Bridgestone Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bridgestone Bundle

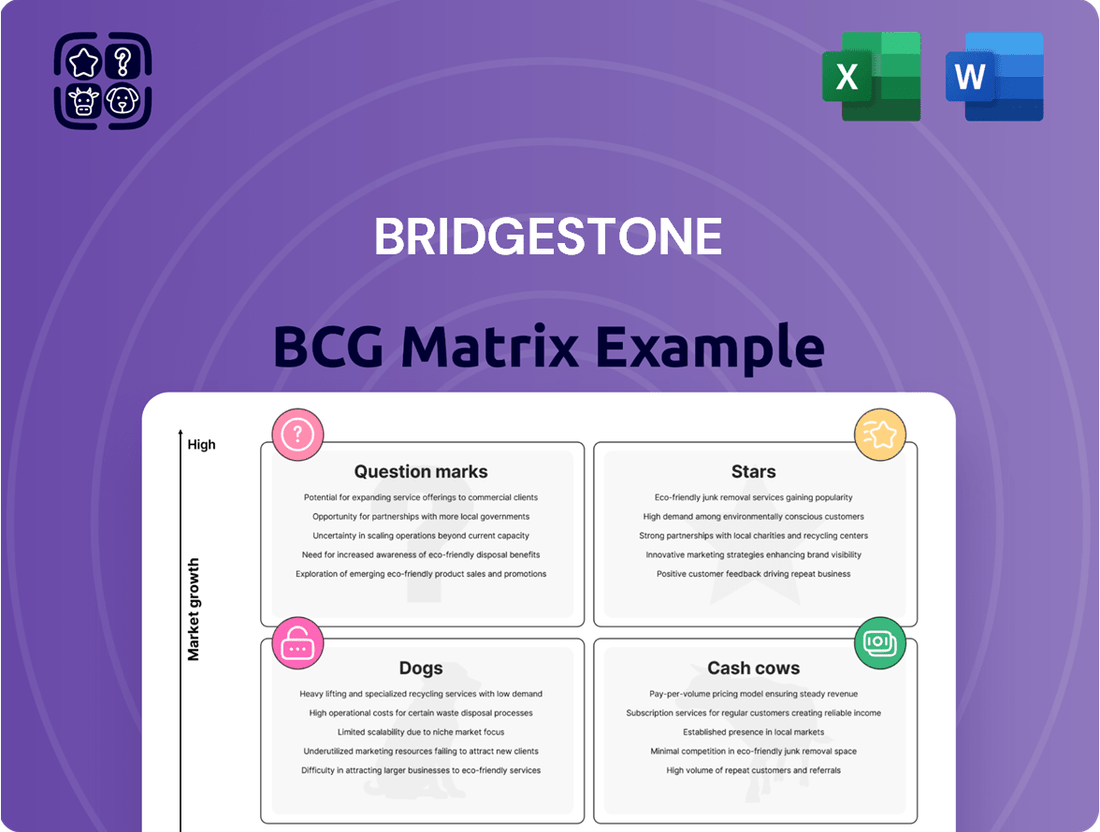

Curious about Bridgestone's product portfolio performance? Our exclusive BCG Matrix preview highlights their key market positions, revealing potential Stars, Cash Cows, and areas needing attention. Don't miss out on the complete picture!

Purchase the full Bridgestone BCG Matrix to unlock detailed quadrant analysis, strategic recommendations for each product category, and actionable insights to optimize your investment decisions and drive future growth.

Stars

Premium EV Tires, like Bridgestone's Turanza EV with Enliten Technology, are positioned as Stars in the BCG Matrix. They command a significant share within the booming electric vehicle market. Bridgestone's strategic expansion of this line aims to capture a substantial portion of the U.S. EV market, leveraging Enliten technology for enhanced sustainability and performance.

Bridgestone is experiencing significant growth in the high-rim diameter (HRD) passenger tire segment, encompassing 20-inch wheels and larger. This strategic focus aligns with evolving consumer preferences for vehicles equipped with bigger wheels, a trend that has been steadily gaining traction.

The demand for HRD tires is particularly robust, driven by the increasing popularity of SUVs and performance vehicles that often feature these larger wheel sizes as standard or desirable options. This segment commands premium pricing, contributing positively to Bridgestone's revenue and profitability.

In 2024, the global market for passenger car tires with rim diameters of 20 inches and above is projected to see continued expansion. For instance, industry reports indicate that the market share of tires with 19-inch rims and larger has been steadily increasing, with 20-inch and above segments showing particularly strong year-over-year growth in key automotive markets.

Bridgestone Mobility Solutions for Fleets represents a significant growth area, driven by demand in sectors like last-mile delivery and long-haul trucking. In 2024, the global fleet management market was projected to reach over $37 billion, highlighting the substantial opportunity.

Bridgestone is investing heavily in advanced technology to enhance its data collection and analysis capabilities. This allows them to offer fleet operators tools designed to boost operational efficiency and promote sustainability.

Off-the-Road (OTR) Tires for Mining Vehicles

Bridgestone's Off-the-Road (OTR) tires for mining vehicles represent a significant strength in their portfolio. The company holds a robust market share in ultra-large mining tires, a segment that benefits from consistently stable demand. This stability translates into substantial contributions to Bridgestone's overall revenue and profitability, further enhanced by the company's focus on integrated solutions beyond just the tire itself.

The mining industry's reliance on these heavy-duty tires ensures a steady revenue stream. For instance, in 2024, the global mining tire market, particularly for OTR applications, continued to show resilience, driven by ongoing infrastructure projects and commodity demand. Bridgestone's strategic investments in advanced tire technologies and services, such as tire monitoring and management, solidify its position as a preferred supplier.

- Market Dominance: Bridgestone is a leading player in the ultra-large mining tire segment.

- Stable Demand: The mining sector provides consistent demand for these specialized tires.

- Revenue Contribution: OTR tires are a significant driver of Bridgestone's financial performance.

- Integrated Solutions: Expansion into services like tire management enhances value and profitability.

Tires with ENLITEN Technology

Bridgestone's ENLITEN technology represents a significant shift in their product design, prioritizing both enhanced performance and environmental responsibility. This technology allows for greater flexibility in tire capabilities while integrating more renewable and recycled materials, a crucial aspect for sustainability-focused markets.

Bridgestone is actively rolling out new tires featuring ENLITEN across diverse segments, from commercial vehicles to passenger cars. The company has a clear objective to see a substantial increase in the number of vehicle models that come equipped with original equipment (OE) tires infused with ENLITEN technology.

- ENLITEN Technology Focus: Performance enhancement and sustainability through increased use of renewable and recycled materials.

- Product Rollout: New ENLITEN-equipped products are launching in commercial and passenger tire segments.

- OE Tire Expansion: Bridgestone aims to equip more car models with ENLITEN technology in their original tires.

Bridgestone's premium EV tires, like those featuring Enliten Technology, are firmly positioned as Stars in the BCG Matrix. These tires are capturing a significant share of the rapidly expanding electric vehicle market. Bridgestone's strategic push to broaden its EV tire offerings, particularly in North America, aims to capitalize on this growth.

The high-rim diameter (HRD) passenger tire segment, encompassing 20-inch wheels and larger, is a key growth area for Bridgestone. This trend is fueled by consumer preference for SUVs and performance vehicles that commonly utilize these larger wheel sizes. In 2024, the market for tires with 19-inch rims and above, especially 20-inch and larger, continued its upward trajectory in major automotive markets.

Bridgestone's advanced mobility solutions for fleets are also performing strongly, driven by demand in sectors such as last-mile delivery. The global fleet management market, valued at over $37 billion in 2024, presents a substantial opportunity for Bridgestone's data-driven efficiency tools.

The company's Off-the-Road (OTR) tires for mining vehicles are a consistent performer, holding a strong market position in ultra-large mining tires. This segment benefits from stable demand, contributing significantly to Bridgestone's revenue. The global mining tire market demonstrated resilience in 2024, supported by infrastructure development and commodity needs.

| Segment | BCG Category | Key Drivers | 2024 Market Insight | Bridgestone Strategy |

| Premium EV Tires | Star | EV market growth, sustainability focus | Strong year-over-year growth in EV tire sales | Expanding product line, Enliten Technology |

| High-Rim Diameter (HRD) Tires | Star | SUV/performance vehicle popularity, larger wheel trends | Increasing market share for 20-inch+ tires | Focus on premium pricing and market capture |

| Mobility Solutions for Fleets | Star | Fleet efficiency needs, last-mile delivery demand | Global fleet management market exceeding $37 billion | Investment in data analytics and efficiency tools |

| Off-the-Road (OTR) Mining Tires | Star | Stable mining demand, infrastructure projects | Resilient market performance driven by commodity demand | Leveraging existing market share, integrated solutions |

What is included in the product

The Bridgestone BCG Matrix analyzes its business units based on market share and growth, guiding strategic decisions for investment and resource allocation.

The Bridgestone BCG Matrix provides a clear, one-page overview, instantly clarifying which business units need investment and which can generate cash.

Cash Cows

Mainstream replacement passenger car tires are a cornerstone of Bridgestone's portfolio, acting as a reliable Cash Cow. Despite the industry's evolution towards premium and electric vehicle (EV) specific tires, this segment remains a substantial and mature market. Bridgestone's strong presence here ensures consistent revenue streams.

The ongoing need for tire replacements by a vast number of passenger car owners worldwide fuels predictable demand. This steady consumer requirement translates into a stable and significant cash flow for Bridgestone, underpinning its financial stability. For instance, the global replacement tire market was valued at over $100 billion in 2023, with passenger car tires forming a significant portion.

Bridgestone's Truck and Bus (TB) replacement tire segment in North America is a strong performer, often considered a cash cow. This market has been showing signs of a slow but steady recovery, and Bridgestone is actively working to capitalize on this trend.

The company is enhancing its fleet business by weaving in services like tire retreading, advanced mobility solutions, and essential maintenance. This integrated approach not only reinforces their position but also aims to boost profitability in a segment where Bridgestone already holds a significant market share.

Bridgestone's Bandag retreading business is a significant Cash Cow, demonstrating robust profitability and a commanding market share in North America. This segment effectively capitalizes on the circular economy by giving a second life to used tire casings, a process that is both economically advantageous and environmentally responsible for commercial fleets.

The cost-effectiveness of retreading is a major draw for fleet operators. For instance, Bandag retreads can offer savings of up to 50% compared to new tires, a crucial factor in managing operational expenses. This economic incentive, coupled with the sustainability aspect, solidifies Bandag's position as a leader in the commercial tire market.

Premium Passenger Car Tires (General)

Bridgestone's premium passenger car tires, a category that includes high-performance and larger diameter options, represent a significant pillar of their business. This segment is a major contributor to both the company's overall revenue and its adjusted operating profit.

The company has a robust history and a solid market position within this premium tire segment. Bridgestone is actively working to enhance its sales mix, focusing on increasing the proportion of these higher-margin products in its portfolio.

- Revenue Driver: Premium passenger car tires are a cornerstone of Bridgestone's financial performance, generating substantial revenue.

- Profitability: This segment boasts higher profit margins, directly boosting Bridgestone's adjusted operating profit.

- Strategic Focus: Bridgestone is strategically prioritizing the growth of premium tire sales to improve overall profitability.

Industrial Rubber and Chemical Products

Bridgestone's Industrial Rubber and Chemical Products segment is a key component of its diversified portfolio, operating within mature markets. These products, ranging from conveyor belts to specialized chemical compounds, cater to industries like construction, mining, and automotive manufacturing, which often exhibit steady demand but limited high-growth potential.

This segment functions as a Cash Cow within the BCG Matrix framework. While not experiencing rapid expansion, its established market presence and consistent demand translate into reliable cash generation for Bridgestone. In 2023, Bridgestone reported that its diversified products segment, which includes industrial goods, contributed significantly to its overall revenue, demonstrating the stability of these offerings.

- Stable Revenue Streams: The mature nature of the industries served ensures consistent, albeit slower, revenue generation.

- Consistent Profitability: Established operations and economies of scale likely lead to predictable and healthy profit margins.

- Cash Generation: Profits from this segment can be reinvested in high-growth areas of the business or used for debt reduction.

- Market Maturity: Growth is limited by the saturation of end-user markets, preventing rapid expansion.

Bridgestone's mainstream replacement passenger car tires are a prime example of a Cash Cow. This segment benefits from consistent, predictable demand from a vast global customer base, ensuring stable revenue streams. The company's strong market position in this mature segment allows for efficient operations and reliable cash generation.

The Truck and Bus (TB) replacement tire segment, particularly in North America, also functions as a Cash Cow for Bridgestone. By integrating services like retreading and fleet management, Bridgestone enhances profitability and reinforces its leadership in this steady market. The economic benefits of retreading, offering significant cost savings for fleet operators, further solidify this segment's cash cow status.

Bridgestone's Bandag retreading business is a highly profitable Cash Cow, leveraging the circular economy to provide cost-effective solutions for commercial fleets. This segment's success is driven by substantial cost savings, with Bandag retreads offering up to 50% savings compared to new tires, a key factor in its strong performance.

The Industrial Rubber and Chemical Products segment, serving mature industries like construction and mining, acts as a stable Cash Cow. While growth is limited, its established market presence and consistent demand generate reliable cash flow, which can be reinvested in other business areas. In 2023, Bridgestone's diversified products segment demonstrated this stability, contributing significantly to overall revenue.

| Segment | BCG Classification | Key Characteristics | Financial Contribution |

| Mainstream Passenger Car Replacement Tires | Cash Cow | High, stable demand; mature market; consistent revenue | Significant contributor to overall revenue and profitability |

| Truck and Bus (TB) Replacement Tires (North America) | Cash Cow | Steady demand; service integration enhances profitability | Reliable cash generation, supported by fleet services |

| Bandag Retreading | Cash Cow | Cost-effective for fleets; strong market share; circular economy | High profitability and robust cash flow |

| Industrial Rubber and Chemical Products | Cash Cow | Mature industries; consistent demand; limited growth potential | Stable revenue and predictable cash generation |

Preview = Final Product

Bridgestone BCG Matrix

The Bridgestone BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase, ready for immediate strategic application. This comprehensive analysis, detailing Bridgestone's product portfolio across Stars, Cash Cows, Question Marks, and Dogs, is delivered without any watermarks or demo content. You can confidently use this preview as a direct representation of the professional, actionable insights contained within the final report. Once purchased, this meticulously prepared BCG Matrix will be instantly available for your business planning and decision-making processes.

Dogs

The Truck and Bus (TB) Original Equipment (OE) tire segment in North America, Europe, and Asia is currently experiencing a significant downturn. Year-on-year demand for new truck and bus tires has notably decreased across these major markets, signaling a low-growth environment for this sector.

This challenging market dynamic is underscored by Bridgestone's strategic decision to exit the TB business in China, a clear indicator of the perceived lack of growth potential and profitability in the region. For instance, in 2023, the global commercial vehicle tire market saw a general slowdown, with some regions reporting single-digit declines in OE fitments.

The increasing availability of low-priced imported tires, particularly following tariff reductions, has put considerable pressure on North American tire manufacturers. This competitive landscape has directly affected demand for tires produced by U.S. and Canadian companies, impacting Bridgestone's market share and profitability in these regions.

In Europe and Latin America, Bridgestone is also facing similar challenges from these imported tires. The lower price points make it difficult for domestic and established brands to compete, leading to a decline in market share and squeezing profit margins for Bridgestone in these key markets.

Bridgestone's operations in Latin America, especially Brazil, have been a point of concern. This region has experienced a downturn, negatively affecting the company's broader financial results. The market there is characterized by low growth and a shrinking share for Bridgestone.

In 2023, Bridgestone reported that its Latin America segment saw a decline in net sales, contributing to a challenging year. The tire market in Brazil, a key component of this segment, faced headwinds from economic slowdowns and increased competition, leading to a reduction in Bridgestone's market penetration.

Traditional, Lower-Rim Diameter Passenger Tires

Traditional, lower-rim diameter passenger tires are likely positioned as Cash Cows within Bridgestone's BCG Matrix. While demand in this segment may be softening due to a consumer shift towards larger wheel sizes, these tires still represent a significant portion of the market, generating substantial, stable cash flow. For instance, in 2024, the global passenger car tire market, which includes these traditional sizes, was valued at approximately $190 billion, indicating continued, albeit slower, revenue generation.

- Declining Growth: Consumer and automaker preferences are increasingly leaning towards larger wheel diameters, impacting the growth trajectory of traditional tire sizes.

- Stable Cash Flow: Despite slower growth, these tires continue to be a reliable source of revenue for Bridgestone, contributing significantly to cash generation.

- Market Share Pressure: Evolving vehicle designs and consumer tastes pose a risk of eroding market share for manufacturers heavily reliant on traditional tire segments.

- Mature Market: This segment represents a mature market with limited opportunities for aggressive expansion, focusing instead on maintaining profitability.

Divested Businesses (e.g., US Building Materials, Anti-Vibration Rubber, Chemical Products Solutions)

Bridgestone has strategically categorized certain business units, including its U.S. building materials, anti-vibration rubber, and chemical products solutions, as discontinued operations. This classification signals that these segments were identified as underperforming assets, characterized by a limited market share and subdued growth potential, making them prime candidates for divestiture.

The divestiture of these businesses aligns with Bridgestone's broader strategy to streamline its portfolio and concentrate resources on core, high-growth areas. For instance, in 2023, the company continued its portfolio optimization efforts, though specific financial details on these particular divested segments are often reported as part of discontinued operations, impacting overall revenue figures but isolating their performance.

- Divested Segments: U.S. Building Materials, Anti-Vibration Rubber, Chemical Products Solutions.

- Reason for Divestiture: Low market share and low growth prospects.

- Strategic Impact: Focus on core, high-growth businesses and portfolio optimization.

Bridgestone's traditional, lower-rim diameter passenger tires are likely positioned as Dogs in the BCG Matrix. These segments face declining growth due to evolving consumer preferences for larger wheel sizes, a trend that is expected to continue. While they still generate some cash, the limited growth potential and increasing market share pressure suggest they are not strategic growth drivers.

The market for these tires is mature, with minimal opportunities for significant expansion. This suggests that Bridgestone may eventually consider divesting or further reducing investment in these product lines to reallocate resources to more promising areas of its business. For example, the overall passenger car tire market, while large, is seeing shifts that disadvantage older, smaller tire sizes.

| BCG Category | Bridgestone Segment Example | Market Trend | Strategic Implication |

|---|---|---|---|

| Dogs | Traditional, lower-rim diameter passenger tires | Declining demand due to shift to larger wheel sizes | Low growth, potential divestiture candidate |

Question Marks

Bridgestone is making significant strides in advanced sustainable materials, aiming for tires with a remarkable 70%, 75%, and even 90% recycled and renewable content. This positions them to tap into a rapidly expanding market fueled by increasing consumer and regulatory pressure for eco-friendly solutions.

While the potential for these high-sustainability tires is substantial, they are currently in the early stages of development and commercialization. This means their market share is still relatively small, reflecting the ongoing testing and refinement required to bring these innovative products to a wider audience.

Bridgestone's new digital Service Dispatch Solution is positioned as a potential star within its BCG matrix. This innovative offering targets the burgeoning mobility solutions market, aiming to significantly cut fleet downtime and improve operational efficiency through streamlined communication. While the exact market share for these nascent digital services isn't publicly detailed, their introduction signifies Bridgestone's strategic move into a high-growth segment.

Bridgestone's investment in guayule-derived natural rubber positions this initiative as a potential Star within its BCG matrix. The company is targeting commercial production by the end of the decade, signaling a belief in high future growth for this sustainable raw material. While the current market share contribution is minimal, the significant R&D investment underscores its strategic importance for long-term market leadership in eco-friendly tire components.

New Product Launches in Emerging Segments (e.g., All-Terrain Enliten Tires, Heavy-Duty Truck Products with Enliten)

Bridgestone's introduction of Enliten technology into all-terrain tires and heavy-duty truck products signifies a strategic move towards emerging, high-growth market segments. This expansion targets areas like off-road vehicles and commercial transport, which are experiencing increasing demand for durability and efficiency.

These new product lines, while promising, are currently in their nascent stages of market penetration. Consequently, their market share is understandably low as Bridgestone builds brand recognition and distribution networks for these specialized offerings.

- All-Terrain Enliten Tires: Targeting the expanding SUV and light truck market, which saw global sales exceeding 30 million units in 2023.

- Heavy-Duty Truck Products with Enliten: Aimed at the commercial vehicle sector, where fuel efficiency and tire longevity are critical, with the global commercial tire market projected to grow at a CAGR of 4.5% through 2028.

- Market Share: Initial market share for these specific Enliten-equipped products is estimated to be less than 1% as of early 2024, reflecting their recent launch.

Expansion into New OE Fitments with ENLITEN Technology (increasing from 117 to 170 models)

Bridgestone is strategically expanding its original equipment (OE) fitments for vehicles utilizing its ENLITEN technology. The company plans to increase the number of car models equipped with these advanced tires from 117 to 170 by 2025. This aggressive growth initiative targets the burgeoning electric vehicle (EV) market, where demand for specialized, lightweight, and low-rolling-resistance tires is escalating.

This expansion represents a significant play in a high-growth segment, capitalizing on the increasing adoption of EVs. While the overall OE market is established, the specific market share for these new ENLITEN fitments is still in a developmental phase, offering substantial room for Bridgestone to capture market leadership.

- Target Expansion: Increase ENLITEN OE fitments from 117 to 170 car models by 2025.

- Market Focus: Primarily targeting the growing electric vehicle (EV) original equipment market.

- Strategic Importance: High-growth strategy aiming to capture developing market share in new fitments.

- Technology Advantage: Leveraging ENLITEN technology for enhanced performance and efficiency in EV tires.

Question Marks represent business units with low market share in high-growth industries. Bridgestone's development of tires with 70-90% recycled/renewable content, while promising for future growth, currently holds a minimal market share. Similarly, their new digital Service Dispatch Solution is entering a high-growth mobility market but has yet to establish a significant market presence.

Bridgestone's investment in guayule-derived natural rubber and the expansion of Enliten technology into all-terrain and heavy-duty truck tires also fall into the Question Mark category. These initiatives are targeting rapidly expanding segments, such as the SUV and commercial vehicle markets, but their initial market penetration is low, estimated at less than 1% for specific Enliten products as of early 2024.

The company's strategic push to increase ENLITEN OE fitments for electric vehicles, aiming for 170 car models by 2025, further exemplifies a Question Mark. This is a high-growth area with significant potential, but Bridgestone is still in the process of capturing market share for these specialized EV tires.

| Business Unit | Industry Growth | Market Share | BCG Category |

| High-Sustainability Tires (70-90% Recycled/Renewable) | High | Low | Question Mark |

| Digital Service Dispatch Solution | High (Mobility Solutions) | Low | Question Mark |

| Guayule-Derived Natural Rubber | High (Sustainable Materials) | Low | Question Mark |

| All-Terrain & Heavy-Duty Enliten Tires | High (SUV, Commercial Transport) | Low (<1% early 2024) | Question Mark |

| ENLITEN OE Fitments (EV Focus) | High (EV Market) | Developing | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth projections, to accurately position each business unit.