Bridgestone Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bridgestone Bundle

Uncover the strategic genius behind Bridgestone's global success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable lessons for your own venture. Ready to build your own winning strategy?

Partnerships

Bridgestone cultivates key partnerships with major automotive Original Equipment Manufacturers (OEMs) worldwide, providing the tires that come fitted on new cars. In 2024, this strategy remained central, with Bridgestone continuing to supply tires for a significant portion of global new vehicle production. These OEM relationships are vital for Bridgestone's market share in the lucrative new car segment.

These collaborations often extend beyond simple supply agreements, involving joint development of advanced tire technologies. Bridgestone works with OEMs to create tires specifically engineered for the unique performance, efficiency, and safety requirements of particular vehicle models. For instance, partnerships often focus on developing tires that enhance electric vehicle range or improve the handling characteristics of performance cars.

Bridgestone cultivates long-term relationships with its raw material suppliers, including those for natural rubber, synthetic rubber, and various chemicals. These partnerships are crucial for maintaining a consistent and reliable supply chain, which directly impacts production efficiency and cost management. For instance, in 2023, Bridgestone continued to emphasize sustainable sourcing, working with suppliers who adhere to environmental and social responsibility standards, a trend expected to intensify in 2024 and beyond.

Bridgestone actively partners with leading universities and research institutions globally to foster groundbreaking advancements. In 2024, for instance, their collaboration with the University of Akron focused on developing novel sustainable rubber compounds, aiming to reduce environmental impact. These academic alliances are crucial for accelerating the discovery and implementation of next-generation tire technologies and advanced mobility solutions.

Distribution and Retail Networks

Bridgestone's success in the replacement tire market hinges on its extensive network of key partners. These include independent tire dealers, regional distributors, and major retail chains, all crucial for ensuring broad customer access. For instance, in 2024, Bridgestone continued to leverage thousands of independent dealers across North America, providing localized sales and service points.

These partnerships are vital for offering not just tire sales but also essential services like installation and maintenance, enhancing customer convenience and brand loyalty. The company's strategy often involves supporting these partners with training and marketing resources to maintain consistent service quality and brand representation.

Bridgestone's channel strategy in 2024 emphasized strengthening relationships with large retail chains, which represent significant volume opportunities. These collaborations are designed to maximize market coverage and ensure that Bridgestone products are readily available to a diverse customer base, from individual car owners to fleet operators.

- Independent Dealers: Provide localized expertise and service, forming the backbone of Bridgestone's retail presence.

- Distributors: Facilitate efficient supply chain management, ensuring product availability across various regions.

- Retail Chains: Offer high-volume sales channels and broad consumer reach, enhancing brand visibility and accessibility.

Mobility Solution Providers

Bridgestone is forging key partnerships with mobility solution providers to adapt to the evolving automotive landscape. These collaborations focus on fleet management, telematics, and digital mobility services, allowing Bridgestone to offer more than just tires.

These strategic alliances are crucial for Bridgestone's expansion into new service-based revenue streams and participation in smart mobility ecosystems. For instance, by integrating with fleet management platforms, Bridgestone can proactively offer tire maintenance and replacement based on real-time vehicle data, improving operational efficiency for fleet operators.

- Fleet Management Integration: Partnering with companies like Samsara or Geotab allows Bridgestone to access fleet data for predictive maintenance and optimized tire performance.

- Telematics Data Utilization: Collaborations enable the use of telematics data to monitor tire pressure, wear, and temperature, reducing downtime and enhancing safety.

- Digital Mobility Services: Working with digital mobility service providers expands Bridgestone's reach into subscription-based models and connected vehicle solutions.

- Industry Growth: The global fleet management market was valued at approximately $30 billion in 2023 and is projected to grow significantly, underscoring the importance of these partnerships.

Bridgestone's key partnerships are foundational to its business model, spanning OEM collaborations, raw material suppliers, research institutions, and a vast distribution network. These alliances are critical for market penetration, technological advancement, and supply chain resilience.

In 2024, Bridgestone continued to deepen its ties with automotive manufacturers, ensuring its tires were factory-fitted on millions of new vehicles globally. Simultaneously, its commitment to sustainable sourcing intensified, with supplier relationships increasingly focused on environmental and social governance metrics.

The company's extensive network of independent dealers and retail chains remained a vital conduit for reaching consumers in the replacement market, supported by ongoing training and marketing initiatives.

Bridgestone also actively pursued partnerships in the burgeoning mobility services sector, integrating its tire solutions with fleet management and telematics providers to offer data-driven maintenance and enhanced vehicle efficiency.

| Partnership Type | Focus Area | 2024 Significance | Example |

|---|---|---|---|

| Automotive OEMs | New vehicle tire supply, joint development | Securing market share in new car segment | Supplying tires for major global car brands |

| Raw Material Suppliers | Natural rubber, synthetic rubber, chemicals | Ensuring supply chain stability and cost management | Sustainable sourcing initiatives for rubber |

| Research Institutions | Advanced tire technology, sustainable materials | Accelerating innovation and next-gen product development | Collaboration on novel rubber compounds |

| Distribution & Retail Network | Independent dealers, retail chains | Broad market access and customer service | Thousands of independent dealers in North America |

| Mobility Solution Providers | Fleet management, telematics | Expanding into service-based revenue streams | Integration with fleet management platforms |

What is included in the product

A detailed framework outlining Bridgestone's strategy, focusing on its global tire manufacturing and diversified product offerings, while highlighting key partnerships and revenue streams.

Bridgestone's Business Model Canvas acts as a pain point reliver by offering a visual, structured approach to understanding and optimizing their complex global operations, from raw material sourcing to customer delivery.

It efficiently maps out key activities and resources, helping to pinpoint and address inefficiencies or bottlenecks in their extensive tire manufacturing and distribution network.

Activities

Bridgestone's commitment to Research and Development is a cornerstone of its strategy, driving innovation in tire technology and sustainable practices. In 2024, the company continued to allocate significant resources towards exploring advanced rubber compounds and novel tread designs aimed at boosting fuel efficiency and extending tire lifespan.

This focus extends to developing eco-friendly materials and production methods, reflecting a growing emphasis on environmental responsibility. Bridgestone's R&D efforts in 2024 also targeted future mobility trends, including the integration of digital services and smart tire technologies to enhance connectivity and user experience.

Bridgestone’s manufacturing and production activities are centered around operating a vast global network of advanced facilities. These sites are crucial for efficiently producing a wide array of tires and rubber goods, all while upholding rigorous quality standards. For instance, in 2023, Bridgestone continued to invest in modernizing its plants, with a focus on enhancing automation and process optimization to meet growing global demand.

The company places a significant emphasis on optimizing its production processes, integrating cutting-edge automation technologies to boost efficiency and consistency. This commitment to operational excellence is key to maintaining their competitive edge. In 2024, Bridgestone is expected to further roll out advanced manufacturing techniques across its key production hubs, aiming for improved output and reduced lead times.

Sustainability is a growing priority within Bridgestone's manufacturing operations. They are actively integrating energy-efficient practices and waste reduction initiatives into their daily routines. By 2023, Bridgestone reported a notable reduction in CO2 emissions per ton of product compared to previous years, underscoring their dedication to environmentally responsible production.

Bridgestone's supply chain management focuses on the intricate global network, from securing raw materials like natural rubber to delivering tires worldwide. This involves optimizing logistics and inventory to ensure timely product availability across diverse markets. In 2024, Bridgestone continued to invest in digital transformation to enhance supply chain visibility and responsiveness, aiming to mitigate risks and improve efficiency.

Sales and Marketing

Bridgestone's sales and marketing efforts are central to its business model, focusing on creating and implementing comprehensive strategies across global and regional markets. This includes a strong emphasis on brand building and the successful introduction of new products. For instance, in 2023, Bridgestone continued its global marketing campaigns, leveraging digital platforms and sponsorships to enhance brand visibility and connect with consumers.

The company's approach involves targeted advertising to showcase the advantages of its tire and rubber products, from high-performance tires to advanced material solutions. Building and maintaining robust relationships with a wide network of distributors and directly with key customers is also a critical component.

- Global Strategy Development: Crafting overarching sales and marketing plans that cater to diverse international markets.

- Brand Promotion: Executing campaigns that highlight Bridgestone's commitment to quality, innovation, and sustainability.

- Channel Management: Nurturing relationships with distributors and direct sales channels to ensure efficient product reach.

- Customer Engagement: Utilizing digital and traditional marketing to communicate product benefits and reinforce brand loyalty.

Sustainability Initiatives

Bridgestone's key activities now heavily feature sustainability initiatives, integrating Environmental, Social, and Governance (ESG) principles across its operations. This involves everything from sourcing eco-friendly raw materials to managing tires responsibly after their useful life.

The company is actively working to shrink its carbon footprint and champion circular economy models. For instance, by 2023, Bridgestone had set targets to achieve 100% sustainable materials by 2050, with significant progress in renewable materials and recycled content.

- Reducing Carbon Footprint: Bridgestone aims to cut direct and indirect CO2 emissions by 35% by 2030 compared to 2018 levels.

- Circular Economy Practices: The company is investing in technologies for tire recycling and the development of materials from renewable sources.

- Responsible Operations: Ensuring ethical labor practices and community engagement are integral to their sustainability framework.

- Innovation Driver: Sustainability is a core focus for developing new, environmentally conscious products and business models.

Bridgestone's key activities encompass robust research and development, efficient global manufacturing, strategic sales and marketing, and a strong commitment to sustainability. These pillars drive innovation, ensure product quality, reach diverse markets, and align with environmental responsibility.

In 2024, Bridgestone continued its focus on advanced tire technologies and eco-friendly materials, while also optimizing its extensive manufacturing network. The company actively engaged in global sales and marketing campaigns, emphasizing brand value and customer relationships. Furthermore, sustainability initiatives, including carbon footprint reduction and circular economy practices, remained central to their operational strategy.

| Key Activity | 2023/2024 Focus | Impact/Goal |

|---|---|---|

| Research & Development | Advanced rubber compounds, smart tire tech, eco-materials | Enhanced fuel efficiency, longer tire life, future mobility solutions |

| Manufacturing & Production | Plant modernization, automation, process optimization | Increased efficiency, consistent quality, meeting global demand |

| Sales & Marketing | Global campaigns, digital platforms, channel management | Brand visibility, customer engagement, market penetration |

| Sustainability Initiatives | Carbon reduction (35% by 2030), circular economy, renewable materials | Reduced environmental impact, responsible sourcing, long-term viability |

Preview Before You Purchase

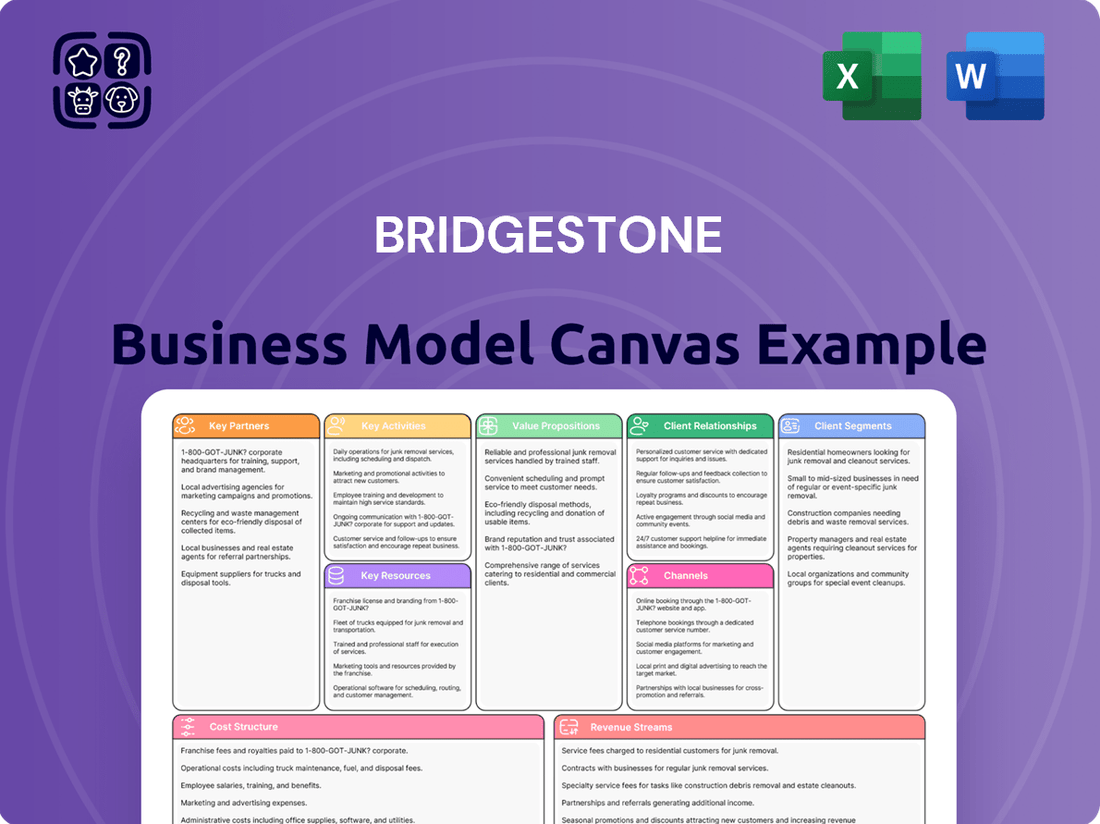

Business Model Canvas

The Bridgestone Business Model Canvas you're previewing is the actual document you will receive upon purchase. This isn't a sample or a mockup, but a direct representation of the complete, ready-to-use file. Once your order is complete, you'll gain full access to this same comprehensive business model, allowing you to immediately begin strategizing and refining your approach.

Resources

Bridgestone's global manufacturing facilities are a cornerstone of its operations, comprising over 150 production sites across the Americas, Europe, and Asia as of 2024. These plants are outfitted with sophisticated technology, allowing for the efficient production of a wide array of tires and rubber-based products, from passenger car tires to industrial materials. This extensive network ensures Bridgestone can meet diverse regional demands and maintain a robust global supply chain.

Bridgestone's intellectual property, including a substantial patent portfolio and proprietary technologies in tire design and material science, is a cornerstone of its competitive edge. This IP shields their innovations, particularly in areas like advanced rubber compounds and sustainable materials, which are vital for their high-performance products.

In 2023, Bridgestone continued its significant investment in research and development, allocating approximately 3.1% of its net sales to R&D activities, underscoring its commitment to maintaining a leading-edge technology base and expanding its intellectual property assets.

Bridgestone's brand equity and reputation are cornerstones of its business model, built on a legacy of quality, reliability, and innovation. This global recognition translates directly into customer trust and loyalty, a critical factor in purchasing decisions. In 2024, Bridgestone continued to leverage this strong brand perception to maintain its competitive edge.

The company's reputation allows it to command premium pricing for its tire products and related services. This brand strength also facilitates easier entry and acceptance in new geographical markets and product categories, as seen in their ongoing expansion efforts. Bridgestone's commitment to sustainability further bolsters its brand image, appealing to an increasingly environmentally conscious consumer base.

Skilled Workforce and R&D Talent

Bridgestone's business model heavily relies on its highly skilled workforce. This includes engineers, scientists, manufacturing experts, and sales professionals who are crucial for everything from daily operations to driving innovation and achieving market success. Their collective expertise is the engine behind Bridgestone's technological advancements and new product development.

The company's R&D talent is particularly vital. These individuals are at the forefront of discovering and implementing new materials, manufacturing processes, and tire technologies. For instance, Bridgestone's ongoing investment in R&D, including areas like sustainable materials and advanced sensor technology for tires, is directly fueled by the expertise of its scientific and engineering teams.

Recognizing this, Bridgestone actively invests in its human capital. Through continuous training and development programs, the company ensures its employees stay ahead of industry trends and possess the latest skills. This commitment to nurturing talent is a key factor in maintaining Bridgestone's competitive edge in the global market.

- Highly Skilled Workforce: Bridgestone employs a diverse range of professionals, from engineers and scientists to manufacturing and sales experts, underpinning its operational excellence and market presence.

- R&D Talent as a Growth Driver: The expertise of its research and development teams is fundamental to Bridgestone's ability to innovate and develop cutting-edge products, such as advanced sustainable tire technologies.

- Human Capital Investment: Bridgestone's commitment to employee training and development is a strategic imperative, ensuring its workforce remains skilled and adaptable to maintain a competitive advantage.

Extensive Distribution Network

Bridgestone's extensive distribution network is a cornerstone of its business model, encompassing a vast global web of distribution centers, warehouses, and strategic alliances with dealers and retailers. This robust infrastructure is fundamental to achieving broad market reach and ensuring timely product availability across diverse geographical regions.

This sophisticated network facilitates the efficient and reliable delivery of Bridgestone's tire and rubber products to a global customer base. In 2023, Bridgestone operated over 2,200 company-owned stores and service centers worldwide, underscoring the scale of its direct distribution capabilities.

- Global Reach: Bridgestone's network spans over 150 countries, enabling access to a wide array of consumer and commercial markets.

- Efficiency: The optimized logistics and inventory management systems within this network contribute to cost-effectiveness and prompt order fulfillment.

- Partnerships: Collaborations with thousands of independent dealers and retailers amplify market penetration and customer accessibility.

- Market Responsiveness: The distribution infrastructure allows Bridgestone to adapt quickly to regional demand fluctuations and specific market needs.

Bridgestone's key resources are multifaceted, encompassing its extensive global manufacturing footprint with over 150 production sites as of 2024, its robust intellectual property portfolio including significant patents, and its strong brand equity built on decades of quality and innovation. These are complemented by a highly skilled workforce and a vast, efficient distribution network reaching over 150 countries.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Manufacturing Facilities | Over 150 production sites globally. | Ensures efficient production and meets diverse regional demands. |

| Intellectual Property | Extensive patent portfolio and proprietary technologies. | Drives innovation in areas like advanced rubber compounds and sustainability. |

| Brand Equity | Global reputation for quality, reliability, and innovation. | Fosters customer trust, loyalty, and premium pricing capabilities. |

| Skilled Workforce | Engineers, scientists, manufacturing and sales experts. | Crucial for operations, innovation, and market success. |

| Distribution Network | Global web of centers, warehouses, and retail partnerships. | Facilitates efficient delivery and broad market access. |

Value Propositions

Bridgestone's tires are engineered for exceptional performance, boasting superior grip, handling, and durability. This directly translates to enhanced vehicle safety and significant operational cost savings through improved fuel efficiency. For instance, in 2024, many of Bridgestone's premium tire lines demonstrated up to a 5% improvement in fuel economy compared to industry averages.

Advanced technologies embedded in Bridgestone products ensure unwavering reliability across a wide spectrum of driving conditions and vehicle types. This commitment to dependable performance is a key differentiator in a highly competitive market.

Bridgestone is moving beyond just tires to offer smart mobility solutions. Think about their smart tires, which come equipped with sensors to monitor tire health and performance in real-time. This innovation is crucial for modern fleets.

These advanced solutions are designed to boost efficiency and minimize downtime for commercial clients. For instance, fleet management services leverage data from these smart tires to optimize routes and maintenance schedules, directly impacting operational costs.

This strategic shift transforms Bridgestone from a product manufacturer into a provider of integrated mobility services. By 2024, the company has invested significantly in digital transformation to support these new offerings, aiming to capture a larger share of the evolving transportation market.

Bridgestone's commitment to sustainability resonates with a growing segment of consumers actively seeking environmentally responsible products. This is evidenced by the increasing market share of eco-friendly tires, with sales of low rolling resistance tires, a key sustainability feature, showing robust growth. Bridgestone's development of tires incorporating higher percentages of recycled and renewable materials directly addresses this demand, contributing to a circular economy and bolstering the company's reputation.

Comprehensive Product Portfolio

Bridgestone's comprehensive product portfolio addresses a vast spectrum of needs, offering everything from passenger car tires to specialized solutions for commercial trucks, buses, motorcycles, and even aircraft. This extensive range ensures that a wide variety of customers, from individual drivers to large fleet operators, can find suitable products. In 2024, Bridgestone continued to leverage this breadth, aiming to capture market share across these diverse segments.

Beyond tires, Bridgestone's diversification into industrial rubber and chemical products further solidifies its value proposition. This strategic expansion allows the company to serve multiple industries, including automotive, construction, and manufacturing, with essential rubber-based components and materials. For instance, their conveyor belt systems are critical for mining and logistics operations.

- Diverse Tire Offerings: Bridgestone provides tires for passenger cars, light trucks, commercial vehicles, buses, motorcycles, and aircraft, meeting varied mobility demands.

- Industrial Solutions: The company also supplies industrial rubber products like conveyor belts, hoses, and anti-vibration systems, crucial for sectors such as mining, construction, and manufacturing.

- Chemical Products: Bridgestone's chemical segment produces synthetic rubber, resins, and other materials used in various industrial applications, enhancing their integrated value chain.

- One-Stop Shop Convenience: Customers benefit from a single, reliable source for a wide array of rubber and chemical-based solutions, simplifying procurement and ensuring quality across different product categories.

Reliability and Global Support

Bridgestone's commitment to reliability is a cornerstone of its value proposition, assuring customers that their tires will perform consistently. This is powerfully amplified by a robust global support network, ensuring product availability and expert after-sales assistance across diverse markets. For instance, in 2024, Bridgestone continued to expand its service centers, with over 3,000 locations operating globally, providing accessible maintenance and support.

This extensive infrastructure not only offers peace of mind to customers by guaranteeing help is always nearby but also cultivates deep, long-term loyalty. The consistent quality and service delivery achieved through this worldwide presence mean that whether a customer is in Tokyo or Toronto, they can expect the same high standard of support and product performance.

The benefits for customers are clear:

- Unwavering Product Performance: Customers can trust Bridgestone tires for dependable performance in various conditions.

- Worldwide Accessibility: A vast network of service centers ensures support and product availability across the globe.

- Enhanced Customer Confidence: The global support system provides assurance and peace of mind for all users.

- Sustained Brand Loyalty: Consistent quality and reliable service foster strong, lasting relationships with customers.

Bridgestone offers a comprehensive suite of mobility solutions, extending beyond traditional tires to include advanced services. Their smart tire technology, featuring real-time monitoring, enhances fleet efficiency and minimizes downtime, a critical factor for businesses. By 2024, significant investments in digital infrastructure supported these integrated offerings, positioning Bridgestone as a key player in the evolving transportation landscape.

Customer Relationships

Bridgestone assigns dedicated account managers to its B2B clients, including commercial fleets, original equipment manufacturers (OEMs), and industrial customers. This ensures a deep understanding of each client's unique operational demands and challenges.

These specialized managers focus on developing customized tire solutions and providing continuous technical assistance, aiming to optimize performance and minimize downtime for their clients.

This personalized, high-touch approach cultivates robust, enduring partnerships, as exemplified by Bridgestone's strong relationships with major automotive OEMs and large logistics companies worldwide.

Bridgestone prioritizes customer relationships through comprehensive service and support, utilizing a multi-channel approach. This includes dedicated call centers, extensive online resources, and a vast dealer network designed to swiftly address customer inquiries, deliver detailed product information, and efficiently process warranty claims.

In 2024, Bridgestone continued to focus on enhancing customer satisfaction by ensuring accessibility and rapid issue resolution across all support platforms. This commitment is vital for fostering trust and loyalty, as evidenced by their ongoing investments in customer service technology and training.

Bridgestone leverages digital platforms like its website and social media to engage customers, offering detailed product information and convenient online purchasing. This digital presence allows for direct interaction, facilitating feedback and enhancing accessibility. In 2023, Bridgestone reported a significant increase in online sales, contributing to its overall revenue growth, demonstrating the effectiveness of these digital channels.

Brand Loyalty Programs and Promotions

Bridgestone actively cultivates brand loyalty among individual consumers through strategic programs and promotions. These efforts are designed to foster repeat business and strengthen customer connections.

- Loyalty Programs: Bridgestone offers programs that reward customers for their continued patronage, encouraging them to choose Bridgestone tires for future purchases.

- Promotions and Rebates: Seasonal sales, tire purchase rebates, and bundled offers are frequently utilized to incentivize buying decisions and attract price-sensitive consumers. For instance, in 2024, Bridgestone ran a significant mail-in rebate program offering up to $100 back on qualifying tire purchases, aiming to boost sales during key seasonal driving periods.

- Customer Retention: By making it beneficial for customers to remain loyal, Bridgestone aims to increase customer lifetime value and solidify its market position against competitors.

Technical Training and Education

Bridgestone actively invests in technical training and educational programs for its extensive dealer networks and key commercial clients. This commitment ensures that partners possess a deep understanding of Bridgestone's product applications, proper maintenance protocols, and the intricacies of their tire technologies. For instance, in 2024, Bridgestone continued its global rollout of specialized training modules focusing on electric vehicle tire performance and sustainable tire management solutions.

By equipping its partners and customers with comprehensive knowledge, Bridgestone cultivates stronger, more collaborative relationships. This educational empowerment directly translates into enhanced product performance and customer satisfaction, as users are better informed about maximizing the lifespan and efficiency of their Bridgestone tires.

- Dealer Training Programs: Bridgestone offers specialized training on new tire technologies and service best practices.

- Commercial Client Education: Focuses on fleet management, fuel efficiency, and tire longevity for business partners.

- Knowledge Transfer: Ensures proper installation, maintenance, and understanding of tire performance characteristics.

- Relationship Strengthening: Empowers customers, leading to increased loyalty and better product utilization.

Bridgestone fosters deep customer relationships through dedicated account management for B2B clients, offering tailored solutions and continuous technical support to optimize performance. This high-touch approach, combined with multi-channel service including call centers and online resources, ensures prompt issue resolution and builds lasting partnerships. In 2024, Bridgestone continued to invest in customer service technology and training to enhance accessibility and loyalty.

| Customer Relationship Type | Key Activities | 2024 Focus/Data |

|---|---|---|

| B2B Dedicated Account Management | Customized solutions, technical assistance, understanding client needs | Strengthening partnerships with OEMs and logistics companies; focus on EV tire solutions |

| Multi-channel Support | Call centers, online resources, dealer network, warranty processing | Enhancing accessibility and rapid issue resolution across all platforms |

| Digital Engagement | Website, social media, online purchasing, customer feedback | Increasing online sales and direct customer interaction |

| Consumer Loyalty Programs | Rewards, promotions, rebates | Incentivizing repeat purchases; example: $100 rebate program in 2024 |

| Dealer & Client Education | Product application, maintenance, tire technology training | Global rollout of training modules for EV tires and sustainable management |

Channels

Bridgestone leverages a vast global network of independent tire dealers, auto service centers, and major retail chains to distribute its replacement tires. This expansive reach, encompassing over 150 countries as of 2024, guarantees widespread product availability and accessibility for a diverse customer base, from individual car owners to fleet operators.

This robust distribution infrastructure is fundamental to Bridgestone's strategy for penetrating local markets and delivering localized service. The network's strength lies in its ability to provide convenient access and expert support, directly contributing to customer satisfaction and brand loyalty in a competitive aftermarket landscape.

Bridgestone's Original Equipment Manufacturer (OEM) Direct Sales channel is fundamental to its strategy, supplying tires directly to car makers for fitment on new vehicles. This approach is vital for capturing a significant portion of the new car market and demonstrating Bridgestone's latest tire technologies and innovations. In 2024, Bridgestone continued its strong partnerships with major automotive manufacturers globally, securing a substantial share of the OEM tire market.

This direct engagement with OEMs necessitates the establishment of long-term supply agreements and fosters a deep, collaborative relationship. Such partnerships allow Bridgestone to tailor tire designs and specifications to meet the precise performance and efficiency requirements of each vehicle model. For instance, Bridgestone's focus on sustainable materials and electric vehicle (EV) optimized tires has been a key driver in securing new OEM contracts in recent years, reflecting the evolving automotive landscape.

Bridgestone leverages a robust network of company-owned retail stores and service centers, acting as crucial touchpoints for direct customer engagement. These locations facilitate not only tire sales and installation but also vital maintenance services, offering a comprehensive customer experience.

In 2024, Bridgestone continued to emphasize these owned outlets as key drivers of brand loyalty and direct revenue. This direct channel provides invaluable insights into customer preferences and service needs, informing product development and operational enhancements.

These flagship stores and service hubs also serve as critical platforms for showcasing the full breadth of Bridgestone's offerings, from premium tire lines to advanced automotive services, reinforcing the brand's commitment to quality and customer satisfaction.

E-commerce Platforms and Online Retailers

Bridgestone utilizes its own e-commerce website and collaborates with prominent online retailers to directly sell products to consumers, significantly boosting accessibility. This strategy aligns with the increasing consumer preference for online shopping, offering unparalleled convenience. In 2024, global e-commerce sales are projected to reach over $6.3 trillion, highlighting the substantial market opportunity this channel represents for Bridgestone.

The company's online presence extends its market reach considerably, fostering greater digital engagement with customers. This allows for targeted marketing campaigns and a more personalized customer experience, driving brand loyalty and sales. Bridgestone's digital strategy is crucial for remaining competitive in a landscape where online visibility directly correlates with market share.

- Direct-to-Consumer Sales: Bridgestone's e-commerce platform enables direct engagement and sales, cutting out intermediaries.

- Partnerships with Online Retailers: Collaborations with major online marketplaces expand product availability and reach a broader customer base.

- Enhanced Accessibility and Convenience: The online channels cater to the growing demand for convenient, at-home purchasing options.

- Wider Market Reach and Digital Engagement: Bridgestone leverages its online presence to connect with more customers globally and build stronger brand relationships.

Direct Sales to Commercial Fleets and Industrial Clients

Bridgestone directly serves large commercial fleets, mining operations, and industrial clients through dedicated sales and technical support teams. This approach allows for highly customized solutions and fosters long-term contractual relationships, addressing the specific, high-volume needs of these sectors.

These direct engagements are crucial for Bridgestone's strategy, as they often involve significant contract values and recurring revenue streams. For instance, in 2024, Bridgestone's global commercial tire business, which heavily relies on these direct sales channels, continued to be a substantial contributor to its overall revenue, reflecting the ongoing demand from industrial and fleet customers.

- Direct Sales Teams: Specialized personnel focused on understanding and meeting the complex requirements of commercial and industrial clients.

- Technical Support: On-site and remote expertise to ensure optimal tire performance and maintenance for heavy-duty applications.

- Customized Solutions: Tailoring tire products and service packages to specific operational demands, such as load capacity, terrain, and usage patterns.

- Long-Term Contracts: Securing predictable revenue through multi-year agreements that often include maintenance and lifecycle management services.

Bridgestone's channels are multifaceted, ensuring broad market penetration and diverse customer engagement. The company utilizes an extensive network of independent dealers and service centers for replacement tires, alongside direct sales to Original Equipment Manufacturers (OEMs) for new vehicles. Company-owned retail stores provide direct customer interaction and service, while e-commerce platforms cater to the growing online market. Additionally, dedicated teams serve large commercial fleets and industrial clients with tailored solutions.

| Channel Type | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Independent Dealers/Service Centers | Wide geographic reach, local service, aftermarket focus | Over 150 countries served; crucial for customer accessibility and brand loyalty. |

| OEM Direct Sales | Supplying new vehicles, showcasing latest technology, long-term partnerships | Secured substantial share of OEM market, focusing on EV-optimized tires. |

| Company-Owned Retail/Service Centers | Direct customer engagement, comprehensive services, brand experience | Key drivers of brand loyalty and direct revenue; provide valuable customer insights. |

| E-commerce (Own & Retailer Partnerships) | Convenience, accessibility, digital engagement, wider market reach | Leverages growing online market (projected over $6.3 trillion globally in 2024) for sales and marketing. |

| Direct Commercial/Industrial Sales | Customized solutions, high-volume needs, long-term contracts | Substantial revenue contributor, serving fleets and industrial clients with specific operational demands. |

Customer Segments

Passenger vehicle owners are the backbone of the replacement tire market, seeking reliable tires for their cars, SUVs, and light trucks. These individuals, driven by a need for safety and performance, often weigh factors like fuel efficiency and all-weather capabilities in their purchasing decisions. In 2024, the global passenger car tire market was valued at approximately $150 billion, with replacement sales forming a significant portion of this figure.

Commercial truck and bus fleets, the backbone of logistics and public transportation, represent a critical customer segment. These businesses, operating extensive networks of vehicles, prioritize tires that offer exceptional durability, superior fuel efficiency, and extended lifespan to manage operational costs effectively. In 2024, the global commercial vehicle tire market was valued at over $60 billion, with fleets being the primary drivers of this demand.

For these fleet operators, the total cost of ownership is paramount. This includes not only the initial tire purchase price but also factors like retreadability, which significantly extends tire life and reduces per-mile costs, and the availability of reliable service and support to minimize costly vehicle downtime. Bridgestone addresses these needs by providing a range of specialized tires engineered for heavy-duty applications and offering comprehensive fleet management solutions designed to optimize tire performance and maintenance.

Bridgestone's Motorcycle and Specialty Vehicle Enthusiasts segment comprises a dedicated customer base needing highly specific tire solutions. This includes riders of motorcycles, operators of ATVs, and professionals utilizing agricultural and construction equipment. These customers are not looking for a one-size-fits-all approach; they demand tires engineered for distinct performance attributes, whether it's superior off-road traction for an ATV or exceptional grip and durability for heavy machinery.

Bridgestone caters to these specialized needs by offering a broad portfolio of niche tires. For instance, in the motorcycle segment, Bridgestone's Battlax line is renowned for its performance on both street and track, with specific models designed for sport touring, hypersport, and adventure riding. This demonstrates a clear understanding of the diverse demands within just the motorcycle market alone, highlighting the segment's need for tailored product offerings.

Original Equipment Manufacturers (OEMs)

Original Equipment Manufacturers (OEMs) are a cornerstone customer segment for Bridgestone, primarily encompassing major players in the automotive, truck, and motorcycle industries. These manufacturers procure tires directly from Bridgestone for fitment on brand-new vehicles rolling off their assembly lines. In 2024, Bridgestone continued its strong partnerships with leading OEMs, supplying tires for a vast array of new vehicle models.

OEMs place a high premium on several key factors when selecting tire suppliers. These include robust technical collaboration to ensure tires meet specific vehicle performance and safety standards, unwavering product quality and consistency across all batches, and exceptional supply chain reliability to avoid production line disruptions. Bridgestone's commitment to these areas underpins its enduring relationships with these critical business partners.

- Key OEM Partnerships: Bridgestone supplies tires to a significant portion of global automotive production, including major brands in North America, Europe, and Asia.

- Volume and Value: OEM sales represent a substantial portion of Bridgestone's revenue, with tire shipments for new vehicles reaching tens of millions annually.

- Technical Integration: Bridgestone engineers work closely with OEM design teams to develop bespoke tire solutions, often starting years before a vehicle model launch.

- Supply Chain Dominance: The ability to deliver millions of tires precisely when needed for factory assembly is a critical competitive advantage for Bridgestone in this segment.

Industrial and Chemical Product Users

Bridgestone's industrial segment caters to a diverse range of businesses that rely on specialized rubber and chemical products. These clients operate in demanding sectors such as manufacturing, mining, construction, and infrastructure, where the longevity and performance of components are critical to operational efficiency and safety.

These customers require robust solutions like conveyor belts, industrial hoses, and advanced anti-vibration systems designed to withstand harsh environments and heavy usage. For instance, the global mining equipment market, a key consumer of durable rubber products, was valued at approximately $25 billion in 2023 and is projected to grow, indicating sustained demand for Bridgestone's industrial offerings.

- Conveyor Belts: Essential for material handling in mining, manufacturing, and logistics, requiring high tensile strength and abrasion resistance.

- Industrial Hoses: Used for fluid and gas transfer across various industries, needing specific chemical resistance and pressure handling capabilities.

- Anti-vibration Systems: Crucial for machinery and infrastructure to reduce noise and mechanical stress, enhancing equipment lifespan and working conditions.

- Chemical Products: Including synthetic rubber and related chemicals, serving as raw materials for other manufacturers.

Bridgestone's customer segments are diverse, ranging from individual car owners seeking reliable tires to large commercial fleets prioritizing durability and cost-efficiency. The company also serves specialized markets like motorcycle and ATV enthusiasts, as well as original equipment manufacturers (OEMs) who integrate Bridgestone tires into new vehicles.

Furthermore, Bridgestone caters to industrial clients requiring robust rubber and chemical products for sectors such as mining and manufacturing. This broad customer base highlights Bridgestone's ability to tailor its offerings to meet the specific performance and operational demands of various industries.

In 2024, the global tire market continued to show strong demand across these segments. For instance, the passenger vehicle replacement tire market alone was valued at approximately $150 billion, with individual consumers forming a significant portion of this demand.

Commercial fleets, a vital segment, drove over $60 billion in the global commercial vehicle tire market in 2024, emphasizing their need for long-lasting and fuel-efficient solutions. OEMs also represent a substantial revenue stream, with Bridgestone supplying millions of tires annually for new vehicle production.

| Customer Segment | Key Needs | 2024 Market Relevance (Illustrative) |

|---|---|---|

| Passenger Vehicle Owners | Safety, performance, fuel efficiency | Global passenger car tire market ~$150 billion |

| Commercial Fleets | Durability, fuel efficiency, low TCO | Global commercial vehicle tire market >$60 billion |

| Motorcycle & Specialty Vehicles | Niche performance, specific applications | High demand for specialized tire technologies |

| Original Equipment Manufacturers (OEMs) | Technical collaboration, quality, supply chain reliability | Millions of tires supplied annually for new vehicles |

| Industrial Sector | Robustness, longevity, specialized materials | Key for mining, manufacturing, construction sectors |

Cost Structure

Bridgestone's cost structure heavily relies on raw materials like natural and synthetic rubber, carbon black, and chemicals. For instance, in 2023, the price of natural rubber saw volatility, impacting production expenses. Efficient global sourcing and robust supply chain management are therefore paramount to controlling these significant manufacturing costs.

Bridgestone's manufacturing and production expenses are substantial, covering the operation of its extensive global network of tire factories. These costs include significant outlays for labor wages, energy consumption for plant operations, ongoing machinery maintenance, and general factory overheads. For instance, in 2023, Bridgestone reported that its cost of sales, which encompasses these manufacturing expenses, was approximately ¥2,753 billion.

To mitigate these significant costs, Bridgestone actively invests in advanced automation and lean manufacturing techniques. These initiatives are designed to boost operational efficiency and drive down per-unit production costs. Furthermore, rigorous quality control processes and effective waste management strategies are critical elements in controlling expenses and ensuring product integrity.

Bridgestone dedicates significant resources to Research and Development (R&D) to drive innovation in tire technology, material science, and emerging mobility solutions. These investments are crucial for staying ahead in a competitive market and ensuring long-term growth.

In 2024, Bridgestone's commitment to R&D is evident in its ongoing efforts to develop sustainable materials and advanced tire designs. For instance, the company continues to invest in research for tires made from renewable and recycled materials, aiming to reduce environmental impact. These expenditures cover personnel costs for scientists and engineers, as well as operational costs for advanced research facilities and prototyping.

Sales, Marketing, and Distribution Costs

Bridgestone's cost structure heavily features expenses tied to its extensive sales, marketing, and distribution efforts. This encompasses the salaries of its global sales force, significant investments in marketing campaigns, and ongoing advertising to maintain brand visibility and drive demand. For instance, in 2024, the tire industry saw increased marketing spend as companies vied for market share, with Bridgestone actively participating in digital and traditional advertising platforms.

The logistics of getting tires to customers worldwide also represent a substantial cost. This includes the expenses associated with global transportation networks, maintaining warehousing facilities to manage inventory, and the operational costs of supporting a vast dealer and retail network. The complexity of managing these supply chains, especially with fluctuating fuel prices in 2024, directly impacts these distribution costs.

- Sales Force Compensation: Salaries, commissions, and benefits for a global sales team.

- Marketing and Advertising: Investment in brand promotion, digital marketing, and traditional advertising campaigns.

- Distribution and Logistics: Costs for transportation, warehousing, and managing the global dealer network.

- Brand Promotion: Expenses related to sponsorships and public relations to enhance brand image.

Administrative and General Expenses

Bridgestone's Administrative and General Expenses cover the essential backbone of its global operations. These are the costs associated with keeping the lights on and the business running smoothly across all its divisions and geographies. Think of corporate overhead, the salaries of administrative staff, and the technology that keeps everything connected.

In 2024, companies like Bridgestone are increasingly focused on optimizing these costs. For instance, significant investments in IT infrastructure are common, supporting everything from supply chain management to digital customer engagement. These expenses are crucial for maintaining compliance with international regulations and robust corporate governance, which are non-negotiable for a company of Bridgestone's scale.

- Corporate Overhead: Costs for executive management, finance, and other central support functions.

- IT Infrastructure: Expenses related to hardware, software, network maintenance, and cybersecurity.

- Legal and Compliance: Fees for legal counsel, regulatory filings, and adherence to global standards.

- Human Resources: Costs for employee recruitment, training, benefits administration, and payroll.

Bridgestone's cost structure is dominated by its significant investment in raw materials, manufacturing, and research and development. In 2023, the cost of sales alone reached approximately ¥2,753 billion, highlighting the scale of production expenses. These costs are managed through automation, lean manufacturing, and strategic sourcing to maintain competitiveness.

Sales, marketing, and distribution also represent a substantial portion of Bridgestone's expenditures. For 2024, increased marketing spend across the industry, including Bridgestone's participation in digital and traditional advertising, reflects the drive for market share. Managing a global logistics network, particularly with fluctuating fuel prices, directly impacts these operational costs.

| Key Cost Components | Description | 2023 Data (Approximate) |

| Cost of Sales | Includes raw materials, manufacturing, and production expenses. | ¥2,753 billion |

| Sales, Marketing & Distribution | Covers sales force, advertising, logistics, and warehousing. | Significant investment in global operations. |

| Research & Development | Investments in new tire technology and sustainable materials. | Ongoing commitment to innovation. |

Revenue Streams

Bridgestone's core revenue generation hinges on the sale of replacement tires. This encompasses a wide array of vehicles, from everyday passenger cars to heavy-duty commercial trucks and buses, as well as motorcycles and specialized equipment.

The demand for these tires is directly tied to how much vehicles are used, leading to natural wear and tear, and the ongoing consumer desire for improved tire performance and safety features. For instance, in 2024, the global automotive aftermarket sector, which includes tire replacement, continued to show resilience, driven by an aging vehicle parc in many key markets.

Bridgestone generates significant revenue by selling tires directly to car manufacturers for new vehicles. This Original Equipment (OE) tire sales segment is a cornerstone of their business, directly reflecting global automotive production trends. For instance, in 2023, the global automotive industry saw production rebound in many regions, positively impacting OE tire demand.

Securing these OE contracts is crucial, as it not only provides immediate sales but also establishes a relationship that often translates into lucrative aftermarket replacement tire sales down the line. Bridgestone's ability to innovate and meet the specific performance and sustainability requirements of automakers is key to winning and retaining these valuable partnerships.

Bridgestone's revenue streams extend well beyond tires, with substantial contributions from its diversified products sales. In 2024, the company continued to leverage its expertise in rubber and chemical technologies to offer a wide array of industrial rubber products, such as conveyor belts, hoses, and anti-vibration systems, serving critical sectors like mining and manufacturing.

The chemical products segment also plays a key role, supplying materials for various applications, while the sporting goods division, notably through its golf and tennis equipment, taps into consumer markets. This strategic diversification in 2024 helped buffer against fluctuations in the automotive sector, demonstrating Bridgestone's commitment to stable growth across multiple industries.

Mobility Solutions and Services

Bridgestone is expanding its revenue through mobility solutions and services, moving beyond just selling tires. This includes offering integrated services like fleet management and tire monitoring systems specifically for commercial clients. These data-driven insights help businesses optimize their operations.

This strategic pivot taps into the increasing need for smart transportation. For example, in 2024, the global fleet management market was valued at approximately $30 billion and is projected to grow significantly, highlighting the demand for such services.

- Fleet Management Services: Offering end-to-end solutions for managing vehicle fleets, including maintenance scheduling and route optimization.

- Tire Monitoring Systems: Utilizing sensors and data analytics to track tire pressure, temperature, and wear in real-time, preventing downtime and improving safety.

- Data-Driven Insights: Providing commercial customers with actionable intelligence derived from vehicle and tire data to enhance efficiency and reduce costs.

Retreading and Tire Maintenance Services

Bridgestone generates significant revenue from retreading and tire maintenance services offered to commercial customers. These services are crucial for extending the operational life of tires used by fleets, directly translating into cost savings for these businesses. For example, in 2024, the demand for retreading solutions remained robust as companies focused on optimizing operational expenses amidst economic pressures.

Beyond individual retreading jobs, Bridgestone provides comprehensive tire maintenance programs. These programs often involve regular inspections, proactive repairs, and optimized tire management strategies, ensuring peak performance and safety for commercial vehicles. This focus on ongoing service fosters deeper customer loyalty and creates a predictable, recurring revenue stream for the company.

- Cost Savings for Fleets: Retreading can offer substantial savings compared to purchasing new tires, with estimates suggesting savings of up to 50% or more.

- Circular Economy Contribution: These services align with sustainability goals by reducing tire waste and conserving resources, a growing consideration for corporate clients.

- Recurring Revenue Model: Maintenance programs create a stable income base, enhancing predictability in Bridgestone's revenue streams.

Bridgestone's revenue is diversified across multiple segments, with tire sales forming the largest portion. This includes both replacement tires for the aftermarket and original equipment (OE) tires supplied to vehicle manufacturers. In 2024, the aftermarket segment continued to be a stable contributor, driven by vehicle usage and consumer demand for performance upgrades. The OE segment closely tracked global automotive production volumes, which saw a notable recovery in many regions throughout 2023 and into 2024.

Beyond tires, Bridgestone generates substantial revenue from its diversified products. This includes industrial rubber goods like conveyor belts and hoses, essential for sectors such as mining and manufacturing, as well as chemical products. The sporting goods division, particularly golf and tennis equipment, also contributes to this segment. This broad product portfolio, actively developed in 2024, provides resilience against market fluctuations in any single sector.

Bridgestone is increasingly monetizing its expertise through mobility solutions and services, a growing revenue stream. This involves offering fleet management, tire monitoring systems, and data-driven insights to commercial clients, aiming to optimize their operations and reduce costs. The global fleet management market, valued at approximately $30 billion in 2024, demonstrates the significant potential of this strategic expansion into service-oriented revenue.

Furthermore, retreading and tire maintenance services represent a key revenue source, particularly for commercial fleets. These offerings extend tire life, providing cost savings and contributing to sustainability. In 2024, the demand for these services remained strong as businesses prioritized operational efficiency. Bridgestone's comprehensive maintenance programs foster recurring revenue and customer loyalty.

| Revenue Stream | Description | 2024 Relevance/Data Point |

| Replacement Tires | Tires sold for vehicles already in use. | Global automotive aftermarket sector resilience noted. |

| Original Equipment (OE) Tires | Tires supplied to vehicle manufacturers for new cars. | Impacted by global automotive production trends; rebound observed in 2023. |

| Diversified Products | Industrial rubber goods, chemicals, and sporting equipment. | Key sectors served include mining and manufacturing; strategic diversification in 2024. |

| Mobility Solutions & Services | Fleet management, tire monitoring, data analytics. | Global fleet management market valued ~ $30 billion in 2024; strong growth projected. |

| Retreading & Maintenance | Services extending tire life for commercial fleets. | Robust demand in 2024 due to focus on operational expenses. |

Business Model Canvas Data Sources

The Bridgestone Business Model Canvas is informed by a blend of internal financial data, extensive market research on tire and automotive industries, and strategic insights derived from global economic trends and competitive analysis.