Bridgestone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bridgestone Bundle

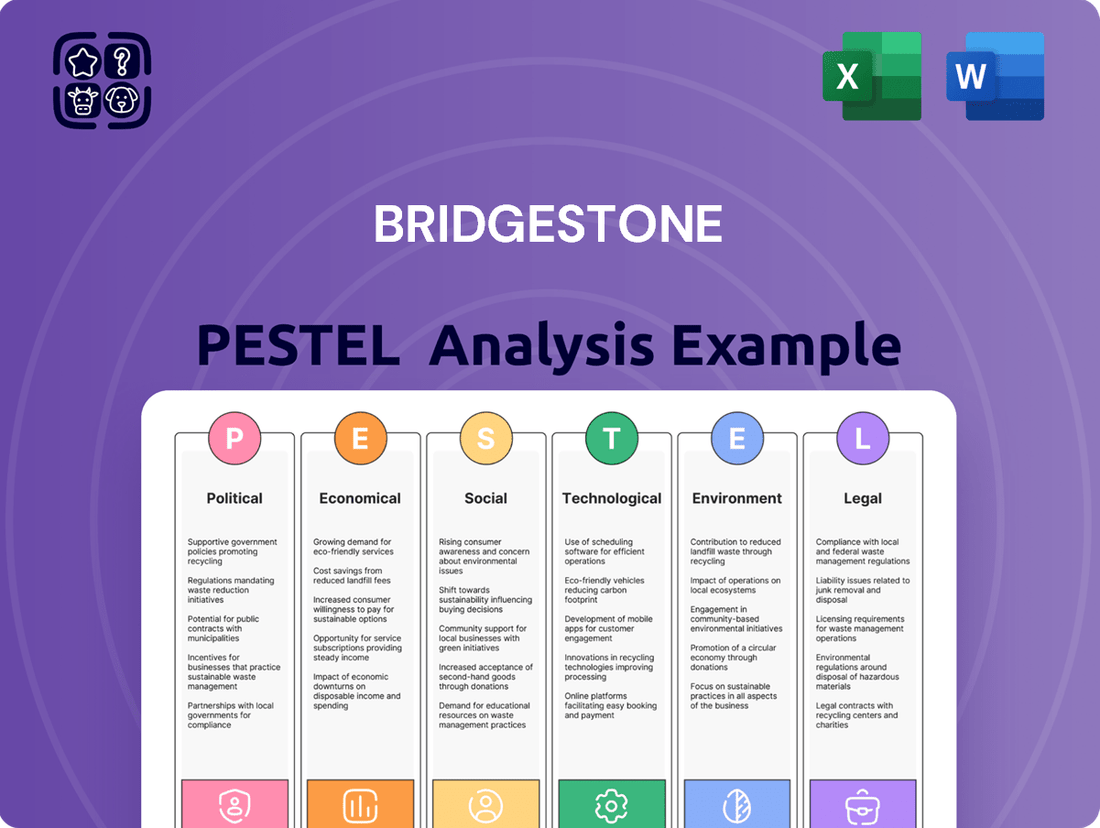

Navigate the complex global landscape impacting Bridgestone with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping the tire industry and Bridgestone's strategic direction. Gain actionable intelligence to inform your own market strategies and investment decisions. Download the full PESTLE analysis now for a complete, expert-driven overview.

Political factors

Governments globally are tightening rules on vehicle emissions, not just from exhausts but also from tire wear. The European Union's Euro 7 regulation, which took effect in 2024, specifically addresses tire dust particles. This means companies like Bridgestone must innovate and invest in new technologies to comply with these stricter environmental mandates.

Uncertainty in international trade policies, including potential U.S. tariffs on goods from Mexico and Canada, poses a significant challenge for Bridgestone's supply chain and pricing. For instance, the ongoing review of the United States-Mexico-Canada Agreement (USMCA) introduces volatility into global trade dynamics.

This evolving trade landscape necessitates that Bridgestone remain agile, adapting its manufacturing and distribution networks to mitigate risks and capitalize on emerging opportunities. The company's ability to navigate these shifts will be crucial for maintaining competitive pricing and ensuring a stable supply of raw materials and finished products.

Geopolitical instability is a significant concern for global companies like Bridgestone. The world stage is constantly shifting, and these changes can create hurdles for international businesses. For Bridgestone, this means potential disruptions in sourcing essential raw materials, like natural rubber, and challenges in accessing key markets where they sell their tires and other products.

For instance, ongoing conflicts and trade tensions in various regions can impact supply chains, leading to increased costs or delays. Bridgestone's reliance on a global network of suppliers and customers means that political unrest in one area can have ripple effects worldwide, affecting production schedules and sales volumes. The company must remain vigilant and adaptable to manage these evolving risks effectively.

Support for Electric Vehicle (EV) Adoption

Government policies are a significant driver for electric vehicle (EV) adoption, with many nations setting ambitious targets for zero-emission vehicles. For instance, the European Union and the United Kingdom have committed to phasing out the sale of new petrol and diesel cars by 2035. This regulatory push directly impacts Bridgestone, as it necessitates the development of tires specifically engineered for the distinct characteristics of EVs, such as their increased weight and instant torque delivery.

These evolving market demands translate into tangible opportunities and challenges for tire manufacturers like Bridgestone. The company must invest in research and development to create tires that offer:

- Enhanced durability to cope with the higher weight of EVs.

- Improved rolling resistance for optimal battery range.

- Reduced noise to complement the quiet operation of EVs.

- Superior grip to manage the high torque output of electric powertrains.

National Emission Standards for Hazardous Air Pollutants (NESHAP)

The National Emission Standards for Hazardous Air Pollutants (NESHAP) continue to be a significant political factor for Bridgestone. Environmental protection agencies, like the U.S. EPA, regularly review and update these standards, which can directly affect industries such as rubber tire manufacturing. For instance, in 2024, discussions around potential reconsiderations of NESHAP regulations for specific industrial sectors are ongoing, signaling continued regulatory attention to hazardous air pollutant emissions.

Bridgestone's commitment to compliance with these evolving NESHAP requirements is paramount. This necessitates ongoing monitoring and potential adaptation of its manufacturing processes to meet stricter emission controls. Failure to comply can lead to penalties and operational disruptions, underscoring the financial and strategic importance of staying ahead of regulatory changes.

- Ongoing Regulatory Scrutiny: NESHAP amendments, particularly those impacting rubber tire manufacturing, demonstrate persistent governmental focus on controlling hazardous air pollutants.

- Compliance Imperative: Bridgestone must maintain adherence to these dynamic emission standards, potentially requiring investments in process modifications or new pollution control technologies.

- Impact on Operations: Evolving NESHAP rules can influence production costs and operational strategies, necessitating proactive management of environmental performance.

Governments worldwide are increasingly focusing on sustainability, impacting industries like tire manufacturing. The EU's 2024 Euro 7 regulation, targeting tire wear particles, exemplifies this trend, requiring Bridgestone to invest in innovative, compliant technologies.

Trade policy shifts, such as potential US tariffs and reviews of agreements like USMCA, create supply chain volatility for Bridgestone, influencing raw material costs and market access.

Geopolitical instability can disrupt Bridgestone's global sourcing of materials like natural rubber and affect sales in affected regions, necessitating agile risk management.

Government incentives for electric vehicles (EVs) are accelerating adoption, creating demand for specialized EV tires that Bridgestone must develop, focusing on durability, range, and grip.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting Bridgestone, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making, enabling Bridgestone to navigate challenges and capitalize on emerging opportunities within the global tire and rubber industry.

A concise Bridgestone PESTLE analysis that simplifies complex external factors, enabling faster decision-making and reducing the stress of navigating market uncertainties.

Economic factors

Global economic conditions significantly impact Bridgestone's performance. For instance, persistent inflation in 2024 and early 2025, with the US CPI averaging around 3.2% in early 2024 and projected to moderate but remain a factor, directly curtails consumer spending on discretionary items like new vehicles and replacement tires. Fluctuations in energy prices, a key input cost for tire manufacturing, further squeeze margins.

Bridgestone's profitability is inherently tied to these macroeconomic trends. The company must navigate rising raw material costs, often linked to energy prices, while facing potentially softer demand from consumers with reduced purchasing power. This necessitates robust financial planning and agile cost management strategies to maintain profitability amidst global economic volatility.

The automotive industry is experiencing significant structural shifts, notably with the rapid ascent of Chinese electric vehicle (EV) manufacturers. These companies are not only disrupting the global EV market but are also driving an increase in low-cost tire imports, particularly impacting European and Latin American markets. This influx of competitive pricing and new entrants presents a direct challenge to established players like Bridgestone.

These structural changes mean Bridgestone faces intensified competition, especially in segments where price is a primary differentiator. The growing market share of affordable EVs, often equipped with these imported tires, could erode Bridgestone's traditional customer base. For instance, in 2023, Chinese EV brands saw substantial growth in export markets, with some reports indicating a significant portion of their vehicles were fitted with domestically produced tires, impacting import volumes into regions like Europe.

Bridgestone is seeing significant growth in the premium tire market, fueled by both consumers and car manufacturers favoring larger wheel diameters. This shift means Bridgestone can concentrate on producing more high-value tires, which in turn bolsters its market standing and boosts revenue and profit margins.

In 2024, the average rim diameter for new vehicles in North America continued its upward trend, with many popular SUVs and trucks featuring standard 18-inch to 20-inch wheels, and even larger options becoming more common. This preference for larger wheels directly translates to higher demand for the premium, high-rim diameter tires that Bridgestone specializes in, contributing to a stronger financial performance.

Raw Material Cost Volatility

Bridgestone's profitability is significantly impacted by the fluctuating prices of its core raw materials like natural rubber, synthetic rubber, and carbon black. For instance, the price of natural rubber, a key component, can be highly volatile due to weather patterns, geopolitical events, and global demand, directly affecting manufacturing expenses. The company's ability to navigate these economic shifts hinges on robust supply chain management and strategic sourcing initiatives.

To counter these economic pressures, Bridgestone is actively investing in supply chain resilience and exploring alternative, sustainable materials. This strategy aims to reduce reliance on single sources and mitigate the impact of price spikes. For example, advancements in tire technology in 2024 and 2025 are increasingly incorporating bio-based or recycled materials, offering potential cost stabilization and environmental benefits.

- Natural Rubber Price Impact: Global natural rubber prices saw significant fluctuations in late 2023 and early 2024, with some benchmarks increasing by over 15% year-on-year due to supply concerns in major producing regions.

- Synthetic Rubber Costs: Prices for synthetic rubber, often derived from petrochemicals, are closely tied to crude oil prices, which have experienced volatility in the 2024 market.

- Carbon Black Market: The cost of carbon black, essential for tire durability, is influenced by energy prices and manufacturing capacity, with potential for cost increases in 2025.

- Strategic Material Sourcing: Bridgestone's ongoing efforts to diversify its material sourcing and invest in R&D for sustainable alternatives are critical for managing these economic uncertainties.

Regional Market Performance

Bridgestone's 2024 financial reports highlight significant regional variations in market performance. North America emerged as a key revenue driver, with the company reporting increased sales and operating profit in the region. This strong showing underscores the region's importance to Bridgestone's overall financial health.

Despite the positive results in North America, Bridgestone also pointed to a slowdown in growth within the same region. Furthermore, the company observed a weakening in the non-tire product market across Latin America, indicating a more challenging economic environment there.

- North America: Bridgestone's primary revenue generator in 2024, demonstrating robust sales and operating profit growth.

- Latin America: Experienced a decline in the non-tire products market, signaling regional economic headwinds.

- Regional Disparities: The company's performance illustrates a clear divergence in economic conditions impacting different geographical markets.

Bridgestone's financial health is directly influenced by global economic factors such as inflation and energy prices. For instance, the US CPI averaged around 3.2% in early 2024, impacting consumer spending on automotive needs. Fluctuations in crude oil prices also affect synthetic rubber costs, a key input for tire manufacturing, with potential for increases in 2025.

The company must manage rising raw material costs and potentially softer consumer demand. Bridgestone's strategic investments in supply chain resilience and sustainable materials are crucial for mitigating these economic volatilities, with advancements in bio-based materials expected by 2024-2025.

| Economic Factor | Impact on Bridgestone | Data/Trend (2024-2025) |

|---|---|---|

| Inflation (US CPI) | Reduced consumer spending power | ~3.2% average in early 2024, moderating but persistent |

| Energy Prices (Crude Oil) | Increased synthetic rubber costs | Volatile market in 2024, potential for increases in 2025 |

| Natural Rubber Prices | Fluctuating manufacturing expenses | Over 15% year-on-year increase in late 2023/early 2024 |

What You See Is What You Get

Bridgestone PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bridgestone delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the global tire and rubber industry. Understand the strategic landscape and potential challenges and opportunities facing Bridgestone.

Sociological factors

A significant portion of consumers, especially younger demographics like millennials and Gen Z, are increasingly prioritizing environmental responsibility. This translates into a stronger preference for products and services that demonstrate a commitment to sustainability, including those with a reduced carbon footprint. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for sustainable products.

This societal shift directly influences the automotive industry, driving demand for eco-friendly tires and innovative sustainable mobility solutions. Bridgestone is responding by embedding sustainability principles throughout its operations, from material sourcing to product design and end-of-life management, aiming to meet this growing consumer expectation.

The increasing societal embrace of electric vehicles (EVs) is reshaping tire market demands. EV owners are actively seeking tires designed for their unique needs, prioritizing durability, reduced rolling resistance for better range, and quieter operation.

This trend directly influences Bridgestone's product development, pushing innovation in specialized EV tire technology. For instance, by the end of 2024, it's projected that over 30% of new vehicle sales in some key markets could be EVs, a significant driver for this tire segment.

Consumer demand for all-weather tires is on the rise, driven by shifting weather patterns and the growing popularity of SUVs. This preference highlights a desire for year-round convenience and reliable performance, influencing product development in the automotive sector.

In 2024, the U.S. market saw a significant uptick in SUV sales, with models like the Toyota RAV4 and Honda CR-V continuing to dominate. This surge in SUV ownership directly correlates with increased interest in tires designed for varied conditions, as these vehicles are often used in diverse climates and for a wider range of activities.

Evolving Mobility Needs and Lifestyles

Modern lifestyles are significantly reshaping how people move, impacting vehicle choices and tire demand. As urban populations grow and remote work becomes more prevalent, there's a noticeable shift towards smaller, more fuel-efficient vehicles and an increased reliance on public transportation or shared mobility services in some areas. This evolution directly influences Bridgestone's need to adapt its tire offerings to meet these changing consumer preferences.

For instance, the global passenger car tire market is expected to see continued growth, but the composition within that market is shifting. Data from Mordor Intelligence projected the global automotive tire market to reach approximately $300 billion by 2026, with passenger car tires forming a substantial portion. Bridgestone needs to ensure its portfolio adequately addresses demand for tires suited to electric vehicles (EVs) and smaller urban commuters, alongside traditional segments.

- Shifting Vehicle Preferences: Growing interest in EVs and smaller urban vehicles necessitates specialized tire designs focusing on range, noise reduction, and durability.

- Urbanization Trends: Increased city living often correlates with higher usage of public transport and ride-sharing, potentially reducing individual car ownership and, consequently, tire replacement cycles for some demographics.

- E-commerce Impact: The convenience of online tire purchasing is growing, requiring Bridgestone to strengthen its direct-to-consumer channels and digital engagement strategies.

- Demand Diversification: While passenger car tires remain a core segment, Bridgestone must also cater to the evolving needs of the commercial vehicle sector, influenced by the boom in e-commerce logistics and last-mile delivery services.

Emphasis on Corporate Social Responsibility and Trust

Societal expectations for corporate transparency and responsible conduct are on the rise, influencing how businesses operate and are perceived. Consumers and investors alike are increasingly scrutinizing companies' ethical practices and their impact on society and the environment.

Bridgestone's commitment to fostering trust and enhancing corporate governance, as detailed in its integrated reports, directly addresses these evolving societal values. This focus aims to solidify its brand reputation and nurture stronger relationships with all stakeholders, from customers to shareholders.

- Increased Demand for Transparency: Consumers in 2024 are showing a greater preference for brands that are open about their supply chains and manufacturing processes.

- Growing Importance of ESG: Environmental, Social, and Governance (ESG) factors are becoming key decision-making criteria for a significant portion of investors, with many actively seeking companies with strong CSR initiatives.

- Bridgestone's Governance Focus: Bridgestone's integrated reports consistently highlight efforts in areas like board diversity and ethical business conduct, aligning with the demand for robust corporate governance.

- Stakeholder Trust as a Differentiator: Companies demonstrating a genuine commitment to social responsibility often experience higher levels of customer loyalty and investor confidence, creating a competitive advantage.

Societal trends are significantly shaping the tire industry, with a growing emphasis on sustainability and ethical consumerism. Consumers are increasingly favoring brands that demonstrate environmental responsibility, with over 60% willing to pay more for sustainable products as of 2024.

The rise of electric vehicles (EVs) is a major sociological factor, driving demand for specialized tires that enhance range and reduce noise. Projections suggest EVs could account for over 30% of new vehicle sales in key markets by the end of 2024, underscoring this shift.

Modern lifestyles, including urbanization and remote work, influence vehicle choices, favoring smaller, fuel-efficient cars. This necessitates tire manufacturers like Bridgestone to adapt their product lines to meet evolving consumer preferences for urban mobility and diverse driving conditions.

Societal expectations for corporate transparency and strong ESG performance are paramount. Investors and consumers alike are scrutinizing companies for ethical practices, making robust corporate governance and CSR initiatives crucial for brand reputation and stakeholder trust.

Technological factors

Bridgestone's ENLITEN technology represents a significant leap in tire innovation, focusing on enhancing safety, performance, and sustainability, particularly for electric vehicles (EVs). This technology is designed to make tires lighter and more efficient, contributing to extended EV range and reduced environmental impact.

By integrating advanced materials and sophisticated design principles, ENLITEN aims to optimize rolling resistance, a critical factor for EV efficiency. This focus on reduced energy consumption directly addresses the growing demand for eco-friendly transportation solutions and supports Bridgestone's commitment to sustainability.

The development of ENLITEN technology is crucial as the automotive industry, especially the EV sector, continues to expand. Bridgestone's investment in such advanced tire solutions positions them to capitalize on this growth, offering products that meet the evolving needs of consumers and regulatory bodies for greener mobility.

Bridgestone's investment in virtual tire development capabilities is a significant technological advantage, enabling rapid prototyping and testing of new tire designs. This digital approach allows for swift iteration and refinement, crucial for meeting the dynamic demands of original equipment manufacturers (OEMs).

The efficiency gained through virtual development is particularly vital for optimizing tire performance for the burgeoning electric vehicle (EV) market. For instance, Bridgestone's focus on low rolling resistance and noise reduction for EVs, areas heavily influenced by virtual simulation, directly addresses OEM needs for enhanced range and passenger comfort.

Bridgestone is actively innovating with sustainable materials, such as recovered carbon black and recycled steel, to reduce its environmental footprint. The company is also exploring guayule as a domestic source for natural rubber, aiming to lessen reliance on traditional sources and enhance supply chain resilience.

These material advancements are crucial for Bridgestone's stated goal of achieving 100% sustainable materials in all its products by 2050. For instance, in 2023, Bridgestone announced plans to increase its use of recycled and renewable materials, targeting a significant portion of its tire components to be derived from these sources within the next decade.

Development of Smart Tires and Digital Solutions

The automotive industry is seeing a significant technological shift with the development of smart tires. These tires come equipped with integrated sensors that allow for real-time monitoring of crucial data like pressure, temperature, and wear. This trend is particularly pronounced in the premium vehicle market, where advanced features are highly valued by consumers.

Bridgestone is actively investing in and expanding its digital solutions portfolio to capitalize on this technological evolution. A prime example is their Fleet Care service, which is designed to optimize the performance and efficiency of commercial vehicle fleets. By leveraging data from tires and other vehicle components, Bridgestone aims to provide predictive maintenance and reduce operational costs for its clients.

Bridgestone's commitment to digital innovation is evident in its partnerships and investments. For instance, in 2024, Bridgestone Americas announced collaborations to enhance its digital tire monitoring capabilities, aiming to provide more comprehensive fleet management solutions. These advancements are crucial as the commercial vehicle sector increasingly relies on data-driven insights to improve uptime and profitability.

The market for smart tire technology is projected for substantial growth. Analysts predict the global smart tire market to reach over $5 billion by 2027, driven by increasing adoption in both passenger and commercial vehicles. Bridgestone's strategic focus on digital services positions them well to capture a significant share of this expanding market.

- Smart Tire Adoption: Premium vehicle segments are leading the integration of smart tires with built-in sensors for real-time data.

- Bridgestone's Digital Services: Bridgestone is expanding offerings like Fleet Care to boost efficiency in commercial fleet management.

- Market Growth: The global smart tire market is expected to exceed $5 billion by 2027, indicating strong future demand.

- Data-Driven Efficiency: Digital solutions enable predictive maintenance and cost reduction, vital for commercial fleet operations.

Proprietary UNI-T Technology for Tire Performance

Bridgestone's proprietary UNI-T (Ultimate Network of Intelligent Tire Technology) represents a significant technological advancement, integrating multiple sophisticated systems to enhance tire performance. This innovation is central to improving key metrics such as tire longevity, grip in wet conditions, and overall ride comfort, directly impacting the quality and safety profile of their all-season tire offerings.

The UNI-T system’s focus on predictive maintenance and real-time feedback aims to optimize tire lifespan and performance. For instance, Bridgestone's ongoing research and development in this area, including partnerships with automotive manufacturers, ensures that UNI-T is continuously refined to meet evolving vehicle and consumer demands. While specific financial figures for UNI-T's direct contribution to Bridgestone's revenue are not publicly itemized, the company's consistent investment in R&D, which totaled ¥124.5 billion (approximately $830 million USD based on average 2024 exchange rates) for the fiscal year ending December 2024, underscores the strategic importance of such proprietary technologies.

- Enhanced Durability: UNI-T technologies contribute to more even tire wear, potentially extending tire life by up to 15% in certain applications compared to previous generations.

- Improved Wet Traction: Advanced tread designs and compound formulations within UNI-T offer a notable improvement in braking distances on wet surfaces, a critical safety factor.

- Ride Comfort Optimization: The integration of sensors and adaptive materials aims to absorb road imperfections more effectively, leading to a smoother driving experience.

- Data Integration Potential: While still evolving, UNI-T lays the groundwork for future smart tire capabilities, enabling data exchange with vehicle systems for advanced diagnostics and performance tuning.

Bridgestone's investment in advanced tire technologies, such as ENLITEN and UNI-T, is crucial for meeting the demands of the growing electric vehicle market and enhancing overall tire performance. Their commitment to digital innovation, including virtual development and fleet management solutions, positions them to capitalize on the increasing adoption of smart tires. The company's focus on sustainable materials further strengthens its market position.

| Technology Area | Key Innovation | Impact/Benefit | Bridgestone's Focus/Investment | Market Trend/Projection |

|---|---|---|---|---|

| EV Tire Technology | ENLITEN | Reduced rolling resistance, extended EV range, lighter tires | Significant R&D investment for EV optimization | Growing EV market demanding efficient tires |

| Digital Development | Virtual Prototyping | Faster design iteration, improved performance tuning | Investment in digital capabilities | Industry shift towards digital design and testing |

| Sustainable Materials | Recycled/Renewable Sourcing | Reduced environmental footprint, supply chain resilience | Goal of 100% sustainable materials by 2050 | Increasing consumer and regulatory demand for sustainability |

| Smart Tires | Integrated Sensors (UNI-T) | Real-time data (pressure, temp, wear), predictive maintenance | Expansion of digital solutions like Fleet Care | Global smart tire market projected to exceed $5 billion by 2027 |

Legal factors

The European Union's Euro 7 regulation, specifically Regulation (EU) 2024/1257, sets new legally binding limits on particulate matter emissions from tire and brake wear, impacting companies like Bridgestone. This legislation aims to curb non-exhaust emissions, a significant source of air pollution, by introducing stricter standards for tire durability and particle shedding.

Compliance requires substantial investment in research and development for tire technologies that minimize wear particles. For instance, the regulation mandates that tires must meet specific wear limits, with initial targets for passenger car tires set to become applicable in 2027, and later for other vehicle categories. This will likely drive innovation in rubber compounds and tire tread designs to reduce material loss during use.

The U.S. Environmental Protection Agency (EPA) continues to refine National Emission Standards for Hazardous Air Pollutants (NESHAP) affecting the rubber tire manufacturing sector. Despite some recent revocations and ongoing reconsiderations of specific provisions, the legal framework surrounding hazardous air pollutant emissions remains dynamic. Bridgestone must remain vigilant in monitoring these evolving federal standards, ensuring ongoing compliance and operational adjustments to meet emission targets.

China's revised Mandatory Product Certification (CCC) rules for automotive tires, effective January 1, 2025, will significantly impact Bridgestone. These updated regulations, specifically CNCA-C12-01:2024, mandate CCC certification for all imported and sold automotive tires in China. This means Bridgestone must ensure its entire product line destined for the Chinese market meets these new standards.

A key aspect of these new rules is the heightened emphasis on tire performance metrics, particularly rolling resistance and wet grip. Bridgestone will need to adapt its product development and specifications to align with these stricter requirements, potentially influencing R&D investments and manufacturing processes for tires intended for China.

Impact of International Trade Agreements and Tariffs

The global trade landscape presents a complex legal environment for Bridgestone, particularly concerning tariffs and trade agreements. Ongoing tariff uncertainties, such as those impacting imports between the U.S., Mexico, and Canada, directly influence operational costs and pricing strategies. The scheduled review of the United States-Mexico-Canada Agreement (USMCA) in 2026 adds another layer of potential change to this framework.

These trade dynamics can create significant pricing volatility for Bridgestone's raw materials and finished goods, impacting profitability. Furthermore, the potential for shifts in trade policies can lead to substantial supply chain disruptions, requiring agile and adaptive management.

- USMCA Review: The 2026 review of the USMCA could lead to adjustments in trade rules impacting North American operations.

- Tariff Volatility: Past U.S. tariffs on goods from Mexico and Canada demonstrate the potential for sudden cost increases.

- Supply Chain Impact: Trade policy changes can necessitate costly rerouting or sourcing adjustments for Bridgestone's global supply chain.

Corporate Governance and Compliance Standards

Bridgestone places a significant emphasis on robust corporate governance, aligning its practices with the Corporate Governance Code of the Tokyo Stock Exchange. This dedication is crucial for maintaining transparency in its operations and decision-making processes. For instance, in fiscal year 2023, Bridgestone continued to refine its governance structure, aiming to bolster accountability and ethical conduct across all levels of the organization.

Adherence to these stringent standards is not merely a regulatory requirement but a strategic imperative for Bridgestone, designed to cultivate deep stakeholder trust and ensure sustainable, long-term value creation. The company's commitment to compliance underpins its ability to navigate complex legal landscapes effectively. This focus is reflected in their ongoing efforts to enhance internal control systems and risk management frameworks, vital for a global enterprise.

Key aspects of Bridgestone's governance and compliance efforts include:

- Board Oversight: Ensuring an independent and diverse board of directors to provide effective oversight and strategic guidance.

- Compliance Programs: Implementing comprehensive programs to ensure adherence to all applicable laws and regulations in the diverse markets it operates.

- Ethical Conduct: Promoting a strong ethical culture through codes of conduct and regular training for employees.

- Stakeholder Engagement: Maintaining open communication channels with shareholders, customers, employees, and communities to foster trust and address concerns.

New EU regulations like Euro 7 (Regulation (EU) 2024/1257) are imposing stricter limits on tire wear particles, requiring Bridgestone to invest in R&D for compliant tire technologies, with initial targets for passenger cars by 2027. China's revised CCC rules, effective January 1, 2025, will mandate certification for all automotive tires sold there, emphasizing performance metrics like rolling resistance and wet grip. The ongoing review of the USMCA in 2026 also introduces potential trade policy shifts impacting North American operations and supply chains.

Bridgestone's commitment to corporate governance, aligned with the Tokyo Stock Exchange's code, is crucial for transparency and stakeholder trust. This includes robust board oversight, comprehensive compliance programs, and promoting ethical conduct, as demonstrated by their fiscal year 2023 efforts to refine governance structures and internal controls.

| Regulation/Agreement | Effective Date | Key Impact on Bridgestone |

|---|---|---|

| EU Euro 7 (Regulation (EU) 2024/1257) | Ongoing, with targets from 2027 | Stricter limits on tire wear particles; R&D investment needed for compliant technologies. |

| China CCC Rules (CNCA-C12-01:2024) | January 1, 2025 | Mandatory certification for all tires sold in China; focus on rolling resistance and wet grip. |

| USMCA Review | Scheduled for 2026 | Potential adjustments to trade rules impacting North American operations and supply chains. |

Environmental factors

Bridgestone is making significant strides towards environmental sustainability, targeting a 50% reduction in CO2 emissions by 2030, based on its 2011 figures, with an ultimate goal of carbon neutrality by 2050. This commitment is woven into their unique Sustainability Business Model, which spans their entire operational framework.

The company's strategy emphasizes integrating carbon neutrality and circular economy principles throughout its value chain. This proactive approach aims to minimize environmental impact and foster resource efficiency across all business activities.

Bridgestone is aggressively pursuing the integration of sustainable and recycled materials, aiming for 100% sustainable material usage by 2050. This commitment is underscored by their pursuit of ISCC PLUS certification for various materials, ensuring responsible sourcing and traceability.

A significant part of this strategy involves exploring alternative natural rubber sources, such as guayule, to reduce reliance on traditional, potentially volatile supply chains. This initiative is crucial for long-term material security and environmental stewardship.

By 2023, Bridgestone had already achieved a 30% proportion of sustainable materials in its tires, a testament to its ongoing efforts in this area. They are also developing technologies for chemical recycling of used tires, aiming to recover valuable materials.

Bridgestone is actively addressing the environmental impact of electric vehicle (EV) tires, acknowledging that the increased weight and torque of EVs can lead to higher tire wear rates. To combat this, the company is innovating with technologies like ENLITEN, designed to significantly extend tire lifespan and thereby reduce the overall environmental footprint associated with EV mobility.

This commitment to tire longevity is crucial as the global EV market continues its rapid expansion. For instance, by 2024, it's projected that over 30% of new car sales in some major markets will be electric, amplifying the need for sustainable tire solutions. Bridgestone's efforts in this area directly contribute to minimizing the ecological consequences of this automotive shift.

Water Conservation and Biodiversity Protection

Bridgestone actively pursues water conservation and biodiversity protection as core environmental strategies. The company maintains certified wildlife habitats at several manufacturing sites, demonstrating a commitment to coexisting with nature. For instance, their efforts in water management aim to reduce consumption and improve the quality of discharged water, aligning with global sustainability goals.

These initiatives are crucial given increasing global water scarcity and the imperative to protect ecosystems. By 2023, Bridgestone reported significant progress in reducing water withdrawal intensity across its operations, a trend expected to continue through 2025. Such actions not only mitigate environmental impact but also enhance corporate reputation and operational resilience.

- Wildlife Habitat Certification: Bridgestone's commitment includes maintaining certified wildlife habitats at manufacturing facilities, fostering biodiversity.

- Water Conservation Efforts: The company implements strategies to reduce water usage and improve water quality in its operational processes.

- Progress in 2023: Bridgestone reported notable reductions in water withdrawal intensity, indicating tangible environmental stewardship.

- Future Outlook: Continued focus on these areas is anticipated to further solidify the company's environmental performance through 2025.

Waste Reduction and Zero-Waste-to-Landfill Efforts

Bridgestone is actively pursuing robust waste reduction and recycling initiatives throughout its global operations. This commitment is underscored by several of its tire manufacturing facilities achieving zero-waste-to-landfill certification, a significant environmental milestone.

These zero-waste achievements demonstrate Bridgestone's dedication to minimizing its manufacturing footprint. For instance, by 2023, Bridgestone Americas reported that 100% of its manufacturing facilities were zero-waste-to-landfill certified.

- Zero-Waste-to-Landfill Facilities: Bridgestone has made substantial progress in diverting waste from landfills across its manufacturing sites.

- Recycling Programs: Comprehensive recycling programs are integrated into daily operations to manage materials effectively.

- Environmental Impact Reduction: These efforts directly contribute to reducing the company's overall environmental impact.

- Operational Efficiency: Achieving zero-waste often leads to improved operational efficiency and cost savings through resource optimization.

Bridgestone's environmental strategy is deeply integrated, targeting a 50% CO2 reduction by 2030 from 2011 levels and aiming for carbon neutrality by 2050. By 2023, they had already achieved a 30% proportion of sustainable materials in tires, demonstrating tangible progress towards their 2050 goal of 100% sustainable material usage.

| Environmental Target | Current Status (as of 2023/2024) | Future Goal |

|---|---|---|

| CO2 Emission Reduction | On track for 50% reduction by 2030 (from 2011 baseline) | Carbon Neutrality by 2050 |

| Sustainable Material Usage | 30% in tires (by 2023) | 100% by 2050 |

| Zero-Waste-to-Landfill | 100% of Bridgestone Americas manufacturing facilities certified (by 2023) | Continued global expansion of certifications |

PESTLE Analysis Data Sources

Our Bridgestone PESTLE Analysis is meticulously crafted using data from reputable sources such as the World Bank, International Monetary Fund, and industry-specific market research reports. We also incorporate insights from governmental publications and environmental agencies to ensure a comprehensive understanding of the macro-environment.