Borouge Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Borouge Bundle

Understand Borouge's strategic product portfolio with a glance at its BCG Matrix, revealing where its innovations sit as Stars, Cash Cows, Dogs, or Question Marks. This preview offers a glimpse into their market position. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to optimize your investment strategy.

Stars

Borouge is strategically investing in its high-value polyolefin solutions, particularly for the energy transition. Their expansion of cross-linked polyethylene (XLPE) and semiconductive (semicon) compounds is a direct response to the escalating demand for high-voltage power cables, essential for modernizing and expanding global energy grids. This focus positions them strongly within a sector experiencing significant growth.

By the end of 2027, Borouge plans to double its capacity for these critical cable components. This ambitious expansion underscores their confidence in the market and their commitment to meeting the needs of a rapidly evolving energy landscape. The Borouge 4 facility in Ruwais is a key part of this strategy, with its XLPE capacity expansion slated for completion by the end of 2025, reinforcing their leadership in this vital market segment.

The Borouge 4 Mega Project, slated for completion by the end of 2025, is a significant expansion set to boost Borouge's polyolefin production capacity by 28%, reaching 6.4 million tonnes. This expansion will solidify its Al Ruwais site as the globe's largest single-site polyolefin complex.

This ambitious undertaking is anticipated to deliver considerable annual revenue and EBITDA growth. It's strategically positioned to be a primary engine for Borouge's future expansion and market leadership within the polyolefins sector.

Borouge's specialized polyethylene (PE) and polypropylene (PP) for infrastructure, like pipes and cables, are market leaders that consistently achieve higher prices. These products represented a substantial 38% of Borouge's sales volumes in the first quarter of 2025, building on a strong 40% share for the full year 2024.

The ongoing global need for better infrastructure means these materials are in a segment experiencing robust growth, a space where Borouge holds a dominant position. This strong market presence, backed by consistent volume contributions, solidifies their importance within Borouge's portfolio.

Advanced Packaging Solutions

Advanced Packaging Solutions is a strong contender in Borouge's portfolio, showcasing significant growth potential and market traction. The company has been proactive in launching new polymer grades specifically designed for advanced packaging applications, with a keen eye on improving recyclability and barrier performance. This strategic focus aligns perfectly with the rising global demand for sustainable and high-quality packaging materials.

The market for advanced packaging is booming, fueled by increasing consumer preference for eco-friendly options and the need for enhanced product protection. Borouge’s commitment to innovation in this segment is evident. For instance, in 2024 alone, Borouge introduced nine new product grades aimed at capturing a larger share of this dynamic and expanding market.

- Innovation Focus: Borouge is developing advanced polymer grades for packaging that offer improved recyclability and superior barrier properties.

- Market Growth Driver: The sector is experiencing high growth due to increasing consumer demand for sustainable and high-performance packaging solutions.

- Product Expansion: Borouge launched nine new advanced packaging products in 2024, underscoring its strategy to capitalize on market expansion.

Healthcare Applications

Borouge offers specialized polyolefin solutions critical for the healthcare industry, enabling the production of advanced medical devices. This sector is experiencing robust growth, fueled by ongoing technological innovation and a rising global demand for healthcare services.

The healthcare market segment represents a significant growth opportunity for Borouge. For instance, the global medical devices market was valued at approximately USD 579.5 billion in 2023 and is projected to reach USD 907.7 billion by 2030, growing at a CAGR of 6.7% during the forecast period. Borouge's commitment to this area, focusing on high-value applications, positions it well to capitalize on these trends.

- High Growth Potential: Driven by technological advancements and increasing global healthcare needs.

- Specialized Solutions: Polyolefin compounds designed for medical device components.

- Strategic Focus: Borouge's investment in high-value applications within this expanding market.

Borouge's specialized polyolefins for infrastructure, like pipes and cables, are market leaders commanding premium prices. These products constituted 38% of Borouge's sales volumes in Q1 2025, building on a 40% share in 2024, highlighting their consistent strength and market dominance in a robustly growing sector.

Advanced packaging solutions represent another strong area for Borouge, with significant growth potential. The company actively launched nine new polymer grades in 2024 specifically for advanced packaging, focusing on enhanced recyclability and barrier performance to meet rising demand for sustainable materials.

Borouge's focus on the healthcare sector, providing specialized polyolefins for medical devices, is also a key growth driver. The global medical devices market, valued at USD 579.5 billion in 2023, is projected to reach USD 907.7 billion by 2030, indicating substantial opportunity for Borouge's high-value applications.

| Borouge Business Segment | Key Products/Applications | 2024/2025 Data Points | Market Growth Driver | Strategic Importance |

| Infrastructure (Energy & Utilities) | XLPE and Semicon compounds for power cables | Capacity to double by end of 2027; Borouge 4 XLPE expansion by end of 2025 | Energy transition, grid modernization | Core growth area, leadership position |

| Infrastructure (Pipes) | Specialized PE/PP for pipes | 40% of volumes in 2024; 38% in Q1 2025 | Global infrastructure development | Consistent high volume contributor |

| Advanced Packaging | Polymers for recyclable, high-barrier packaging | 9 new product grades launched in 2024 | Consumer demand for sustainable packaging | Capturing dynamic market expansion |

| Healthcare | Polyolefins for medical devices | Global market valued at USD 579.5 billion in 2023 | Technological innovation, increased healthcare demand | High-value application focus |

What is included in the product

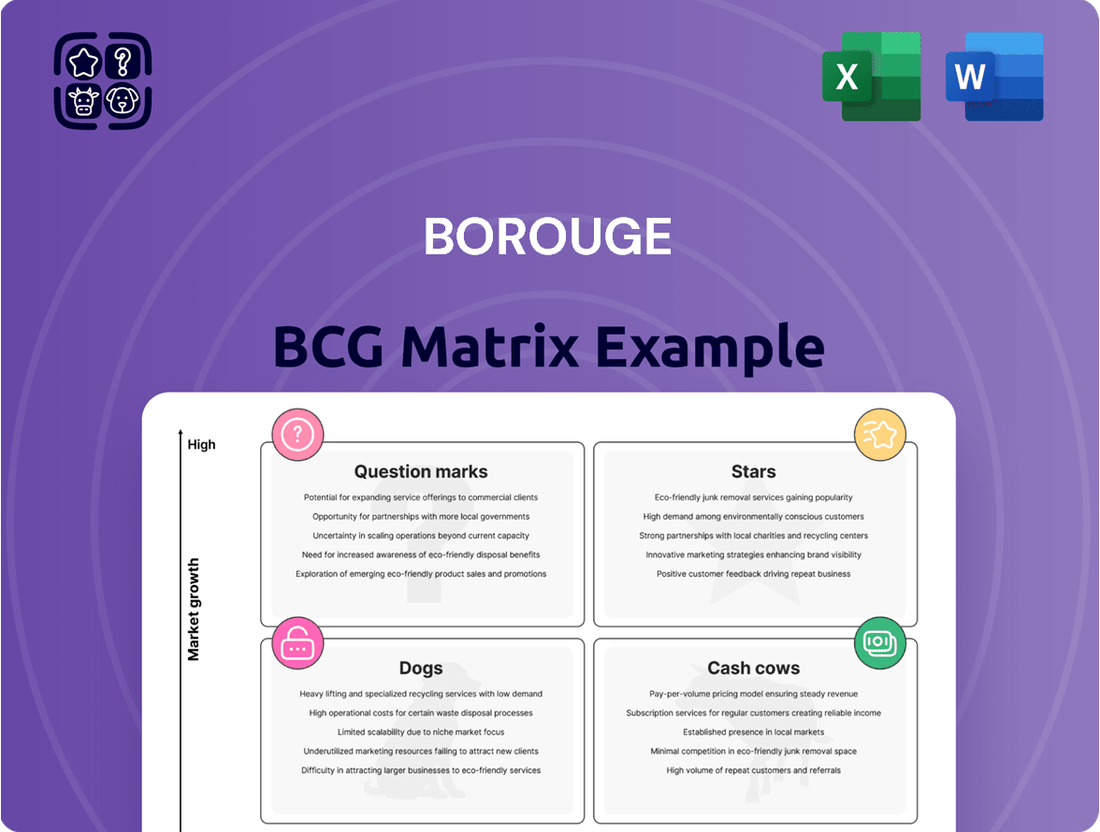

The Borouge BCG Matrix offers a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

It guides investment decisions by highlighting which business units to grow, maintain, or divest for optimal resource allocation.

Borouge's BCG Matrix offers clarity by visually categorizing business units, simplifying strategic decisions.

Cash Cows

Borouge's core polyethylene production stands as a robust Cash Cow within its portfolio. This segment consistently achieves impressive operational efficiency, evidenced by utilization rates hitting 101% in Q1 2025 and a remarkable 110% for the full year 2024.

These high utilization rates translate directly into significant sales volumes, making polyethylene a substantial contributor to Borouge's overall revenue generation. As a mature product with a commanding market share, it reliably supplies stable cash flow.

Consequently, this segment demands comparatively minimal investment for promotion and market placement, reinforcing its status as a dependable source of funds for the company.

Borouge's core polypropylene production is a true cash cow, mirroring the success of its polyethylene operations. In Q1 2025 and throughout FY2024, utilization rates for polypropylene remained exceptionally high at 98%, underscoring robust demand and efficient operations.

This segment commands a significant market share within its existing applications, translating into predictable revenue streams and robust profit margins. The consistent cash generation from polypropylene solidifies its position as a foundational element of Borouge's financial strength.

Borouge's dominance in the Asia Pacific region is undeniable, with this market accounting for a significant 63% of its total sales volumes in fiscal year 2024 and the fourth quarter of 2024. This robust presence signifies a commanding market share within a large and mature market.

The consistent and substantial demand originating from Asia Pacific translates directly into a reliable and considerable cash inflow for Borouge. This strong regional performance underpins its status as a Cash Cow within the BCG matrix.

Industry-Leading EBITDA Margins and Operational Efficiency

Borouge's position as a Cash Cow is strongly supported by its outstanding financial performance and operational excellence. The company consistently demonstrates industry-leading EBITDA margins, reaching 40% in Q1 2025 and a remarkable 41% for the full year 2024. This profitability stems from a highly efficient production process, underscored by an impressive asset reliability rate of 94.4% in Q1 2025.

These robust margins are a clear indicator of Borouge's ability to generate substantial cash flow from its core business, even within a mature market. This operational efficiency and cost discipline are key drivers of its Cash Cow status.

- Industry-Leading EBITDA Margins: Achieved 40% in Q1 2025 and 41% in FY2024.

- High Asset Reliability: Reached 94.4% in Q1 2025, ensuring consistent production.

- Operational Efficiency: Translates into strong profitability and cash generation.

- Mature Market Strength: Demonstrates superior performance in a competitive landscape.

Consistent and Attractive Dividend Payouts

Borouge has established a robust history of delivering substantial shareholder returns via consistent dividend payments. The company has signaled its intent to maintain a dividend of $1.3 billion for Fiscal Year 2025, with a specific payout of 16.2 fils per share planned for the same year.

This commitment extends to maintaining this minimum payout level through to 2030 under the Borouge Group International structure. Such a dependable and appealing dividend strategy strongly suggests a mature business segment that generates surplus cash, enabling sustained returns to shareholders.

- Consistent Dividend Payouts: Borouge aims for a $1.3 billion dividend for FY2025.

- Shareholder Value: A payout of 16.2 fils per share is planned for 2025.

- Long-Term Commitment: The minimum payout is targeted to be maintained until 2030.

- Cash Generation: This policy reflects a mature business unit with strong cash flow.

Borouge's polyethylene and polypropylene segments are its definitive Cash Cows, characterized by high utilization rates. Polyethylene saw 101% utilization in Q1 2025 and 110% in FY2024, while polypropylene maintained 98% in the same periods. These segments boast significant market share, particularly in the Asia Pacific region which accounted for 63% of sales in FY2024, driving consistent and substantial cash flow with minimal new investment required.

| Segment | FY2024 Utilization | Q1 2025 Utilization | Key Market Share | FY2024 EBITDA Margin |

|---|---|---|---|---|

| Polyethylene | 110% | 101% | Dominant in Asia Pacific | 41% (Overall Company) |

| Polypropylene | 98% | 98% | Significant in Asia Pacific | 41% (Overall Company) |

What You’re Viewing Is Included

Borouge BCG Matrix

The Borouge BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, offers an in-depth look at Borouge's product portfolio, categorizing each business unit into Stars, Cash Cows, Question Marks, and Dogs based on market growth and relative market share. By purchasing, you gain access to this professionally formatted, ready-to-use report, enabling you to effectively assess Borouge's strategic positioning and identify opportunities for resource allocation and future investment.

Dogs

Hypothetical undifferentiated commodity polyolefins within Borouge's portfolio would represent products facing significant global price pressures and offering little differentiation. These would likely possess a low market share and contribute minimally to overall profitability, potentially acting as cash drains if not managed strategically.

Borouge's stated strategy centers on high-value, differentiated products, indicating a deliberate effort to reduce exposure to these commodity segments. For instance, in 2024, the global polyolefins market experienced price volatility, with benchmark prices for polyethylene fluctuating significantly due to feedstock costs and supply-demand dynamics.

Products in this category are those linked to industries experiencing a decline or are becoming obsolete due to technological advancements. Borouge's involvement in these areas, particularly where its market share is minimal, presents a challenge. Maintaining these legacy offerings demands resources that could be better allocated, especially given the limited potential for future growth or profit.

For instance, if Borouge had products serving the traditional pipe extrusion market for non-specialized applications, and this segment was increasingly being replaced by more advanced materials or manufacturing techniques, these would fall into the Dogs category. The company's strategic focus on innovation is key to addressing this, aiming to phase out or significantly upgrade these older product lines to align with market evolution.

Smaller, non-strategic geographic markets with limited market penetration and significant growth barriers would be placed in this quadrant of Borouge's BCG Matrix. These regions often demand substantial investment for what typically translates into minimal returns, making them less attractive for resource allocation.

Borouge's strategic emphasis on high-growth areas such as the Asia Pacific, Middle East, and Africa suggests a deliberate decision to de-prioritize expansion in less promising territories. For instance, while specific market penetration data for all minor regions isn't publicly detailed, Borouge's 2024 investor reports highlight substantial capital expenditure directed towards expanding capacity in the Middle East and Asia, underscoring this focus.

Inefficient or Older Production Facilities

Inefficient or older production facilities within Borouge's portfolio could be considered Dogs in the BCG matrix. These units might struggle with higher operational costs and produce lower-margin products. For instance, if older plants have significantly lower energy efficiency compared to newer ones, their contribution to overall profitability might be minimal. Borouge's consistent investment in upgrades, like the expansion projects and technology enhancements seen in recent years, aims to prevent such assets from becoming obsolete and underperforming.

While Borouge emphasizes high asset reliability, any specific legacy assets that haven't undergone substantial modernization could fall into this category. The company's strategic focus on enhancing operational efficiency and adopting advanced technologies helps mitigate the risk of assets becoming Dogs.

- Potential for higher operating costs due to outdated technology.

- Lower profit margins on products manufactured in these facilities.

- Risk of becoming obsolete if not upgraded or repurposed.

- Minimal contribution to overall company growth and profitability.

Non-Core or Divested Business Lines

Non-core or divested business lines within Borouge's BCG Matrix represent segments that are no longer central to the company's strategic direction. These might include smaller product offerings or business units that have demonstrated low profitability and a limited market share. Their divestiture is typically driven by a desire to reallocate resources towards more promising growth areas.

While specific details on recent divestitures of non-core segments for Borouge are not publicly available, this category would encompass any operations that consume capital without generating sufficient returns or contributing significantly to the company's overall strategic goals. Such segments are often candidates for sale or closure to streamline operations and enhance focus.

- Low Profitability: Segments that consistently underperform financially, dragging down overall company margins.

- Limited Market Share: Business units with a small presence in their respective markets, making competitive growth challenging.

- Strategic Misalignment: Operations that do not fit with Borouge's long-term vision and core competencies in polyolefins.

Dogs in Borouge's BCG Matrix represent products or business units with low market share and low growth potential. These segments often consume resources without generating significant returns, potentially acting as cash drains.

Borouge's strategic focus on differentiated and high-value products means that any legacy commodity offerings or less competitive segments would likely fall into this category. For example, if Borouge has older product lines facing intense price competition with minimal innovation, they would be classified as Dogs.

The company's efforts to invest in advanced technologies and expand into high-growth markets further highlight a strategy to move away from such underperforming areas. In 2024, the global polyolefins market continued to see shifts, with demand for specialized grades increasing while commodity segments faced margin pressures.

Borouge's portfolio management likely involves assessing these Dog segments for potential divestiture, restructuring, or phasing out to reallocate capital towards more promising ventures. This proactive approach ensures resources are directed towards areas aligned with long-term strategic objectives and market demands.

Question Marks

Borouge's feasibility study for a new specialty polyolefins complex in China places this venture squarely in the Question Mark category of the BCG matrix. China's burgeoning demand for specialized polyolefins, driven by sectors like automotive and advanced packaging, presents a significant growth opportunity.

This expansion into China, a market where Borouge's presence in specialty polyolefins is less established than in its core markets, requires careful consideration of investment versus potential market share gains. The Chinese polyolefins market is projected to grow at a compound annual growth rate of approximately 5.5% through 2027, according to industry analyses.

The substantial capital investment required for such a complex, coupled with the inherent risks of entering a new, competitive market, underscores its Question Mark status. Success hinges on Borouge's ability to secure market share and achieve profitability in a dynamic environment, with potential for high future returns if market penetration is successful.

Borouge is actively exploring emerging electrification solutions, notably components for Lithium-ion batteries and materials for floating solar pontoons. These innovations position Borouge within the rapidly expanding energy transition market, a sector poised for substantial growth. However, the company's market share in these developing technologies is still in its early stages.

Significant investment in research and development, alongside focused market penetration strategies, will be crucial for Borouge to elevate these promising electrification applications from question marks to star performers in its portfolio. For instance, the global battery materials market alone was valued at over $20 billion in 2023 and is projected to grow at a compound annual growth rate of over 15% through 2030, highlighting the immense potential.

Borouge's Borcycle™ initiative is a key component of its strategy to drive circularity in the plastics sector, focusing on advanced recycling solutions. This commitment aligns with the growing global demand for sustainable materials, spurred by increasing environmental regulations and consumer preferences.

The circular economy represents a significant growth opportunity, with the global recycled plastics market projected to reach USD 68.9 billion by 2027, growing at a CAGR of 5.4%. However, the market for recycled content solutions is still developing, requiring substantial investment to achieve economies of scale and widespread adoption.

While Borcycle™'s innovative approach positions Borouge favorably, its current market share in recycled polymers is relatively small compared to virgin polymer production. Continued investment in technology, infrastructure, and market development is crucial for these circular solutions to scale effectively and capture a larger portion of the plastics market.

AI and Digital Transformation Initiatives

Borouge's commitment to AI and digital transformation is a significant driver of its future growth. These initiatives are designed to optimize production processes and foster innovation across its operations. For instance, in 2023, Borouge reported a 15% year-on-year increase in digital project implementation, highlighting the pace of these advancements.

- Focus on AI-driven process optimization: Borouge is leveraging AI to improve energy efficiency and reduce waste in its manufacturing facilities.

- Digitalization of supply chains: Investments in digital platforms aim to enhance transparency and responsiveness throughout the value chain.

- Development of smart materials: AI is being explored to accelerate the creation of new polymer grades with enhanced properties, though market penetration for these specific innovations is still nascent.

- Data analytics for predictive maintenance: The company is deploying advanced analytics to anticipate equipment failures, thereby minimizing downtime and operational costs.

Specific Niche Applications from Recent Product Launches

Borouge's 2024 product launches, featuring nine innovative products and five new grades, particularly in infrastructure and advanced packaging, demonstrate a strategic push into expanding markets. While these new offerings target growth areas, specific niche applications or very recent grades might initially possess a low market share. This is typical as potential customers explore and integrate these novel materials into their existing processes.

These niche applications, despite their current limited market penetration, represent potential future Stars within Borouge's portfolio. Their success hinges on dedicated marketing efforts and targeted investment to build awareness and drive adoption. For instance, a new high-performance polymer grade for specialized infrastructure projects, while currently used by few, could become a market leader if its unique benefits are effectively communicated and demonstrated.

- Nine innovative products and five new grades launched in 2024.

- Targeting growth sectors like infrastructure and advanced packaging.

- Niche applications may have low initial market share due to discovery and adoption phases.

- Focused marketing and investment are crucial for these products to become Stars.

Borouge's ventures into emerging markets and new technologies, such as specialty polyolefins in China and electrification solutions, are classic examples of Question Marks. These areas offer high growth potential but require significant investment and face market uncertainties. Borouge's strategic investments in these segments, like the new China complex, reflect a calculated approach to capture future market share, despite the inherent risks and the need to build brand presence in less established segments.

| Borouge Business Unit | BCG Category | Rationale | Market Growth Potential | Borouge Market Share |

| Specialty Polyolefins (China Expansion) | Question Mark | High growth market, but Borouge's presence is nascent, requiring substantial investment and market penetration efforts. | China's polyolefins market projected to grow at ~5.5% CAGR through 2027. | Low to Moderate (developing) |

| Electrification Solutions (Battery Materials, Solar Pontoons) | Question Mark | Emerging technologies in a high-growth sector (energy transition), but Borouge's market share is still in early stages. | Global battery materials market >$20 billion in 2023, growing at >15% CAGR through 2030. | Low (nascent) |

| Borcycle™ (Circular Economy Solutions) | Question Mark | Growing demand for sustainable materials, but the market for recycled content solutions is still developing and requires scale. | Global recycled plastics market projected to reach $68.9 billion by 2027 (5.4% CAGR). | Low (developing) |

| 2024 New Product Launches (Niche Applications) | Question Mark | Targeting growth sectors, but new niche applications often start with low initial market share as adoption phases begin. | Targeting infrastructure and advanced packaging growth areas. | Low (initial adoption phase) |

BCG Matrix Data Sources

Our Borouge BCG Matrix leverages comprehensive data, including Borouge's financial reports, market share data, and industry growth projections, to accurately position its product portfolio.