British Land Company Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

British Land Company Bundle

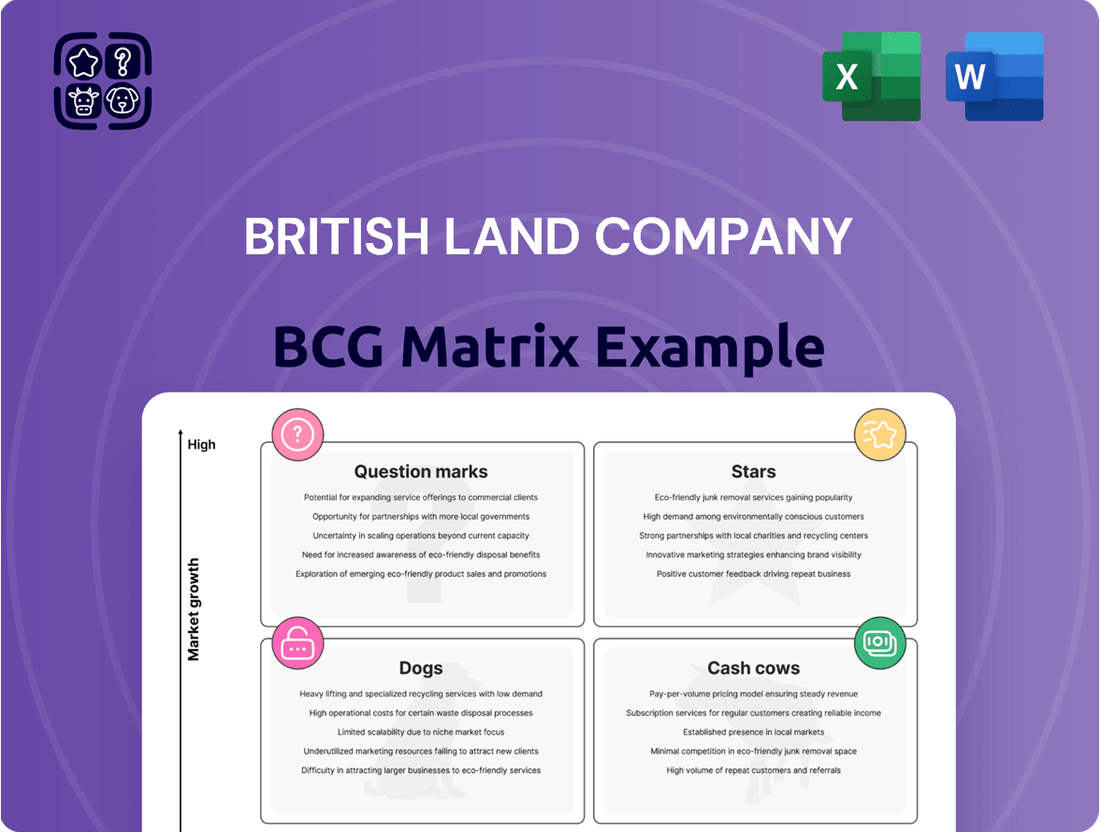

Curious about British Land Company's strategic product portfolio? Our BCG Matrix analysis reveals their current market standing, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture – purchase the complete report for a detailed breakdown and actionable insights to guide your investment decisions.

Stars

British Land's London Urban Logistics segment is a star performer within its BCG Matrix. The company reported an impressive 10.0% estimated rental value (ERV) growth in FY24 for this sector, highlighting robust demand and rental appreciation. Furthermore, a combined 5.6% ERV growth for Retail and London Urban Logistics in FY25, coupled with 100% occupancy, underscores the strength and stability of these assets.

The company's commitment to this high-growth market is evident in its substantial £1.3 billion development pipeline. This includes the successful acquisition of planning consent for new multi-storey logistics schemes, directly addressing the increasing need for efficient last-mile delivery solutions. This strategic focus positions British Land to capitalize on the ongoing e-commerce boom and sustained occupier demand anticipated throughout 2025.

British Land is strategically investing in 3 million sq ft of prime campus developments in central London, positioning these as key contributors to future earnings. This focus on high-quality, modern office spaces is designed to capture strong rental growth.

Despite earlier market volatility, campus values began to rebound and grow in the latter half of fiscal year 2025, signaling a positive turn. This recovery underscores the resilience of well-located, high-specification assets in the London market.

The demand for super-prime office space in London significantly outstrips supply. This imbalance allows British Land to secure leases above projected rental values, demonstrating robust rental growth potential for its campus developments.

British Land is strategically pivoting towards the Science & Technology (S&T) sector, with ambitions for it to represent up to half of its campus portfolio by 2030. This represents a significant increase from its current exposure of around 20%.

This strategic shift is driven by the robust growth trajectory of the S&T industry. Evidence of this demand is clearly visible at The Optic in Cambridge, where British Land has seen successful tenant acquisition for its specialized S&T spaces, validating the market's appetite.

By concentrating investment in this high-growth area, British Land aims to capture significant market share and establish leadership within the specialized S&T real estate niche, anticipating strong returns from these targeted assets.

Strategic Capital Recycling into Growth Areas

British Land actively recycles its capital, selling off less crucial assets to fund investments in promising areas like retail parks and urban logistics. This strategic move allows them to shift resources to sectors with better tenant demand and higher potential returns.

For instance, in the fiscal year ending March 2024, British Land reported significant progress in its capital recycling program. They completed disposals totaling £300 million, primarily from their office portfolio, while simultaneously increasing investment in their growth segments. This active management is key to their strategy.

- Capital Recycling: Disposals of £300 million in FY24, focusing on non-core assets.

- Reinvestment Focus: Increased capital allocation towards retail parks and urban logistics.

- Growth Sector Performance: These areas demonstrate stronger occupational fundamentals and higher return prospects.

- Market Position: Reinforcing market share in key growth subsectors.

Development-Led Growth Strategy

British Land's strategy heavily relies on development to fuel future income, especially within its campus and urban logistics segments. This approach focuses on creating premium, modern spaces designed to capture robust rental growth, driven by limited availability in key markets.

The company's development pipeline is poised to be a significant contributor to its earnings per share in the upcoming years. For instance, as of their latest reports, British Land has a substantial development pipeline valued in the billions, with a significant portion allocated to these high-growth sectors. This focus on creating new, in-demand properties is a core tenet of their Star positioning.

- Development Focus: Emphasis on campus and urban logistics for future income.

- Rental Growth Potential: High-quality spaces in supply-constrained markets expected to command strong rents.

- Earnings Contribution: Development pipeline projected to boost underlying earnings per share.

- Market Position: Development-led growth aligns with Star quadrant characteristics due to high growth potential.

British Land's London Urban Logistics and its campus developments, particularly those transitioning into Science & Technology spaces, are positioned as Stars. The company reported a 10.0% estimated rental value (ERV) growth in FY24 for its urban logistics segment, with a combined 5.6% ERV growth for Retail and Urban Logistics in FY25, alongside 100% occupancy.

The company is actively developing 3 million sq ft of prime campus space in central London, with a strategic pivot towards Science & Technology, aiming for this sector to constitute up to half of its campus portfolio by 2030, up from approximately 20% currently.

This strategic focus on high-growth sectors, supported by a substantial development pipeline and active capital recycling, including £300 million in disposals in FY24, positions these assets for significant future earnings and rental growth.

| Segment | FY24 ERV Growth | FY25 ERV Growth (Retail & Urban Logistics) | Occupancy | Development Focus |

| London Urban Logistics | 10.0% | 5.6% (combined) | 100% | Multi-storey logistics schemes |

| Campus (incl. S&T) | N/A | N/A | N/A | 3 million sq ft prime campus development |

What is included in the product

The British Land Company BCG Matrix categorizes its real estate portfolio, identifying units for investment, divestment, or holding.

The British Land Company BCG Matrix provides a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

British Land's established retail parks are a clear cash cow within their portfolio. These locations are performing exceptionally well, showing rental growth of 7.2% in the full year 2024 and a projected 6.0% for 2025. With a near-perfect occupancy rate of 99%, they are a stable and reliable source of income for the company.

The company has strategically increased its investment in retail parks, which now make up 32% of its total holdings. This sector is considered a key area of focus due to its strong underlying demand from shoppers and businesses, leading to attractive returns on investment and consistent cash flow generation with minimal ongoing capital needs.

Mature, well-occupied London campuses, like sections of Broadgate, are British Land's cash cows. Their high occupancy rates, reaching 96% in FY24 and a projected 97% for HY25 and FY25, coupled with prime London locations, ensure a steady and predictable stream of rental income.

These established assets, while perhaps not seeing explosive growth, are crucial for generating consistent profits. They form a dependable foundation for the company's cash flow, providing the necessary funds to support other strategic initiatives and development projects across the portfolio.

British Land Company consistently achieves impressive portfolio occupancy rates, reaching 97% in FY24 and maintaining a strong 98% in both the first half of FY25 and the full year FY25.

This high occupancy across its varied property holdings is a key indicator of stable rental income generation.

By minimizing vacant spaces, British Land maximizes the revenue potential of its existing assets, solidifying their position as reliable cash cows within its portfolio.

Consistent Dividend Payouts

British Land's commitment to consistent dividend payouts highlights its status as a cash cow within its business portfolio. The company's dividend per share saw a modest increase of 1% in FY24 and the first half of FY25, demonstrating resilience and a stable earnings base. This steady return is further supported by its policy to distribute 80% of its underlying earnings per share (EPS) as dividends, directly linking shareholder returns to the profitability of its operations.

This approach underscores British Land's mature and dependable earnings stream, a hallmark of cash cow businesses. The consistent dividend payout signifies the company's ability to generate substantial free cash flow from its established assets, which can then be returned to investors. This reliability makes British Land an attractive option for income-focused investors.

- Stable Dividend Growth: British Land's dividend per share increased by 1% in FY24 and HY25, reflecting consistent cash flow generation.

- Shareholder Return Policy: The company maintains a policy of paying out 80% of its Underlying EPS as dividends, signaling a commitment to shareholders.

- Mature Earnings Stream: The steady dividend payout is indicative of a mature business segment generating reliable profits.

Strong Cost Discipline

British Land's commitment to strong cost discipline is a key factor in its success. The company has actively worked to reduce its operational expenses, which directly benefits its cash-generating capabilities.

This focus on efficiency is clearly reflected in its financial performance. The EPRA cost ratio, a measure of operational efficiency, saw a notable decrease. It moved from 19.5% in FY23 to 16.4% in FY24, and further improved to 15.3% by HY25.

Such a reduction in the cost ratio is significant because it means more of the revenue generated from its high-market-share assets is converted into profit. This enhanced efficiency strengthens the underlying profit of the company and bolsters the cash flow from its core property portfolio.

- EPRA Cost Ratio Reduction: From 19.5% (FY23) to 16.4% (FY24) and 15.3% (HY25).

- Enhanced Profit Margins: Lower costs directly translate to better profitability.

- Improved Cash Conversion: More revenue is converted into usable cash from existing assets.

- Strengthened Underlying Profit: Demonstrates efficient management of core operations.

British Land's retail parks and mature London campuses are its prime cash cows. These segments boast high occupancy rates, with retail parks at 99% and London campuses at 96% in FY24, projected to reach 97% by HY25 and FY25. This stability, coupled with rental growth of 7.2% in FY24 for retail parks, ensures consistent and reliable income streams.

The company's strategic focus on these established assets, now representing 32% of its portfolio, highlights their importance in generating predictable cash flow. This dependable income supports overall company strategy and shareholder returns.

British Land's commitment to shareholder returns is evident in its dividend policy, paying out 80% of underlying EPS. The 1% dividend per share increase in FY24 and HY25 reflects the strength and maturity of these cash-generating assets.

Furthermore, enhanced operational efficiency, seen in the reduction of the EPRA cost ratio from 19.5% (FY23) to 15.3% (HY25), directly boosts profitability and cash conversion from these core holdings.

| Asset Type | FY24 Occupancy | FY25 Projected Occupancy | FY24 Rental Growth (Retail Parks) | EPRA Cost Ratio (HY25) |

|---|---|---|---|---|

| Retail Parks | 99% | 99% | 7.2% | 15.3% |

| London Campuses | 96% | 97% | N/A | 15.3% |

Preview = Final Product

British Land Company BCG Matrix

The British Land Company BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be delivered to you without any watermarks or demo content, ensuring immediate usability for your business planning needs.

Dogs

British Land has been strategically divesting from non-core shopping centres, a move that aligns with its BCG matrix positioning. The sale of its 50% stake in Meadowhall in July 2024 for £360 million is a prime example of this divestment strategy.

These disposals suggest that these particular assets are likely categorized as 'Dogs' within the BCG matrix. This classification stems from their perceived lower growth prospects and their misalignment with British Land's current strategic emphasis on retail parks and campuses.

Such assets often tie up significant capital without offering the attractive returns that the company is now prioritizing, making their divestment a logical step to optimize capital allocation and focus on higher-potential business segments.

Older, Non-Strategic Office Assets in British Land's portfolio represent properties that don't align with the company's focus on prime London campuses. These might be older buildings in less desirable locations or those that are challenging to update or repurpose for modern office needs.

British Land's strategy includes recycling capital from lower-yielding assets, indicating a potential move away from these legacy office holdings. For instance, in their 2024 fiscal year results, British Land reported a significant reduction in their non-core office portfolio, a clear indication of this capital recycling in action.

These assets likely possess a smaller market share within the competitive office sector and exhibit limited prospects for future growth. Their repositioning or redevelopment might be costly, making them candidates for divestment to free up capital for more strategic investments.

Underperforming retail properties, distinct from their successful retail parks, represent a challenge for British Land. These smaller, less dominant assets often grapple with persistent vacancy issues and weak tenant demand, indicating a low market share. For instance, in the fiscal year ending March 31, 2024, British Land continued its strategy of disposing of non-core retail assets, a move that directly addresses properties falling into this category, aiming to streamline the portfolio and focus on higher-performing segments.

Assets Requiring Excessive Capital Expenditure for Limited Return

Properties that would demand significant capital investment for refurbishment or repositioning but are unlikely to deliver a substantial uplift in rental value or market share could be classified as Dogs within British Land Company's portfolio, according to the BCG Matrix framework.

British Land's strategic focus on 'value add' and 'higher yielding opportunities' means that assets not meeting these criteria are prime candidates for divestment. For instance, in their 2024 fiscal year, the company actively managed its portfolio, seeking to optimize returns.

Such assets can become cash traps, tying up resources without adequate returns. This can hinder the company's ability to invest in more promising ventures. British Land's commitment to a more focused portfolio, as evidenced by their ongoing disposals of non-core assets, aims to mitigate this risk.

- Dogs: Assets requiring substantial capital for refurbishment with limited potential for rental value growth.

- Strategic Alignment: These properties often fall outside British Land's focus on 'value add' and 'higher yielding' opportunities.

- Financial Implication: They risk becoming cash traps, diverting resources from more profitable investments.

- Divestment Rationale: British Land's portfolio management strategy prioritizes the sale of such underperforming assets to reallocate capital effectively.

Properties Outside Chosen Markets

British Land has strategically focused its portfolio, with 93% now concentrated in its chosen markets: campuses, retail parks, and London urban logistics. This active capital recycling demonstrates a clear commitment to core growth areas.

The remaining 7% of properties fall outside these strategically selected markets. These non-core assets, particularly those exhibiting low growth and market share, are prime candidates for divestment as British Land continues to optimize its property holdings.

- Portfolio Concentration: 93% of British Land's portfolio is now within its core markets.

- Chosen Markets: Campuses, retail parks, and London urban logistics.

- Non-Core Assets: The remaining 7% are outside these identified growth sectors.

- Strategic Disposal: Assets with low growth and market share are likely candidates for sale.

Assets classified as 'Dogs' within British Land's portfolio are those with limited growth potential and a small market share, often requiring significant capital investment for improvement without a clear path to substantial returns. These properties, such as older, non-strategic office buildings or underperforming retail spaces, represent a drag on capital and do not align with the company's current strategic focus on high-growth sectors like campuses and retail parks. British Land's active divestment strategy, exemplified by the £360 million sale of its stake in Meadowhall in July 2024, targets these 'Dog' assets to optimize capital allocation and enhance overall portfolio performance.

| Asset Type | BCG Classification | Rationale | Strategic Action |

| Older Office Buildings | Dog | Low growth, misaligned with campus strategy, high refurbishment cost | Divestment, Capital Recycling |

| Underperforming Retail | Dog | Low market share, vacancy issues, weak tenant demand | Disposal of non-core assets |

| Non-Core Shopping Centres | Dog | Lower growth prospects, not aligned with retail park focus | Strategic divestment (e.g., Meadowhall sale for £360m in July 2024) |

Question Marks

British Land's early-stage urban logistics developments in London, such as the multi-storey scheme approved in Thurrock slated for Q1 2025 construction, represent significant investments in a rapidly expanding e-commerce driven market. These projects are currently classified as Question Marks within the BCG Matrix due to their high capital intensity and the absence of substantial returns or established market share at this juncture.

The company's strategic focus on these developments, including a 150,000 sq ft multi-storey facility in Thurrock, highlights their commitment to capturing future growth in urban logistics. However, these ventures are cash consumers, demanding considerable upfront investment before they can generate meaningful revenue or solidify their market position.

The success of these nascent London urban logistics projects hinges on their efficient and timely completion, coupled with the ability to attract and secure high-demand occupiers. This will be crucial for transforming them from capital-intensive Question Marks into potential Stars within British Land's portfolio, capitalizing on the projected growth in the sector.

British Land’s large-scale campus redevelopments, particularly those in their nascent or uncommitted stages, represent significant future capital outlays. These projects, while demanding substantial investment and carrying inherent development risks, are strategically positioned to capitalize on the prime London office market's high growth potential. For instance, the ongoing development at Canada Water, a major regeneration project, embodies this long-term vision, requiring phased investment over several years before full realization of its market share and cash flow contributions.

British Land is actively integrating new technologies into its operations, particularly within its sustainability framework. For example, they are exploring citizen science apps aimed at nature recovery and utilizing geospatial tools for enhanced environmental monitoring. These efforts reflect a forward-looking approach to property management and environmental stewardship.

Investments in novel, unproven technologies and innovative property management solutions represent potential high-growth areas for British Land. However, these initiatives are currently in their nascent stages of adoption. This necessitates significant upfront capital expenditure and dedicated strategic planning to foster market acceptance and establish a competitive edge.

Deep Retrofit and Decarbonisation Projects

Deep retrofit and decarbonisation projects for British Land Company, while not directly generating immediate market share or high short-term financial returns, represent significant investments in their existing portfolio. These initiatives are critical for achieving the company's ambitious net-zero carbon targets by 2030, aligning with increasing investor and regulatory focus on Environmental, Social, and Governance (ESG) factors.

These projects are essential for future-proofing assets, reducing operational costs over the long term, and enhancing their appeal in a market increasingly valuing sustainability. For example, British Land has committed to reducing its operational carbon emissions by 70% by 2030 and achieving net zero by 2040 across its whole value chain. While specific figures for individual retrofit projects’ immediate ROI are often not publicly detailed, the strategic imperative for decarbonisation is clear.

- Strategic Importance: Crucial for meeting 2030 net-zero targets and enhancing long-term asset value.

- Capital Expenditure: Involves substantial upfront investment with benefits realised over an extended period.

- Market Perception: Addresses growing demand for sustainable real estate, potentially improving tenant attraction and retention.

- Risk Mitigation: Reduces exposure to future carbon pricing and regulatory changes.

Strategic Acquisitions in Emerging Sub-sectors

British Land's strategic acquisitions in emerging sub-sectors represent potential "Question Marks" in their BCG Matrix. These ventures, while offering high growth prospects, currently hold a smaller market share and necessitate significant investment to mature. For instance, exploring niche areas like flexible workspace solutions or specialized logistics hubs could fit this category.

The company's active capital recycling strategy, exemplified by their disposal of mature assets to fund new ventures, signals a willingness to embrace these higher-risk, higher-reward opportunities. This approach allows them to pivot towards segments with greater future upside potential, even if their current market penetration is limited.

- Emerging Sub-sector Focus: British Land may target nascent real estate segments with strong growth forecasts, such as proptech-integrated urban logistics or specialized life sciences facilities.

- Investment Required: Significant capital will be needed to establish a foothold and scale operations in these new areas, potentially impacting short-term returns.

- Market Share Potential: While initial market share will be low, successful integration and development could lead to substantial future market dominance.

- Capital Recycling: Proceeds from selling established assets, like retail properties, can be strategically redeployed into these promising, albeit unproven, sub-sectors.

British Land's investments in new technologies, such as their exploration of citizen science apps for nature recovery and the use of geospatial tools for environmental monitoring, represent ventures with high potential but currently low market share. These initiatives require substantial upfront capital and strategic development to gain traction and establish a competitive advantage, fitting the "Question Mark" profile.

The company's commitment to deep retrofit and decarbonisation projects, aiming for net-zero carbon by 2040 across its value chain, involves significant capital expenditure without immediate market share gains. While essential for long-term asset value and meeting ESG targets, these projects are cash consumers in the short term.

Strategic acquisitions in emerging sub-sectors, like flexible workspace or specialized logistics, also fall into the Question Mark category. These areas offer high growth prospects but demand considerable investment to build market share, often funded by the disposal of mature assets.

British Land's Q1 2024 financial results showed a strong focus on their London portfolio, with significant development activity underway. For example, their urban logistics developments, like the Thurrock multi-storey site, are capital intensive and yet to establish significant returns, aligning with the Question Mark classification.

| Category | Description | Investment Focus | Market Position | Cash Flow |

|---|---|---|---|---|

| Urban Logistics Developments | Multi-storey facilities in London (e.g., Thurrock) | High Capital Expenditure, E-commerce Growth | Nascent, Low Market Share | Negative (Cash Consumer) |

| New Technologies/Innovation | Citizen science apps, geospatial tools | R&D, Sustainability Integration | Unproven, Low Market Share | Negative (Cash Consumer) |

| Deep Retrofit & Decarbonisation | Net-zero targets, ESG compliance | Portfolio Enhancement, Long-term Value | Operational, Not Market Share Driven | Negative (Cash Consumer) |

| Emerging Sub-sectors | Flexible workspace, specialized logistics | Strategic Acquisitions, Capital Recycling | Low Market Share, High Growth Potential | Negative (Cash Consumer) |

BCG Matrix Data Sources

Our British Land Company BCG Matrix is built on comprehensive data, integrating financial reports, property market analysis, and internal performance metrics to provide a clear strategic overview.