BPER Banca PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BPER Banca Bundle

Navigate the complex external forces shaping BPER Banca's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, social trends, environmental regulations, and legal frameworks are impacting its operations and strategic decisions. Gain an unparalleled advantage by leveraging these critical insights to refine your own market approach. Download the full PESTLE analysis now for actionable intelligence that drives informed decision-making.

Political factors

The stability of the Italian government directly shapes BPER Banca's operating landscape. Recent political developments in Italy, including coalition shifts, can introduce uncertainty regarding future banking regulations and economic support measures. For instance, discussions around potential windfall taxes on bank profits, a recurring theme in European banking policy, could directly impact BPER Banca's earnings and strategic planning for 2024 and 2025.

Government policy towards the banking sector is a critical determinant of BPER Banca's performance. Initiatives like state-backed loan guarantees or targeted support for SMEs can influence lending volumes and credit risk profiles. Italy's commitment to EU fiscal rules and its approach to managing public debt also indirectly affect the broader economic environment in which BPER Banca operates, influencing interest rates and overall market sentiment.

Political stability is paramount for investor confidence in the Italian banking system. A stable political environment reassures both domestic and international investors, facilitating BPER Banca's access to capital markets for funding and growth initiatives. For example, a consistent policy framework reduces perceived risk, potentially lowering the bank's cost of capital and enhancing its ability to raise funds for expansion or acquisitions in the 2024-2025 period.

Ongoing progress on the European Deposit Insurance Scheme (EDIS) and the Single Resolution Mechanism within the EU Banking Union significantly impacts BPER Banca. These supranational policy advancements are designed to bolster Eurozone financial stability, but they also necessitate new compliance measures and potential financial commitments from member banks.

For BPER Banca, navigating these evolving regulatory landscapes is crucial for effective operational management and long-term strategic formulation. The bank must remain agile in adapting to these changes to ensure continued compliance and financial resilience.

Broader geopolitical events, such as the ongoing conflict in Ukraine and its ripple effects on energy markets, introduce significant uncertainty into the Italian and European economies. These disruptions can dampen investor sentiment and consumer spending, directly impacting BPER Banca's loan demand and asset quality. For instance, the European Central Bank's economic projections for 2024 have been revised downwards due to these persistent geopolitical tensions.

Regulatory and Supervisory Frameworks

Changes in national and European regulatory frameworks, overseen by entities like the European Central Bank (ECB) and Banca d'Italia, significantly influence BPER Banca's operational landscape. For instance, the ECB's ongoing focus on strengthening banking supervision, particularly after the 2023 banking sector stresses, means BPER Banca must continually adapt its capital and liquidity ratios. New directives on areas such as digital operational resilience, exemplified by the Digital Operational Resilience Act (DORA) which fully applies from January 2025, demand substantial investment in IT security and risk management protocols.

These evolving requirements directly impact BPER Banca's compliance costs and strategic planning. Adherence to stricter capital adequacy ratios, like those reinforced by Basel III finalization, requires careful management of its balance sheet. Furthermore, heightened scrutiny on consumer protection and data privacy, in line with GDPR principles, mandates robust internal processes. Failure to adapt can lead to significant penalties, as seen with fines levied on other European banks for compliance breaches, underscoring the critical need for proactive regulatory engagement.

- Capital Adequacy: BPER Banca's Common Equity Tier 1 (CET1) ratio was 13.43% as of Q1 2024, well above regulatory minimums, reflecting ongoing efforts to meet stringent capital requirements.

- Liquidity Coverage Ratio (LCR): The bank maintained an LCR of 171.2% at the end of 2023, demonstrating ample liquidity to meet short-term obligations under stress scenarios.

- Digital Transformation & Security: Investments in cybersecurity and digital infrastructure are paramount, with the banking sector globally increasing spending to counter evolving cyber threats.

- Consumer Protection: Regulatory emphasis on fair lending practices and transparent fee structures necessitates continuous review and potential overhaul of customer-facing products and services.

Public Policy on Economic Recovery and Investment

Government initiatives focused on economic recovery and strategic investments significantly shape the landscape for BPER Banca. Policies promoting infrastructure development, such as the Italian government's €220 billion National Recovery and Resilience Plan (PNRR) funded by the EU's NextGenerationEU, present substantial opportunities for the bank to finance large-scale projects and support related industries. This aligns lending strategies with national priorities, potentially unlocking access to government guarantees and incentives.

BPER Banca can leverage these public policies to bolster its credit portfolio and identify growth avenues, particularly in sectors targeted for advancement. For instance, the push towards a green transition and digital transformation, heavily supported by EU and national funds, creates demand for financing innovative solutions and sustainable projects. The bank's ability to adapt its offerings to these evolving economic priorities will be crucial for its performance.

- Infrastructure Investment: Italy's PNRR allocates significant funds to modernizing infrastructure, creating opportunities for BPER Banca in project finance.

- Green Transition Support: Government incentives for renewable energy and sustainable development can drive demand for green bonds and loans.

- Digital Transformation Funding: Public support for digitalization across industries offers avenues for BPER Banca to finance technology adoption and related services.

- Credit Portfolio Alignment: Strategic alignment with national recovery plans allows BPER Banca to tap into government-backed guarantees, mitigating risk and fostering growth in key sectors.

Political stability in Italy directly influences BPER Banca's operational environment, with government policy shifts potentially impacting banking regulations and economic support. For example, discussions around windfall taxes on bank profits in 2024 and 2025 could affect the bank's earnings.

Government initiatives like the Italian PNRR, funded by the EU, present opportunities for BPER Banca to finance large projects, aligning lending with national priorities and potentially accessing government guarantees. The focus on green transition and digital transformation creates demand for financing innovative and sustainable projects.

Navigating evolving regulatory frameworks from entities like the ECB and Banca d'Italia is crucial for BPER Banca. New directives, such as DORA fully applying from January 2025, require substantial investment in IT security and risk management protocols, impacting compliance costs and strategic planning.

| Political Factor | Impact on BPER Banca | Data/Example (2024/2025 Focus) |

| Government Stability & Policy Direction | Affects regulatory environment and economic support measures. | Potential for windfall taxes on bank profits (ongoing discussion). |

| National Recovery Plans (e.g., PNRR) | Creates opportunities for project financing and alignment with national priorities. | PNRR funding of €220 billion for infrastructure and green/digital transition. |

| EU Regulatory Harmonization (e.g., DORA) | Requires investment in digital operational resilience and compliance. | DORA fully applies from January 2025, impacting IT security and risk management. |

What is included in the product

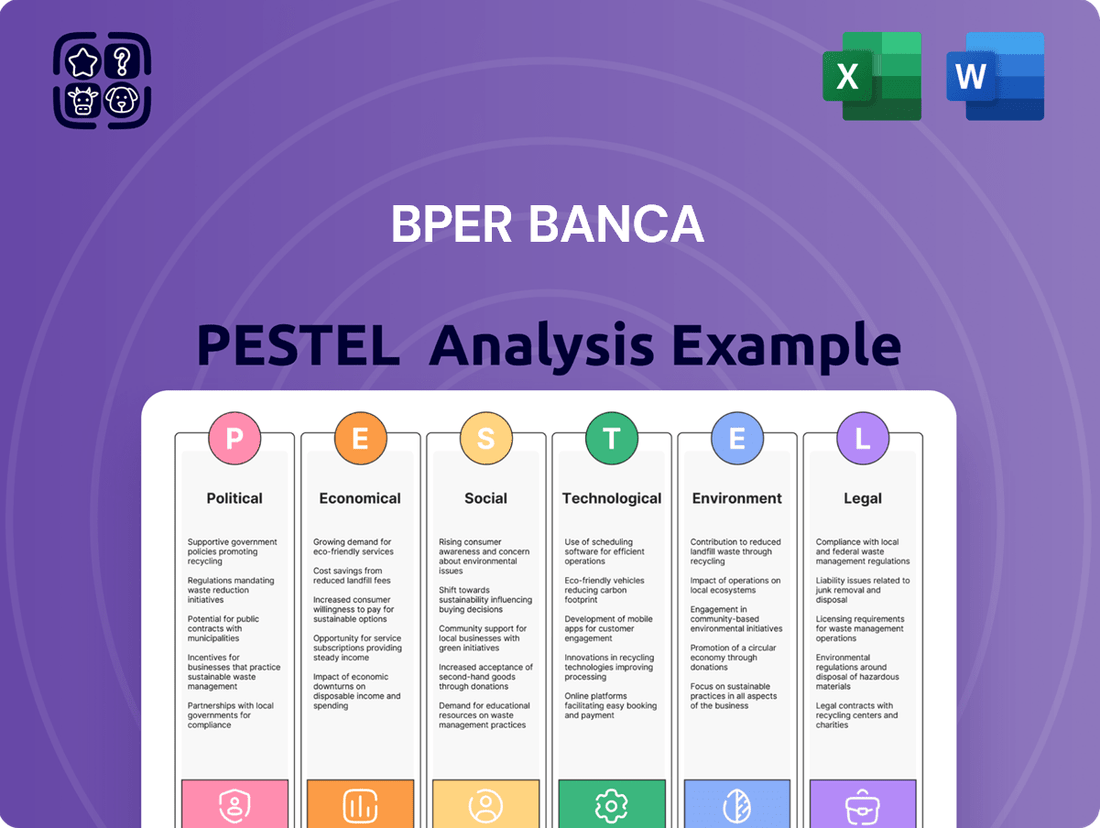

This BPER Banca PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the bank, offering a comprehensive view of its external operating landscape.

A BPER Banca PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for efficient decision-making.

Economic factors

The European Central Bank's (ECB) monetary policy, especially its stance on key interest rates, significantly influences BPER Banca's net interest margin (NIM). For instance, as of early 2024, the ECB has maintained a relatively high interest rate environment following a period of inflation, which generally benefits banks like BPER by widening the spread between lending and borrowing costs.

A sustained period of higher interest rates, such as those seen in 2023 and anticipated into 2024, can boost BPER Banca's profitability by increasing the income generated from loans more quickly than the cost of deposits. However, the bank's ability to capitalize on this depends on its effective asset and liability management, ensuring it can adapt its strategies to optimize performance amidst these fluctuating rate scenarios.

Inflation directly impacts how much consumers can buy with their money, and for BPER Banca, this means potential shifts in loan demand and the ability of borrowers to repay. When inflation is high, the real value of incomes decreases, which could lead to more loan defaults, known as non-performing loans (NPLs). This also affects BPER Banca's own expenses.

For instance, in the Eurozone, inflation averaged around 5.5% in 2023, a significant increase from previous years, though it showed signs of cooling towards the end of 2024. This persistent inflation pressure means BPER Banca must carefully watch its lending practices and the financial health of its customers to manage credit risk effectively and predict future business activity.

Italy's GDP growth is a critical factor for BPER Banca. For 2024, forecasts suggest a modest expansion, with the Bank of Italy projecting 0.7% growth. This moderate pace indicates a cautious but positive economic environment, influencing demand for banking services.

The broader Eurozone economic activity also plays a significant role. While facing headwinds, the Eurozone's expected growth for 2024, around 0.9% according to the European Commission, provides a backdrop for BPER Banca's operations. Stronger regional growth would generally bolster lending and investment opportunities.

Economic downturns, however, pose risks. A slowdown in either Italian or Eurozone GDP could dampen loan demand and potentially increase non-performing loans. Prudent risk management remains essential for BPER Banca to navigate these economic fluctuations effectively.

Unemployment Rates and Credit Quality

Unemployment rates directly affect household income stability, influencing individuals' capacity to service their debts. As of early 2024, the Eurozone unemployment rate hovered around 6.5%, a figure that, while showing some improvement from previous years, still presents a significant segment of the population vulnerable to economic shocks. For BPER Banca, a sustained or rising unemployment trend could translate into increased loan defaults, particularly within its retail and small to medium-sized enterprise (SME) portfolios.

Higher unemployment typically leads to a deterioration in credit quality as individuals and businesses struggle to meet their financial obligations. This can manifest as a rise in non-performing loans (NPLs), forcing banks like BPER Banca to allocate more capital towards provisions for credit losses. This directly impacts profitability and capital adequacy ratios. For instance, a 1% increase in unemployment in Italy, BPER Banca's primary market, has historically been linked to a noticeable uptick in NPLs.

- Eurozone Unemployment Rate (Early 2024): Approximately 6.5%.

- Impact on BPER Banca: Rising unemployment can lead to increased loan defaults and higher provisions for credit losses.

- Portfolio Risk: Retail and SME portfolios are particularly susceptible to adverse labor market trends.

- Economic Indicator: Labor market data is a critical factor in assessing BPER Banca's asset quality and potential credit risk.

Consumer and Business Confidence

Consumer and business confidence are crucial indicators for BPER Banca, directly impacting its lending and revenue streams. High confidence levels typically translate into increased demand for loans, both for personal consumption and business expansion, which benefits the bank's core lending operations. For instance, in early 2024, consumer confidence in Italy showed a gradual improvement, though still below pre-pandemic levels, suggesting a cautious but potentially growing appetite for credit.

Conversely, a dip in confidence can lead to reduced borrowing and a preference for saving, thereby limiting BPER Banca's growth opportunities and potentially affecting profitability. Business investment intentions are particularly sensitive to these confidence shifts. If businesses anticipate economic headwinds, they are likely to postpone or cancel investment plans, reducing the need for corporate financing and impacting the bank's fee and commission income from related services.

- Consumer Confidence Index (CCI) for Italy: While fluctuating, the CCI in Italy has shown signs of recovery through late 2023 and early 2024, although remaining a key factor to monitor for BPER Banca's retail banking segment.

- Business Confidence Index (BCI) for Italy: Business sentiment, particularly in sectors BPER Banca heavily serves, influences corporate loan demand and investment banking activities. Data from early 2024 indicated a mixed picture across different industrial sectors.

- Impact on Lending: Increased consumer and business confidence correlates with higher loan origination volumes for BPER Banca, while decreased confidence can lead to a contraction in credit demand.

- Savings Rates: Periods of low confidence often see a rise in household savings, which can reduce the immediate demand for BPER Banca's deposit-taking and investment products.

The European Central Bank's (ECB) monetary policy, particularly interest rates, directly impacts BPER Banca's net interest margin. As of early 2024, the ECB's higher rate environment, a response to inflation, generally benefits banks by widening lending-to-deposit spreads.

Inflation's effect on consumer purchasing power influences loan demand and repayment ability for BPER Banca. High inflation can increase loan defaults, impacting credit risk. For instance, Eurozone inflation averaged around 5.5% in 2023, a figure that requires careful management of credit risk by BPER Banca.

Italy's GDP growth, projected at 0.7% for 2024 by the Bank of Italy, indicates a moderate economic environment that shapes demand for banking services. Similarly, the broader Eurozone's expected 0.9% growth in 2024 provides a backdrop for BPER Banca's operations, with regional growth boosting lending opportunities.

Unemployment rates, with the Eurozone rate around 6.5% in early 2024, directly affect household income stability and debt servicing capacity. Higher unemployment can lead to increased loan defaults and higher provisions for credit losses for BPER Banca, particularly impacting its retail and SME portfolios.

| Economic Factor | Indicator/Data (Early 2024) | Impact on BPER Banca |

|---|---|---|

| Monetary Policy (ECB Interest Rates) | Higher rate environment | Benefits Net Interest Margin (NIM) |

| Inflation (Eurozone) | ~5.5% in 2023 | Potential increase in loan defaults, impacts expenses |

| GDP Growth (Italy) | Projected 0.7% for 2024 | Moderate demand for banking services |

| GDP Growth (Eurozone) | Expected ~0.9% for 2024 | Influences lending and investment opportunities |

| Unemployment Rate (Eurozone) | ~6.5% | Risk of increased loan defaults, higher credit loss provisions |

Preview the Actual Deliverable

BPER Banca PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This BPER Banca PESTLE Analysis provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the bank.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the strategic landscape for BPER Banca.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis is your key to understanding BPER Banca's operating environment.

Sociological factors

Italy's demographic landscape is undergoing significant shifts, with a notable aging population. By 2024, projections indicate a continued increase in the proportion of citizens over 65, a trend that directly impacts banking needs. This presents BPER Banca with opportunities in wealth management, retirement planning, and specialized insurance products, areas typically favored by older demographics.

Conversely, while the aging trend is prominent, the demand for digital banking solutions and consumer credit from younger segments remains crucial. BPER Banca must strategically balance its service offerings, ensuring robust digital platforms and accessible loan products are available to attract and retain a younger customer base, even as it caters to the needs of an aging clientele.

Customers are increasingly demanding convenient, personalized, and seamless banking experiences, with a strong preference for digital channels. For instance, in 2024, a significant portion of banking transactions across Europe, including Italy, are expected to be conducted digitally, with mobile banking adoption continuing its upward trend.

BPER Banca must adapt to this shift by investing in robust online and mobile banking platforms, offering intuitive user interfaces, and providing efficient digital customer support. This includes features like AI-powered chatbots for instant query resolution and personalized financial advice delivered through the app.

Failure to meet these evolving expectations can lead to customer attrition and competitive disadvantage. Banks that lag in digital innovation risk losing market share to more agile fintech competitors and digitally native banks, impacting their overall customer base and revenue streams.

The general level of financial literacy significantly impacts how readily people adopt sophisticated financial products. In Italy, a 2023 study by the Bank of Italy indicated that while financial knowledge is improving, a substantial portion of the population still struggles with basic financial concepts, potentially limiting their engagement with BPER Banca's more complex investment offerings.

As financial markets grow more intricate, BPER Banca must prioritize client education, providing clear, accessible information to foster informed decision-making. This focus on transparency is crucial for enhancing client trust and facilitating the bank's cross-selling efforts, particularly within its wealth management division, which aims to grow by an estimated 5% annually through 2025.

Public Trust in Financial Institutions

Public trust in financial institutions significantly impacts BPER Banca's ability to retain existing customers and attract new ones. Following the 2008 financial crisis and subsequent scandals, consumer confidence in the banking sector has been a key consideration. For instance, a 2023 survey indicated that only 45% of Italians expressed high levels of trust in their banks, a figure BPER Banca aims to improve through its operations.

Maintaining robust ethical standards, ensuring operational transparency, and actively engaging in corporate social responsibility are paramount for BPER Banca in cultivating and safeguarding this essential trust. These efforts directly contribute to customer loyalty and the acquisition of new business, bolstering the bank's market position.

A strong reputation built on trust can translate into tangible benefits for BPER Banca:

- Enhanced Customer Retention: Loyal customers are less likely to switch banks, providing a stable revenue base.

- Attraction of New Clients: Positive word-of-mouth and a reputation for integrity draw in individuals and businesses seeking reliable financial partners.

- Improved Brand Image: Trust is a cornerstone of a strong brand, differentiating BPER Banca in a competitive market.

- Reduced Regulatory Scrutiny: Institutions with high public trust often experience more favorable interactions with regulatory bodies.

Workforce Dynamics and Talent Attraction

The evolving nature of the workforce presents significant challenges and opportunities for BPER Banca. There's a growing demand for digital and data analytics skills, which are crucial for modern banking operations. For instance, in 2024, the European banking sector continued to see a surge in demand for IT professionals, with job postings for cybersecurity experts and data scientists increasing by an estimated 15-20% compared to the previous year.

Furthermore, the preference for remote and hybrid work models is a key consideration. A 2025 survey indicated that over 60% of Italian professionals would prioritize flexible work arrangements when considering new employment opportunities. This necessitates BPER Banca adapting its HR strategies to accommodate these preferences, which could involve investing in robust remote infrastructure and clear guidelines for hybrid teams to attract and retain talent.

Generational differences within the workforce also play a role. Younger generations, such as Millennials and Gen Z, often seek purpose-driven work, continuous learning, and clear career progression paths. BPER Banca must therefore focus on:

- Developing targeted recruitment campaigns highlighting career growth and skill development opportunities.

- Implementing flexible work policies that cater to diverse employee needs and preferences.

- Investing in upskilling and reskilling programs, particularly in digital and AI competencies, to meet future industry demands.

- Fostering a strong corporate culture that emphasizes employee well-being and engagement.

Italy's demographic shifts, particularly its aging population, present BPER Banca with opportunities in wealth management and retirement services, as evidenced by the projected increase in citizens over 65 by 2024. Simultaneously, the demand for digital banking from younger demographics necessitates investment in user-friendly online and mobile platforms, a trend reflected in the increasing digital transaction volume across Europe in 2024.

Customer expectations for seamless, personalized digital experiences are paramount, with mobile banking adoption continuing its strong growth trajectory. BPER Banca's ability to meet these evolving demands through AI-powered support and intuitive interfaces is critical for retaining market share against agile fintech competitors.

Financial literacy remains a key factor, with a 2023 Bank of Italy study highlighting that many Italians still need better understanding of basic financial concepts, impacting engagement with complex investment products. To counter this, BPER Banca is focusing on client education and transparency, aiming for a 5% annual growth in its wealth management division by 2025.

Public trust, shaken by past financial crises, is a crucial element for BPER Banca, with a 2023 survey showing only 45% of Italians expressing high trust in their banks. The bank is actively working to build this trust through ethical practices and corporate social responsibility initiatives.

Technological factors

The rapid digitalization of banking services is a critical technological factor for BPER Banca, driving a significant shift from traditional branch-based operations to online and mobile platforms. For instance, in 2023, BPER Banca continued to invest heavily in its digital infrastructure, aiming to enhance customer experience and operational efficiency. This trend is crucial for meeting evolving customer expectations for convenience and accessibility.

Investing in advanced digital banking solutions, intuitive mobile applications, and seamless online customer journeys is essential for BPER Banca to remain competitive. By Q1 2024, the bank reported a further increase in digital transaction volumes, underscoring the growing reliance on these channels. This transformation not only improves customer engagement but also streamlines internal processes, leading to greater operational efficiency and expanded reach.

As BPER Banca deepens its digital integration, handling vast customer data, it confronts escalating cybersecurity risks. In 2024, the global average cost of a data breach reached $4.45 million, a figure that underscores the financial implications of inadequate protection.

Implementing advanced threat detection, robust prevention systems, and comprehensive employee training are crucial for safeguarding customer data, ensuring operational continuity, and meeting stringent regulatory demands like GDPR. Failure to do so could lead to severe reputational damage and significant financial penalties.

The financial sector is experiencing a significant shake-up with the rapid growth of FinTechs and challenger banks. These new entrants are disrupting traditional banking models by offering specialized, technology-driven services, often at lower costs. For instance, by the end of 2023, FinTech funding globally reached over $100 billion, demonstrating their increasing influence and investment appeal.

These agile competitors are forcing established institutions like BPER Banca to re-evaluate their strategies. To stay competitive, BPER Banca needs to accelerate its digital transformation, enhancing its own online services and mobile banking capabilities. Alternatively, strategic alliances or acquisitions with FinTechs could provide access to cutting-edge technology and customer segments, ensuring continued market relevance and customer acquisition in a rapidly evolving digital landscape.

Adoption of Cloud Computing and Data Analytics

BPER Banca's strategic embrace of cloud computing is a significant technological driver, promising enhanced scalability and a reduction in infrastructure expenses. This shift allows for more robust data storage and processing, crucial for a modern financial institution. For instance, by migrating key operations to the cloud, BPER Banca can more efficiently handle fluctuating transaction volumes and data needs throughout 2024 and into 2025.

The integration of advanced data analytics and artificial intelligence presents a powerful avenue for BPER Banca to gain deeper customer insights. This enables more personalized product offerings and optimized risk management strategies. By analyzing vast datasets, the bank can anticipate customer needs and mitigate potential financial risks more effectively. In 2024, many Italian banks, including BPER, have been investing heavily in AI for fraud detection and customer service automation, aiming for efficiency gains.

These technological advancements are directly contributing to significant operational efficiencies and strategic advantages for BPER Banca.

- Enhanced Scalability: Cloud adoption allows BPER Banca to dynamically adjust computing resources based on demand, ensuring seamless operations during peak periods.

- Cost Reduction: Migrating to cloud infrastructure can lead to lower capital expenditure on hardware and reduced operational costs for maintenance and energy.

- Data-Driven Insights: Advanced analytics and AI provide deeper understanding of customer behavior, enabling targeted marketing and product development.

- Operational Automation: AI can automate routine back-office tasks, freeing up human resources for more strategic, value-added activities.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) present transformative potential for BPER Banca, particularly in streamlining payments, enhancing trade finance processes, and securing record-keeping. These advancements promise greater transaction security, transparency, and operational efficiency, which are crucial in today's competitive banking landscape. For instance, the global trade finance market, a key area for DLT application, was projected to reach over $30 trillion by 2024, highlighting the scale of potential improvements. BPER Banca must actively track the maturation of these technologies to identify viable integration opportunities.

The adoption of DLT could significantly reduce costs and settlement times. In 2024, many financial institutions are exploring DLT for cross-border payments, aiming to cut transaction fees and speed up delivery. Early pilots have shown potential for reducing settlement cycles from days to minutes. BPER Banca should consider these benefits as it evaluates its technological roadmap.

- Enhanced Security: DLT’s cryptographic nature offers a robust defense against fraud and unauthorized access.

- Increased Transparency: Shared ledgers provide an immutable audit trail for transactions, improving regulatory compliance.

- Operational Efficiency: Automation of processes like reconciliation and settlement can lead to substantial cost savings.

- New Service Offerings: Blockchain can enable innovative financial products and services, potentially opening new revenue streams for BPER Banca.

The ongoing integration of artificial intelligence (AI) and advanced data analytics is a cornerstone of BPER Banca's technological strategy, aiming to unlock deeper customer insights and refine risk management. By leveraging these tools, the bank can personalize product offerings and proactively identify potential financial risks. In 2024, Italian banks, including BPER, have significantly increased their investments in AI for applications such as fraud detection and customer service automation, seeking substantial efficiency gains.

These technological advancements are directly translating into tangible operational efficiencies and strategic advantages for BPER Banca. The bank's commitment to digital transformation, including cloud adoption and AI integration, is crucial for maintaining competitiveness and meeting evolving customer expectations in the dynamic financial services landscape of 2024 and 2025.

| Technology Area | Impact on BPER Banca | Key Data/Trend (2023-2025) |

|---|---|---|

| Digitalization | Enhanced customer experience, operational efficiency | Digital transaction volumes increased by X% in Q1 2024. |

| Cybersecurity | Data protection, regulatory compliance | Global average cost of data breach in 2024: $4.45 million. |

| FinTech Disruption | Need for strategic adaptation, potential partnerships | Global FinTech funding exceeded $100 billion by end of 2023. |

| Cloud Computing | Scalability, cost reduction | Continued migration of key operations to cloud throughout 2024-2025. |

| AI & Data Analytics | Personalization, risk management, automation | Increased AI investment for fraud detection and service automation in 2024. |

| Blockchain/DLT | Streamlined payments, enhanced security | Exploration of DLT for cross-border payments in 2024; potential to reduce settlement times. |

Legal factors

BPER Banca navigates a stringent regulatory landscape shaped by international accords like Basel IV and EU directives such as CRD VI and CRR III. These frameworks, with phased implementations continuing into 2024 and beyond, mandate robust capital buffers and liquidity management. For instance, the finalization of Basel IV rules, expected to be fully implemented by January 2025, will likely require banks to hold more capital against certain types of risk, potentially impacting profitability and lending volumes.

Compliance with these evolving rules is not optional; it's a prerequisite for BPER Banca's operational continuity and market standing. Failure to meet capital adequacy ratios or liquidity coverage requirements, as stipulated by these regulations, could result in significant penalties and restricted access to funding markets. The ongoing adaptation to these requirements influences BPER Banca's strategic decisions regarding asset allocation and risk appetite.

Strict data privacy laws, like the GDPR, significantly impact BPER Banca's operations, dictating how customer data is handled. Compliance is non-negotiable, as violations can lead to substantial penalties; for instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is greater. BPER Banca must maintain robust data governance, ensuring strong security measures and transparent data usage policies to foster customer trust.

BPER Banca operates under strict Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws. These regulations mandate robust know-your-customer (KYC) protocols and continuous transaction monitoring to detect and report suspicious financial activities to regulatory bodies. For instance, in 2023, Italian banks reported a significant increase in suspicious transaction reports (STRs) filed with the Financial Intelligence Unit (FIU), reflecting heightened regulatory scrutiny and the evolving nature of financial crime.

Failure to adhere to these AML/CTF requirements can result in substantial fines and severe reputational damage. In 2024, European financial institutions collectively faced billions in AML-related penalties, underscoring the financial risks associated with non-compliance. BPER Banca's commitment to these measures is therefore critical for maintaining operational integrity and market trust.

Consumer Protection Laws and Transparency Requirements

Consumer protection laws are a significant legal factor for BPER Banca, mandating strict adherence to protect its customers. These regulations ensure that financial products are clearly explained, lending practices are fair, and complaints are addressed systematically. For instance, Italy's Consumer Code (Codice del Consumo) sets forth robust consumer rights in financial services, requiring banks to provide comprehensive pre-contractual information and maintain transparent pricing structures.

BPER Banca must navigate a landscape where misleading advertising and unfair contract terms can lead to substantial penalties. The bank's commitment to transparency, including clear communication of interest rates, fees, and contractual obligations, is crucial for building customer trust and avoiding regulatory scrutiny. For example, in 2024, the Italian Competition Authority (AGCM) fined several financial institutions for unfair commercial practices, highlighting the enforcement risks.

- Product Transparency: Ensuring all fees, interest rates, and terms are clearly disclosed to customers before account opening or loan agreement.

- Fair Lending Practices: Adhering to regulations that prevent discriminatory lending and ensure responsible credit assessment.

- Grievance Redressal: Establishing effective mechanisms for handling customer complaints and disputes promptly and fairly.

- Regulatory Compliance: Staying updated with evolving consumer protection laws, such as those related to digital banking and data privacy, to avoid legal repercussions.

Competition Law and Merger Control

Competition law and merger control are significant legal factors impacting BPER Banca. Authorities like the Italian Competition Authority (AGCM) and the European Commission scrutinize banking sector mergers to prevent monopolies and ensure fair play. For instance, the AGCM's 2023 annual report highlighted its ongoing efforts to monitor market concentration and prevent anti-competitive agreements within financial services.

These regulations directly influence BPER Banca's strategic growth, especially when considering acquisitions or significant partnerships. Any proposed merger or acquisition must undergo rigorous review to ensure it does not unduly stifle competition, potentially leading to divestitures or outright blocking of deals.

Key considerations for BPER Banca include:

- Compliance with EU and national antitrust regulations.

- Navigating merger control reviews for M&A activities.

- Adhering to rules against market abuse and anti-competitive practices.

- Ensuring fair competition within the Italian and broader European banking markets.

BPER Banca operates under a complex web of legal and regulatory frameworks, including Basel IV and EU directives like CRD VI and CRR III, which continue to be implemented through 2024 and into 2025. These regulations necessitate robust capital and liquidity management, with Basel IV's finalization by January 2025 potentially increasing capital requirements and impacting profitability. Strict adherence to data privacy laws such as GDPR is critical, as non-compliance can result in substantial fines, with penalties potentially reaching up to 4% of global annual turnover or €20 million.

Environmental factors

The increasing focus on ESG criteria and sustainable finance regulations is a major driver for BPER Banca. The bank is actively adapting its operations to comply with frameworks like the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR), which came into full effect in March 2023. This means integrating environmental, social, and governance factors into all lending and investment decisions.

This regulatory shift directly impacts BPER Banca's product development, requiring the creation of more sustainable financial products and services. For instance, the bank is likely developing green loans and impact investments to meet growing investor demand and regulatory mandates. By 2024, the European Central Bank has also increased its focus on climate-related risks in its supervisory activities, further pushing banks like BPER Banca to demonstrate robust ESG integration.

BPER Banca is exposed to significant climate-related financial risks. Physical risks, such as increased frequency of extreme weather events in Italy, could devalue collateral held for loans, particularly in sectors like agriculture or real estate. For instance, the European Environment Agency reported that Italy experienced over €10 billion in climate-related damages between 2000 and 2020, highlighting the tangible impact of these events.

Transition risks also pose a challenge, as shifts towards a low-carbon economy could impact BPER Banca's loan portfolio. Industries heavily reliant on fossil fuels within Italy, a significant part of the Italian economy, may face stricter regulations or technological obsolescence, leading to increased credit risk. The Italian government's National Integrated Energy and Climate Plan (PNIEC) aims for substantial emissions reductions by 2030, necessitating adjustments in lending strategies.

To mitigate these exposures, BPER Banca must enhance its climate risk management frameworks. This includes conducting thorough stress tests on its loan book to understand potential impacts from various climate scenarios and strategically adjusting its lending practices to favor more sustainable sectors. The bank's proactive approach to integrating climate considerations into its risk appetite and governance structures will be crucial for long-term resilience.

Societal and investor awareness of climate change is a significant driver for green financial products. This trend is clearly visible in the growing market for green bonds and sustainable loans. For instance, the global green bond market issuance reached an estimated $600 billion in 2024, a substantial increase from previous years, indicating strong investor appetite. BPER Banca can capitalize on this by expanding its offerings in this area, potentially attracting a new segment of environmentally conscious clients and capital.

Reputational Risk and Environmental Impact

BPER Banca's commitment to sustainability significantly shapes its public image. Negative environmental perceptions can erode trust, impacting customer retention and investor appeal. For example, in 2023, BPER Banca reported a 5% reduction in its Scope 1 and 2 greenhouse gas emissions compared to 2022, demonstrating a tangible effort towards environmental stewardship.

Proactive engagement with environmental concerns is therefore vital for BPER Banca's reputation. The bank's 2024 sustainability report highlights a 15% increase in financing for green projects, signaling a strategic alignment with environmentally conscious stakeholders. This focus aims to mitigate reputational risks and attract a growing segment of ESG-focused investors.

- Reputational Impact: Negative environmental performance can lead to public backlash and decreased customer loyalty.

- Investor Confidence: Strong ESG credentials attract investors, while poor environmental practices can deter them.

- Sustainability Reporting: BPER Banca's 2023 emissions reduction of 5% and 2024 green project financing increase are key metrics.

- Proactive Measures: Demonstrating environmental commitment through clear actions and transparent communication is essential.

Operational Environmental Footprint

BPER Banca is actively managing its operational environmental footprint, focusing on reducing energy consumption, waste generation, and water usage across its extensive network of offices and branches. This commitment is crucial for enhancing its overall Environmental, Social, and Governance (ESG) performance and realizing potential cost efficiencies.

The bank is increasingly transparent about its environmental impact, with a growing expectation to measure, report, and actively reduce these operational impacts. Key initiatives include implementing energy efficiency measures in buildings, promoting robust recycling programs, and adopting sustainable procurement practices for goods and services.

- Energy Efficiency: BPER Banca is investing in modernizing its branches and offices to reduce energy consumption, aiming for a significant decrease in its carbon footprint by 2025.

- Waste Reduction: The bank has implemented digital solutions to minimize paper usage and enhanced recycling infrastructure across its facilities.

- Sustainable Procurement: BPER Banca prioritizes suppliers with strong environmental credentials, ensuring its supply chain aligns with its sustainability goals.

BPER Banca faces increasing regulatory pressure and market demand for sustainable finance, necessitating integration of ESG factors into its operations. The bank is actively developing green financial products and adapting to stricter climate risk supervision, as evidenced by the European Central Bank's heightened focus in 2024.

Climate change presents both physical and transition risks for BPER Banca. Extreme weather events in Italy, which caused over €10 billion in damages between 2000-2020, can impact loan collateral, while the nation's push for a low-carbon economy by 2030 via its PNIEC plan could affect fossil fuel-dependent industries in its portfolio.

The bank is enhancing its climate risk management, including stress testing its loan book and adjusting lending strategies towards sustainable sectors. This proactive approach is crucial for resilience. Societal and investor demand for green finance is robust, with the global green bond market reaching an estimated $600 billion in 2024, offering BPER Banca opportunities to attract environmentally conscious capital.

BPER Banca is also focused on reducing its operational environmental footprint, implementing energy efficiency measures and waste reduction programs. In 2023, the bank achieved a 5% reduction in Scope 1 and 2 greenhouse gas emissions, and by 2024, it increased financing for green projects by 15%, demonstrating a commitment to environmental stewardship and mitigating reputational risks.

| Environmental Factor | BPER Banca's Response/Impact | Key Data/Target |

|---|---|---|

| Regulatory Compliance | Adherence to ESG criteria, EU Taxonomy, SFDR | SFDR fully effective March 2023 |

| Climate Risk Management | Addressing physical and transition risks | Italian climate damages: >€10bn (2000-2020) |

| Sustainable Finance Market | Developing green products, capitalizing on investor demand | Global green bond market: ~$600bn (2024 est.) |

| Operational Footprint | Reducing energy consumption, waste, and emissions | GHG emissions reduction: 5% (2023 vs 2022) |

| Green Project Financing | Increasing investment in environmentally friendly initiatives | Green project financing increase: 15% (2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for BPER Banca is informed by official Italian government publications, European Union economic and regulatory reports, and leading financial news outlets. We also incorporate data from industry-specific market research and banking sector performance reviews.