustainability has become a crucial battleground in the real estate sector, directly impacting competitive rivalry. Major institutional investors are increasingly demanding demonstrable progress on environmental upgrades and robust ESG (Environmental, Social, and Governance) compliance, making it a prerequisite for securing financing. This trend significantly amplifies the pressure on companies to integrate sustainable practices into their core operations.

Companies like British Land, which have proactively invested in and championed sustainability, are carving out a distinct competitive advantage. This leadership position not only attracts environmentally conscious tenants and investors but also positions them favorably for future regulatory landscapes. Conversely, businesses that fail to adapt to this evolving demand risk being sidelined, potentially facing higher capital costs or even obsolescence in a market that increasingly values green credentials.

- Investor Demand: In 2024, a significant portion of institutional real estate capital is earmarked for ESG-compliant assets, with many funds actively divesting from properties that do not meet stringent environmental standards.

- Financing Advantage: Leading sustainable developers often secure more favorable loan terms and attract a broader pool of lenders committed to green finance initiatives.

- Tenant Attraction: Businesses are increasingly choosing office spaces that align with their own sustainability goals, boosting occupancy rates for eco-friendly buildings.

- Brand Reputation: Strong sustainability performance enhances brand image, attracting talent and fostering positive stakeholder relationships, which translates to a competitive edge.

Development Pipeline and Capital Deployment

British Land's substantial committed development pipeline, valued at £3.5 billion as of late 2023, fuels its competitive stance. The company is strategically deploying capital, particularly into high-demand areas like retail parks and large-scale campus developments, aiming for future growth and returns.

However, this aggressive development strategy places British Land in direct competition with other major property companies. These rivals also boast significant development pipelines and are actively engaged in strategic acquisitions to secure prime assets and market share, intensifying the rivalry for attractive growth opportunities.

- Development Pipeline Value: British Land's committed pipeline stood at £3.5 billion in late 2023.

- Capital Recycling Focus: Investments are concentrated in retail parks and campus developments.

- Competitive Landscape: Rivals also possess ambitious development plans and acquisition strategies.

- Rivalry Driver: Competition for prime assets and market expansion is fierce.

The competitive rivalry for British Land is intense, driven by a fragmented UK property market and significant activity from major REITs and developers. This rivalry is amplified by the increasing importance of sustainability, where companies with strong ESG credentials gain a distinct advantage in attracting capital and tenants. British Land's substantial development pipeline of £3.5 billion also places it in direct competition with rivals pursuing similar growth strategies and asset acquisitions.

| Competitor Type | Key Focus Areas | 2024 Market Activity Example |

| National Giants | Large-scale campus, retail parks | Derwent London, Great Portland Estates active in London office development |

| Specialized Firms | Niche segments, boutique projects | Numerous smaller developers competing for specific project types |

| Institutional Investors | ESG-compliant assets, prime acquisitions | High demand for green buildings, potential divestment from non-compliant properties |

SSubstitutes Threaten

The rise of remote and hybrid work offers a compelling substitute for traditional office environments. Companies are increasingly reassessing their need for large physical spaces, opting for smaller, more flexible arrangements or entirely remote setups. This shift directly impacts the demand for office buildings, a core asset for British Land.

In 2024, the trend of reduced office footprints continues. For instance, a significant portion of businesses surveyed indicated plans to maintain or increase hybrid work policies, leading to an estimated 10-15% reduction in overall office space requirements for many organizations compared to pre-pandemic levels. This directly challenges the traditional leasing model for office properties.

The ongoing migration to online shopping presents a significant threat of substitution for physical retail. In 2024, e-commerce continued to capture a substantial portion of the UK's retail market, with online sales representing approximately 27% of total retail turnover, a figure that has steadily climbed over recent years.

This trend directly impacts the footfall and sales potential for brick-and-mortar stores, including those within British Land's portfolio. While retail parks are evolving with experiential offerings and convenience-focused tenants, the fundamental availability of online alternatives remains a potent competitive force.

For urban logistics properties, potential substitutes are emerging that could reduce demand for traditional distribution hubs. More efficient last-mile delivery networks, such as those utilizing smaller, localized depots or even dedicated couriers, can bypass the need for large, centrally located facilities. For instance, some retailers are increasingly leveraging dark stores, essentially repurposed retail spaces for online order fulfillment, as a substitute for larger warehouse footprints.

Furthermore, advancements in technology, including the potential widespread adoption of delivery drones and autonomous vehicles, could fundamentally alter future space requirements in the logistics sector. These innovations might enable more direct and decentralized delivery models, thereby diminishing the reliance on extensive physical distribution networks. The ongoing evolution of e-commerce logistics, with a focus on speed and proximity to the end consumer, directly pressures the traditional large-scale urban logistics model.

Shared Economy and Flexible Spaces

The proliferation of co-working spaces and flexible office solutions presents a significant threat of substitutes for traditional office leases, particularly impacting companies prioritizing agility and cost-efficiency. These alternatives allow businesses, especially smaller ones, to bypass the commitment of long-term leases, thereby reducing the demand for large, dedicated office footprints.

This shift directly challenges the core offering of companies like British Land, which historically relied on long-term commitments for their office portfolios. For instance, by mid-2024, the flexible workspace sector continued its robust growth, with providers like WeWork and Industrious expanding their offerings globally. These flexible models reduce the capital expenditure and operational overhead for tenants, making them an attractive substitute.

- Reduced Lease Commitments: Businesses can opt for shorter, more flexible terms, avoiding the long-term financial obligations of traditional leases.

- Cost-Effectiveness for SMEs: Start-ups and small to medium-sized enterprises find co-working spaces more affordable, offering bundled services.

- Agility and Scalability: Companies can easily scale their space up or down based on fluctuating workforce needs, a flexibility not easily matched by traditional leases.

Technological Advancements

Technological advancements present a significant and evolving threat of substitution for British Land Company. Innovations like virtual reality (VR) are transforming property viewings, potentially reducing the need for physical site visits and thus impacting traditional leasing models. For instance, by mid-2024, many real estate firms were integrating advanced VR tours, making remote property assessment more feasible.

Furthermore, artificial intelligence (AI) is increasingly used in building management, offering efficiencies that could substitute for certain human-led operational aspects or even influence the design and necessity of traditional office spaces. The development of smart city infrastructure, integrating digital technologies into urban environments, could also create alternative ways for businesses and individuals to interact with urban spaces, potentially reducing reliance on conventional commercial property assets.

This ongoing technological evolution signifies a long-term substitution threat, as new digital or hybrid solutions may emerge that fulfill the needs currently met by physical real estate. For example, the rise of sophisticated remote collaboration tools and the potential for greater decentralization of workforces, accelerated by trends observed throughout 2023 and into 2024, could lessen the demand for large, centralized office buildings.

The threat of substitutes for British Land is multifaceted, encompassing shifts in work patterns, retail habits, and technological advancements. Remote and hybrid work models directly substitute traditional office spaces, with many companies in 2024 maintaining or increasing flexible policies, potentially reducing office space needs by 10-15%. E-commerce continues to offer a potent substitute for physical retail, capturing around 27% of UK retail turnover in 2024, impacting footfall in brick-and-mortar locations.

The rise of co-working spaces and flexible office solutions provides an alternative to long-term leases, offering agility and cost-effectiveness, particularly for SMEs. By mid-2024, this sector saw continued robust growth, with providers expanding their global offerings. Technological innovations, such as VR for property viewings and AI in building management, also present emerging substitutes that could alter the demand for traditional real estate assets.

| Substitute Type | Impact on British Land | 2024 Data Point |

| Remote/Hybrid Work | Reduced demand for traditional office space | Estimated 10-15% reduction in office space needs for some organizations |

| E-commerce | Decreased footfall and sales for physical retail | Approx. 27% of UK retail turnover from online sales |

| Co-working/Flexible Offices | Lower demand for long-term office leases | Continued robust growth in the flexible workspace sector |

| Virtual Reality (VR) | Potential reduction in physical site visits | Increased integration of VR tours by real estate firms |

Entrants Threaten

The threat of new entrants for British Land Company is significantly mitigated by high capital requirements. Entering the large-scale property development and investment sector, particularly in prime locations and for high-quality assets, demands immense financial resources. For instance, major development projects often run into hundreds of millions, if not billions, of pounds, creating a substantial barrier to entry.

The UK's planning system is notoriously intricate, and for new entrants, this complexity acts as a substantial barrier. Obtaining the necessary approvals for development projects can be a lengthy and unpredictable process, often taking years.

Stringent regulations, from building codes to environmental impact assessments, add further layers of difficulty and cost. For instance, in 2024, the average time to secure planning permission for major developments in the UK remained a significant concern, with many projects experiencing delays beyond initial projections, directly impacting the capital expenditure and timelines for new market participants.

Securing prime development sites, especially in bustling urban centers, is a significant hurdle for newcomers. This requires not only deep-rooted networks and specialized land acquisition skills but also substantial financial resources. Existing companies like British Land, with their long-standing presence and proven track record, naturally possess a considerable edge in this competitive arena.

Brand Reputation and Tenant Relationships

British Land's strong brand reputation and established relationships with key corporate and retail tenants present a significant barrier to new entrants. Attracting and retaining these high-value tenants requires a proven track record of delivering exceptional, sustainable properties and reliable service, which takes considerable time and investment to build.

- Brand Strength: British Land's established name signifies trust and quality in the commercial property sector.

- Tenant Loyalty: Long-standing relationships with major occupiers create a sticky customer base for existing players.

- Entry Cost: New entrants face the challenge of building similar credibility and demonstrating a commitment to sustainability and tenant satisfaction.

- Market Access: Securing prime locations and attracting top-tier tenants is difficult without an established reputation.

Sustainability Compliance and Expertise

The growing emphasis on sustainability and Environmental, Social, and Governance (ESG) factors in the real estate sector acts as a significant barrier to entry. New companies entering the market must navigate complex and evolving regulatory landscapes, including stringent disclosure requirements that are becoming standard practice. For instance, in 2024, the UK government continued to push for higher energy efficiency standards in commercial buildings, with potential penalties for non-compliance, making it harder for less prepared entrants.

Meeting these sustainability benchmarks requires substantial upfront investment in expertise and technology. Entrants need to demonstrate a clear understanding of green building certifications, carbon footprint reduction strategies, and sustainable material sourcing. This need for specialized knowledge and financial capacity means that only well-resourced and forward-thinking companies can effectively compete, thereby protecting established players like British Land Company.

Financing for new developments is increasingly linked to green credentials, further raising the entry barrier. Lenders and investors in 2024 are prioritizing projects that align with ESG goals, offering more favorable terms for sustainable developments. Companies lacking the necessary expertise or commitment to sustainability may find it difficult to secure the capital required to enter and operate in the market.

- High Capital Investment: New entrants require significant capital to meet evolving ESG standards and green building certifications.

- Specialized Expertise: A deep understanding of sustainability regulations, green technologies, and carbon reduction strategies is essential.

- Access to Green Financing: Securing favorable financing is increasingly dependent on a company's demonstrated commitment to sustainability.

- Regulatory Compliance: Navigating and adhering to increasingly strict environmental disclosures and building codes presents a challenge for newcomers.

The threat of new entrants for British Land Company is considerably low due to several formidable barriers. The sheer scale of capital required for property development and investment, often in the hundreds of millions of pounds, immediately deters smaller players. Furthermore, the UK's complex planning and regulatory environment, coupled with stringent ESG standards, demands significant expertise and investment, making it difficult for newcomers to navigate and comply. For instance, in 2024, securing planning permission remained a lengthy process, with many projects facing delays, impacting capital expenditure for new market participants.

| Barrier Type | Description | Impact on New Entrants | Example (2024 Context) |

|---|---|---|---|

| Capital Requirements | High financial resources needed for land acquisition and development. | Substantial barrier, limiting entry to well-funded entities. | Major London developments can exceed £500 million. |

| Regulatory Complexity | Intricate planning laws and building codes. | Lengthy approval processes increase time-to-market and costs. | Average planning permission timelines remain a concern. |

| Sustainability Demands (ESG) | Need for adherence to green building standards and carbon reduction. | Requires specialized knowledge and investment in technology. | Stricter energy efficiency mandates for commercial buildings. |

| Brand Reputation & Tenant Relationships | Established trust and long-term tenant contracts. | Difficult for new entrants to attract high-value tenants without proven track record. | Major occupiers prioritize reliable, sustainable partners. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for British Land Company leverages data from their annual reports, investor presentations, and industry-specific market research from sources like Savills and CBRE. This blend of company-disclosed information and expert industry analysis provides a comprehensive view of the competitive landscape.