Borouge PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Borouge Bundle

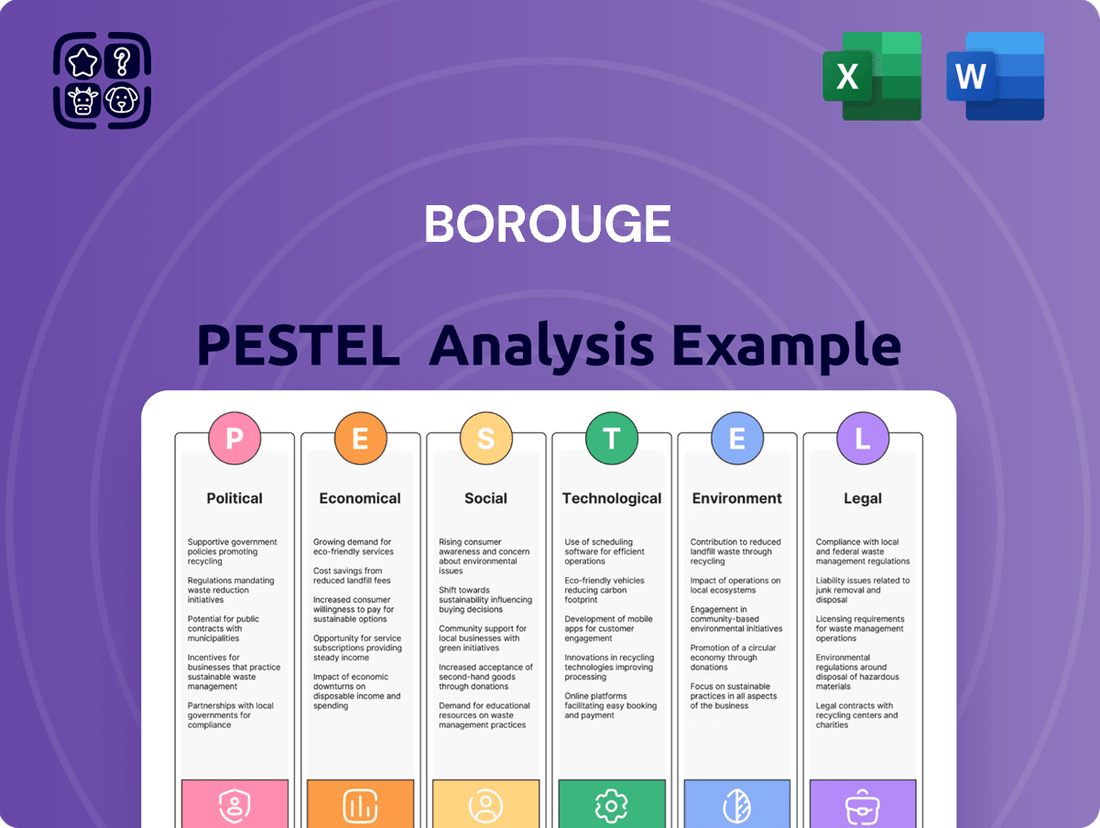

Borouge's strategic landscape is profoundly shaped by political stability in its operating regions, economic fluctuations impacting demand for petrochemicals, and technological advancements driving innovation in polymer production. Understanding these external forces is crucial for any stakeholder aiming to capitalize on opportunities or mitigate risks within the industry. Our comprehensive PESTLE analysis delves deep into these critical factors, offering actionable intelligence to inform your decisions.

Gain an unparalleled understanding of the political, economic, social, technological, legal, and environmental factors influencing Borouge's trajectory. This expertly crafted PESTLE analysis provides the strategic foresight you need to navigate the complexities of the global petrochemical market. Don't be left behind; download the full version now and unlock the insights that will empower your business strategy.

Political factors

Borouge, a significant force in the UAE's petrochemical landscape, directly benefits from government programs designed to boost industrial diversification and expansion. The UAE's ambitious 'Operation 300bn' strategy is a prime example, aiming to almost double the industrial sector's contribution to the nation's Gross Domestic Product by 2031. Petrochemicals are specifically highlighted as a key focus area within this plan.

This strategic alignment creates a favorable policy climate for Borouge, potentially unlocking further investment and development opportunities. The government's commitment to growing the industrial base, with petrochemicals at its core, underpins Borouge's strategic objectives and future growth trajectory.

The United Arab Emirates' consistent political stability and robust diplomatic network are fundamental to Borouge's international reach and the resilience of its supply chains. This stability fosters an environment conducive to long-term investment and operational continuity.

Maintaining strong trade relationships in crucial markets, particularly in Asia, the Middle East, and Africa, is paramount for Borouge. These regions represent significant demand centers, and stable trade agreements directly impact sustained sales volumes and the company's ability to deepen market penetration.

In 2024, the UAE's commitment to economic diversification, as highlighted by initiatives like the "We the UAE 2031" vision, further solidifies its political landscape, indirectly benefiting companies like Borouge by promoting a favorable business climate and fostering international partnerships.

Borouge's strategic direction is significantly shaped by its major shareholders, ADNOC and Borealis. Their policies and long-term visions directly influence the company's path, ensuring alignment with overarching shareholder objectives.

The proposed combination of Borouge and Borealis, along with the acquisition of Nova Chemicals, aims to forge a formidable $60 billion global petrochemicals leader, a move clearly driven by shareholder ambitions for expansion and market dominance.

Regulatory Environment and Compliance

The regulatory environment for petrochemicals, including production, trade, and environmental standards, significantly influences Borouge's activities. Compliance with international trade pacts and regional rules is crucial for seamless operations and market entry. Borouge's 2023 annual report highlighted the need to monitor and adapt to evolving trade policies and potential tariff adjustments in key markets.

Proactive engagement with regulatory bodies can help shape policies favorable to the industry. For instance, discussions around carbon pricing mechanisms and sustainability mandates, which are gaining traction globally, could impact production costs and market competitiveness. Borouge's strategic focus on innovation in sustainable polyolefins is partly a response to these anticipated regulatory shifts.

- Environmental Regulations: Borouge must navigate increasingly stringent emissions standards and waste management regulations, particularly in Europe and North America, impacting operational costs and investment in cleaner technologies.

- Trade Agreements: Adherence to agreements like the GCC-EU Free Trade Agreement is vital for tariff-free access to European markets, while monitoring potential changes in other trade blocs remains a priority.

- Product Safety Standards: Compliance with evolving international standards for plastic product safety and recyclability, such as those being developed by ISO and national bodies, directly affects product development and market acceptance.

- Chemical Registration: Regulations like REACH in Europe require extensive data submission and registration for chemical substances, adding complexity and cost to market access for Borouge's products.

National Economic Diversification Agendas

The United Arab Emirates' strategic push for economic diversification away from hydrocarbons significantly elevates Borouge's importance. This national agenda, aiming to build a robust non-oil economy, positions Borouge as a cornerstone of the UAE's future industrial strength and manufacturing capabilities. In 2024, the UAE's non-oil GDP growth was projected to remain strong, underscoring the success of these diversification efforts.

Government initiatives actively championing advanced industries and sustainable manufacturing practices provide a fertile ground for Borouge's operations. This support directly bolsters Borouge's commitment to developing innovative polyolefin solutions, ensuring its sustained relevance and expansion within the national economic framework. The UAE's Vision 2030 explicitly targets the growth of manufacturing sectors, with petrochemicals playing a key role.

- National Diversification Focus: The UAE aims to reduce its reliance on oil, making companies like Borouge vital for economic resilience.

- Government Support: Policies favoring advanced manufacturing and sustainability directly benefit Borouge's innovative product lines.

- Industrial Landscape: Borouge is a critical player in the UAE's evolving industrial sector, contributing to its non-oil economic growth.

- Long-term Viability: Alignment with national strategies ensures Borouge's continued importance and growth prospects within the UAE economy.

The UAE's political stability and proactive government support are foundational to Borouge's success. Initiatives like the 'Operation 300bn' strategy, targeting industrial expansion and diversification, directly benefit petrochemicals, with Borouge being a key beneficiary. This alignment ensures a favorable policy environment for investment and growth.

Strong trade relationships, particularly with Asian markets, are critical for Borouge's sales volumes. The UAE's commitment to economic diversification, as seen in the 2031 vision, fosters a positive business climate and international partnerships. Borouge's strategic direction is also heavily influenced by its major shareholders, ADNOC and Borealis, whose expansion ambitions are evident in proposed mergers.

Borouge must navigate evolving environmental and product safety regulations, such as REACH in Europe, impacting operational costs and market access. For example, 2023 reports highlighted the need to adapt to changing trade policies and potential tariffs in key markets, underscoring the importance of regulatory engagement.

| Political Factor | Impact on Borouge | Supporting Data/Context |

| Government Diversification Strategy | Creates favorable policy environment, boosts industrial expansion | UAE's 'Operation 300bn' aims to double industrial GDP by 2031; petrochemicals a key focus. |

| Political Stability & Diplomacy | Ensures supply chain resilience and international reach | UAE's stable political climate fosters long-term investment and operational continuity. |

| Shareholder Influence (ADNOC & Borealis) | Drives strategic direction and expansion plans | Proposed $60 billion global petrochemicals leader formation signals shareholder ambition. |

| Regulatory Compliance | Affects operational costs, market access, and product development | 2023 reports noted need to monitor trade policies and tariffs; REACH compliance adds complexity. |

What is included in the product

This Borouge PESTLE analysis delves into the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview designed to identify strategic threats and opportunities for Borouge's growth and sustainability.

A Borouge PESTLE analysis acts as a pain point reliver by providing a clear, summarized version of complex external factors, enabling efficient decision-making and strategic alignment during critical planning sessions.

Economic factors

The global polyolefin market is on a strong upward trajectory, with forecasts suggesting a significant volume expansion by 2034. This robust demand is fueled by key sectors like packaging, automotive, and construction, creating a favorable environment for Borouge's product portfolio.

Borouge is well-positioned to benefit from this trend, as its strategic emphasis on high-growth regions, particularly Asia Pacific and the Middle East, aligns perfectly with the expanding global demand for polyolefins.

As a petrochemical producer, Borouge's financial health is closely tied to the price swings of its core inputs, ethylene and propylene. These critical components are ultimately sourced from crude oil and natural gas, making global energy market dynamics a significant influence.

Despite Borouge's advantageous integration with ADNOC, a substantial player in oil and gas production, the inherent volatility of global energy prices can still affect its production expenses and profit margins. For instance, Brent crude oil prices, a key benchmark, saw significant fluctuations throughout 2024, impacting feedstock costs for petrochemical companies.

Borouge has a clear strategy focused on rewarding its shareholders through consistent dividend payouts. The company has signaled its intention to increase dividends for the 2025 financial year, underscoring its commitment to delivering value. This forward-looking approach aims to attract and retain investors by demonstrating robust financial health and a dedication to shareholder returns.

Furthermore, Borouge plans to maintain an attractive payout ratio for the proposed Borouge Group International. This suggests a confidence in the group's future earnings potential and a desire to share that success directly with shareholders. For instance, in 2023, Borouge declared a total dividend of $0.20 per share, reflecting a commitment to profitability distribution.

Operational Efficiency and Cost Management

Borouge's commitment to operational efficiency and cost management is a significant driver of its financial success. The company reported strong performance in Q1 2025 and throughout 2024, largely due to record production levels and increased sales volumes. This focus on efficiency is not just about producing more, but doing so in a cost-effective way.

The company's Value Enhancement Programme has been instrumental in this regard, yielding substantial benefits. This program has helped Borouge achieve industry-leading EBITDA margins, a key indicator of profitability. Furthermore, the program has boosted robust cash conversion, meaning the company is effectively turning its earnings into actual cash.

Key achievements in operational efficiency and cost management include:

- Record Production Volumes: Borouge achieved its highest ever production output in 2024, demonstrating enhanced operational capacity.

- Cost Discipline: Continuous efforts in cost management have supported the company's strong financial results.

- Value Enhancement Programme: This initiative has directly contributed to improved financial metrics, including EBITDA margins.

- Strong Cash Conversion: The focus on efficiency translates into a healthy conversion of earnings into cash, providing financial flexibility.

Capital Investment and Expansion Projects

Borouge's strategic vision hinges on significant capital investments in expansion projects, with Borouge 4 being a prime example. This initiative is critical for bolstering future growth and substantially increasing production capacity.

Borouge 4 is slated to commence operations in 2025, with full operational capacity anticipated by late 2026. This expansion will introduce considerable polyethylene capacity, a move expected to significantly boost annual EBITDA and solidify Borouge's competitive standing in the market.

- Borouge 4 Project Start: 2025

- Borouge 4 Full Operations: Late 2026

- Capacity Addition: Significant polyethylene capacity

- Expected Financial Impact: Substantial contribution to annual EBITDA

Economic factors significantly influence Borouge's performance, primarily through the demand for polyolefins and the cost of its key feedstocks, ethylene and propylene. The global polyolefin market is projected for robust growth, driven by sectors like packaging and automotive, which directly benefits Borouge's product lines.

Fluctuations in crude oil and natural gas prices, the ultimate sources of its feedstocks, introduce volatility to Borouge's production costs and profit margins. For example, Brent crude oil prices experienced notable shifts in 2024, impacting petrochemical input expenses.

Borouge's strategic focus on high-growth regions, particularly Asia Pacific and the Middle East, aligns with global demand trends, positioning the company to capitalize on market expansion. This geographic strategy is crucial for navigating the economic landscape.

Borouge's financial strategy emphasizes shareholder returns through consistent dividend payouts, with plans to increase dividends for the 2025 financial year. This reflects confidence in its earnings potential and a commitment to rewarding investors, evidenced by a $0.20 per share dividend declared in 2023.

Preview Before You Purchase

Borouge PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Borouge PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to detailed insights into Borouge's operational context, market dynamics, and future growth opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. It offers a thorough examination of external forces that shape Borouge's business strategy and competitive positioning.

Sociological factors

Societal shifts are increasingly prioritizing environmental responsibility. Global awareness of climate change and a growing consumer preference for eco-friendly products are significantly boosting the demand for sustainable plastic alternatives. This trend directly supports Borouge's strategic direction.

Borouge's commitment to developing and offering sustainable, value-added polyolefin solutions perfectly aligns with this societal evolution. This focus presents a clear avenue for innovation in their product lines and a strong opportunity for market differentiation in an increasingly conscious marketplace.

Societal expectations for robust health and safety standards in industrial operations are increasingly stringent. Borouge's operational philosophy, emphasizing excellence and asset reliability, directly addresses this by prioritizing a secure working environment for its employees and fostering positive public perception.

In 2023, Borouge reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.17 per million working hours, reflecting a strong commitment to minimizing workplace incidents and upholding high safety benchmarks.

The availability of a skilled workforce is crucial for operating advanced petrochemical facilities and fostering innovation. Borouge relies on a pool of talent proficient in complex processes and technological advancements to maintain its competitive edge.

The UAE government's strategic emphasis on developing a specialized workforce for advanced industries directly benefits Borouge. Initiatives aimed at upskilling and reskilling the local population ensure a steady supply of qualified personnel, supporting the company's operational needs and future growth.

As of late 2024, the UAE has seen significant investment in technical and vocational training programs, with a particular focus on STEM fields. For instance, the Ministry of Education reported a 15% increase in enrollment in petrochemical-related engineering programs in the 2023-2024 academic year, directly addressing the talent pipeline Borouge requires.

Community Engagement and Social License to Operate

Borouge places significant emphasis on cultivating strong relationships with the communities surrounding its operational hubs, a crucial element for maintaining its social license to operate. This involves proactively addressing local concerns and demonstrating a commitment to responsible industrial practices.

In 2023, Borouge continued its community investment initiatives, focusing on education and environmental stewardship. For instance, its initiatives in the Al Ain region supported local schools with educational resources, impacting over 5,000 students. These efforts underscore the company's dedication to contributing positively to the social fabric where it operates.

- Community Investment: Borouge's commitment to social license is demonstrated through ongoing investments in local development projects, aiming to foster goodwill and mutual benefit.

- Stakeholder Dialogue: Regular engagement with community leaders and residents helps Borouge understand and address evolving social expectations and concerns.

- Local Impact: The company strives to ensure its operations minimize negative social impacts and maximize positive contributions, such as job creation and skills development for local populations.

- Corporate Social Responsibility: Borouge's CSR programs are designed to align with community needs, reinforcing its role as a responsible corporate citizen.

Changing Lifestyles and Consumption Patterns

Global urbanization continues its upward trajectory, with projections indicating that by 2050, nearly 70% of the world's population will reside in urban areas. This shift fundamentally alters consumer lifestyles, driving increased demand for convenience and packaged goods. The burgeoning e-commerce sector, which saw global online retail sales reach an estimated $6.3 trillion in 2023, further amplifies this trend, necessitating robust and versatile packaging solutions.

Borouge's polyolefin products are intrinsically linked to these evolving consumption patterns. Their applications in flexible films and rigid packaging directly cater to the growing need for safe, efficient, and appealing product delivery. For instance, the demand for food packaging, a key segment for polyolefins, is projected to grow significantly as urban populations seek convenient and preserved food options.

- Urbanization Growth: Nearly 70% of the global population is expected to live in urban areas by 2050.

- E-commerce Impact: Global online retail sales were approximately $6.3 trillion in 2023, boosting packaging demand.

- Packaging Needs: Changing lifestyles favor convenience, driving demand for flexible and rigid polyolefin-based packaging.

- Market Linkage: Borouge's polyolefins are essential for films and packaging, directly benefiting from these societal shifts.

Societal demand for sustainability is a powerful driver, with consumers increasingly favoring eco-friendly products. This trend directly benefits Borouge, as its focus on sustainable polyolefin solutions aligns perfectly with growing environmental consciousness, creating opportunities for market differentiation.

Borouge's commitment to safety is paramount, reflected in its 2023 Total Recordable Injury Frequency Rate (TRIFR) of 0.17 per million working hours, demonstrating a strong adherence to high safety standards and a secure working environment.

The UAE's investment in technical and vocational training, particularly in STEM fields, ensures a vital talent pipeline. Enrollment in petrochemical engineering programs saw a 15% increase in the 2023-2024 academic year, directly supporting Borouge's need for skilled personnel.

Borouge actively engages with local communities, investing in development projects and education. In 2023, its initiatives in Al Ain supported over 5,000 students, reinforcing its role as a responsible corporate citizen and maintaining its social license to operate.

Urbanization and the growth of e-commerce are reshaping consumption, increasing demand for convenient packaging. Global online retail sales reached $6.3 trillion in 2023, highlighting the critical role of Borouge's polyolefin products in meeting these evolving consumer needs.

Technological factors

Borouge is deeply invested in technological innovation, focusing on advanced polyolefin solutions that cater to critical sectors like infrastructure, energy, and healthcare. This commitment is evident in their continuous development of new polyethylene and polypropylene grades, designed with superior performance characteristics.

For instance, Borouge's proprietary Borstar® technology enables the creation of differentiated polyolefins. In 2023, the company reported strong demand for its advanced materials, contributing to its revenue growth, with a significant portion of its sales coming from value-added products stemming from these technological advancements.

Borouge is aggressively integrating artificial intelligence and digital technologies to streamline operations and drive innovation. This strategic focus is designed to boost efficiency and achieve ambitious sustainability targets. For example, in 2023, Borouge reported that its digital transformation initiatives, including AI-powered solutions, contributed to significant value generation, although specific financial impacts are detailed in their annual reports.

Borouge's competitive edge is significantly bolstered by its proprietary technologies, such as Borstar®, which allows for the creation of high-performance, differentiated polyolefin products. This technological advantage is crucial in a market demanding advanced material solutions.

The planned Borouge Group International is set to amplify this strength by integrating substantial research and development capabilities with a robust pipeline of patents. This strategic move is designed to cement Borouge's position as a leader in product innovation and the development of cutting-edge materials.

Advancements in Recycling Technologies

Technological advancements are significantly reshaping the plastics industry, with a particular focus on enhanced recycling methods. Chemical recycling, which breaks down plastics into their molecular components for reprocessing, and advanced mechanical recycling, which uses more sophisticated sorting and cleaning, are key innovations. These technologies offer the potential to create higher-quality recycled materials, thereby boosting the circular economy.

Borouge's strategic moves reflect this technological shift. The company's acquisition of Integra Plastics, a significant player in the recycled polyethylene terephthalate (PET) market, demonstrates a commitment to integrating advanced recycling capabilities. While Borealis, Borouge's parent company, has navigated changes in its mechanical recycling plans, its ongoing investment in circular production underscores the broader industry trend towards leveraging these new technologies.

The impact of these advancements is substantial. For instance, the global chemical recycling market is projected to grow significantly, with some estimates suggesting it could reach tens of billions of dollars by the early 2030s, driven by increasing demand for sustainable materials and stricter regulations. This growth trajectory highlights the economic and environmental imperative for companies like Borouge to adopt and scale these innovative recycling solutions.

- Chemical Recycling Growth: The chemical recycling market is expected to expand rapidly, with forecasts indicating substantial growth in the coming decade, fueled by innovation and policy support.

- Borouge's Strategic Investments: The acquisition of Integra Plastics by Borouge signals a clear intent to bolster its position in the recycled plastics sector through advanced technologies.

- Circular Economy Integration: Companies are increasingly focused on integrating circular economy principles, with recycling technologies playing a pivotal role in achieving sustainability goals and meeting market demands for eco-friendly products.

Development of Bio-based and Sustainable Polymers

The polymer industry is experiencing a substantial pivot towards bio-based and renewable materials, alongside the emergence of smart polymers. This trend signifies a growing demand for environmentally friendly alternatives to traditional plastics derived from fossil fuels.

Borouge's strategic emphasis on sustainable solutions directly aligns with these evolving market demands. This presents a clear opportunity for the company to expand its product portfolio with innovative, eco-conscious offerings and decrease its dependence on conventional, petroleum-based feedstocks.

For instance, the global bioplastics market was valued at approximately USD 11.5 billion in 2023 and is projected to reach USD 31.2 billion by 2030, growing at a compound annual growth rate of 15.3% during this period. This robust growth underscores the significant market potential for companies investing in sustainable polymer development.

- Market Shift: Increasing consumer and regulatory pressure is driving the adoption of bio-based and recycled polymers.

- Innovation Opportunity: Borouge can leverage its expertise to develop advanced sustainable polymer solutions, including biodegradable and compostable materials.

- Feedstock Diversification: Investing in bio-based feedstocks reduces exposure to volatile oil prices and enhances supply chain resilience.

- Growth Potential: The expanding bioplastics market, projected to more than double in value by 2030, offers substantial revenue growth opportunities.

Borouge's technological edge is significantly enhanced by its proprietary Borstar® technology, which produces differentiated polyolefins for key sectors. This innovation was a notable contributor to revenue growth in 2023, with a substantial portion derived from these advanced materials.

The company is actively integrating AI and digital solutions to improve efficiency and meet sustainability goals, with digital transformation initiatives demonstrating significant value generation in 2023. Furthermore, Borouge's strategic acquisition of Integra Plastics highlights its commitment to advanced recycling technologies, aligning with the industry's growing focus on chemical and mechanical recycling innovations.

The global chemical recycling market is poised for substantial growth, projected to reach tens of billions of dollars by the early 2030s, driven by demand for sustainable materials and regulatory support. This trend is further amplified by the increasing market demand for bio-based and renewable polymers, with the bioplastics market valued at approximately USD 11.5 billion in 2023 and expected to reach USD 31.2 billion by 2030.

Legal factors

Borouge, operating on a global scale, faces the intricate landscape of international trade regulations and tariffs. These rules directly influence its ability to compete and set prices effectively in various markets. For instance, changes in tariffs can alter the cost of raw materials or finished goods, impacting Borouge's profitability and its customers' purchasing power.

The company's competitiveness hinges on its adeptness at navigating these trade complexities. As of early 2024, ongoing discussions and potential adjustments to trade agreements, particularly those involving major economic blocs, require constant vigilance. Borouge's strategic approach includes closely monitoring tariff developments in key regions like Europe, Asia, and the Middle East to ensure its pricing remains competitive and to support its customer base effectively.

Borouge faces increasing pressure from environmental regulations, especially concerning plastic waste and recycling. For instance, the EU's ambitious targets for recycled content in packaging, aiming for 30% recycled plastic in packaging by 2030 under the Packaging and Packaging Waste Regulation, directly influence product design and material sourcing.

Legislation such as the EU's Single-Use Plastics Directive, which bans certain disposable plastic items, also pushes companies like Borouge to innovate in developing more sustainable alternatives and investing in advanced recycling technologies.

Borouge's commitment to product safety and adherence to stringent industry standards, such as those for healthcare, automotive, and food packaging, is paramount. For instance, in 2023, Borouge's polyolefins were certified for food contact applications by bodies like the FDA and EFSA, crucial for its expansion in packaging markets.

Compliance ensures not only the integrity and quality of Borouge's polymer solutions but also fosters customer confidence and safeguards against potential legal repercussions and recalls. Failure to meet these evolving regulatory landscapes could impact market access and brand reputation, especially as sustainability requirements become more integrated into product standards.

Corporate Governance and Shareholder Protections

As a publicly traded entity, Borouge adheres to stringent corporate governance standards designed to safeguard shareholder interests. These frameworks mandate transparency in financial reporting and operational conduct, crucial for fostering and maintaining investor trust. For instance, during 2024, Borouge continued to emphasize its commitment to best practices in governance, aligning with Abu Dhabi Securities Exchange (ADX) listing rules and international standards.

Adherence to financial regulations is paramount for Borouge's continued access to capital markets and its overall valuation. The company's compliance with these rules directly impacts its ability to attract and retain investors who prioritize stability and accountability. In 2024, regulatory bodies continued to refine disclosure requirements, pushing companies like Borouge to enhance their reporting accuracy and timeliness.

- Shareholder Rights: Borouge is bound by regulations that protect minority shareholder rights, ensuring fair treatment and access to information.

- Transparency Mandates: Publicly listed companies in Borouge's operating regions face increasing demands for granular and timely disclosure of financial and operational data.

- Regulatory Compliance: Ongoing adherence to evolving financial regulations, including those related to ESG reporting, is a key legal factor influencing Borouge's operations and investor relations.

Joint Venture and Acquisition Legal Frameworks

The proposed integration of Borouge and Borealis, alongside the acquisition of Nova Chemicals, necessitates navigating a complex web of legal and regulatory approvals across multiple jurisdictions. This process is critical for the successful establishment of the envisioned 'Borouge Group International'.

Key legal considerations include antitrust reviews, foreign investment regulations, and compliance with competition laws in regions where these entities operate. For instance, the European Commission's merger control regulations and similar bodies in North America and Asia will scrutinize the transaction for potential market impacts.

The successful completion of these legal frameworks is paramount for Borouge's strategic objectives. As of early 2024, such large-scale M&A activities often face extensive due diligence and require significant lead times for regulatory clearance, impacting deal timelines and potential integration phases.

- Antitrust Filings: Borouge and Borealis's combined market share in certain petrochemical segments will trigger mandatory filings with competition authorities globally.

- Foreign Investment Approvals: Depending on the specific jurisdictions involved, government approvals for foreign direct investment may be required.

- Contractual Obligations: Existing joint venture agreements and supply contracts for Borouge and Borealis will need to be reviewed and potentially renegotiated or assigned.

- Regulatory Compliance: Ensuring adherence to environmental, safety, and product labeling regulations in all operating regions is a continuous legal requirement.

Borouge's operations are significantly shaped by international trade policies and tariffs, directly impacting its pricing strategies and market competitiveness. For example, in early 2024, ongoing trade discussions between major economic blocs necessitated Borouge's close monitoring of tariff adjustments in key markets like Europe and Asia to maintain favorable pricing and customer support.

The company must also navigate evolving environmental legislation, particularly concerning plastic waste and recycling. Regulations such as the EU's Packaging and Packaging Waste Regulation, which aims for 30% recycled content in packaging by 2030, influence Borouge's product development and material sourcing decisions.

Borouge’s commitment to product safety and adherence to stringent industry standards, such as those for food packaging, is critical for market access and customer trust. In 2023, Borouge's polyolefins received crucial certifications from bodies like the FDA and EFSA for food contact applications, underscoring its compliance efforts.

As a publicly traded entity, Borouge is subject to rigorous corporate governance and financial reporting standards, as exemplified by its 2024 alignment with Abu Dhabi Securities Exchange listing rules and international best practices to ensure transparency and investor confidence.

Environmental factors

The escalating global plastic waste crisis, with an estimated 8.3 billion metric tons generated by 2020, presents a critical environmental challenge and a significant driver for the circular economy. Borouge is responding by prioritizing solutions that enhance plastic recyclability and minimize ecological footprints, aligning with a growing demand for sustainable materials.

Borouge's commitment to sustainability is evident in its development of advanced polyolefins designed for improved recyclability and its participation in initiatives aimed at creating a more circular plastic economy. For instance, the company's Borstar technology enables the production of lighter, stronger plastics, meaning less material is needed and facilitating easier recycling processes.

The petrochemical sector is under significant scrutiny to lower its environmental impact. Borouge, with backing from its major shareholder Borealis, is actively pursuing decarbonization strategies, aiming to integrate more renewable energy into its production processes to achieve its emission reduction goals.

For instance, Borouge has committed to reducing its Scope 1 and Scope 2 greenhouse gas emissions. In 2023, the company reported progress towards these targets, with specific figures on its emission intensity improvements and the percentage of renewable electricity utilized in its operations, though exact percentages for 2024/2025 will be detailed in upcoming reports.

Borouge's long-term viability hinges on securing consistent access to essential raw materials and actively pursuing the development of more sustainable feedstock options. The increasing industry focus on bio-based and renewable polymers underscores a growing recognition of resource limitations and the critical need for alternative material sourcing.

Water Usage and Management

Borouge, operating in the petrochemical sector, faces significant environmental considerations regarding water. Its industrial processes, like polymer production, are inherently water-intensive for cooling, steam generation, and cleaning. This makes efficient water usage and robust management strategies paramount, particularly given the increasing global focus on water scarcity.

In 2023, Borouge reported its commitment to sustainable water management, aiming to reduce its freshwater intensity. While specific figures for 2024 are still emerging, the company's 2023 sustainability report highlighted efforts to optimize water recycling and reuse within its operations. For instance, initiatives at its Ruwais complex in Abu Dhabi focus on minimizing discharge and maximizing the circularity of water resources.

The company's approach to water management includes:

- Implementing advanced water treatment technologies to enable higher rates of water recycling.

- Investing in infrastructure to reduce water consumption in cooling systems.

- Monitoring water usage across all operational sites to identify areas for further efficiency gains.

- Adhering to stringent environmental regulations concerning water discharge quality.

Climate Change and Extreme Weather Events

Climate change poses a significant environmental challenge for Borouge, with the increasing frequency and intensity of extreme weather events like heatwaves, floods, and storms directly impacting its operations. These events can disrupt production, damage infrastructure, and strain supply chains. For instance, the UAE, Borouge's home base, is particularly vulnerable to rising temperatures and water scarcity, necessitating robust adaptation strategies.

Building resilience against these environmental risks is a continuous effort for petrochemical companies. Borouge, like its peers, must invest in infrastructure that can withstand extreme weather and diversify its supply chains to mitigate disruptions. The company's commitment to sustainability includes efforts to reduce its carbon footprint, which indirectly addresses the root causes of climate change.

- Operational Disruptions: Extreme weather can lead to temporary shutdowns, impacting production volumes and revenue.

- Infrastructure Damage: Flooding or high winds can damage critical assets like pipelines, storage facilities, and manufacturing plants.

- Supply Chain Vulnerability: Weather events can impede the transportation of raw materials and finished goods, causing delays and increased costs.

- Resource Scarcity: Changes in precipitation patterns and rising temperatures can affect water availability, crucial for cooling and processing in petrochemical operations.

Borouge is actively addressing the global plastic waste crisis by focusing on enhanced recyclability and circular economy solutions, aligning with increasing market demand for sustainable materials. The company's Borstar technology, for example, produces lighter, stronger plastics that require less material and are easier to recycle.

The company is also committed to reducing its environmental footprint through decarbonization strategies, aiming to integrate more renewable energy into its production processes. In 2023, Borouge reported progress in reducing its Scope 1 and Scope 2 greenhouse gas emissions, with ongoing efforts to increase the utilization of renewable electricity in its operations.

Water management is another key environmental focus, with Borouge implementing advanced water treatment and recycling technologies to minimize freshwater intensity. Initiatives at its Ruwais complex are designed to reduce water discharge and maximize water resource circularity, reflecting the sector's increasing attention to water scarcity.

Borouge is also building resilience against climate change impacts, such as extreme weather events that can disrupt operations and damage infrastructure. The company's sustainability efforts include reducing its carbon footprint, which indirectly contributes to mitigating the root causes of climate change.

| Environmental Factor | Borouge's Response/Focus | Data/Example (as of latest available reports) |

| Plastic Waste & Circularity | Developing recyclable polymers, promoting circular economy initiatives | Borstar technology enhances recyclability; participation in industry collaborations for plastic waste solutions. |

| Greenhouse Gas Emissions | Decarbonization strategies, integration of renewable energy | Commitment to reducing Scope 1 & 2 emissions; increasing renewable electricity usage in operations. (Specific 2024/2025 data to be detailed in upcoming reports). |

| Water Management | Efficient water usage, recycling, and reuse | Focus on reducing freshwater intensity; advanced water treatment and recycling at Ruwais complex to minimize discharge. (2023 report highlighted efforts). |

| Climate Change Resilience | Adapting to extreme weather, investing in infrastructure | Developing strategies to mitigate impacts of heatwaves, floods, and storms on operations and supply chains. |

PESTLE Analysis Data Sources

Our Borouge PESTLE analysis is meticulously constructed using data from reputable international organizations like the IMF and World Bank, alongside official government publications and leading industry research firms. This ensures a comprehensive understanding of political, economic, and social landscapes.