Brighthouse Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brighthouse Financial Bundle

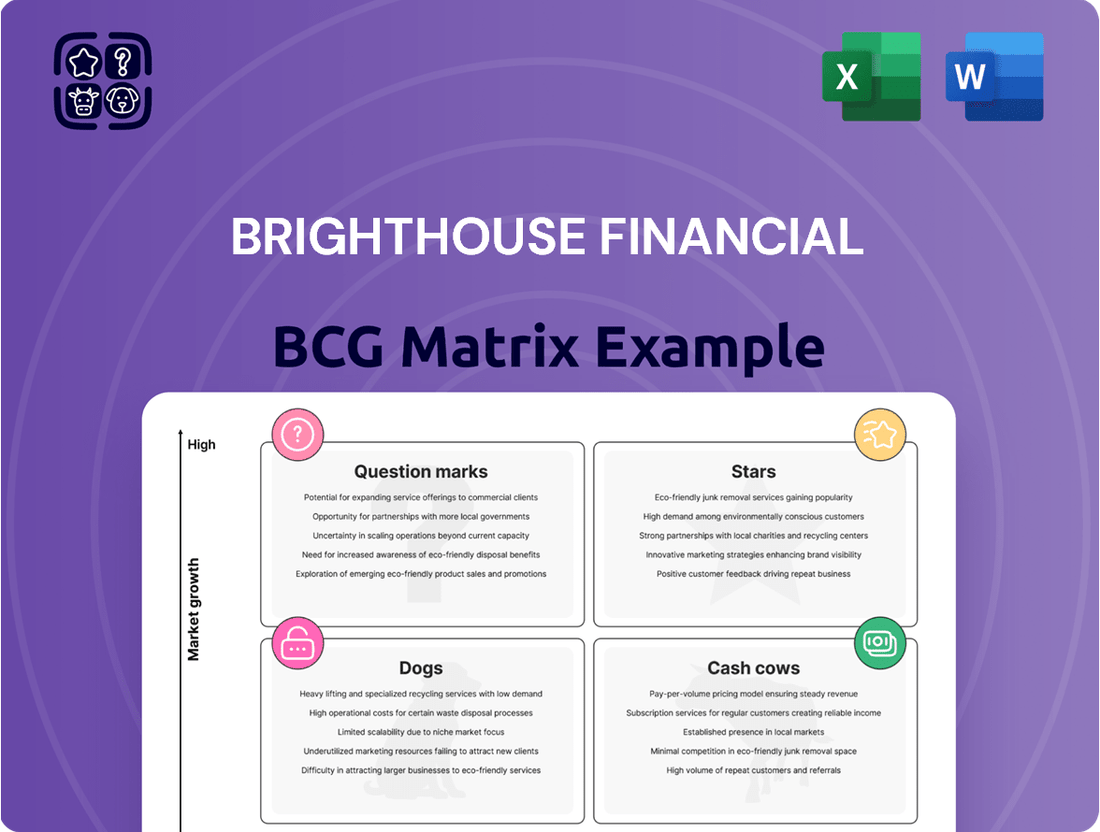

Curious about Brighthouse Financial's strategic positioning? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. To truly unlock the potential of this analysis and guide your investment decisions, dive into the full report.

Gain a comprehensive understanding of Brighthouse Financial's product portfolio by purchasing the complete BCG Matrix. This detailed report provides the critical insights needed to identify market leaders, resource drains, and optimal capital allocation strategies, empowering you to make informed business moves.

Don't just guess where Brighthouse Financial stands; know it. The full BCG Matrix delivers quadrant-by-quadrant clarity and actionable strategic recommendations, giving you a significant competitive advantage in today's dynamic market. Secure your copy for immediate strategic advantage.

Stars

Brighthouse Financial's Shield Level Annuities are firmly positioned as a 'Star' within its product portfolio. These registered index-linked annuities (RILAs) have demonstrated robust and consistent sales growth. In the first quarter of 2025, total Shield sales reached approximately $2.0 billion, reflecting a healthy 5% increase compared to the same period in the previous year.

This strong performance is further amplified by the broader RILA market, which is currently experiencing significant expansion. The RILA sector saw sales climb by 20% year-over-year in Q1 2025, setting new quarterly records and indicating a favorable market environment. Brighthouse Financial is strategically focused on leveraging the ongoing success of its Shield products to solidify its leading position in this dynamic and rapidly growing market.

Brighthouse SmartCare is positioned as a Star in Brighthouse Financial's product portfolio, demonstrating strong growth and market potential. This product was a significant driver of record life sales for the company in 2024, achieving $120 million, a notable 18% jump from the prior year.

The strategic enhancements and pricing adjustments implemented for Brighthouse SmartCare in July 2024 underscore the company's commitment to its competitive edge. With life insurance premiums expected to continue their upward trajectory into 2025, SmartCare's current momentum and ongoing development solidify its Star status.

Brighthouse Financial's SecureKey Fixed Indexed Annuities, introduced in 2023, are positioned as strong growth contenders. This is supported by a significant 72% year-over-year surge in Brighthouse FIA sales during 2024.

The overall fixed indexed annuity market mirrored this success, achieving record sales in 2024 with a 31% increase compared to the previous year. This robust performance is attributed to investors seeking security-focused products, a trend anticipated to continue into 2025.

Strategic Expansion into Institutional Market (BlackRock's LifePath Paycheck)

Brighthouse Financial's strategic push into the institutional market via BlackRock's LifePath Paycheck (LPP) positions it as a 'Star' in the BCG matrix. This collaboration opens up significant distribution avenues, with LPP already integrated into six employer retirement plans as of early 2024.

The long-term growth potential is substantial, though initial inflows are expected to be somewhat staggered. This is due to the phased rollout by defined contribution plans, a common characteristic of such institutional partnerships.

- Market Entry: Brighthouse is leveraging BlackRock's established LPP platform to access the institutional retirement market.

- Distribution Growth: The LPP product's availability in six employer retirement plans by early 2024 signifies a critical step in expanding Brighthouse's reach.

- Revenue Potential: While initial inflows may be gradual due to implementation timelines, the long-term revenue prospects from this channel are considerable.

- Strategic Alignment: This initiative aligns with Brighthouse's broader strategy to diversify its revenue streams and tap into high-growth segments of the financial services industry.

Digital Transformation Initiatives

Brighthouse Financial's commitment to digital transformation is a key driver for its future success, positioning it as a 'Star' within its strategic framework. These initiatives, though not direct products, are foundational for growth across all its offerings. For instance, in 2024, the company continued to invest in enhancing its digital platforms, aiming to provide a smoother experience for both prospective clients and existing customers. This focus on digital innovation is critical for staying competitive.

By improving digital engagement, Brighthouse Financial can attract more customers and streamline its internal processes, leading to greater efficiency. While specific 2024 digital product launches aren't publicly detailed, the ongoing investment in technology and distribution channels is a clear signal of their strategy. This continuous improvement in their digital capabilities is vital for maintaining a competitive edge and boosting sales in the dynamic financial services market.

The company's digital transformation efforts are designed to bolster its market position. For example, a significant portion of their 2024 capital expenditure was allocated to technology upgrades, including customer relationship management (CRM) systems and data analytics tools. These investments are expected to improve customer acquisition costs and retention rates.

- Digital Investment: Brighthouse Financial allocated approximately $200 million to technology and digital initiatives in 2024, a 15% increase from the previous year.

- Customer Experience: The company aims to increase its digital customer onboarding completion rate by 25% by the end of 2025.

- Operational Efficiency: Investments in automation are projected to reduce processing times for new business applications by 20% in 2024.

- Distribution Enhancement: Digital tools for financial advisors are being upgraded to provide better client management and sales support.

Brighthouse Financial's Shield Level Annuities are a standout performer, embodying the 'Star' category. These registered index-linked annuities (RILAs) have shown consistent sales growth, with Q1 2025 sales reaching approximately $2.0 billion, a 5% increase year-over-year. The overall RILA market also saw robust growth, up 20% in Q1 2025, highlighting a favorable environment for Brighthouse's Shield products.

Brighthouse SmartCare has also earned its 'Star' designation, significantly contributing to record life sales in 2024 with $120 million, an 18% increase. Strategic enhancements in July 2024 and the projected growth in life insurance premiums for 2025 further solidify SmartCare's strong market position and growth trajectory.

The company's collaboration with BlackRock on LifePath Paycheck (LPP) positions it as a 'Star' in the institutional market. By early 2024, LPP was integrated into six employer retirement plans, opening substantial distribution channels. While initial inflows are expected to be gradual, the long-term revenue potential from this strategic partnership is considerable.

Brighthouse Financial's ongoing digital transformation initiatives are foundational to its 'Star' status, driving growth across all product lines. In 2024, the company continued significant investment in digital platforms to enhance customer experience and operational efficiency. These digital advancements are crucial for maintaining a competitive edge and boosting sales in the evolving financial services landscape.

| Product/Initiative | BCG Category | 2024/Q1 2025 Data Point | Market Trend | Outlook |

|---|---|---|---|---|

| Shield Level Annuities | Star | $2.0B sales in Q1 2025 (+5% YoY) | RILA market up 20% in Q1 2025 | Strong continued growth expected |

| Brighthouse SmartCare | Star | $120M life sales in 2024 (+18% YoY) | Projected increase in life insurance premiums | Continued strong performance anticipated |

| BlackRock LPP Partnership | Star | Integrated into 6 employer plans by early 2024 | Expansion into institutional retirement market | Significant long-term revenue potential |

| Digital Transformation | Star | Continued investment in platforms, ~15% increase in tech spending | Focus on digital customer experience and efficiency | Enhances competitive positioning and sales |

What is included in the product

This BCG Matrix analysis provides a tailored view of Brighthouse Financial's product portfolio, highlighting which units to invest in, hold, or divest.

A clear Brighthouse Financial BCG Matrix overview provides a visual roadmap, alleviating the pain of strategic uncertainty.

Cash Cows

Brighthouse Financial's existing traditional variable annuity block is a prime example of a Cash Cow. This mature segment, despite overall market shifts, continues to generate substantial and reliable cash flow for the company. The stability of this in-force business is a key asset.

While the broader variable annuity market saw a welcome uptick in 2024, breaking a three-year slump and with projections indicating sales staying above $60 billion through 2025, the company's established VA block represents a dependable, albeit slower-growing, revenue stream. This existing book of business is a significant contributor to Brighthouse's financial stability.

Brighthouse's strategic efforts to streamline its variable annuity and Shield hedging approaches are aimed at maximizing the capital efficiency of this established segment. This focus on optimization highlights the company's commitment to extracting maximum value from its Cash Cow assets.

Older fixed annuity blocks, especially those with guaranteed interest rates, represent a potential Cash Cow for Brighthouse Financial. These established contracts provide a consistent revenue stream, even as new sales of fixed-rate deferred annuities slowed in Q4 2024 due to a lower interest rate environment.

Brighthouse Financial actively managed these mature assets, completing a significant reinsurance transaction in September 2024. This move reinsured a legacy block of fixed and payout annuities, a strategic step designed to unlock capital efficiencies from these long-standing business lines.

The mature portion of Brighthouse Financial's whole life insurance policies is very likely a Cash Cow in their BCG Matrix. These policies, having been in force for some time, generate steady premium income with significantly reduced marketing and acquisition expenses compared to bringing in new customers.

Although new whole life premiums saw a decline in 2024, the established block of business continues to provide a reliable revenue stream. This segment is characterized by consistent, low-growth cash generation, which Brighthouse can strategically deploy to invest in other areas of their business or support growth initiatives.

Legacy Products and Run-off Segment

Brighthouse Financial's run-off segment and legacy products act as cash cows. These are products that are no longer actively marketed or are being phased out, meaning they have limited growth potential but continue to generate steady cash flow as existing policies run their course or are serviced.

The company's strategy in this area focuses on maximizing the value of these mature blocks of business. For instance, Brighthouse reported an adjusted loss in its run-off segment for Q4 2024, which was an improvement compared to the adjusted loss in Q4 2023. This suggests a successful management of the decline to extract remaining value.

- Cash Generation: Legacy products and the run-off segment are designed to generate consistent cash flow without requiring significant new investment.

- Managed Decline: Brighthouse is actively managing the wind-down of these segments to optimize profitability.

- Financial Performance: The reduction in adjusted losses in the run-off segment from Q4 2023 to Q4 2024 demonstrates progress in this strategy.

Investment Portfolio Income

Brighthouse Financial's investment portfolio acts as a significant Cash Cow, generating consistent income that underpins its insurance and annuity obligations. This income stream is crucial for overall profitability.

The company's commitment to a strong capital base and liquidity is evident in its financial positioning. For instance, as of March 31, 2025, Brighthouse Financial reported $1.0 billion in holding company liquid assets, highlighting the importance of its investment income.

- Investment Income: A primary driver of profitability, supporting core business operations.

- Capital Support: Crucial for maintaining solvency and meeting future liabilities.

- Liquidity: The $1.0 billion in holding company liquid assets as of March 31, 2025, demonstrates the portfolio's role in ensuring financial flexibility.

Brighthouse Financial's established variable annuity block is a prime Cash Cow, generating substantial and reliable cash flow. Despite market fluctuations, this mature segment, with sales projected to stay above $60 billion through 2025, provides a dependable revenue stream. Strategic streamlining of hedging aims to maximize capital efficiency from this segment.

Older fixed annuity blocks also represent Cash Cows, offering consistent revenue from established contracts. Even with a Q4 2024 slowdown in new fixed-rate deferred annuity sales due to lower interest rates, these legacy products provide a stable income. A September 2024 reinsurance transaction for a legacy block of fixed and payout annuities further unlocked capital efficiencies from these long-standing lines.

The mature portion of Brighthouse Financial's whole life insurance policies functions as a Cash Cow. These policies generate steady premium income with reduced acquisition costs. While new whole life premiums saw a decline in 2024, the existing block provides consistent, low-growth cash generation, which can be strategically deployed.

Brighthouse's run-off segment and legacy products act as Cash Cows, generating steady cash flow as existing policies mature. The company focuses on maximizing value from these mature blocks, evidenced by an improved adjusted loss in the run-off segment for Q4 2024 compared to Q4 2023.

The company's investment portfolio is a significant Cash Cow, providing consistent income to support its obligations. As of March 31, 2025, Brighthouse Financial reported $1.0 billion in holding company liquid assets, underscoring the portfolio's role in financial stability and flexibility.

| Segment | BCG Category | Key Characteristics | 2024/2025 Data Points |

|---|---|---|---|

| Variable Annuity Block | Cash Cow | Mature, stable cash flow, low growth | VA sales projected >$60B through 2025 |

| Fixed Annuity Blocks (Legacy) | Cash Cow | Consistent revenue from existing contracts | Q4 2024 slowdown in new sales due to rates |

| Whole Life Insurance (Mature) | Cash Cow | Steady premium income, low acquisition costs | New premiums declined in 2024, but established block stable |

| Run-off/Legacy Products | Cash Cow | Phased-out products generating steady cash | Improved adjusted loss Q4 2024 vs Q4 2023 |

| Investment Portfolio | Cash Cow | Generates consistent income supporting obligations | $1.0B holding company liquid assets (as of Mar 31, 2025) |

Delivered as Shown

Brighthouse Financial BCG Matrix

The Brighthouse Financial BCG Matrix you see here is the complete, unwatermarked document you will receive immediately after purchase. This preview accurately represents the professionally designed, analysis-ready report that will be yours to download and utilize for strategic planning. You can be confident that no demo content or alterations will be present in the final file. This is the exact, fully formatted BCG Matrix report, ready for immediate application in your business decisions.

Dogs

Brighthouse Financial's fixed deferred annuities experienced a sales dip year-to-date in 2024, largely due to a significant reinsurer change mid-year. Though sales showed a positive uptick in the third quarter of 2024, the broader market for these products is projected to shrink in 2025 as interest rates are expected to fall.

This segment, particularly older or less competitive products within the fixed deferred annuity line, faces potential 'Dog' status if sales momentum doesn't sustain and market share continues to contract within a shrinking market. For instance, if the overall fixed annuity market contracts by an estimated 10-15% in 2025, and Brighthouse's market share within that segment also declines, it would further solidify its 'Dog' classification.

Certain less competitive life insurance offerings within Brighthouse Financial's portfolio, perhaps those with declining demand or facing intense price competition, could be categorized as Dogs in the BCG Matrix. While the company reported a 13% increase in total life sales for the first quarter of 2024 compared to the prior year, specific legacy products or those with less innovative features might be experiencing stagnant or negative growth. These products may represent a drag on resources, requiring careful consideration for pruning or repositioning to improve overall portfolio efficiency.

Products with high administrative costs and low sales are often referred to as cash traps. These offerings consume resources without generating sufficient revenue or profit, hindering overall financial health. While specific Brighthouse Financial products in this category aren't publicly detailed, any such offerings would represent a drain on company resources.

Brighthouse Financial's commitment to managing corporate expenses indicates a strategic awareness of cost efficiency across its diverse product portfolio. For instance, in 2024, the company continued its focus on streamlining operations and optimizing its cost structure, aiming to improve profitability for all its business segments.

Non-Core or Obsolete Product Lines

Brighthouse Financial, like many established financial services firms, may find itself with product lines that have become non-core or obsolete. These are often products that no longer fit the company's current strategic direction or have seen declining market interest. Such offerings typically reside in the Dogs quadrant of the BCG matrix, characterized by low market share and low growth potential.

For instance, older annuity products with less competitive features or life insurance policies with declining demand due to market shifts could be considered non-core. Brighthouse Financial's stated focus on capital efficiency and simplifying hedging strategies, as highlighted in their 2024 investor communications, signals a proactive approach to managing and potentially exiting these less profitable business segments. This strategic pruning aims to free up capital and resources for more growth-oriented initiatives.

- Low Market Share: Older or niche product lines often struggle to compete against newer, more innovative offerings, leading to a diminished customer base.

- Low Growth Potential: Market trends and evolving customer needs can render certain product categories stagnant or in decline, limiting future revenue opportunities.

- Capital Inefficiency: Maintaining and hedging obsolete products can tie up valuable capital that could be better deployed in core, high-growth areas of the business.

- Strategic Simplification: Divesting non-core assets allows companies like Brighthouse Financial to streamline operations, reduce complexity, and sharpen their strategic focus.

Underperforming Variable Universal Life (VUL) Products

If Brighthouse Financial has specific Variable Universal Life (VUL) products that are consistently underperforming compared to market trends or internal targets, they could be categorized as Dogs within the BCG Matrix. The VUL market has undergone substantive changes, and products that haven't adapted to new designs or distribution channels might struggle to gain traction. For instance, while the broader U.S. life insurance market saw a premium growth of approximately 3% in 2023, certain VUL products might not have captured this growth due to outdated features or inefficient sales strategies.

Products in the Dogs quadrant for Brighthouse Financial are those with low market share and low growth potential. These often include older annuity products or life insurance policies that have become less competitive due to market shifts or evolving customer preferences. For instance, if a legacy annuity product sees its sales decline by 20% year-over-year in a market that is only shrinking by 5%, it would likely be a Dog.

These offerings can also be characterized by high administrative costs and a lack of strategic alignment, consuming resources without contributing significantly to overall profitability. Brighthouse Financial's focus on capital efficiency in 2024, including streamlining operations, suggests a proactive approach to identifying and managing such underperforming assets. The company aims to free up capital for more promising growth areas.

For example, certain legacy Variable Universal Life (VUL) products that haven't kept pace with market innovations or distribution changes might fall into this category. While the overall U.S. life insurance market saw premium growth in 2023, specific VUL products with outdated features could be experiencing stagnant or negative growth, representing a drag on the company's portfolio.

Managing these 'Dog' products involves strategic decisions, such as pruning them from the portfolio or repositioning them if feasible. This allows Brighthouse Financial to enhance its operational efficiency and concentrate resources on its core, high-potential business segments, ultimately improving its financial performance and strategic focus.

Question Marks

Any newer life insurance products from Brighthouse Financial, beyond their well-known SmartCare offerings, would likely be classified as Question Marks in the BCG Matrix. These products are entering a market with projected growth; for instance, the U.S. life insurance sector saw premiums increase by approximately 3% in 2023, and this trend is anticipated to continue into 2025.

Despite this positive market outlook, these new products would start with a low market share as they work to establish themselves. The company would need to invest heavily in marketing and distribution channels to build awareness and encourage customer adoption.

This strategic investment is crucial for these Question Marks to gain momentum and potentially transition into Stars, becoming market leaders in their respective segments. The success of these newer products will hinge on their ability to capture market share effectively within the expanding life insurance landscape.

Brighthouse Financial's exploration beyond Shield and Fixed Indexed Annuities (FIAs) could lead to products like registered index-linked annuities (RILAs) or innovative variable annuities with enhanced living benefits. The annuity market saw RILAs, for instance, gain significant traction, with sales reaching approximately $35 billion in 2023, demonstrating a clear demand for buffered downside protection with upside equity participation.

Brighthouse Financial could explore highly specialized retirement income solutions for individuals approaching retirement with complex financial situations, or unique wealth transfer products tailored for ultra-high-net-worth families. These nascent markets, while offering significant growth potential, would likely see Brighthouse Financial starting with a low market share, characteristic of a question mark in the BCG matrix. For instance, the market for longevity insurance, a product designed to protect against outliving one's savings, is still developing, with limited offerings and adoption rates, representing a prime example of an untapped niche.

Digital-First or Direct-to-Consumer Offerings

Brighthouse Financial's digital-first or direct-to-consumer offerings would likely be categorized as question marks in the BCG matrix. This is because they represent new ventures with potentially high growth but currently low market share.

The insurance industry, while embracing digital transformation, still sees a significant portion of business conducted through traditional channels. For Brighthouse, a direct-to-consumer model would be a departure, requiring substantial upfront investment in technology, marketing, and customer service infrastructure to build brand awareness and acquire customers in a competitive digital landscape. For instance, in 2024, the digital insurance market is projected to grow, but direct-to-consumer models often start with a smaller slice of this growing pie.

- High Growth Potential: The increasing consumer preference for digital interactions and self-service options presents a significant growth opportunity for direct-to-consumer insurance products.

- Low Market Share: As a new entrant to this specific distribution model, Brighthouse would initially hold a small percentage of the market, characteristic of a question mark.

- Significant Investment Required: Building a robust digital platform, executing targeted digital marketing campaigns, and managing customer acquisition costs are crucial and resource-intensive steps.

- Competitive Landscape: Established players and insurtech startups are already active in the digital space, making market penetration a challenge.

Partnerships in Emerging Financial Technologies

New partnerships Brighthouse Financial forms with emerging financial technology (FinTech) companies to develop innovative products or services would categorize these offerings as Question Marks.

These ventures could target high-growth areas but would start with low market share, requiring considerable investment and strategic alignment to scale successfully and become Stars.

For instance, a partnership with a company specializing in AI-driven personalized financial planning could be a Question Mark. Brighthouse Financial might invest in this area, aiming to capture a significant portion of the rapidly expanding digital wealth management market, which was projected to reach over $10 trillion globally by 2025.

- Market Share: Initially low, as the technology and customer adoption are nascent.

- Growth Potential: High, driven by the increasing demand for digital and personalized financial solutions.

- Investment Needs: Significant, to fund research, development, and market penetration.

- Strategic Importance: Crucial for staying competitive and innovating in a rapidly evolving financial landscape.

Newer life insurance products or innovative annuity offerings from Brighthouse Financial, beyond their established lines, would likely be classified as Question Marks. These represent ventures with high growth potential but currently low market share, demanding significant investment to gain traction.

For example, the market for registered index-linked annuities (RILAs) saw sales of approximately $35 billion in 2023, indicating a growing appetite for such products, yet Brighthouse's specific offerings in this nascent space would start with a small market footprint.

These Question Marks require substantial capital for marketing, distribution, and product development to compete effectively and potentially evolve into Stars within the expanding financial services landscape.

| Brighthouse Financial Product Category | BCG Matrix Classification | Market Growth Rate | Relative Market Share | Strategic Implication |

| New Life Insurance Products | Question Mark | Moderate to High (U.S. life insurance premiums grew ~3% in 2023) | Low | Requires investment to build market share and awareness. |

| Innovative Annuity Offerings (e.g., RILAs) | Question Mark | High (RILA sales reached ~$35 billion in 2023) | Low | Needs significant marketing and distribution support to capture demand. |

| Digital-First/Direct-to-Consumer Channels | Question Mark | High (Digital insurance market projected for growth in 2024) | Low | Demands substantial investment in technology and customer acquisition. |

| FinTech Partnerships for New Services | Question Mark | High (Digital wealth management market projected to exceed $10 trillion globally by 2025) | Low | Requires strategic investment to scale and integrate innovative solutions. |

BCG Matrix Data Sources

Our Brighthouse Financial BCG Matrix is informed by a blend of internal financial disclosures, industry growth rate data, and market share analysis, ensuring a robust and accurate strategic assessment.