Brighthouse Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brighthouse Financial Bundle

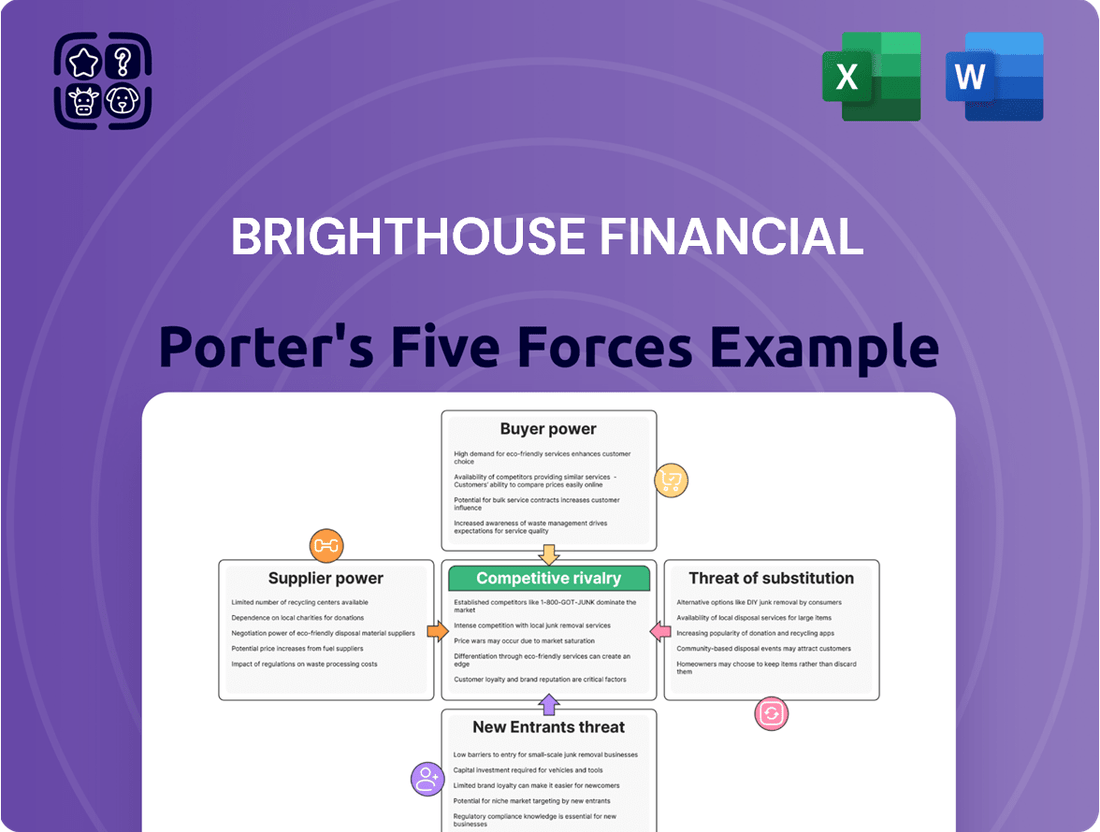

Brighthouse Financial faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers playing crucial roles in its market landscape. Understanding these dynamics is key to navigating the insurance industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Brighthouse Financial’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Brighthouse Financial depends on external investment managers for the strategies behind its variable annuities and other offerings. If these managers provide unique, top-performing funds or specialized knowledge that's hard to find elsewhere, their bargaining power increases, potentially driving up fees for Brighthouse.

The sheer number of investment firms available generally acts as a counterweight, limiting the individual power of any single supplier. This competitive landscape means Brighthouse can often find alternative managers, thereby moderating supplier influence.

Reinsurers hold considerable bargaining power over Brighthouse Financial by offering essential risk transfer services, particularly for large and catastrophic claims. This power intensifies during market conditions where reinsurance capacity is limited and prices are on the rise, a trend observed in casualty reinsurance markets in 2025.

Brighthouse Financial must cultivate robust relationships with reinsurers to negotiate favorable terms and ensure sufficient coverage. The ability of reinsurers to dictate terms can significantly impact Brighthouse's profitability and risk management capabilities.

As the insurance sector rapidly embraces digital transformation, AI, and machine learning, Brighthouse Financial relies heavily on technology and software providers. These suppliers are crucial for optimizing operations, underwriting, claims handling, and enhancing customer interactions. For instance, specialized Insurtech solutions offering significant efficiency gains or unique competitive advantages can wield considerable influence.

The bargaining power of these technology suppliers can range from moderate to high. Companies that develop proprietary AI algorithms for risk assessment or advanced customer relationship management platforms often hold strong leverage. In 2023, the Insurtech market continued its robust growth, with significant investments pouring into AI-driven solutions, indicating the increasing dependence and potential power of these specialized providers.

Data and Analytics Providers

Data and analytics providers wield significant influence over Brighthouse Financial. Access to high-quality, real-time data is fundamental for Brighthouse's operations, impacting everything from risk assessment and product pricing to customer behavior analysis. Companies offering comprehensive data sets and sophisticated analytics tools can command leverage because their services are crucial for Brighthouse to achieve more accurate underwriting and effective targeted marketing strategies.

The bargaining power of these suppliers is amplified by the uniqueness and perceived quality of their data. For instance, specialized datasets that offer predictive insights into market trends or customer lifetime value can be difficult for Brighthouse to replicate internally, thus increasing the suppliers' negotiating position. By mid-2024, the global data analytics market was projected to reach over $300 billion, highlighting the scale and importance of these services.

- Critical Data Dependency: Brighthouse Financial relies heavily on data providers for essential functions like risk management and product development.

- Value-Added Services: Advanced analytics tools offered by these suppliers enhance underwriting precision and marketing effectiveness.

- Data Uniqueness and Quality: The exclusivity and accuracy of data sets directly correlate to the suppliers' bargaining power.

- Market Growth: The substantial growth of the data analytics market underscores the increasing importance and potential leverage of its providers.

Rating Agencies and Regulatory Compliance Services

The bargaining power of suppliers, specifically rating agencies and regulatory compliance services, presents a significant factor for Brighthouse Financial. Agencies like AM Best assign financial strength ratings, which are critical for Brighthouse's credibility and attracting customers. For instance, in 2024, AM Best continued to be a primary source for evaluating the financial stability of insurers, with ratings directly influencing an insurer's ability to compete and secure business.

Providers of regulatory compliance services also hold considerable sway. The insurance industry is subject to stringent and constantly changing regulations across various jurisdictions. Brighthouse Financial relies on these specialized firms to navigate this complex environment, ensuring adherence to solvency requirements, consumer protection laws, and reporting standards. Failure to comply can lead to severe penalties and reputational damage, underscoring the essential nature of these services.

- Financial Strength Ratings: AM Best's ratings, such as those issued throughout 2024, directly impact customer trust and Brighthouse Financial's market competitiveness.

- Regulatory Compliance Necessity: The intricate and evolving nature of insurance regulations makes specialized compliance services indispensable for Brighthouse's operational legitimacy.

- Supplier Dependence: Brighthouse's reliance on these external providers for critical functions grants them a degree of bargaining power.

The bargaining power of suppliers for Brighthouse Financial is influenced by several key areas, including investment managers, reinsurers, technology providers, data analytics firms, and rating/compliance services. The availability of alternative suppliers and the uniqueness of their offerings significantly shape their leverage.

In 2024, the increasing reliance on specialized Insurtech solutions and AI-driven platforms by insurers like Brighthouse means technology providers can wield considerable influence. Similarly, the critical nature of data for accurate underwriting and marketing amplifies the power of data analytics firms, with the global data analytics market projected to exceed $300 billion by mid-2024.

Reinsurers, particularly for catastrophic risk, and essential rating agencies like AM Best, also hold significant sway. Their ability to dictate terms or influence market perception directly impacts Brighthouse's operational stability and competitive standing.

What is included in the product

Tailored exclusively for Brighthouse Financial, analyzing its position within its competitive landscape by evaluating supplier and buyer power, threat of new entrants, substitutes, and industry rivalry.

Quickly identify and neutralize competitive threats with a visual, easy-to-understand breakdown of each force.

Customers Bargaining Power

The bargaining power of individual policyholders with Brighthouse Financial is typically low. This is largely because many annuity and life insurance products are standardized, and the cost for insurers to acquire new customers is significant. While policyholders can compare prices, the intricate nature of financial products and the desire for security often restrict their ability to heavily influence pricing.

Financial advisors and large distribution networks are key conduits for Brighthouse Financial's offerings, significantly shaping consumer decisions. Their ability to direct clients to competing firms, based on commission structures, product appeal, or support levels, grants them moderate to substantial bargaining power.

To retain these crucial partnerships, Brighthouse Financial must consistently provide compelling incentives and demonstrate superior product value. For instance, in 2024, the financial services industry saw an average commission rate for advisors ranging from 1% to 5% on certain investment products, highlighting the financial leverage these intermediaries possess.

While Brighthouse Financial primarily caters to individual customers, its bargaining power with institutional buyers, such as pension funds seeking group annuities or pension risk transfer solutions, is notably lower. These large entities, often managing billions in assets, wield significant influence due to the sheer volume of business they represent. For instance, a pension fund considering a multi-million dollar annuity purchase can demand highly customized terms and aggressive pricing, directly impacting Brighthouse’s profit margins on such deals.

Customer Information and Transparency

Customers today have unprecedented access to information, making it simpler than ever to compare products and pricing across different insurance providers. This heightened transparency directly impacts bargaining power, particularly for straightforward insurance products that are easily commoditized.

The ability to readily compare options means customers can identify the best value, putting pressure on companies like Brighthouse Financial to remain competitive. For instance, in 2024, online comparison platforms saw a significant surge in usage for life insurance quotes, with many consumers reporting they switched providers based on price and feature comparisons.

- Information Accessibility: Online tools and review sites empower consumers with detailed product information and pricing.

- Price Sensitivity: Increased transparency fosters price sensitivity, especially for standardized insurance products.

- Competitive Landscape: This empowers customers to negotiate better terms or switch providers, increasing the bargaining power.

- Impact on Brighthouse: Brighthouse Financial must ensure competitive pricing and clear value propositions to retain customers in this environment.

Demographic Trends and Longevity Expectations

The aging U.S. population, with increasing life expectancies, fuels a significant demand for retirement income solutions, such as annuities. This demographic shift generally weakens customer bargaining power for these products because the need for guaranteed income becomes paramount, lessening price sensitivity for financial security.

For instance, in 2024, the U.S. Census Bureau projected that individuals aged 65 and over would represent a growing portion of the population, highlighting the sustained need for long-term financial planning. This growing segment of the population is more focused on wealth preservation and guaranteed income streams, making them less likely to shop aggressively on price for essential retirement products.

- Aging Population: The U.S. continues to experience an increase in its elderly population, a key demographic for annuity sales.

- Increased Longevity: Longer lifespans mean individuals need retirement income solutions that can last for decades.

- Demand for Guarantees: Customers are often willing to pay a premium for the security of guaranteed income, reducing their bargaining leverage.

- Financial Security Focus: As people age, the desire for financial stability outweighs minor price differences for critical retirement products.

The bargaining power of customers with Brighthouse Financial is generally low for individual policyholders due to product standardization and high customer acquisition costs, though financial advisors possess moderate to substantial power given their role as intermediaries. Institutional buyers, like pension funds, have significantly lower bargaining power due to the substantial volume of business they represent, allowing them to negotiate customized terms and pricing. The increasing accessibility of information and price transparency in 2024 empowers customers to compare offerings more readily, particularly for commoditized products, thereby increasing their leverage.

| Customer Segment | Bargaining Power | Key Factors Influencing Power |

| Individual Policyholders | Low | Product standardization, high acquisition costs, complexity of products |

| Financial Advisors/Distributors | Moderate to Substantial | Ability to direct clients, commission structures, product appeal |

| Institutional Buyers (e.g., Pension Funds) | Low | Volume of business, demand for customization, significant asset management |

Same Document Delivered

Brighthouse Financial Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our Brighthouse Financial Porter's Five Forces Analysis meticulously details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the life insurance and annuity sector. This comprehensive report provides actionable insights for strategic decision-making.

Rivalry Among Competitors

Brighthouse Financial faces formidable competition from large, established insurers like New York Life, MassMutual, Prudential, and Athene, all offering comparable annuity and life insurance products. This crowded landscape intensifies the battle for market share, forcing companies to innovate and offer competitive pricing and features to attract and retain customers.

Competitive rivalry in the life insurance and annuity sector is intense, fueled by a constant stream of product innovation. Companies are actively introducing new annuity and life insurance solutions designed to capture market share and appeal to a diverse customer base. This drive for differentiation is crucial in a market where many offerings can appear similar.

Brighthouse Financial, for instance, is strategically focusing on products like its Shield registered index-linked annuities (RILAs) and fixed indexed annuities (FIAs). These offerings represent an effort to carve out distinct market positions. In 2023, Brighthouse reported $17.7 billion in total annuity sales, with RILAs showing significant growth, indicating customer interest in these more innovative, yet still familiar, product structures.

Brighthouse Financial faces intense rivalry through aggressive pricing and diverse distribution channels. Insurers constantly adjust premiums and commission structures to attract and retain both financial advisors and direct customers. For instance, the life insurance industry, where Brighthouse operates, saw a 4% increase in new premium volume in 2024, highlighting the competitive pressure to offer appealing rates.

The battle for market share is also fought on the accessibility and efficiency of distribution. Independent financial advisors remain a crucial conduit, but direct-to-consumer platforms are gaining traction, forcing companies like Brighthouse to optimize both approaches. This dual focus requires significant investment in technology and advisor support to maintain competitive reach.

Marketing and Brand Strength

Brighthouse Financial invests heavily in marketing to build its brand, a crucial element in the competitive insurance landscape. Established players often leverage their long-standing reputations and perceived financial stability to attract and retain customers, creating a significant barrier for newer entrants.

In 2024, the life insurance industry continued to see substantial marketing expenditures. For instance, major insurers typically allocate billions annually to advertising and brand building. This significant investment underscores how brand strength directly influences customer acquisition and loyalty.

- Marketing Spend: Insurers commonly spend a significant portion of their revenue on marketing and advertising to enhance brand visibility and customer trust.

- Brand Reputation: A strong brand reputation, built over years of reliable service and financial strength, provides a competitive edge in attracting new policyholders.

- Customer Trust: Trust is paramount in financial services; companies with a long history of stability and integrity often command higher customer retention rates.

- Competitive Advantage: Established brands can leverage their market presence and customer loyalty to maintain market share against competitors with less recognized brands.

Regulatory Environment and Compliance

The insurance industry, particularly for annuities and life insurance, operates under a stringent and constantly shifting regulatory landscape. This complexity necessitates significant investment in compliance infrastructure and expertise, directly impacting competitive rivalry. Companies that can efficiently navigate these regulations often gain a competitive edge.

Recent regulatory shifts, such as increased focus on data privacy and enhanced consumer protection measures, are reshaping how companies compete. For instance, the NAIC's adoption of updated Cybersecurity Best Practices in 2023 requires insurers to bolster their data security protocols, adding to operational costs and influencing product development. This creates a barrier for smaller or less capitalized competitors.

- Regulatory Burden: Companies must allocate substantial resources to ensure adherence to rules from bodies like the SEC, FINRA, and state insurance departments.

- Compliance Costs: Investments in technology, legal counsel, and specialized personnel for compliance are significant, impacting profitability and pricing strategies.

- Impact of Changes: Evolving regulations, such as those concerning fiduciary duties or capital requirements, can alter market dynamics and favor firms with robust compliance frameworks.

- Data Security Mandates: Stricter data protection laws increase the cost of doing business and can lead to competitive disadvantages for firms with less sophisticated systems.

Competitive rivalry is fierce for Brighthouse Financial, with established giants and agile innovators vying for dominance. This intense competition drives product development, with companies like Brighthouse focusing on offerings like Shield RILAs, which saw strong sales in 2023, contributing to $17.7 billion in total annuity sales. The industry also witnessed a 4% increase in new premium volume in 2024, underscoring the pressure to offer competitive pricing and attractive features to capture market share.

| Competitor | Key Product Focus | 2023 Estimated Market Share (Annuities) |

|---|---|---|

| New York Life | Variable Annuities, Fixed Annuities | ~7.5% |

| MassMutual | Fixed Indexed Annuities, Variable Annuities | ~6.2% |

| Prudential | Indexed Annuities, Variable Annuities | ~5.8% |

| Athene | Fixed Indexed Annuities, Fixed Annuities | ~9.1% |

| Brighthouse Financial | Registered Index-Linked Annuities, Fixed Indexed Annuities | ~6.5% |

SSubstitutes Threaten

For individuals aiming for wealth growth or retirement income, traditional investment vehicles such as mutual funds, ETFs, and bonds stand as significant substitutes for annuities. These options provide diverse risk-return trade-offs and varying levels of liquidity, attracting investors who desire direct engagement with markets or more autonomy over their investments.

For conservative investors focused on safety and predictable growth, high-yield savings accounts and Certificates of Deposit (CDs) present a significant threat of substitution to fixed annuities. These bank products offer capital preservation and guaranteed returns, albeit typically at lower rates than some annuities, making them appealing for their simplicity and accessibility. For instance, as of mid-2024, average high-yield savings account rates hovered around 4.3%, while 1-year CD rates were often above 5%, providing competitive yields for risk-averse individuals.

The availability of strong employer-sponsored retirement plans, such as 401(k)s with generous company matches, can significantly reduce the appeal of individual annuities. For instance, in 2024, the average employer match for 401(k)s often reaches 50% of employee contributions up to 6% of salary, effectively providing a substantial guaranteed return that competes with annuity products.

Defined benefit pension plans, though less common now, still provide a guaranteed income stream in retirement for many. This pre-arranged financial security directly substitutes for the income-replacement function that annuities aim to fulfill, lessening the perceived need for individuals to purchase them independently.

The threat of these employer-provided retirement vehicles is amplified by their tax advantages and perceived simplicity for employees. As of 2024, contribution limits for 401(k)s are substantial, allowing individuals to accumulate significant retirement assets with tax-deferred growth, making them a highly attractive alternative to taxable annuity investments.

Real Estate Investments

Investing in real estate, whether directly or via Real Estate Investment Trusts (REITs), presents a significant substitute for traditional financial products like annuities and life insurance. These tangible assets offer potential for long-term wealth accumulation and income generation, attracting investors seeking physical ownership and capital appreciation. For instance, in 2024, the U.S. housing market continued to show resilience, with median home prices experiencing a notable increase year-over-year, demonstrating the asset class's appeal.

The accessibility of real estate as an alternative is further amplified by the growing popularity of REITs, which allow for diversified exposure without the complexities of direct property management. This makes real estate a viable substitute for individuals looking to diversify their portfolios beyond insurance-based products. In 2024, the REIT market saw continued investor interest, with several sectors, such as industrial and residential REITs, reporting strong performance metrics.

- Real Estate as an Alternative: Direct property ownership and REITs offer tangible assets and potential appreciation, substituting for some functions of annuities and life insurance.

- Investor Appeal: This substitute appeals to those prioritizing physical assets and potential capital growth over traditional insurance-based wealth-building vehicles.

- Market Performance (2024): The U.S. housing market demonstrated continued strength with rising median home prices, highlighting real estate's attractiveness.

- REIT Growth: REITs provide diversified, accessible real estate exposure, drawing investor capital away from solely insurance-linked investments.

Alternative Financial Planning Strategies

Customers increasingly explore financial planning avenues that de-emphasize traditional insurance products. They are leaning towards diversified investment portfolios, strategic withdrawal strategies, and alternative income generation methods to secure their financial future.

The growing popularity of independent financial planning highlights a shift towards highly personalized strategies. These approaches often prioritize investment vehicles and income streams that may not heavily feature annuities or specific life insurance products.

For instance, the robo-advisor market, a key substitute, saw significant growth. In 2023, assets under management for robo-advisors globally reached approximately $3.5 trillion, indicating a strong customer preference for technology-driven, diversified investment solutions over traditional insurance-centric planning.

- Growing Robo-Advisor Adoption: Assets under management for robo-advisors globally were around $3.5 trillion in 2023, showcasing a clear alternative for investment management.

- Rise of Independent Advisors: The independent financial advisor channel continues to expand, offering tailored advice that may not align with traditional product-heavy models.

- Focus on Diversification: Investors are prioritizing broad diversification across asset classes, reducing reliance on single-product solutions for long-term financial security.

- Alternative Income Streams: The exploration of dividend investing, real estate crowdfunding, and peer-to-peer lending presents substitutes for guaranteed income often associated with annuities.

The threat of substitutes for Brighthouse Financial's annuity and life insurance products is considerable. Many individuals now opt for diversified investment portfolios, including mutual funds and ETFs, which offer greater flexibility and direct market participation. For instance, as of mid-2024, high-yield savings accounts and CDs provided competitive yields, with 1-year CD rates often exceeding 5%, directly competing with the safety offered by fixed annuities.

Employer-sponsored retirement plans, such as 401(k)s, present a significant substitute, especially with generous employer matches. In 2024, average 401(k) matches often reached 50% of contributions up to 6% of salary, offering a substantial guaranteed return that diminishes the need for individual annuity purchases. Furthermore, the accessibility and tax advantages of these plans, with high contribution limits and tax-deferred growth, make them highly attractive alternatives.

Real estate, both direct ownership and through REITs, also serves as a strong substitute, appealing to investors seeking tangible assets and capital appreciation. The U.S. housing market's resilience in 2024, marked by rising median home prices, underscores this appeal. Robo-advisors, a key substitute in financial planning, saw global assets under management reach approximately $3.5 trillion in 2023, indicating a clear preference for technology-driven, diversified investment solutions.

| Substitute Category | Specific Examples | Key Appeal | 2024/2023 Data Point |

|---|---|---|---|

| Traditional Investments | Mutual Funds, ETFs, Bonds | Market participation, diverse risk-return | N/A |

| Bank Products | High-Yield Savings Accounts, CDs | Capital preservation, guaranteed returns | 1-year CD rates > 5% (mid-2024) |

| Employer Retirement Plans | 401(k)s | Employer match, tax advantages | Average 401(k) match: 50% up to 6% of salary (2024) |

| Real Estate | Direct Property, REITs | Tangible assets, capital appreciation | U.S. housing market resilience (2024) |

| Digital Wealth Management | Robo-advisors | Technology-driven, diversified solutions | Global AUM ~$3.5 trillion (2023) |

Entrants Threaten

Insurtech startups represent a significant threat of new entrants for established players like Brighthouse Financial. These nimble companies, armed with cutting-edge technologies such as artificial intelligence and big data analytics, are introducing more efficient, tailored, and often more affordable insurance products. For instance, by mid-2024, several insurtechs were reporting substantial user growth, with some achieving millions of active policies through simplified digital onboarding and claims processes.

The ability of insurtechs to enhance customer experience and streamline operations allows them to challenge traditional business models. Their digital-first approach often translates to lower overhead costs, enabling them to compete on price. Reports from early 2024 indicated that some insurtechs were able to offer comparable coverage at premiums 10-15% lower than incumbents, directly impacting market share and customer acquisition for companies relying on older infrastructure.

Broader fintech companies, already possessing robust digital platforms and established customer bases, are increasingly eyeing the insurance sector. Their technological prowess and existing financial relationships position them to potentially enter the annuity and life insurance markets, directly challenging incumbents like Brighthouse Financial.

This expansion could result in innovative, integrated financial products that offer a more seamless customer experience. For instance, by 2024, fintech adoption in financial services continued its upward trajectory, with many platforms already managing significant customer assets, giving them a substantial advantage in cross-selling insurance products.

The insurance sector is inherently protected by stringent regulatory oversight and substantial capital demands, effectively creating a formidable barrier for aspiring new entrants. For instance, in 2024, insurance companies are still required to maintain significant risk-based capital levels, often in the hundreds of millions of dollars, to ensure solvency and protect policyholders.

Brighthouse Financial leverages these high entry thresholds, as any new competitor must first successfully navigate intricate licensing procedures, adhere to complex compliance mandates, and meet rigorous solvency standards before even considering market entry.

Brand Recognition and Trust

Building brand recognition and trust in financial services is a long game, requiring significant upfront investment and consistent delivery of value. Brighthouse Financial benefits from its established presence, a crucial factor in an industry where customers prioritize reliability and security. Newcomers face the daunting task of cultivating this same level of confidence.

For instance, in 2024, the financial services industry continues to see a strong preference for well-known brands, especially for complex products like life insurance and annuities. A recent survey indicated that over 60% of consumers consider brand reputation a primary factor when selecting financial products, highlighting the barrier to entry for less-established firms.

- Significant Investment: New entrants must allocate substantial resources to marketing and customer acquisition to even begin competing with established brands.

- Customer Loyalty: Existing customers often exhibit loyalty to trusted financial institutions, making it difficult for new players to gain market share.

- Regulatory Hurdles: The financial sector's stringent regulations also add complexity and cost for new entrants seeking to establish credibility.

- Perception of Stability: Consumers associate established brands with greater financial stability, a key concern when entrusting their long-term financial well-being.

Distribution Network Development

Developing a strong distribution network is a significant hurdle for new companies entering the annuity and life insurance sector. Brighthouse Financial, like its peers, relies on a vast network of financial advisors and agents to reach customers. For a new entrant, establishing such relationships and infrastructure is a time-consuming and capital-intensive endeavor.

The process of building trust and securing commitments from a large number of financial professionals can take years. This is particularly true in a market where established players already have deep-rooted partnerships. For instance, in 2024, the financial advisory landscape continues to be dominated by established firms, making it challenging for newcomers to gain traction.

- High Capital Investment: New entrants need substantial funds to recruit, train, and incentivize a sales force.

- Time to Market: Building a widespread distribution network is a gradual process, often taking several years.

- Brand Recognition: Established companies benefit from existing brand loyalty among advisors and their clients.

- Regulatory Compliance: Navigating the complex regulatory environment for financial product distribution adds another layer of difficulty.

The threat of new entrants for Brighthouse Financial remains moderate, primarily due to high capital requirements and regulatory barriers. While insurtechs and fintech firms can disrupt with technology, the need for substantial reserves and complex licensing processes in 2024 still presents a significant challenge for new players aiming to offer traditional insurance and annuity products.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Brighthouse Financial is built upon a foundation of comprehensive data, including Brighthouse's own annual reports and SEC filings, alongside industry-specific research from leading financial data providers like S&P Capital IQ and IBISWorld.