Brighthouse Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brighthouse Financial Bundle

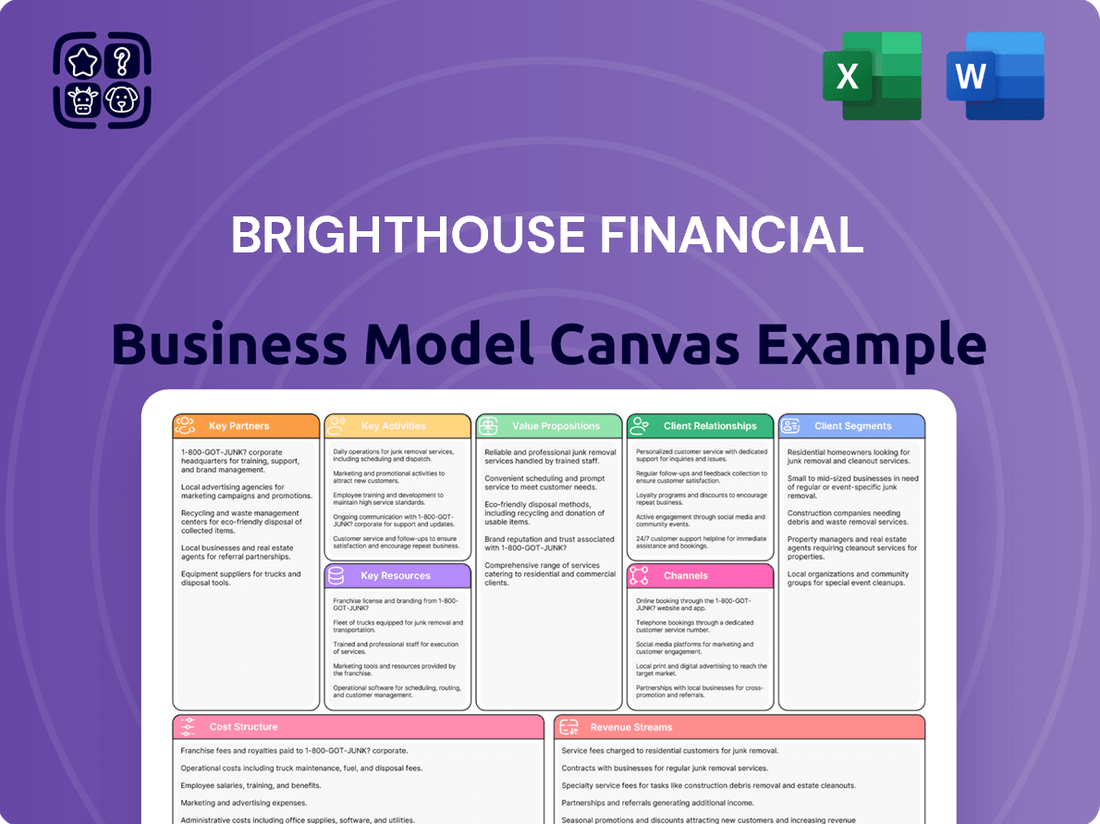

Unlock the strategic blueprint of Brighthouse Financial's business model. This comprehensive Business Model Canvas dissects how they create and deliver value, manage customer relationships, and generate revenue in the competitive financial services industry. Discover their key resources, activities, and partnerships.

Dive deeper into Brighthouse Financial's operational strategy with the complete Business Model Canvas. This downloadable resource offers a clear, section-by-section breakdown of their value propositions, customer segments, and cost structure, providing actionable insights for your own business planning.

Want to understand how Brighthouse Financial thrives? Our full Business Model Canvas provides a detailed, editable look at their revenue streams, cost drivers, and competitive advantages, perfect for strategic analysis and benchmarking.

Partnerships

Brighthouse Financial leverages a vast network of independent distribution partners, including financial advisors, broker-dealers, and various agent groups. This strategy is fundamental to their business model, enabling them to connect with a wide range of potential customers for their annuity and life insurance offerings. In 2023, Brighthouse reported that approximately 93% of their new business premiums came from these third-party channels, highlighting the critical role of these partnerships in their sales and client acquisition efforts.

Brighthouse Financial's key partnerships with major reinsurers like Munich Re and Swiss Re are foundational to its business model. These alliances are critical for effectively managing and offloading the significant risks inherent in its substantial portfolio of annuity and life insurance contracts.

These reinsurance agreements allow Brighthouse to maintain optimal capital efficiency and control its overall risk exposure. For instance, in 2023, the company reported that its reinsurance arrangements contributed to a reduction in its risk-weighted assets, thereby enhancing its financial flexibility.

Brighthouse Financial collaborates with leading asset management firms, such as BlackRock, to broaden its investment offerings and strengthen its product portfolio. This strategic alliance is particularly evident in products like LifePath Paycheck, which benefits from BlackRock's extensive investment management expertise.

Technology and Software Vendors

Brighthouse Financial relies heavily on technology and software vendors to drive its digital initiatives and streamline operations. Key partners like Salesforce provide customer relationship management capabilities, enhancing client engagement and service delivery. In 2023, Salesforce reported approximately $34.9 billion in revenue, underscoring the scale of technology investments made by companies like Brighthouse.

Amazon Web Services (AWS) is another critical partner, offering cloud infrastructure that supports Brighthouse's platforms for product distribution and customer support. This allows for scalability and agility in their digital offerings. AWS continues to be a dominant force in cloud computing, with its revenue reaching $90.8 billion in 2023, highlighting the foundational role of such partnerships.

These collaborations are essential for maintaining and evolving Brighthouse's technological backbone. They ensure the company can adapt to market changes and deliver innovative solutions to its customers.

- Salesforce: Powers customer relationship management and enhances client interaction.

- AWS: Provides scalable cloud infrastructure for digital platforms.

- Digital Transformation: These partnerships are crucial for modernizing services and improving efficiency.

- Operational Efficiency: Vendors enable robust platforms for product delivery and customer support.

Institutional Collaborations

Brighthouse Financial strategically leverages institutional collaborations to broaden its market presence. A prime example is its partnership with BlackRock for the LifePath Paycheck product, specifically designed for defined contribution plans. This alliance allows Brighthouse to access a significant new customer base and distribution channels within the retirement savings market.

These key partnerships are crucial for Brighthouse Financial's growth strategy, enabling access to broader distribution networks and new customer segments. By aligning with established institutions, Brighthouse can effectively reach individuals seeking retirement income solutions.

- BlackRock Collaboration: Partnership with BlackRock for LifePath Paycheck targets defined contribution plans, expanding Brighthouse's reach into the retirement market.

- Market Access: These alliances provide access to new customer segments and distribution channels, enhancing market penetration.

- Growth Strategy: Institutional collaborations are a core component of Brighthouse's strategy to drive growth and expand its service offerings.

Brighthouse Financial's distribution network is heavily reliant on independent financial advisors and broker-dealers, with approximately 93% of its new business premiums in 2023 originating from these third-party channels. This demonstrates the critical nature of these relationships for client acquisition and sales success.

Strategic reinsurance partnerships with firms like Munich Re and Swiss Re are essential for managing the substantial risks associated with Brighthouse's annuity and life insurance portfolios. These collaborations help maintain capital efficiency and control risk exposure, as evidenced by a reduction in risk-weighted assets in 2023 due to these arrangements.

Collaborations with asset management leaders such as BlackRock, particularly for products like LifePath Paycheck, enhance Brighthouse's investment offerings and expand its reach into the defined contribution plan market. This strategic alliance leverages BlackRock's expertise to tap into new customer bases.

Technology vendors like Salesforce and AWS are vital partners, supporting Brighthouse's digital transformation and operational efficiency. Salesforce powers customer relationship management, while AWS provides scalable cloud infrastructure, both crucial for modernizing services and enhancing client support.

| Partner Type | Key Partners | 2023 Data/Impact |

|---|---|---|

| Distribution | Independent Financial Advisors, Broker-Dealers | 93% of new business premiums |

| Reinsurance | Munich Re, Swiss Re | Risk management, capital efficiency |

| Asset Management | BlackRock | LifePath Paycheck product, DC plan market access |

| Technology | Salesforce, AWS | CRM, cloud infrastructure, digital initiatives |

What is included in the product

This Business Model Canvas outlines Brighthouse Financial's strategy for providing life insurance and annuity products, focusing on its customer segments, value propositions, and key partnerships.

It details revenue streams and cost structures, reflecting their approach to managing risk and delivering financial security to policyholders.

Brighthouse Financial's Business Model Canvas effectively relieves pain points by offering a clear, one-page snapshot of their core components, simplifying complex financial strategies for easier understanding and communication.

Activities

Brighthouse Financial's key activities center on the ongoing creation and refinement of its annuity and life insurance offerings. This includes products like the Shield Level Annuities and Brighthouse SmartCare, designed to address changing customer requirements and market trends.

A significant portion of their effort is dedicated to ensuring these products remain competitive and relevant in the financial landscape. This proactive approach to product evolution is crucial for sustained growth and customer satisfaction.

Brighthouse Financial actively manages a significant investment portfolio, aiming to generate robust returns while carefully mitigating market risks. This is crucial for meeting their long-term obligations to policyholders.

Sophisticated hedging strategies are a cornerstone of their operations, designed to protect against adverse market movements. For instance, in 2023, the company reported net investment income of $11.2 billion, demonstrating the scale of their asset management efforts.

Their approach includes active portfolio optimization, rebalancing assets to align with market conditions and risk appetites. This dynamic management is essential for ensuring financial stability and the long-term viability of the company’s product offerings.

Brighthouse Financial's sales and distribution management is centered on nurturing its vast network of independent financial advisors and broker-dealers. This is crucial for driving sales and reaching more customers. In 2023, the company continued to invest in its distribution partners, offering training and marketing resources to ensure they are well-equipped to present Brighthouse products.

Maintaining robust relationships with these partners is paramount. This includes providing ongoing support and ensuring they have the tools and information needed to effectively serve their clients. For instance, Brighthouse's commitment to its distribution channels is reflected in its consistent engagement through various partner programs and events designed to foster collaboration and knowledge sharing.

Risk and Capital Management

Brighthouse Financial actively manages a range of financial risks, including market fluctuations, credit quality of its investments, and the potential for higher-than-expected insurance claims. This proactive approach is crucial for safeguarding the company's financial health and ensuring it can meet its obligations to policyholders.

Maintaining a strong capital position is paramount. For instance, in the first quarter of 2024, Brighthouse Financial reported a strong Risk-Based Capital (RBC) ratio, a key indicator of its ability to absorb unexpected losses. This robust capital buffer is essential for regulatory compliance and long-term solvency.

- Market Risk Management: Brighthouse employs strategies to mitigate losses arising from adverse movements in interest rates, equity prices, and other market factors affecting its investment portfolio.

- Credit Risk Mitigation: The company carefully assesses and manages the creditworthiness of its fixed-income investments to minimize the risk of default by issuers.

- Insurance Risk Control: Through sophisticated actuarial modeling and pricing, Brighthouse manages the risks associated with mortality, morbidity, and policyholder behavior.

- Capital Adequacy: Brighthouse consistently monitors and maintains its capital levels, aiming to exceed regulatory minimums and ensure financial resilience.

Customer Service and Policy Administration

Brighthouse Financial's customer service and policy administration are critical for retaining its customer base. This involves ongoing support for policyholders and the efficient management of insurance policies and annuity contracts. Key functions include processing claims, making policy adjustments, and responding to customer inquiries to foster strong, lasting relationships.

In 2024, a significant focus for Brighthouse Financial was enhancing its digital platforms to streamline policy administration and customer interactions. This initiative aims to improve response times and provide more self-service options for policyholders.

- Policyholder Support: Providing continuous assistance and information to individuals holding life insurance and annuity products.

- Claims Processing: Efficiently managing and settling claims submitted by beneficiaries or contract holders.

- Policy Adjustments: Facilitating changes to existing policies, such as updating beneficiaries or coverage amounts.

- Customer Inquiry Resolution: Addressing and resolving policyholder questions and concerns promptly and effectively.

Brighthouse Financial's key activities encompass product development, investment management, risk management, and distribution. The company focuses on creating and refining annuity and life insurance products, managing a substantial investment portfolio to generate returns, and employing sophisticated strategies to mitigate market and insurance risks. Furthermore, they actively manage their sales channels through relationships with financial advisors and broker-dealers, alongside robust customer service and policy administration.

In 2023, Brighthouse Financial reported net investment income of $11.2 billion, highlighting the scale of their investment management activities. The company also emphasizes maintaining strong capital positions, evidenced by its robust Risk-Based Capital (RBC) ratio in Q1 2024, crucial for meeting obligations and regulatory requirements.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Product Development & Refinement | Creating and updating annuity and life insurance offerings. | Continued investment in distribution partners for product presentation. |

| Investment Management | Managing a large investment portfolio for returns and risk mitigation. | Net investment income of $11.2 billion in 2023. |

| Risk Management | Mitigating market, credit, and insurance risks. | Strong RBC ratio reported in Q1 2024. |

| Sales & Distribution | Nurturing relationships with financial advisors and broker-dealers. | Focus on training and marketing resources for distribution partners. |

| Customer Service & Policy Administration | Supporting policyholders and managing contracts efficiently. | Enhancing digital platforms for streamlined administration in 2024. |

What You See Is What You Get

Business Model Canvas

The Brighthouse Financial Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive analysis, ready for your strategic planning needs.

Resources

Brighthouse Financial's significant financial capital, including holding company liquid assets and a robust risk-based capital (RBC) ratio, is a cornerstone resource. As of the first quarter of 2024, Brighthouse Financial reported a consolidated RBC ratio of 673%, demonstrating substantial financial strength that allows it to underwrite policies and manage its investment portfolio effectively.

This financial bedrock is crucial for Brighthouse Financial to meet its long-term obligations to policyholders and maintain market confidence. The company's ability to generate and hold substantial reserves, bolstered by its strong capital position, directly supports its operations as a major player in the life insurance and annuity market.

Brighthouse Financial's proprietary product portfolio, featuring innovations like Shield Level Annuities and Brighthouse SmartCare, serves as a crucial intellectual asset. These specialized offerings, designed to meet diverse consumer needs in retirement and long-term care, differentiate the company and attract targeted customer bases.

In 2024, Brighthouse Financial continued to emphasize its annuity and life insurance products, which form the core of its value proposition. The company's commitment to developing unique solutions, such as the SecureKey variable annuity, underscores its strategy to capture market share by offering distinct advantages over competitors.

Brighthouse Financial relies heavily on its experienced human capital, a diverse team encompassing actuaries, investment managers, and sales professionals. This skilled workforce is fundamental to the company's ability to design innovative products, effectively manage risk, and navigate complex market dynamics. For instance, in 2023, Brighthouse reported that over 1,000 employees held advanced designations, underscoring the depth of expertise within the organization.

The leadership team's strategic vision and operational acumen are equally vital. Their guidance ensures the effective execution of the company's strategy, driving growth and profitability. This expertise is crucial for maintaining competitive positioning in the financial services industry, where deep knowledge of regulations and market trends is paramount for success.

Advanced Technology Infrastructure

Brighthouse Financial’s advanced technology infrastructure is a cornerstone of its operations, encompassing robust and modern systems. This includes sophisticated digital platforms designed for seamless sales processes, efficient policy administration, and enhanced customer interactions, all vital for maintaining a competitive edge and delivering superior service.

These technological assets are critical for enabling efficient data management and processing, which directly impacts operational costs and service speed. In 2023, Brighthouse Financial reported significant investments in technology as part of its ongoing modernization efforts, aiming to improve scalability and customer experience.

- Digital Platforms: Facilitate end-to-end customer journeys from initial sales to ongoing policy management.

- Data Management: Ensures secure, accurate, and accessible information for analytics and decision-making.

- Operational Efficiency: Streamlines back-office processes, reducing manual intervention and errors.

- Competitive Advantage: Enables faster product development and more responsive customer service compared to less technologically advanced competitors.

Brand Reputation and Trust

Brand reputation and trust are paramount for Brighthouse Financial. A strong, recognizable brand name signifies reliability and financial security, acting as a powerful magnet for customers. This intangible asset is cultivated through years of dependable service and fulfilling promises, directly impacting customer acquisition and loyalty.

Building and maintaining this trust is an ongoing process. For instance, in 2024, customer satisfaction scores are a key metric. Brighthouse Financial's commitment to transparency and ethical practices underpins its reputation, making it a preferred choice in a competitive market.

- Brand Recognition: A well-established brand name like Brighthouse Financial reduces customer uncertainty.

- Customer Loyalty: Trust fosters repeat business and positive word-of-mouth referrals.

- Financial Security Perception: A strong reputation assures customers of the company's stability.

- Market Differentiation: Trust sets Brighthouse Financial apart from competitors, attracting a discerning clientele.

Brighthouse Financial's distribution channels, including its relationships with financial advisors and broker-dealers, are critical for reaching its target market. These partnerships provide access to a broad customer base seeking life insurance and annuity solutions. The company's ability to leverage these networks effectively is key to its sales volume and market penetration.

In 2024, Brighthouse Financial continued to strengthen its partnerships, focusing on advisors who serve the retirement and protection needs of their clients. This strategic focus ensures that its products are presented to the right audience by trusted professionals.

The company's established network of independent distributors and financial institutions is a vital asset. These channels facilitate the sale and servicing of Brighthouse Financial's diverse product offerings, from annuities to life insurance policies.

As of the first quarter of 2024, Brighthouse Financial reported that its total assets under management were approximately $241 billion, reflecting the scale of its operations and the trust placed in its investment capabilities by a wide range of clients and distribution partners.

| Distribution Channel | Key Characteristic | 2024 Focus |

|---|---|---|

| Financial Advisors | Trusted advisors providing tailored solutions | Strengthening relationships, product training |

| Broker-Dealers | Broad reach across diverse client segments | Expanding product placement, advisor support |

| Independent Banks | Access to banking customers seeking financial products | Developing tailored offerings, joint marketing initiatives |

Value Propositions

Brighthouse Financial's core value proposition centers on fostering long-term financial security for its customers. They achieve this by offering a suite of products, primarily annuities and life insurance, designed to protect accumulated wealth and ensure its longevity.

This focus translates into peace of mind for individuals and families, knowing their hard-earned assets are shielded and can provide for their future needs. For instance, in 2024, Brighthouse continued to emphasize its role in providing stable income streams through its annuity offerings, a critical component for retirement security.

Brighthouse Financial's Shield Level Pay Plus annuities offer a compelling value proposition: guaranteed lifetime income. This feature directly tackles a primary retirement concern, providing a predictable income stream that lasts for the rest of a customer's life, regardless of market performance.

This security is particularly valuable as individuals age and their financial needs become more stable. In 2024, with ongoing economic uncertainties, the appeal of a guaranteed income that cannot be outlived is amplified, offering peace of mind to those planning for or already in retirement.

Brighthouse Financial's Shield Level Annuity offers a compelling value proposition by providing downside protection coupled with growth potential. This is achieved through Registered Index-Linked Annuities (RILAs) that buffer against market downturns while allowing participation in market gains, up to a specified cap.

This dual benefit directly addresses the needs of investors who want to participate in market upside without being fully exposed to significant losses. For instance, in 2024, many investors sought strategies that could mitigate the impact of potential market corrections, making products like the Shield suite particularly attractive.

Customizable and Flexible Solutions

Brighthouse Financial offers a suite of customizable financial products, including variable annuities, fixed annuities, and life insurance. This adaptability allows individuals to align their investments with unique financial objectives and comfort levels with risk.

The company's approach emphasizes tailoring solutions, ensuring that policyholders can fine-tune their coverage and investment strategies. This flexibility is a cornerstone of their value proposition, catering to a broad spectrum of client needs.

For instance, in 2024, Brighthouse Financial's product development continued to focus on enhanced rider options and benefit features within their annuity and life insurance portfolios. These additions provide policyholders with greater control over their financial futures.

- Variable Annuities: Customizable income and death benefit options.

- Fixed Annuities: Guaranteed interest rates with flexible surrender charge periods.

- Life Insurance: Adjustable premiums and death benefits to match changing needs.

- Rider Options: Access to features like guaranteed minimum withdrawal benefits and long-term care riders.

Expertise and Stability

Brighthouse Financial leverages decades of industry knowledge, offering customers the confidence of stability and trusted expertise in insurance and retirement planning. This deep well of experience underpins their commitment to fulfilling long-term promises.

The company's robust financial foundation, demonstrated by its strong capital position, provides a tangible measure of this stability. For instance, as of the first quarter of 2024, Brighthouse Financial reported a strong adjusted shareholder equity, underscoring its financial resilience.

- Decades of Industry Experience: Accumulated knowledge in insurance and retirement solutions.

- Robust Financial Foundation: Strong capital reserves and financial stability.

- Customer Confidence: Assurance in the company's ability to meet future obligations.

- Trusted Expertise: Guidance through complex financial planning landscapes.

Brighthouse Financial's value proposition is anchored in providing financial security and peace of mind through its specialized annuity and life insurance products. They focus on helping customers build and protect wealth for the long term.

A key offering is guaranteed lifetime income through their annuities, addressing a critical retirement need for predictable cash flow. In 2024, this feature remained a significant draw for individuals seeking stability in their retirement years.

The company also offers products like Registered Index-Linked Annuities (RILAs) that provide downside protection while allowing participation in market gains, up to a cap. This strategy appeals to investors aiming to balance growth potential with risk mitigation.

Brighthouse Financial's commitment to customizable solutions, including variable and fixed annuities and life insurance, allows clients to tailor their financial strategies. This adaptability, enhanced by rider options, ensures products align with individual financial goals and risk tolerances.

| Product Type | Key Value Proposition | 2024 Focus/Data Point |

|---|---|---|

| Annuities (e.g., Shield Level Pay Plus) | Guaranteed lifetime income, retirement security | Continued emphasis on stable income streams for retirement planning. |

| Registered Index-Linked Annuities (RILAs) | Downside protection with market upside participation (capped) | Appealed to investors seeking to mitigate market downturn impact. |

| Variable Annuities | Customizable income and death benefit options | Enhanced rider options for greater policyholder control. |

| Fixed Annuities | Guaranteed interest rates, flexible surrender periods | Provided predictable growth for conservative investors. |

| Life Insurance | Adjustable premiums and death benefits | Flexibility to adapt to changing personal financial circumstances. |

Customer Relationships

Brighthouse Financial cultivates strong customer bonds through a dedicated network of financial advisors. These professionals offer personalized guidance, helping clients navigate complex product selections and manage their financial portfolios to meet specific goals.

This advisory approach ensures that customers receive tailored recommendations, aligning Brighthouse's offerings with their unique life stages and financial aspirations. For instance, in 2024, Brighthouse continued to emphasize its advisor-driven model, aiming to provide a human touch in an increasingly digital financial landscape.

Brighthouse Financial is committed to nurturing long-term customer loyalty through consistent policy servicing. This includes providing dedicated claims support and maintaining responsive customer service channels, ensuring policyholders feel supported at every stage of their contract life. For instance, in 2023, the company reported a customer satisfaction score of 88% for its claims handling process.

Brighthouse Financial is committed to enhancing consumer financial literacy. In 2024, they continued to invest in educational resources designed to simplify complex financial concepts. This dedication to empowering customers with knowledge fosters greater trust and solidifies long-term relationships.

Digital Engagement and Self-Service

Brighthouse Financial, while relying heavily on its advisor network, also utilizes digital channels to improve customer engagement. These platforms offer policyholders convenient access to information and self-service tools, streamlining interactions.

For instance, in 2023, Brighthouse reported a continued focus on digital transformation initiatives aimed at enhancing the customer experience. This includes investments in user-friendly online portals and mobile applications designed to provide policyholders with greater control and transparency over their accounts.

- Digital Access: Policyholders can access account information, policy documents, and manage certain aspects of their coverage online.

- Self-Service Tools: Features like online premium payments and beneficiary updates are available, reducing reliance on direct advisor contact for routine tasks.

- Information Hub: Digital platforms serve as a resource for educational materials and frequently asked questions, empowering customers with knowledge.

Building Trust and Reliability

Brighthouse Financial prioritizes building deep trust and reliability with its customers. This commitment is demonstrated through consistent delivery on promises and a strong emphasis on financial strength, essential for fostering long-term loyalty in the financial services sector.

- Customer Trust: Building trust is paramount, especially in financial services where customers entrust companies with their future security.

- Reliability in Action: Brighthouse Financial aims to be a reliable partner, consistently meeting policyholder obligations and providing dependable service.

- Financial Strength as a Pillar: Maintaining robust financial health, evidenced by strong capital reserves and credit ratings, underpins this reliability. For instance, as of the first quarter of 2024, Brighthouse Financial reported a strong statutory surplus.

- Long-Term Loyalty: This focus on trust and reliability is the bedrock for cultivating enduring customer relationships and ensuring sustained business growth.

Brighthouse Financial's customer relationships are built on a foundation of personalized advice delivered through a network of financial advisors. This human-centric approach ensures tailored solutions for clients' unique financial journeys, with a continued emphasis in 2024 on blending this personal touch with digital accessibility.

The company also fosters loyalty through dependable policy servicing, including efficient claims support and accessible customer service channels, as highlighted by their 88% customer satisfaction score for claims handling in 2023. Furthermore, Brighthouse actively enhances financial literacy in 2024 through educational resources, aiming to build greater customer trust and long-term engagement.

| Relationship Aspect | 2023 Data | 2024 Focus |

|---|---|---|

| Advisor-Driven Model | Continued emphasis on personalized guidance | Enhancing advisor training and digital tools |

| Customer Satisfaction (Claims) | 88% | Maintaining high service standards |

| Digital Engagement | Investment in user-friendly portals and mobile apps | Expanding self-service capabilities |

| Financial Literacy Initiatives | Ongoing investment in educational resources | Simplifying complex financial concepts for consumers |

Channels

Independent financial advisors are a cornerstone for Brighthouse Financial, serving as the primary conduit for distributing their annuity and life insurance offerings. This vast network allows Brighthouse to connect directly with individual and family clients, ensuring broad market penetration. In 2024, the independent advisor channel remained crucial, reflecting the ongoing trust consumers place in personalized financial guidance.

Brighthouse Financial leverages extensive broker-dealer networks to get its annuity and life insurance products into the hands of more customers. This strategy is crucial for reaching a broad spectrum of financial advisors and their clients across the United States.

These partnerships are vital for Brighthouse's growth, allowing them to tap into established distribution channels and expand their market reach significantly. In 2023, Brighthouse reported total revenues of $17.9 billion, with a substantial portion of this driven by sales through these intermediary relationships.

Brighthouse Financial utilizes partnerships with banks and other financial institutions to broaden its product distribution. This strategy allows them to tap into customer bases that are already engaged with these traditional financial channels, enhancing their market reach.

In 2024, the financial services industry continued to see significant collaboration. For instance, many wealth management firms and banks are actively seeking to integrate annuity products into their offerings to provide clients with more comprehensive retirement solutions. This trend underscores the value Brighthouse places on these relationships.

Digital Platforms for Financial Professionals

Brighthouse Financial leverages digital platforms designed to simplify complex products like annuities for financial professionals. These platforms are crucial for streamlining the sales process, offering advisors efficient tools and enhanced accessibility. For instance, in 2024, the company continued to invest in its digital advisor experience, aiming to reduce onboarding time and improve client proposal generation.

These digital solutions are central to Brighthouse Financial's strategy for empowering its distribution partners. They provide a more integrated and user-friendly environment for managing client needs and product offerings.

- Streamlined Annuity Integration: Digital tools facilitate the seamless integration and presentation of annuity products, making them easier for advisors to understand and sell.

- Enhanced Advisor Efficiency: Platforms offer quick access to product information, illustrations, and application processing, saving valuable time for financial professionals.

- Improved Client Engagement: Digital capabilities enable advisors to present proposals and manage client portfolios more effectively, leading to better client experiences.

- Data-Driven Insights: The platforms often provide analytics and reporting, allowing advisors to track performance and identify opportunities.

Worksite and Institutional

Brighthouse Financial is expanding its reach through worksite and institutional channels. This strategic move aims to tap into the growing market of employees participating in defined contribution plans.

A key aspect of this expansion is the partnership with entities like BlackRock, specifically with products such as LifePath Paycheck. This collaboration allows Brighthouse to offer its solutions directly to employees via their employer-sponsored retirement accounts.

This strategy significantly broadens Brighthouse Financial's distribution network, providing access to a large and often underserved segment of the population seeking retirement income solutions.

- Worksite Channel Expansion: Brighthouse is actively developing its presence in the worksite market.

- Institutional Partnerships: Collaborations with institutions like BlackRock are central to this strategy.

- Product Distribution: Accessing employees through defined contribution plans is a primary goal.

- Market Reach: This approach targets a substantial employee base seeking retirement income products.

Brighthouse Financial utilizes a multi-channel distribution strategy to reach a diverse customer base. Independent financial advisors and broker-dealer networks form the backbone of their distribution, facilitating sales of annuities and life insurance. Partnerships with banks and financial institutions further broaden their market penetration, while digital platforms are crucial for enhancing advisor efficiency and client engagement. The company is also expanding into worksite and institutional channels, notably through collaborations like the one with BlackRock for LifePath Paycheck, to access employees within employer-sponsored retirement plans.

| Channel | Key Strategy | 2024 Focus/Data Point |

|---|---|---|

| Independent Financial Advisors | Direct sales of annuities and life insurance | Remains crucial for personalized financial guidance |

| Broker-Dealer Networks | Broad market reach through established relationships | Key for accessing a wide spectrum of advisors and clients |

| Banks & Financial Institutions | Leveraging existing customer bases | Integrating annuity products into wealth management offerings |

| Digital Platforms | Streamlining sales processes, enhancing advisor tools | Investment in digital advisor experience for efficiency |

| Worksite & Institutional | Accessing employees via retirement plans | Partnerships like BlackRock's LifePath Paycheck |

Customer Segments

Pre-retirees and retirees represent a core customer base for Brighthouse Financial, with a strong emphasis on securing stable income and protecting their accumulated assets. This demographic actively seeks financial products, particularly annuities, designed to provide guaranteed income streams and mitigate the risks associated with outliving their savings, a key concern as lifespans extend.

In 2024, the demand for retirement income solutions remains robust, driven by an aging population. For instance, Brighthouse Financial's annuity sales reflect this trend, with a significant portion of their business catering to individuals aged 50 and above who prioritize capital preservation and predictable income in their post-working years.

Brighthouse Financial offers life insurance solutions designed for families and individuals who want to secure their loved ones' financial future. These policies provide essential death benefits, offering a financial safety net during difficult times.

For this segment, the primary focus is on ensuring that beneficiaries receive financial support, covering expenses like mortgages, education, and daily living costs. Many also look for policies that can address potential long-term care needs, providing a dual layer of protection.

In 2024, the life insurance industry continues to see strong demand. For instance, a significant portion of households still rely on life insurance to protect their families, with many policies in force across the United States, reflecting the ongoing importance of this financial tool.

Financial advisors and brokerage firms are essential partners for Brighthouse Financial, acting as the primary channel through which their products reach individual investors. These professionals are not end-users themselves, but their trust and engagement are paramount for Brighthouse's market penetration and sales success.

Maintaining robust relationships with this segment is crucial for Brighthouse to effectively distribute its annuity and life insurance solutions. For instance, in 2023, Brighthouse reported that a significant portion of its new business premiums were generated through its network of financial intermediaries, underscoring their vital role.

Institutional Clients

Brighthouse Financial is actively broadening its appeal to institutional clients, particularly focusing on defined contribution plans. This strategic push aims to capture a larger share of the retirement savings market.

A key product facilitating this expansion is BlackRock's LifePath Paycheck, which offers a structured approach to retirement income. This initiative signals a significant growth opportunity for Brighthouse.

- Targeting Defined Contribution Plans: Brighthouse is enhancing its offerings for employers managing retirement plans for their employees.

- Strategic Partnership with BlackRock: Leveraging products like LifePath Paycheck demonstrates a commitment to providing robust retirement solutions.

- Growth Potential in Institutional Segment: This segment is identified as a crucial area for future revenue and market presence expansion.

- Focus on Retirement Income Solutions: The company is positioning itself as a provider of reliable income streams for retirees.

Mass Affluent and High-Net-Worth Individuals

Brighthouse Financial specifically targets mass affluent and high-net-worth individuals. These clients typically possess substantial financial assets and seek advanced financial planning services. The company offers them sophisticated products like variable and structured annuities, alongside comprehensive life insurance policies designed to meet complex wealth management needs.

For these discerning customers, Brighthouse Financial emphasizes tailored solutions. Their product suite is crafted to address the intricate requirements of individuals with significant portfolios, often involving estate planning, wealth transfer, and long-term financial security. This focus on customization is key to serving clients who demand more than standardized financial products.

- Target Demographic: Mass affluent and high-net-worth individuals.

- Product Focus: Variable and structured annuities, comprehensive life insurance.

- Client Needs: Sophisticated financial planning, wealth management, estate planning.

- Value Proposition: Tailored and complex financial solutions for significant asset holders.

Brighthouse Financial serves multiple customer segments, including pre-retirees and retirees seeking stable income and asset protection, and families needing life insurance for financial security. Additionally, they partner with financial advisors and brokerage firms as a key distribution channel, and are expanding into institutional markets like defined contribution plans.

| Customer Segment | Key Needs | Brighthouse Offerings | 2024 Relevance |

|---|---|---|---|

| Pre-retirees & Retirees | Guaranteed income, asset protection | Annuities, retirement solutions | High demand for income solutions due to aging population |

| Families | Financial security for loved ones | Life insurance policies | Continued strong demand for family protection |

| Financial Advisors | Reliable products for clients | Annuities, life insurance distribution | Crucial channel for sales; significant new business premiums generated |

| Institutional Clients (DC Plans) | Retirement savings solutions | Structured income products (e.g., LifePath Paycheck) | Growing focus area for market expansion |

| Mass Affluent & High-Net-Worth | Sophisticated planning, wealth transfer | Variable/structured annuities, complex life insurance | Targeting clients with significant assets needing tailored solutions |

Cost Structure

Brighthouse Financial dedicates substantial resources to the research, development, and ongoing actuarial assessment of its annuity and life insurance products. These investments are fundamental to creating competitive offerings and accurately pricing risk.

In 2024, the company continued to emphasize innovation, with significant expenditures allocated to enhancing its product portfolio. For instance, the development of new variable annuity riders and the refinement of existing universal life products represent key areas of investment, directly impacting future revenue streams and market positioning.

Commissions paid to independent financial advisors and broker-dealers are a significant cost for Brighthouse Financial, representing a substantial portion of their distribution expenses. These commissions incentivize sales partners to offer Brighthouse's annuity and life insurance products to their clients.

In 2024, the company's selling, general, and administrative expenses, which include these distribution costs, were reported to be around $1.2 billion. This figure highlights the considerable investment Brighthouse makes in its sales network and market reach.

Beyond direct commissions, Brighthouse also incurs costs for marketing initiatives and sales support services. These expenses are crucial for brand building, product promotion, and providing resources to their distribution partners, ultimately driving product sales and revenue growth.

Operational and administrative expenses at Brighthouse Financial encompass a wide range of costs, including general corporate overhead, employee salaries (excluding sales commissions), and the upkeep of essential IT infrastructure. These are the fundamental costs of running the business day-to-day.

The company has demonstrated a commitment to disciplined expense management. For instance, in the first quarter of 2024, Brighthouse Financial reported adjusted non-interest expenses of $680 million, reflecting their ongoing efforts to control operational costs.

Claims and Benefits Payments

Claims and benefits payments represent the most significant cost for Brighthouse Financial, directly reflecting its core insurance and annuity business. These are variable costs, meaning they fluctuate based on the number of policyholders who pass away or annuitants who receive payouts. In 2023, Brighthouse reported total benefits and claims paid of $12.1 billion.

- Life Insurance Claims: The primary driver of this cost is the payout of death benefits to beneficiaries upon the death of a policyholder.

- Annuity Payouts: This includes payments to individuals who have purchased annuities, providing them with a stream of income during retirement.

- Policyholder Obligations: These payments are fundamental to the company's promise to its customers and are a direct cost of fulfilling those obligations.

- Impact on Profitability: Managing these payouts effectively is crucial for maintaining the company's financial health and profitability.

Investment Management and Hedging Costs

Brighthouse Financial incurs significant expenses managing its vast investment portfolio and executing sophisticated hedging strategies. These costs are crucial for minimizing exposure to market volatility.

These expenses include fees paid to external asset managers who oversee portions of the company's holdings, as well as the costs associated with acquiring and maintaining derivative instruments used for hedging. For instance, in 2023, Brighthouse reported $1.9 billion in net investment income, but managing this portfolio involves substantial operational and transactional costs.

- Asset Management Fees: Payments to third-party firms responsible for investment strategy and execution.

- Hedging Instrument Costs: Expenses related to derivatives like options and futures used to offset potential losses.

- Operational Costs: Internal resources dedicated to portfolio monitoring, risk analysis, and compliance.

Brighthouse Financial’s cost structure is heavily influenced by claims and benefits paid, which totaled $12.1 billion in 2023, reflecting its core insurance and annuity business. Significant investments in product development and actuarial assessments are also key, alongside substantial selling, general, and administrative expenses, including approximately $1.2 billion in distribution costs in 2024. The company also incurs considerable expenses managing its investment portfolio and executing hedging strategies.

| Cost Category | 2023/2024 Data | Significance |

| Claims and Benefits Paid | $12.1 billion (2023) | Core insurance and annuity payouts; variable cost. |

| Selling, General & Administrative (SG&A) | ~$1.2 billion (2024) | Includes distribution commissions, marketing, and sales support. |

| Product Development & Actuarial | Ongoing investment | Essential for competitive product offerings and risk pricing. |

| Investment & Hedging Costs | Significant operational/transactional costs | Managing portfolio and mitigating market volatility. |

Revenue Streams

Brighthouse Financial's core revenue generation hinges on annuity premiums and sales across a spectrum of offerings, including variable, fixed, and registered index-linked annuities. The company saw robust sales in 2023, with Shield Level Annuities, a key product line, notably contributing to this growth.

Brighthouse Financial generates significant revenue from the sale of various life insurance products. This includes traditional offerings like term, universal, and whole life insurance, as well as innovative hybrid products such as Brighthouse SmartCare, which combines life insurance with long-term care benefits.

The company has experienced consistent growth in its life insurance sales. For instance, in the first quarter of 2024, Brighthouse Financial reported total life insurance sales of $326 million, marking a 6% increase compared to the same period in the prior year, demonstrating a healthy demand for their life insurance solutions.

Brighthouse Financial generates significant revenue through investment income, derived from managing its substantial portfolio of premiums and reserves. This income encompasses interest earned on fixed-income securities, dividends from equities, and capital appreciation across various asset classes. For instance, as of the first quarter of 2024, Brighthouse Financial reported total investments of $222.5 billion, a testament to the scale of assets managed to produce these returns.

Management Fees and Rider Fees

Brighthouse Financial generates recurring revenue from management fees on its annuity products, especially variable annuities, and from fees associated with optional riders that policyholders select. These fees are a core component of their income stream.

In 2024, Brighthouse Financial's financial reports indicate that fees and other income, which encompass these management and rider fees, played a significant role in their earnings. For instance, in the first quarter of 2024, the company reported total revenue from fees and investment spread of $2.1 billion, highlighting the importance of these recurring charges.

- Management Fees: Charged as a percentage of assets under management for variable annuities, covering investment management and administrative costs.

- Rider Fees: Applied to optional benefits like guaranteed minimum withdrawal benefits (GMWBs) or guaranteed minimum income benefits (GMIBs), providing policyholders with enhanced guarantees.

- Recurring Revenue: These fees contribute to a stable and predictable income base, supporting ongoing operations and profitability.

Reinsurance Income

Brighthouse Financial generates revenue through reinsurance income, primarily from agreements where it assumes risk or manages existing blocks of business for other insurance companies. This income stream, while balanced against associated costs, can bolster the company's overall financial performance.

For instance, in 2023, Brighthouse Financial reported approximately $1.7 billion in net investment income from its reinsurance segment, highlighting its significance. This income is crucial for offsetting operational expenses and contributing to profitability.

- Reinsurance Income Generation: Brighthouse Financial earns income by taking on risk from other insurers through reinsurance contracts.

- Management of Business Blocks: Revenue is also derived from managing and administering blocks of insurance business ceded by other companies.

- 2023 Financial Impact: In 2023, the company's reinsurance operations contributed significantly to its net investment income, reaching around $1.7 billion.

- Strategic Contribution: This income stream plays a vital role in the company's financial strategy, helping to manage risk and enhance overall revenue.

Brighthouse Financial's revenue streams are diverse, primarily driven by annuity and life insurance sales. In the first quarter of 2024, total life insurance sales reached $326 million, a 6% increase year-over-year. Management and rider fees on its annuity products, particularly variable annuities, also form a significant and recurring income base.

| Revenue Stream | 2023 Data | Q1 2024 Data |

|---|---|---|

| Annuity Premiums & Sales | Not specified | Shield Level Annuities contributed to growth |

| Life Insurance Sales | Not specified | $326 million (6% increase YoY) |

| Investment Income | Not specified | Total Investments: $222.5 billion |

| Fees and Investment Spread | Not specified | $2.1 billion (Q1 2024) |

| Reinsurance Income | Approx. $1.7 billion (Net Investment Income) | Not specified |

Business Model Canvas Data Sources

The Brighthouse Financial Business Model Canvas is built upon comprehensive financial statements, internal operational data, and extensive market research. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the company's strategic positioning and performance.