BP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BP Bundle

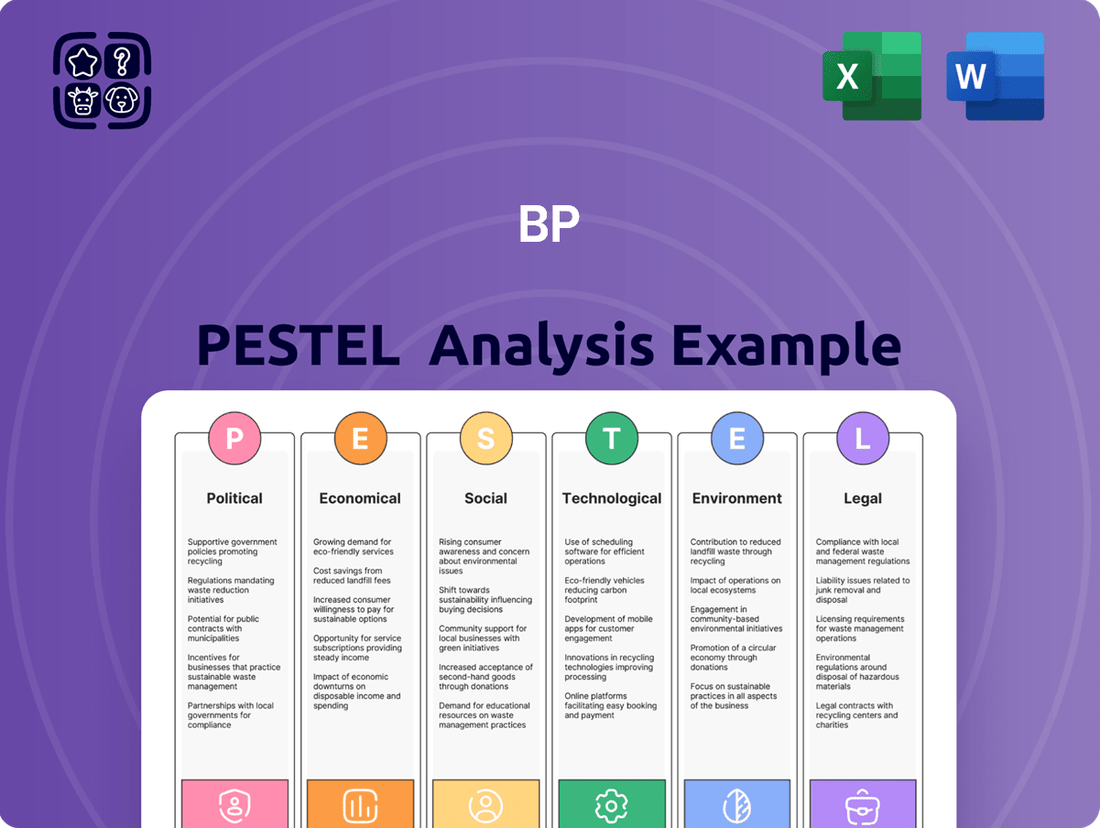

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting BP's strategic direction. Our expertly crafted PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence for informed decision-making. Don't get left behind; download the full version today to gain a competitive edge.

Political factors

Governments worldwide are tightening climate regulations, with initiatives like carbon taxes and renewable energy mandates becoming more prevalent. For instance, the European Union's Emissions Trading System (ETS) saw carbon prices average around €65 per tonne in 2023, impacting industries like oil and gas. These policies directly steer BP's capital allocation towards lower-carbon ventures, affecting operational expenses and the speed of its transition from traditional fossil fuels.

Geopolitical tensions in regions like the Middle East and Eastern Europe continue to pose a significant risk to global energy markets. For instance, ongoing conflicts in 2024 have led to temporary supply disruptions, contributing to Brent crude oil prices fluctuating around $80-$90 per barrel at various points, impacting BP's operational costs and revenue projections.

Governments worldwide are increasingly focused on energy security, a trend likely to intensify through 2025. This is driving a dual approach: some nations are bolstering domestic fossil fuel production to reduce reliance on imports, while others are accelerating investments in renewable energy sources. This policy divergence directly influences BP's strategic planning regarding resource allocation and market access.

BP's extensive global footprint means its operations are inherently sensitive to these geopolitical shifts and energy security policies. In 2024, the company has navigated varying regulatory landscapes, from supporting increased natural gas production in some European markets to expanding its renewable energy portfolio in others, demonstrating its need for agile risk management and adaptable resource deployment.

International trade agreements and economic sanctions significantly influence BP's global operations. For instance, ongoing geopolitical tensions in 2024 and early 2025 could lead to new sanctions or trade restrictions affecting energy markets, potentially impacting BP's access to crucial resources or key customer bases. Compliance with evolving international trade laws, such as those related to carbon emissions or energy security, is paramount for BP's continued market participation and financial stability.

Subsidies for Renewable Energy

Governments worldwide are increasingly providing subsidies and tax incentives to encourage renewable energy adoption. For instance, the U.S. Inflation Reduction Act of 2022 extended tax credits for wind and solar power, significantly boosting project economics. These policies directly impact BP's strategic investments in lower-carbon energy sources, making projects more attractive.

The financial viability of BP's renewable energy ventures, including wind farms and solar installations, is heavily influenced by the availability and longevity of these government supports. For example, the U.S. federal investment tax credit (ITC) and production tax credit (PTC) for solar and wind projects, respectively, have been crucial drivers of growth. BP's ability to secure these incentives shapes its competitive edge in the evolving energy landscape.

- Government Support: Many nations offer subsidies, tax credits, and grants to accelerate renewable energy development.

- Financial Impact: These incentives make lower-carbon projects, such as wind and solar, more financially appealing for companies like BP.

- Strategic Importance: The duration and availability of these subsidies are key factors in BP's energy transition strategy and market competitiveness.

- Recent Data: In 2024, the U.S. continued to see significant investment in renewables, partly driven by the extended tax credits from the Inflation Reduction Act, with renewable energy capacity additions projected to reach record levels.

Regulatory Frameworks for Oil & Gas

The oil and gas sector operates under a dense web of regulations that significantly influence BP's activities. These rules govern everything from initial exploration and drilling to the final refining processes, with environmental protection and operational safety being key concerns. For instance, in 2024, the International Energy Agency (IEA) highlighted that governments globally are increasingly scrutinizing new fossil fuel projects, potentially leading to longer approval times and higher compliance costs.

Shifts in these regulatory frameworks can directly affect BP's bottom line and strategic planning. Stricter environmental impact assessments, for example, can delay project commencement and increase capital expenditure. In 2025, many regions are expected to implement enhanced carbon capture and storage (CCS) mandates, which could necessitate substantial investment in new technologies for BP's operations.

- Environmental Standards: Jurisdictions are tightening emissions standards, impacting refining operations and requiring investment in cleaner technologies.

- Safety Regulations: Enhanced safety protocols for offshore drilling and pipeline management add to operational costs but are crucial for risk mitigation.

- Permitting Processes: More rigorous permitting for new exploration sites can extend project timelines and increase upfront investment.

- Carbon Pricing Mechanisms: The expansion of carbon taxes or cap-and-trade systems directly influences the profitability of fossil fuel production.

Government policies on energy transition and climate change are a primary driver for BP's strategic shifts. Initiatives like carbon taxes and renewable energy mandates, exemplified by the EU's Emissions Trading System where carbon prices averaged around €65 per tonne in 2023, directly influence BP's capital allocation towards lower-carbon assets.

Geopolitical instability, particularly in the Middle East and Eastern Europe, continues to impact global energy markets. Conflicts in 2024 caused Brent crude oil prices to fluctuate between $80-$90 per barrel, affecting BP's operational costs and revenue forecasts.

Governments' focus on energy security in 2024-2025 encourages both domestic fossil fuel production and renewable energy investment, creating a complex environment for BP's resource allocation and market access strategies.

International trade agreements and sanctions, such as potential new restrictions in 2024-2025 due to geopolitical tensions, can impact BP's access to resources and markets, emphasizing the need for compliance with evolving trade laws.

What is included in the product

This BP PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting BP, providing a strategic overview of the external landscape.

The BP PESTLE analysis provides a structured framework to proactively identify and address external factors, alleviating the pain of unpredictable market shifts and regulatory changes by fostering informed strategic decision-making.

Economic factors

Fluctuations in global crude oil and natural gas prices directly impact BP's revenue, profitability, and investment capacity. For instance, Brent crude oil prices averaged around $83 per barrel in 2024, a significant factor influencing BP's upstream earnings.

Geopolitical events, supply-demand imbalances, and OPEC+ decisions are primary drivers of this volatility. A tightening of global oil supply, potentially influenced by geopolitical tensions in the Middle East, could push prices higher, benefiting BP's exploration and production segments.

Sustained low prices can reduce cash flow for traditional operations, potentially impacting BP's ability to fund new projects. Conversely, high prices, such as those seen in early 2025 if supply disruptions occur, can accelerate investments in new projects or increase shareholder returns through dividends and buybacks.

Global economic growth directly impacts BP's performance by shaping energy demand. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, which can translate to moderated demand for oil and gas. Conversely, a stronger economic outlook would likely boost consumption across industrial, commercial, and transportation sectors, benefiting BP's sales volumes.

Rising inflation in 2024 and 2025 directly impacts BP's operational expenses. For instance, the UK Consumer Price Index (CPI) saw a notable increase, meaning BP faces higher costs for everything from raw materials to employee wages, potentially squeezing their profit margins.

Central bank decisions on interest rates significantly influence BP's borrowing costs for large-scale projects, such as those in renewable energy. For example, if the Bank of England maintains or raises its base rate in 2024-2025, BP's cost of financing new ventures will increase.

Higher interest rates can make capital-intensive investments, including BP's crucial energy transition projects, less financially appealing. This economic environment might lead to a slowdown in the pace of these initiatives as the return on investment becomes less attractive compared to the increased cost of capital.

Investment in Lower Carbon Technologies

Economic shifts are significantly boosting investment in lower-carbon technologies, directly impacting BP's capital allocation. The global energy transition, driven by climate concerns and policy, is reorienting financial flows towards renewables and sustainable solutions.

The cost-effectiveness and scalability of technologies like solar and wind power are becoming increasingly competitive with traditional energy sources. For instance, the global average cost of electricity from onshore wind fell by 16% and from solar PV by 13% between 2022 and 2023, according to IRENA data, making these options more attractive for companies like BP looking to diversify.

Consumer and investor demand for sustainable options is a powerful economic driver. Many institutional investors now prioritize Environmental, Social, and Governance (ESG) factors, influencing their investment decisions and pushing companies to adopt greener strategies. BP's own strategy reflects this, with significant capital earmarked for low-carbon businesses.

- Renewable Energy Growth: Global renewable energy capacity additions reached a record 510 GW in 2023, a 50% increase from 2022, highlighting the accelerating economic viability and adoption of these technologies.

- Capital Allocation: BP has committed to investing $5-6 billion annually in its low carbon energy segment through 2025, demonstrating a clear economic strategy shift.

- Cost Competitiveness: The levelized cost of electricity (LCOE) for new utility-scale solar PV projects in 2023 averaged $75 per megawatt-hour, down from $80 in 2022, further enhancing its economic appeal.

- Investor Demand: ESG-focused funds saw net inflows of over $200 billion in 2023, indicating strong investor appetite for sustainable investments.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact BP, a global energy giant. As BP generates revenue and incurs costs in numerous currencies, shifts in exchange rates directly affect its reported financial performance. For instance, a stronger US dollar, against which oil is typically priced, can reduce the value of BP's earnings when translated back into dollars from other currencies.

In 2023, BP reported significant impacts from currency movements. The company's financial results are often presented in US dollars, but substantial operations occur in pounds sterling, euros, and other currencies. For example, changes in the GBP/USD exchange rate directly influence the reported value of BP's UK-based assets and earnings. Managing this currency risk is a critical component of BP's financial strategy, employing hedging techniques to mitigate potential adverse effects.

The volatility of currency markets presents a continuous challenge. BP's strategy involves actively managing its foreign currency exposures. This includes hedging programs designed to protect against unfavorable movements in exchange rates, ensuring greater stability in its financial reporting and asset valuations. The company's ability to navigate these fluctuations is key to maintaining consistent profitability and investor confidence.

Key considerations for BP regarding currency exchange rates include:

- Impact on Reported Earnings: Fluctuations in exchange rates, particularly against the US dollar, affect the translation of foreign currency earnings into BP's reporting currency, impacting reported net income.

- Valuation of International Assets: The value of BP's overseas assets, such as refineries and exploration rights, is influenced by the prevailing exchange rates when translated into US dollars.

- Operational Costs: Costs incurred in local currencies for exploration, production, and refining can become more or less expensive in dollar terms depending on currency movements.

- Competitive Positioning: Exchange rates can affect the relative cost competitiveness of BP's products and services in different geographic markets.

Economic factors significantly shape BP's operational landscape, from commodity price volatility to global growth trends. Fluctuations in crude oil and natural gas prices directly influence revenue and investment capacity, with Brent crude averaging around $83 per barrel in 2024. Global economic growth, projected at 3.2% for 2024 by the IMF, dictates energy demand, while rising inflation in 2024-2025 increases operational expenses. Interest rate decisions by central banks, such as the Bank of England's base rate, impact borrowing costs for large projects, potentially slowing down energy transition initiatives.

The economic shift towards sustainability is a major driver for BP's capital allocation. The increasing competitiveness of solar and wind power, with costs falling by 13% and 16% respectively between 2022 and 2023, makes diversification attractive. Strong investor demand for ESG-focused investments, evidenced by over $200 billion in inflows in 2023, further encourages BP's commitment to low-carbon businesses, with annual investments of $5-6 billion earmarked through 2025.

Currency exchange rate fluctuations present a continuous challenge for BP, impacting reported earnings and asset valuations. For instance, a stronger US dollar can diminish the value of earnings generated in other currencies. BP actively manages these risks through hedging programs to ensure greater financial stability and investor confidence.

| Economic Factor | 2024/2025 Data/Projection | Impact on BP |

| Brent Crude Oil Price | Avg. ~$83/barrel (2024) | Influences upstream earnings and investment capacity. |

| Global Economic Growth | Projected 3.2% (2024) | Shapes overall energy demand. |

| UK Inflation (CPI) | Notable Increase | Raises operational expenses, potentially squeezing margins. |

| Interest Rates (e.g., Bank of England) | Maintained or Raised | Increases borrowing costs for new projects. |

| Renewable Energy Cost Reduction (Solar PV) | 13% decrease (2022-2023) | Enhances economic viability of diversification. |

| ESG Fund Inflows | >$200 billion (2023) | Drives investor demand for sustainable investments. |

| BP Low Carbon Investment | $5-6 billion annually (through 2025) | Demonstrates strategic capital allocation towards sustainability. |

Full Version Awaits

BP PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive BP PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping BP's strategic landscape.

Sociological factors

Public sentiment towards fossil fuel companies, including BP, has become increasingly negative. This shift is largely due to growing concerns about climate change and the environmental impact of oil and gas operations, exacerbated by past incidents. For instance, the aftermath of the Deepwater Horizon oil spill continues to influence public perception, highlighting the sensitivity surrounding environmental responsibility.

BP's brand reputation is a significant asset, directly impacting its ability to attract top talent and secure public trust for future projects, especially those involving new energy technologies. A positive reputation also influences consumer choices, particularly as more individuals and businesses prioritize sustainability in their purchasing decisions.

To improve its public image, BP must demonstrably commit to its sustainability goals and net-zero targets. The company's investments in renewable energy sources, such as offshore wind and solar power, are crucial steps. For example, BP's 2023 annual report detailed significant capital expenditure in low-carbon energy, aiming to rebrand itself as an integrated energy company rather than solely a fossil fuel producer.

Consumers are increasingly favoring cleaner energy options and electric vehicles, which directly affects the demand for traditional fossil fuels. For instance, in 2024, global EV sales are projected to reach over 17 million units, a significant jump from previous years, indicating a clear consumer shift.

BP needs to adjust its retail strategies by investing in and expanding its electric vehicle charging infrastructure. The company also needs to actively promote its portfolio of lower-carbon products and services to align with these evolving consumer preferences and maintain its competitive edge.

The energy transition necessitates a significant evolution in workforce skills, shifting from established oil and gas proficiencies to expertise in renewable energy technologies and digital competencies. BP must prioritize investment in reskilling its current employees and actively recruit individuals possessing specialized aptitudes for this new landscape.

Effectively navigating this workforce transformation is paramount for BP's sustained operational excellence and its capacity for future innovation. For instance, as of early 2024, the renewable energy sector globally saw a demand surge for roles in solar installation and wind turbine maintenance, highlighting the skills gap BP needs to address.

Corporate Social Responsibility (CSR) Expectations

Stakeholders, from investors to local communities, are increasingly demanding robust Corporate Social Responsibility (CSR) from companies like BP. This translates to expectations around ethical practices, meaningful community involvement, respect for human rights, and clear reporting on environmental footprints. For instance, in 2023, BP reported a 15% increase in stakeholder engagement initiatives focused on community development and environmental stewardship.

Meeting these elevated CSR standards is crucial for maintaining a social license to operate and proactively managing reputational damage. A strong CSR track record can directly influence investment decisions; in 2024, ESG (Environmental, Social, and Governance) funds saw continued growth, with assets under management projected to reach $33.9 trillion globally by year-end, highlighting investor appetite for responsible companies.

- Ethical Sourcing: Ensuring raw materials and supply chains meet ethical labor and environmental standards.

- Community Engagement: Investing in and actively participating in the well-being of communities where BP operates.

- Human Rights: Upholding and promoting human rights throughout all business activities and partnerships.

- Transparent Reporting: Providing clear and verifiable data on environmental impact, social initiatives, and governance practices.

Activist Investor and ESG Pressure

Activist investors and increasing ESG (Environmental, Social, and Governance) scrutiny are profoundly shaping BP's strategic landscape. These stakeholders are demanding faster decarbonization pathways and enhanced transparency regarding the company's environmental impact and social responsibility.

BP is under considerable pressure to not only establish aggressive climate targets but also to demonstrably achieve them, ensuring its business model aligns with overarching global sustainability objectives. This focus directly influences capital allocation decisions and the company's overall strategic trajectory, with significant implications for future investments and operational priorities.

- ESG Investment Surge: Global ESG assets were projected to reach $33.9 trillion by 2026, indicating a substantial shift in capital towards sustainable investments.

- Activist Investor Influence: In 2023, activist campaigns targeting oil and gas majors, including those focused on climate, saw a notable increase in engagement and success rates.

- BP's Net Zero Ambition: BP aims to reduce its net oil and gas production by 25% by 2030 and achieve net zero by 2050, a target under constant review by investors.

- Shareholder Resolutions: In 2024, shareholder proposals related to climate transition and reporting continue to be a key area of focus, often driving management responses and strategic adjustments.

Societal expectations are increasingly pushing BP towards a more sustainable operational model. Public opinion, influenced by climate change awareness and past environmental incidents, demands greater corporate responsibility. This sentiment directly impacts BP's brand image and its ability to attract investment and talent, particularly as consumers and investors prioritize ethical and environmentally sound practices.

The energy transition is also reshaping consumer behavior, with a growing preference for cleaner energy alternatives and electric vehicles. This shift necessitates that BP adapt its retail strategies, investing in EV charging infrastructure and promoting its lower-carbon product offerings to remain competitive.

Workforce skills are evolving, requiring BP to invest in reskilling its employees for renewable energy technologies and digital competencies. The global demand for such skills, evident in the renewable energy sector's growth, highlights the need for BP to proactively manage this talent transformation to ensure operational excellence and future innovation.

Stakeholders, including investors and local communities, are demanding robust Corporate Social Responsibility (CSR). BP's commitment to ethical sourcing, community engagement, human rights, and transparent reporting is crucial for maintaining its social license to operate and attracting ESG-focused investment, which saw global assets projected to reach $33.9 trillion by 2026.

| Sociological Factor | Impact on BP | Supporting Data/Trend |

|---|---|---|

| Public Sentiment & Climate Concerns | Negative perception, demand for accountability | Increased scrutiny post-Deepwater Horizon; growing public demand for climate action. |

| Consumer Preferences | Shift towards EVs and cleaner energy | Global EV sales projected to exceed 17 million units in 2024; rising demand for sustainable products. |

| Workforce Skills Evolution | Need for reskilling and new talent acquisition | Surge in demand for solar and wind energy expertise globally as of early 2024. |

| Stakeholder Expectations (CSR/ESG) | Pressure for ethical practices and transparency | ESG assets projected to reach $33.9 trillion by 2026; 15% increase in BP's CSR initiatives in 2023. |

Technological factors

Technological advancements are rapidly transforming the energy landscape, making renewables increasingly viable. For instance, global solar PV capacity is projected to reach over 3,000 GW by the end of 2025, a significant leap from around 1,000 GW in 2022, driven by improved panel efficiency and falling costs. Similarly, wind turbine technology continues to evolve, with offshore turbines now exceeding 15 MW capacity, boosting energy generation potential.

BP's strategic focus on the energy transition directly leverages these technological leaps. The company is investing heavily in scaling up its renewable energy projects, aiming to significantly increase its renewable power generation capacity. For example, BP aims to have 50 GW of net renewable capacity by 2030, up from 3.7 GW in 2022, underscoring the critical role of adopting and integrating these innovations.

The ongoing research and development in areas like advanced battery storage, with energy density improving by an estimated 5-10% annually, and more efficient hydrogen production methods are crucial for BP's long-term strategy. These innovations are key to ensuring the reliability and cost-effectiveness of renewable energy sources, enabling BP to effectively transition its portfolio and meet evolving market demands.

BP is increasingly integrating digitalization and artificial intelligence (AI) across its operations, from exploring new energy sources to managing its supply chains. These technologies are key to optimizing efficiency and safety. For instance, AI-powered predictive maintenance can reduce downtime in BP's refining operations, potentially saving millions. In 2024, the energy sector saw significant investment in AI for reservoir analysis, with some firms reporting a 15% increase in exploration success rates.

Leveraging AI and machine learning allows BP to enhance decision-making in areas like production forecasting and risk management. By analyzing vast datasets, BP can better predict equipment failures, leading to proactive maintenance and improved operational uptime. This digital transformation is vital for maintaining a competitive edge in both traditional oil and gas and emerging renewable energy sectors.

Carbon Capture, Utilization, and Storage (CCUS) technologies are becoming increasingly crucial for decarbonizing industries that are difficult to clean up, like cement and steel, and for producing blue hydrogen. These advancements are central to BP's strategy for reaching its net-zero goals and for providing industrial customers with cleaner energy alternatives.

BP's commitment to CCUS is evident in its significant investments. For instance, BP is a partner in the H2Teesside project, aiming to produce low-carbon hydrogen, and is involved in the Northern Lights project in Norway, a major CCUS infrastructure development. These initiatives underscore the company's focus on scaling up these solutions.

The real success of CCUS hinges on its ability to become more affordable and widely deployable. While significant progress is being made, the economic viability and technological maturity of CCUS at scale remain key factors that will shape its overall impact on global emissions reduction efforts in the coming years.

Electric Vehicle (EV) Charging Infrastructure Development

The accelerating adoption of electric vehicles (EVs) directly fuels the demand for widespread and efficient charging infrastructure. BP is actively expanding its EV charging network, recognizing this shift in consumer mobility and aiming to broaden its retail revenue streams. This strategic move positions BP to capitalize on the growing EV market by offering essential services.

Technological progress in charging speed and the overall reliability of charging stations are critical enablers for mass EV adoption. BP's investments in these areas are paramount for solidifying its competitive standing in this evolving energy landscape. For instance, by mid-2024, BP aimed to have over 30,000 charging points globally, with a significant portion in the UK and Europe.

Exploration and Production Technology

BP continues to leverage sophisticated technologies for its oil and gas exploration and production. Innovations in seismic imaging, for instance, are crucial for identifying new reserves with greater precision. In 2023, BP reported significant progress in its deepwater projects, utilizing advanced drilling techniques that enhance efficiency and safety, thereby optimizing output from these challenging environments.

Enhanced Oil Recovery (EOR) methods are also vital, helping BP to extract more hydrocarbons from mature fields. These techniques can increase recovery rates by 10-20% or more, making previously uneconomical reserves viable. This focus on technological advancement allows BP to maximize the value derived from its existing hydrocarbon assets while navigating the energy transition.

BP's investment in R&D for exploration and production technologies is substantial. For example, in 2024, the company allocated a significant portion of its capital expenditure towards digitalizing its upstream operations, including AI-driven reservoir analysis and predictive maintenance for drilling equipment. This technological push aims to reduce operational costs and minimize the environmental impact of its production activities.

Key technological advancements supporting BP's operations include:

- Advanced Seismic Imaging: Improving the accuracy of subsurface geological mapping.

- Deepwater Drilling Capabilities: Enabling safe and efficient operations in challenging offshore locations.

- Enhanced Oil Recovery (EOR) Techniques: Maximizing extraction from existing oil and gas fields.

- Digitalization and AI: Optimizing operational efficiency, predictive maintenance, and data analysis.

Technological factors are reshaping the energy sector, with renewables like solar and wind becoming increasingly cost-effective and efficient. BP is strategically investing in these advancements, aiming to significantly expand its renewable capacity. Innovations in battery storage and hydrogen production are also crucial for BP's long-term transition strategy.

Digitalization and AI are being integrated across BP's operations to boost efficiency and safety. These technologies aid in everything from exploration to supply chain management. For instance, AI-powered predictive maintenance is being used to reduce downtime in refining operations, with the energy sector seeing substantial AI investment in 2024 for exploration analysis.

Carbon Capture, Utilization, and Storage (CCUS) technologies are vital for decarbonizing hard-to-abate sectors and producing low-carbon hydrogen, aligning with BP's net-zero goals. BP is actively involved in major CCUS projects, highlighting its commitment to scaling these solutions, though widespread economic viability remains a key focus.

The growth of electric vehicles (EVs) is driving the expansion of charging infrastructure, a key area for BP's retail strategy. Technological improvements in charging speed and reliability are essential for mass EV adoption, with BP targeting over 30,000 global charging points by mid-2024.

Legal factors

BP navigates a dense landscape of environmental legislation, including stringent emissions targets for both air and water quality. Failure to adhere to these rules can result in significant penalties, legal battles, and even temporary cessation of operations. For instance, in 2024, the EU's Emissions Trading System saw carbon prices fluctuate, impacting operational costs for companies like BP.

The ongoing tightening of these environmental benchmarks necessitates substantial capital allocation towards developing and implementing greener technologies and enhancing operational efficiency. This trend is evident in BP's own capital expenditure plans, which increasingly prioritize low-carbon projects, reflecting a strategic response to evolving regulatory pressures and market expectations for sustainability.

BP operates under stringent Health and Safety Legislation globally, impacting its extensive network of offshore platforms, refineries, and retail sites. These regulations are paramount for preventing incidents, safeguarding employees, and ensuring the continuity of operations, with non-compliance carrying significant legal and financial repercussions.

In 2023, BP reported a total recordable injury frequency rate (TRIFR) of 0.76 per million hours worked, demonstrating a commitment to safety standards. The company invests heavily in safety, with significant operational expenditures allocated to maintaining and exceeding these legal requirements, recognizing that a strong safety record is vital for its reputation and license to operate.

BP, as a global energy giant, navigates a complex web of antitrust and competition laws worldwide, aimed at fostering fair market practices and preventing monopolistic behavior. Regulatory bodies meticulously review proposed mergers, acquisitions, and joint ventures to safeguard competitive landscapes.

Failure to comply with these stringent regulations can result in substantial financial penalties and forced divestitures, underscoring the critical importance of proactive legal adherence for BP's operations and strategic growth initiatives.

International Energy Treaties and Agreements

BP's global operations are significantly shaped by international energy treaties and climate agreements. The Paris Agreement, for instance, sets targets for emissions reduction that directly influence BP's long-term investment in fossil fuels versus renewables. As of early 2025, many nations are updating their Nationally Determined Contributions (NDCs) under the Paris Agreement, potentially increasing pressure on companies like BP to accelerate their energy transition strategies.

Bilateral investment treaties (BITs) also play a crucial role, offering BP legal protections and recourse in case of disputes with host governments regarding its assets and operations in various countries. These treaties can impact the security of cross-border energy projects and the ability to access and develop resources, especially in emerging markets where regulatory frameworks can be less stable.

Navigating this complex international legal landscape is paramount for BP's strategic planning. For example, the ongoing development of offshore wind projects in the North Sea requires adherence to multiple EU regulations and international maritime laws, impacting project timelines and costs. The evolving nature of these agreements means BP must continuously adapt its approach to ensure compliance and mitigate legal risks across its diverse portfolio.

Corporate Governance and Reporting Requirements

BP faces stringent legal obligations regarding corporate governance and financial reporting across its global operations. These requirements mandate transparency in areas like climate-related disclosures, executive pay, and board composition, reflecting a growing emphasis on accountability. For instance, in 2024, regulatory bodies worldwide continued to refine and enforce standards for Environmental, Social, and Governance (ESG) reporting, impacting how BP must communicate its performance and risks.

Adherence to these legal frameworks is not merely a compliance exercise but a cornerstone of maintaining investor trust. Robust governance structures are legally mandated and directly influence BP's ability to attract and retain capital. Failure to meet these reporting standards can result in significant penalties and reputational damage, underscoring the critical nature of these legal factors.

Key areas of compliance for BP include:

- Climate-related Financial Disclosures: Adhering to evolving international standards for reporting on climate risks and opportunities, with significant progress expected in 2024-2025 on standardized frameworks.

- Executive Compensation Transparency: Meeting legal requirements for disclosing executive remuneration packages and linking them to company performance and strategic objectives.

- Board Independence and Diversity: Complying with regulations that promote independent oversight and diversity within the board of directors to ensure effective governance.

- Financial Reporting Standards: Meeting rigorous accounting and financial reporting standards, such as IFRS or US GAAP, depending on listing and operational jurisdictions.

BP's legal standing is heavily influenced by evolving international climate agreements and national legislation concerning energy production and emissions. For example, the EU's ongoing efforts to bolster its carbon pricing mechanisms in 2024 and 2025 directly affect BP's operational costs and investment strategies in renewable energy versus traditional fossil fuels.

The company's commitment to health and safety is legally mandated, with strict regulations governing its global operations. BP reported a total recordable injury frequency rate (TRIFR) of 0.76 per million hours worked in 2023, a metric that underscores the intense scrutiny and investment required to meet these legal safety benchmarks.

Antitrust and competition laws are critical, as regulatory bodies worldwide scrutinize mergers and acquisitions, impacting BP's strategic growth. Non-compliance can lead to substantial financial penalties and forced divestitures, making adherence to these legal frameworks paramount.

| Legal Area | 2023/2024/2025 Focus | Impact on BP |

|---|---|---|

| Environmental Regulations | EU Emissions Trading System, stricter emissions targets | Increased operational costs, investment in green tech |

| Health & Safety | Global safety standards compliance | Significant investment in safety protocols, reputational risk |

| Competition Law | Merger/acquisition scrutiny, antitrust enforcement | Potential for penalties, forced divestitures, strategic limitations |

| Corporate Governance | ESG reporting, executive compensation transparency | Investor confidence, access to capital, reputational management |

Environmental factors

BP is under significant pressure to cut its greenhouse gas emissions, aiming for net-zero. This requires substantial investment in cleaner technologies and a strategic pivot away from fossil fuels. For instance, BP has committed to investing up to $23 billion in its low carbon energy business between 2023 and 2030.

The company faces operational disruptions from the physical impacts of climate change, such as increasingly severe weather events. These can affect infrastructure and supply chains, adding another layer of complexity to its operations and strategic planning.

BP's extensive exploration and production activities, particularly in remote or ecologically sensitive regions, pose a direct risk of impacting biodiversity and degrading vital ecosystems. The company faces mounting pressure from regulators, investors, and the public to demonstrably reduce its environmental footprint, safeguard natural habitats, and implement effective restoration programs for any disturbed areas. For instance, a 2024 report highlighted that BP's offshore operations in the North Sea are subject to stringent environmental impact assessments aimed at protecting marine life, with fines levied for non-compliance in previous years.

Adherence to robust sustainable land and marine management practices is no longer optional; it is a prerequisite for securing project approvals and maintaining its social license to operate. In 2025, BP announced a commitment to invest $500 million in biodiversity-focused projects globally, aiming to offset operational impacts and contribute to ecosystem resilience. This includes initiatives like mangrove restoration in Southeast Asia and coral reef protection programs in the Caribbean, demonstrating a strategic shift towards integrating conservation into core business operations.

The finite nature of fossil fuels, combined with rising global energy needs, is pushing for a significant energy transition. BP is responding by investing in renewables such as wind and solar power, aiming to diversify its energy sources and lessen its dependence on dwindling oil and gas reserves. This strategic pivot is crucial for BP's enduring business viability.

Pollution and Waste Management

BP faces significant challenges in managing diverse forms of pollution, from air emissions and wastewater to hazardous waste produced during its extensive operations. The increasing stringency of environmental regulations and heightened public scrutiny necessitate the adoption of sophisticated pollution control technologies and robust waste management strategies. A key focus remains on preventing accidental spills and leaks, which carry substantial environmental and reputational risks.

The company's commitment to environmental stewardship is reflected in its investments in cleaner technologies. For instance, in 2023, BP reported investing approximately $2 billion in low-carbon energy and other decarbonization projects. This includes efforts to reduce methane emissions, a potent greenhouse gas, where the company has set targets to reduce its operational methane intensity to below 0.1% by 2025.

- Air Emissions: BP is working to reduce emissions of sulfur dioxide, nitrogen oxides, and particulate matter from its refineries and exploration activities.

- Wastewater Management: The company implements advanced treatment processes to ensure discharged water meets or exceeds regulatory standards.

- Hazardous Waste: BP prioritizes the safe handling, treatment, and disposal of all hazardous waste generated, often utilizing specialized facilities.

- Spill Prevention: Significant resources are dedicated to maintaining the integrity of pipelines and facilities to prevent oil spills, with ongoing monitoring and response preparedness.

Water Scarcity and Management

Water scarcity is a growing concern for BP, impacting its global operations. Regions where BP extracts oil and gas, like the Permian Basin in the US, are experiencing increased water stress. For instance, by 2023, the Permian Basin was already facing significant water demand from oil and gas operations, with projections indicating this demand would continue to rise.

This scarcity directly affects BP's ability to conduct its core activities, from hydraulic fracturing to cooling in refineries. The company must invest in advanced water management techniques to ensure operational continuity and mitigate risks. This includes optimizing water use and exploring alternative sources.

Sustainable water sourcing and effective wastewater treatment are paramount for BP's environmental stewardship and long-term viability. By 2024, many energy companies, including BP, are increasing their focus on water recycling and reducing freshwater intake. For example, BP has set targets to reduce its freshwater withdrawal intensity, aiming for a more sustainable approach to its water footprint.

- Operational Impact: Water scarcity in key operational areas like the Permian Basin presents significant risks to hydrocarbon extraction and refining processes.

- Investment in Technology: BP is investing in technologies for water efficiency, recycling, and advanced wastewater treatment to address scarcity.

- Sustainability Goals: The company is committed to reducing its freshwater withdrawal intensity, with ongoing efforts to improve water management practices by 2025.

- Regulatory Scrutiny: Increasing environmental regulations globally place greater emphasis on responsible water usage and discharge standards for energy companies.

BP's environmental strategy is heavily influenced by the need to mitigate climate change impacts and reduce its carbon footprint. The company is actively investing in lower-carbon energy sources, aiming to transition its portfolio. For instance, BP committed to investing up to $23 billion in its low-carbon energy business between 2023 and 2030.

The company also faces operational challenges due to the physical effects of climate change, such as extreme weather events that can disrupt infrastructure and supply chains.

Biodiversity protection is another key environmental consideration, with BP facing pressure to minimize its impact on ecosystems. In 2025, BP announced a $500 million investment in global biodiversity projects, including mangrove restoration and coral reef protection.

Water scarcity is a growing concern, particularly in regions like the Permian Basin, impacting operations. By 2024, BP is increasing its focus on water recycling and reducing freshwater intake, setting targets to lower its freshwater withdrawal intensity.

| Environmental Factor | BP's Response/Commitment | Relevant Data/Target |

|---|---|---|

| Greenhouse Gas Emissions | Net-zero ambition, investment in low-carbon energy | Up to $23 billion investment in low-carbon energy (2023-2030) |

| Physical Climate Impacts | Adapting operations to extreme weather | Ongoing risk assessment and infrastructure resilience planning |

| Biodiversity Protection | Investment in conservation projects | $500 million investment in biodiversity projects (2025) |

| Water Scarcity | Improving water efficiency and recycling | Targets to reduce freshwater withdrawal intensity |

PESTLE Analysis Data Sources

Our BP PESTLE Analysis is informed by a comprehensive blend of data, including official government reports, international energy agency publications, and reputable market research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting BP.