Brighthouse Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brighthouse Financial Bundle

Navigate the complex external landscape affecting Brighthouse Financial with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the insurance and annuities sector. Gain a strategic advantage by identifying opportunities and mitigating risks. Download the full PESTLE analysis now for actionable intelligence to inform your investment or business strategy.

Political factors

Governmental regulatory oversight changes present a significant dynamic for Brighthouse Financial. The Securities and Exchange Commission (SEC) and state insurance departments continually update rules impacting product development, sales, and compliance. For instance, in 2024, the SEC continued its focus on enhancing investor protection, potentially leading to more stringent disclosure requirements for annuity products, a core offering for Brighthouse.

Changes in U.S. tax laws, particularly concerning capital gains and the taxation of annuities, directly impact the appeal of Brighthouse Financial's offerings. For instance, shifts in how investment income within annuities is taxed can influence customer demand for these long-term savings vehicles.

Potential reforms to income taxation, including those affecting retirement accounts and estate taxes, could reshape how individuals perceive the value of life insurance and annuities for wealth transfer. These policy adjustments are critical considerations for Brighthouse's product development and marketing strategies.

New or enhanced consumer protection laws, especially those concerning suitability standards and disclosure requirements for financial advisors, directly impact Brighthouse Financial's product marketing and sales strategies. For instance, the SEC's Regulation Best Interest, implemented in 2020, requires financial professionals to act in the best interest of their retail customers when making recommendations, a shift that necessitates robust compliance frameworks.

Adherence to these evolving regulations is paramount for Brighthouse Financial to avoid significant penalties and, more importantly, to cultivate and maintain customer trust. Failure to comply can lead to hefty fines; for example, the Consumer Financial Protection Bureau (CFPB) has levied billions in penalties against financial institutions for consumer protection violations in recent years, underscoring the financial and reputational risks involved.

Political stability and its impact on long-term investments

Political stability in the United States directly impacts investor confidence, a critical factor for Brighthouse Financial's long-term growth. Periods of heightened political uncertainty, such as during election cycles or significant policy debates, can lead to market volatility. For instance, the 2024 US presidential election cycle, with its potential for shifts in fiscal and regulatory policies, could influence investor sentiment towards long-term financial products like annuities and life insurance.

This uncertainty can affect Brighthouse Financial's investment portfolios and customer willingness to commit to long-term financial planning. For example, changes in tax laws or capital gains regulations, which are often debated during election years, can alter the attractiveness of certain investment vehicles. In 2024, ongoing discussions around federal spending and national debt could contribute to market fluctuations, impacting the valuation of assets held by Brighthouse Financial.

The regulatory environment, shaped by political decisions, is also paramount. Changes in financial regulation, such as those impacting insurance solvency requirements or consumer protection laws, can directly affect Brighthouse Financial's operational costs and product offerings. The Biden administration's focus on financial sector oversight, continuing into 2024 and 2025, means that legislative and regulatory developments remain a key political consideration.

- Investor Confidence: Political stability fosters confidence, encouraging long-term investment in financial products.

- Market Volatility: Uncertainty can lead to market swings, impacting portfolio performance and customer behavior.

- Regulatory Landscape: Political decisions shape financial regulations, influencing operational costs and product design.

- Policy Debates: Discussions on fiscal policy and taxation can alter the appeal of financial instruments.

International trade agreements influencing global financial markets

While Brighthouse Financial primarily operates within the U.S., its investment portfolios are subject to global economic shifts influenced by international trade agreements. For instance, the renegotiation or implementation of major trade deals can introduce volatility into global markets, affecting asset valuations and interest rate environments that are crucial for life insurance and annuity products. The World Trade Organization’s (WTO) dispute settlement system, for example, plays a role in maintaining a degree of predictability in international commerce, indirectly supporting stable financial markets.

Disruptions in global supply chains, often exacerbated by trade disputes, can lead to inflation and impact consumer spending, which in turn affects demand for financial products. In 2024, ongoing geopolitical tensions and evolving trade relationships, such as those between major economic blocs, continue to create a dynamic landscape. For example, the European Union's trade policies and its agreements with countries like the United Kingdom and Canada create a framework that influences capital flows and investment opportunities accessible to companies like Brighthouse.

These international dynamics can influence the cost of capital and the availability of investment-grade assets. For example, changes in tariffs or trade barriers can alter the profitability of companies operating globally, impacting their creditworthiness and the attractiveness of their bonds within Brighthouse's investment holdings. The continued focus on digital trade agreements also presents new avenues and potential risks for financial services firms.

Key considerations include:

- Impact of Global Trade Volatility: Fluctuations in international trade can directly affect the performance of Brighthouse's diversified investment portfolio, which includes global equities and fixed income.

- Interest Rate Sensitivity: Global economic stability, often underpinned by trade agreements, influences central bank policies and interest rates, a critical factor for annuity product pricing and profitability.

- Supply Chain and Inflationary Pressures: Trade-related disruptions can contribute to inflation, impacting the real returns on investments and the cost of doing business.

- Emerging Market Opportunities and Risks: Evolving trade relationships with emerging economies present both opportunities for growth and risks associated with political and economic instability.

Governmental policies and regulatory shifts significantly shape Brighthouse Financial's operating environment. Changes in tax laws, particularly concerning retirement savings and investment income, directly influence product demand. For instance, potential adjustments to capital gains tax rates in 2024 or 2025 could alter the attractiveness of annuity products. Furthermore, evolving consumer protection regulations, such as those mandating enhanced suitability standards for financial products, necessitate ongoing compliance efforts and can impact sales strategies.

What is included in the product

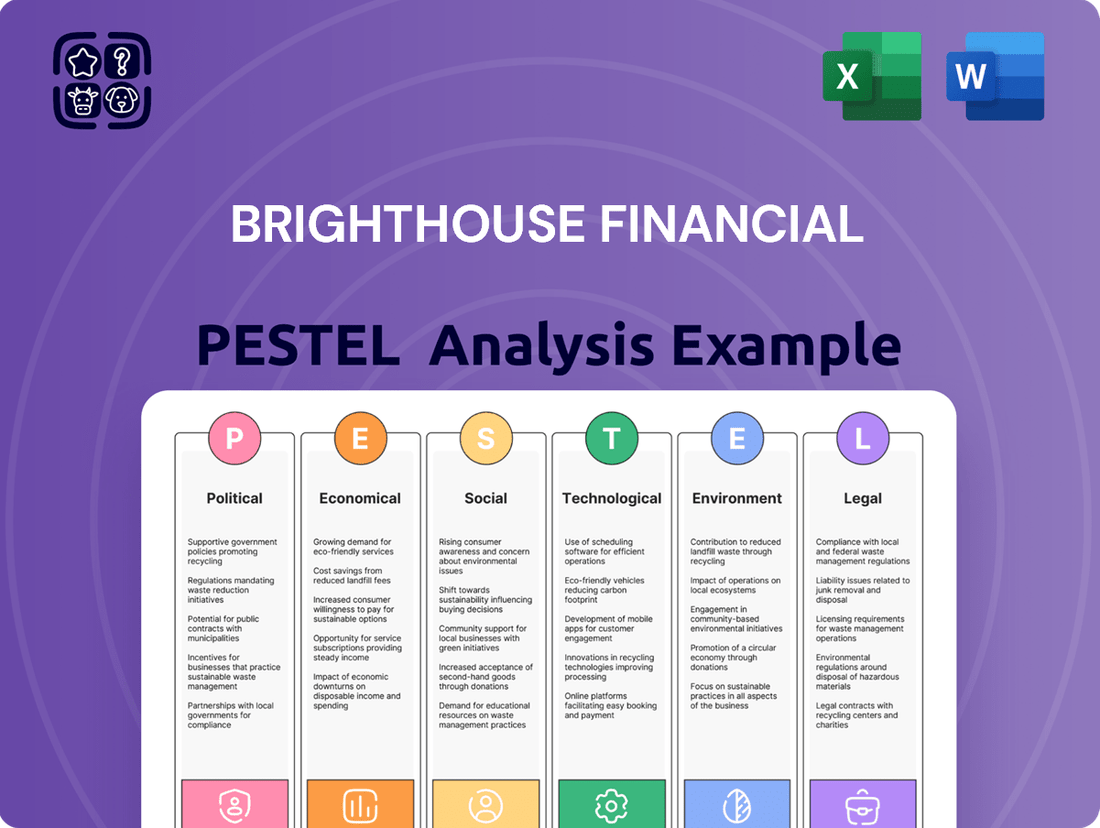

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Brighthouse Financial, offering a comprehensive understanding of its operating landscape.

A Brighthouse Financial PESTLE analysis acts as a pain point reliever by providing a clear, summarized version of the full analysis for easy referencing during meetings or presentations, enabling stakeholders to quickly grasp key external factors impacting the business.

Economic factors

Brighthouse Financial's annuity business is significantly influenced by interest rate fluctuations. In a low-rate environment, like the extended period seen through much of 2020-2021, investment income for insurers is compressed, making it harder to offer competitive guaranteed returns on annuities. This can directly impact profitability.

Conversely, rising interest rates, such as the Federal Reserve's aggressive hikes in 2022 and into 2023, can boost investment yields on new fixed-income assets. However, these rising rates also negatively affect the market value of existing bond portfolios, creating a dual impact that Brighthouse must navigate.

For example, the Federal Reserve's policy rate remained near zero until early 2022, with the federal funds rate at 0-0.25%. By mid-2023, it had climbed to 5.25-5.50%, illustrating the dramatic shift Brighthouse has had to manage in its investment strategy and product pricing.

Inflation directly impacts the purchasing power of Brighthouse Financial's future payouts. For instance, if inflation averages 3% annually, a $1,000 payout in 20 years would only have the equivalent purchasing power of about $553 today. This erosion of real value can make long-term products, like annuities, less attractive to customers concerned about maintaining their lifestyle.

Brighthouse Financial needs to actively manage this risk. In 2024, inflation remained a key concern globally, with the US CPI showing a year-over-year increase of 3.4% as of April 2024. This necessitates product design that may include inflation-adjusted features or clear communication about how product guarantees are structured to mitigate these effects.

During periods of robust economic expansion, such as the projected 2.3% GDP growth for the US in 2024, consumers tend to feel more secure about their financial futures. This increased confidence, coupled with higher disposable incomes, often translates into a greater willingness to invest in long-term savings vehicles like annuities and life insurance policies offered by companies like Brighthouse Financial.

Conversely, economic slowdowns or recessions present challenges. For instance, if inflation remains elevated and interest rates stay high, consumer spending power can be diminished. This economic pressure might lead individuals to delay purchasing new long-term financial products or, in some cases, surrender existing policies to meet immediate financial obligations, impacting Brighthouse Financial's new business volumes and retention rates.

Investment market volatility and asset valuation

Brighthouse Financial’s investment portfolio, crucial for backing its policyholder obligations, is highly sensitive to capital market performance. Fluctuations in equity and bond markets directly influence asset valuations, impacting the company's financial stability and its capacity to manage long-term commitments, particularly for variable annuity products.

For instance, during periods of elevated market turbulence, the valuation of these assets can decline sharply. Brighthouse Financial reported that as of the first quarter of 2024, a significant portion of its general account assets were invested in fixed income securities, which are susceptible to interest rate changes and credit spread widening. This exposure means that market downturns can directly affect the company's statutory surplus and risk-based capital ratios.

- Market Volatility Impact: Increased volatility in equity markets can lead to substantial unrealized losses on equity holdings within Brighthouse's investment portfolio.

- Interest Rate Sensitivity: Rising interest rates, while potentially beneficial for new investments, can decrease the market value of existing fixed-income assets held by the company.

- Asset Valuation Adjustments: Changes in market conditions necessitate periodic adjustments to asset valuations, which can affect reported earnings and statutory capital.

- Policyholder Guarantees: For variable annuity products, market performance directly impacts the value of guaranteed benefits, potentially increasing the company's liabilities if markets underperform.

Unemployment rates influencing premium payments and new policy sales

High unemployment rates can significantly impact Brighthouse Financial by straining existing policyholders' ability to maintain premium payments, potentially leading to policy lapses and reduced revenue. For instance, if unemployment rises, individuals may prioritize essential expenses over insurance premiums. This economic pressure directly affects Brighthouse's premium income stream.

Elevated unemployment also shrinks the pool of potential new customers actively seeking long-term financial security solutions like life insurance and annuities. As job security diminishes, consumers may postpone or forgo purchasing new financial products, thereby slowing down Brighthouse's new business growth and acquisition efforts.

- Impact on Premium Payments: Rising unemployment can lead to an increase in premium defaults as individuals face financial hardship.

- New Policy Sales: A weaker job market often correlates with lower consumer confidence and reduced demand for new insurance products.

- Economic Indicator: The unemployment rate is a key economic indicator that directly influences consumer spending and investment in financial services.

- 2024/2025 Outlook: While projections vary, many economists anticipate continued volatility in labor markets through 2024 and into 2025, posing ongoing challenges for the life insurance sector.

Economic growth directly influences consumer confidence and disposable income, impacting demand for Brighthouse Financial's products. For example, the US economy was projected to grow around 2.3% in 2024, which generally supports increased spending on financial services. However, persistent inflation, with US CPI at 3.4% year-over-year in April 2024, can erode purchasing power, making long-term commitments like annuities less appealing if not structured carefully.

Interest rate movements are critical for Brighthouse Financial, affecting both investment income and the valuation of existing assets. The Federal Reserve's aggressive rate hikes, moving the federal funds rate from near zero in early 2022 to 5.25-5.50% by mid-2023, created a challenging environment. While higher rates can boost yields on new investments, they simultaneously decrease the market value of existing bond portfolios.

Labor market conditions, such as unemployment rates, play a significant role in Brighthouse Financial's revenue. High unemployment can lead to policy lapses as individuals struggle to afford premiums, and it also reduces the pool of new customers. While specific 2024/2025 unemployment forecasts vary, continued labor market volatility is anticipated, presenting ongoing challenges for the sector.

Same Document Delivered

Brighthouse Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Brighthouse Financial PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this detailed report upon completing your purchase.

Sociological factors

The aging U.S. population is a substantial growth driver for retirement solutions. By 2030, all Baby Boomers will be 65 or older, a demographic shift creating immense demand for financial products that ensure stable income throughout retirement.

This trend directly fuels demand for annuities, particularly those offering guaranteed lifetime income, a core product for Brighthouse Financial. In 2024, the U.S. annuity market is projected to see continued strong growth as individuals prioritize financial security in their later years.

Generational differences significantly shape financial planning. For instance, a 2024 survey indicated that 65% of Gen Z and 58% of Millennials prioritize digital-first financial tools, contrasting with Baby Boomers who still lean towards in-person advice. This means Brighthouse Financial must offer robust digital platforms alongside traditional advisory services.

Risk tolerance also varies; younger generations may be more open to investment strategies with higher potential returns but also higher risk, while older generations often favor capital preservation. Brighthouse Financial's product development needs to reflect this spectrum, offering a range of investment vehicles suitable for different risk appetites.

Furthermore, financial literacy levels differ, with younger demographics often seeking more accessible educational content. Brighthouse Financial's marketing should therefore focus on clear, engaging content that demystifies financial planning and investment, utilizing channels preferred by each generation, such as social media for younger audiences and email for older ones.

Consumers are increasingly seeking out financial education, with a significant portion of adults reporting a desire to improve their financial knowledge. For instance, a 2024 survey indicated that over 60% of individuals want to learn more about managing their money and investments. This heightened awareness directly translates to a demand for user-friendly digital tools that offer transparency and simplify complex financial concepts.

The digital shift is undeniable, with a substantial majority of consumers now preferring online channels for banking and financial management. Brighthouse Financial needs to ensure its digital platforms are not only robust but also provide intuitive access to planning resources and educational content to cater to this preference. This includes offering interactive tools and personalized digital advice.

Shifting demographic trends and diversity in customer base

The U.S. population is becoming increasingly diverse, with significant growth in Hispanic and Asian populations. For instance, the Hispanic population is projected to reach 62 million by 2025, representing a substantial portion of potential customers. This evolving demographic landscape necessitates that Brighthouse Financial understand and cater to the unique financial needs and cultural preferences of these varied groups.

Tailoring financial products and marketing strategies to resonate with this diversity is key. By reflecting the varied ethnic and cultural backgrounds in their outreach, Brighthouse Financial can tap into new market segments. This approach not only expands their customer base but also cultivates deeper, more meaningful relationships by demonstrating an understanding of individual circumstances and aspirations.

- Growing Diversity: The U.S. Census Bureau projects continued growth in minority populations, particularly Hispanic and Asian Americans, by 2025.

- Targeted Needs: Different cultural groups may have distinct savings habits, investment preferences, and retirement planning expectations.

- Market Expansion: Embracing diversity in product development and marketing can unlock previously underserved market segments, driving revenue growth.

- Customer Loyalty: Authentic representation and tailored solutions foster trust and loyalty among a broader customer base.

Social attitudes towards long-term care and legacy planning

Societal views on who should bear the costs of long-term care are shifting, with an increasing expectation that individuals will plan for these expenses themselves. This evolving attitude directly impacts the demand for financial products designed to cover such needs, including life insurance and annuity options with built-in long-term care benefits. Brighthouse Financial can capitalize on this trend by highlighting its offerings that provide flexibility and security for aging populations, such as riders that allow access to death benefits for care needs.

The desire to leave a financial legacy remains a strong motivator for many, influencing decisions about life insurance and estate planning. As people live longer, they are more conscious of ensuring their assets are preserved and passed on according to their wishes. Brighthouse Financial can tailor its messaging and product features to resonate with this sentiment, emphasizing how its solutions can help secure both personal financial well-being during life and a lasting inheritance for beneficiaries. For instance, a 2024 survey indicated that over 70% of individuals aged 50 and above are actively engaged in planning for their retirement and legacy.

- Growing demand for hybrid long-term care solutions: Products combining life insurance death benefits with long-term care access are becoming more popular as individuals seek comprehensive coverage.

- Increased focus on financial preparedness for aging: Societal attitudes are shifting towards greater personal responsibility for funding extended care needs.

- Legacy planning remains a key driver: The desire to provide for future generations influences choices in life insurance and annuity products.

- Brighthouse Financial's opportunity: Offering robust long-term care riders and enhanced death benefit options aligns with these evolving social attitudes and market demands.

Societal expectations are increasingly placing the onus of long-term care costs on individuals, driving demand for financial products that address these needs. This shift favors solutions like annuities with built-in long-term care benefits, a growing market segment. Furthermore, the enduring desire to leave a financial legacy remains a significant motivator, with over 70% of individuals aged 50+ actively planning for retirement and legacy in 2024, influencing choices in life insurance and estate planning products.

| Sociological Factor | Trend Description | Impact on Brighthouse Financial | 2024/2025 Data Point |

|---|---|---|---|

| Aging Population & Retirement Needs | Baby Boomers, all 65+ by 2030, create immense demand for stable retirement income solutions. | Drives demand for annuities and guaranteed lifetime income products. | U.S. annuity market projected for continued strong growth in 2024. |

| Generational Financial Preferences | Younger generations (Gen Z, Millennials) favor digital-first tools, while older generations prefer in-person advice. | Requires Brighthouse Financial to offer robust digital platforms alongside traditional advisory services. | 65% of Gen Z and 58% of Millennials prioritize digital financial tools (2024 survey). |

| Diversity & Cultural Needs | The U.S. is becoming more diverse, with significant growth in Hispanic and Asian populations. | Necessitates tailoring financial products and marketing to unique needs and cultural preferences of varied groups. | Hispanic population projected to reach 62 million by 2025. |

| Long-Term Care Planning Attitudes | Societal view is shifting towards individuals bearing more responsibility for long-term care expenses. | Increases demand for life insurance and annuities with long-term care benefits. | Growing demand for hybrid long-term care solutions combining death benefits with LTC access. |

Technological factors

Brighthouse Financial is leveraging AI and advanced data analytics to sharpen its underwriting and claims processes. This technological push aims to speed up approvals and improve risk assessment accuracy, potentially leading to better pricing and reduced fraud. For instance, by mid-2024, the company was exploring AI-driven tools that could analyze vast datasets to identify subtle risk patterns previously missed by traditional methods.

The impact on operational efficiency is significant, with projections suggesting that AI could automate up to 40% of routine underwriting tasks by 2025. This not only frees up human underwriters for more complex cases but also promises a more personalized experience for customers. Faster claims handling, a key area for customer satisfaction, is also a major focus, with AI-powered systems expected to accelerate payout times by an average of 20% in the next 18 months.

Brighthouse Financial, like all financial institutions, navigates a landscape fraught with escalating cybersecurity threats. The constant evolution of these threats, from ransomware to sophisticated phishing attacks, demands continuous investment in advanced defense mechanisms to protect sensitive customer data.

Compliance with data protection regulations, such as GDPR and CCPA, adds another layer of complexity. For instance, the average cost of a data breach in 2024 reached $4.73 million, underscoring the substantial financial implications of non-compliance and security failures for companies like Brighthouse.

Maintaining customer trust hinges on demonstrating a strong commitment to data security. A significant breach could lead to severe reputational damage and a loss of customer confidence, impacting Brighthouse Financial's market position and long-term viability.

Brighthouse Financial must prioritize its digital sales and customer service channels due to a significant shift in consumer behavior. In 2024, a substantial majority of insurance customers expressed a preference for digital self-service options, indicating a clear demand for accessible online platforms. This trend necessitates investment in intuitive websites and mobile applications for product discovery, policy management, and customer support.

By enhancing its digital footprint, Brighthouse Financial can broaden its reach and improve customer engagement. For instance, the company reported a 15% year-over-year increase in digital policy inquiries during the first half of 2025. This expansion into digital channels offers a more cost-effective alternative to traditional sales methods, potentially leading to improved operational efficiency and a stronger competitive position in the evolving financial services landscape.

Blockchain and distributed ledger technology potential in insurance

Blockchain and distributed ledger technology (DLT) are poised to revolutionize the insurance industry by boosting transparency, security, and efficiency across the entire value chain. This includes everything from managing policies and processing claims to combating fraud. For instance, a 2024 report indicated that the global blockchain in insurance market was valued at approximately $2.5 billion and is projected to grow significantly, with some estimates reaching over $15 billion by 2030, highlighting the increasing adoption and potential impact of these technologies.

Brighthouse Financial should actively monitor and consider piloting these emerging technologies to secure a competitive edge. Early adoption could lead to streamlined operations and enhanced customer trust. For example, DLT can automate complex processes, reducing administrative costs and speeding up claim settlements, which is crucial in today's fast-paced market.

The potential applications are broad:

- Enhanced Policy Management: DLT can create immutable records of policy details, reducing disputes and administrative overhead.

- Streamlined Claims Processing: Smart contracts on a blockchain can automate claim payouts upon verification of predefined conditions, accelerating the process and minimizing fraud.

- Fraud Prevention: Shared, tamper-proof ledgers can help identify and prevent fraudulent activities by providing a single source of truth for policyholder and claim data.

Telemedicine and wearable tech influencing life insurance risk assessment

The increasing adoption of telemedicine and wearable devices is revolutionizing how health data is collected, offering Brighthouse Financial opportunities to enhance life insurance risk assessment. By leveraging this data, the company can potentially develop more accurate underwriting models and provide personalized premiums, making its offerings more attractive. For instance, a report from Statista in early 2024 indicated that the global telemedicine market was projected to reach over $200 billion by 2027, highlighting the significant growth and data generation potential.

Brighthouse Financial can explore strategic partnerships with telehealth providers or wearable technology companies. This integration could lead to innovative underwriting processes, allowing for a more dynamic and real-time evaluation of applicant health. Such a move would position Brighthouse to offer more competitive and customer-centric life insurance products in a rapidly evolving digital health landscape.

- Telemedicine Growth: The global telemedicine market is expected to exceed $200 billion by 2027, indicating a vast pool of accessible health data.

- Wearable Data Integration: Wearable devices, such as smartwatches, are becoming ubiquitous, with an estimated 1.1 billion wearable devices shipped globally in 2023.

- Personalized Premiums: Data from these sources can enable more granular risk segmentation, leading to fairer and more competitive pricing for policyholders.

- Underwriting Innovation: Brighthouse can leverage this technological shift to streamline underwriting and create a competitive advantage in the life insurance market.

Brighthouse Financial is actively integrating AI and advanced data analytics to refine its underwriting and claims processes, aiming for faster approvals and more precise risk assessments. By mid-2024, the company was exploring AI tools capable of analyzing extensive datasets to identify complex risk patterns, a significant leap from traditional methods.

The company recognizes the critical need to bolster its digital sales and customer service channels, driven by a strong consumer preference for self-service options observed in 2024. This necessitates investment in user-friendly online platforms to enhance customer engagement and broaden market reach, as evidenced by a 15% year-over-year increase in digital policy inquiries during the first half of 2025.

Emerging technologies like blockchain and distributed ledger technology (DLT) present opportunities to enhance transparency and efficiency in policy management and claims processing. The global blockchain in insurance market, valued at roughly $2.5 billion in 2024, is projected for substantial growth, indicating a strong trend towards adopting these innovations.

The increasing use of telemedicine and wearable devices offers Brighthouse Financial a chance to improve life insurance risk assessment by leveraging new health data sources. With the global telemedicine market projected to exceed $200 billion by 2027, integrating this data could lead to more accurate underwriting and personalized premiums, offering a competitive edge.

| Technology Area | Key Development/Impact | Data/Projection |

|---|---|---|

| AI & Data Analytics | Enhanced underwriting & claims processing | AI could automate 40% of routine underwriting by 2025 |

| Digital Channels | Improved customer engagement & reach | 15% YoY increase in digital policy inquiries (H1 2025) |

| Blockchain & DLT | Increased transparency & efficiency | Global blockchain in insurance market ~$2.5B (2024), projected growth |

| Telemedicine & Wearables | Advanced risk assessment & personalized premiums | Telemedicine market >$200B by 2027 |

Legal factors

Brighthouse Financial navigates a dual regulatory landscape, adhering to both state-specific insurance laws and federal guidelines, often influenced by National Association of Insurance Commissioners (NAIC) model laws. These frameworks dictate crucial aspects of its business, such as capital adequacy, consumer protection, and product approvals.

For instance, the NAIC's model laws on solvency and risk management provide a blueprint for state regulators, ensuring a baseline level of financial stability across the industry. Brighthouse Financial's 2023 annual report highlights significant investments in compliance and risk management systems to meet these evolving requirements, underscoring the critical nature of regulatory adherence for its ongoing operations and market reputation.

The evolving landscape of data privacy, exemplified by state laws like the California Consumer Privacy Act (CCPA) and the potential for federal legislation, significantly shapes how Brighthouse Financial manages customer information. Compliance with these regulations, which dictate data handling, storage, and usage, is paramount for avoiding substantial penalties and preserving customer confidence.

Consumer protection laws, such as the SEC's Regulation Best Interest, mandate that financial professionals act in their clients' best interests when recommending securities, including annuities. This means Brighthouse Financial must ensure its product recommendations are suitable and clearly disclose all fees and potential risks. Failure to comply can result in significant penalties and reputational damage.

Anti-money laundering (AML) and know-your-customer (KYC) compliance

Brighthouse Financial operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These legal frameworks are crucial for preventing financial crimes like money laundering and terrorist financing. For instance, in 2024, the Financial Crimes Enforcement Network (FinCEN) continued to emphasize the importance of robust KYC programs, with ongoing enforcement actions against financial institutions for non-compliance, underscoring the significant penalties for breaches.

Adherence to these laws necessitates substantial investment in internal controls and processes. This includes rigorous customer identification, ongoing transaction monitoring, and timely reporting of suspicious activities to regulatory bodies. The compliance burden, while significant, is essential for maintaining financial system integrity and Brighthouse Financial's reputation.

- Ongoing Regulatory Scrutiny: Financial regulators globally, including those in the US, are consistently updating and enforcing AML/KYC requirements.

- Cost of Compliance: Institutions like Brighthouse Financial allocate substantial resources annually to technology, training, and personnel dedicated to AML/KYC compliance.

- Data Integrity: Maintaining accurate and up-to-date customer information is paramount, with failures in KYC leading to significant fines and operational disruptions.

- International Standards: Compliance also extends to aligning with international standards set by bodies like the Financial Action Task Force (FATF).

Contract law and enforceability of insurance policies

The legal enforceability of Brighthouse Financial's insurance and annuity contracts is absolutely crucial for its operations. This means that clear policy language, proper execution, and effective dispute resolution are not just good practices, but legal necessities. Adhering to contract law principles ensures Brighthouse can meet its obligations and safeguard its interests.

In 2023, the insurance industry, including annuity providers like Brighthouse, continued to navigate a complex legal landscape. Regulatory scrutiny, particularly around consumer protection and contract clarity, remained high. For instance, state insurance departments actively review policy forms to ensure compliance with consumer protection laws, impacting contract design and enforceability.

- Contractual Clarity: Ensuring all policy terms and conditions are unambiguous is paramount to prevent legal challenges and disputes.

- Regulatory Compliance: Adherence to state and federal insurance regulations, including those related to contract disclosures and sales practices, is essential.

- Dispute Resolution: Implementing fair and efficient mechanisms for handling claims and policyholder grievances is vital for maintaining legal standing.

- Litigation Trends: Monitoring trends in insurance-related litigation, such as class-action lawsuits concerning policy provisions, informs Brighthouse's risk management.

Brighthouse Financial's operations are deeply intertwined with evolving consumer protection laws, such as Regulation Best Interest, requiring clear disclosures and suitability in product recommendations. The company must also navigate state-specific data privacy laws, like the CCPA, impacting how customer information is handled. Furthermore, robust Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, emphasized by FinCEN in 2024, necessitates significant investment in internal controls to prevent financial crimes and avoid substantial penalties.

The enforceability of Brighthouse Financial's contracts is a critical legal pillar, demanding unambiguous policy language and adherence to contract law principles. State insurance departments, in 2023, continued to scrutinize policy forms for compliance with consumer protection statutes, directly influencing contract design and legal standing. This regulatory oversight underscores the need for meticulous attention to contractual clarity and dispute resolution mechanisms.

Environmental factors

Investor and consumer awareness regarding environmental, social, and governance (ESG) factors continues to surge, directly impacting financial services. This growing demand for ESG-compliant investments means companies like Brighthouse Financial are increasingly expected to align their strategies with these principles.

For Brighthouse Financial, this translates into potential pressure to integrate ESG criteria into its investment methodologies and product offerings. Failing to adapt could mean missing out on a significant and growing segment of socially conscious investors. For instance, global sustainable investment assets reached $37.8 trillion in early 2024, demonstrating the sheer scale of this market shift.

Climate change presents significant risks to Brighthouse Financial's investment portfolios, especially those heavily weighted in real estate and infrastructure. Physical risks, like extreme weather events, can directly damage or devalue these assets. For instance, the increasing frequency of hurricanes and rising sea levels pose substantial threats to coastal properties and infrastructure, potentially leading to significant capital losses.

Transition risks, stemming from the shift to a lower-carbon economy, also impact investments. Companies heavily reliant on fossil fuels or carbon-intensive processes may face regulatory changes, technological disruptions, and shifts in consumer preferences, all of which can negatively affect their market value and, consequently, Brighthouse's holdings. For example, a 2024 report indicated that infrastructure projects with high carbon footprints could see their valuations decrease by up to 20% by 2030 due to anticipated carbon pricing mechanisms.

Effectively assessing and mitigating these climate-related financial risks is crucial for Brighthouse Financial. This involves understanding the specific vulnerabilities of its real estate holdings to physical climate impacts and evaluating the transition risk exposure of its infrastructure and industrial investments. Proactive risk management strategies are essential to safeguard portfolio value in a changing climate.

Stakeholders, including investors and employees, are increasingly scrutinizing the environmental footprint of corporations. For Brighthouse Financial, this means a growing expectation to demonstrate concrete actions towards sustainability.

Brighthouse Financial may need to implement initiatives to reduce its operational carbon emissions, improve energy efficiency, and promote sustainability within its corporate practices. For example, many companies are setting targets for renewable energy usage and waste reduction, aiming to align with broader environmental expectations and investor demands for Environmental, Social, and Governance (ESG) performance.

Increased scrutiny on corporate environmental responsibility

There's a significant uptick in public and regulatory demands for financial firms like Brighthouse Financial to prove their environmental commitment extends beyond their investment holdings. This means being upfront about their own operational environmental footprint.

This heightened focus encompasses transparent reporting on environmental impacts, adopting green building certifications for their office spaces, and implementing robust waste management practices. These actions directly shape Brighthouse Financial's corporate reputation and public perception.

- 2024: Over 60% of surveyed investors indicated that a company's environmental, social, and governance (ESG) performance influences their investment decisions.

- 2025 Projections: Anticipated regulatory frameworks in major markets will likely mandate more detailed environmental impact disclosures for financial institutions.

- Operational Focus: Brighthouse Financial, like its peers, is increasingly evaluating its own carbon emissions from office operations and business travel.

- Stakeholder Expectations: Customers and employees are also voicing stronger preferences for environmentally conscious corporate practices.

Impact of natural disasters on claims and underwriting in specific regions

While Brighthouse Financial primarily focuses on life insurance and annuities, severe natural disasters, increasingly linked to climate change, can pose indirect risks. For instance, widespread economic disruption following a major hurricane or wildfire could affect policyholders' ability to pay premiums, impacting Brighthouse's revenue streams.

The increasing frequency and intensity of events like the 2023 Atlantic hurricane season, which saw 20 named storms, highlight a growing concern. Such events can lead to broader economic downturns, potentially affecting investment portfolios and the financial health of policyholders, which in turn could indirectly impact Brighthouse through reduced demand for its products or increased policy lapses.

Although Brighthouse is not a direct property insurer, catastrophic events in highly populated regions could theoretically lead to an uptick in mortality claims, particularly if such disasters overwhelm emergency services or cause widespread infrastructure collapse. For example, the economic fallout from events like the 2024 California wildfires, which caused billions in damages, can have ripple effects across various financial sectors.

- Economic Disruption: Severe weather events can disrupt local and national economies, affecting policyholder income and their capacity to maintain insurance coverage.

- Investment Portfolio Impact: Broader economic instability caused by natural disasters can negatively affect the performance of Brighthouse's investment portfolios.

- Mortality Risk: While indirect, a significant increase in the frequency and severity of catastrophic events could, in extreme scenarios, lead to higher mortality claims.

- Underwriting Adjustments: Over time, insurers may need to adjust underwriting practices and pricing in regions with demonstrably higher climate-related risks.

Environmental factors present both risks and opportunities for Brighthouse Financial, driven by increasing stakeholder awareness and the tangible impacts of climate change. The growing demand for ESG-compliant investments, with global sustainable investment assets reaching $37.8 trillion in early 2024, underscores the market's shift. Climate change itself poses physical risks to assets like real estate and transition risks from the move to a low-carbon economy, potentially impacting Brighthouse's investment portfolios.

Brighthouse Financial faces pressure to demonstrate its own environmental commitment, beyond its investments. This includes reducing operational carbon emissions and improving energy efficiency, with over 60% of surveyed investors in 2024 stating ESG performance influences their decisions. Anticipated 2025 regulatory frameworks will likely mandate more detailed environmental impact disclosures for financial institutions.

| Environmental Factor | Impact on Brighthouse Financial | Data Point/Trend |

|---|---|---|

| Climate Change (Physical Risks) | Devaluation of real estate and infrastructure assets due to extreme weather. | Increasing frequency of hurricanes and rising sea levels. |

| Climate Change (Transition Risks) | Reduced value of investments in carbon-intensive industries. | High carbon footprint infrastructure projects could see valuations decrease by up to 20% by 2030. |

| Stakeholder Demand for ESG | Pressure to integrate ESG into investment strategies and operations. | Over 60% of surveyed investors in 2024 cited ESG performance as an investment influence. |

| Operational Footprint | Need to reduce carbon emissions and improve sustainability in corporate practices. | Anticipated 2025 regulations may mandate more detailed environmental disclosures. |

| Extreme Weather Events (Indirect) | Economic disruption affecting policyholder ability to pay premiums. | 2023 Atlantic hurricane season had 20 named storms, highlighting increased event frequency. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Brighthouse Financial is built on data from official government publications, leading financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.