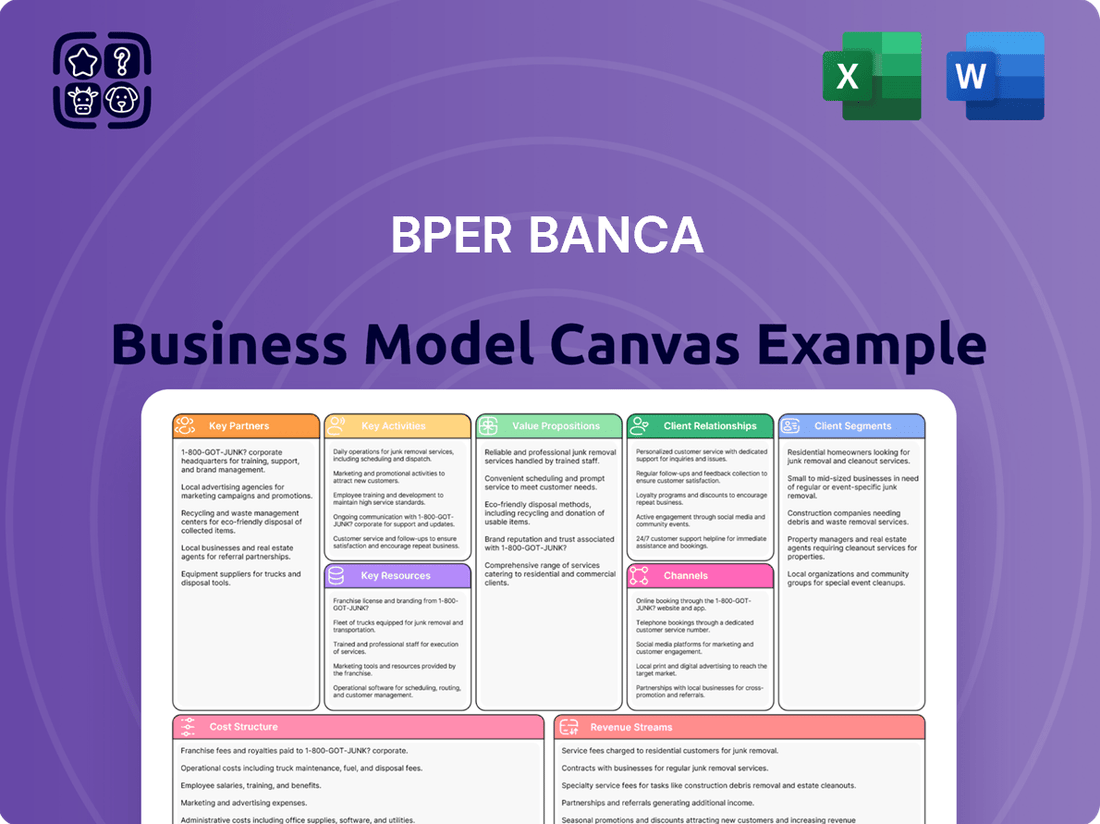

BPER Banca Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BPER Banca Bundle

Discover the strategic core of BPER Banca with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Unlock the full strategic blueprint and gain invaluable insights for your own business endeavors.

Partnerships

BPER Banca actively cultivates strategic alliances to broaden its service portfolio and expand its market presence. A key collaboration is with the European Investment Bank (EIB), which has provided substantial financing, particularly in 2024, to bolster Italian businesses. This partnership is instrumental in supporting economic growth and the ecological transition within Italy.

Through its alliance with the EIB, BPER Banca facilitates access to credit for small and medium-sized enterprises (SMEs) and mid-cap companies. These financing agreements, often structured with favorable terms, underscore BPER Banca's dedication to fostering wider economic development and providing crucial capital for businesses navigating the green transition.

BPER Banca actively collaborates with technology giants like IBM to spearhead its core banking system modernization and digital transformation initiatives. These strategic alliances are vital for advancing hybrid cloud adoption and integrating cutting-edge AI solutions.

These partnerships focus on enhancing omnichannel customer service delivery, aiming to create a seamless and efficient banking experience across all touchpoints. By leveraging advanced technologies, BPER Banca seeks to significantly boost its operational efficiency and customer satisfaction in the dynamic digital environment.

BPER Banca actively cultivates key partnerships, notably in bancassurance, and utilizes internal product factories like Bibanca. This dual approach allows them to offer specialized financial services, including consumer finance and insurance products, thereby broadening their appeal to a diverse customer base.

These strategic alliances are crucial for BPER Banca's revenue diversification strategy. By focusing on capital-light, high-quality non-interest income streams, they aim to enhance profitability. For instance, in 2023, BPER Banca reported a significant increase in its fee and commission income, partly driven by its bancassurance activities.

Training and Human Capital Development

BPER Banca recognizes the critical role of its workforce in achieving its strategic objectives. To that end, the bank has forged key partnerships focused on training and human capital development. A significant collaboration is the five-year agreement with Digit'Ed, aimed at establishing a comprehensive corporate academy. This partnership directly supports BPER Banca's 'B:Dynamic Full Value 2027' business plan by prioritizing investment in its employees.

The corporate academy, powered by the Digit'Ed partnership, will deliver advanced training programs. These programs are meticulously designed to equip employees with essential skills for the evolving banking landscape. Key areas of focus include digital competencies, proficiency in new technologies, and effective change management strategies. This proactive approach ensures BPER Banca's staff are well-prepared to navigate and capitalize on future industry challenges and opportunities.

These human capital development initiatives are crucial for fostering innovation and agility within the bank. By investing in upskilling and reskilling its employees, BPER Banca aims to enhance operational efficiency and customer service. The strategic alignment of training with the 'B:Dynamic Full Value 2027' plan underscores a commitment to building a future-ready organization. For instance, as of early 2024, BPER Banca has been actively promoting internal mobility and continuous learning programs, with a notable increase in participation rates for digital skills workshops.

- Digit'Ed Partnership: A five-year agreement to establish a corporate academy.

- Strategic Alignment: Supports the 'B:Dynamic Full Value 2027' business plan.

- Training Focus: Digital skills, new technologies, and change management.

- Employee Development: Prioritizes investment in human capital for future readiness.

Acquisition and Integration Partners

BPER Banca actively pursues growth through strategic acquisitions, a key element of its business model. A significant recent example is the acquisition of a majority stake in Banca Popolare di Sondrio, a move aimed at strengthening its market presence and achieving greater operational efficiencies. This expansion strategy relies heavily on effective integration partners who can navigate the complexities of merging different banking systems and cultures.

The successful integration of acquired entities is crucial for realizing the intended benefits, such as economies of scale and enhanced market share. BPER Banca collaborates with specialized consulting firms and technology providers to manage these intricate processes. These partnerships are vital for ensuring a smooth transition and maximizing the value derived from each acquisition, contributing to the group's overall consolidation within the Italian banking landscape.

In 2024, the Italian banking sector continued to see consolidation trends. BPER Banca's strategic moves, like the Banca Popolare di Sondrio integration, are indicative of this broader market dynamic. These partnerships are essential for managing the technical and operational challenges inherent in such large-scale integrations, ultimately supporting BPER Banca's objective to enhance its competitive positioning.

Key aspects of these partnerships include:

- Expertise in post-merger integration: Leveraging external specialists for IT system consolidation, regulatory compliance, and operational alignment.

- Synergy realization: Collaborating with partners to identify and implement cost savings and revenue enhancement opportunities arising from the acquisition.

- Risk management: Working with advisors to mitigate integration risks, ensuring financial stability and regulatory adherence throughout the process.

BPER Banca's strategic partnerships are crucial for its growth and operational efficiency. Collaborations with entities like the European Investment Bank (EIB) in 2024 provided significant financing for Italian businesses, particularly supporting SMEs and the green transition. Furthermore, alliances with technology leaders such as IBM are central to modernizing core banking systems and advancing digital transformation, enhancing customer service across all channels.

These alliances extend to bancassurance and internal product development through entities like Bibanca, diversifying revenue streams with a focus on capital-light, high-quality non-interest income. BPER Banca also invests heavily in its workforce through a five-year agreement with Digit'Ed to establish a corporate academy, equipping employees with essential digital and technological skills aligned with its 'B:Dynamic Full Value 2027' plan.

The bank's acquisition strategy, exemplified by the integration of Banca Popolare di Sondrio, relies on partnerships with specialized firms for post-merger integration, synergy realization, and risk management, reinforcing its competitive position in a consolidating banking sector.

What is included in the product

A detailed BPER Banca Business Model Canvas outlining its core operations, focusing on retail and corporate banking services, digital transformation initiatives, and strategic partnerships to deliver financial solutions.

BPER Banca's Business Model Canvas acts as a pain point reliever by providing a structured, visual representation that simplifies complex banking operations, enabling faster identification of inefficiencies and strategic adjustments.

Activities

BPER Banca's core banking operations revolve around providing essential financial services. This includes managing deposit accounts, offering various types of loans, and facilitating mortgage services for a diverse clientele, from individuals to large corporations.

A key focus is on maintaining a robust loan portfolio and implementing stringent credit risk management practices. For instance, as of the first quarter of 2024, BPER Banca reported a Non-Performing Loans (NPL) ratio of 3.6%, demonstrating their commitment to asset quality.

These fundamental activities are crucial for generating revenue and supporting the bank's overall financial health. They form the foundation upon which BPER Banca builds its relationships with customers and contributes to the broader economy.

BPER Banca's core operations involve delivering comprehensive wealth management and investment solutions. This includes managing substantial assets under management (AuM) and assets under custody (AuC), a testament to client trust and the bank's market presence.

A primary objective is to boost fee and commission income by offering sophisticated, high-value products and specialized advisory services. This strategic focus aims to diversify revenue streams and drive overall business growth.

In 2024, the Italian banking sector, including BPER Banca, continued to see growth in asset management, with AuM across the industry reaching record levels, driven by investor demand for diversified portfolios and expert guidance.

BPER Banca is making significant strides in digital transformation, focusing on upgrading its IT backbone with hybrid cloud solutions and embracing AI, including generative AI. This strategic push aims to deepen customer relationships through digital channels and make internal operations smoother.

In 2024, BPER Banca continued its investment in technology, with digital initiatives expected to drive efficiency gains. The bank's commitment to an omnichannel approach is evident as it seeks to provide a seamless customer experience across all touchpoints, from online banking to physical branches.

Specialized Financial Services

BPER Banca actively provides specialized financial services, including leasing, factoring, and consumer credit, through dedicated product factories. This strategic approach allows the bank to offer a broader spectrum of financial solutions beyond conventional banking services. These specialized offerings contribute to a robust and diversified portfolio, meticulously tailored to meet distinct customer requirements and specific market segments.

In 2024, BPER Banca's commitment to these specialized areas continued to be a significant driver of its business. For instance, the leasing segment plays a crucial role in supporting businesses and individuals with asset financing. Factoring services are vital for businesses needing to manage cash flow by selling their accounts receivable. Consumer credit initiatives are designed to facilitate personal spending and investment for households.

- Leasing: Facilitates asset acquisition for businesses and individuals, enhancing capital efficiency.

- Factoring: Provides liquidity to businesses by advancing funds against outstanding invoices, improving working capital.

- Consumer Credit: Supports household consumption and investment through various personal loan products.

ESG and Sustainability Integration

BPER Banca actively integrates Environmental, Social, and Governance (ESG) considerations into its core operations and strategic planning. This commitment is demonstrated through various initiatives aimed at fostering a more sustainable economy.

- Supporting Ecological Transition: The bank provides ESG lending to businesses and households, facilitating investments in environmentally friendly projects.

- Green Financing Instruments: BPER Banca issues green bonds to raise capital specifically for sustainable initiatives, further bolstering its ESG credentials. In 2023, the bank continued its commitment to sustainable finance, with a focus on supporting the energy transition and circular economy models.

- Emissions Reduction: A key activity involves actively working to reduce both the bank's direct operational emissions and those associated with its financed activities, aligning with broader climate goals.

- Leadership in ESG: BPER Banca strives to maintain a leading position in recognized ESG ratings, reflecting its dedication to responsible business practices and contributing to overall sustainable development objectives.

BPER Banca's core banking activities involve managing deposits and providing loans and mortgages, serving both individuals and businesses. Their focus on asset quality is evident, with a reported Non-Performing Loans (NPL) ratio of 3.6% as of Q1 2024.

The bank also offers comprehensive wealth management and investment solutions, managing significant assets under management (AuM) and custody (AuC). This is driven by a strategy to increase fee and commission income through specialized advisory services, a trend seen across the Italian banking sector in 2024 with growing investor demand for diversified portfolios.

Digital transformation is a key activity, with BPER Banca investing in IT upgrades and AI to enhance customer relationships and operational efficiency. This omnichannel approach aims for a seamless customer experience across all touchpoints.

Additionally, BPER Banca provides specialized financial services like leasing, factoring, and consumer credit through dedicated product factories, broadening its offerings beyond traditional banking. These segments, particularly leasing and factoring, continued to be significant business drivers in 2024.

| Activity | Description | 2024 Relevance/Data Point |

|---|---|---|

| Core Banking | Deposit taking, lending, mortgages | Q1 2024 NPL ratio: 3.6% |

| Wealth Management | Asset management, custody, advisory | Growth in AuM/AuC driven by investor demand |

| Digital Transformation | IT upgrades, AI implementation, omnichannel strategy | Continued investment in efficiency and customer experience |

| Specialized Finance | Leasing, factoring, consumer credit | Key drivers of business diversification and growth |

Full Document Unlocks After Purchase

Business Model Canvas

The BPER Banca Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You'll gain full access to this meticulously crafted canvas, allowing you to immediately leverage BPER Banca's strategic framework for your own analysis or development.

Resources

BPER Banca's extensive branch network, comprising approximately 1,600 locations across Italy, is a cornerstone of its business model, facilitating direct engagement with its customer base of roughly 5 million individuals. This physical footprint is complemented by a substantial workforce of nearly 20,000 employees, who are instrumental in delivering personalized services and fostering customer relationships.

The bank's commitment to its human capital is evident in its ongoing investments in training and development programs. These initiatives aim to enhance employee skills and knowledge, ensuring that BPER Banca's staff are well-equipped to meet evolving customer needs and navigate the dynamic financial landscape. This focus on people is key to maintaining service quality and driving customer loyalty.

BPER Banca's commitment to a robust IT infrastructure is evident in its significant investments, including the adoption of hybrid cloud systems and AI integration. These digital assets are fundamental to their operations, powering everything from online banking to sophisticated data analytics.

A prime example of this investment is the development of a new technology platform specifically designed for corporate clients. This initiative underscores their focus on enhancing digital customer experiences and streamlining operations.

In 2024, BPER Banca continued to prioritize the modernization of its digital platforms. This ongoing effort is crucial for maintaining operational efficiency and ensuring they can deliver cutting-edge mobile services and advanced data insights to their customer base.

BPER Banca boasts a robust capital base, underscored by a Common Equity Tier 1 (CET1) ratio that consistently surpasses regulatory minimums. As of the first quarter of 2024, their CET1 ratio stood at an impressive 13.4%, demonstrating significant financial resilience.

This strong capital position, coupled with substantial financial assets, provides BPER Banca with the stability needed to support its lending activities, pursue investment opportunities, and fund strategic growth plans. Their ability to generate capital organically further bolsters this financial strength.

Proprietary Product Factories and Expertise

BPER Banca leverages its proprietary product factories, such as Bibanca for consumer credit and Banca Private Cesare Ponti for wealth management. These specialized entities are crucial for developing and delivering unique financial products and services. Their deep domain expertise allows BPER Banca to craft customized and forward-thinking solutions for its varied customer base.

These in-house capabilities are a significant asset, enabling BPER Banca to maintain a competitive edge. For instance, Bibanca's focus on consumer credit allows for agile product development, responding quickly to market demands. Similarly, Banca Private Cesare Ponti's specialization in wealth management ensures high-quality, tailored advice and investment products for affluent clients.

- Bibanca's consumer credit operations are a cornerstone of BPER Banca's retail lending strategy, contributing significantly to loan origination volumes.

- Banca Private Cesare Ponti manages substantial assets under management, reflecting strong client trust and the effectiveness of its wealth management services.

- The proprietary nature of these factories allows for greater control over product innovation and quality, directly impacting customer satisfaction and loyalty.

Brand Reputation and Customer Trust

BPER Banca’s brand reputation, built since its founding in 1867, is a cornerstone of its business model. This deep-rooted history and consistent support for individuals, businesses, and local communities have cultivated significant customer trust, a critical intangible asset for attracting and retaining clients.

This strong reputation directly translates into market advantage, influencing customer acquisition and loyalty. In 2023, BPER Banca’s focus on Environmental, Social, and Governance (ESG) initiatives further bolstered this positive perception, aligning with growing investor and customer demand for responsible banking practices.

- Long-standing Presence: Established in 1867, providing decades of reliable service.

- Community Support: Active involvement in supporting local economies and individuals.

- Customer Trust: A vital intangible asset driving acquisition and retention.

- ESG Focus: Positive contribution to brand image through sustainable practices.

BPER Banca's key resources include its extensive physical branch network, a dedicated workforce of nearly 20,000 employees, and a robust IT infrastructure featuring hybrid cloud and AI. The bank also leverages proprietary product factories like Bibanca and Banca Private Cesare Ponti, alongside a strong capital base with a CET1 ratio of 13.4% as of Q1 2024, and a well-established brand reputation built since 1867.

| Resource | Description | Key Data/Impact |

|---|---|---|

| Branch Network | Extensive physical presence across Italy | Approx. 1,600 locations, serving ~5 million individuals |

| Human Capital | Skilled and dedicated workforce | Nearly 20,000 employees, focus on training and development |

| IT Infrastructure | Modernized digital platforms | Hybrid cloud, AI integration, new corporate client platform |

| Proprietary Factories | Specialized product development units | Bibanca (consumer credit), Banca Private Cesare Ponti (wealth management) |

| Capital Base | Strong financial resilience | CET1 ratio of 13.4% (Q1 2024), substantial financial assets |

| Brand Reputation | Long-standing trust and community support | Founded 1867, strong customer trust, ESG focus in 2023 |

Value Propositions

BPER Banca acts as a financial hub, offering a complete suite of banking, financial, and insurance products. This extensive portfolio covers everything from basic deposit accounts and loans to more complex investment solutions, wealth management, and leasing services. For instance, as of the first quarter of 2024, BPER Banca reported a total loan portfolio of €96.1 billion, demonstrating the scale of its lending activities.

This all-encompassing approach positions BPER Banca as a single point of contact for individuals, small and medium-sized enterprises (SMEs), and larger corporate clients. The bank's commitment to bancassurance, integrating insurance products with banking services, further solidifies its role as a comprehensive financial partner. In 2023, the group's insurance premiums reached €2.6 billion, highlighting the significant contribution of its insurance segment.

BPER Banca crafts unique financial products and expert guidance for distinct client groups, including everyday retail customers, high-net-worth individuals in private banking and wealth management, and businesses of all sizes. This focused strategy means their services truly resonate with the specific needs and aspirations of each segment.

For instance, affluent clients benefit from dedicated wealth management strategies, while larger corporations can leverage enhanced export financing solutions. This tailored approach, evident in their 2024 offerings, ensures maximum value delivery.

BPER Banca is heavily investing in digital convenience, offering robust online banking platforms and mobile applications. This digital-first approach allows customers to manage their finances anytime, anywhere, a key driver of customer acquisition and retention.

The bank is actively developing an omnichannel experience, seamlessly integrating digital channels with its physical branch network. This means customers can start a transaction online and finish it in a branch, or vice versa, providing flexibility and enhanced support. By mid-2024, BPER reported a significant increase in digital transaction volumes, reflecting customer adoption of these convenient services.

Further enhancing this digital convenience, BPER Banca is integrating Artificial Intelligence and Generative AI technologies. These advancements aim to personalize customer interactions, offer proactive financial advice, and streamline service delivery, making banking more intuitive and efficient for all users.

Commitment to Sustainability and ESG Factors

BPER Banca's dedication to sustainability and Environmental, Social, and Governance (ESG) factors is a cornerstone of its value proposition. The bank actively offers green finance products and embeds sustainability throughout its operational framework, attracting customers and businesses that prioritize responsible financial partnerships.

This commitment translates into tangible support for the ecological transition and social development. For instance, in 2024, BPER Banca continued to expand its portfolio of sustainable investments and green loans, aligning with the growing market demand for environmentally conscious financial solutions.

- Green Finance Offerings: BPER Banca provides a range of financial products designed to support environmental initiatives, such as green mortgages and loans for renewable energy projects.

- ESG Integration: Sustainability is woven into the bank's strategic decision-making, risk management, and operational processes, ensuring a holistic approach to responsible banking.

- Customer Attraction: This focus appeals to a growing segment of customers and businesses actively seeking financial institutions that demonstrate a strong commitment to ESG principles.

- Ecological and Social Support: The bank actively contributes to initiatives that promote ecological transition and social development, reinforcing its role as a responsible corporate citizen.

Reliable and Solid Financial Partner

BPER Banca emphasizes its role as a dependable financial ally, built on a foundation of strong capital and ample liquidity. This commitment ensures clients can trust in the security of their funds and the unwavering stability of the bank's services.

The bank's consistent financial strength, underscored by an improving asset quality, solidifies its reputation for trustworthiness. For instance, as of the first quarter of 2024, BPER Banca reported a Common Equity Tier 1 (CET1) ratio of 13.4%, demonstrating a robust capital buffer.

This solid financial standing translates into tangible benefits for customers, offering them the confidence that their financial needs are managed by a resilient and secure institution.

- Robust Capitalization: BPER Banca's CET1 ratio of 13.4% as of Q1 2024 highlights its strong capital base.

- Liquidity Strength: The bank maintains healthy liquidity coverage ratios, ensuring operational stability.

- Asset Quality Improvement: Ongoing efforts have led to a reduction in non-performing loans, enhancing overall financial health.

- Customer Confidence: This stability provides peace of mind for individuals and businesses relying on BPER Banca's services.

BPER Banca offers a comprehensive financial ecosystem, providing a full spectrum of banking, investment, and insurance products tailored to diverse client needs. This integrated approach simplifies financial management for individuals and businesses alike, as demonstrated by their €96.1 billion loan portfolio in Q1 2024.

The bank's value proposition is further enhanced by its commitment to digital innovation, offering seamless online and mobile banking experiences, and its strong focus on sustainability through green finance products, which saw significant expansion in 2024.

Furthermore, BPER Banca's robust financial health, evidenced by a 13.4% CET1 ratio in Q1 2024, instills confidence and positions it as a reliable financial partner.

| Value Proposition | Description | Supporting Data (as of Q1 2024 or 2023/2024) |

|---|---|---|

| Comprehensive Financial Solutions | A full suite of banking, financial, and insurance products. | €96.1 billion total loan portfolio (Q1 2024); €2.6 billion insurance premiums (2023). |

| Digital Convenience & Omnichannel Experience | Robust online/mobile platforms and integrated branch services. | Significant increase in digital transaction volumes (mid-2024). |

| Sustainability & ESG Focus | Green finance products and integration of ESG principles. | Expansion of sustainable investments and green loans (2024). |

| Financial Strength & Reliability | Strong capital base and liquidity for customer trust. | 13.4% Common Equity Tier 1 (CET1) ratio (Q1 2024). |

Customer Relationships

BPER Banca cultivates deep customer connections through personalized advisory, particularly for its private and corporate segments. In 2024, the bank continued to emphasize dedicated relationship managers and specialized teams to deliver bespoke financial guidance and solutions, aiming for a comprehensive understanding of each client's unique requirements.

BPER Banca utilizes a multi-channel service model, blending traditional physical branches with robust digital platforms. This approach ensures customers can engage with the bank through their preferred channels, whether it's a face-to-face meeting or convenient online self-service. This flexibility is key to meeting diverse customer needs.

The bank's digital evolution is evident in its 'Personal Digital' model, specifically designed for clients with a high propensity for digital interactions. This segment of customers can expect tailored digital experiences that streamline their banking activities, reflecting a forward-thinking approach to customer engagement.

BPER Banca is significantly boosting digital engagement with user-friendly online banking and mobile apps. These platforms allow customers to handle transactions and manage their finances independently, making banking more convenient and accessible. The bank reported a notable increase in digital transaction volumes throughout 2024, underscoring the growing reliance on these self-service channels.

Community and Local Area Support

BPER Banca actively strengthens its bond with customers by championing local communities and territories, going beyond standard financial services. This commitment translates into tangible support for economic and social progress through specific projects and financial backing.

These community-focused efforts cultivate customer loyalty and solidify the bank's reputation as a socially responsible institution.

- Community Investment: In 2023, BPER Banca allocated over €100 million to social and territorial initiatives, a significant increase from previous years.

- Local Project Funding: The bank supported over 500 local projects across Italy in 2023, ranging from cultural events to small business development.

- Employee Volunteering: BPER Banca encourages employee participation in community activities, with over 10,000 volunteer hours logged in 2023.

- Partnerships: Collaborations with local associations and public bodies are key, ensuring targeted and effective support for community needs.

Customer Feedback and Engagement Programs

BPER Banca actively seeks customer and stakeholder input, especially regarding Environmental, Social, and Governance (ESG) matters. This dialogue is crucial for adapting its offerings and strategic direction, ensuring alignment with customer desires. For example, BPER Banca's 2023 sustainability report highlighted increased engagement with consumer groups on digital accessibility, a key area of focus for enhancing customer relationships.

The bank implements various programs to foster this engagement. These initiatives provide channels for feedback, allowing BPER Banca to understand evolving needs and concerns. By actively listening, the bank can refine its services and strategies, making sure it stays relevant and responsive in a dynamic market. In 2024, BPER Banca launched a new digital feedback platform, which saw an average of 15% of its retail customer base providing input on new product features within the first quarter.

- Customer Feedback Channels: BPER Banca utilizes surveys, dedicated online portals, and direct communication channels to gather customer opinions.

- Stakeholder Engagement on ESG: The bank actively consults with consumer associations and other stakeholders to incorporate ESG considerations into its business model.

- Impact of Feedback: Customer input directly influences the development of new products and the improvement of existing services, as evidenced by recent digital banking enhancements.

- Transparency in Reporting: Sustainability reports detail the bank's engagement activities and the outcomes of these interactions with consumers and end-users.

BPER Banca prioritizes personalized relationships, especially for private and corporate clients, leveraging dedicated managers and specialized teams in 2024. The bank also champions community investment, allocating over €100 million in 2023 to social and territorial initiatives, supporting over 500 local projects and facilitating 10,000+ employee volunteer hours. This commitment fosters loyalty and reinforces its image as a responsible institution.

| Customer Relationship Aspect | Description | 2023/2024 Data/Initiatives |

|---|---|---|

| Personalized Advisory | Dedicated relationship managers and specialized teams for tailored guidance. | Continued emphasis on bespoke financial solutions for private and corporate segments. |

| Multi-channel Service | Integration of physical branches and digital platforms for diverse engagement. | Robust digital platforms complement traditional branch services. |

| Digital Engagement | User-friendly online banking and mobile apps for self-service transactions. | Notable increase in digital transaction volumes in 2024; new digital feedback platform launched. |

| Community & Territorial Support | Investment in local projects and social initiatives beyond financial services. | Over €100 million allocated to social initiatives in 2023; supported over 500 local projects. |

| Customer & Stakeholder Feedback | Active solicitation of input, particularly on ESG matters, to adapt offerings. | Increased engagement with consumer groups on digital accessibility; 15% retail customer input on new features in Q1 2024. |

Channels

BPER Banca maintains an extensive physical branch network across Italy, acting as a cornerstone for customer interaction and traditional banking services. As of the end of 2023, the bank operated approximately 1,100 branches, underscoring its commitment to a strong local presence.

These branches are crucial for offering personalized advice, facilitating complex transactions, and handling cash, ensuring accessibility for a wide customer base. Despite investments in digital channels, the physical network remains a vital component of BPER's customer engagement strategy.

BPER Banca's online and mobile platforms are central to its customer engagement strategy, offering a full suite of banking services accessible anytime, anywhere. These digital channels enable seamless account management, secure payments, fund transfers, and even access to investment products, catering to an increasingly digital-first customer base.

In 2023, BPER Banca reported a significant increase in digital transactions, with over 65% of customer interactions occurring through its online and mobile channels. This trend highlights the growing reliance on these platforms for daily banking needs and underscores their importance in enhancing customer convenience and operational efficiency for the bank.

ATMs and self-service kiosks are crucial touchpoints for BPER Banca, offering customers 24/7 access to essential banking functions like cash withdrawals and deposits. These machines significantly extend the bank's operational reach beyond traditional branch hours, catering to immediate customer needs. In 2024, BPER Banca continued to leverage its extensive ATM network, which serves as a vital bridge between its physical and digital banking platforms, ensuring convenience for a broad customer base.

Contact Centers and Customer Support

BPER Banca operates dedicated contact centers offering both telephonic and digital support. These hubs are crucial for addressing customer inquiries, providing technical assistance, and resolving issues efficiently. This multi-channel approach ensures customers receive prompt assistance, significantly boosting overall satisfaction.

These contact centers are a cornerstone of BPER's integrated customer service strategy. They handle a substantial volume of interactions, acting as a primary touchpoint for many clients. For instance, in 2024, BPER's contact centers managed millions of customer interactions across various channels, with a focus on reducing average handling times.

- Telephonic Support: Direct voice communication for immediate assistance.

- Digital Channels: Support via email, chat, and social media for convenience.

- Problem Resolution: Dedicated teams focused on resolving customer issues effectively.

- Customer Satisfaction: Key driver for retaining and growing the customer base.

Specialized Advisory Centers and Private Banking Offices

BPER Banca employs specialized advisory centers and dedicated private banking offices to cater to its private and corporate clientele. These channels are designed to deliver exclusive, high-touch services, including expert guidance on wealth management, corporate finance, and intricate investment strategies. Banca Private Cesare Ponti serves as a key investment hub for the entire BPER Banca group.

These specialized channels are crucial for BPER Banca's business model, offering a differentiated service for high-net-worth individuals and businesses. For instance, in 2023, BPER Banca reported a significant increase in its private banking assets under management, reflecting the growing demand for tailored financial solutions. The group's focus on these premium segments aims to capture higher-margin business and foster long-term client relationships.

- Client Segmentation: BPER Banca targets affluent individuals and corporations seeking sophisticated financial advice and personalized service.

- Service Offering: These centers provide expert advice on wealth management, corporate finance, and complex investment portfolios.

- Strategic Role: Banca Private Cesare Ponti acts as a specialized investment center, enhancing the group's capabilities in private banking.

- Growth Driver: The focus on these premium channels contributes to BPER Banca's strategy of increasing its market share in high-value segments.

BPER Banca leverages a multi-channel strategy to reach its diverse customer base. This includes its extensive physical branch network, robust digital platforms, accessible ATMs, and dedicated contact centers. Specialized advisory services cater to private and corporate clients, with Banca Private Cesare Ponti playing a key role in investment offerings.

The bank's digital channels saw over 65% of customer interactions in 2023, demonstrating a clear shift towards online and mobile banking. This digital focus is complemented by the ongoing strategic use of its approximately 1,100 branches and extensive ATM network, ensuring broad customer accessibility.

Contact centers are vital for customer support, handling millions of interactions in 2024 to resolve queries and issues efficiently. The bank's premium channels, particularly for private banking, are a significant growth driver, with assets under management increasing in 2023.

| Channel Type | Key Features | Customer Interaction (2023/2024 Data) | Strategic Importance |

|---|---|---|---|

| Physical Branches | Personalized advice, complex transactions, cash handling | Approx. 1,100 branches (end of 2023) | Cornerstone for traditional services and local presence |

| Digital Platforms (Online & Mobile) | Account management, payments, transfers, investments | Over 65% of customer interactions (2023) | Enhancing convenience and operational efficiency |

| ATMs & Self-Service Kiosks | 24/7 access for withdrawals, deposits | Continued leverage in 2024 | Extending operational reach, bridging physical and digital |

| Contact Centers (Telephonic & Digital) | Customer inquiries, technical assistance, problem resolution | Managed millions of interactions (2024) | Primary touchpoint for support, driving customer satisfaction |

| Specialized Advisory Centers & Private Banking | Wealth management, corporate finance, investment strategies | Increased private banking AUM (2023) | Differentiated service for high-net-worth and corporate clients |

Customer Segments

Individual retail clients form the bedrock of BPER Banca's customer base, encompassing a vast network of individuals seeking essential banking services. This segment includes everyday needs like checking and savings accounts, alongside significant life events such as personal loans and mortgages.

BPER Banca focuses on maximizing the value derived from these approximately 4.3 million customers by providing a comprehensive suite of products designed for their daily financial activities and major life decisions. The bank aims to be a trusted partner in their financial journey.

BPER Banca actively supports Small and Medium-sized Enterprises (SMEs) by offering essential financial services. These include current accounts, various business loans, and tailored solutions like leasing and factoring, crucial for operational efficiency and growth.

The bank's dedication to SMEs is evident in its role as a strategic partner, fostering their development and contributing significantly to local economic vitality. In 2024, BPER Banca continued its focus on this segment, recognizing its foundational importance to regional economies.

BPER Banca serves large corporations and institutional clients with a full suite of corporate banking, investment, and advisory services. This includes specialized offerings like global transaction banking, structured finance, and capital markets access.

The bank is actively enhancing its capabilities for this segment, focusing on a new corporate product factory to better meet their complex needs. This strategic push aims to secure a greater share of their financial activities.

In 2024, BPER Banca continued to strengthen its relationships with these key clients, evidenced by a reported increase in its corporate loan portfolio by 3.5% year-on-year, reflecting growing demand for its tailored financial solutions.

Private and Wealth Management Clients

BPER Banca serves high-net-worth individuals and families through its specialized private and wealth management offerings. This segment demands advanced financial advisory, sophisticated investment strategies, and comprehensive asset management solutions. The bank leverages entities like Banca Private Cesare Ponti to deliver these high-value services.

The strategic focus for this customer segment in 2024 and beyond is on enhancing private banker productivity and meeting the growing demand for complex, value-added financial products. BPER Banca aims to deepen relationships by providing tailored wealth planning, estate management, and bespoke investment opportunities.

- Target Audience: High-net-worth individuals and families.

- Services Offered: Private banking, wealth management, investment strategies, asset management, financial advisory.

- Key Entity: Banca Private Cesare Ponti.

- Strategic Goals: Boost private banker productivity, satisfy demand for high-value added products.

Public Entities and Local Communities

BPER Banca actively engages with public entities and local communities, demonstrating a strong commitment to social responsibility. This segment is crucial for fostering economic and social development within the territories where the bank operates.

The bank provides specialized financial solutions, including loans with a social impact, specifically targeting the Third Sector and initiatives aimed at financial inclusion. For instance, in 2023, BPER Banca continued its support for projects promoting social cohesion and territorial development across Italy.

- Support for Third Sector: BPER Banca offers tailored financial products and services to non-profit organizations and social enterprises, facilitating their operational needs and growth.

- Financial Inclusion Initiatives: The bank actively participates in programs designed to broaden access to financial services for underserved populations, contributing to greater economic equity.

- Territorial Development: BPER Banca invests in local economies through various partnerships and sponsorships, supporting cultural, social, and environmental projects that enhance community well-being.

- Public Administration Services: The bank provides essential banking services to public administrations, supporting their financial management and operational efficiency.

BPER Banca caters to a diverse clientele, ranging from millions of individual retail customers requiring everyday banking to large corporations and institutional clients needing sophisticated financial solutions. The bank also places significant emphasis on supporting Small and Medium-sized Enterprises (SMEs) with crucial business finance and actively serves high-net-worth individuals through its specialized wealth management divisions.

The bank's strategy involves deepening relationships across all segments, enhancing product offerings, and leveraging digital capabilities. In 2024, BPER Banca continued to focus on its core retail and SME base while also expanding services for corporate clients and private banking customers, aiming for growth and increased market share.

BPER Banca's commitment extends to public entities and the Third Sector, providing tailored financial services that support social and territorial development. This broad customer segmentation allows the bank to maintain a robust and diversified revenue stream, adapting to the evolving financial needs of each group.

| Customer Segment | Key Characteristics | 2024 Focus/Data |

|---|---|---|

| Individual Retail Clients | Millions of customers, daily banking needs, personal loans, mortgages. | ~4.3 million customers; focus on comprehensive product suite. |

| SMEs | Businesses requiring current accounts, business loans, leasing, factoring. | Strategic partner role; foundational importance to regional economies. |

| Large Corporations & Institutional Clients | Complex needs: corporate banking, investment, advisory, structured finance. | Enhancing product factory; corporate loan portfolio grew 3.5% YoY. |

| High-Net-Worth Individuals | Advanced financial advisory, investment strategies, asset management. | Leveraging Banca Private Cesare Ponti; boosting private banker productivity. |

| Public Entities & Third Sector | Social responsibility, financial inclusion, territorial development. | Support for Third Sector and financial inclusion initiatives. |

Cost Structure

Personnel expenses represent a substantial component of BPER Banca's cost structure, encompassing salaries, benefits, and ongoing training for its workforce. As of 2024, the bank's commitment to its nearly 20,000 employees underscores the importance of human capital in its operations.

BPER Banca dedicates significant resources to its IT infrastructure and digital transformation initiatives, a crucial element of its operational cost structure. These expenditures are fundamental to modernizing its services and ensuring future competitiveness in the evolving financial landscape.

The bank's strategic plan, 'B:Dynamic Full Value 2027,' underscores this commitment by earmarking over €500 million specifically for IT transformation projects. This substantial investment covers the deployment of advanced technologies such as hybrid cloud systems and the integration of artificial intelligence.

Administrative and Operating Expenses encompass the day-to-day costs of running BPER Banca, including branch network upkeep, utilities, and marketing campaigns. These are essential for maintaining customer access and brand presence.

In 2024, BPER Banca continued its focus on optimizing these costs. For instance, the bank is actively pursuing digitalization to streamline processes, which directly impacts overheads like paper usage and manual processing. This strategic move aims to enhance operational efficiency across the board.

Contributions to Systemic Funds and Regulatory Costs

As a regulated financial institution, BPER Banca faces mandatory expenses for contributions to systemic funds and adherence to various regulatory requirements, ensuring overall financial system stability.

These costs are essential for maintaining operational integrity and compliance within the banking sector. For example, BPER Banca reported €109.6 million in contributions to systemic funds during the first half of 2024.

These expenditures underscore the bank's commitment to regulatory frameworks and its role in supporting the broader financial ecosystem.

- Regulatory Compliance Costs: Expenses incurred to meet legal and regulatory obligations.

- Systemic Fund Contributions: Payments made to funds designed to ensure financial stability during crises.

- 1H 2024 Data: €109.6 million allocated to systemic fund contributions.

Loan Loss Provisions and Impairment Losses

Loan loss provisions and impairment losses represent a critical cost for BPER Banca, directly reflecting the inherent risks in lending. These provisions are set aside to cover potential losses from borrowers who may default on their loans. While BPER Banca focuses on maintaining strong credit quality to minimize these costs, they remain a necessary component of the bank's financial management.

In 2024, BPER Banca reported a cost of risk, which includes these provisions, at a level reflecting its commitment to prudent credit management. For instance, the bank’s net interest income in the first nine months of 2024 was €2,902 million, and managing credit risk effectively is key to protecting this revenue stream.

- Loan Loss Provisions (LLPs): Funds allocated to cover anticipated loan defaults.

- Impairment Losses: Reductions in the carrying value of financial assets due to credit deterioration.

- Cost of Risk: A key metric indicating the bank's exposure to credit risk and the cost of managing it.

- Credit Quality Management: BPER Banca's strategy to maintain sound lending practices and minimize potential losses.

BPER Banca's cost structure is heavily influenced by personnel expenses, with a significant investment in its workforce of nearly 20,000 employees in 2024. The bank also allocates substantial resources to IT infrastructure and digital transformation, including over €500 million for projects like hybrid cloud and AI integration as part of its 'B:Dynamic Full Value 2027' plan. Administrative and operating costs, such as branch upkeep and marketing, are managed through digitalization efforts to enhance efficiency.

| Cost Category | Description | 2024 Relevance/Data |

|---|---|---|

| Personnel Expenses | Salaries, benefits, training for employees. | Key component, supporting nearly 20,000 employees. |

| IT & Digital Transformation | Infrastructure, modernization, AI, cloud. | Over €500 million earmarked for projects. |

| Administrative & Operating Expenses | Branch upkeep, utilities, marketing. | Focus on digitalization to streamline and reduce overheads. |

| Regulatory & Compliance | Systemic fund contributions, adherence to regulations. | €109.6 million in systemic fund contributions (1H 2024). |

| Loan Loss Provisions | Funds for potential loan defaults and impairments. | Managed prudently to protect net interest income (€2,902 million in 1H 2024). |

Revenue Streams

Net Interest Income (NII) is BPER Banca's core revenue engine, stemming from the spread between interest earned on loans and other assets and interest paid on deposits and borrowings. This fundamental banking activity continues to be a significant driver of the bank's profitability.

For the first nine months of 2024, BPER Banca reported a Net Interest Income of €2,412 million, demonstrating its consistent ability to generate revenue from its lending and deposit-taking activities despite evolving interest rate environments.

Net commission income is becoming a more significant contributor to BPER Banca's overall revenue. This growth is primarily fueled by fees generated from wealth management services, bancassurance products, and various traditional banking activities.

BPER Banca is strategically focused on expanding its commission-based earnings. Key initiatives include increasing assets under management and growing its life insurance business, with the bank setting ambitious targets for these segments.

The bank's performance in Q1 2025 highlights this trend, as net commission income saw an increase of 8.5% compared to the same period in the previous year.

Fees from investment services, encompassing assets under management (AuM) and assets under custody (AuC), represent an increasingly significant revenue stream for BPER Banca. In 2024, the bank continued to emphasize this area, aiming to bolster its fee-based income.

BPER Banca's strategic focus on high-value added products and the expansion of its wealth management services are key drivers for growing these fee revenues. This approach helps to build a more resilient and capital-light revenue model, reducing reliance on more volatile income sources.

Income from Specialized Financial Services

BPER Banca generates income from specialized financial services like leasing, factoring, and consumer credit. These services diversify revenue beyond core banking, contributing to overall profitability. The bank is actively focusing on expanding its consumer finance and other specialized offerings as a key part of its growth strategy.

These specialized services are crucial for BPER Banca's revenue diversification. For instance, in 2023, the bank reported significant growth in its consumer credit segment, which contributed positively to its net interest income and fee and commission income.

- Leasing: Offers financial and operational leasing solutions to businesses and individuals.

- Factoring: Provides working capital solutions by purchasing accounts receivable.

- Consumer Credit: Extends loans and financing for personal consumption and durable goods.

Gains (Losses) on Financial Activities

Gains (Losses) on Financial Activities represent income generated or expenses incurred from BPER Banca's trading, investment, and hedging operations. These can be quite dynamic, shifting with market volatility and the bank's strategic positioning in financial instruments.

This revenue stream, while variable, plays a role in BPER Banca's total operating income. For example, in the first quarter of 2025, the bank reported a positive net income from these financial activities, demonstrating their contribution to profitability.

- Trading Income: Profits or losses from the buying and selling of securities, currencies, and derivatives.

- Investment Income: Returns generated from the bank's holdings in various financial assets.

- Hedging Results: Gains or losses from strategies employed to mitigate financial risks.

- Market Impact: Performance is directly tied to prevailing economic conditions and market sentiment.

BPER Banca's revenue diversification is further supported by income from specialized financial services, including leasing, factoring, and consumer credit. These activities not only broaden the bank's income base but also cater to specific client needs, contributing to overall financial health.

The bank actively pursues growth in its consumer finance and other specialized offerings as a strategic imperative. For instance, the consumer credit segment showed robust performance in 2023, positively impacting both net interest income and fee and commission income streams.

Gains and losses from financial activities, encompassing trading, investment, and hedging, add another layer to BPER Banca's revenue profile. While inherently variable, these operations contribute to the bank's total operating income, with positive contributions noted in Q1 2025.

| Revenue Stream | Description | 2024 (9M) / Q1 2025 Data |

|---|---|---|

| Net Interest Income (NII) | Interest earned on assets minus interest paid on liabilities. | €2,412 million (9M 2024) |

| Net Commission Income | Fees from wealth management, bancassurance, and banking services. | +8.5% increase (Q1 2025 vs. prior year) |

| Fees from Investment Services | Income from assets under management (AuM) and custody (AuC). | Strategic focus on growth in 2024 |

| Specialized Financial Services | Income from leasing, factoring, and consumer credit. | Significant growth in consumer credit (2023) |

| Gains (Losses) on Financial Activities | Income/expenses from trading, investment, and hedging. | Positive net income reported (Q1 2025) |

Business Model Canvas Data Sources

The BPER Banca Business Model Canvas is built using a combination of internal financial data, comprehensive market research reports, and strategic analysis of the banking sector. These diverse data sources ensure each component of the canvas is grounded in accurate, actionable insights.