BP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BP Bundle

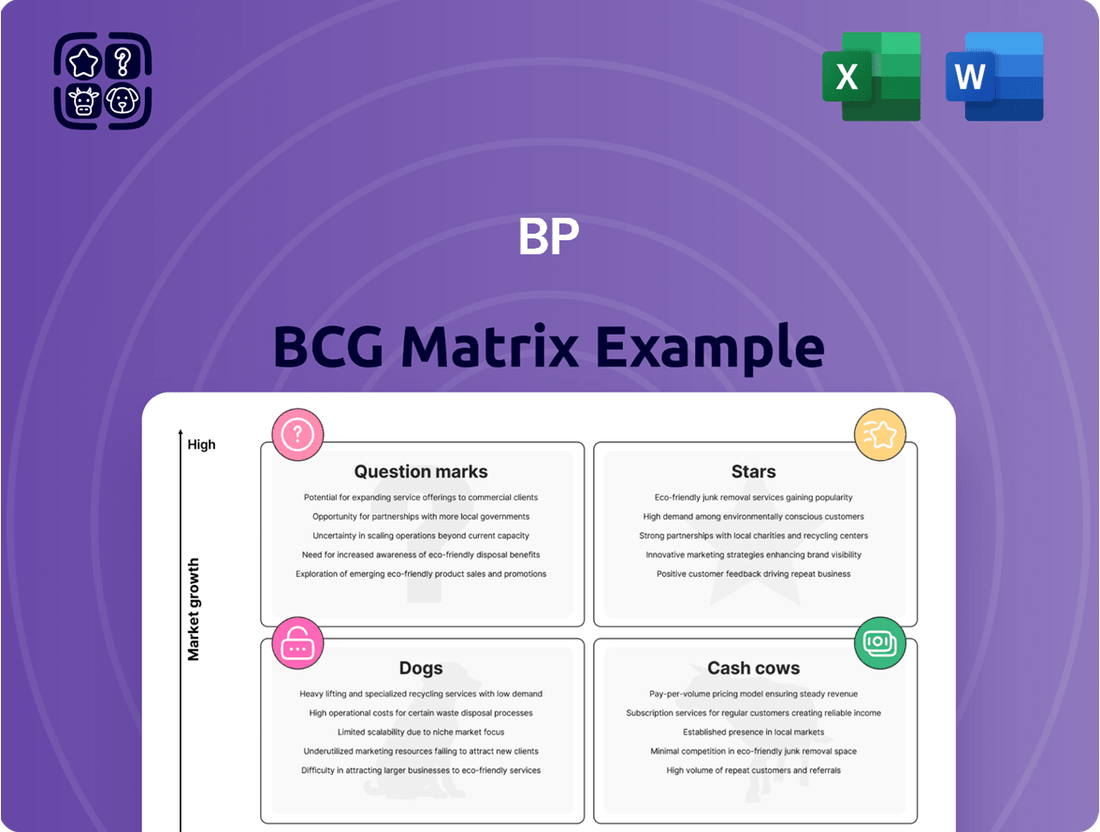

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. This preview offers a glimpse into how these classifications can illuminate strategic opportunities and challenges.

To truly leverage the BCG Matrix for your business, you need the full picture. Purchase the complete report for detailed quadrant analysis, actionable insights, and a clear roadmap to optimize your product investments and drive growth.

Stars

BP's upstream oil and gas production segment is positioned as a cash cow within its BCG matrix. The company plans to increase production to 2.3 to 2.5 million barrels of oil equivalent per day by 2030, demonstrating a commitment to this core business.

This strategic focus is designed to generate immediate returns and robust cash flow, supporting BP's broader energy transition goals. Investments are being channeled into high-margin areas such as the U.S. Gulf of Mexico and the Middle East.

bp pulse represents a significant growth opportunity for BP, positioned as a Star in the BCG matrix. The company is channeling substantial investment into this sector, aiming for over 3,000 fast charging points in the US by 2025 and a global target of 100,000 by 2030. This aggressive expansion, including a notable $100 million order for Tesla ultra-fast chargers and strategic alliances with companies like Hertz, underscores the high-growth potential and market demand for EV infrastructure.

Bioenergy, encompassing biofuels and biogas, is a key focus for BP, positioned as a vital transition growth engine. This strategic emphasis is backed by significant performance metrics, with biofuels production increasing by 18% and biogas supply volumes surging by 80% in 2023. This impressive growth trajectory, partly fueled by strategic acquisitions such as Archaea Energy, underscores BP's commitment to developing and scaling lower-carbon energy solutions.

Strategic Convenience and Mobility Retail

BP is strategically focusing on its integrated convenience and mobility retail segment, viewing it as a key growth area within its customer-facing operations. This involves divesting non-core assets to concentrate resources on reshaping and expanding this portfolio in important markets.

The company aims to enhance returns and efficiency by leveraging its existing retail footprint and introducing new services, such as electric vehicle (EV) charging. This approach aligns with evolving consumer needs and the broader energy transition.

BP's 2024 strategy for this segment emphasizes growth and integration. For instance, in the first half of 2024, BP reported a significant increase in its convenience gross margin, reaching an average of $2.3 billion globally, up from $2.1 billion in the same period of 2023. This growth is driven by expanding its store network and offering more diverse products and services.

- Strategic Focus: Reshaping and growing the integrated convenience and mobility retail portfolio.

- Key Initiatives: Expanding EV charging infrastructure and enhancing customer offerings.

- Financial Performance (H1 2024): Global convenience gross margin increased to approximately $2.3 billion.

- Growth Drivers: Store network expansion and diversification of retail services.

High-Return Upstream Exploration and Major Projects

BP is focusing its capital on upstream oil and gas ventures that promise significant returns. This strategy includes bringing 10 major projects online between 2025 and 2027, a move designed to enhance its asset base and ensure future earnings from existing discoveries.

The company is also actively replenishing its exploration prospects to maintain long-term growth. This proactive approach in upstream activities is crucial for BP's strategic positioning.

- Investment Focus: High-return upstream oil and gas exploration and development.

- Project Pipeline: 10 new major projects scheduled for startup between 2025-2027.

- Strategic Aim: Strengthen portfolio and secure future cash flows from discovered resources.

- Exploration Strategy: Actively refreshing the exploration pipeline for sustained growth.

BP's investment in electric vehicle charging infrastructure, particularly through bp pulse, positions it as a Star in the BCG matrix. The company is aggressively expanding its charging network, aiming for over 3,000 fast charging points in the US by 2025 and a global target of 100,000 by 2030. This rapid growth is supported by significant investments, including a $100 million order for Tesla ultra-fast chargers and strategic partnerships, indicating strong market demand and high growth potential in this emerging sector.

Bioenergy, including biofuels and biogas, is also a key Star for BP, representing a vital transition growth engine. The company saw an 18% increase in biofuels production and an 80% surge in biogas supply volumes in 2023. This impressive performance, bolstered by acquisitions like Archaea Energy, highlights BP's commitment to scaling lower-carbon energy solutions and capturing growth in this expanding market.

| Segment | BCG Matrix Position | Key Metrics/Targets | Strategic Rationale |

|---|---|---|---|

| bp pulse (EV Charging) | Star | 3,000+ US fast chargers by 2025; 100,000 global by 2030. $100M Tesla charger order. | High growth potential, strong market demand, expanding EV infrastructure. |

| Bioenergy (Biofuels & Biogas) | Star | Biofuels production +18% (2023); Biogas supply +80% (2023). Archaea Energy acquisition. | Transition growth engine, scaling lower-carbon solutions, expanding market share. |

What is included in the product

Strategic evaluation of business units based on market share and growth rate.

Quickly identify underperforming "Dogs" and "Cash Cows" to reallocate resources for maximum impact.

Cash Cows

BP's established upstream oil and gas operations function as its cash cows. These mature assets consistently generate substantial and stable cash flow, providing the financial backbone for the company. This reliable income stream is crucial for funding new ventures and returning value to shareholders.

Despite the ongoing energy transition, these traditional operations remain vital. In the first quarter of 2024, BP reported an increase in upstream production, underscoring the continued strength and output from these core assets. This consistent performance ensures the capital needed for strategic investments and dividends.

BP's global refining business is a significant cash cow, reliably generating profits for the company. By 2025, BP is targeting its refining portfolio to be in the top quartile globally based on net cash margin, highlighting a strategic focus on optimizing this segment.

The efficiency of BP's refining operations is evident, with refining availability consistently exceeding 96% in Q1 2025. This high level of operational uptime directly translates to consistent cash generation from these assets.

BP's conventional fuels marketing and distribution network is a significant cash cow, generating substantial profits from its vast global reach. This segment benefits from established infrastructure and strong brand recognition, ensuring consistent demand for its products. In 2024, this segment continued to be a primary contributor to BP's earnings, reflecting the enduring reliance on traditional energy sources despite the ongoing energy transition.

Lubricants Business (e.g., Castrol)

BP's lubricants business, notably through its global brand Castrol, has historically been a significant contributor to the company's financial health. This segment is characterized by its mature market position and typically offers high profit margins, making it a reliable source of cash flow for BP.

While Castrol is presently undergoing a strategic review that could lead to its divestment, its performance up to this point underscores its role as a cash cow. The brand's established global presence and strong customer loyalty have ensured consistent revenue generation.

In 2023, BP's lubricants segment, including Castrol, continued to demonstrate resilience. For example, Castrol's underlying operating profit for the full year 2023 was reported at $1.5 billion, highlighting its substantial contribution to BP's overall earnings before interest and taxes (EBIT).

- Strong Market Position: Castrol is a leading global lubricants brand with a well-established reputation and extensive distribution network.

- High Margins: The lubricants sector generally commands higher profit margins compared to other fuel-related businesses, contributing to robust cash generation.

- Strategic Review: BP is actively considering the future of its lubricants business, including a potential sale, as part of its broader strategic realignment.

- Financial Contribution: In 2023, Castrol's underlying operating profit was $1.5 billion, showcasing its significant financial impact on BP.

Integrated Gas Trading and Marketing

BP's integrated gas trading and marketing operations function as a significant cash cow within its portfolio. This segment consistently generates substantial and stable profits by effectively leveraging existing infrastructure and established market relationships. The business benefits from higher gas realisations, ensuring a reliable and predictable cash flow that supports the company's broader strategic initiatives and investments.

In 2024, BP reported robust performance in its gas and low carbon energy segment, driven by strong trading results. For the first quarter of 2024, BP's adjusted EBITDA for Gas and Low Carbon Energy reached $3.3 billion, a notable increase attributed to favourable trading conditions and higher gas prices in key markets. This highlights the segment's capability to capitalize on market volatility for consistent profit generation.

- Stable Profit Generation: The integrated nature of gas trading and marketing provides a consistent and substantial underlying profit.

- Infrastructure Leverage: Existing infrastructure and market access enable efficient revenue generation and cost management.

- Higher Gas Realisations: The segment benefits from favorable market conditions that lead to increased revenue from gas sales.

- Reliable Cash Stream: It acts as a dependable source of cash flow, crucial for funding other business areas and shareholder returns.

Cash cows in the BCG matrix are established, low-growth, high-market-share businesses or products that generate more cash than they consume. These entities are the financial backbone of a company, providing stable returns and funding for other ventures. BP's upstream oil and gas operations, its refining business, and its conventional fuels marketing are prime examples of these reliable income generators.

These mature assets consistently produce substantial cash flow, essential for supporting BP's strategic investments and shareholder returns. For instance, BP's refining availability consistently exceeded 96% in Q1 2025, a testament to the operational efficiency that underpins their cash-generating capability.

The lubricants business, particularly through the Castrol brand, also historically functioned as a cash cow, boasting high profit margins and a strong market position. Despite a potential strategic review, its 2023 underlying operating profit of $1.5 billion underscores its significant financial contribution.

BP's integrated gas trading and marketing operations are another key cash cow, benefiting from strong trading results and favorable market conditions. The segment's adjusted EBITDA reached $3.3 billion in Q1 2024, highlighting its robust and reliable cash generation.

| BP Business Segment | BCG Matrix Classification | Key Financial Indicator (2023/Q1 2024 Data) | Rationale |

|---|---|---|---|

| Upstream Oil and Gas | Cash Cow | Increased upstream production in Q1 2024 | Mature assets with stable, substantial cash flow |

| Refining | Cash Cow | Targeting top quartile global net cash margin by 2025; Refining availability >96% in Q1 2025 | Reliable profit generation through efficient operations |

| Conventional Fuels Marketing | Cash Cow | Primary contributor to earnings in 2024 | Established infrastructure and brand recognition ensure consistent demand |

| Lubricants (Castrol) | Cash Cow (historically) | Underlying operating profit of $1.5 billion in 2023 | High profit margins and strong market position |

| Integrated Gas Trading & Marketing | Cash Cow | Adjusted EBITDA of $3.3 billion in Q1 2024 | Leverages infrastructure and market relationships for stable profits |

What You’re Viewing Is Included

BP BCG Matrix

The BCG Matrix analysis you are previewing is the complete, unedited document you will receive immediately after purchase. This means you get the fully formatted strategic tool, ready for immediate application in your business planning, without any watermarks or placeholder content. You can confidently use this preview as a direct representation of the high-quality, actionable insights you'll be acquiring.

Dogs

BP's US onshore wind operations are currently classified as a 'Dog' within the BCG matrix. This is evidenced by BP's ongoing divestment of its US onshore wind energy business, bp Wind Energy, to LS Power. This strategic move reflects a decision to exit mature assets that no longer align with BP's focused investment strategy and are part of a larger $20 billion asset sale program.

BP has been strategically divesting non-core retail and mobility assets, exemplified by its sale of retail fuel stations and associated EV charging infrastructure in markets like the Netherlands and Austria. These moves are part of a broader effort to streamline its downstream operations.

The company's focus is on optimizing its portfolio for higher returns and greater integration, meaning assets that don't fit this strategic vision or have a smaller market presence are being considered for divestment. This approach allows BP to concentrate resources on core, more profitable areas.

BP's strategy includes divesting at least 200,000 barrels per day of refining capacity by 2025. This move targets older, less efficient assets that fall short of top-quartile net cash margin goals. The objective is to enhance the overall profitability of its refining segment.

Certain Biofuel Production Units (Shelved Projects)

BP has strategically scaled back investments in certain sustainable aviation fuel (SAF) and renewable diesel production units, choosing to shelve some proposals. This recalibration stems from a more challenging market landscape and BP's strategic intent to streamline its biofuel operations.

The decision suggests these shelved projects were not meeting anticipated financial performance benchmarks or encountered substantial market obstacles, potentially impacting their profitability and growth prospects.

- Shelved SAF and Renewable Diesel Projects: BP's decision impacts units at existing refining sites, reflecting a strategic pivot.

- Market Headwinds: A tougher market environment is cited as a key driver for the scaling back of these biofuel initiatives.

- Portfolio Simplification: The move aims to simplify BP's overall biofuel portfolio, focusing on more promising ventures.

- Return on Investment Concerns: Projects likely faced challenges in delivering desired returns, prompting their re-evaluation.

Legacy, Lower-Margin Oil & Gas Assets

BP's strategy involves divesting around 600,000 barrels of oil equivalent per day of its oil and gas production by 2025. This move specifically targets assets with lower profit margins. The company is shedding these older, less profitable operations to build a more robust and valuable upstream business. This strategic pruning supports BP's commitment to expanding its core hydrocarbon operations.

The rationale behind this portfolio optimization is to enhance overall profitability and resilience. By focusing on higher-margin assets, BP aims to improve its financial performance and better navigate market volatility. This aligns with the broader industry trend of energy companies rationalizing their asset bases to concentrate on more competitive and sustainable production.

- Divestment Target: Approximately 600,000 boepd by 2025.

- Asset Focus: Lower-margin oil and gas production.

- Strategic Goal: Create a more resilient and higher-value upstream portfolio.

- Alignment: Supports focus on core hydrocarbon growth.

BP's US onshore wind operations are categorized as a 'Dog' in the BCG matrix, as indicated by its ongoing divestment of bp Wind Energy to LS Power. This move aligns with BP's strategy to exit less profitable, mature assets and streamline its portfolio, contributing to a broader $20 billion asset sale program. The company is prioritizing investments in areas offering higher returns and greater integration, leading to the divestment of assets that no longer fit its strategic vision.

| BCG Category | BP's Business Unit | Market Share | Market Growth | BP's Strategy |

|---|---|---|---|---|

| Dog | US Onshore Wind Energy (bp Wind Energy) | Low | Low | Divestment (e.g., sale to LS Power) |

Question Marks

BP's divestment from the Australian Renewable Energy Hub (AREH) positions large-scale green hydrogen projects like AREH as potential 'Question Marks' in a BCG Matrix. These ventures require significant capital investment, as evidenced by AREH's projected multi-billion dollar cost, but currently lack established market share or guaranteed revenue streams.

The challenges in high production costs and securing offtake agreements, as highlighted by BP's strategic reset, mean these projects are cash-intensive without immediate clear returns. This uncertainty about future market dominance and profitability places them firmly in the Question Mark category, needing careful evaluation for potential growth or divestment.

Early-stage, unproven renewable power ventures often fall into the question mark category of the BP BCG Matrix. BP's strategy shift, emphasizing fewer, more selective investments and capital-light partnerships, indicates a cautious approach to these nascent projects. This means new, large-scale renewable power ventures lacking a clear path to market dominance or profitability are viewed with significant uncertainty.

Advanced Carbon Capture, Utilization, and Storage (CCUS) projects represent a significant area of investment for BP, aiming to decarbonize existing operations and tap into future growth markets. These technologies, while holding substantial potential, are still in the nascent stages of widespread commercial adoption, placing them squarely in the question mark category of the BCG matrix.

The substantial upfront capital required for CCUS deployment, coupled with the uncertainty surrounding the long-term profitability and scalability of returns, defines their current position. For instance, BP's involvement in projects like the H2Teesside blue hydrogen facility, which incorporates CCUS, highlights the scale of investment needed. While these ventures offer high growth potential, their current low market share and unproven commercial viability at scale make them classic question marks.

New Energy Storage Solutions (beyond existing applications)

New energy storage solutions beyond established applications, such as advanced battery chemistries like solid-state or flow batteries, or emerging technologies like compressed air or gravity storage, would be considered question marks for BP. These represent potential high-growth areas within the broader energy transition, but BP's current market share and profitability in these nascent segments are likely still minimal and uncertain.

These technologies are crucial for grid stability and integrating intermittent renewables, but they require significant upfront investment and face technological hurdles. For instance, the global energy storage market, excluding pumped hydro, was projected to reach over $300 billion by 2030, indicating substantial future growth potential.

- Nascent Technologies: BP might be exploring technologies like solid-state batteries, which promise higher energy density and faster charging than current lithium-ion batteries, or long-duration storage solutions like advanced compressed air energy storage (CAES) for grid-scale applications.

- Market Uncertainty: While the overall energy storage market is expanding rapidly, the specific market share and profitability for BP in these newer, unproven storage technologies are yet to be established, reflecting their question mark status.

- High Growth Potential: These emerging storage solutions are vital for decarbonization efforts and could unlock new revenue streams for BP if they successfully scale and gain market traction, aligning with the high-growth characteristic of question marks.

Unspecified Future 'Transition Growth Engines'

BP, in its strategic outlook, acknowledges 'transition growth engines' that extend beyond its current bioenergy and EV charging ventures. These emerging areas, such as specific hydrogen applications and other lower-carbon technologies, represent significant future potential but are still in nascent stages of development. For instance, while the global hydrogen market is projected to reach $270.1 billion by 2026, the specific segments BP is targeting might still have very limited current market share.

These new initiatives are classified as question marks within the BCG matrix framework. This classification highlights their high growth potential, mirroring the characteristics of stars, but their current low market share and uncertain future success due to early-stage development. BP's investment in these areas reflects a forward-looking strategy to diversify its energy portfolio and capture future market opportunities.

- Emerging Technologies: Focus on hydrogen (e.g., green hydrogen production, hydrogen fuel cells) and other novel low-carbon solutions.

- High Growth Potential: These sectors are expected to experience significant expansion in the coming decades as the world transitions to cleaner energy.

- Low Market Penetration: Currently, these technologies have minimal market share, making their future success uncertain.

- Strategic Investment: BP is allocating resources to nurture these question marks, aiming to transform them into future stars.

Question Marks in BP's BCG Matrix represent business units or projects with low market share in high-growth industries. These ventures require substantial investment to capture market share, and their future success is uncertain. BP's strategic focus on emerging energy technologies places many of these initiatives in this category, demanding careful resource allocation.

These are essentially new ventures with potential but unproven market viability. BP's approach involves evaluating whether to invest more to turn them into Stars or divest if they fail to gain traction. The key is the high growth potential coupled with low current market penetration.

Many of BP's investments in advanced biofuels, for instance, would fit this description. While the renewable fuels market is growing, BP's specific market share in these advanced segments is likely small, and profitability is not yet assured, making them classic question marks.

| Business Unit/Project | Industry Growth | Market Share | Cash Flow | Strategic Focus |

|---|---|---|---|---|

| Green Hydrogen Projects (e.g., AREH) | High | Low | Negative | Investment for growth / Divestment evaluation |

| Advanced CCUS Technologies | High | Low | Negative | Investment for growth / Divestment evaluation |

| Emerging Energy Storage Solutions | High | Low | Negative | Investment for growth / Divestment evaluation |

| Novel Low-Carbon Technologies | High | Low | Negative | Investment for growth / Divestment evaluation |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial disclosures, market research reports, and industry growth forecasts to provide a clear strategic overview.