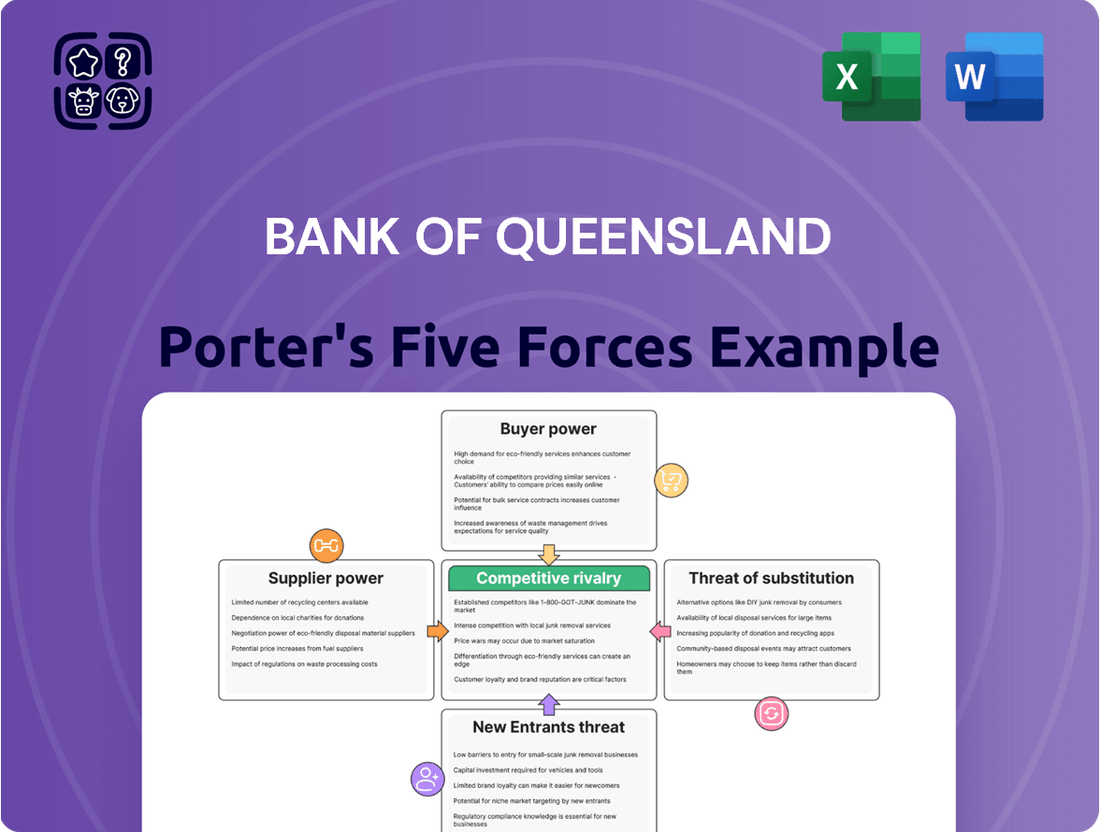

Bank of Queensland Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Queensland Bundle

Bank of Queensland faces moderate competitive rivalry, with established players and a few emerging fintechs vying for market share. Buyer power is significant due to the availability of alternative banking services and the ease of switching providers.

The threat of new entrants is moderate, as significant capital and regulatory hurdles exist, yet digital-only banks present a growing challenge. Supplier power is relatively low for most inputs, but technology providers can exert influence.

The threat of substitutes is high, with a wide range of financial products and services available, from other banks to non-traditional lenders and payment platforms. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bank of Queensland’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Depositors, especially those with substantial funds or specific rate demands, exert a degree of influence because banks actively vie for funding. The Bank of Queensland, similar to its peers, depends heavily on customer deposits as a foundational source of capital.

The Australian banking sector's competitive landscape for deposits, as observed in recent trends, can escalate funding expenses for BOQ, thereby affecting its net interest margin. For instance, in early 2024, major Australian banks were observed increasing term deposit rates to attract and retain customer funds, a clear indicator of this competitive pressure.

Bank of Queensland's (BOQ) bargaining power with technology providers is influenced by its significant digital transformation, including the ME Bank integration. This reliance on vendors for core banking, digital platforms, and cybersecurity can grant powerful tech suppliers leverage, especially given the specialized nature of these services. For instance, in 2024, many banks are investing heavily in cloud migration and AI, increasing demand for specialized tech talent and solutions, which can strengthen supplier positions.

However, BOQ's strategic push to simplify its operations and adopt new digital platforms is designed to enhance its control and efficiency over its technology infrastructure. This move towards greater internal oversight and potentially multi-vendor strategies can mitigate the concentrated power of any single technology supplier. As of mid-2024, the banking sector is seeing a trend towards platform consolidation and greater in-house capability development to manage costs and data security more effectively.

The bargaining power of suppliers in the labor market for Bank of Queensland (BOQ) is significant, especially concerning skilled financial professionals. Demand for expertise in areas like digital banking, risk management, and specialized lending is high, driving up wages and making it challenging for BOQ to attract and keep top talent. For instance, in 2024, the average salary for a senior data scientist in Australian banking saw a notable increase, reflecting this competitive landscape.

BOQ's strategic adjustments, including workforce restructuring and a focus on specialized roles, directly address these labor market dynamics. This pivot aims to align its talent acquisition with evolving operational needs, potentially mitigating the impact of rising labor costs by prioritizing essential skills and efficiency. The bank's efforts to reskill existing staff also highlight a proactive approach to managing supplier power within its own workforce.

Interbank Lending and Capital Markets

The Bank of Queensland (BOQ) supplements its customer deposits by tapping into interbank lending and capital markets for essential liquidity and funding. These external sources are directly impacted by overarching economic trends and central bank directives, factors that BOQ cannot directly influence. For instance, in early 2024, the Reserve Bank of Australia’s cash rate adjustments and broader global monetary policy shifts created a more variable cost environment for wholesale funding.

A contraction in these markets, characterized by reduced availability or increased pricing of funds, would inevitably raise BOQ's overall funding expenses. This dynamic highlights the supplier bargaining power of financial institutions and investors operating within these wholesale markets.

- Interbank Lending Costs: Fluctuations in benchmark rates like the Australian Overnight Index Swap (OIS) directly affect the cost of interbank borrowing for BOQ.

- Capital Market Access: BOQ's ability to issue bonds or other debt instruments depends on investor appetite and prevailing market yields, demonstrating the power of capital market participants.

- Central Bank Influence: Monetary policy decisions, such as quantitative tightening or easing, significantly shape the liquidity and cost of funds available in the broader financial system.

Regulatory Bodies

Regulatory bodies such as the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) exert considerable influence over the Bank of Queensland (BOQ) by acting as key suppliers of essential operating licenses and compliance frameworks. These entities dictate the rules of engagement for financial institutions.

The stringent requirements imposed by APRA and ASIC, covering areas like capital adequacy ratios, robust risk management practices, and comprehensive consumer protection measures, directly translate into significant operational and investment costs for BOQ. For instance, APRA’s heightened capital requirements, particularly following global financial stability assessments, necessitate substantial capital retention, impacting profitability and strategic investment capacity.

- APRA's Capital Adequacy: BOQ must maintain specific Common Equity Tier 1 (CET1) ratios, as mandated by APRA, influencing lending capacity and dividend policies.

- ASIC's Conduct Oversight: ASIC's focus on consumer protection and market integrity, evidenced by its enforcement actions and regulatory reviews, compels BOQ to invest heavily in compliance and remediation programs.

- Recent Regulatory Shifts: Ongoing reforms in areas such as sustainability reporting, Anti-Money Laundering/Counter-Terrorism Financing (AML/CTF) obligations, and financial advisor remuneration structures, all driven by these regulatory bodies, continue to shape BOQ's strategic direction and operational expenditures.

The bargaining power of suppliers for Bank of Queensland (BOQ) is evident in its reliance on external funding sources beyond customer deposits, such as interbank lending and capital markets. These markets are influenced by broader economic conditions and central bank policies, which BOQ cannot control.

For example, in early 2024, Reserve Bank of Australia cash rate adjustments and global monetary policy shifts created a more volatile cost environment for wholesale funding, directly impacting BOQ's borrowing expenses. A tightening of these markets, meaning less available or more expensive funds, would inevitably increase BOQ's overall funding costs, underscoring the leverage held by participants in these wholesale financial markets.

This reliance means that changes in benchmark rates, like the Australian Overnight Index Swap (OIS), directly influence BOQ's interbank borrowing costs. Furthermore, BOQ's capacity to issue debt instruments like bonds is contingent on investor demand and prevailing market yields, demonstrating the power of capital market participants.

What is included in the product

This analysis dissects the competitive landscape for Bank of Queensland, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its profitability.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, tailored for the Bank of Queensland's unique market position.

Customers Bargaining Power

Individual customer switching costs for banks like Bank of Queensland (BOQ) are evolving. While inertia and the perceived hassle of changing banks used to keep many customers locked in, the landscape is shifting. The growth of digital banking and open banking, driven by initiatives like Australia's Consumer Data Right (CDR), is making it easier for customers to compare offerings and move their business. This trend directly impacts BOQ by increasing customer bargaining power, especially for straightforward products like transaction accounts and home loans.

Business customers, particularly larger corporations, often possess a heightened level of financial acumen and significant influence when negotiating terms for their banking relationships. This includes everything from loan agreements and transaction accounts to essential merchant services.

The Bank of Queensland's strategic emphasis on expanding its business banking segment necessitates the provision of highly competitive and tailored financial products to secure and maintain these sophisticated clientele. For instance, in 2024, the Australian business lending market saw significant competition, with major banks offering competitive rates to attract corporate clients, putting pressure on smaller institutions like BOQ to innovate.

Customers in the Australian banking sector, especially for products like home loans and savings accounts, are demonstrating heightened price sensitivity. This means they actively shop around for the best deals, pushing banks like BOQ to offer competitive interest rates to attract and retain business. For instance, in 2023, the average variable home loan interest rate in Australia hovered around 6.5%, prompting significant customer comparison shopping.

Information Availability and Digital Tools

The internet has fundamentally changed how customers interact with banks. Comparison websites and readily available online information empower individuals to easily research and compare financial products, such as home loans or savings accounts, across numerous institutions. This heightened transparency directly increases customer bargaining power, as they can quickly identify the best rates and terms available.

In 2024, the digital landscape continues to facilitate this shift. For instance, a significant portion of Australians actively use online channels for their banking needs. Data from the Reserve Bank of Australia in late 2023 indicated that over 70% of retail payments were made electronically, underscoring the digital savviness of consumers. This trend means banks like Bank of Queensland must remain competitive on pricing and service to retain customers who can readily switch providers with a few clicks.

- Increased Transparency: Online platforms provide easy access to product details, fees, and interest rates from multiple banks.

- Informed Decision-Making: Customers can compare offerings based on their specific needs, leading to better-informed choices.

- Ease of Switching: Digital tools simplify the process of opening new accounts or applying for loans elsewhere, reducing customer inertia.

- Price Sensitivity: Widespread access to pricing information makes customers more sensitive to differences in interest rates and fees.

Broker Influence in Mortgage Market

The bargaining power of customers is amplified by the significant role of mortgage brokers in the Australian home loan landscape. In March 2025, a record 76.8% of new residential home loans were settled through brokers, indicating their substantial influence over customer choice and lender access. This trend directly translates to increased customer leverage, as brokers act on behalf of borrowers, presenting them with a wider array of competitive loan options from various financial institutions, including Bank of Queensland.

This intermediation by brokers means that Bank of Queensland must compete not only with other banks directly but also within a broker-driven ecosystem. Customers, guided by brokers, can more easily compare offerings and negotiate terms, thereby intensifying the pressure on BOQ to offer attractive rates and flexible products to secure business. The high market share of brokers underscores their ability to channel significant volumes of business, making them key gatekeepers for BOQ's mortgage origination.

- Broker Market Share: 76.8% of new residential home loans settled by brokers in March 2025.

- Customer Representation: Brokers advocate for borrower interests, facilitating comparison shopping.

- Increased Competition: Brokers drive competition by presenting multiple lender options to customers.

- BOQ's Challenge: Bank of Queensland must offer competitive terms to attract customers through broker channels.

The bargaining power of customers for Bank of Queensland (BOQ) is substantial and growing, particularly due to increased transparency and ease of switching facilitated by digital platforms. In 2024, Australian consumers are highly digitally engaged, with a significant portion actively comparing financial products online. This heightened awareness means BOQ must consistently offer competitive pricing and superior service to retain its customer base, as switching costs are diminishing rapidly.

The influence of mortgage brokers further amplifies customer bargaining power in the home loan market. With a significant majority of new home loans being settled through brokers, as seen in March 2025 figures, these intermediaries effectively channel customer demand and negotiate terms on their behalf. Consequently, BOQ faces intensified competition not just from other banks but also within this broker-dominated landscape, necessitating attractive offerings to secure business.

| Factor | Impact on BOQ | Supporting Data (as of early 2025) |

|---|---|---|

| Digital Transparency | Increased customer ability to compare rates and fees | Over 70% of retail payments in Australia are electronic (RBA, late 2023) |

| Ease of Switching | Reduced customer inertia, higher churn risk | Open banking initiatives and CDR facilitating easier account movement |

| Mortgage Broker Influence | Significant channel for home loan acquisition, driving negotiation | 76.8% of new residential home loans settled by brokers (March 2025) |

| Price Sensitivity | Customers actively seek best rates, pressuring margins | Average variable home loan rates in Australia around 6.5% (2023), prompting comparison |

Preview Before You Purchase

Bank of Queensland Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for the Bank of Queensland, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You will gain a deep understanding of the competitive landscape and strategic positioning of BOQ within the Australian banking sector, enabling informed decision-making.

Rivalry Among Competitors

The Australian banking landscape is heavily influenced by the 'Big Four' – Commonwealth Bank, NAB, ANZ, and Westpac. These major institutions collectively held approximately 77% of the total assets in the Australian banking system as of December 2023, demonstrating their significant market dominance. Bank of Queensland (BOQ), as a regional player, finds itself in direct and intense competition with these giants across its entire product and service offering, facing challenges in matching their scale and established brand loyalty.

Competition in crucial areas such as home lending and deposit gathering remains fierce, directly impacting net interest margins for banks like Bank of Queensland. While there are indications that major lenders might be slightly easing their aggressive mortgage competition, the Australian banking landscape continues to be highly contested.

Product homogenization is a significant challenge in the banking sector. Many core offerings like home loans and transaction accounts are quite similar across institutions, making it tough for banks to stand out based on product features alone. This often pushes competition towards price and the quality of customer service. For instance, in 2024, the average variable mortgage rate for owner-occupiers in Australia hovered around 6-7%, highlighting the price sensitivity in this market segment.

This commoditization intensifies rivalry as banks vie for customers by offering competitive rates and superior customer experiences. Bank of Queensland's strategy, leveraging its owner-managed branch network, aims to cultivate a more personalized customer relationship, a key differentiator in an otherwise standardized market. This approach seeks to build loyalty beyond just the product itself.

Industry Growth Rate and Economic Outlook

The Australian banking sector is bracing for a subdued outlook in 2025, with forecasts indicating a slowdown in economic growth. This environment is expected to lead to anticipated interest rate cuts by the Reserve Bank of Australia, further impacting profitability.

A low-growth economic climate naturally intensifies competition among banks. As the pie of new customers and market share stops expanding as rapidly, financial institutions must vie more aggressively for existing opportunities.

- Slowing Economic Growth: Australia's GDP growth is projected to moderate in 2025, impacting loan demand and overall banking activity.

- Interest Rate Environment: Anticipated cuts to the official cash rate could compress net interest margins for banks.

- Increased Competition: A less dynamic market forces banks to compete harder on pricing and product offerings to attract and retain customers.

High Exit Barriers

The banking sector, including institutions like Bank of Queensland, faces substantial exit barriers. These include stringent regulatory approvals needed to cease operations, the considerable value tied up in physical branches and technology infrastructure, and the complex process of unwinding existing customer contracts and loan commitments.

These high exit barriers mean that even financially strained banks often remain in the market longer than they might otherwise. This persistence can sustain competitive intensity, as these entities continue to vie for market share, potentially impacting pricing and profitability for all players.

- Regulatory Hurdles: Banks require explicit approval from regulators like APRA to exit the market, a process that can be lengthy and complex.

- Asset Commitment: Significant investment in physical branches, ATMs, and IT systems represents sunk costs that are difficult to recover upon exit.

- Customer and Loan Portfolios: The need to manage existing customer relationships and the ongoing administration of loan portfolios creates an obligation that hinders a swift departure.

Competitive rivalry is a dominant force for Bank of Queensland (BOQ), particularly given the entrenched market share of the 'Big Four' Australian banks, which collectively held about 77% of total banking assets in December 2023. BOQ competes directly with these giants across all product lines, facing a constant challenge to differentiate itself. The market is characterized by product similarity, pushing competition towards price and customer service, with average variable mortgage rates for owner-occupiers around 6-7% in 2024.

In a low-growth economic environment projected for 2025, with anticipated interest rate cuts, competition is expected to intensify further as banks vie more aggressively for a smaller pool of new business. BOQ's strategy of leveraging its owner-managed branches to foster personalized relationships is a key tactic to counter the commoditization of banking products and build customer loyalty beyond price.

| Competitor Type | Market Share (Est. Total Assets) | Competitive Intensity |

|---|---|---|

| Big Four Banks (CBA, NAB, ANZ, Westpac) | ~77% (Dec 2023) | Very High |

| Other Regional Banks | Moderate | High |

| Neobanks/Digital Banks | Growing but smaller | Increasing |

SSubstitutes Threaten

Fintech and digital-only banks represent a significant threat of substitution for traditional institutions like Bank of Queensland. These agile competitors, often leveraging AI and mobile-first strategies, provide streamlined, low-cost banking solutions that appeal strongly to tech-savvy consumers. For instance, by mid-2024, neobanks globally have continued to capture market share, with some reporting customer growth rates exceeding 20% year-over-year, directly impacting the customer base of incumbent banks.

Specialized non-bank lenders and peer-to-peer (P2P) platforms present a growing threat by offering alternative financing options, especially for personal loans and certain business segments. These entities can target lucrative niches, siphoning off potential customers from traditional banks like Bank of Queensland (BOQ).

For instance, in 2024, the Australian P2P lending market continued its expansion, with platforms facilitating billions in loans, offering competitive rates and faster approvals for consumers and small businesses seeking alternatives to traditional banking channels.

Customers increasingly turn to direct investment platforms and superannuation funds for their savings and investment needs, bypassing traditional bank accounts. These alternatives offer diverse risk-reward profiles, potentially diverting substantial customer capital away from banks. For instance, in 2024, the Australian superannuation industry managed over AUD 3.7 trillion in assets, highlighting the significant scale of these non-bank investment channels.

Buy Now Pay Later (BNPL) Services

Buy Now Pay Later (BNPL) services present a significant threat of substitution for Bank of Queensland (BOQ) by offering an alternative to traditional credit cards and personal loans. These services allow consumers to spread purchases over time, often with interest-free installments and less stringent credit checks, directly competing with BOQ's core lending products.

The rapid expansion of BNPL, particularly for consumer goods, reflects a clear shift in how people prefer to finance their spending. This trend directly impacts BOQ's revenue streams from credit card interest and fees, as well as its personal loan origination volumes. For instance, in 2023, the global BNPL market was valued at over $120 billion and is projected to grow substantially, indicating a strong consumer preference for these flexible payment options.

- BNPL as a Credit Alternative: Services like Afterpay, Klarna, and Zip offer immediate point-of-sale financing, bypassing traditional credit application processes.

- Impact on BOQ's Portfolios: This directly siphons demand from BOQ's credit card and personal loan segments, potentially reducing market share and profitability.

- Consumer Behavior Shift: The increasing adoption of BNPL highlights a growing consumer appetite for payment flexibility and deferred gratification.

- Market Growth Data: The BNPL sector experienced significant growth in 2024, with transaction volumes continuing to rise, underscoring its competitive pressure on incumbent financial institutions.

Embedded Finance

The threat of substitutes for Bank of Queensland is amplified by the rise of embedded finance. Non-financial companies are increasingly integrating financial services, like payments or lending, directly into their customer journeys. For instance, a retail app allowing instant point-of-sale financing or a ride-sharing platform offering integrated payment solutions bypasses traditional banking channels.

This trend makes financial services more convenient and contextual, potentially drawing customers away from direct engagement with banks like BOQ. By embedding financial capabilities, these platforms offer a seamless experience, reducing the perceived need for customers to interact with a bank directly for everyday financial needs. This can erode the customer base for core banking products.

Consider the growth in buy-now-pay-later (BNPL) services, which are often embedded at e-commerce checkouts. In 2023, the global BNPL market was valued at over $120 billion and is projected to grow significantly. This directly substitutes traditional credit card or personal loan offerings from banks.

- Embedded Payments: Companies like Apple Pay and Google Pay offer frictionless payment solutions that are integrated into mobile devices, reducing reliance on traditional debit or credit cards issued by banks.

- Embedded Lending: E-commerce platforms and fintech companies are offering point-of-sale financing or small business loans directly within their ecosystems, providing an alternative to bank loans.

- Embedded Insurance: Travel booking sites or car dealerships often offer insurance products at the point of purchase, substituting the need for customers to seek insurance from a separate financial institution.

The threat of substitutes for Bank of Queensland (BOQ) is substantial, driven by digital-first fintechs, specialized lenders, and evolving consumer payment preferences. These alternatives offer convenience, lower costs, and tailored solutions that directly challenge BOQ's traditional product offerings.

Fintechs and neobanks continue to gain traction by providing streamlined, mobile-centric banking experiences. In 2024, the Australian neobank sector saw continued customer acquisition, with some entities reporting significant growth, directly impacting traditional banks' customer bases.

Peer-to-peer lending platforms and specialized non-bank lenders offer competitive alternatives for personal and business financing, diverting potential customers from BOQ. The Australian P2P market facilitated billions in loans in 2024, providing faster approvals and attractive rates.

Buy Now Pay Later (BNPL) services, often embedded at point-of-sale, are a direct substitute for credit cards and personal loans. The global BNPL market, exceeding $120 billion in 2023, demonstrates a strong consumer preference for flexible payment options, impacting BOQ's credit portfolios.

Entrants Threaten

The Australian banking sector presents formidable regulatory barriers to new entrants. The Australian Prudential Regulation Authority (APRA) imposes strict capital requirements and complex licensing procedures, significantly deterring new players from entering the market. For instance, in 2024, the average capital adequacy ratio for major Australian banks remained robust, well above APRA's minimums, illustrating the substantial financial commitment required.

However, APRA is actively working to streamline these entry requirements. Proposed changes to the licensing framework, expected to be implemented in 2025, aim to make the process clearer, faster, and more conducive to new competition. This initiative signals a potential shift, acknowledging the need for innovation while still maintaining prudential standards.

The threat of new entrants into the Australian banking sector is significantly moderated by the immense capital requirements. Establishing a new bank, even with a digital-first approach, necessitates substantial upfront investment in technology, regulatory compliance, and marketing to build trust and customer base, making it a formidable barrier for aspiring competitors looking to challenge established players like Bank of Queensland (BOQ).

Furthermore, existing banks, including BOQ, benefit from significant economies of scale. These scale advantages allow them to spread fixed costs over a larger operational base, leading to lower per-unit costs for services and a greater capacity for investment in innovation and customer service. New entrants often find it challenging to achieve similar cost efficiencies, particularly in areas like loan processing, risk management, and customer support, which are crucial for profitability and competitive pricing.

In 2024, the Australian Prudential Regulation Authority (APRA) continues to maintain rigorous capital adequacy requirements for all authorized deposit-taking institutions. For instance, the Common Equity Tier 1 (CET1) capital ratio, a key measure of a bank's financial strength, is mandated to be above certain thresholds, requiring new entrants to secure considerable funding to meet these prudential standards and operate on a level playing field with established institutions like BOQ.

Existing banks, including Bank of Queensland (BOQ), leverage decades of established brand recognition and deep-seated customer trust. This is a significant barrier for newcomers. For instance, in 2023, major Australian banks like Commonwealth Bank and Westpac consistently ranked high in customer satisfaction surveys, indicating a strong existing loyalty base.

New entrants, especially those operating primarily online, must invest heavily in marketing and customer acquisition to build comparable trust and brand loyalty. While digital banks can offer competitive rates, overcoming the ingrained trust in traditional institutions remains a formidable hurdle in attracting and retaining customers in the Australian banking sector.

Access to Funding and Distribution Networks

New entrants into the banking sector, like Bank of Queensland, face significant hurdles in securing adequate funding and establishing robust distribution networks. Attracting a substantial and consistent deposit base is paramount for a bank's ability to fund its lending operations. Without this, growth and stability are severely compromised.

Building effective distribution channels, whether through advanced digital platforms or physical branches, is another critical challenge. These channels are essential for customer acquisition and service delivery. For instance, in 2024, the Australian banking sector continued to see a strong reliance on digital channels, with a significant portion of transactions occurring online, highlighting the investment required to compete effectively.

- Funding Acquisition: New banks must compete with established institutions for customer deposits, a primary source of low-cost funding. In 2024, average savings account interest rates in Australia remained competitive, making it harder for new entrants to attract substantial balances without offering premium rates.

- Distribution Network Development: Establishing a widespread and accessible network, encompassing both digital and physical touchpoints, demands considerable capital investment and time. This includes developing user-friendly mobile apps and online banking portals, alongside strategic branch placement where necessary.

- Customer Trust and Loyalty: Incumbent banks benefit from years of established trust and customer loyalty. New entrants must invest heavily in marketing and customer service to overcome this inertia and build a comparable level of confidence.

Technological Investment and Infrastructure

While new entrants in the banking sector can certainly bring innovative technology, establishing a competitive presence necessitates substantial investment in core IT infrastructure. This includes secure platforms for transactions, robust data analytics capabilities for customer insights, and advanced cybersecurity measures to protect against evolving threats. For instance, in 2024, the average cost for a mid-sized bank to upgrade its core banking system could range from tens of millions to over a hundred million dollars, a significant barrier.

These technological outlays are not merely about functionality; they are critical for regulatory compliance and maintaining customer trust. New entrants must also factor in the ongoing costs associated with maintaining and upgrading these systems to keep pace with industry standards and evolving consumer expectations. The Australian Prudential Regulation Authority (APRA) continues to emphasize stringent cybersecurity requirements, adding to the capital burden for any new player aiming to enter the market.

- Significant upfront investment in IT infrastructure is a key barrier for new entrants.

- Costs include secure transaction platforms, data analytics, and cybersecurity.

- Regulatory compliance, particularly in cybersecurity, adds to the financial burden.

- Ongoing maintenance and upgrades are essential, representing a continuous cost.

The threat of new entrants for Bank of Queensland is significantly low due to high capital requirements and stringent regulatory hurdles imposed by APRA. For example, in 2024, meeting capital adequacy ratios demanded substantial financial backing, making it difficult for new players to enter and compete effectively.

Established brand loyalty and customer trust also act as major deterrents. In 2023, major Australian banks consistently scored well in customer satisfaction, indicating a strong existing customer base that new entrants must work hard to penetrate.

Furthermore, the need for significant investment in IT infrastructure and distribution networks, alongside the challenge of acquiring funding, creates a formidable barrier. For instance, upgrading core banking systems in 2024 could cost tens of millions, a cost new entrants must absorb.

| Barrier | Impact on New Entrants | Example (2024 Data) |

|---|---|---|

| Capital Requirements | Very High | Robust capital adequacy ratios mandated by APRA |

| Regulatory Compliance | High | Strict licensing procedures and cybersecurity mandates |

| Brand Loyalty & Trust | High | Established customer relationships of incumbent banks |

| IT Infrastructure Costs | High | Millions required for system upgrades and cybersecurity |

| Funding Acquisition | High | Competition for customer deposits with competitive interest rates |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank of Queensland leverages data from the bank's annual reports, investor presentations, and official ASX announcements. We also incorporate insights from reputable financial news outlets, industry analysis reports, and government regulatory bodies to provide a comprehensive view of the competitive landscape.