BP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BP Bundle

Porter's Five Forces Analysis for BP reveals the intense competition within the energy sector, highlighting the significant power of buyers and the constant threat of new entrants. Understanding these dynamics is crucial for navigating BP's complex market landscape.

The complete report reveals the real forces shaping BP’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oil and gas sector often faces significant supplier concentration, particularly for specialized equipment and advanced technologies essential for exploration and production. A limited number of global suppliers dominate the provision of these critical inputs, granting them considerable leverage.

For instance, companies requiring proprietary drilling technologies or highly specialized engineering services may find themselves dependent on a handful of providers. This dependence is amplified when alternative suppliers are scarce or lack the necessary expertise, as seen in the market for advanced seismic imaging technology where a few key players hold a substantial market share.

The bargaining power of these suppliers is directly tied to the availability of viable alternatives for crucial components and services. When switching costs are high and specialized knowledge is paramount, suppliers can command premium pricing, impacting the profitability of oil and gas firms.

Suppliers offering highly specialized components, like advanced drilling technology or unique catalysts essential for refining, wield significant bargaining power. This is because finding suitable alternatives for such inputs can be challenging and costly. For instance, in 2024, the demand for specialized equipment in offshore wind farm installation saw suppliers with proprietary technology commanding higher prices due to limited competition.

Switching suppliers in the oil and gas industry often carries significant financial and operational burdens. These can include the expense of retooling existing infrastructure to accommodate new materials or equipment, the cost of retraining personnel on new processes, and the potential for costly disruptions to ongoing operations. For example, a refinery might need to invest millions in modifications to process a different type of crude oil, directly impacting its flexibility and increasing reliance on its current supplier.

These substantial switching costs effectively bolster the bargaining power of established suppliers. When it's difficult and expensive for a company like BP to change providers, existing suppliers can command higher prices or more favorable terms. BP's strategic use of long-term contracts and its highly integrated supply chain further solidify this dynamic, making it even more challenging and costly to explore alternative sourcing options.

Threat of Forward Integration

The threat of forward integration by suppliers can significantly bolster their bargaining power against BP. If suppliers possess the capability and inclination to move into BP's core business areas, such as exploration, production, or refining, they can directly challenge BP's market position. While this is less probable in the extremely capital-intensive upstream and refining segments, it remains a pertinent consideration for specialized service providers or technology firms that could offer integrated solutions.

For instance, a sophisticated technology provider offering advanced drilling services might leverage its expertise to eventually offer end-to-end project management, thereby competing with BP's operational capabilities. Such a move would shift the power dynamic, as BP would then face a direct competitor rather than just a supplier.

Consider the scenario where a key supplier of specialized subsea equipment, having developed deep operational knowledge through its contracts with BP, decides to enter the offshore field development market. This would transform a supplier relationship into a competitive one, forcing BP to contend with a new market player that already understands its operational needs and challenges.

- Supplier Capability: Suppliers with unique technologies or deep operational knowledge are more likely to consider forward integration.

- Capital Intensity: The high capital requirements in oil and gas operations generally deter many suppliers from direct integration into core BP activities.

- Specialized Services: Niche service providers or technology firms represent a more plausible threat for forward integration than raw material suppliers.

- Competitive Landscape: The overall competitive intensity within BP's operational segments influences the attractiveness of forward integration for suppliers.

Importance of Supplier to BP

The degree to which a supplier depends on BP for its business significantly influences the bargaining power dynamic. If BP accounts for a substantial percentage of a supplier's total sales, BP can leverage this importance to negotiate more favorable terms, potentially lowering costs or improving service levels. For instance, in 2024, major oilfield service providers often saw their revenue heavily tied to the production volumes of large integrated companies like BP, giving those companies considerable sway in contract negotiations.

Conversely, if BP represents only a minor portion of a supplier's revenue stream, the supplier holds more power. This is particularly true for specialized or niche suppliers whose products or services are critical and not easily substituted. In such scenarios, suppliers are less incentivized to concede to BP's demands, as losing BP as a client would have a minimal impact on their overall business. This was evident in the procurement of advanced digital solutions for upstream operations, where a few specialized technology firms held significant leverage over major energy players.

- Supplier Dependence: When BP constitutes a large share of a supplier's revenue, BP's bargaining power increases.

- BP's Client Size: Conversely, if BP is a small client to the supplier, the supplier's power is amplified.

- Market Concentration: The availability of alternative suppliers for critical inputs also dictates this power balance.

- Strategic Importance of Goods/Services: The criticality of the procured item to BP's operations further shapes the negotiation leverage.

Suppliers of critical, specialized inputs or services possess significant bargaining power. This is particularly true when there are few alternative providers or when switching costs for the buyer are high.

In 2024, the oil and gas industry continued to see suppliers of advanced subsea equipment and proprietary drilling technologies command premium prices. For example, companies needing specialized seismic data processing services often faced a concentrated market, with a few firms holding the majority of the market share.

The threat of forward integration by suppliers, though less common in capital-intensive segments, can also enhance their leverage. This is more plausible for niche technology providers who might offer integrated solutions, thereby becoming direct competitors.

Ultimately, the bargaining power of suppliers is a key factor in the profitability of firms within the oil and gas sector, influencing pricing and operational flexibility.

| Factor | Impact on Supplier Bargaining Power | Example in Oil & Gas (2024) |

|---|---|---|

| Supplier Concentration | High | Limited providers of advanced seismic imaging technology. |

| Switching Costs | High | Significant investment needed to retool refineries for different crude types. |

| Forward Integration Threat | Moderate (for niche providers) | Technology firms offering integrated drilling services. |

| Supplier Dependence on Buyer | Low (when buyer is a small client) | Specialized digital solution providers to large energy companies. |

What is included in the product

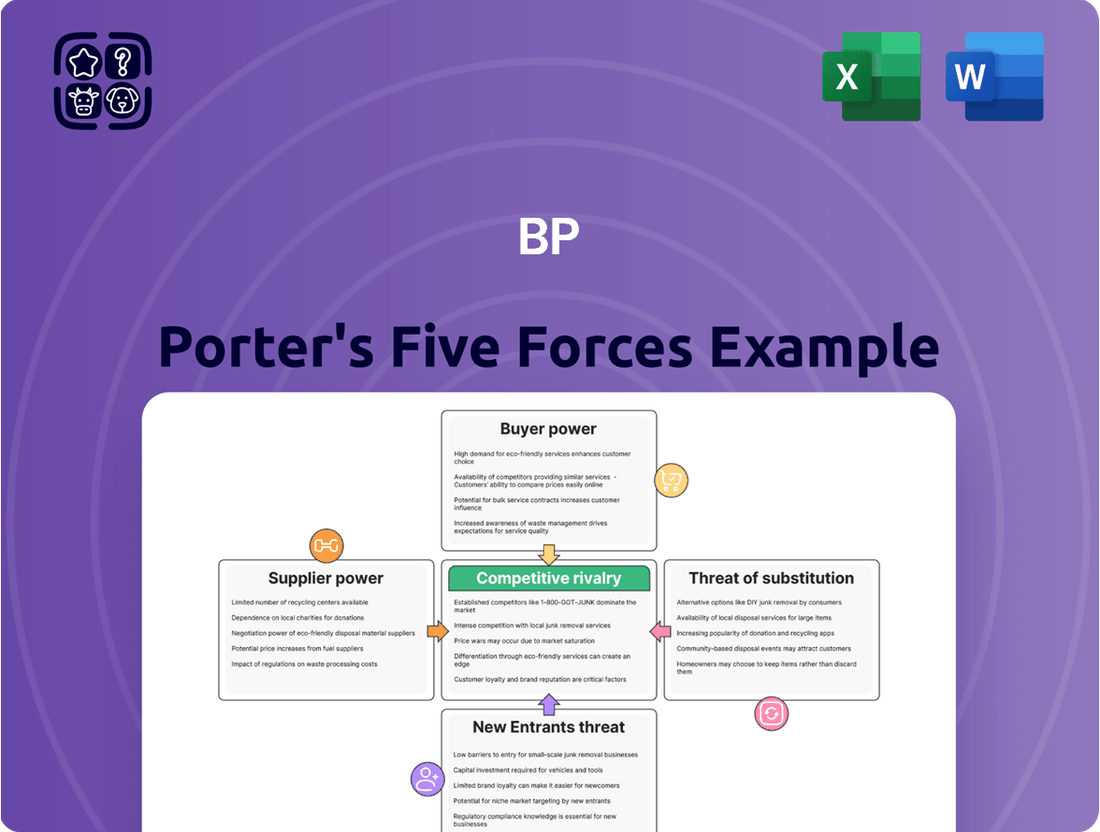

Analyzes the five competitive forces shaping BP's industry: the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Quickly identify and address competitive threats by visually mapping the intensity of each Porter's Five Force, allowing for targeted strategic adjustments.

Customers Bargaining Power

BP's customer base is incredibly diverse, ranging from massive industrial corporations and government entities to everyday individuals filling up at their petrol stations. This broad spectrum means the power customers wield isn't uniform. Large industrial buyers, for instance, often command greater influence due to the sheer volume of fuel they purchase, enabling them to negotiate more favorable terms.

In contrast, individual consumers at retail sites typically possess much less bargaining power. Their purchasing decisions are often driven by immediate need and location, with less ability to influence pricing or terms significantly. This segmentation is crucial for understanding the overall customer bargaining power dynamic within BP's operations.

The company's strategic push into areas like electric vehicle (EV) charging and biofuels further diversifies its customer touchpoints. While still nascent, these emerging segments represent new customer groups with potentially different expectations and bargaining capacities, adding another layer to the analysis of customer power.

Customers' price sensitivity is a major factor in their bargaining power. For basic, widely available products like gasoline, consumers are very aware of price differences and will readily switch suppliers for a better deal. This makes them highly price-sensitive, giving them significant leverage over companies like BP. For instance, in 2024, the average retail price of gasoline in the US saw considerable volatility, directly influencing consumer purchasing decisions.

However, this sensitivity isn't uniform across all of BP's offerings. When it comes to specialized petrochemicals or long-term energy supply agreements, customers often have fewer alternatives and may be locked into contracts, making them less price-sensitive. This allows BP more room to negotiate pricing and maintain margins on these specific products.

Global energy markets play a crucial role in shaping customer price sensitivity. Significant swings in oil and gas prices, such as those observed throughout 2024 due to geopolitical events and supply chain adjustments, directly amplify or dampen how much customers care about the price they pay. When prices are high, customers become more attuned to every cent, increasing their bargaining power.

Customers increasingly have a wider array of choices for energy, especially with the growth in renewable sources like solar and wind power, alongside the expanding electric vehicle market. This abundance of alternatives directly enhances their bargaining power against traditional energy providers like BP, as they can more readily switch to different solutions.

For instance, in 2023, global renewable energy capacity saw a significant surge, with solar PV alone accounting for a substantial portion of new installations. This trend directly impacts BP's customer base, offering them viable alternatives to fossil fuels and pressuring the company to adapt.

BP's strategic investments in lower-carbon energy solutions, such as biofuels and EV charging infrastructure, are a direct response to this evolving market dynamic. By diversifying its offerings, BP aims to retain its customer base by providing them with the cleaner energy options they increasingly demand.

Customer Information and Transparency

The increasing transparency in energy markets, especially for retail fuel, significantly empowers customers. Easy access to price comparison tools means customers can quickly identify the most competitive offers, directly diminishing BP's ability to dictate prices. For instance, in 2024, the proliferation of fuel price comparison apps across major markets has made real-time pricing information readily available to millions of drivers.

Industrial clients, by their nature, often employ highly sophisticated procurement strategies. Their deep understanding of market dynamics, coupled with extensive data analysis capabilities, grants them substantial information advantages. This allows them to negotiate more effectively, leveraging their knowledge to secure better terms and pricing from suppliers like BP.

- Retail Fuel Transparency: In 2024, over 70% of consumers in developed markets reported using price comparison apps for fuel purchases, a significant increase from previous years.

- Industrial Procurement Sophistication: Large industrial customers often have dedicated procurement teams that conduct detailed cost-benefit analyses and supplier performance reviews, giving them considerable leverage.

- Information Access: The widespread availability of market data, including futures prices and supply chain information, levels the playing field, reducing information asymmetry between BP and its customers.

- Price Sensitivity: For many customer segments, particularly in the retail and transportation sectors, price remains a primary decision-making factor, amplifying the impact of enhanced customer information.

Switching Costs for Customers

For everyday consumers, the ease of switching fuel providers significantly bolsters their bargaining power. In 2024, the retail fuel market continues to see low barriers to entry and minimal customer loyalty programs that lock consumers in, allowing them to readily move to competitors offering better prices or services.

Industrial customers, however, often face higher switching costs. Those with substantial investments in specific fuel infrastructure or locked into long-term supply contracts in 2024 may find it more difficult and expensive to change providers, thus diminishing their immediate leverage.

Nevertheless, the broader energy landscape is evolving. The increasing diversification of energy sources and the development of more flexible infrastructure are gradually lowering switching costs across the board, even for industrial users, over the long term.

- Consumer Switching: Retail fuel customers in 2024 face negligible costs when changing providers, enhancing their bargaining power.

- Industrial Switching: For large industrial clients, established infrastructure and existing contracts can create substantial switching costs, reducing their immediate leverage.

- Long-Term Trend: The ongoing energy transition and technological advancements are progressively reducing switching costs industry-wide.

The bargaining power of customers with BP is notably influenced by their price sensitivity and the availability of alternatives. For readily available products like gasoline, consumers are highly attuned to price differences, readily switching suppliers to find better deals. This price sensitivity was evident in 2024, with significant volatility in retail gasoline prices directly impacting consumer choices.

Conversely, for specialized products or long-term energy contracts, customers often have fewer options and are less price-sensitive due to contractual obligations, granting BP more negotiation flexibility. The global energy market's fluctuations, influenced by geopolitical events and supply chain dynamics in 2024, further amplify or diminish this customer price sensitivity.

The increasing availability of alternative energy sources, such as renewables and electric vehicles, directly empowers customers by providing viable substitutes to traditional fossil fuels. This trend pressures companies like BP to adapt and diversify their offerings to retain their customer base, as seen in BP's investments in biofuels and EV charging infrastructure.

| Customer Segment | Bargaining Power Factors | 2024 Data/Observation |

|---|---|---|

| Retail Consumers | High price sensitivity, low switching costs, access to price comparison tools. | Over 70% of consumers in developed markets used fuel price apps in 2024. |

| Industrial Clients | Lower price sensitivity for specialized products, higher switching costs, sophisticated procurement. | Long-term contracts and infrastructure investments can limit immediate leverage. |

| Overall Market | Increasing availability of alternative energy sources, growing transparency. | Global renewable capacity surged in 2023, offering more choices to energy consumers. |

Preview Before You Purchase

BP Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for BP, providing a detailed examination of industry competition. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. You can trust that this professionally formatted analysis is ready for your immediate use and strategic planning needs.

Rivalry Among Competitors

The oil and gas sector is characterized by a highly concentrated market, with a handful of major international oil companies (IOCs) and national oil companies (NOCs) holding significant sway. This structure breeds intense competition among these giants.

BP faces formidable rivals such as Shell, ExxonMobil, Chevron, and Saudi Aramco, all of whom possess substantial resources and global reach. For instance, in 2023, ExxonMobil reported a net income of $36 billion, while Chevron posted $21.4 billion, illustrating the financial muscle of key competitors.

This concentration means that competition for market share, access to reserves, and technological innovation is exceptionally fierce. Companies like BP are constantly vying for advantageous positions in exploration, production, and refining.

In the traditional oil and gas sector, which is largely mature, a slowing or even negative demand growth rate naturally fuels more intense competition. Companies are vying more aggressively for the existing market share, leading to heightened rivalry. For instance, in 2023, global oil demand growth was projected to be around 2 million barrels per day, a slowdown from previous years, which puts pressure on established players.

The evolving energy landscape presents both challenges and opportunities. The growth in lower-carbon energy segments, such as renewables and biofuels, is creating new arenas for competition and, importantly, for collaboration. BP's strategic pivot, with its 2025 reset, acknowledges this by maintaining a focus on oil and gas production while strategically allocating capital to promising low-carbon ventures, aiming to balance current revenue streams with future energy needs.

For foundational energy commodities like crude oil and natural gas, product differentiation is inherently low, intensifying competition primarily on price. BP, however, actively works to stand out through its established brand recognition, its extensive retail network, and a growing emphasis on lower-carbon energy solutions and integrated service offerings.

The company's strategic investments in electric vehicle (EV) charging infrastructure and biofuels are key initiatives designed to cultivate distinct value propositions in an evolving energy landscape. In 2023, BP reported significant investments in its convenience and mobility segment, which includes its retail operations and EV charging, signaling a commitment to these differentiating factors.

Exit Barriers

BP faces significant competitive rivalry partly due to high exit barriers. These barriers, like substantial investments in fixed assets such as refineries and extensive pipeline networks, make it economically unfeasible for companies to leave the oil and gas market easily. Even when profits are low, these sunk costs compel firms to continue operating, thereby maintaining a crowded and competitive landscape.

BP's own considerable asset base, including its global refining capacity and logistical infrastructure, exemplifies these high exit barriers. This means BP, like its peers, is likely to remain engaged in the market, contributing to sustained competitive intensity. For instance, in 2023, BP's capital expenditure was around $16 billion, much of which is directed towards maintaining and upgrading these long-lived assets, reinforcing the difficulty of exiting the industry.

- High Fixed Asset Investment: The oil and gas sector requires massive upfront capital for exploration, extraction, refining, and distribution.

- Specialized Assets: Assets like offshore platforms, refineries, and pipelines are highly specialized and have limited alternative uses, increasing exit costs.

- Long-Term Contracts: Companies often enter into long-term supply, transportation, and sales agreements that are costly to break.

- Workforce and Decommissioning: Significant costs are associated with laying off specialized labor and decommissioning or restoring sites to environmental standards.

Strategic Objectives and Divergence

Competitive rivalry within the energy sector is significantly influenced by the diverse strategic objectives of market participants. Some companies remain focused on expanding traditional hydrocarbon production, seeking to maximize near-term returns from existing assets.

Conversely, others, including BP, are actively pursuing an energy transition, which necessitates different investment strategies and creates new competitive arenas. This divergence means that battlegrounds are shifting from solely production volumes to areas like renewable energy development, low-carbon technologies, and integrated energy solutions.

BP's strategic repositioning in 2024 exemplifies this. The company announced a renewed emphasis on its core oil and gas operations, aiming for disciplined investment in this segment. Simultaneously, it continues to allocate capital towards transition opportunities, signaling a dual-pronged approach to competition.

- Divergent Strategies: Some energy firms prioritize legacy hydrocarbon growth, while others, like BP, focus on the energy transition.

- Investment Priorities: This strategic divergence leads to different allocation of capital, impacting competitive focus areas.

- BP's 2024 Focus: BP has signaled a renewed commitment to its traditional oil and gas business alongside disciplined investment in transition projects.

- Shifting Battlegrounds: Competition is increasingly being defined by investments in renewables, low-carbon tech, and integrated energy systems, not just fossil fuels.

Competitive rivalry in the oil and gas sector is intense due to the presence of major global players and high barriers to exit. BP competes with giants like Shell and ExxonMobil, who possess substantial financial resources, as evidenced by ExxonMobil's $36 billion net income in 2023.

The mature nature of the traditional oil and gas market, coupled with slowing demand growth, forces companies to aggressively vie for market share. This rivalry is further exacerbated by the low product differentiation for commodities like crude oil, pushing competition towards price and efficiency.

BP differentiates itself through its brand, retail network, and increasing investment in lower-carbon solutions, such as EV charging infrastructure. The company's significant capital expenditure, around $16 billion in 2023, often goes towards maintaining long-lived assets, reinforcing the difficulty for any player to exit, thus sustaining high rivalry.

| Competitor | 2023 Net Income (USD Billions) | Key Strategic Focus |

|---|---|---|

| ExxonMobil | 36.0 | Maximizing hydrocarbon production, efficiency |

| Chevron | 21.4 | Balanced approach to traditional and lower-carbon energy |

| Shell | 15.5 | Energy transition, integrated energy solutions |

| Saudi Aramco | 121.3 | Dominant oil production, diversification into petrochemicals |

SSubstitutes Threaten

The most significant threat of substitutes for BP stems from the increasing viability of alternative energy sources, such as solar, wind, and electric vehicles. As these technologies mature, they offer improved cost-effectiveness and efficiency, directly challenging BP's core fossil fuel offerings.

BP's own Energy Outlook for 2024 projects oil demand to reach its peak by 2025. This forecast is largely influenced by the accelerating adoption of electric vehicles and the subsequent decline in oil consumption for road transportation, underscoring the tangible impact of substitutes.

Customer willingness to switch to alternatives is on the rise, fueled by increasing environmental consciousness, government support for sustainable options, and rapid technological progress. This trend is especially pronounced in sectors like transportation, where electric vehicles (EVs) are gaining traction, and in energy production, with renewable sources becoming more prevalent.

For instance, in 2024, global EV sales are projected to surpass 16 million units, a significant jump from previous years. This growing adoption directly impacts traditional internal combustion engine vehicle manufacturers and the oil and gas industry. Similarly, renewable energy sources accounted for approximately 30% of global electricity generation in 2023, a figure expected to climb further.

In response, BP is actively investing in areas that cater to this shift. The company announced in early 2024 a commitment to invest an additional $2 billion in EV charging infrastructure globally by 2025, aiming to significantly expand its network. Furthermore, BP's biofuels division saw a 15% increase in production capacity in 2023, reflecting its strategy to capitalize on the demand for lower-carbon fuels.

While the upfront investment for alternative energy, like electric vehicles or solar installations, can seem daunting for consumers, these costs are steadily declining. For instance, the average cost of residential solar panel installation in the US has seen a significant drop, making the switch more accessible than ever before.

For businesses, particularly in industrial sectors, transitioning to alternative energy often necessitates substantial infrastructure upgrades. These can include new machinery or grid connections, which represent higher switching costs. However, the long-term savings on energy bills and potential government incentives are increasingly outweighing these initial expenditures, driving adoption.

Regulatory and Policy Support for Substitutes

Government policies actively encourage the use of alternative energy sources, directly impacting the threat of substitutes for traditional fossil fuels. For instance, by mid-2024, many nations have intensified their commitments to renewable energy targets, with the International Energy Agency reporting significant growth in solar and wind power installations worldwide. This regulatory push, including carbon pricing mechanisms and stricter emissions standards, makes cleaner alternatives more economically viable and attractive.

This environment compels companies like BP to adapt. Their strategic shift towards lower-carbon energy solutions is partly a response to these supportive policies. BP's own sustainability targets, such as aiming for a significant reduction in its oil and gas production by 2030, are directly influenced by the evolving regulatory landscape and the growing competitiveness of substitute energy technologies.

- Government Incentives: Many countries offer tax credits and subsidies for renewable energy projects, lowering the cost of adoption for consumers and businesses.

- Carbon Pricing: The implementation of carbon taxes or emissions trading schemes increases the operational cost of carbon-intensive activities, making substitutes more cost-effective.

- Stricter Regulations: Mandates on vehicle emissions and power plant efficiency push demand towards cleaner alternatives and technologies.

- BP's Adaptation: BP's investment in areas like hydrogen and biofuels demonstrates a proactive response to regulatory pressures and the increasing viability of substitutes.

Technological Advancements in Substitutes

Technological advancements are significantly boosting the threat of substitutes for traditional energy providers like BP. Innovations in renewable energy sources, such as solar and wind power, are not only becoming more efficient but also more cost-effective. For instance, the global average cost of electricity from solar photovoltaics fell by approximately 89% between 2010 and 2022, making it increasingly competitive with fossil fuels.

Battery storage technology is also rapidly improving, addressing the intermittency issues of renewables. This progress allows for more reliable and consistent energy supply from substitute sources. Furthermore, advancements in energy efficiency solutions across industries and in consumer products reduce overall energy demand, lessening reliance on conventional energy. In 2023, global renewable energy capacity additions reached a record 510 gigawatts, a 50% increase from 2022, highlighting the accelerating shift.

- Renewable Energy Cost Reduction: Solar PV costs have seen a dramatic decrease, making it a more viable substitute.

- Battery Storage Improvements: Enhanced storage capabilities are making intermittent renewable sources more reliable.

- Energy Efficiency Gains: Technologies reducing energy consumption directly lower demand for traditional energy.

- Rapid Capacity Additions: The significant year-over-year growth in renewable capacity underscores the growing threat.

The threat of substitutes for BP is substantial, driven by the increasing competitiveness and adoption of alternative energy sources like solar, wind, and electric vehicles. These substitutes directly challenge BP's core fossil fuel business by offering cleaner and, increasingly, more cost-effective solutions. BP's own 2024 Energy Outlook forecasts oil demand peaking by 2025, largely due to EV growth, demonstrating the tangible impact of these alternatives.

Customer preference is shifting towards sustainable options, supported by government policies and technological advancements. For instance, global EV sales were projected to exceed 16 million units in 2024, while renewables accounted for about 30% of global electricity generation in 2023. BP is responding by investing in areas like EV charging and biofuels, aiming to adapt to this evolving market landscape.

| Substitute Category | Key Drivers | Impact on BP |

|---|---|---|

| Renewable Energy (Solar, Wind) | Falling costs (e.g., ~89% drop in solar PV costs 2010-2022), government incentives, technological efficiency | Reduced demand for fossil fuels in power generation |

| Electric Vehicles (EVs) | Improving battery technology, government subsidies, increasing charging infrastructure, declining purchase costs | Decreased demand for gasoline and diesel in transportation |

| Biofuels | Government mandates, investment in production capacity (BP's 15% increase in 2023) | Alternative fuel source for transportation and industry |

Entrants Threaten

The oil and gas sector demands immense upfront investment for exploration, extraction, processing, and delivery, acting as a formidable barrier for newcomers. BP's capital expenditure, even after adjustments, underscores this significant financial hurdle. For instance, BP's 2024 capital expenditure was projected to be around $16 billion, demonstrating the scale of investment required.

Similarly, the burgeoning renewable energy industry, while offering a different risk profile, also necessitates substantial capital for projects like offshore wind farms or large-scale solar installations. Developing a single offshore wind project can easily run into billions of dollars, making it challenging for smaller entities to enter the market without significant backing.

BP's massive scale in operations, from securing crude oil to delivering refined products, creates a significant cost advantage. Newcomers struggle to match the per-unit efficiency BP achieves in areas like refining and global shipping, where massive infrastructure investments are essential. For instance, BP's refining capacity in 2024, processing millions of barrels of oil daily across its global network, represents an insurmountable hurdle for smaller, less established entities looking to enter the market on a competitive cost basis.

New companies entering the oil and gas sector face a significant hurdle in replicating BP's established global distribution channels. BP leverages an extensive network of pipelines, shipping capabilities, and a widespread retail presence, including over 18,000 retail sites globally as of 2024, which includes a growing number of EV charging stations.

The sheer scale and cost associated with building comparable infrastructure, which can run into billions of dollars, create a substantial barrier. For instance, developing a new pipeline system can cost hundreds of millions, if not billions, depending on the length and complexity.

BP's strategic investments, such as its expansion into electric vehicle charging infrastructure, further solidify its distribution advantage. This ongoing investment makes it exceedingly difficult and economically unviable for potential new entrants to gain comparable market access and reach customers effectively.

Brand Loyalty and Switching Costs for Customers

While brand loyalty in the commodity fuel market can be somewhat fluid, BP leverages its strong brand recognition and the convenience of its extensive retail network to retain customers. This established presence makes it harder for new, less-known entrants to capture significant market share. In 2024, BP continued to invest in its brand, aiming to be a top-of-mind choice for consumers seeking reliable fuel and associated services.

For industrial and commercial clients, switching costs can be a more substantial barrier. Long-standing relationships, integrated supply agreements, and the potential disruption associated with changing fuel providers can make it economically unfeasible for these customers to switch to a new entrant. These established partnerships represent a significant hurdle for potential competitors looking to gain a foothold.

BP's Earnify loyalty program, which offers rewards and benefits for repeat purchases, is specifically designed to foster and strengthen customer loyalty. By incentivizing continued patronage, BP aims to increase the switching costs for its retail customers, making it less attractive for them to consider alternative fuel providers.

- Brand Recognition: BP's established brand name is a key asset in attracting and retaining customers.

- Convenience Factor: The widespread network of BP service stations offers a significant convenience advantage.

- Industrial Relationships: Long-term contracts and integrated supply chains for business clients create substantial switching costs.

- Loyalty Programs: Initiatives like Earnify are designed to lock in customers and increase loyalty.

Government Policy and Regulations

Government policies and regulations significantly deter new entrants in the oil and gas sector. The industry faces extensive permitting requirements, stringent environmental compliance mandates, and rigorous safety standards. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act, impacting operational permits and emissions controls for all players, including BP. These compliance costs and the time involved in securing approvals create substantial barriers.

Government support for established energy infrastructure or particular energy sources can further entrench incumbents. Policies that favor existing production methods or provide subsidies for established companies can make it harder for newcomers to compete on a level playing field. BP's extensive experience navigating these complex regulatory landscapes, including adhering to evolving climate disclosure requirements, provides a distinct advantage over potential new market participants.

- Regulatory Hurdles: Stringent permitting, environmental, and safety regulations act as significant barriers to entry in the oil and gas industry.

- Compliance Costs: The financial and operational demands of meeting these regulations are substantial, favoring established companies with existing infrastructure and expertise.

- Government Support: Policies favoring existing energy infrastructure or specific energy types can create an uneven playing field for new entrants.

- BP's Advantage: BP's long-standing compliance with evolving regulations, such as those related to emissions and climate disclosures in 2024, positions it favorably against potential new competitors.

The threat of new entrants in the oil and gas sector is significantly mitigated by the enormous capital requirements for exploration, extraction, and refining. BP's 2024 capital expenditure, projected around $16 billion, highlights the substantial financial commitment needed, creating a high barrier for new companies. Furthermore, established companies like BP benefit from economies of scale in operations, refining, and global shipping, making it difficult for newcomers to match their cost efficiencies. BP's refining capacity in 2024, processing millions of barrels daily, exemplifies this advantage.

Established distribution networks and brand loyalty also pose significant challenges. BP's extensive retail presence, with over 18,000 sites globally in 2024, and loyalty programs like Earnify, foster customer retention and increase switching costs. For industrial clients, long-standing relationships and integrated supply agreements create further barriers. Navigating complex and stringent government regulations, including permitting and environmental compliance, also favors incumbents like BP, which possesses extensive experience in adhering to evolving standards such as climate disclosures.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial reports, industry-specific market research, and expert commentary from reputable trade publications.