BPER Banca Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BPER Banca Bundle

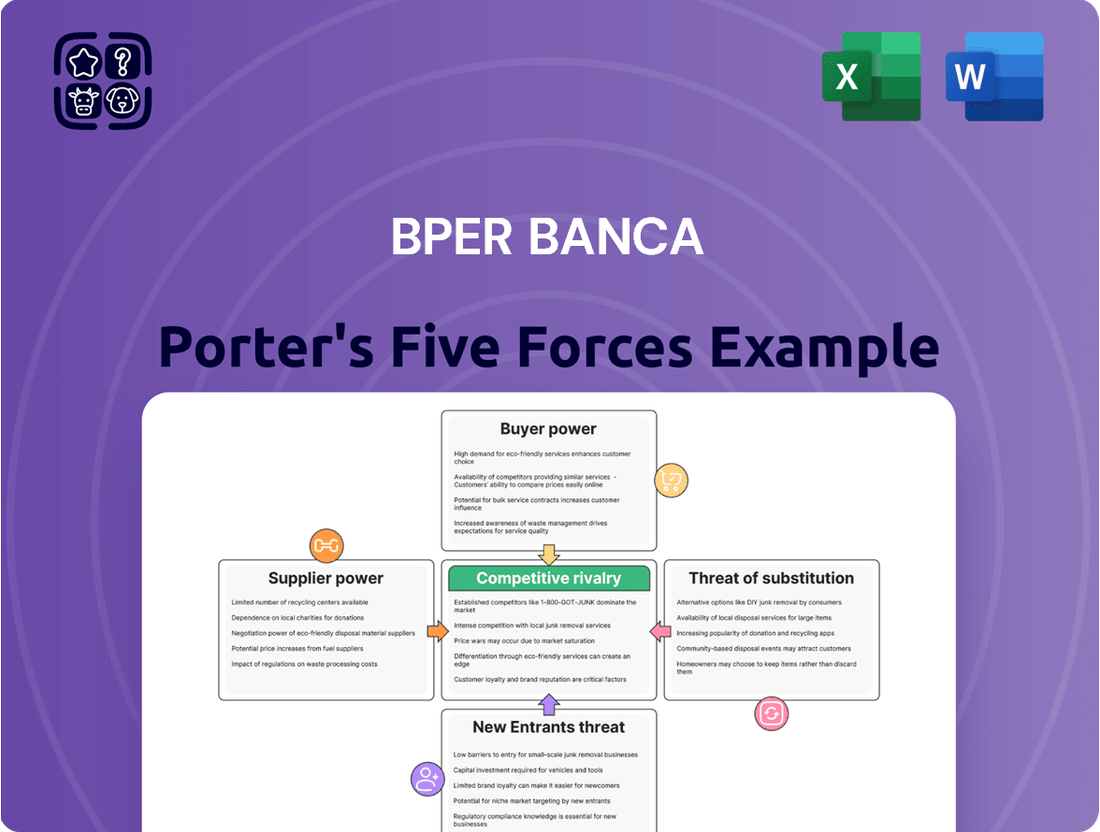

A Porter's Five Forces analysis of BPER Banca reveals the intense competitive landscape of the Italian banking sector, highlighting the significant threat of new entrants and the bargaining power of buyers. Understanding these forces is crucial for navigating BPER Banca's strategic environment.

The complete report reveals the real forces shaping BPER Banca’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of technology and software providers is on the rise for banks like BPER Banca. This is driven by the increasing need for sophisticated digital systems to manage operations, bolster cybersecurity, and enhance customer experiences. Specialized providers of core banking, AI analytics, or cloud services hold considerable sway due to their unique solutions and the substantial costs involved in switching platforms, a factor BPER Banca must consider.

Suppliers like payment networks, clearing houses, and interbank liquidity providers wield significant influence over BPER Banca. These entities are indispensable for the bank's daily operations, acting as essential conduits for transactions and liquidity management.

The market for these critical financial infrastructure services is often characterized by a lack of competition, with many operating as regulated monopolies or oligopolies. This structure inherently limits BPER Banca's ability to negotiate terms or seek alternative providers, effectively dictating compliance with their established standards and fee structures.

Consequently, BPER Banca faces non-negotiable operational costs and efficiency impacts stemming from these supplier relationships. For instance, in 2024, the European Central Bank's TARGET2 system, a key interbank settlement system, processed trillions of euros daily, highlighting the scale of reliance and the cost implications of such infrastructure.

The market for highly skilled professionals in data science, cybersecurity, fintech, and compliance is a critical supplier for BPER Banca. As digital transformation accelerates, the demand for these specialized talents outstrips supply. This scarcity directly impacts recruitment costs and salary expectations, giving these professionals significant bargaining power.

In 2024, the average salary for a cybersecurity analyst in Italy saw an increase of approximately 8-10% year-over-year, reflecting this high demand. Similarly, experienced fintech developers can command salaries upwards of €60,000 annually, putting pressure on BPER Banca’s compensation strategies and making internal training and retention paramount to mitigate these supplier costs.

Data and Information Services

For BPER Banca, the bargaining power of suppliers in the data and information services sector is significant. Providers of financial data, market intelligence, credit ratings, and economic forecasts are crucial for informed decision-making, risk assessment, and strategic planning. For instance, in 2024, major financial data providers like Bloomberg and Refinitiv continued to command substantial market share, reflecting the high cost and complexity of acquiring and integrating such critical information.

The essential nature of accurate and timely data means that BPER Banca, like many financial institutions, is heavily reliant on these suppliers. This dependency grants suppliers considerable leverage, especially when the data is proprietary or requires specialized integration. The cost of switching providers can also be a deterrent, further solidifying the suppliers' strong market positions.

Key aspects influencing this bargaining power include:

- Data Quality and Timeliness: The accuracy and speed at which data is delivered directly impact BPER Banca's operational efficiency and strategic agility.

- Market Concentration: A limited number of dominant players in the financial data market often leads to less competitive pricing and terms for BPER Banca.

- Switching Costs: The expense and effort involved in migrating data systems and retraining personnel can make it difficult for BPER Banca to change suppliers.

- Proprietary Information: Unique datasets or analytical tools offered by certain suppliers create a strong dependence, increasing their bargaining power.

Regulatory and Compliance Services

Regulators and specialized compliance service providers wield substantial bargaining power over BPER Banca. Their influence stems from the critical need for adherence to a complex and ever-changing regulatory landscape. Failure to comply can result in substantial fines, damage to reputation, and operational limitations, making their demands difficult to ignore.

The increasing intricacy of financial regulations, particularly in the European Union, necessitates ongoing and significant investment in compliance infrastructure and expertise. This reliance on external legal and audit firms, for example, grants them considerable leverage in dictating terms and service costs. For instance, in 2023, the European Banking Authority continued to emphasize stringent capital requirements and anti-money laundering (AML) protocols, directly impacting the compliance expenditures of banks like BPER Banca.

- Regulatory Oversight: Bodies like the European Central Bank (ECB) and national authorities set the rules BPER Banca must follow.

- Compliance Service Providers: Law firms and audit firms specializing in financial regulations are essential for navigating these rules.

- Cost of Non-Compliance: Penalties for breaches can be severe, including hefty fines and reputational damage, increasing the power of those who ensure compliance.

- Investment in Compliance: The ongoing need to adapt to new regulations forces banks to allocate significant resources, giving compliance experts influence over operational costs.

The bargaining power of suppliers for BPER Banca is notably high across several key areas, driven by market concentration and the critical nature of their offerings. Technology providers, essential financial infrastructure entities, and specialized talent pools all exert significant influence.

The reliance on exclusive or dominant suppliers for core banking systems, payment networks, and specialized IT skills creates a situation where BPER Banca has limited negotiation leverage. This is compounded by the high costs and complexities associated with switching providers, particularly for integrated technology solutions.

In 2024, the increasing demand for specialized skills in areas like AI and cybersecurity meant that BPER Banca faced rising recruitment and retention costs, with average salaries for cybersecurity analysts in Italy seeing an estimated 8-10% year-over-year increase. Furthermore, the indispensable nature of financial data providers, with limited market alternatives, means BPER Banca must often accept established pricing structures.

| Supplier Category | Key Providers/Examples | Bargaining Power Factors | Impact on BPER Banca |

|---|---|---|---|

| Technology & Software | Core Banking System Providers, Cloud Services, AI Analytics | Specialized solutions, high switching costs, limited alternatives | Increased operational costs, dependence on vendor roadmaps |

| Financial Infrastructure | Payment Networks (e.g., Visa, Mastercard), Clearing Houses, TARGET2 | Market concentration, regulated monopolies, essential services | Non-negotiable fees, operational reliance, compliance with standards |

| Specialized Talent | Data Scientists, Cybersecurity Experts, Fintech Developers | High demand, limited supply, specialized skills | Elevated salary expectations, recruitment challenges, retention costs |

| Data & Information Services | Bloomberg, Refinitiv, Credit Rating Agencies | Proprietary data, market dominance, integration complexity | Significant subscription costs, reliance on data accuracy |

| Compliance & Legal Services | Regulatory Bodies, Audit Firms, Legal Consultancies | Mandatory compliance, high cost of non-compliance, complex regulations | Increased compliance expenditure, dependence on expert advice |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to BPER Banca's banking operations and Italian market presence.

Instantly identify competitive threats and strategic vulnerabilities within BPER Banca's market landscape, enabling proactive risk mitigation.

Customers Bargaining Power

The bargaining power of retail depositors and individual savers with BPER Banca is typically low. This is because core banking products like savings accounts are largely standardized, and the effort required for customers to switch financial institutions often outweighs the perceived benefits of minor rate differences. As of early 2024, Italian banks, including BPER Banca, operate in a market where deposit rates have been influenced by the European Central Bank's monetary policy, making significant individual negotiation power unlikely for most retail clients.

However, the increasing digitalization of banking services and greater transparency in product offerings empower customers to more readily compare interest rates, fees, and overall service quality across different banks. This heightened awareness can exert some pressure on BPER Banca to maintain competitive pricing and excellent customer service to retain its retail deposit base. For instance, the widespread availability of online comparison tools means a small difference in an annual percentage yield (APY) on a savings account can influence customer decisions.

Small and medium-sized enterprises (SMEs) generally possess moderate bargaining power with banks like BPER Banca. Their reliance on financial institutions for essential services such as loans, credit lines, and cash management can limit their leverage. However, financially sound and growing SMEs may find multiple banking partners willing to compete for their business, enabling them to negotiate more favorable terms. For instance, in 2023, SMEs accounted for a significant portion of the Italian economy, representing over 99% of all businesses, highlighting their collective importance and potential for negotiation if they demonstrate strong financial health.

Large corporate clients wield considerable influence over BPER Banca, primarily due to their substantial financing requirements and sophisticated financial service needs. Their ability to negotiate favorable terms, such as lower interest rates and reduced fees, is amplified by their sheer volume of business and their capacity to engage with multiple banking institutions.

In 2024, the Italian corporate banking sector saw intense competition for these high-value clients. BPER Banca, like its peers, had to offer a comprehensive suite of services, including specialized investment banking, robust trade finance solutions, and efficient treasury management, to attract and retain these demanding relationships.

Wealth Management and High Net Worth Individuals

Wealth management clients, especially those with substantial assets, wield significant bargaining power. They expect highly tailored services, advanced investment options, and competitive pricing. Their continued patronage hinges on trust, consistent performance, and the caliber of their financial advisors.

BPER Banca navigates this by offering superior client experiences, a diverse array of customized financial products, and showcasing robust investment performance. This segment is crucial, with global high-net-worth individual (HNWI) wealth reaching an estimated $47.8 trillion in 2023, according to Knight Frank.

- High Net Worth Individual (HNWI) Wealth: Global HNWI wealth was estimated at $47.8 trillion in 2023.

- Client Demands: Personalized services, sophisticated investment products, and competitive fees are paramount.

- Loyalty Drivers: Trust, investment performance, and advisor expertise are key to retaining HNWI clients.

- BPER Banca's Strategy: Focus on exceptional service, bespoke solutions, and strong investment returns to attract and retain this valuable segment.

Digital-Savvy Customers

Digital-savvy customers wield significant bargaining power, demanding intuitive and secure online and mobile banking. In 2024, a significant portion of banking transactions are expected to occur digitally, with customers readily switching providers if digital experiences fall short. For instance, a recent survey indicated that over 70% of consumers consider digital banking capabilities a primary factor when choosing a bank.

BPER Banca faces pressure to maintain and enhance its digital offerings to retain these customers. Failure to provide a seamless user experience, robust security, and innovative features can lead to customer attrition, particularly towards agile fintech competitors. In 2023, the Italian digital banking market saw a notable increase in customer acquisition by challenger banks, often driven by superior digital interfaces.

- Digital Proficiency: Customers expect frictionless online and mobile interactions.

- Switching Propensity: Poor digital experiences drive customers to competitors.

- Investment Imperative: BPER Banca must prioritize continuous digital channel development.

- Competitive Landscape: Fintechs and digitally advanced banks are key rivals for digitally engaged customers.

The bargaining power of customers for BPER Banca is a nuanced factor, varying significantly across different customer segments. While retail depositors generally have low individual power due to standardized products, the collective demand for competitive rates, especially in 2024 with the influence of ECB policy, means banks must remain attentive to market pricing. Digitalization further amplifies this, enabling easier comparison and increasing customer expectations for seamless online experiences, a trend highlighted by over 70% of consumers prioritizing digital capabilities.

SMEs, representing over 99% of Italian businesses as of 2023, possess moderate bargaining power, particularly when financially robust, as banks compete for their essential service needs. Large corporate clients and High Net Worth Individuals (HNWIs) wield substantial influence, demanding tailored services and competitive terms, with global HNWI wealth reaching $47.8 trillion in 2023. BPER Banca's strategy involves offering superior digital platforms and personalized financial solutions to retain these valuable segments amidst intense competition.

| Customer Segment | Bargaining Power | Key Drivers | BPER Banca's Response |

|---|---|---|---|

| Retail Depositors | Low to Moderate | Standardized products, rate sensitivity, digitalization enabling comparison | Competitive pricing, focus on digital experience |

| SMEs | Moderate | Reliance on banking services, financial health, potential for multiple banking relationships | Tailored credit and cash management solutions |

| Large Corporations | High | Significant financing needs, sophisticated service demands, ability to switch banks | Comprehensive financial services, investment banking, treasury management |

| HNWIs | High | Substantial assets, demand for personalized advice and investment performance | Bespoke wealth management, expert advisory, strong investment returns |

| Digital-Savvy Customers | High | Expectation of intuitive and secure online/mobile banking, low switching costs | Continuous investment in digital channels, user experience enhancement |

What You See Is What You Get

BPER Banca Porter's Five Forces Analysis

This preview showcases the complete BPER Banca Porter's Five Forces Analysis, reflecting the exact document you will receive immediately after purchase. You'll gain a comprehensive understanding of the competitive landscape, including detailed insights into buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector. No placeholders or sample content; this is the full, professionally formatted analysis ready for your strategic planning.

Rivalry Among Competitors

BPER Banca faces intense competition from major Italian banks such as Intesa Sanpaolo and UniCredit. These dominant players boast extensive branch networks, substantial capital reserves, and a wide array of financial products, enabling them to aggressively vie for market share through competitive pricing and innovative offerings.

The sheer scale of these larger competitors presents a significant challenge, as they possess greater resources for marketing, technology investment, and talent acquisition. For instance, Intesa Sanpaolo reported total assets of over €1 trillion as of the end of 2023, dwarfing BPER Banca's balance sheet.

To navigate this landscape, BPER Banca must strategically capitalize on its established regional presence and strong customer loyalty. Building on these strengths allows BPER to differentiate itself and foster deeper relationships, which can be a powerful counterpoint to the broad reach of its larger rivals.

BPER Banca contends with a fragmented competitive landscape populated by smaller regional and cooperative banks. These institutions, deeply embedded in their local communities, leverage specialized knowledge and personalized service to foster strong customer loyalty, often within specific geographic or demographic niches.

For instance, in 2023, the Italian banking sector saw a significant number of smaller entities actively competing for market share. While BPER Banca's total assets were substantial, many of these regional players maintained high customer satisfaction ratings due to their tailored offerings, demonstrating the ongoing challenge of balancing a national strategy with granular, localized engagement to secure and expand market share.

International banks operating in Italy, especially those targeting corporate and high-net-worth clients with services like investment banking and wealth management, present a significant competitive challenge. These global players often leverage their extensive financial expertise, advanced product suites, and aggressive pricing strategies to attract and retain premium customers.

For instance, major European and global banking groups with established Italian branches, such as UniCredit, Intesa Sanpaolo, and various French and Swiss banks, actively compete for BPER Banca's key client segments. These competitors frequently offer specialized advisory services and cross-border financial solutions that can be highly attractive to large corporations and affluent individuals seeking international market access.

To counter this, BPER Banca needs to bolster its specialized product development and expand its international reach. By focusing on niche areas and enhancing its capacity to serve clients with global financial needs, BPER Banca can better position itself against these formidable international competitors in the Italian market.

Fintech Companies and Digital Challengers

Fintech companies and digital challengers are significantly ramping up competition in banking, particularly in areas like payments, consumer loans, and investments. These nimble firms often use technology to provide lower costs, better digital experiences, and specialized offerings, drawing in younger, tech-savvy customers. For instance, by the end of 2023, the global fintech market was valued at over $1.1 trillion, demonstrating substantial growth and market penetration.

These new entrants frequently offer more attractive pricing and user-friendly interfaces, directly challenging traditional banks. Their ability to innovate quickly allows them to adapt to market changes and customer demands more effectively. By Q1 2024, challenger banks in Europe reported significant user base growth, with some exceeding 10 million active users.

- Increased Competition: Fintechs and digital banks are eroding market share in key banking segments.

- Technological Advantage: Their reliance on advanced technology enables lower fees and enhanced user experiences.

- Customer Acquisition: Digitally native customers are increasingly opting for these new financial service providers.

- Market Impact: By late 2023, fintech funding reached new highs, indicating continued investment and innovation in the sector.

BPER Banca must prioritize its digital transformation efforts and consider strategic collaborations to remain competitive and relevant in this evolving landscape. Failing to adapt could lead to a loss of market share and customer loyalty.

Poste Italiane and Non-Bank Financial Institutions

Poste Italiane represents a formidable competitor, leveraging its extensive physical presence and integrated financial services, including PostePay and BancoPosta. This allows it to effectively compete for retail customers seeking straightforward banking, payment, and savings solutions, directly challenging BPER Banca's market share in these areas.

The competitive landscape is further intensified by a growing array of non-bank financial institutions. These entities, encompassing insurance companies, asset managers, and fintech providers, are increasingly encroaching on traditional banking services. Their offerings often overlap with BPER Banca's, creating broader competitive pressure across its various business lines.

- Poste Italiane's Financial Services Growth: In 2023, Poste Italiane reported a significant increase in its financial services revenue, driven by growth in payments and savings products, indicating its strong appeal to a broad customer base.

- Fintech's Expanding Reach: The Italian fintech sector saw substantial investment in 2024, with new digital payment solutions and investment platforms emerging, directly competing with traditional bank offerings.

- Insurance Sector Competition: Italian insurance companies continue to expand their investment-linked products and savings accounts, presenting a direct alternative to bank deposits and investment services offered by BPER Banca.

BPER Banca operates in a fiercely competitive Italian banking sector, facing pressure from large domestic rivals like Intesa Sanpaolo and UniCredit, which possess greater scale and resources. Smaller regional banks also pose a challenge through localized expertise and customer loyalty.

International banks and agile fintech companies are further intensifying this rivalry by offering specialized services and superior digital experiences, particularly in high-value client segments and payment solutions. The market is dynamic, with new entrants continually disrupting traditional banking models.

BPER Banca must leverage its regional strengths and invest in digital transformation to effectively compete. The sector's fragmentation and the increasing capabilities of non-bank financial institutions underscore the need for strategic differentiation and customer-centric approaches.

For instance, as of early 2024, Italian fintechs continued to attract significant venture capital, with payment services and digital lending platforms showing robust growth, directly challenging BPER Banca's traditional revenue streams. Furthermore, Poste Italiane's expansion into financial services in 2023, reporting increased revenue from its banking and payment offerings, highlights a significant competitor in the retail space.

SSubstitutes Threaten

The proliferation of direct investment platforms and robo-advisors presents a significant threat of substitutes for BPER Banca. These digital services empower individuals to manage their investments directly, often at a fraction of the cost associated with traditional bank advisory services. For instance, by mid-2024, the assets under management (AUM) for leading robo-advisors in Europe were projected to exceed €100 billion, demonstrating their growing appeal.

These platforms offer user-friendly interfaces and sophisticated algorithms, making investing accessible to a broader audience and reducing reliance on bank-provided wealth management. This shift means clients can bypass BPER Banca for their investment needs, opting for more cost-effective and convenient alternatives. The ease of opening an account and executing trades online further intensifies this competitive pressure.

To counter this threat, BPER Banca needs to significantly bolster its digital investment capabilities. This includes developing intuitive online platforms and enhancing its robo-advisory services to match or exceed the offerings of standalone fintech firms. Furthermore, emphasizing unique value-added advisory services that go beyond basic portfolio management will be crucial in retaining investment-focused clientele.

Peer-to-peer (P2P) lending platforms present a significant threat of substitutes for BPER Banca, offering alternative avenues for both borrowing and investing. These platforms bypass traditional banking channels, providing quicker access to capital and potentially more attractive returns for investors. For instance, the P2P lending market globally saw substantial growth, with volumes reaching hundreds of billions of dollars by 2024, demonstrating a clear preference among some segments of the market for these streamlined services.

For individual and small business borrowers, P2P platforms can offer more flexible terms and faster approval processes compared to conventional bank loans. This can be particularly appealing for those who find traditional banking procedures cumbersome or slow. BPER Banca must actively monitor and adapt its product offerings, ensuring its loan products remain competitive in speed, accessibility, and interest rates to retain customers who might otherwise opt for these digital alternatives.

Cryptocurrencies and decentralized finance (DeFi) present emerging substitutes for traditional banking services. While still in early stages for widespread use, these technologies offer peer-to-peer alternatives for payments, lending, and asset management. For instance, the total value locked in DeFi protocols reached over $100 billion in early 2024, indicating growing user adoption and transaction volume.

As blockchain technology matures, it could significantly reduce customer reliance on incumbent banks for core financial operations. This shift necessitates that institutions like BPER Banca actively monitor these evolving digital asset landscapes and explore potential integration of blockchain solutions to remain competitive.

Non-Bank Financial Institutions (NBFIs)

Non-bank financial institutions (NBFIs) present a significant threat of substitutes for BPER Banca. Insurance companies, asset management firms, and specialized lenders are increasingly encroaching on traditional banking services. For instance, many insurance providers now offer investment-linked savings products that compete directly with bank deposits and investment accounts, while specialized lenders are capturing market share in areas like consumer credit and mortgages. In 2023, the global alternative lending market, a key segment of NBFI activity, was estimated to be worth over $2.6 trillion, demonstrating its substantial and growing influence.

These NBFIs often benefit from lighter regulatory burdens compared to traditional banks, allowing them to innovate and offer more competitive pricing or specialized products. This flexibility enables them to target specific customer segments or product niches effectively. For example, fintech lenders can often process loan applications much faster than traditional banks. BPER Banca must actively monitor these evolving competitive dynamics and adapt its own product development and service offerings to counter the appeal of these substitutes.

- Insurance companies are offering savings and investment products that rival bank deposits.

- Asset management firms compete for customer wealth through various investment vehicles.

- Specialized lending companies, including fintechs, are gaining traction in mortgages and consumer loans.

- The global alternative lending market reached over $2.6 trillion in 2023, highlighting the scale of NBFI competition.

Embedded Finance Solutions

The rise of embedded finance presents a significant threat. Non-financial companies, from retailers to tech platforms, are increasingly embedding financial services like buy-now-pay-later (BNPL) directly into their customer journeys. For instance, in 2024, BNPL transaction volumes in Europe were projected to reach over €100 billion, demonstrating a clear shift in consumer behavior away from traditional banking channels.

This trend allows customers to access financial solutions seamlessly at the point of need, bypassing direct engagement with banks like BPER Banca. By integrating payments or credit into their own ecosystems, these companies offer convenient alternatives that can substitute for traditional banking products and services.

- Embedded finance growth: The global embedded finance market is expected to grow significantly, with some estimates suggesting it could reach $7 trillion by 2030, indicating a massive potential shift away from traditional financial institutions.

- BNPL adoption: In 2024, adoption rates for buy-now-pay-later services continued to climb across various demographics, particularly among younger consumers, who increasingly prefer these integrated payment options.

- Customer experience focus: Companies embedding finance often prioritize a superior customer experience, making it harder for traditional banks to compete on convenience alone.

- Partnership opportunities: BPER Banca needs to consider strategic partnerships with fintechs or large non-financial companies to offer its own embedded finance solutions, thereby retaining customer relationships and accessing new revenue streams.

The threat of substitutes for BPER Banca is substantial, driven by digital platforms and alternative financial providers. These substitutes offer convenience, lower costs, and specialized services that can directly compete with traditional banking offerings. For instance, by early 2024, the total value locked in decentralized finance (DeFi) protocols surpassed $100 billion, indicating a growing user base for non-traditional financial services.

Fintech innovations, including robo-advisors and peer-to-peer lending, are capturing market share by providing streamlined, user-friendly alternatives. The global alternative lending market, a key area for non-bank financial institutions (NBFIs), was valued at over $2.6 trillion in 2023, underscoring the scale of this competitive landscape.

Furthermore, embedded finance, where financial services are integrated into non-financial platforms, presents a growing challenge. By 2024, buy-now-pay-later (BNPL) transaction volumes in Europe were projected to exceed €100 billion, demonstrating a significant shift in consumer preference towards integrated financial solutions.

| Substitute Type | Key Characteristics | Market Trend/Data (as of mid-2024 or latest available) | Impact on BPER Banca |

|---|---|---|---|

| Digital Investment Platforms/Robo-Advisors | Low cost, accessibility, user-friendly interface | European AUM projected to exceed €100 billion by mid-2024 | Loss of wealth management clients, reduced advisory fees |

| Peer-to-Peer (P2P) Lending | Faster access to capital, potentially higher investor returns | Global P2P lending volumes in hundreds of billions of dollars by 2024 | Competition for loan origination, reduced interest income |

| Cryptocurrencies & DeFi | Decentralized, peer-to-peer transactions, alternative asset classes | DeFi total value locked over $100 billion by early 2024 | Potential disintermediation of core banking services (payments, lending) |

| Non-Bank Financial Institutions (NBFIs) | Specialized products, lighter regulation, competitive pricing | Global alternative lending market over $2.6 trillion in 2023 | Erosion of market share in retail credit, mortgages, and savings products |

| Embedded Finance (e.g., BNPL) | Seamless integration into customer journeys, point-of-need solutions | European BNPL transactions projected to exceed €100 billion in 2024 | Loss of transaction volume, reduced customer touchpoints for credit products |

Entrants Threaten

The banking sector, including players like BPER Banca, faces a significant threat from new entrants due to high capital requirements and stringent regulatory oversight. Establishing a new bank necessitates substantial initial capital, often in the hundreds of millions of euros, to meet solvency and liquidity standards. For instance, the minimum regulatory capital requirements under frameworks like Basel III are substantial. This financial barrier, coupled with the complex and lengthy process of obtaining banking licenses and adhering to compliance frameworks such as CRD V, effectively deters most potential new competitors.

Established brand loyalty and trust represent a significant barrier to new entrants in the banking sector. Existing institutions like BPER Banca have cultivated decades of recognition and deep customer relationships, fostering a sense of reliability that is crucial in financial services. For instance, in 2024, a significant portion of banking customers in Italy expressed a preference for their primary bank due to trust and familiarity, often citing long-standing relationships as a key factor in their decision-making. This entrenched trust makes it challenging for newcomers to attract customers, as building comparable credibility and persuading individuals to switch from established, trusted providers requires substantial effort and investment.

The significant capital required for advanced technology infrastructure and robust cybersecurity measures presents a substantial barrier to entry in the banking sector. Newcomers face the daunting task of building or acquiring sophisticated core banking systems, digital customer interfaces, and state-of-the-art security protocols, a process that is both incredibly expensive and time-consuming. For instance, in 2023, European banks collectively invested billions in digital transformation and cybersecurity, with BPER Banca itself allocating significant resources to enhance its technological capabilities.

Access to Distribution Networks and Customer Data

Established banks like BPER Banca benefit immensely from their entrenched distribution networks and deep wells of customer data. These existing channels, encompassing a significant physical branch presence and sophisticated digital platforms, allow for broad market reach and the delivery of tailored financial products. Furthermore, the wealth of customer data enables more accurate risk assessments and personalized service offerings, a significant hurdle for newcomers.

New entrants face considerable challenges in building comparable distribution capabilities and accumulating the necessary customer data to compete effectively. Replicating the extensive branch networks and advanced digital infrastructure of incumbent banks requires substantial capital investment and time. Similarly, acquiring and analyzing customer data to the same degree of sophistication is a lengthy and resource-intensive process, creating a clear barrier to entry.

BPER Banca's strategic advantage is amplified by its multi-channel approach, which effectively utilizes its existing infrastructure and data insights. For instance, as of late 2024, BPER Banca reported a robust digital banking adoption rate among its customer base, demonstrating the effectiveness of its integrated channel strategy. This allows them to serve a diverse range of customer needs efficiently, further solidifying their market position against potential new competitors who lack this established foundation.

The threat of new entrants is therefore moderated by the significant upfront investment and time required to establish comparable distribution and data capabilities.

Economies of Scale and Scope

Economies of scale present a formidable barrier for new entrants aiming to challenge established players like BPER Banca. Large banks leverage their extensive customer base and operational volume to spread fixed costs, such as technology infrastructure and regulatory compliance, over a much larger base. For instance, in 2024, major European banks reported significant investments in digital transformation, amounting to billions of euros, a cost that smaller, newer entities would find exceptionally difficult to absorb and still remain competitive on pricing.

Furthermore, economies of scope allow incumbent banks to offer a wide array of products and services – from retail banking and mortgages to investment and corporate finance – often cross-selling to existing customers. This integrated approach creates a more robust revenue stream and customer loyalty. New entrants, especially those focusing on niche digital services, may find it challenging to replicate this breadth of offering, forcing them to compete on a narrower front and potentially limiting their market appeal.

- Significant Capital Investment: New entrants require massive upfront investment to build comparable operational capacity and technological infrastructure to established banks.

- Brand Recognition and Trust: Incumbents benefit from decades of brand building and customer trust, which new players must painstakingly earn.

- Regulatory Hurdles: Navigating complex banking regulations is costly and time-consuming, creating an additional barrier for newcomers.

- Customer Inertia: Existing customers often exhibit loyalty to their current banks due to convenience and established relationships, making acquisition difficult for new entrants.

The threat of new entrants in the banking sector, impacting BPER Banca, is generally considered moderate. While high capital requirements and stringent regulations create substantial barriers, the increasing digitalization of banking services could potentially lower some of these traditional entry hurdles.

New digital-only banks or fintech companies can enter with lower overheads compared to traditional brick-and-mortar institutions. However, building significant market share and customer trust remains a considerable challenge, especially when competing against established brands like BPER Banca that have deep customer relationships and extensive service offerings.

In 2024, the European banking landscape saw continued investment in digital transformation, with incumbent banks like BPER Banca enhancing their online platforms. This focus on digital customer experience aims to retain existing clients and attract new ones, further solidifying their competitive position against potential digital disruptors.

The need for substantial capital to comply with regulations and invest in technology, alongside the difficulty in replicating established distribution networks and customer data insights, means that while new entrants pose a threat, it is often mitigated by these factors.

| Barrier to Entry | Impact on New Entrants | BPER Banca's Position |

|---|---|---|

| Capital Requirements | Very High | Well-established due to scale |

| Regulatory Compliance | High & Complex | Experienced and resourced |

| Brand Trust & Loyalty | Significant Challenge | Strong, built over years |

| Technological Infrastructure | Costly to replicate | Investing heavily in upgrades |

| Distribution Networks | Difficult to match | Extensive physical and digital presence |

Porter's Five Forces Analysis Data Sources

Our BPER Banca Porter's Five Forces analysis is built upon a foundation of verified data, including BPER's annual reports, industry-specific publications from banking associations, and regulatory filings from the Bank of Italy and European Central Bank.