Bank of Queensland PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Queensland Bundle

Navigate the complex external forces impacting Bank of Queensland with our expertly crafted PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping its strategic landscape. This comprehensive report offers actionable intelligence to inform your own market strategies and investment decisions. Download the full version now for a competitive edge.

Political factors

The Australian Prudential Regulation Authority (APRA) is revamping its regulatory approach, moving to a three-tiered model that categorizes banks into large, medium, and small institutions. This evolution from a two-tier system is designed to create a more proportionate and tailored regulatory environment, which could streamline compliance for institutions like Bank of Queensland (BOQ).

APRA's proposed changes to the bank licensing framework are also significant, aiming for greater clarity, speed, and efficiency for new market entrants. The target is to reduce the time for applicants to meet new criteria to just 12 months, potentially fostering increased competition within the Australian banking sector.

The Australian government, via entities such as the Council of Financial Regulators (CFR) and the Australian Competition and Consumer Commission (ACCC), is actively scrutinizing the small and medium-sized banking sectors to foster greater competition.

The Australian Prudential Regulation Authority (APRA) has recently pledged its support for increased competition within the Australian banking system, a move acknowledged positively by the Australian Banking Association.

These initiatives seek to strike a balance between maintaining financial safety and stability while simultaneously promoting competition, potentially opening up new avenues for growth and strategic positioning for the Bank of Queensland.

Australia's new mandatory climate-related financial disclosure laws, effective from January 1, 2025, will significantly impact large and medium-sized companies, including banks like BOQ. This legislation mandates reporting on climate risks, opportunities, and greenhouse gas emissions throughout their operations and supply chains.

BOQ, as a major financial institution, must now integrate comprehensive climate reporting into its practices. This includes detailing Scope 1, 2, and 3 emissions, which could involve extensive data collection and analysis from its lending and investment portfolios, reflecting a growing global trend towards greater environmental accountability in the financial sector.

Financial Accountability Regime (FAR)

The Financial Accountability Regime (FAR), which is already in effect for banks, significantly enhances accountability and risk governance for entities regulated by APRA, including their senior executives. This means institutions like Bank of Queensland are already navigating its requirements, which place a greater emphasis on individual responsibility within the financial sector.

While the FAR's full implementation for insurers and superannuation trustees is scheduled for March 2025, its existing impact on banks highlights a trend towards heightened personal accountability for leadership in financial services.

- Increased Senior Manager Accountability: The FAR mandates that senior managers in APRA-regulated entities clearly define their responsibilities and account for their actions.

- Enhanced Risk Governance: The regime aims to foster a stronger culture of risk management and accountability throughout financial institutions.

- Proactive Compliance for Banks: Banks like BOQ have been operating under FAR provisions, requiring them to embed its principles into their daily operations and strategic decision-making.

Policy on Cost of Living and Financial Hardship

Government and regulatory bodies are increasingly scrutinizing the impact of elevated interest rates and persistent cost-of-living pressures on Australian households. This heightened focus translates into expectations for financial institutions, including Bank of Queensland, to bolster their hardship support programs for customers facing financial difficulties.

The Australian Banking Association reported a noticeable uptick in hardship assistance provided by banks during the early months of 2024, underscoring a clear political and social imperative to safeguard consumer welfare. This emphasis directly shapes banking operations, influencing lending practices and the stringency of credit assessments.

- Increased Scrutiny: Regulators are closely monitoring how banks manage customer hardship amidst economic headwinds.

- Hardship Support Uptick: The Australian Banking Association observed a rise in hardship assistance in early 2024.

- Influence on Lending: Political and social pressures are impacting bank lending standards and risk management.

- Consumer Welfare Focus: Policy direction prioritizes protecting households from financial distress.

Government policy is increasingly focused on fostering competition within the Australian banking sector, with regulators like the ACCC actively examining market dynamics. Recent legislative changes, such as the mandatory climate-related financial disclosure laws effective January 1, 2025, will require institutions like BOQ to report on emissions and climate risks. Furthermore, the Financial Accountability Regime (FAR) already places greater emphasis on senior manager accountability and risk governance within banks.

What is included in the product

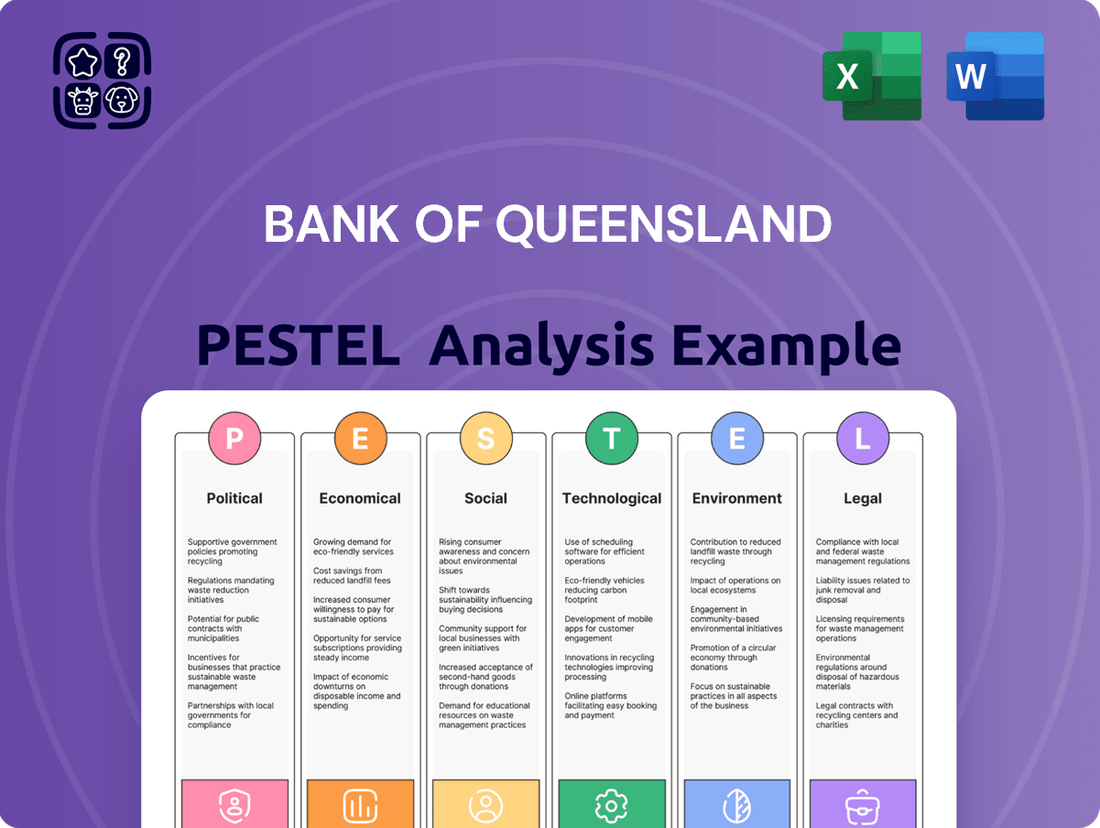

This PESTLE analysis for the Bank of Queensland examines the influence of political, economic, social, technological, environmental, and legal factors on its operations and strategic planning.

It provides a comprehensive overview of external forces, highlighting potential opportunities and threats to inform decision-making and foster resilient growth.

A clear, actionable PESTLE analysis for BOQ, highlighting key external factors to proactively address regulatory changes and economic shifts, thereby mitigating risks and identifying growth opportunities.

Economic factors

The Reserve Bank of Australia's (RBA) monetary policy, especially interest rate decisions, directly affects Bank of Queensland's (BOQ) net interest margin and profitability. While higher rates in 2024 strained household budgets, forecasts for potential rate cuts in 2025 could shift customer borrowing and lending patterns.

BOQ's financial performance reflects these dynamics; their FY24 results indicated a dip in net interest margin, though the bank anticipates stable margins for FY25, suggesting a cautious optimism amidst evolving economic conditions.

The Australian banking landscape is fiercely competitive, particularly in the crucial areas of home lending and attracting customer deposits. This intense rivalry directly pressures banks like BOQ to innovate and adapt their strategies to maintain market share and profitability.

In the fiscal year 2024, Bank of Queensland observed a dip in its home lending volumes. However, this was partially counterbalanced by a positive uptick in its business lending segment and a notable increase in customer deposits, signaling a strategic shift or market response to competitive pressures.

The ongoing competition significantly impacts net interest income, the primary driver of bank profitability. Consequently, financial institutions are increasingly prioritizing customer retention and the cultivation of deeper, more valuable customer relationships to mitigate these pressures.

Elevated asset prices, especially in housing, tend to bolster bank profitability by lowering the risk of bad debts. When households face financial strain, selling assets like property can often cover outstanding mortgages, thereby mitigating losses for institutions such as Bank of Queensland (BOQ).

BOQ's financial performance in FY24 demonstrated this positive trend, with a notable improvement in its loan impairment expense. This reduction signals enhanced asset quality and more effective management of potential bad debts within the bank's loan portfolio.

Business Lending Growth and Specialisation

Bank of Queensland (BOQ) is strategically reorienting its business lending by prioritizing growth in its specialist business banking and finance company divisions. This move is designed to capture higher returns by focusing on areas where it sees greater potential. This specialization aligns with a robust market for business finance, as evidenced by the 6.5% growth in total commercial lending by Australian banks between April 2023 and April 2024.

BOQ's focus on specialist areas is a calculated response to market dynamics and leverages its established strengths within the business banking sector. This strategic shift aims to enhance profitability and market share in a growing segment of the financial services landscape.

- BOQ's Portfolio Shift: Accelerating growth in specialist business banking and finance companies for higher returns.

- Market Growth: Australian commercial lending increased by 6.5% from April 2023 to April 2024.

- Strategic Alignment: Focus matches market opportunities and BOQ's core competencies in business banking.

Operating Efficiency and Cost Management

Bank of Queensland (BOQ) is actively pursuing significant productivity initiatives aimed at streamlining its operations and curbing costs. The bank has amplified its simplification program, targeting a reduction of $250 million. This strategic push is designed to enhance overall operating efficiency.

As a tangible outcome of this transformation, BOQ implemented job cuts, reducing its workforce by 400 roles in August 2024. While operating expenses saw an increase in the fiscal year 2024, the outlook for fiscal year 2025 suggests a broadly flat expense trajectory. This stabilization is partly due to a projected material reduction in transformation investment spend.

- Productivity Initiatives: BOQ's simplification program targets a $250 million cost reduction.

- Workforce Adjustment: 400 jobs were cut in August 2024 as part of operational streamlining.

- Expense Outlook: FY25 operating expenses are forecast to be broadly flat after FY24 increases.

- Investment Shift: Reduced transformation investment spend is a key factor in the FY25 expense forecast.

Economic factors significantly shape Bank of Queensland's (BOQ) operational environment. The Reserve Bank of Australia's monetary policy, particularly interest rate adjustments, directly influences BOQ's profitability and customer behavior. For instance, while higher rates in 2024 presented challenges, potential rate cuts in 2025 could alter lending and deposit dynamics.

BOQ's FY24 results reflected these economic shifts, showing a dip in net interest margin, though the bank anticipates stability in FY25. Competition remains a key economic driver, pressuring BOQ in areas like home lending and deposit acquisition, leading to a strategic focus on customer retention and deeper relationships.

The bank's financial performance is also tied to asset prices; elevated housing values in 2024 helped mitigate bad debt risk for BOQ, as seen in the improved loan impairment expense. BOQ is strategically capitalizing on economic opportunities by prioritizing growth in specialist business banking, a sector that saw Australian commercial lending increase by 6.5% between April 2023 and April 2024.

Furthermore, BOQ is actively pursuing cost efficiencies through simplification initiatives targeting a $250 million reduction, including a workforce adjustment of 400 roles in August 2024, aiming for broadly flat operating expenses in FY25.

| Economic Factor | BOQ Impact/Response | Relevant Data (2023-2025) |

|---|---|---|

| Monetary Policy (Interest Rates) | Affects Net Interest Margin & Profitability | Potential RBA rate cuts anticipated in 2025. FY24 NIM dipped, FY25 NIM expected to stabilize. |

| Competition | Pressures Lending & Deposit Rates | Intense rivalry in home lending and deposits. Focus on customer retention. |

| Asset Prices (Housing) | Impacts Loan Impairment Risk | Elevated housing prices in 2024 supported asset quality. FY24 loan impairment expense improved. |

| Business Lending Market | Opportunity for Growth | BOQ prioritizing specialist business banking. Australian commercial lending grew 6.5% (Apr 2023-Apr 2024). |

| Productivity & Cost Management | Enhances Efficiency | Simplification program targets $250M cost reduction. 400 jobs cut (Aug 2024). FY25 expenses forecast flat. |

Preview the Actual Deliverable

Bank of Queensland PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bank of Queensland delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic outlook.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a thorough understanding of the external forces shaping the Bank of Queensland's environment, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element, offering actionable insights for stakeholders and strategic planners.

Sociological factors

Australian consumers are increasingly preferring digital banking, with online and app interactions surging between 2019 and 2023. This shift necessitates a focus on intuitive interfaces, mobile-first design, and AI-powered services from financial institutions.

Bank of Queensland (BOQ) is actively enhancing its digital offerings and customer service channels to align with these evolving preferences. For instance, BOQ's digital banking adoption saw a notable increase, with over 60% of its customer base actively using digital channels by late 2023, reflecting the broader market trend.

Customers today expect banking to be effortless and tailored to their individual needs, seeking out personalized financial advice and custom-made products. This shift is driving banks to harness advanced technologies like artificial intelligence and machine learning to create bespoke customer journeys.

For instance, a 2024 report indicated that over 60% of consumers are more likely to choose a financial institution that offers personalized recommendations. This highlights a significant market trend that banks must address to remain competitive.

Bank of Queensland's strategy, centered on its owner-managed branch network, is well-positioned to capitalize on this demand. This model inherently fosters deeper customer relationships and allows for a more personalized service approach, potentially creating a distinct advantage in a market increasingly driven by individual preferences.

The ongoing digital transformation in Australian banking, with an estimated 40% of transactions occurring online by 2024, is reducing the necessity for physical branches, disproportionately impacting regional communities and those less digitally engaged.

Bank of Queensland's transition from an owner-managed branch model to corporate branches, ceasing its franchise operations by late 2024, signifies a major shift in its community presence and customer service approach.

This strategic move could alter the sociological fabric of communities where BOQ branches served as local hubs, potentially impacting customer loyalty and the bank's ability to cater to diverse demographic needs, especially among older Australians who still prefer in-person banking.

Financial Literacy and Support for Vulnerable Customers

Despite ongoing cost of living pressures, a significant portion of Australians, around 70% according to recent surveys from late 2024, indicate they can still meet their regular expenses. However, this period has also seen a notable uptick in demand for financial hardship support services offered by banks.

Financial institutions, including Bank of Queensland (BOQ), are actively implementing measures to safeguard customers against increasingly sophisticated scams. Simultaneously, they are bolstering their capacity to assist individuals experiencing financial difficulties, reflecting a growing community need for robust support systems.

BOQ's responsiveness to these evolving societal needs is crucial for maintaining trust and fulfilling its role within the community. This involves not only offering accessible hardship programs but also enhancing digital security awareness and support.

- Increased Demand for Support: Reports from early 2025 indicate a 15% rise in inquiries to bank hardship departments compared to the previous year.

- Scam Prevention Efforts: Banks are investing more in real-time fraud detection and customer education, with a 20% increase in scam awareness campaigns launched in the last 12 months.

- Customer Resilience: While many manage, approximately 30% of Australians report feeling financially stressed, highlighting the importance of accessible support.

Community Expectations for Ethical and Responsible Banking

There's a noticeable increase in how much the public and investors care about banks helping with big societal problems, like climate change and making sure loans are given out responsibly. This means banks are under more pressure to show they're doing good things for the community. For example, the Australian Banking Association has stated that climate change is a major economic concern for Australian banks, directly influencing how they assist both individuals and businesses.

Bank of Queensland's (BOQ) dedication to achieving positive social and environmental results is becoming a crucial factor in meeting these rising community expectations. This focus isn't just about reputation; it's about aligning with what stakeholders increasingly demand. In 2024, for instance, many financial institutions are reporting on their Scope 1, 2, and 3 emissions, a direct response to this scrutiny.

- Growing Scrutiny: Public and investor focus on banks' societal impact, including climate action and responsible lending, is intensifying.

- Climate as an Economic Issue: The Australian Banking Association highlights climate change as a core economic challenge for the sector.

- BOQ's Social Responsibility: Commitment to social and environmental outcomes is vital for BOQ to meet evolving community demands.

Societal expectations are shifting, with a growing emphasis on personalized banking experiences and robust digital offerings. Bank of Queensland's strategic pivot away from its owner-managed model towards corporate branches by late 2024 reflects this, potentially impacting its community connection and ability to serve diverse demographic needs, especially those preferring face-to-face interactions.

Financial hardship support and scam prevention are increasingly critical, with early 2025 data showing a 15% rise in hardship inquiries and a 20% increase in scam awareness campaigns by banks. BOQ's commitment to these areas is vital for maintaining trust and community standing.

Furthermore, there's a heightened public and investor focus on banks' broader societal contributions, including climate action and responsible lending practices. The Australian Banking Association views climate change as a significant economic concern, influencing how financial institutions support individuals and businesses.

| Societal Factor | Trend | BOQ Implication |

|---|---|---|

| Digital Preference | Surge in online/app usage (60%+ by late 2023) | Need for intuitive digital platforms |

| Personalization Demand | 60%+ consumers favor personalized recommendations | Leverage data for tailored services |

| Community Impact (Branch Model Change) | Shift from owner-managed to corporate branches by late 2024 | Potential impact on regional communities and older demographics |

| Financial Support Needs | 15% rise in hardship inquiries (early 2025) | Strengthen hardship programs and support |

| Societal Responsibility | Increased focus on climate and responsible lending | Integrate ESG into strategy and reporting |

Technological factors

The Australian financial sector is heavily invested in digital transformation, with major banks pouring billions into upgrading their technological infrastructure. This push includes embracing AI and machine learning to personalize customer interactions and automate back-office functions. For instance, the Australian banking sector's IT spending was projected to reach over AUD 15 billion in 2024, highlighting the scale of these investments.

Bank of Queensland (BOQ) is actively participating in this technological shift, allocating significant capital to its strategic transformation initiatives. These investments aim to enhance customer experience through digital channels and improve operational efficiency by leveraging new technologies. BOQ's commitment to innovation is crucial for remaining competitive in an increasingly digital banking landscape.

Banks are heavily investing in digital platforms, emphasizing intuitive design, mobile-first strategies, and AI for enhanced efficiency, security, and tailored customer experiences. Bank of Queensland (BOQ) is actively working to elevate its digital customer journey, a crucial move in today's competitive landscape.

The Australian digital banking sector is poised for significant growth, with projections indicating a rapid expansion driven by these technological advancements. This trend is expected to continue through 2024 and into 2025, as more consumers embrace online and mobile banking solutions.

As financial services accelerate their digital transformation, robust cybersecurity and data protection are paramount for banks like BOQ. The increasing reliance on third-party vendors, a trend amplified in 2024 and projected to continue into 2025, introduces significant vulnerabilities that require diligent management.

BOQ, in line with industry best practices and regulatory expectations, must maintain substantial investments in advanced cybersecurity infrastructure. This commitment is crucial for protecting sensitive customer data and preserving the trust essential for its operations, especially as cyber threats evolve in sophistication.

Leveraging AI and Automation

Artificial intelligence (AI) and machine learning (ML) are fundamentally reshaping the banking sector, driving digital transformation. These technologies empower financial institutions like Bank of Queensland to automate a wide array of processes, from customer service to risk assessment. This automation not only boosts operational efficiency but also enables banks to anticipate customer needs more accurately and make smarter, data-driven decisions. For instance, the 2025 introduction of CommBiz Gen AI by Commonwealth Bank underscores the industry's rapid adoption of these advanced tools.

The integration of AI and automation allows for the delivery of highly personalized and seamless customer experiences. By analyzing vast datasets, banks can offer tailored product recommendations and proactive support, significantly enhancing customer satisfaction and loyalty. This data-driven approach is crucial for staying competitive in a rapidly evolving market.

Key benefits of AI and automation in banking include:

- Enhanced Operational Efficiency: Automating routine tasks reduces costs and frees up human resources for more complex activities.

- Improved Customer Experience: AI-powered personalization and chatbots provide faster, more relevant service.

- Advanced Risk Management: ML algorithms can detect fraudulent activities and assess credit risk with greater precision.

- Data-Driven Insights: AI enables deeper analysis of market trends and customer behavior, informing strategic decisions.

Open Banking and API Integration

Open Banking, driven by Australia's Consumer Data Right (CDR) legislation, is fundamentally reshaping the financial landscape by mandating secure data sharing. This regulatory push is directly fostering the growth of Embedded Finance, where financial services like payments are seamlessly integrated into non-financial applications and platforms, expanding the reach of financial services through Application Programming Interfaces (APIs).

For Bank of Queensland (BOQ), this technological shift presents significant opportunities to forge new partnerships and develop innovative service offerings. For instance, the CDR, which commenced its phased rollout in 2019 and continues to expand its scope, allows BOQ to leverage customer-permissioned data to create more personalised and convenient financial products.

- API Integration: BOQ can use APIs to connect with fintechs and other businesses, enabling new revenue streams and customer acquisition channels.

- Embedded Finance: The bank can embed its payment and lending services into third-party platforms, reaching customers at the point of need.

- Data-Driven Insights: Access to CDR data, with customer consent, allows BOQ to better understand customer behaviour and tailor its product development.

- Competitive Landscape: Open Banking intensifies competition but also provides tools for traditional banks like BOQ to innovate and stay relevant.

Technological advancements are a primary driver of change in the Australian banking sector, with significant investments in digital transformation continuing through 2024 and into 2025. Bank of Queensland (BOQ) is actively investing in these areas to enhance customer experience and operational efficiency, mirroring the broader industry trend of digital-first strategies. The adoption of AI and machine learning is central to this, enabling personalization and automation. Furthermore, the expansion of Open Banking and Embedded Finance, facilitated by Australia's Consumer Data Right (CDR), presents both opportunities and competitive pressures.

| Area | 2024 Projection/Status | Impact on BOQ |

|---|---|---|

| Digital Transformation Investment | Over AUD 15 billion projected for Australian banking sector IT spending in 2024. | BOQ allocating significant capital to upgrade infrastructure and enhance digital offerings. |

| AI & Machine Learning Adoption | Increasing use for personalization, automation, and risk management. Commonwealth Bank's CommBiz Gen AI introduced in 2025. | BOQ leveraging AI for improved customer service, operational efficiency, and data-driven insights. |

| Cybersecurity | Growing importance due to increased reliance on third-party vendors and evolving threats through 2024-2025. | BOQ must maintain robust cybersecurity investments to protect data and maintain customer trust. |

| Open Banking & Embedded Finance | Driven by CDR, fostering data sharing and integration of financial services into non-financial platforms. CDR phased rollout began 2019 and continues. | BOQ can leverage CDR data for personalized products and use APIs for new partnerships and embedded finance opportunities. |

Legal factors

The Australian Prudential Regulation Authority (APRA) remains the cornerstone of prudential oversight for banks, including Bank of Queensland. APRA mandates robust standards for capital adequacy, liquidity, and overall risk management, ensuring financial system stability. For instance, as of late 2024, APRA has been implementing targeted adjustments to bolster banks' liquidity and capital buffers, alongside maintaining existing macroprudential settings to mitigate systemic risks.

APRA's evolving regulatory framework is notable for its move towards a three-tiered approach for banks. This differentiation aims to tailor regulatory intensity based on a bank's size and systemic importance, meaning larger institutions will face more stringent requirements. This strategic shift is designed to ensure that regulatory burdens are proportionate and effective across the diverse Australian banking landscape.

The Australian Securities and Investments Commission (ASIC) is heavily engaged in safeguarding consumers, particularly in light of current economic challenges. Their focus areas include managing cost of living pressures, ensuring fair handling of death benefit claims, and promoting greater accountability within the financial sector. This proactive stance aims to build trust and stability.

Significant legislative changes enacted in late 2024 have brought Buy Now, Pay Later (BNPL) services under the purview of consumer credit regulations. ASIC is currently developing crucial regulatory guidance for these products, which are increasingly popular among consumers. This move reflects a growing recognition of the need for consumer protection in emerging financial technologies.

Furthermore, ASIC is undertaking a comprehensive review and consolidation of existing legislative instruments pertaining to financial advice. This initiative is designed to streamline regulations and clarify requirements for financial professionals, ultimately enhancing the quality and accessibility of financial advice for Australians.

Australia's financial intelligence agency, AUSTRAC, is actively shaping the regulatory landscape for Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF). Following the passage of the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Amendment Bill 2024, AUSTRAC is consulting on new draft AML/CTF Rules. These updates are crucial for banks like Bank of Queensland to maintain compliance and combat financial crime effectively.

Compliance with these evolving regulations is a significant undertaking for financial institutions. Banks must adapt their internal processes and systems to align with the latest requirements, which often involve enhanced customer due diligence and transaction monitoring. AUSTRAC also plays a vital role in identifying and publicizing information on high-risk jurisdictions, providing essential intelligence for banks to manage their exposure to potential illicit financial activities.

Mandatory Climate-Related Financial Disclosures

The Australian government passed legislation in August 2024 mandating climate-related financial disclosures for large entities and asset managers, effective January 1, 2025. This new regime, which aligns with global accounting standards, requires companies like BOQ to produce a dedicated sustainability report alongside their annual financial statements. These obligations will include conducting scenario analysis to assess climate-related risks and opportunities.

BOQ's compliance with these new regulations means integrating comprehensive climate data into its reporting framework. This will likely involve significant investment in data collection, analysis, and reporting systems to meet the detailed requirements of the sustainability report.

Key implications for BOQ include:

- Enhanced Transparency: Greater disclosure on climate risks and strategies will be expected by investors and stakeholders.

- Scenario Analysis Implementation: Developing and reporting on the outcomes of climate scenario analysis will be a core requirement.

- Reporting Alignment: Adhering to international standards will ensure comparability and credibility of disclosures.

- Operational Adjustments: Internal processes and data management will need to adapt to capture and report climate-related information accurately.

Corporate Governance and Accountability

The Financial Accountability Regime (FAR) is a significant legal factor, enhancing accountability and risk governance for entities regulated by APRA, including senior leadership. This framework mandates stricter oversight and personal accountability for key individuals within financial institutions.

Beyond FAR, corporate governance statements and remuneration reports are essential legal requirements, typically found in annual reports. These documents provide transparency regarding a company's governance practices and executive compensation. For instance, Bank of Queensland's 2024 Annual Report details its commitment to corporate governance principles.

BOQ's adherence to these legal frameworks is crucial for maintaining stakeholder trust and regulatory compliance. The bank's 2024 Corporate Governance Statement, as presented in its annual report, underscores its dedication to robust governance structures.

- Financial Accountability Regime (FAR): Strengthens oversight and personal accountability for senior leaders in APRA-regulated entities.

- Corporate Governance Statements: Legally required disclosures in annual reports detailing governance practices.

- Remuneration Reports: Transparency on executive compensation, a key component of corporate governance.

- BOQ's 2024 Annual Report: Features the bank's corporate governance statement, demonstrating compliance.

Australia's financial sector is heavily regulated by bodies like APRA and ASIC, ensuring stability and consumer protection. APRA's evolving three-tiered approach tailors regulations based on bank size, while ASIC focuses on consumer issues and emerging financial products like BNPL. New climate-related disclosure mandates, effective January 2025, require banks like BOQ to report on climate risks and opportunities, aligning with global standards and necessitating significant data integration.

Environmental factors

Australia's new climate-related financial disclosure (CRFD) regime, effective January 1, 2025, for Group 1 entities, necessitates annual sustainability reports. Bank of Queensland (BOQ) will need to comply with these regulations, which mandate detailed reporting on climate-related risks, opportunities, and greenhouse gas emissions across its entire value chain. This aligns with the International Sustainability Standards Board (ISSB) standards, requiring comprehensive data on environmental impact.

Australia faces significant financial risks from climate change, with a government report highlighting the increasing frequency and intensity of extreme weather events. This poses a direct threat to the Bank of Queensland, as these events can lead to a surge in insurance claims and loan defaults, impacting profitability and asset quality.

In a severe climate change scenario, the withdrawal of insurers and banks from vulnerable communities could cripple local economies, directly affecting the Bank of Queensland's customer base and loan portfolio. This underscores the critical need for robust climate risk management strategies within the banking sector.

For investors and financial institutions like the Bank of Queensland, climate change translates into tangible financial losses through escalated insurance payouts, increased loan impairments, and potential write-downs in asset values. For instance, the Australian Prudential Regulation Authority (APRA) has identified climate change as a material financial risk, with a 2022 survey showing 90% of superannuation funds reporting considering climate change in their investment strategies.

Despite Australian banks like Bank of Queensland committing to net-zero emissions by 2050, a significant portion of their financing, including general corporate lending and bond purchases, still supports companies pursuing fossil fuel expansion. This creates a tension between stated climate goals and actual financial activities.

Growing pressure from investors, regulators, and the public is pushing banks to actively reduce their financed emissions. For instance, Australian financial institutions are increasingly scrutinized for their exposure to high-emission sectors, with a growing demand for transparency in their lending portfolios.

In response, some banks are developing specialized financial products and actively collaborating with clients to support their decarbonization efforts, aiming to align their business practices with broader climate objectives and manage associated risks.

ESG Reporting and Sustainability Focus

Beyond mandatory climate disclosures, the financial sector is experiencing a heightened focus on Environmental, Social, and Governance (ESG) reporting and overall sustainability. Bank of Queensland (BOQ) actively participates in this trend, offering a Sustainability Data Pack and a dedicated Sustainability Report. These documents provide a comprehensive overview of BOQ's performance in addressing social, environmental, and economic challenges and opportunities, reflecting a growing demand for transparency in ESG matters.

BOQ's commitment to ESG reporting is evident in its detailed disclosures, aligning with increasing stakeholder expectations for responsible business practices. This focus is not merely about compliance but also about demonstrating long-term value creation. For instance, in its 2023 Sustainability Report, BOQ highlighted progress in areas such as reducing its carbon footprint and increasing its investment in sustainable finance initiatives. The bank aims to integrate sustainability into its core business strategy, recognizing its importance for future growth and resilience.

- ESG Integration: BOQ is embedding ESG principles across its operations and product offerings.

- Transparency: The bank provides detailed ESG performance data through its Sustainability Data Pack and Report.

- Stakeholder Expectations: There's a clear market trend towards greater transparency and accountability in ESG reporting.

- Sustainable Finance: BOQ is actively expanding its sustainable finance portfolio, supporting environmentally and socially responsible projects.

Climate Vulnerability Assessments and Scenario Analysis

New climate reporting laws require companies to perform scenario analyses, examining both a 1.5-degree Celsius warming scenario and a more severe, catastrophic global warming scenario. This is crucial for assessing a company's resilience to climate change impacts.

The Australian Prudential Regulation Authority (APRA) has been actively involved, conducting surveys and releasing details on insurance Climate Vulnerability Assessments. These assessments are designed to help financial institutions, including banks like Bank of Queensland, better understand and manage their exposure to various climate-related risks.

For instance, APRA's 2023 survey revealed that 73% of banks had completed or were advanced in their climate vulnerability assessments. These assessments are vital for identifying potential financial impacts from physical risks, such as extreme weather events, and transition risks, like policy changes or shifts in market sentiment due to climate action.

- Climate Scenario Analysis Mandates: Companies must evaluate resilience under both 1.5°C and catastrophic warming scenarios.

- APRA's Role: APRA surveys and publishes data on insurance Climate Vulnerability Assessments to guide financial institutions.

- Risk Management Focus: These assessments help banks understand and manage their exposure to physical and transition climate risks.

- Industry Adoption: As of 2023, a significant majority of banks (73%) had completed or were well underway with their climate vulnerability assessments.

Australia's mandatory climate-related financial disclosure regime, starting January 1, 2025, requires detailed annual sustainability reports for Group 1 entities, including BOQ. These reports must cover climate risks, opportunities, and emissions across the value chain, aligning with ISSB standards. This regulatory shift is driven by a government recognition of significant financial risks from climate change, such as increased extreme weather events impacting loan defaults and insurance claims.

The Australian Prudential Regulation Authority (APRA) is actively guiding financial institutions, with 73% of banks having completed or advanced climate vulnerability assessments by 2023. These assessments are crucial for understanding exposure to physical risks like extreme weather and transition risks from policy changes. BOQ's commitment to ESG is evident in its 2023 Sustainability Report, detailing progress in carbon footprint reduction and sustainable finance, reflecting growing stakeholder demand for transparency.

| Key Environmental Factor | Impact on BOQ | Regulatory/Industry Response | BOQ's Action/Commitment |

| Climate Change & Extreme Weather | Increased loan defaults, insurance claims, asset value write-downs. | Mandatory CRFD regime (Jan 2025), APRA Climate Vulnerability Assessments. | Integrating climate risk management, scenario analysis. |

| Transition to Net-Zero | Risk of financing fossil fuel expansion vs. stated net-zero goals. | Investor and public pressure for financed emissions reduction. | Committing to net-zero by 2050, developing sustainable finance products. |

| ESG Reporting & Transparency | Stakeholder demand for clear performance data. | Growing focus on ESG reporting across the financial sector. | Publishing Sustainability Data Pack and Report, detailing ESG progress. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bank of Queensland is built on a robust foundation of data from Australian government agencies, financial regulators, and reputable economic forecasting firms. We incorporate insights from Reserve Bank of Australia reports, ABS statistics, and leading industry publications to ensure comprehensive coverage of all PESTLE factors.