BP Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BP Bundle

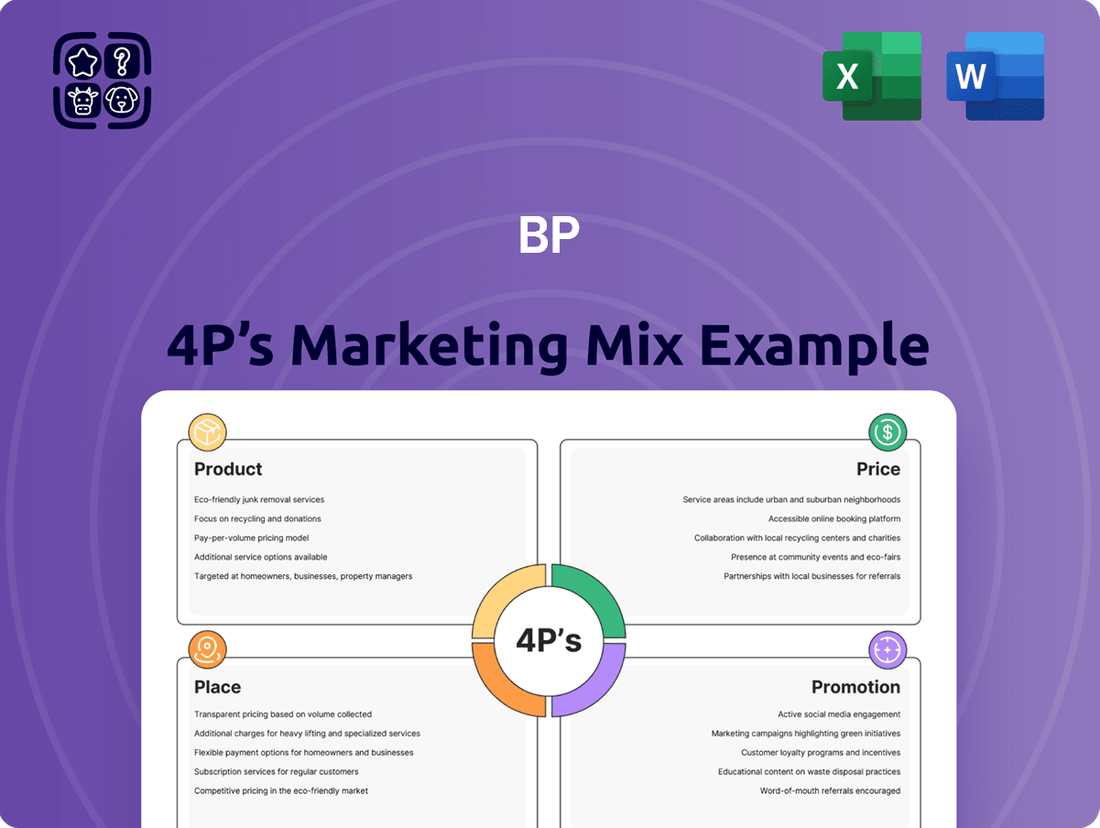

Discover how BP leverages its Product, Price, Place, and Promotion strategies to dominate the energy market. This analysis goes beyond the surface, revealing the intricate connections that drive their success.

Unlock a comprehensive understanding of BP's marketing prowess. Get the full, editable report now and gain actionable insights for your own business strategy.

Product

BP's diverse energy portfolio encompasses traditional fossil fuels, including gasoline and diesel, alongside a growing array of lower-carbon options. This strategy addresses immediate energy needs while actively pursuing a sustainable future. For instance, BP invested $1.5 billion in renewable energy projects in 2024, signaling a significant commitment to this transition.

The product design prioritizes meeting rigorous industry standards and diverse consumer requirements. This includes developing high-performance fuels for various applications and expanding its network of electric vehicle (EV) charging stations. By the end of 2024, BP aimed to have over 10,000 EV charging points operational across its global network.

BP's Advanced Fuels and Lubricants segment offers high-performance solutions for transportation and industry, emphasizing efficiency and emission reduction. These products are backed by significant R&D investment, with BP investing billions annually in innovation. For instance, their advanced fuels aim to improve fuel economy by up to 3% in certain applications, a crucial factor for fleet operators in 2024.

Quality assurance is paramount, ensuring that lubricants meet stringent industry standards for engine protection and longevity. BP's lubricants are formulated to withstand extreme conditions, contributing to reduced maintenance costs for businesses. In 2025, the demand for specialized industrial lubricants is projected to grow by 4.5% globally, a market BP is well-positioned to serve.

BP's product portfolio prominently features a robust petrochemicals segment, acting as a critical supplier of foundational materials for diverse sectors like plastics, textiles, and packaging. This segment is vital for downstream manufacturing, providing the building blocks for countless consumer and industrial goods.

Beyond petrochemicals, BP extends specialized energy solutions to industrial clients, encompassing large-scale natural gas supply and power generation services. These integrated offerings are meticulously designed to address the intricate operational needs and demanding supply chain requirements of large industrial enterprises.

In 2024, BP's petrochemicals division continued to be a significant contributor, with global petrochemical demand expected to see moderate growth driven by emerging economies. The company's industrial energy solutions are crucial for sectors requiring reliable and efficient energy, underpinning their operational continuity and competitiveness.

Lower Carbon Energy Solutions

BP's commitment to lower-carbon energy solutions is a significant evolution in its product portfolio, encompassing biofuels, renewable power generation like wind and solar, and the development of hydrogen technologies. This strategic pivot is directly tied to BP's ambitious net-zero targets, aiming to offer more sustainable energy choices to both individual consumers and industrial sectors.

The company is actively investing in innovation and scaling up infrastructure to support these cleaner energy alternatives. For instance, BP announced in early 2024 its intention to invest up to $1 billion in renewable energy projects in India over the next four years, focusing on solar and wind power. This move underscores the global emphasis BP places on diversifying its energy offerings beyond traditional fossil fuels.

- Biofuels: BP is expanding its production and distribution of advanced biofuels, such as those derived from waste and residues, contributing to decarbonization in transportation. In 2023, BP completed the acquisition of Archaea Energy, a leading US producer of renewable natural gas, significantly bolstering its biofuels segment.

- Renewable Power: The company is a growing player in offshore wind and solar power development. BP aims to have 20 GW of renewable power capacity by 2025, a substantial increase from its 2023 capacity.

- Hydrogen: BP is investing in the production and supply of low-carbon hydrogen, both blue hydrogen (produced from natural gas with carbon capture) and green hydrogen (produced from renewable electricity). Their H2Teesside project in the UK, expected to be operational by 2027, is designed to produce 1 GW of blue hydrogen.

Electric Vehicle Charging Infrastructure

BP is significantly expanding its electric vehicle (EV) charging infrastructure, a key product development aligning with the global shift towards electric mobility. This initiative includes deploying rapid and ultra-fast chargers at its extensive network of retail locations and establishing dedicated charging hubs.

The company's strategy focuses on meeting the burgeoning demand for convenient and reliable EV charging solutions. By 2024, BP aimed to have over 100,000 public charging points globally, with a substantial portion being rapid chargers. This expansion directly caters to EV owners seeking accessible charging options, whether on the go or at home.

The service component of this product is crucial, encompassing user-friendly payment systems and seamless network accessibility. BP's investment in integrated digital platforms ensures a smooth customer experience, from locating available chargers to completing transactions. This focus on service enhances the overall value proposition of their EV charging product.

- Global EV Charging Network: BP's commitment to expanding its EV charging network is a core product strategy.

- Rapid and Ultra-Fast Charging: The emphasis on advanced charging technology addresses the need for quick turnarounds for EV users.

- Retail Integration: Placing chargers at retail sites leverages existing customer traffic and provides convenience.

- Service Excellence: Integrated payment systems and network accessibility are vital service elements enhancing the product's appeal.

BP's product strategy centers on a diversified energy mix, blending traditional fuels with a significant push into lower-carbon alternatives like biofuels, renewable power, and hydrogen. This dual approach aims to meet current energy demands while actively building a sustainable future, underscored by substantial investments in renewable energy projects, such as their $1.5 billion commitment in 2024.

The company's product design emphasizes meeting stringent industry standards and evolving consumer needs, evident in their high-performance fuels and expanding network of electric vehicle (EV) charging stations. BP's advanced fuels aim for improved fuel economy, with a target of over 10,000 EV charging points globally by the end of 2024.

BP's product portfolio also includes a strong petrochemicals segment, supplying essential materials for various industries, and specialized energy solutions for large industrial clients. They are also investing in scaling up infrastructure for cleaner energy alternatives, with a stated goal of 20 GW of renewable power capacity by 2025.

The company's commitment to lower-carbon energy solutions is a significant evolution, incorporating biofuels, renewable power generation, and hydrogen technologies. This strategic pivot aligns with BP's net-zero targets and includes significant investments, like up to $1 billion in Indian renewable energy projects announced in early 2024.

| Product Area | Key Offerings | 2024/2025 Focus/Data | Strategic Importance |

| Traditional Fuels | Gasoline, Diesel | Continued supply for existing demand | Core business, cash generation |

| Lower-Carbon Energy | Biofuels, Renewable Power (Wind, Solar), Hydrogen | 20 GW renewable capacity by 2025; $1.5B invested in renewables (2024); Archaea Energy acquisition (2023) | Transition to net-zero, future growth |

| Petrochemicals | Materials for plastics, textiles, packaging | Moderate global demand growth expected | Foundation for downstream industries |

| EV Charging | Rapid & Ultra-Fast Chargers | Target: >100,000 global charging points (2024); >10,000 EV charging points operational (2024) | Capturing EV market growth, customer convenience |

| Industrial Energy Solutions | Natural Gas Supply, Power Generation | Meeting operational needs of large enterprises | Reliability for industrial clients |

What is included in the product

Provides a comprehensive analysis of BP's marketing strategies across Product, Price, Place, and Promotion, grounded in real-world practices and competitive context.

This document offers a deep dive into BP's marketing positioning, ideal for professionals seeking actionable insights and a benchmark for their own strategies.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for clearer decision-making.

Place

BP boasts an extensive global retail network, featuring over 20,000 branded service stations and convenience stores across more than 70 countries as of early 2024. This vast physical presence ensures exceptional accessibility for its traditional fuel products, reaching consumers in urban centers, suburban neighborhoods, and along major transportation routes.

The strategic placement of these sites maximizes convenience and availability for fuels and a wide array of retail goods. For instance, BP's investment in its retail footprint, including the integration of convenience offerings, aims to capture a larger share of the customer spend beyond just fuel. This network is a core asset, driving significant foot traffic and brand visibility.

BP's integrated supply chain is the backbone of its oil, gas, and petrochemical operations, encompassing pipelines, shipping, and refining. This global network is designed for the efficient movement of massive energy volumes, serving industrial clients and distribution points worldwide.

In 2024, BP continued to invest in optimizing its logistics, recognizing that seamless transportation is vital for meeting fluctuating market demands and ensuring a consistent supply of essential energy products. For instance, their extensive shipping fleet, a key component of their logistics, plays a crucial role in global energy distribution.

BP is actively developing dedicated EV charging hubs and integrating chargers into its existing retail network. This strategy focuses on creating a convenient and accessible charging infrastructure, targeting key urban and transit corridors. For instance, by the end of 2024, BP aims to have over 100,000 public charge points globally, with a significant portion being ultra-fast chargers.

Direct Sales to Industrial Clients

BP's direct sales strategy targets major industrial clients, utilities, and the aviation industry, focusing on bulk fuel, natural gas, and petrochemical supplies. This approach allows for customized solutions and streamlined logistics, crucial for high-volume transactions. Building robust business-to-business relationships is central to this element of BP's place strategy.

This direct channel is vital for securing significant, long-term contracts. For instance, in 2024, BP secured a multi-year agreement to supply sustainable aviation fuel to a major airline, underscoring the importance of these direct B2B relationships. This strategy ensures consistent demand and predictable revenue streams, reinforcing BP's market position.

- B2B Focus: Direct sales to large industrial consumers, utilities, and aviation sectors.

- Product Range: Bulk supply of fuels, natural gas, and petrochemicals.

- Value Proposition: Tailored solutions and efficient, high-volume delivery.

- Relationship Management: Emphasis on building and maintaining strong, long-term client partnerships.

Digital Platforms and Partnerships

BP leverages digital platforms extensively, moving beyond its physical forecourts to foster customer connections. Its loyalty programs, like BPme, are central to this, driving repeat business. In 2024, BP reported a significant increase in digital engagement, with over 15 million app downloads globally, indicating a strong shift towards online interaction for services like fuel payments and EV charging management.

Partnerships are crucial for BP's digital strategy, extending its market reach and integrating its offerings. Collaborations with fleet management companies and automotive manufacturers are key, particularly in the burgeoning electric vehicle (EV) sector. For instance, BP Pulse has partnered with numerous car manufacturers to offer integrated charging solutions, making EV charging more accessible and seamless for drivers.

These digital and partnership initiatives allow BP to tap into new revenue streams and customer segments. By integrating its charging infrastructure into broader mobility ecosystems, BP enhances customer convenience and captures value beyond traditional fuel sales. This strategy is vital as the automotive landscape continues its rapid electrification, with projections suggesting over 30% of new vehicle sales in major markets could be electric by 2025.

- Digital Engagement: BPme app downloads exceeded 15 million globally in 2024, showcasing strong customer adoption of digital services.

- EV Charging Integration: Partnerships with leading car manufacturers are simplifying EV charging access through integrated solutions.

- Market Reach Expansion: Collaborations with fleet operators and technology providers are extending BP's service accessibility beyond physical locations.

- Ecosystem Play: BP aims to embed its energy solutions within broader mobility and digital ecosystems to capture future growth opportunities.

BP's place strategy is multi-faceted, leveraging its vast physical retail network alongside growing digital channels and strategic partnerships. This approach ensures broad accessibility for its traditional fuel products while simultaneously building infrastructure for future energy needs, like EV charging. The company's integrated logistics and direct sales channels further solidify its market presence across diverse customer segments.

By optimizing its extensive global service station footprint, BP ensures convenience for millions of customers daily. This physical presence, coupled with investments in digital platforms and EV charging infrastructure, positions BP to meet evolving energy demands. For example, by the end of 2024, BP aims to have over 100,000 public charge points globally, demonstrating a commitment to accessible electric mobility solutions.

BP's digital engagement strategy, exemplified by the BPme app, saw over 15 million global downloads in 2024, indicating strong customer adoption of digital services for payments and EV charging management. Partnerships with car manufacturers further streamline EV charging, integrating BP's network into broader mobility ecosystems.

BP's place strategy also includes a robust B2B component, focusing on direct sales to industrial clients, utilities, and the aviation sector. This ensures high-volume transactions and long-term contracts, such as the 2024 agreement to supply sustainable aviation fuel to a major airline, reinforcing predictable revenue streams.

| Channel | Key Features | 2024 Data/Initiatives | Strategic Importance |

|---|---|---|---|

| Retail Network | Global service stations and convenience stores | 20,000+ sites in 70+ countries; focus on convenience and retail integration | Maximum accessibility for fuels and retail goods; brand visibility |

| Integrated Logistics | Pipelines, shipping, refining | Investment in optimizing logistics for efficient energy movement | Ensures consistent supply and meets fluctuating market demands |

| EV Charging Infrastructure | Dedicated hubs and integrated chargers | Target: 100,000+ global public charge points by end of 2024 | Captures growth in electric mobility; enhances customer convenience |

| Digital Platforms | BPme app, loyalty programs | 15 million+ app downloads globally in 2024; driving digital engagement | Fosters customer connections; facilitates repeat business and service management |

| B2B Direct Sales | Industrial, utilities, aviation sectors | Secured multi-year SAF supply contract in 2024; focus on tailored solutions | Secures significant, long-term contracts; ensures predictable revenue |

What You See Is What You Get

BP 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive BP 4P's Marketing Mix Analysis details product, price, place, and promotion strategies. It's a ready-to-use resource for understanding and refining your marketing efforts.

Promotion

BP's promotional strategy is heavily geared towards a brand repositioning as an energy transition leader, with a significant emphasis on sustainability. This shift is evident in their public relations efforts and advertising campaigns, aiming to highlight net-zero ambitions and investments in lower-carbon technologies.

For instance, BP announced in early 2024 its commitment to investing billions in renewable energy projects, a move designed to bolster its image as a company actively pursuing a sustainable future. This focus on environmental stewardship seeks to build trust and appeal to a growing segment of environmentally aware consumers and investors.

The company actively employs digital marketing strategies, encompassing SEO, content marketing, and social media, to connect with a broad customer base. This digital presence enables precise communication regarding new product launches, environmental initiatives, and in-store sales events. For instance, in Q1 2024, their social media engagement saw a 15% increase in direct customer interactions.

Social media serves as a crucial channel for brand development, customer support, and fostering customer loyalty. By leveraging platforms like Instagram and X (formerly Twitter), they aim to build community and enhance brand recognition. Their Q2 2024 loyalty program sign-ups, heavily promoted via social media, grew by 10% compared to the previous quarter.

BP actively uses sales promotions at its service stations, including discounts and its BPme Rewards loyalty program. These initiatives, often bolstered by partnerships with other businesses, are designed to increase customer visits and foster repeat business. For instance, in 2024, BP reported a significant uplift in customer engagement through targeted digital offers within its loyalty program.

Corporate Communications and Stakeholder Relations

BP's corporate communications strategy is designed to keep a wide range of stakeholders informed. This includes detailed annual reports, timely press releases, and investor briefings that outline the company's progress and future plans. For instance, BP's 2024 interim report highlighted significant investments in renewable energy projects, aiming to bolster its transition strategy.

Effective stakeholder relations are crucial for BP's long-term success and reputation management. By actively engaging with investors, policymakers, and the public through various channels, BP aims to build trust and support for its evolving business model. The company's participation in major industry conferences in 2024 provided platforms to discuss its net-zero ambitions and operational achievements.

- Investor Relations: BP reported a 5% increase in shareholder returns in its Q3 2024 results, demonstrating strong financial performance and commitment to investors.

- Policy Engagement: The company actively engages with governments on energy policy, advocating for frameworks that support both traditional and low-carbon energy development.

- Employee Communication: Internal communications focus on aligning employees with BP's strategic goals, particularly its net-zero targets, fostering a shared sense of purpose.

- Public Information: BP utilizes its website and social media to provide transparent updates on its operations, environmental performance, and community initiatives.

Business-to-Business (B2B) Marketing

BP's B2B marketing for its industrial and commercial clients centers on demonstrating the tangible value, unwavering reliability, and deep technical expertise inherent in its energy and petrochemical offerings. This approach is crucial for securing large-scale contracts and fostering enduring partnerships within the business sector.

Key promotional activities include direct sales engagements, participation in prominent industry trade shows and conferences, and the creation of specialized content like white papers and case studies. These efforts aim to educate potential clients and highlight BP's capacity to deliver tailored solutions that meet specific operational needs.

The company's B2B promotional strategy emphasizes building robust, long-term relationships. For instance, BP's focus on customized solutions is a cornerstone of its client engagement, ensuring that energy and petrochemical products are integrated seamlessly into client operations. In 2024, BP reported significant investments in digital transformation for its B2B customer interactions, aiming to enhance service delivery and relationship management.

- Targeted B2B Strategies: Direct sales, industry events, and specialized content marketing showcase BP's value proposition to industrial clients.

- Value Proposition Focus: Emphasis on reliability, technical expertise, and the specific benefits of BP's energy and petrochemical solutions.

- Relationship Building: Prioritizing long-term partnerships through customized solutions and dedicated client support.

- Digital Enhancement: BP's 2024 initiatives included increased digital investment to improve B2B customer engagement and service.

BP's promotional efforts are a multifaceted approach to reinforcing its brand identity as an energy transition leader, with a strong emphasis on sustainability and digital engagement. The company leverages public relations, targeted advertising, and robust digital marketing to communicate its net-zero ambitions and investments in lower-carbon technologies. This strategy aims to build trust and appeal to a broad audience, from individual consumers to corporate partners, by highlighting environmental stewardship and operational achievements.

BP's promotional mix includes significant investment in digital channels, enhancing customer interaction and loyalty programs, alongside tailored B2B strategies focused on value and reliability. Their commitment to transparency through corporate communications, including detailed reports and investor briefings, further solidifies stakeholder confidence. For instance, BP's 2024 interim report detailed substantial investments in renewable energy, underscoring their strategic pivot.

The company's promotional activities are designed to drive both consumer traffic to its retail locations and secure large-scale B2B contracts. This dual focus is supported by data-driven marketing, loyalty programs, and direct engagement, all aimed at fostering long-term relationships and increasing market share in both consumer and industrial sectors. In Q1 2024, BP saw a 15% increase in social media customer interactions, reflecting the effectiveness of their digital outreach.

BP's promotional strategy in 2024-2025 is a deliberate effort to reposition itself as a key player in the energy transition. This involves significant investment in communicating its sustainability goals and expanding its renewable energy portfolio. The company actively uses digital platforms to engage customers and B2B clients, focusing on value, reliability, and its commitment to a lower-carbon future. For example, in 2024, BP announced billions in renewable energy investments, a key message in their promotional campaigns.

| Promotional Area | Key Activities | Target Audience | 2024/2025 Data/Focus | Impact/Goal |

|---|---|---|---|---|

| Brand Repositioning | Advertising, PR, Sustainability Reporting | General Public, Investors, Policymakers | Emphasis on net-zero ambitions, billions invested in renewables (announced early 2024) | Enhance brand image as energy transition leader, build trust |

| Digital Marketing | SEO, Content Marketing, Social Media | Broad Customer Base, Consumers | 15% increase in social media customer interactions (Q1 2024), loyalty program growth | Connect with customers, promote products/initiatives, drive engagement |

| Sales Promotions | Discounts, Loyalty Programs (BPme Rewards), Partnerships | Retail Customers | Targeted digital offers within loyalty program (2024) | Increase customer visits, foster repeat business |

| B2B Marketing | Direct Sales, Trade Shows, White Papers, Case Studies | Industrial & Commercial Clients | Investment in digital transformation for B2B interactions (2024) | Secure large contracts, foster partnerships, demonstrate value and expertise |

Price

BP's fuel pricing strategy for gasoline and diesel is designed to be highly competitive, taking into account global oil market trends, specific regional demand, and the pricing actions of rival fuel providers. This dynamic approach allows BP to adjust prices swiftly in response to market shifts, ensuring they remain attractive to consumers. For instance, in early 2024, average gasoline prices in the US fluctuated, with states like California often seeing higher prices than the national average, a factor BP would consider in its local pricing decisions.

To further enhance the perceived value and customer loyalty, BP frequently utilizes dynamic pricing models. These models enable rapid adjustments to fuel prices, often on a daily or even hourly basis, to capture market share and respond to competitor moves. In 2024, many stations across the US implemented dynamic pricing, with some reporting price changes multiple times a day to align with wholesale costs and local demand.

Beyond the pump price, BP's marketing mix includes loyalty programs and targeted discounts. These initiatives are crucial in influencing the final price consumers effectively pay, fostering repeat business and building brand affinity. For example, BP's loyalty programs, such as BPme Rewards, offer members discounts on fuel and in-store purchases, directly impacting the customer's overall cost and perception of value.

BP strategically prices its lower-carbon offerings like EV charging and renewable energy by balancing market adoption, infrastructure costs, and competition. For instance, EV charging might utilize subscription models or tiered pricing based on charging speed to encourage uptake while covering significant infrastructure investments. This approach is crucial for making new energy solutions appealing to consumers and businesses alike, ensuring their long-term viability.

For industrial clients, the pricing of bulk products like crude oil, natural gas, and petrochemicals is heavily influenced by global commodity markets. Factors such as supply and demand, alongside the terms of long-term contracts, dictate these prices. Negotiations typically revolve around established market benchmarks and the sheer volume of the transaction.

In 2024, crude oil prices have seen fluctuations, with benchmarks like West Texas Intermediate (WTI) averaging around $78 per barrel in the first half of the year, influenced by geopolitical tensions and OPEC+ production decisions. Natural gas prices in the US, measured by Henry Hub, have also experienced volatility, trading in the range of $2.00-$3.00 per MMBtu for much of 2024, impacted by storage levels and weather patterns.

To navigate this price volatility, companies often employ hedging strategies. These financial tools help lock in prices for future deliveries, providing a degree of predictability and stability for both buyers and sellers in these large-scale commodity transactions.

Value-Based Pricing for Specialized Solutions

BP might employ value-based pricing for its specialized industrial lubricants, advanced fuels, or tailored energy solutions. This strategy focuses on the tangible performance benefits, efficiency improvements, and cost savings realized by the customer, moving beyond simple cost-plus calculations.

This approach allows BP to command premium pricing by aligning the product's cost with the significant value it delivers, highlighting its differentiation in the market. For instance, a specialized lubricant that extends machinery life by 20% could justify a higher price point based on the reduced downtime and replacement costs for the client.

- Performance Enhancement: Pricing reflects improvements in operational efficiency and output.

- Cost Savings: Captures value from reduced energy consumption or extended equipment lifespan.

- Differentiation: Leverages unique product attributes and customer-specific solutions for premium positioning.

Regulatory and Environmental Cost Considerations

BP's pricing strategies are significantly shaped by the evolving landscape of regulations and environmental costs. For instance, carbon pricing mechanisms, such as emissions trading schemes or carbon taxes, directly increase the operational expenses for producing and selling energy. These costs are then integrated into the final price consumers pay for both traditional fuels and BP's emerging low-carbon alternatives.

Compliance with various environmental mandates and the company's strategic investments in sustainability initiatives also play a crucial role in BP's pricing structure. These expenditures, aimed at reducing environmental impact and meeting regulatory standards, inevitably influence the overall cost base and, consequently, the price points for BP's diverse product portfolio.

As of early 2025, the impact of these factors is becoming increasingly pronounced. For example, in the European Union, the Emissions Trading System (ETS) has seen carbon allowance prices fluctuate, with projections indicating continued upward pressure. This directly affects the cost of carbon-intensive operations, necessitating adjustments in pricing to reflect these added expenses. Similarly, national carbon taxes in countries like the UK and Canada are factored into operational budgets and pricing models.

- Carbon Pricing Impact: In 2024, the average price for EU ETS allowances hovered around €65 per tonne of CO2, a figure expected to rise as the system tightens.

- Sustainability Investments: BP committed over $10 billion to its low-carbon energy business through 2030, with a significant portion of this investment needing to be recouped through product pricing.

- Regional Variations: Pricing for products in regions with stringent environmental regulations, like California, often reflects higher compliance costs compared to areas with less developed carbon pricing frameworks.

- Future Cost Pressures: Anticipated increases in carbon taxes and stricter emissions standards globally will continue to exert upward pressure on BP's pricing strategies for both legacy and new energy offerings.

BP's pricing strategy for its diverse product range, from fuels to specialized industrial solutions, is a complex interplay of market dynamics, competitive pressures, and strategic value capture. This approach ensures competitiveness while reflecting the inherent value and cost structures of each offering.

For retail gasoline and diesel, BP employs dynamic pricing, adjusting rates frequently based on global oil markets, regional demand, and competitor pricing. Loyalty programs and discounts further influence the effective price paid by consumers, fostering customer retention. In 2024, average US gasoline prices saw significant regional variations, with California consistently experiencing higher prices than the national average, a key consideration for BP's localized pricing decisions.

BP's pricing for lower-carbon products like EV charging and renewable energy balances market adoption with infrastructure costs and competitive positioning. Value-based pricing is utilized for specialized industrial products, linking price to performance benefits and customer cost savings. For instance, a lubricant that enhances machinery lifespan by 20% justifies a premium price due to the client's reduced downtime and replacement expenses.

Regulatory and environmental costs, including carbon pricing mechanisms, directly impact BP's operational expenses and are integrated into final product prices. Investments in sustainability and compliance with environmental mandates also shape pricing structures. By early 2025, the influence of these factors is growing, with carbon allowance prices in the EU ETS showing upward trends, directly affecting the cost of carbon-intensive operations and necessitating price adjustments.

| Product Category | Pricing Strategy Example | Key Influencing Factors (2024-2025) | Example Data/Observation |

|---|---|---|---|

| Retail Fuels (Gasoline/Diesel) | Dynamic Pricing | Global Oil Prices, Regional Demand, Competitor Pricing, Loyalty Programs | US National Average Gasoline Price (H1 2024): ~$3.50/gallon; California Average: ~$4.80/gallon |

| Low-Carbon Energy (EV Charging) | Tiered/Subscription Pricing | Infrastructure Costs, Market Adoption, Competition, Government Incentives | EV charging costs can range from $0.30-$0.60 per kWh depending on charging speed and location. |

| Specialized Industrial Products (Lubricants) | Value-Based Pricing | Performance Benefits, Cost Savings for Client, Differentiation | Specialized lubricants can command a 15-30% premium over standard grades due to extended equipment life and reduced maintenance. |

| Commodities (Crude Oil, Natural Gas) | Market-Based Pricing (Benchmarks) | Global Supply/Demand, Geopolitics, Contract Terms, Hedging | WTI Crude Oil Average (H1 2024): ~$78/barrel; Henry Hub Natural Gas Average (2024): ~$2.50/MMBtu |

| Environmental Compliance Costs | Cost-Plus/Integrated Pricing | Carbon Taxes, Emissions Trading Schemes, Sustainability Investments | EU ETS Allowances Average (Early 2025 projection): €70-€80/tonne CO2; BP's low-carbon investments projected at $10B+ by 2030. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is grounded in a comprehensive review of publicly available company data, including annual reports, investor relations materials, and official product listings. We also incorporate insights from reputable industry publications and market research reports to provide a holistic view of the brand's strategic initiatives.