Bank of Queensland Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Queensland Bundle

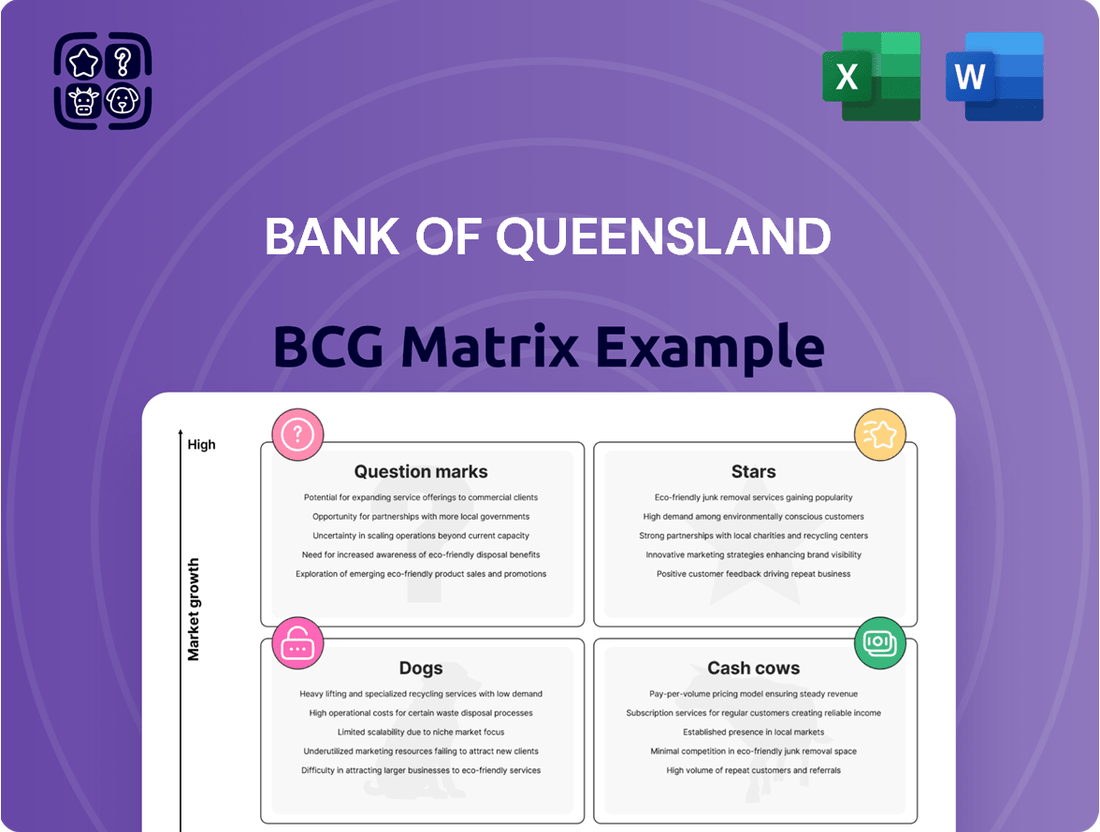

Curious about the Bank of Queensland's strategic product positioning? Our BCG Matrix preview hints at their market performance, but the full report unlocks the complete picture, revealing which products are stars, cash cows, dogs, or question marks. Don't miss out on the detailed analysis and actionable insights needed to make informed decisions.

Ready to dive deeper than a simple overview? Purchase the full Bank of Queensland BCG Matrix for a comprehensive breakdown of their product portfolio, complete with data-driven recommendations and a clear roadmap for future investment. Gain the strategic clarity you need to navigate the competitive landscape.

Stars

Bank of Queensland is actively focusing on its specialist business lending, identifying areas like healthcare, agriculture, equipment finance, and owner-occupied commercial property as key growth drivers. This strategic shift aims to diversify the bank's income streams by targeting higher-value market segments and capitalizing on its long-standing support for Queensland's business community.

In the first half of fiscal year 2025, the bank saw a significant 10% annualized increase in commercial lending within these specialized sectors. This growth underscores BOQ's commitment to expanding its presence and offerings in these critical areas of the economy.

The Bank of Queensland's new digital banking platform represents a significant investment in its future, positioning it as a potential star in the BCG matrix. This cloud-based, end-to-end digital bank is engineered for enhanced efficiency and customer satisfaction. By migrating ME Bank customers and introducing new digital products, BOQ aims for scaled growth and a reduced cost-to-serve ratio.

ME Bank's portfolio is a significant component of Bank of Queensland's (BOQ) strategy, contributing to overall system growth. BOQ aims to balance its acquisition mix, focusing on increasing investor and fixed-rate loan origination to boost volume while simultaneously optimizing profit margins.

The integration of ME Bank's deposit customers onto BOQ's digital platform is a key initiative, with full migration anticipated by the end of FY25. This move is central to BOQ's digital-first approach, aiming to streamline operations and enhance customer experience.

Enhanced Digital Customer Experience

Bank of Queensland (BOQ) is actively investing in its digital transformation to elevate the customer experience. This strategic move is showing tangible results, with a significant portion of its customer base already engaging with the new digital platforms. As of recent reports, approximately a quarter of BOQ's retail customers are utilizing these enhanced digital banking services.

The focus on improving digital capabilities is designed to directly impact customer satisfaction and encourage wider adoption of these channels. BOQ views its advanced digital offerings as a key driver for future growth.

- Digital Adoption: Over 25% of BOQ's retail customers are actively using its new digital banking services.

- Customer Satisfaction: The enhanced digital experience is a primary goal to boost overall customer satisfaction.

- Growth Engine: Digital channels are strategically positioned to be a significant contributor to future business growth.

Strategic Simplification and Automation

Bank of Queensland's strategic pivot towards a 'simpler, specialist bank' heavily relies on streamlining operations through automation. Initiatives leveraging tools like Microsoft 365 Copilot are central to this, aiming to boost efficiency and lower service costs.

These efficiency gains are projected to be substantial. For instance, the bank has indicated that automation could lead to significant reductions in its cost to serve, potentially freeing up capital. This capital can then be reinvested into more profitable areas of the business, fueling growth.

- Strategic Simplification: Efforts to reduce complexity across the bank's operations.

- Automation Initiatives: Implementation of technologies like Microsoft 365 Copilot to enhance productivity.

- Productivity Benefits: Expected material improvements in operational efficiency.

- Cost Reduction: Aims to lower the cost to serve customers.

- Capital Reallocation: Freeing up capital for investment in higher-return segments.

Bank of Queensland's (BOQ) investment in its new digital banking platform positions it as a potential Star in the BCG matrix. This initiative, designed for enhanced efficiency and customer satisfaction, is already seeing traction, with over 25% of retail customers actively using the new digital services. The bank aims for scaled growth and a reduced cost-to-serve ratio through this digital-first approach.

BOQ is focused on its specialist business lending, identifying healthcare, agriculture, equipment finance, and commercial property as key growth areas. In the first half of FY25, commercial lending in these sectors saw a 10% annualized increase, demonstrating BOQ's commitment to these higher-value segments.

The integration of ME Bank's deposit customers onto BOQ's digital platform is a critical step, with full migration expected by the end of FY25. This move is central to streamlining operations and improving the customer experience, further solidifying the digital platform's Star status.

| Business Unit | Market Growth | Relative Market Share | BCG Category |

| Digital Banking Platform | High | High | Star |

| Specialist Business Lending (Healthcare, Agriculture, Equipment Finance, Commercial Property) | High | High | Star |

What is included in the product

Highlights which units to invest in, hold, or divest for Bank of Queensland's product portfolio.

The Bank of Queensland BCG Matrix offers a clear, one-page overview of its business units, simplifying strategic decision-making.

Cash Cows

Bank of Queensland's established customer deposit base acts as a solid foundation, providing a reliable and substantial source of funds for its operations. This base is a key component of its funding strategy, ensuring stability and liquidity.

While deposit growth might be measured, the sheer size of the existing customer deposit base ensures a consistent stream of low-cost funding. For instance, as of the first half of 2024, BOQ reported total customer deposits of $56.2 billion, a testament to its deep customer relationships.

This dependable funding is critical for the bank’s ability to maintain healthy liquidity ratios and support its ongoing lending activities, underscoring its role as a Cash Cow within the BCG Matrix framework.

Bank of Queensland's existing home loan portfolio functions as a Cash Cow within the BCG Matrix. Despite a strategic slowdown in originating new home loans, this substantial portfolio continues to be a reliable source of net interest income, underpinning the bank's profitability.

This established base of home loans, while not a growth engine, delivers consistent cash flow through ongoing interest payments. For the fiscal year 2023, BOQ reported a net interest margin of 1.75%, with its mortgage book forming a significant portion of its interest-earning assets, demonstrating its steady contribution.

Bank of Queensland's core everyday banking accounts are classic cash cows. These are the bread-and-butter accounts that most customers use daily, meaning they're in a mature market with very high penetration among Bank of Queensland's existing customer base.

While these accounts don't see much growth, they reliably bring in steady fee income and are crucial for maintaining strong customer relationships. For instance, in the 2023 financial year, Bank of Queensland reported a net interest margin of 1.77%, with its retail deposit base forming a significant portion of its funding, underscoring the stability these accounts provide with minimal need for further investment.

BOQ Specialist Division

The BOQ Specialist division, serving specialized professional sectors, is a prime example of a cash cow for the Bank of Queensland. Its established market presence and strong relationships with high-value clients ensure consistent revenue generation, contributing significantly to the bank's overall financial health. This segment typically requires minimal reinvestment for growth, allowing capital to be allocated to other strategic areas.

In the 2024 financial year, the BOQ Specialist division continued to demonstrate its resilience. While specific divisional profit figures are often integrated into broader reporting, the bank's overall performance indicates sustained strength in its specialized lending and banking services. For instance, Bank of Queensland reported a statutory profit after tax of $724 million for the full year ending 30 September 2024, reflecting a robust operating environment where established divisions like Specialists play a crucial role in stable earnings.

- Stable Earnings: The BOQ Specialist division consistently generates profits due to its focused market approach and loyal customer base.

- Low Investment Needs: As a mature business, it requires less capital for expansion compared to growth-oriented ventures.

- Diversified Revenue: It adds a valuable and steady income stream to the bank's portfolio.

- Strategic Importance: Its consistent performance underpins the bank's financial stability and supports investment in other areas.

Traditional Business Transaction Accounts

For Bank of Queensland, traditional business transaction accounts function as cash cows. These accounts, offering essential banking services like deposits, withdrawals, and payment processing, provide a consistent and reliable stream of fee-based revenue. In 2024, the Australian banking sector saw continued demand for these foundational services, with business transaction accounts forming the bedrock of customer relationships and a stable income source for institutions like BOQ. This stability is crucial for supporting other, potentially higher-growth, banking products and services.

These accounts are characterized by their maturity and low growth potential, typical of cash cow businesses in the BCG matrix. However, their predictability is their strength. They generate steady cash flow, which can be reinvested into other areas of the bank's operations. For instance, the ongoing operational costs associated with managing these accounts are well-understood, allowing for efficient capital deployment.

- Stable Fee Income: Transaction accounts generate predictable revenue from account fees and transaction charges, contributing significantly to BOQ's overall profitability.

- Foundation for Relationships: These accounts serve as the primary entry point for businesses into BOQ's ecosystem, facilitating cross-selling of more profitable products like loans and credit facilities.

- Low Growth, High Predictability: While not a growth engine, the consistent and reliable cash flow from these accounts is vital for financial planning and stability.

- Support for Ecosystem: The widespread adoption of these accounts by businesses underpins the bank's broader commercial banking operations and digital payment infrastructure.

Bank of Queensland's established customer deposit base acts as a solid foundation, providing a reliable and substantial source of funds for its operations. This base is a key component of its funding strategy, ensuring stability and liquidity. While deposit growth might be measured, the sheer size of the existing customer deposit base ensures a consistent stream of low-cost funding. For instance, as of the first half of 2024, BOQ reported total customer deposits of $56.2 billion, a testament to its deep customer relationships.

This dependable funding is critical for the bank’s ability to maintain healthy liquidity ratios and support its ongoing lending activities, underscoring its role as a Cash Cow within the BCG Matrix framework. Bank of Queensland's existing home loan portfolio functions as a Cash Cow within the BCG Matrix. Despite a strategic slowdown in originating new home loans, this substantial portfolio continues to be a reliable source of net interest income, underpinning the bank's profitability.

This established base of home loans, while not a growth engine, delivers consistent cash flow through ongoing interest payments. For the fiscal year 2023, BOQ reported a net interest margin of 1.75%, with its mortgage book forming a significant portion of its interest-earning assets, demonstrating its steady contribution.

Bank of Queensland's core everyday banking accounts are classic cash cows. These are the bread-and-butter accounts that most customers use daily, meaning they're in a mature market with very high penetration among Bank of Queensland's existing customer base. While these accounts don't see much growth, they reliably bring in steady fee income and are crucial for maintaining strong customer relationships. For instance, in the 2023 financial year, Bank of Queensland reported a net interest margin of 1.77%, with its retail deposit base forming a significant portion of its funding, underscoring the stability these accounts provide with minimal need for further investment.

The BOQ Specialist division, serving specialized professional sectors, is a prime example of a cash cow for the Bank of Queensland. Its established market presence and strong relationships with high-value clients ensure consistent revenue generation, contributing significantly to the bank's overall financial health. This segment typically requires minimal reinvestment for growth, allowing capital to be allocated to other strategic areas. In the 2024 financial year, the BOQ Specialist division continued to demonstrate its resilience. While specific divisional profit figures are often integrated into broader reporting, the bank's overall performance indicates sustained strength in its specialized lending and banking services. For instance, Bank of Queensland reported a statutory profit after tax of $724 million for the full year ending 30 September 2024, reflecting a robust operating environment where established divisions like Specialists play a crucial role in stable earnings.

Bank of Queensland's traditional business transaction accounts function as cash cows. These accounts, offering essential banking services like deposits, withdrawals, and payment processing, provide a consistent and reliable stream of fee-based revenue. In 2024, the Australian banking sector saw continued demand for these foundational services, with business transaction accounts forming the bedrock of customer relationships and a stable income source for institutions like BOQ. This stability is crucial for supporting other, potentially higher-growth, banking products and services.

These accounts are characterized by their maturity and low growth potential, typical of cash cow businesses in the BCG matrix. However, their predictability is their strength. They generate steady cash flow, which can be reinvested into other areas of the bank's operations. For instance, the ongoing operational costs associated with managing these accounts are well-understood, allowing for efficient capital deployment.

| Business Unit | BCG Category | Key Characteristics | 2023/2024 Data Point | Contribution |

| Customer Deposits | Cash Cow | Large, stable, low-cost funding source | $56.2 billion (H1 2024) | Liquidity, funding stability |

| Home Loan Portfolio | Cash Cow | Mature, generates consistent net interest income | Net Interest Margin: 1.75% (FY23) | Profitability, asset base |

| Everyday Banking Accounts | Cash Cow | High penetration, steady fee income | Net Interest Margin: 1.77% (FY23) | Fee revenue, customer relationships |

| BOQ Specialist Division | Cash Cow | Established, loyal high-value clients, minimal reinvestment | Statutory Profit After Tax: $724 million (FY24) | Stable earnings, financial health |

| Business Transaction Accounts | Cash Cow | Mature, predictable fee-based revenue | Continued demand in 2024 sector | Fee income, customer acquisition |

What You’re Viewing Is Included

Bank of Queensland BCG Matrix

The Bank of Queensland BCG Matrix preview you are viewing is the exact, complete document you will receive upon purchase. This means no watermarks, no incomplete sections, and no demo content – just the fully formatted, ready-to-use strategic analysis you need. You can confidently assess the quality and comprehensiveness of this report, knowing the final version will be identical and immediately available for your business planning needs.

Dogs

Bank of Queensland's legacy core banking systems are a prime example of a Dog in the BCG Matrix. These outdated platforms are expensive to maintain, with reports indicating that the financial services industry globally spends billions annually on maintaining legacy IT infrastructure. BOQ's strategic decision to decommission these systems highlights their significant operational costs and their role in limiting the bank's ability to adapt quickly to market changes.

The ongoing investment in these legacy systems represents a considerable drain on BOQ's resources, diverting capital that could otherwise be used for growth initiatives or innovation. As of early 2024, many banks are still grappling with the complexities and costs associated with these older technologies, which often lack the flexibility needed to support modern digital banking services and customer expectations.

The Bank of Queensland's historical owner-managed branch network, once a cornerstone of its operations, is undergoing a significant transformation. This model, characterized by independent ownership and management of individual branches, is being phased out due to an unsustainable economic framework and a pronounced shift towards digital banking channels.

This strategic pivot reflects a broader industry trend where traditional branch networks are proving increasingly inefficient and expensive to maintain. In 2024, the bank continued its program of converting these owner-managed branches to corporate-owned locations, a move aimed at streamlining operations and reducing overhead costs. This consolidation is a direct response to structural market changes and a declining reliance on physical branches for everyday banking needs.

Broker-Originated Home Loans on Legacy Platforms (BOQ/VMA) are likely positioned as Dogs in the Bank of Queensland's BCG Matrix. The bank has notably moderated new home loan originations through its BOQ and Virgin Money Australia broker channels operating on legacy platforms. This strategic pause prioritizes economic return, signaling that these specific channels were yielding lower profitability and acting as a drag on overall performance.

Underperforming Retail Banking Segments

Bank of Queensland's retail banking division saw a notable dip in profitability during the 2024 financial year. This downturn indicates that specific areas within retail banking are not performing as expected, facing challenges in a highly competitive landscape.

The bank is actively reallocating its capital and resources, moving away from retail banking assets that yield lower returns. This strategic pivot is aimed at bolstering segments that demonstrate a higher potential for profitability and growth.

- FY24 Retail Banking Profitability: Overall retail banking profits at Bank of Queensland experienced a significant decline in FY24.

- Underperforming Segments: This suggests that certain segments within retail banking are underperforming and struggling in a competitive market.

- Resource Reallocation: The bank is strategically shifting resources away from lower-returning retail assets to higher-returning segments.

- Competitive Pressures: Increased competition and evolving customer expectations are key factors contributing to the underperformance in specific retail banking areas.

High-Cost, Non-Automated Processes

Bank of Queensland (BOQ) is actively working to automate a significant portion of its core operations to drive down costs. This initiative highlights that many of its current manual or inefficient processes are classified as 'dogs' within the BCG Matrix framework.

These 'dog' processes are characterized by their substantial operational expenses and an inability to scale effectively. For instance, as of early 2024, BOQ has been investing heavily in streamlining these areas, aiming to improve efficiency and reduce the cost-to-serve for its customers.

- High Operational Costs: Manual processes often involve significant labor, paper handling, and potential for errors, leading to higher expenses compared to automated alternatives.

- Lack of Scalability: These processes struggle to handle increasing volumes without a proportional rise in costs or a significant drop in efficiency, hindering growth.

- Target for Automation: BOQ's strategic focus on digitization means these inefficient, high-cost areas are prime candidates for investment in new technologies to improve their performance.

- Impact on Profitability: By addressing these 'dog' processes, BOQ aims to improve its overall profitability and competitive positioning in the banking sector.

Bank of Queensland's legacy core banking systems and manual operational processes are prime examples of 'Dogs' in the BCG Matrix. These areas are characterized by high maintenance costs and low market share or growth potential, acting as a drain on resources. For instance, the global financial services industry continues to spend billions annually on legacy IT infrastructure, a cost BOQ is actively working to reduce through automation and system decommissioning.

The bank's strategic decision to phase out its historical owner-managed branch network and moderate new home loan originations through certain broker channels further illustrates its efforts to divest from underperforming 'Dog' assets. This is a direct response to the unsustainable economic frameworks and declining reliance on physical channels, with BOQ aiming to streamline operations and improve overall profitability by reallocating capital to more promising segments.

BOQ's retail banking division experienced a notable dip in profitability in FY24, indicating that specific segments within this area are struggling against increased competition. The bank is actively shifting resources away from these lower-returning retail assets, targeting areas with higher potential for growth and profitability to enhance its competitive positioning.

The ongoing investment in and maintenance of these legacy systems and manual processes represent a significant cost burden, diverting capital that could be used for innovation and growth. As of early 2024, many financial institutions, including BOQ, are still grappling with the complexities and expenses associated with these older technologies, which often hinder agility and customer service.

| Business Unit/Process | BCG Category | Rationale | FY24 Impact/Trend |

|---|---|---|---|

| Legacy Core Banking Systems | Dog | High maintenance costs, limited scalability, hinders digital transformation. | Ongoing decommissioning efforts, significant operational expense. |

| Manual Operational Processes | Dog | High operational costs, prone to errors, inefficient scaling. | Target for automation initiatives to reduce cost-to-serve. |

| Owner-Managed Branch Network | Dog | Unsustainable economic model, declining customer reliance. | Phased out and converted to corporate-owned locations to reduce overhead. |

| Broker-Originated Home Loans (Legacy Platforms) | Dog | Lower profitability, strategic moderation of new originations. | Prioritizing economic return by reducing activity in these channels. |

| Specific Retail Banking Segments | Dog | Underperforming in a competitive market, lower returns. | Profitability declined in FY24, resources being reallocated. |

Question Marks

Bank of Queensland's new digital mortgage product is a classic example of a question mark in the BCG matrix. Launched in the second half of 2024 as a pilot for staff and friends, it shows promising high growth potential, especially given its significantly lower origination costs. However, its current market share is negligible, necessitating substantial investment to prove its viability and capture a larger slice of the market.

Virgin Money Australia is positioned as a Question Mark within the Bank of Queensland's BCG Matrix, primarily due to its ongoing digital transformation. The bank is actively working to migrate its customer base to a new, advanced digital banking platform, mirroring the strategy previously employed by ME Bank.

This strategic shift aims to capitalize on the expanding digital banking landscape, a sector showing significant growth potential. However, Virgin Money Australia's current market share on this new platform remains relatively low.

The success of Virgin Money Australia as a Question Mark hinges critically on its ability to effectively migrate existing customers and foster widespread adoption of its new digital services. For instance, as of the first half of 2024, the bank reported that a significant portion of its customer base was still being transitioned, highlighting the operational challenge.

Digital personal loans, as envisioned for the Bank of Queensland's new digital bank, are positioned as a Stars within the BCG Matrix. The group sees this as a significant revenue opportunity, targeting a high-growth market segment with an expected rollout from FY26. This strategic move acknowledges the burgeoning demand for digital financial services.

While the market for digital personal loans is expanding rapidly, BOQ's current market share in this specific niche is likely low. This necessitates substantial future investment to build brand recognition and capture a meaningful portion of this burgeoning sector. The potential for high growth, however, justifies the investment, aiming to transform these loans into future cash cows.

Niche Business Banking Expansion (New Corridors)

Within the Bank of Queensland's (BOQ) business banking portfolio, which is generally categorized as a 'Star' due to its strong market position and growth, the expansion into new niche corridors represents a strategic move. These specific segments are identified for their high growth potential, aligning with BOQ's objective to capture emerging market opportunities.

These niche areas, while promising, necessitate significant upfront investment and dedicated market penetration strategies. BOQ's approach here is to build a strong presence in these specialized segments, aiming to achieve a dominant market share over time. For instance, BOQ's 2024 focus on agribusiness lending, a sector experiencing robust growth, exemplifies this strategy. The bank reported a 7.5% increase in its agribusiness loan book in the first half of 2024, indicating early traction in a targeted niche.

- Targeted Niche Growth: BOQ is actively pursuing expansion into specific, high-potential niche segments within its broader business banking operations.

- Investment and Penetration: These new corridors require substantial initial investment and focused market penetration efforts to establish a strong foothold.

- Agribusiness Example: A key area of focus is agribusiness, which saw a 7.5% growth in BOQ's loan book in H1 2024, showcasing the bank's commitment to niche expansion.

- Strategic Positioning: This strategy aims to position BOQ as a leader in these specialized markets, leveraging the high growth potential for future returns.

AI and Advanced Automation Initiatives

Bank of Queensland's AI and advanced automation initiatives, including the adoption of tools like Microsoft 365 Copilot, represent a significant investment aimed at boosting efficiency and fostering innovation. These forward-looking projects are currently in their early stages, meaning their ultimate contribution to market share and profitability is yet to be fully realized.

These investments are strategically positioned to enhance operational capabilities and customer experience. For instance, in 2023, many financial institutions reported substantial increases in IT spending, with a notable portion allocated to AI and automation, signaling a broader industry trend that BOQ is participating in.

- AI & Automation Investment: BOQ is actively deploying advanced technologies like Microsoft 365 Copilot to streamline operations and drive innovation.

- Efficiency and Innovation Focus: These initiatives are designed to unlock future productivity gains and secure a competitive edge.

- Developing Impact: The full benefits and market impact of these early-stage AI and automation projects are still unfolding and subject to future performance.

- Industry Trend Alignment: BOQ's investment aligns with a wider financial sector trend of increasing technology expenditure, particularly in AI and automation, to enhance services and operational efficiency.

Question Marks in BOQ's portfolio represent areas with high growth potential but currently low market share. These are strategic investments where success is uncertain, demanding significant capital to gain traction. Examples include the new digital mortgage product and the ongoing digital transformation of Virgin Money Australia.

The digital mortgage product, piloted in late 2024, aims for lower origination costs but has a negligible market share. Similarly, Virgin Money Australia's migration to a new digital platform shows promise in a growing sector, yet its current adoption rate is low, requiring substantial investment for success.

These Question Marks are critical for BOQ's future growth, necessitating careful management and investment to convert them into Stars or Cash Cows. The bank's commitment to these areas reflects a strategy to capture emerging market opportunities and drive future profitability.

The success of these ventures hinges on effective execution, customer adoption, and competitive positioning within their respective high-growth markets.

BCG Matrix Data Sources

The Bank of Queensland BCG Matrix leverages a blend of internal financial statements, external market research reports, and competitor analysis to accurately position its business units.