Borouge Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Borouge Bundle

Borouge faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers playing crucial roles in its market. Understanding these forces is key to navigating the petrochemical landscape.

The complete report reveals the real forces shaping Borouge’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Borouge's reliance on key petrochemical feedstocks like ethylene and propylene places it at the mercy of its suppliers. These essential building blocks are primarily sourced from crude oil and natural gas, commodities themselves subject to supply and demand dynamics.

The petrochemical industry's feedstock supply chain is often characterized by a limited number of large-scale producers. For Borouge, a significant portion of its feedstock is likely sourced from entities with substantial upstream capabilities, such as ADNOC, a major shareholder in Borouge itself. This concentration means that a few key suppliers can wield considerable influence over pricing and availability.

When suppliers are few and possess significant market share, their bargaining power intensifies. This is particularly true if there are few viable alternative sources for these critical raw materials or if the cost and complexity of switching suppliers are prohibitively high. In 2023, global petrochemical feedstock prices saw fluctuations driven by energy market volatility, highlighting the impact of supplier leverage on companies like Borouge.

While many petrochemical feedstocks are essentially commodities, meaning they are largely interchangeable and widely available, the uniqueness of inputs can still grant suppliers some bargaining power. If a supplier possesses specialized grades of these feedstocks or utilizes proprietary technologies in their production, they might command better terms.

However, for a company like Borouge, this factor is somewhat tempered. Borouge benefits significantly from its strong operational efficiency and its close integration with ADNOC, the Abu Dhabi National Oil Company. This relationship ensures access to cost-advantaged feedstocks, which inherently reduces the leverage any individual feedstock supplier might otherwise have.

Switching suppliers for Borouge's core feedstocks, like ethylene and propylene, can be a costly endeavor. These costs often include significant investments in new logistics infrastructure, adapting existing production facilities, and the complex process of recalibrating manufacturing equipment and quality control systems. For instance, in 2023, the global average cost for setting up new petrochemical feedstock supply chains could range from millions to tens of millions of dollars, depending on the scale and complexity.

This inherent difficulty in changing primary suppliers significantly bolsters the bargaining power of Borouge's existing feedstock providers. Any disruption to these established relationships would not only incur substantial financial penalties but also lead to production downtime and potential loss of market share, making Borouge more reliant on its current suppliers.

Threat of Forward Integration by Suppliers

Major oil and gas producers possess the capability to integrate forward into polyolefin production, directly challenging Borouge's market position. This integration could leverage their existing feedstock advantages to compete on price and supply. For instance, if crude oil prices were to significantly decline, integrated players might find it more attractive to move downstream.

However, Borouge's strategic alliances, particularly its joint venture with ADNOC and Borealis, and the anticipated formation of Borouge Group International, serve to buffer this threat. These partnerships create a more unified front, aligning interests and potentially sharing the risks associated with market volatility. The strength of these collaborations is underscored by Borouge's significant market presence, with its 2023 revenue reaching approximately USD 7.5 billion.

- Forward Integration Risk: Major oil and gas companies could enter polyolefin production, becoming direct rivals.

- Mitigation Strategies: Borouge's joint ventures with ADNOC and Borealis, and the planned Borouge Group International, reduce this threat through strategic alignment.

- Financial Context: Borouge's 2023 revenue of roughly USD 7.5 billion demonstrates its established market position, making direct competition more challenging for new entrants.

Importance of Borouge to Suppliers

Borouge's substantial demand makes it a critical customer for its feedstock suppliers, particularly the Abu Dhabi National Oil Company (ADNOC). In 2023, Borouge's feedstock procurement represented a significant portion of ADNOC's sales, underscoring the supplier's reliance on this business relationship.

The sheer volume of materials Borouge acquires means that suppliers are highly motivated to maintain this partnership. Losing Borouge as a client would represent a considerable financial blow, making them more amenable to Borouge's pricing and terms, thus tempering their inherent bargaining power.

- Borouge's significant purchasing volume directly impacts supplier revenue streams.

- ADNOC, a key supplier, has a vested interest in the continued success of Borouge.

- The risk of losing Borouge as a major customer can lead suppliers to offer more favorable terms.

Borouge's bargaining power with suppliers is moderate, influenced by its scale and strategic relationships, but constrained by the commodity nature of feedstocks and high switching costs. The limited number of large-scale feedstock producers, such as ADNOC, grants them significant leverage. However, Borouge's substantial demand, exemplified by its 2023 revenue of approximately USD 7.5 billion, incentivizes key suppliers like ADNOC to maintain favorable terms, thus mitigating some of this supplier power.

| Factor | Borouge's Position | Impact on Bargaining Power |

| Supplier Concentration | Limited number of large producers (e.g., ADNOC) | Increases supplier power |

| Switching Costs | High due to infrastructure and recalibration needs | Increases supplier power |

| Borouge's Demand Volume | Significant, representing a large portion of supplier revenue | Decreases supplier power |

| Strategic Alliances (ADNOC, Borealis) | Provides access to cost-advantaged feedstocks | Decreases supplier power |

What is included in the product

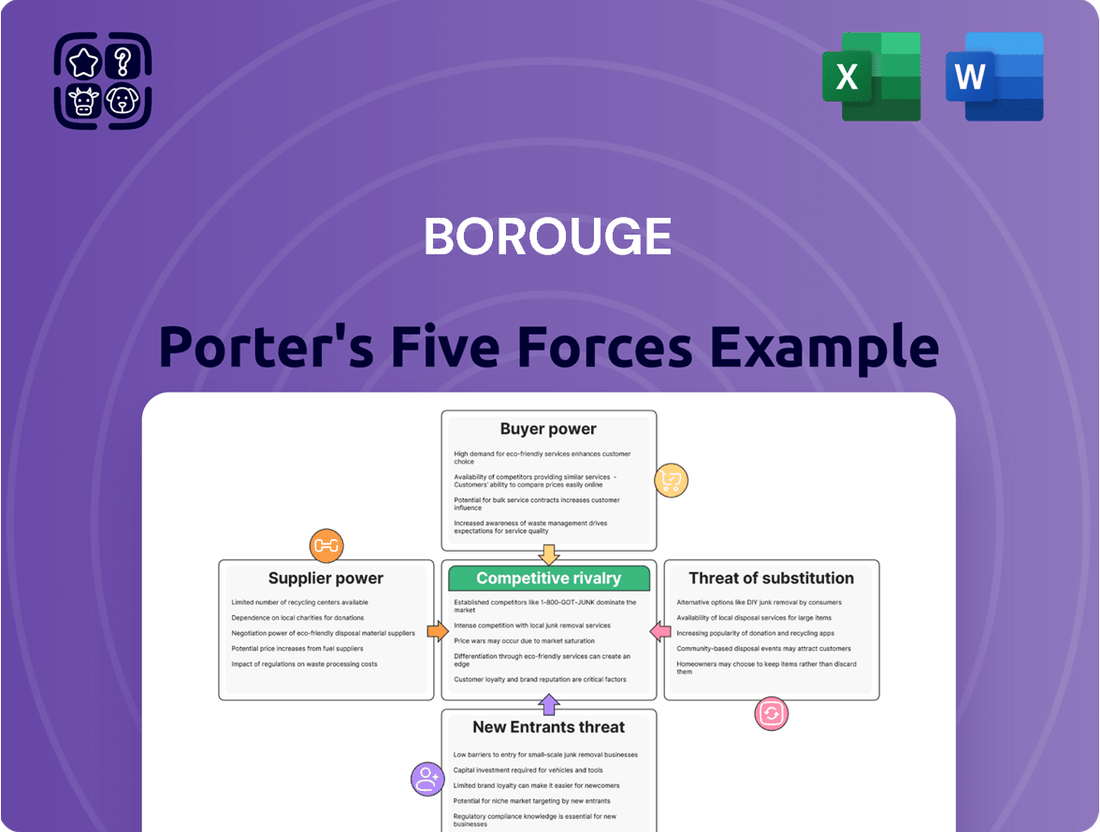

This Borouge Porter's Five Forces analysis dissects the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the polyolefins industry.

Instantly visualize Borouge's competitive landscape with a dynamic Porter's Five Forces model, simplifying complex market pressures for strategic clarity.

Customers Bargaining Power

Borouge serves a broad range of sectors, from infrastructure and energy to healthcare and agriculture, meaning its customer base is inherently diversified. While this diffusion generally limits the bargaining power of any single customer, the situation can shift with large industrial clients or major distribution partners. These significant buyers, due to their substantial order volumes, can indeed wield considerable influence, potentially negotiating more favorable terms and pricing.

Customer switching costs for Borouge's specialized polyolefin products can be moderate. For instance, when customers utilize Borouge's solutions in demanding sectors like automotive or infrastructure, changing suppliers often necessitates rigorous re-qualification and performance validation. This process can involve significant time and resources, thereby increasing the inertia for customers to switch.

Customer price sensitivity for commodity polyolefins is a significant factor, as buyers can readily switch between producers based on the lowest price. In 2024, the global polyolefins market experienced price fluctuations driven by feedstock costs and supply-demand dynamics, making price a key differentiator for standard grades.

However, Borouge's focus on differentiated and value-added solutions, such as advanced packaging materials or specialized automotive components, can reduce this price sensitivity. Customers opting for these products often prioritize performance, reliability, and specific technical attributes over minor price differences, recognizing the long-term benefits of Borouge's innovative offerings.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Borouge is generally low. The petrochemical industry, particularly polyolefin production, is highly capital-intensive and demands significant technical expertise, making it a formidable barrier for most customers to overcome. For instance, establishing a new polyolefin plant can cost billions of dollars, a prohibitive investment for the vast majority of Borouge's client base.

However, exceptionally large industrial consumers, such as major automotive manufacturers or packaging giants, might contemplate backward integration if they face persistent polyolefin supply disruptions or experience sustained price hikes that significantly impact their profitability. These large-scale buyers may possess the financial muscle and operational capacity to explore such a strategic move, though it remains an infrequent occurrence.

In 2023, the global polyolefin market, which Borouge serves, was valued at approximately $240 billion, underscoring the sheer scale of investment required to compete. The complexity of managing feedstock sourcing, chemical processes, and regulatory compliance further mitigates the likelihood of widespread backward integration. Borouge's integrated business model, from feedstock to specialized polymer solutions, also presents a significant competitive advantage.

- Low Likelihood: The substantial capital investment and technical expertise required for petrochemical production make backward integration by most customers highly improbable.

- Potential for Large Consumers: Very large industrial buyers might consider integration if supply becomes unreliable or prices become excessively high, though this is rare.

- Industry Scale: The global polyolefin market's immense size, estimated at around $240 billion in 2023, highlights the significant financial and operational barriers to entry for potential integrating customers.

- Borouge's Advantage: Borouge's integrated value chain offers a competitive edge that discourages customers from attempting to replicate its production capabilities.

Availability of Substitute Products for Customers

The bargaining power of customers is significantly influenced by the availability of substitute products. In the polyolefin market, customers have a wide array of choices from numerous global producers, including major players like ExxonMobil, Dow, SABIC, and LyondellBasell. This extensive competition for similar product offerings directly enhances customer leverage.

Customers can readily switch between suppliers if pricing or terms become unfavorable. This is particularly true for standard grades of polyolefins, where product differentiation is minimal. For instance, in 2024, the global polyolefin market experienced robust supply, with production capacities expanding across various regions, further intensifying competition and empowering buyers.

- Global Polyolefin Market Competition: Customers can source polyolefins from a multitude of producers worldwide.

- Impact of Substitutes: The presence of numerous suppliers offering similar products increases customer bargaining power.

- Standard Grade Vulnerability: Customers have high leverage when purchasing standard polyolefin grades due to easy substitutability.

- 2024 Market Dynamics: Increased global polyolefin supply in 2024 amplified competitive pressures, benefiting customers.

The bargaining power of customers for Borouge is influenced by several factors, including price sensitivity for commodity products and switching costs for specialized ones. While large clients can exert pressure through order volume, Borouge's focus on value-added solutions mitigates price sensitivity for those specific offerings.

Customer switching costs can be moderate, especially in demanding sectors where re-qualification is necessary. However, for standard polyolefin grades, price sensitivity is high, amplified by robust global supply in 2024. The threat of backward integration by customers is generally low due to the industry's capital intensity and technical demands.

| Factor | Borouge Impact | Customer Bargaining Power |

|---|---|---|

| Customer Concentration | Diversified, but large clients have influence | Moderate to High (for large clients) |

| Switching Costs | Moderate for specialized products | Low to Moderate |

| Price Sensitivity | High for commodity grades, low for specialized | High (commodity), Low (specialized) |

| Threat of Backward Integration | Very Low for most, low for large clients | Very Low |

Same Document Delivered

Borouge Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Borouge, detailing the industry's competitive landscape. You'll find an in-depth examination of each force, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. The document displayed here is the exact, fully formatted analysis you'll receive immediately after purchase, offering actionable insights into Borouge's strategic positioning.

Rivalry Among Competitors

The global polyolefins market is intensely competitive, featuring major international players such as ExxonMobil, Dow, SABIC, LyondellBasell, and Sinopec. Borouge, a significant entity, contends with a landscape populated by numerous established and burgeoning producers, especially within the Asia Pacific region, which commands a substantial market share.

The polyolefin market is projected for robust expansion, with analysts forecasting a substantial increase in its global market size in the coming years. For instance, the market was valued at approximately USD 230 billion in 2023 and is expected to reach over USD 330 billion by 2030, growing at a CAGR of around 5%. This expanding demand can ease competitive pressures as there's ample room for all participants to grow.

However, this rapid growth isn't without its complexities. Potential oversupply in key building blocks like ethylene and propylene, driven by new capacity additions, could still exert downward pressure on prices. This dynamic means that while the overall market is expanding, specific product segments might still face intense price competition, tempering the reduction in rivalry.

Borouge actively pursues product differentiation by offering innovative polyolefin solutions, which effectively lessens direct price competition for its specialized offerings. This strategy allows them to command premium pricing for unique product attributes.

However, the competitive landscape shifts for Borouge's more commoditized polyolefin grades. In these segments, differentiation is significantly lower, intensifying price-based rivalry among producers.

For instance, in 2024, the global polyolefins market experienced fluctuating prices, particularly for standard grades, as supply-demand dynamics shifted, highlighting the importance of Borouge's differentiated product portfolio in mitigating these pressures.

Exit Barriers

The petrochemical industry, including players like Borouge, faces significant exit barriers. These are primarily driven by the immense capital tied up in specialized plants and infrastructure, which are not easily repurposed or sold. For instance, building a new integrated polyolefin complex can cost billions of dollars, making it extremely difficult for companies to simply walk away.

These high exit barriers mean that even when market conditions are unfavorable, such as during periods of oversupply or low demand, companies are often compelled to continue operating. This can lead to prolonged periods of intense competition as firms strive to cover their fixed costs, potentially exacerbating price wars and squeezing profit margins for all participants. In 2024, the global petrochemical market experienced fluctuations, with certain segments facing overcapacity, underscoring the impact of these entrenched players.

- High Capital Investment: Petrochemical facilities require substantial upfront investment, often in the billions of dollars, creating a significant financial hurdle for exiting the market.

- Specialized Assets: The highly specialized nature of petrochemical plants and equipment limits their resale value and alternative uses, increasing the cost of exit.

- Operational Inertia: Companies may continue to operate at a loss to cover variable costs and avoid the full write-off of fixed assets, leading to sustained competitive pressure.

- Long-Term Contracts: Existing supply and offtake agreements can also bind companies to operations, further complicating and raising the cost of exiting.

Strategic Stakes

Borouge's robust financial performance in 2024, marked by increased net profit and sales volumes, highlights the intense competition within the polyolefins market. This success fuels the company's drive to defend and expand its market share, making strategic maneuvers crucial.

The impending formation of Borouge Group International, poised to become a $60 billion global polyolefins leader, significantly elevates the strategic stakes for its key shareholders, ADNOC and Borealis. This ambitious consolidation intensifies competitive pressures as rivals vie for dominance in this high-value sector.

- Borouge's 2024 Financials: Increased net profit and sales volumes underscore a strong market position and commitment to growth.

- Strategic Consolidation: The planned $60 billion Borouge Group International formation signals a major shift, intensifying global competition.

- Shareholder Value: High strategic stakes for ADNOC and Borealis mean aggressive competitive strategies are likely to continue.

Competitive rivalry within the polyolefins sector is fierce, with Borouge facing established global giants and numerous regional players, particularly in Asia. While market expansion offers growth opportunities, potential oversupply of key feedstocks like ethylene and propylene in 2024 could intensify price competition for standard polyolefin grades, impacting all market participants.

Borouge's strategy of product differentiation for specialized offerings helps mitigate direct price wars, allowing for premium pricing. However, for its more commoditized products, price-based competition remains a significant challenge, as evidenced by price fluctuations in 2024 for standard grades influenced by supply-demand shifts.

High exit barriers, including massive capital investments in specialized plants and long-term contracts, keep companies like Borouge entrenched, even during unfavorable market conditions. This operational inertia can prolong periods of intense competition and pressure profit margins, a dynamic observed across the petrochemical sector in 2024.

The planned formation of Borouge Group International, creating a $60 billion global leader, signals an aggressive competitive stance. This consolidation elevates the stakes for shareholders and intensifies rivalry as the company aims for market dominance, requiring strategic maneuvers to maintain and expand its share.

SSubstitutes Threaten

While polyethylene and polypropylene are Borouge's core products, the broader plastics and polymers market presents direct substitutes. For instance, PVC, polystyrene, and polyamides can fulfill similar functions in various applications, potentially impacting Borouge's market share if they offer a more compelling cost-benefit proposition. The global market for plastics is vast, with specialized polymers constantly emerging, adding to the competitive landscape.

The performance and price of substitute materials are a significant factor for Borouge. While high-performance polymers can offer superior characteristics, they often come with a considerably higher price tag. For many of Borouge's target applications, polyolefins strike a compelling cost-effectiveness balance, meaning substitutes would need to offer a substantial price reduction or a significant performance upgrade to be truly competitive.

Innovations in bioplastics and other sustainable materials are rapidly advancing, fueled by growing environmental awareness and stricter regulations. For instance, the global bioplastics market was valued at approximately USD 12.7 billion in 2023 and is projected to reach USD 34.6 billion by 2030, indicating significant growth in these substitute areas.

While these alternatives offer promising environmental benefits, their current production scale and cost structures often make them less competitive than traditional polyolefins for many large-volume applications. This means that while substitution is a growing threat, it's not yet a complete replacement across Borouge's entire product portfolio in the immediate future.

Customer Propensity to Substitute

Customer propensity to substitute is a key factor in understanding the competitive landscape. This is influenced by several elements, including environmental mandates, a growing consumer preference for sustainable products, and the actual availability of viable alternatives in the market.

As global concerns about environmental impact continue to rise, the willingness of customers to switch to eco-friendly options is likely to increase. For Borouge, this means that if more sustainable or recycled plastic alternatives become readily available and cost-competitive, customers might be more inclined to move away from traditional polyolefins.

Consider the following points regarding customer propensity to substitute:

- Environmental Regulations: Stricter regulations on plastic waste and single-use plastics can drive demand for biodegradable or easily recyclable materials, increasing the threat of substitution.

- Consumer Preference Shifts: A growing segment of consumers actively seeks out products made from recycled content or materials with a lower carbon footprint.

- Availability of Alternatives: The development of new materials, such as advanced bioplastics or improved recycled polymers from competitors, directly impacts the ease with which customers can switch.

- Price Sensitivity: While sustainability is important, customers will still weigh the cost of alternatives against the benefits. If substitute materials become significantly cheaper, the propensity to switch will rise.

Regulatory and Environmental Pressures

Increasing global regulations and environmental initiatives, particularly those focused on reducing plastic waste and fostering a circular economy, represent a significant threat of substitutes for virgin polyolefins. For instance, the European Union's Plastic Strategy aims to increase recycling rates and reduce single-use plastics, potentially boosting demand for recycled polymers and alternative materials. By 2030, the EU aims for all plastic packaging to be reusable or economically recyclable.

These external pressures can accelerate the development and market penetration of alternatives to virgin polyolefins. As governments implement stricter policies, such as extended producer responsibility schemes or taxes on virgin plastics, the cost-competitiveness of substitutes like bio-based plastics or advanced recycled materials may improve. For example, some regions are exploring mandates for minimum recycled content in new plastic products, directly impacting the market share of virgin materials.

- Regulatory Push: Governments worldwide are enacting policies to curb plastic pollution and promote sustainability.

- Circular Economy Drive: Initiatives promoting reuse, recycling, and the use of recycled content directly challenge virgin material demand.

- Material Innovation: Environmental pressures incentivize research and development into alternative materials, such as biodegradable polymers and advanced recycled feedstocks.

- Cost Competitiveness: Policy changes can alter the cost landscape, making substitutes more economically viable compared to virgin polyolefins.

The threat of substitutes for Borouge's polyolefins is growing, driven by environmental concerns and regulatory pushes. While traditional plastics like PVC and polystyrene offer some functional overlap, the real challenge comes from emerging sustainable alternatives. The global bioplastics market, valued at approximately USD 12.7 billion in 2023, is projected to reach USD 34.6 billion by 2030, highlighting significant investment and growth in this area. These substitutes, including bio-based plastics and advanced recycled materials, are becoming more viable as environmental awareness and regulations increase.

Customer willingness to adopt these substitutes is directly influenced by factors like environmental mandates and the availability of cost-competitive alternatives. For instance, the European Union's strategy to increase plastic recycling rates and reduce single-use plastics by 2030 could significantly boost demand for recycled polymers. While performance and price remain key considerations, the increasing emphasis on sustainability means that substitutes offering a strong eco-friendly proposition, even at a slightly higher cost, are likely to gain traction.

| Substitute Material | Key Drivers | Market Growth Projection (USD Billion) | Borouge's Core Products |

|---|---|---|---|

| Bioplastics | Environmental awareness, regulations, consumer preference | 12.7 (2023) to 34.6 (2030) | Polyethylene, Polypropylene |

| Advanced Recycled Polymers | Circular economy initiatives, regulatory mandates (e.g., recycled content) | Growing significantly, specific figures vary by region and polymer type | Polyethylene, Polypropylene |

| Other Specialty Polymers (e.g., Polyamides) | Specific performance requirements, niche applications | Market size varies by polymer type, but overall growth is steady | Polyethylene, Polypropylene |

Entrants Threaten

The petrochemical sector demands substantial financial commitments, making it difficult for new players to enter. Building state-of-the-art facilities and acquiring advanced technology requires billions of dollars. For instance, Borouge's Borouge 4 project, aimed at expanding production capacity, represents an investment in the billions, creating a formidable financial hurdle for potential competitors.

Established players like Borouge benefit from significant economies of scale in production, procurement, and distribution, which can be a major barrier for newcomers. For instance, in 2023, Borouge's total production capacity reached 6.3 million tonnes per annum, allowing them to spread fixed costs over a much larger output than a new entrant could initially manage.

New entrants would struggle to achieve similar cost efficiencies without substantial output, making it difficult to compete on price against a company that can leverage its existing infrastructure and purchasing power. This cost disadvantage can deter potential competitors from entering the market.

Access to reliable and cost-effective feedstock, like crude oil and natural gas, is a significant hurdle for new players in the petrochemical industry. Borouge's strategic joint venture with ADNOC, a major oil and gas producer, grants it a distinct advantage by ensuring a secure and competitively priced supply of these essential raw materials. This integrated approach significantly raises the barrier to entry.

Furthermore, proprietary technologies and patents held by established companies like Borouge act as formidable deterrents to potential entrants. These innovations in production processes and product development create a technological moat, making it difficult and expensive for newcomers to replicate the same level of efficiency and product quality. For instance, Borouge's focus on differentiated polyolefins, enabled by its advanced Borstar® technology, provides a competitive edge that is not easily matched.

Government Policy and Regulations

Government policies and regulations significantly shape the threat of new entrants in the petrochemical industry, including for companies like Borouge. Favorable policies can encourage investment and expansion, while stringent environmental and operational standards can act as substantial barriers.

For instance, the Middle East, where Borouge operates, has actively sought to bolster its petrochemical sector, potentially easing entry for new players. However, globally, evolving environmental regulations, such as those related to carbon emissions and plastic waste, can increase the cost and complexity of establishing new operations, thereby deterring potential entrants.

- Government Support: Initiatives like Saudi Arabia's Vision 2030 aim to diversify the economy, which includes significant investment in petrochemicals, potentially lowering entry barriers in that specific region.

- Environmental Compliance Costs: The increasing global focus on sustainability means new entrants must factor in substantial upfront costs for compliance with strict environmental standards, such as those mandated by the EU's Green Deal.

- Trade Agreements and Tariffs: International trade agreements can either facilitate or restrict the flow of goods and investment, impacting the ease with which new companies can enter different markets.

- Operational Standards: Adherence to rigorous safety and operational standards, often requiring advanced technology and skilled labor, presents a significant hurdle for new, less established companies.

Brand Loyalty and Distribution Channels

Borouge's commitment to developing innovative polyolefin solutions, moving beyond basic commodity status, fosters significant brand loyalty. This differentiation, combined with their extensive global distribution network, creates a substantial barrier for newcomers aiming to capture market share swiftly.

New entrants face challenges in replicating Borouge's established customer relationships, which are built on trust and a proven track record of delivering specialized products. The company's deep understanding of customer needs and its ability to provide tailored solutions are key components of this loyalty.

- Brand Loyalty: Borouge's focus on value-added, differentiated polyolefins cultivates strong customer allegiance.

- Distribution Network: An established and efficient global distribution system is a significant hurdle for new entrants.

- Customer Relationships: Long-standing partnerships and a deep understanding of client requirements create switching costs for customers.

- Innovation Focus: Borouge's continuous investment in R&D for specialized applications makes it difficult for generic commodity producers to compete directly.

The threat of new entrants in the petrochemical sector, impacting companies like Borouge, is generally low due to high capital requirements and established economies of scale. New players would need billions in investment to match existing production capacities and technological advancements. For instance, Borouge's 2023 production capacity stood at 6.3 million tonnes per annum, a scale difficult for newcomers to replicate quickly.

Access to raw materials and proprietary technology also acts as a significant barrier. Borouge's strategic partnerships, like its joint venture with ADNOC, ensure a stable and cost-effective feedstock supply. Furthermore, their investment in advanced technologies, such as the Borstar® process, creates a technological moat that deters imitation.

Government policies and brand loyalty further solidify these barriers. While some regions may offer incentives, global environmental regulations increase operational costs for new entrants. Borouge's established customer relationships and focus on differentiated polyolefins also create switching costs, making it challenging for new companies to gain market traction.

| Barrier Type | Impact on New Entrants | Borouge's Advantage |

|---|---|---|

| Capital Requirements | Very High (Billions USD) | Established large-scale infrastructure |

| Economies of Scale | Significant Cost Disadvantage | 6.3 MTPA production capacity (2023) |

| Feedstock Access | Challenging & Costly | Strategic JV with ADNOC |

| Technology & Patents | Difficult to Replicate | Borstar® technology, differentiated products |

| Brand Loyalty & Distribution | Hard to Build Quickly | Global network, strong customer relationships |

Porter's Five Forces Analysis Data Sources

Our Borouge Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources, including Borouge's annual reports, industry-specific market research from firms like IHS Markit, and global economic indicators from sources such as the World Bank.