BPER Banca Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BPER Banca Bundle

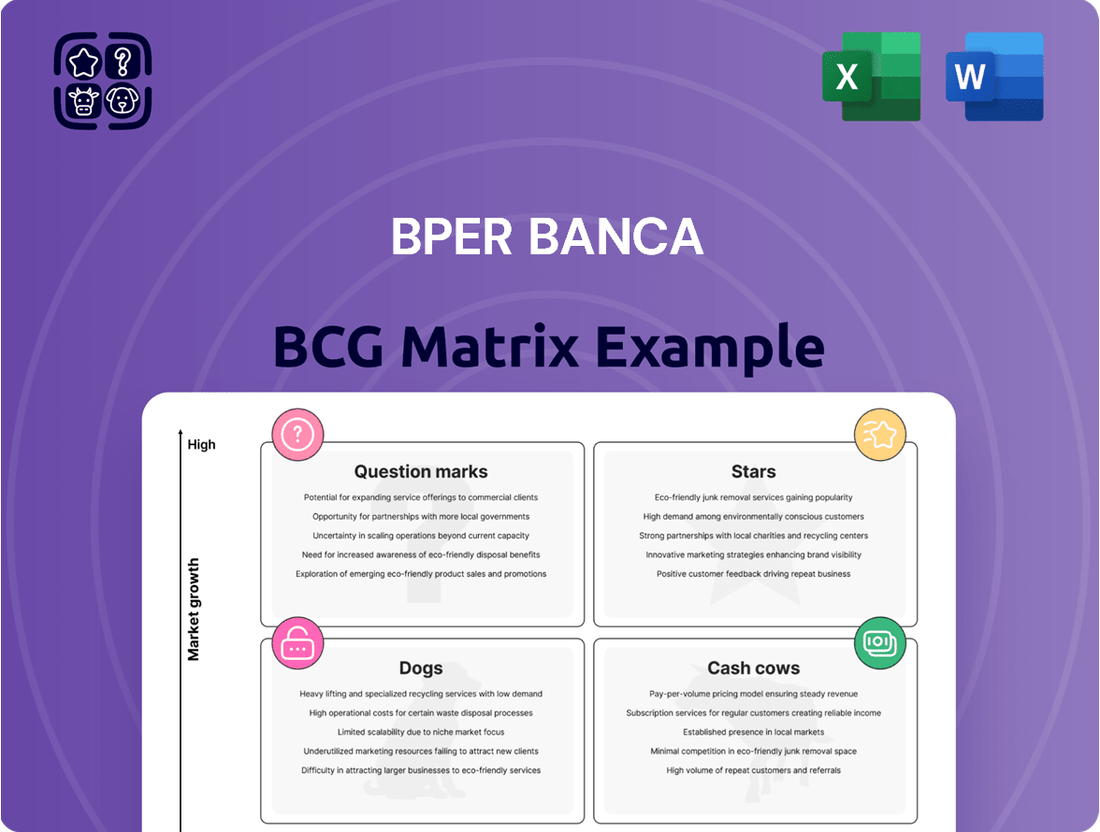

Uncover the strategic positioning of BPER Banca's diverse portfolio with our comprehensive BCG Matrix analysis. See which business units are driving growth and which require careful consideration for future investment. This preview offers a glimpse into the core of their market strategy.

Dive deeper into BPER Banca's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

BPER Banca's Wealth Management and Investment Services are a key driver of its financial success. In the first quarter of 2025, net commission income saw a robust 8.5% increase year-over-year. This growth was significantly bolstered by performance fees from wealth and asset management, signaling a thriving segment where BPER is expanding its market presence.

The bank's commitment to this area is further evidenced by its growing assets under management (AuM). By March 2025, AuM reached €72.1 billion, marking a substantial 7.1% rise from the previous year. This upward trend underscores client confidence and the effectiveness of BPER's investment strategies.

Looking ahead, the 2024-2027 Business Plan targets a 12% expansion in commissions by 2027. A strategic emphasis on Private & Wealth Management is central to this plan, aiming to fully leverage specialized service models and advanced advisory tools to capture further growth.

Bancassurance, specifically non-life insurance, is a significant growth driver for BPER Banca. Commissions in this segment surged by 26.9% year-over-year in the first quarter of 2025, highlighting its increasing importance in the bank's revenue mix. This performance aligns with the bank's strategic objective to boost fee-based income.

The 2024-2027 Business Plan underscores this focus, projecting protection premiums to exceed €360 million by 2025. This represents a substantial increase from the roughly €200 million recorded in 2021, signaling BPER Banca's successful expansion in this high-potential market and its commitment to enhancing profitability through these diversified offerings.

BPER Banca's commitment to digital transformation is evident in its €500 million investment for IT modernization, a key component of its 'B:Dynamic|Full Value 2027' strategy. This substantial allocation targets hybrid cloud adoption and AI integration, aiming to bolster operational efficiency and customer engagement. The bank's focus on digital products and automated customer journeys positions it in a high-growth segment of the banking sector, poised for market share expansion.

Sustainable Finance Products (Green Loans/Mortgages)

BPER Banca is making significant strides in sustainable finance, offering products like green loans and mortgages to support both businesses and individuals in their environmental transition. This commitment is reflected in their substantial disbursements for ecological and climate-related initiatives.

- Green Finance Disbursements: In 2024, BPER Banca allocated approximately €3 billion towards environmental purposes.

- Retail Customer Focus: Of this total, about €900 million was directed towards retail customers through green mortgages and loans.

- Project Finance for Sustainability: The bank also channeled over €260 million into project finance for green infrastructure, such as photovoltaic installations and circular economy projects.

- ESG Leadership and Market Position: These efforts underscore BPER Banca's dedication to ESG leadership and capitalize on the expanding market for sustainable financial products.

Corporate & Investment Banking (CIB) Services

BPER Banca's Corporate & Investment Banking (CIB) services are a key growth engine, with a strategic push to bolster its advisory capabilities and expand its reach to large corporations. The bank projects a significant increase in CIB loans, targeting over €10 billion by 2025. This segment is also expected to see robust revenue growth, with projections reaching approximately €105 million in 2025.

The CIB strategy is multifaceted, focusing on several key areas to drive expansion and client value.

- Global Transaction Banking: Enhancing services in this area to support clients' international cash management and trade finance needs.

- Working Capital Solutions: Developing innovative solutions to optimize clients' liquidity and operational efficiency.

- Structured Finance and Capital Markets: Building expertise and offerings in complex financial arrangements and capital raising activities.

- Corporate Product Factory: Leveraging a new product development framework to accelerate the launch of tailored financial products for corporate clients.

BPER Banca's Wealth Management and Investment Services, along with Bancassurance, represent its Stars in the BCG matrix. These segments are experiencing high growth and hold a significant market share for the bank.

The bank's Wealth Management saw its Assets Under Management (AuM) reach €72.1 billion by March 2025, a 7.1% increase year-over-year. Bancassurance, particularly non-life insurance, saw commission growth of 26.9% in Q1 2025, exceeding €360 million in protection premiums by 2025.

| Segment | Growth Rate | Market Share | BCG Category |

| Wealth Management | High | High | Star |

| Bancassurance (Non-Life) | High | High | Star |

What is included in the product

This BCG Matrix analysis of BPER Banca highlights strategic recommendations for Stars, Cash Cows, Question Marks, and Dogs within its portfolio.

The BPER Banca BCG Matrix offers a clear, visual overview of business unit performance, alleviating the pain of complex data analysis.

Cash Cows

BPER Banca's foundational retail banking services, encompassing deposit accounts, mortgages, and loans, are its bedrock, catering to a broad customer base throughout Italy. With a substantial presence of 1,557 branches as of March 2025, these services are deeply embedded in the Italian economic landscape.

Despite a minor dip in net interest income to €811.9 million in Q1 2025, these core offerings continue to be a principal revenue generator for the bank. This stability is underpinned by a robust asset quality, evidenced by a gross non-performing loan ratio of 2.6% and a net ratio of 1.2% as of March 2025, ensuring consistent cash flow from its extensive lending operations.

Net commission income from traditional banking services reached €274.6 million in Q1 2025, marking a 2.5% rise compared to the previous year. This growth underscores the stability and consistent revenue generation from core banking activities.

This segment, alongside contributions from investment services and bancassurance, forms a crucial pillar of BPER Banca's profitability. It represents a mature market where the bank holds a significant share, ensuring a reliable stream of cash flow.

BPER Banca's strategic outlook projects a sustained positive trajectory for net fees, reinforcing its role as a key revenue driver. This consistent performance is vital for supporting the bank's overall financial health and operational capacity.

BPER Banca demonstrates exceptional financial strength through its consistently high capital ratios. As of March 2025, the bank reported a Common Equity Tier 1 (CET1) ratio of 15.8%, significantly exceeding regulatory requirements and underscoring its stability.

This impressive CET1 ratio is a direct result of robust organic capital generation, enabling BPER Banca to comfortably fund its ongoing operations and pursue strategic growth opportunities without needing substantial external financing. It reflects a solid financial foundation, positioning the bank to effectively absorb potential risks and deliver reliable returns.

Non-Performing Loan (NPL) Management

BPER Banca's robust management of non-performing loans (NPLs) solidifies its position as a cash cow. As of March 2025, the bank reported a gross NPL ratio of 2.6% and a net NPL ratio of 1.2%. These figures are considered best in class within the Italian banking sector, highlighting effective credit risk mitigation strategies.

The bank's commitment to maintaining a strong NPL coverage ratio, which stood at 54.2% in March 2025, further reinforces its cash cow status. This high coverage, among the highest in Italy, ensures that potential losses from bad loans are well-provisioned, minimizing the impact on profitability and freeing up capital.

- Gross NPL Ratio: 2.6% (March 2025)

- Net NPL Ratio: 1.2% (March 2025)

- NPL Coverage Ratio: 54.2% (March 2025)

- Industry Standing: Best in class in the Italian banking industry

Direct Deposits from Customers

Direct deposits from customers represent a significant Cash Cow for BPER Banca. As of March 2025, these deposits reached €117.4 billion, underscoring their importance as a stable and substantial funding base.

While there was a minor year-over-year dip attributed to customers moving funds into managed assets, this core funding source remains exceptionally low-cost. This robust deposit base is crucial for BPER Banca's liquidity and overall financial resilience.

- €117.4 billion in direct deposits as of March 2025.

- Represents a stable and substantial funding base.

- A core, low-cost funding source for operations.

- Contributes significantly to the bank's liquidity and financial stability.

BPER Banca's core retail banking operations, including deposits and loans, function as its primary cash cows. These segments consistently generate substantial revenue and profits, supported by a large customer base and a widespread branch network.

The bank's strong asset quality, demonstrated by low non-performing loan ratios, ensures a steady inflow of interest income. This stability is further bolstered by a significant volume of low-cost customer deposits, providing a reliable funding base.

With a robust CET1 ratio of 15.8% as of March 2025, BPER Banca exhibits strong capital generation capabilities, allowing it to self-fund operations and strategic initiatives, reinforcing its cash cow status.

| Metric | Value (March 2025) | Significance |

|---|---|---|

| Gross NPL Ratio | 2.6% | Indicates strong credit quality and low risk of loan losses. |

| Net NPL Ratio | 1.2% | Further confirms effective management of impaired loans. |

| NPL Coverage Ratio | 54.2% | High coverage ensures minimal impact of potential loan defaults on profitability. |

| CET1 Ratio | 15.8% | Demonstrates robust capital generation and financial stability. |

| Direct Deposits | €117.4 billion | Represents a stable, low-cost funding source crucial for operations. |

What You See Is What You Get

BPER Banca BCG Matrix

The BPER Banca BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase, offering a clear strategic overview of their business units. This comprehensive analysis, ready for immediate use, will be delivered directly to you without any watermarks or demo content, ensuring you have the complete strategic tool. You can confidently use this preview as a representation of the high-quality, professionally designed BCG Matrix report that will be yours to download and implement. This is the final, polished version, designed to provide actionable insights into BPER Banca's portfolio for your business planning needs.

Dogs

BPER Banca's Net Interest Income (NII) is facing headwinds, evidenced by a 3.8% year-over-year decline in the first quarter of 2025. This segment, crucial for traditional banking revenue, is projected to shrink by 5% between 2024 and 2027.

The primary drivers for this anticipated NII contraction are a faster-than-expected decrease in interest rates and the fading impact of the Ecobonus. While positive trends in funding costs and loan volumes offer some buffer, the overall outlook for interest-driven earnings remains challenging.

Without strategic adjustments or a reversal in market dynamics, the declining NII could continue to negatively impact BPER Banca's profitability, potentially categorizing it as a 'Dog' within a BCG matrix framework if its market share and growth prospects are also weak.

BPER Banca's legacy IT systems are a clear candidate for the 'Dog' quadrant in the BCG Matrix. Despite significant investments in modernization, these older systems represent a drag on resources, often incurring high maintenance costs and potential inefficiencies. For instance, as of late 2024, the banking sector globally continues to grapple with the substantial costs associated with maintaining and upgrading aging infrastructure, with some estimates suggesting that up to 70% of IT budgets can be allocated to keeping legacy systems running.

The integration of acquired banks, such as Banca Popolare di Sondrio, further complicates the IT landscape. Unifying disparate systems requires considerable effort and capital, potentially delaying the realization of expected cost savings and operational efficiencies. This integration challenge means that resources are diverted to harmonization rather than innovation, impacting BPER Banca's ability to compete effectively in a rapidly digitalizing financial environment.

These legacy systems inherently limit agility and slow down the adoption of new technologies. In a sector where digital transformation is paramount, such constraints can hinder innovation and customer service improvements. The resources consumed by maintaining these outdated platforms could otherwise be invested in developing cutting-edge digital products or enhancing customer experience, leading to a lower return on investment compared to more modern, agile solutions.

BPER Banca’s strategic reduction of its branch network by 29% is a significant move, freeing up capital and resources for crucial digital transformation initiatives. This rationalization aims to streamline operations and enhance efficiency across the bank.

However, the decision to maintain some underperforming or redundant branches in low-growth regions prior to complete rationalization presents a potential challenge. These branches might continue to represent an operational cost burden, with expenses exceeding the revenue they generate, especially if there's no clear trajectory for increased market share or growth.

Select Non-Performing Exposures (NPEs)

While BPER Banca demonstrates robust management of non-performing loans, the broader Italian banking landscape experienced a modest uptick in total non-performing exposures (NPEs) during the initial six months of 2024. This context highlights the importance of scrutinizing specific asset classes within BPER Banca.

Within BPER Banca's portfolio, any legacy non-performing loan portfolios or exposures that present significant recovery challenges, or demand substantial ongoing resources without a clear resolution strategy, would fall into the Select Non-Performing Exposures (NPEs) category for BCG matrix analysis. These assets represent a drag on capital and resources, yielding minimal or even negative returns.

For instance, if BPER Banca held a portfolio of legacy corporate loans from a struggling industry sector, characterized by extended legal proceedings and low recovery prospects, these would be prime candidates for this classification. Such assets are critical to identify for strategic divestment or specialized workout strategies.

- Legacy NPEs: Specific portfolios of non-performing loans that are difficult to recover and require significant ongoing management resources.

- Low/Negative Returns: These assets tie up capital and resources without generating positive financial returns.

- Italian Banking Sector Trend: A slight increase in total NPEs was observed across the Italian banking sector in H1 2024, underscoring the relevance of this analysis for BPER Banca.

Low-Performing Traditional Credit Products in Stagnant Segments

Low-performing traditional credit products in stagnant segments represent areas where BPER Banca might have a weak position and minimal opportunity for expansion. These could be niche lending areas that don't fit the bank's core strategy or offer little competitive edge. For instance, consider legacy loan portfolios in sectors experiencing structural decline, where BPER Banca's market share is already minimal.

These products often demand significant resources for modest returns, potentially hindering investment in more profitable ventures. In 2024, the Italian banking sector continued to grapple with the impact of economic shifts, with some traditional loan types seeing subdued demand. For example, while overall loan growth might have shown modest gains, specific segments like certain types of commercial real estate financing or legacy industrial loans could have remained flat or declined.

- Niche or Declining Sector Loans: Portfolios focused on industries facing technological disruption or changing consumer preferences, where BPER Banca's market share is less than 5% and growth prospects are projected below 2% annually.

- Low-Yielding Personal Loans: Certain types of unsecured personal loans in saturated markets with intense competition, leading to low net interest margins and minimal volume growth.

- Specialized Commercial Lending: Credit lines to highly specific, non-strategic business niches where BPER Banca lacks a distinct competitive advantage or scale.

Certain legacy loan portfolios within BPER Banca, particularly those in sectors experiencing structural decline or facing intense competition with minimal net interest margins, could be classified as Dogs. These segments often require substantial management resources for meager returns, potentially diverting capital from more promising growth areas.

For instance, specific portfolios of unsecured personal loans in saturated markets, or credit lines to highly specialized business niches where BPER Banca lacks a distinct competitive advantage, exemplify these 'Dog' assets. The Italian banking sector in 2024 saw subdued demand for certain traditional loan types, highlighting the challenges in these areas.

These low-performing assets represent a drag on capital and profitability, offering little prospect for market share expansion or significant revenue growth, thus fitting the 'Dog' quadrant criteria of low market share and low growth. Identifying and strategically managing these segments is crucial for optimizing BPER Banca's overall portfolio performance.

Question Marks

BPER Banca's digital debt issuance framework for Euro Medium-Term Notes (EMTN) under Italian law represents a significant innovation with substantial growth potential. This new approach has already demonstrated its appeal, evidenced by a €2 billion investor demand for a €500 million bond issuance. This strong initial reception highlights its capacity to attract global capital, positioning it as a promising development for the bank's funding strategy.

While the framework has successfully attracted international investors, its ultimate market share and long-term influence on BPER's funding mix are still being established. The bank's commitment to further issuances signals a clear intention to expand this digital offering. Continued success and market acceptance could elevate this initiative to a 'Star' category within the BCG matrix, signifying its high growth and market leadership potential.

BPER Banca's strategic push into AI integration and advanced analytics for customer service signifies a significant investment in enhancing personalized digital offerings and a seamless omnichannel experience. This initiative is relatively new for the bank within the broader financial sector, focusing on boosting digital product sales through automated customer journeys.

The success of these AI-driven services hinges on their market adoption and ability to drive substantial customer acquisition. For instance, if BPER Banca can leverage AI to personalize offers and streamline interactions, potentially increasing digital sales by a projected 15% in 2024, these services could ascend to 'Star' status by capturing a larger market share.

BPER Banca's strategic move to acquire an additional 80.62% of Banca Popolare di Sondrio for roughly €4.5 billion, announced in February 2025, is currently positioned as a 'Question Mark' within the BCG Matrix. This classification stems from the substantial growth potential offered by regional synergies and anticipated cost savings, which could significantly boost BPER's market position.

The primary driver for this 'Question Mark' status lies in the inherent integration risks. Successfully merging two distinct banking entities involves navigating complex challenges such as aligning corporate cultures, unifying disparate IT infrastructures, and harmonizing risk management frameworks. These hurdles are critical to realizing the projected benefits.

The ultimate success of this acquisition, and consequently its future placement in the BCG Matrix, hinges on BPER Banca's ability to effectively manage the integration process. Delivering on targeted synergies and achieving desired market share expansion will be the key determinants of whether Banca Popolare di Sondrio transitions from a 'Question Mark' to a 'Star' or faces other classifications.

Consumer Finance Development and Digitalization

BPER Banca is actively pursuing the development and digitalization of its consumer finance segment. The bank projects a substantial increase in personal loans, targeting approximately €1.35 billion by 2025, a significant jump from €900 million recorded in 2021. This strategic focus aims to capitalize on a burgeoning market, with BPER investing to enhance its competitive standing.

To ascend to a 'Star' position within the broader consumer finance landscape, BPER needs to substantially grow its current market share. The success of this initiative is intrinsically linked to the bank's ability to implement effective digitalization strategies and deliver compelling, competitive product offerings.

- Projected Personal Loan Growth: Targeting €1.35 billion by 2025, up from €900 million in 2021.

- Market Position Goal: Aiming to grow market share to achieve 'Star' status in consumer finance.

- Key Success Factors: Effective digitalization and competitive product development are crucial.

- Investment Focus: BPER is investing to bolster its presence in this expanding market.

ESG Investment Products and Green Bonds

BPER Banca is actively expanding its ESG investment product offerings and Green Bond issuances, aligning with its broader sustainability goals. This strategic focus taps into a burgeoning market demand for environmentally and socially responsible financial instruments.

While BPER's commitment positions it for future growth, its current market share in ESG products and Green Bond volumes are still developing. For these offerings to ascend to 'Star' status within the BCG framework, they require substantial market penetration and competitive positioning.

- BPER Banca's ESG Growth Phase: The bank is investing in sustainable finance, aiming to capture a larger share of the growing ESG market.

- Green Bond Issuance Strategy: BPER is issuing Green Bonds to finance environmentally beneficial projects, a key component of its sustainability agenda.

- Market Traction Needed: Despite strong commitment, BPER's ESG products and Green Bonds need to achieve greater market acceptance and volume to be considered market leaders.

The acquisition of Banca Popolare di Sondrio represents a significant strategic move for BPER Banca, currently classified as a Question Mark in the BCG matrix. This is due to its considerable growth potential, driven by anticipated synergies and cost savings, which could solidify BPER's market standing. However, the integration process itself presents substantial risks, including cultural alignment, IT system unification, and risk management harmonization, all critical for realizing the projected benefits.

The success of this acquisition hinges on BPER Banca's effective management of the integration. Achieving targeted synergies and expanding market share will determine if Banca Popolare di Sondrio moves towards a 'Star' classification or another category. The deal, valued at approximately €4.5 billion, was announced in February 2025, underscoring its scale and potential impact.

BPER Banca's consumer finance segment, particularly personal loans, is another area showing 'Question Mark' characteristics. The bank aims to grow personal loan volumes to €1.35 billion by 2025, a substantial increase from €900 million in 2021. This growth relies heavily on successful digitalization and competitive product development to capture a larger market share and potentially achieve 'Star' status.

The bank's expansion into ESG investment products and Green Bond issuances also falls into the 'Question Mark' category. While BPER is investing in this growing market, its current market share in these sustainable finance areas is still developing. To reach 'Star' status, these offerings need to achieve greater market penetration and establish a stronger competitive position.

| Business Unit/Initiative | Market Growth | Relative Market Share | BCG Classification | Key Considerations |

|---|---|---|---|---|

| BPER Banca Acquisition of Banca Popolare di Sondrio | High (Synergies, Cost Savings) | Low (Integration Risk) | Question Mark | Successful integration of IT, culture, and risk management is crucial. |

| Consumer Finance (Personal Loans) | High (Market Demand) | Low (Needs Market Share Growth) | Question Mark | Digitalization and competitive product offerings are key to increasing market share. |

| ESG Investment Products & Green Bonds | High (Growing Market Demand) | Low (Developing Market Share) | Question Mark | Requires significant market penetration and competitive positioning. |

BCG Matrix Data Sources

Our BPER Banca BCG Matrix is constructed using comprehensive financial disclosures, robust market analytics, and expert industry evaluations to provide a clear strategic overview.