Bank of Queensland Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Queensland Bundle

Unlock the strategic blueprint behind Bank of Queensland's success with our comprehensive Business Model Canvas. This detailed analysis reveals their customer segments, value propositions, and revenue streams, offering invaluable insights for your own financial ventures.

Dive deeper into what makes Bank of Queensland tick. Our full Business Model Canvas provides a clear, section-by-section breakdown of their operations, from key partnerships to cost structures, empowering you to learn from a leading financial institution.

Ready to gain a competitive edge? Access the complete Bank of Queensland Business Model Canvas, a professionally crafted document that illuminates their competitive advantages and growth strategies. Download it now to elevate your strategic planning.

Partnerships

Bank of Queensland (BOQ) is forging key partnerships with technology and digital solution providers to drive its digital transformation. A significant collaboration is with Microsoft, focusing on migrating its core infrastructure to Microsoft Azure by 2025. This move is expected to bolster scalability and operational efficiency.

Further strengthening its digital lending capabilities, BOQ has partnered with Trade Ledger. This alliance aims to streamline and accelerate the development of new lending products, ultimately enhancing the customer experience and improving operational workflows within the bank.

Bank of Queensland actively pursues strategic alliances with fintech companies as a cornerstone of its digital transformation. These partnerships are crucial for developing and delivering innovative digital products and services directly to customers.

By collaborating with fintech innovators, BOQ aims to enhance its customer offerings and explore advancements in automation and robotics. For instance, in 2024, BOQ continued its focus on digital channels, with digital transactions making up a significant portion of its customer interactions, underscoring the value of these fintech integrations.

Bank of Queensland (BOQ) effectively utilizes third-party intermediaries and brokers to extend the reach of its financial products, especially in the crucial home loan and asset finance sectors. This strategy allows BOQ to tap into established networks and customer bases that might otherwise be difficult to access directly.

While the landscape for home loan brokers has seen some adjustments, these partnerships remain vital for BOQ's commercial lending and specialist finance divisions. In 2024, a significant portion of BOQ's new home lending originated through the broker channel, underscoring their continued importance in the mortgage market.

Owner-Managed Branch Network (Transitioning)

Historically, Bank of Queensland (BOQ) relied heavily on its owner-managed branch network as a crucial partnership. These branches, operated by local owners, cultivated strong community ties and personalized customer service, forming a bedrock of BOQ's customer engagement strategy.

This model is undergoing a significant transformation. BOQ is actively converting its entire network of 114 owner-managed branches into corporate-owned branches. This strategic shift, slated for completion by March 2025, is a core component of BOQ's broader simplification and digital transformation initiatives.

The transition signifies a move away from the owner-managed partnership model towards a more centralized, digitally-enabled operational structure. This strategic pivot aims to streamline operations and enhance digital service delivery across the entire customer base.

- Historical Reliance: Owner-managed branches were key partners, building local trust and relationships.

- Network Size: BOQ operated 114 owner-managed branches.

- Strategic Shift: Conversion to corporate branches is part of a simplification and digital transformation strategy.

- Timeline: The conversion of all 114 branches is targeted for completion by March 2025.

Industry Associations and Regulatory Bodies

Bank of Queensland (BOQ) actively partners with key industry associations to stay ahead of market trends and best practices. These collaborations are vital for navigating the complex financial services sector.

Engaging with regulatory bodies such as the Australian Prudential Regulation Authority (APRA) and the Australian Transaction Reports and Analysis Centre (AUSTRAC) is fundamental for BOQ's compliance and robust risk management framework. For instance, APRA's prudential standards directly influence BOQ's capital adequacy and operational resilience.

BOQ also maintains dialogue with the Reserve Bank of Australia (RBA) concerning monetary policy and interest rate decisions. This engagement is critical for aligning its lending and deposit strategies with the broader economic environment. In 2024, the RBA's cash rate movements significantly impacted the Australian banking sector, and BOQ's responsiveness to these changes was a key strategic consideration.

- Industry Association Engagement: Participation in groups like the Australian Banking Association (ABA) allows BOQ to contribute to policy discussions and industry standards.

- Regulatory Compliance: Adherence to APRA's capital requirements, such as the Common Equity Tier 1 (CET1) ratio, is a core function, with BOQ maintaining a CET1 ratio of 10.5% as of March 2024.

- Anti-Money Laundering: Collaboration with AUSTRAC ensures robust Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) programs are in place.

- Monetary Policy Influence: Understanding and responding to RBA cash rate adjustments, which stood at 4.35% in early 2024, directly affects BOQ's net interest margins and product pricing.

Bank of Queensland (BOQ) strategically partners with technology providers like Microsoft for its Azure cloud migration, aiming for enhanced scalability by 2025. Furthermore, collaborations with fintech firms, such as Trade Ledger, are crucial for developing innovative lending products and improving digital customer experiences.

BOQ leverages third-party intermediaries and brokers, particularly in the home loan sector, to expand its market reach. In 2024, a substantial portion of new home lending originated through this broker channel, highlighting its ongoing significance.

Historically, BOQ relied on its 114 owner-managed branches for community engagement, but is converting these to corporate-owned branches by March 2025 to streamline operations and boost digital delivery.

BOQ also engages with industry associations for best practices and maintains vital dialogues with regulatory bodies like APRA and AUSTRAC for compliance and risk management. Its response to RBA cash rate adjustments, which were at 4.35% in early 2024, also shapes its strategic financial decisions.

| Partnership Type | Key Partner Example | Strategic Importance | 2024/2025 Relevance |

|---|---|---|---|

| Technology Providers | Microsoft (Azure) | Scalability, operational efficiency | Cloud migration by 2025 |

| Fintech Collaborations | Trade Ledger | Lending product innovation, customer experience | Streamlining lending development |

| Intermediaries/Brokers | Mortgage Brokers | Market reach, customer acquisition | Significant source of 2024 home lending |

| Branch Network | Owner-Managed Branches (114) | Community ties, customer service | Conversion to corporate by March 2025 |

| Regulatory Bodies | APRA, AUSTRAC, RBA | Compliance, risk management, economic alignment | Capital adequacy (CET1 10.5% Mar 2024), AML/CTF, response to 4.35% RBA cash rate |

What is included in the product

A detailed Bank of Queensland Business Model Canvas outlining their approach to serving diverse customer segments with tailored financial products through multiple channels, emphasizing their community-focused value proposition.

This canvas provides a clear framework of BOQ's revenue streams, cost structure, and key resources, reflecting their strategy of personalized banking and regional presence.

The Bank of Queensland's Business Model Canvas acts as a pain point reliever by providing a clear, visual framework that simplifies complex banking operations, allowing for focused problem-solving and strategic adjustments.

It helps alleviate the pain of overwhelming strategic planning by condensing the bank's entire business into a single, easily digestible page, fostering clarity and actionable insights.

Activities

Core banking operations at Bank of Queensland (BOQ) revolve around the essential functions of taking money from customers and lending it out. This includes managing savings and transaction accounts, which are the foundation for customer relationships. In 2024, BOQ continued to focus on these core activities to serve its retail and business clients.

BOQ's lending activities are a significant part of its core operations, encompassing home loans, personal loans, and business financing. These loans are crucial for both individual customers and the businesses BOQ supports. The bank actively manages its loan portfolio to ensure sound financial health and meet market demand.

Managing credit cards and transaction accounts for individuals and businesses forms another vital component of BOQ's core banking. These services facilitate everyday financial transactions and build customer loyalty. BOQ's commitment to these fundamental banking services underpins its entire financial offering.

Bank of Queensland is heavily investing in digital transformation, aiming to become a fully cloud-based digital bank. This includes launching streamlined digital offerings for mortgages and personal loans, significantly enhancing customer accessibility and speed.

A key part of this strategy involves automating internal processes to boost operational efficiency and elevate the overall customer experience. This digital push is a central pillar of BOQ's strategy through 2025 and into the future.

For example, in the fiscal year 2023, BOQ reported a 7% increase in digital transactions, underscoring the growing customer adoption of their digital platforms.

Bank of Queensland (BOQ) prioritizes strong customer relationships and personalized service, a cornerstone of its business model. Historically, this was driven by its owner-managed branch network, allowing for deep community ties and tailored advice. This commitment continues as BOQ adapts its distribution channels to better understand and meet individual customer needs.

Risk Management and Compliance

Bank of Queensland (BOQ) prioritizes maintaining robust risk management programs and ensuring strict compliance with regulatory requirements, such as those set by APRA and AUSTRAC. These are absolutely critical activities for the bank's ongoing operations and reputation.

Key risk management functions include actively managing credit risk to minimize potential losses from borrowers defaulting, operational risk to prevent disruptions from internal processes or external events, and financial crime compliance to combat money laundering and other illicit activities. For instance, in the first half of 2024, BOQ reported a statutory profit after tax of $520 million, with its common equity tier 1 (CET1) capital ratio remaining strong at 12.0%, demonstrating its capacity to absorb potential risks.

BOQ's commitment to compliance involves continuous monitoring and adaptation to evolving regulatory landscapes. This focus is essential for maintaining stakeholder trust and avoiding significant penalties. The bank's approach ensures it operates within legal frameworks, safeguarding its financial stability and customer interests.

- Credit Risk Management: Implementing stringent lending criteria and ongoing portfolio analysis to mitigate losses from loan defaults.

- Operational Risk Mitigation: Developing resilient systems and processes to prevent failures and manage impacts from internal and external disruptions.

- Financial Crime Compliance: Adhering to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, including robust customer due diligence and transaction monitoring.

- Regulatory Adherence: Continuously updating policies and procedures to align with directives from APRA, AUSTRAC, and other relevant authorities.

Business Banking and Specialist Lending Growth

Bank of Queensland is strategically expanding its business banking operations, with a keen eye on specialized lending segments. This includes a significant push into areas such as asset finance, healthcare, agriculture, and owner-occupied commercial property.

To support this growth, BOQ is investing in dedicated specialist bankers and developing bespoke financial solutions tailored to the unique needs of these sectors. This focus aims to capture a larger share of the business lending market.

- Focus on Specialist Lending: BOQ is prioritizing growth in niche areas like asset finance, healthcare, agriculture, and commercial property.

- Investment in Expertise: The bank is hiring and training specialist bankers to better serve these targeted industries.

- Tailored Solutions: BOQ is developing customized financial products and services to meet the specific demands of its business clients.

Key activities at Bank of Queensland (BOQ) center on core banking functions like deposit-taking and lending, supporting both retail and business customers. They are also heavily invested in digital transformation, aiming for a cloud-based model with streamlined digital offerings for loans and improved operational efficiency. BOQ maintains a strong focus on risk management and regulatory compliance, essential for stability and trust.

What You See Is What You Get

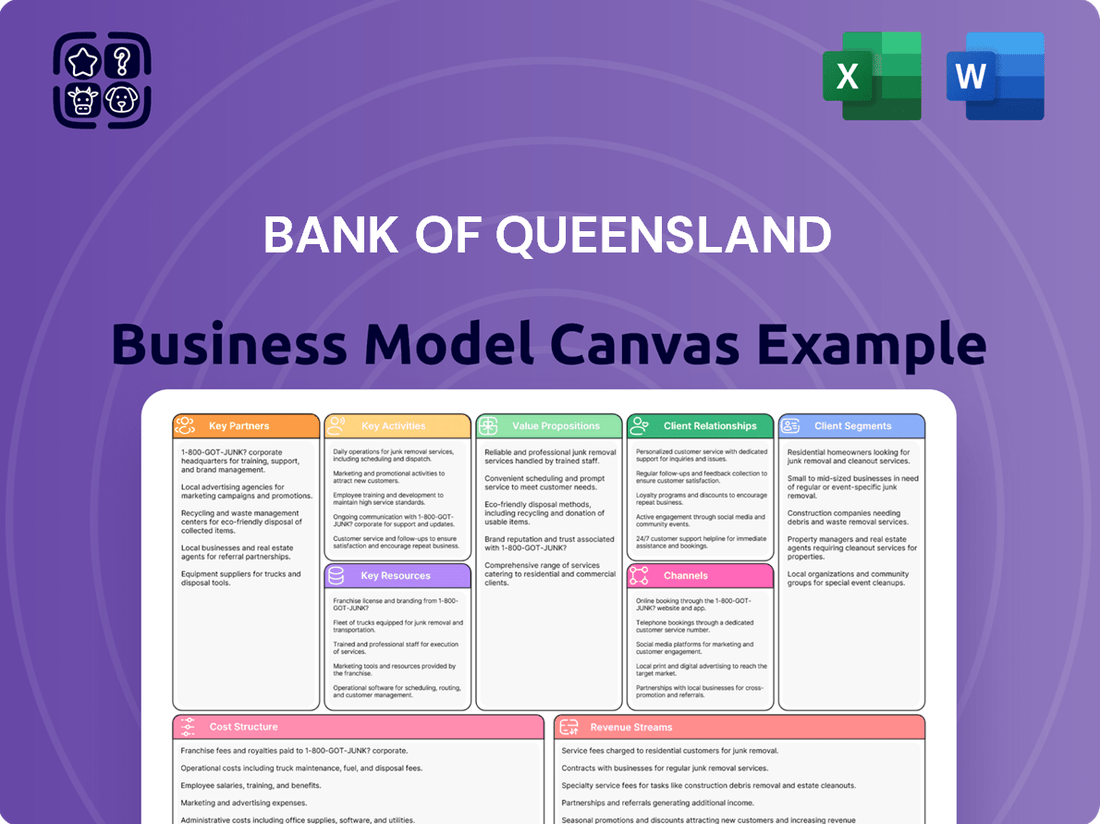

Business Model Canvas

The Bank of Queensland Business Model Canvas preview you are viewing is the precise document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered to you, ensuring no surprises. Upon completing your purchase, you'll gain full access to this comprehensive Business Model Canvas, ready for your analysis and strategic planning.

Resources

Bank of Queensland's financial capital is its lifeblood, primarily sourced from customer deposits, which in 2024 continued to be a cornerstone of its funding strategy, providing stable and low-cost liquidity. This reliance on deposits allows BOQ to fuel its lending operations and maintain robust balance sheet health.

Beyond deposits, BOQ also taps into wholesale funding markets and raises capital directly from financial markets. These diverse funding streams are crucial for managing liquidity, meeting regulatory requirements, and supporting its growth ambitions, particularly in a dynamic economic environment.

BOQ's strategic focus on its digital deposit platform is a key enabler for expanding its low-cost funding base. This digital approach aims to attract and retain customer funds efficiently, thereby strengthening its financial resilience and competitive positioning in the banking sector.

Bank of Queensland’s technology infrastructure, particularly its investment in cloud-based platforms like Microsoft Azure, is a cornerstone of its digital transformation strategy. This move to the cloud allows for greater scalability, flexibility, and efficiency in its operations.

BOQ’s commitment to digital banking applications is evident in its ongoing development and enhancement of customer-facing platforms. These applications are designed to provide seamless and intuitive banking experiences, catering to the evolving needs of its customer base.

The bank is also leveraging advanced digital lending technology, such as its partnership with Trade Ledger. This integration streamlines the lending process, making it faster and more efficient for both the bank and its clients, a key differentiator in the competitive financial landscape.

Bank of Queensland's (BOQ) human capital is a cornerstone of its operations, encompassing a diverse range of skilled employees essential for service delivery and strategic execution. This includes crucial roles filled by bankers, IT professionals, and risk and compliance specialists, all contributing to the bank's overall success.

BOQ places particular emphasis on its specialist business bankers, recognizing their pivotal role in driving the bank's strategy and serving its client base effectively. Their expertise is key to navigating complex financial landscapes and fostering strong customer relationships.

The strategic conversion of owner-managed branches into a more integrated model also necessitates the absorption of a significant workforce, highlighting the importance of managing and leveraging this human capital effectively during periods of change and expansion.

Brand Portfolio (BOQ, Virgin Money, ME Bank)

Bank of Queensland (BOQ) leverages a multi-brand strategy, featuring its namesake BOQ, Virgin Money Australia, and ME Bank. This diversified portfolio is a key resource, enabling the group to effectively reach and serve distinct customer demographics, thereby expanding its overall market presence and competitive edge. In 2024, this brand diversification is crucial for capturing market share across different segments.

- BOQ: Serves a broad range of retail and business customers, often focusing on personalized service and community engagement.

- Virgin Money Australia: Targets a younger, digitally-savvy demographic with a focus on innovative products and a strong brand association.

- ME Bank: Caters to customers seeking competitive rates and straightforward banking solutions, often appealing to first-home buyers and those looking for value.

Branch Network and Digital Channels

Bank of Queensland's (BOQ) branch network and digital channels are crucial for customer interaction. As BOQ continues its transformation, its physical presence, including the shift of owner-managed branches to corporate operations, remains a key resource. This network is complemented by a growing suite of digital offerings, such as online banking and mobile applications, ensuring broad customer accessibility and service.

In 2024, BOQ was actively managing its branch footprint alongside digital expansion. While specific numbers on the exact transition of owner-managed to corporate branches are proprietary, the strategy aims to optimize service delivery. For instance, in the fiscal year 2023, BOQ reported a continued focus on enhancing its digital capabilities, with digital transactions forming a significant portion of overall customer activity.

- Physical Network: BOQ operates a network of physical branches across Australia, facilitating in-person banking services and advisory.

- Digital Channels: The bank's online banking platform and mobile applications provide customers with 24/7 access to a wide range of banking functions.

- Customer Access: These combined channels ensure customers can engage with BOQ through their preferred method, whether face-to-face or digitally.

- Service Delivery: The evolution of both physical and digital resources is central to BOQ's strategy for effective customer service and engagement.

Bank of Queensland's (BOQ) core value proposition lies in its ability to provide accessible and tailored banking solutions. This is achieved through a combination of its multi-brand strategy, which allows it to cater to diverse customer segments, and its integrated physical and digital channels that ensure broad customer reach and engagement.

BOQ’s brand portfolio, including BOQ, Virgin Money Australia, and ME Bank, is a significant asset in 2024, enabling it to capture market share across different demographics. This diversification is supported by a robust network of branches and a growing digital presence, ensuring customers can interact with the bank through their preferred method.

The bank's commitment to enhancing customer accessibility is further demonstrated by its ongoing investment in digital platforms and its strategic management of its physical branch network, adapting to evolving customer preferences and market dynamics.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Multi-Brand Strategy | BOQ, Virgin Money Australia, ME Bank | Targets diverse customer segments, expanding market reach and competitive positioning. |

| Branch Network | Physical presence across Australia | Facilitates in-person services and advisory, adapting to optimize service delivery. |

| Digital Channels | Online banking, mobile applications | Provides 24/7 access to banking functions, complementing physical channels for broad accessibility. |

Value Propositions

Bank of Queensland (BOQ) prioritizes personalized service and strong customer relationships, a core value proposition that historically stemmed from its owner-managed branch network. This human-centric approach aims to differentiate BOQ in a competitive market by offering a more tailored banking experience.

In 2024, BOQ continued to invest in its digital capabilities while retaining a focus on relationship banking. For instance, BOQ’s commitment to customer service was reflected in its Net Promoter Score (NPS) which, while specific figures fluctuate, generally aims to remain competitive within the Australian banking sector, indicating customer loyalty and satisfaction derived from these personalized interactions.

Bank of Queensland (BOQ) distinguishes itself with a comprehensive financial product suite designed to meet diverse customer needs. For individuals, this includes a robust offering of home loans, personal loans, and credit cards, alongside everyday banking accounts. This broad accessibility caters to a wide range of personal financial requirements.

Businesses are equally well-served by BOQ's extensive portfolio. They provide essential services such as business loans, transaction accounts, and crucial merchant services. This integrated approach supports business operations from startup to expansion, demonstrating BOQ's commitment to fostering commercial growth.

In 2024, BOQ continued to emphasize digital innovation within its product offerings, aiming to enhance customer experience and streamline access to its services. This focus is critical in a competitive banking landscape where digital convenience is paramount for customer acquisition and retention.

Bank of Queensland (BOQ) is significantly boosting digital convenience and innovation as a core value proposition. This includes rolling out digital mortgages, streamlining the application process for home loans, and enhancing its online and mobile banking platforms. For instance, BOQ reported a 36% increase in digital transactions in their 2023 financial results, underscoring a strong customer shift towards these channels.

Specialist Business Banking Solutions

Bank of Queensland (BOQ) offers highly customized banking solutions specifically designed for businesses, moving beyond generic offerings to cater to unique needs. This focus is particularly evident in their deep engagement with sectors where they possess significant heritage and expertise, such as healthcare, agriculture, and commercial property.

Leveraging its strong Queensland roots, BOQ’s competitive advantage lies in its ability to understand and support local businesses within these key industries. For example, in 2024, BOQ continued to be a significant lender in the Queensland agricultural sector, with agribusiness lending growing to support farmers through diverse market conditions.

- Tailored Financial Solutions: BOQ provides bespoke lending, deposit, and transaction services that align with the specific operational and growth requirements of businesses.

- Sector Specialization: Expertise is concentrated in areas like healthcare, agriculture, and commercial property, allowing for deeper industry insight and more relevant product development.

- Queensland Focus: A core strength is the bank's commitment to and understanding of the Queensland business landscape, fostering strong local relationships.

- Competitive Advantage: This specialization and local focus enable BOQ to offer competitive pricing and advisory services that larger, more diversified banks may not match.

Trusted and Established Australian Bank

Bank of Queensland (BOQ) leverages its 150-year history to present itself as a trusted and established Australian bank. This long-standing presence translates into a core value proposition of reliability and stability for its retail and commercial customers.

This heritage underpins customer confidence, especially in the current economic climate. For instance, in the first half of 2024, BOQ reported a statutory profit after tax of $551 million, demonstrating its continued operational strength and ability to serve its customer base effectively.

- 150-year history: A significant differentiator in the Australian banking sector.

- Trusted Australian brand: Built on decades of consistent service and financial management.

- Stability and reliability: Key attributes sought by customers, particularly for their financial needs.

- Strong financial performance: As evidenced by its H1 2024 profit, reinforcing its established position.

BOQ's value proposition centers on personalized service, digital convenience, and specialized industry expertise, particularly within Queensland. Its long-standing history as a trusted Australian brand further reinforces its reliability and stability for customers.

In 2024, BOQ continued to enhance its digital offerings, such as digital mortgages, while maintaining its focus on relationship banking. This dual approach aims to meet evolving customer expectations for both convenience and personalized support.

The bank's commitment to tailored solutions is evident in its specialized lending for sectors like agriculture, where it actively supported farmers throughout the year. This deep understanding of specific industries allows BOQ to provide more relevant and competitive financial products.

| Value Proposition Pillar | Key Aspects | Supporting Data/Focus (2024) |

|---|---|---|

| Personalized Service & Relationships | Owner-managed branch heritage, tailored banking | Focus on customer loyalty, competitive Net Promoter Score (NPS) |

| Digital Convenience & Innovation | Digital mortgages, enhanced online/mobile platforms | Continued investment in digital channels, reported 36% increase in digital transactions (FY23) |

| Specialized Industry Expertise | Healthcare, agriculture, commercial property focus | Growth in agribusiness lending, deep engagement in key Queensland sectors |

| Trusted Australian Brand & Stability | 150-year history, reliability, financial strength | H1 2024 statutory profit after tax of $551 million |

Customer Relationships

Bank of Queensland historically leveraged its owner-managed branch network to cultivate deep, personalized customer relationships, offering a distinct local banking experience. This approach fostered loyalty and trust, a cornerstone of their early success.

While evolving towards a more corporate branch structure, Bank of Queensland remains committed to a significant physical presence. This strategic decision acknowledges the enduring importance of accessible, face-to-face interaction for a substantial segment of their customer base, particularly for complex financial needs.

In 2024, Bank of Queensland continued to emphasize its community ties. As of the first half of 2024, the bank operated over 100 branches across Australia, with a significant portion still retaining a strong local community focus, underpinning their personalized service model.

Bank of Queensland is significantly boosting its digital self-service options, aiming to give customers greater control. This means more banking tasks can be handled easily online or via the BOQ mobile app, from account management to accessing various banking services without needing direct human interaction.

In 2024, BOQ reported a substantial increase in digital transaction volumes, with over 70% of customer interactions occurring through digital channels. This shift underscores the success of their investment in user-friendly online platforms and mobile banking features, enhancing customer convenience and operational efficiency.

Bank of Queensland (BOQ) Business Banking prioritizes strong client connections by assigning dedicated business bankers to each business customer. These bankers act as a primary point of contact, offering personalized guidance and developing financial solutions precisely tailored to the unique requirements of each business. This approach aims to build trust and ensure clients receive expert support.

Beyond general business bankers, BOQ also employs specialist roles within its business banking division. These specialists bring deep expertise in specific areas, allowing them to provide even more focused and sophisticated advice. This layered support system ensures that businesses, regardless of their complexity or specific needs, can access the right expertise to manage their finances effectively.

In 2024, BOQ continued to invest in its relationship management capabilities. While specific figures on the number of dedicated business bankers aren't publicly detailed, the bank's strategy emphasizes personalized service. For instance, in the fiscal year ending August 31, 2023, BOQ reported a net profit after tax of $540 million, underscoring the importance of its client relationships in achieving financial performance.

Multi-Channel Customer Interaction

Bank of Queensland (BOQ) offers customers a multi-channel approach to interaction, ensuring flexibility and accessibility. This includes traditional channels like physical branches and Australian-based call centres, alongside modern digital services and a network of mobile mortgage specialists. This diverse range of touchpoints caters to varying customer preferences and needs.

In 2024, BOQ continued to invest in its digital capabilities to enhance customer experience. For instance, the bank's mobile app provides a comprehensive suite of banking services, allowing customers to manage accounts, make payments, and apply for loans conveniently. This digital focus aims to streamline interactions and improve efficiency for its customer base.

- Branch Network: Providing face-to-face service for complex transactions and personalized advice.

- Australian Call Centres: Offering direct support and problem resolution from local representatives.

- Digital Platforms: Enabling self-service banking through online portals and mobile applications.

- Mobile Mortgage Specialists: Delivering specialized assistance for home loan applications and management.

Community Engagement and Local Focus

Bank of Queensland (BOQ) has a long-standing commitment to its communities, evident in its history of supporting regional Australia. This local focus helps build strong customer relationships and fosters loyalty. For instance, BOQ's ongoing initiatives often highlight their dedication to regional businesses and local economic development.

This deep connection to local areas translates into tangible benefits for customers, creating a sense of trust and reliability. BOQ's approach prioritizes understanding the unique needs of each community it serves, differentiating it from larger, more impersonal financial institutions.

- Community Support: BOQ actively participates in local events and sponsorships, reinforcing its presence and commitment.

- Regional Business Focus: The bank provides tailored financial solutions to support the growth of small and medium-sized enterprises in regional areas.

- Customer Loyalty: This dedication to local communities cultivates strong customer loyalty and a positive brand reputation.

Bank of Queensland maintains a multi-channel approach to customer relationships, blending physical accessibility with digital convenience. This strategy caters to diverse customer preferences, ensuring support is available through branches, call centers, digital platforms, and specialized mobile teams.

In 2024, BOQ continued to enhance its digital offerings, aiming for seamless self-service banking. This focus on user-friendly online and mobile platforms supports transactional needs efficiently, complementing more personalized interactions for complex financial advice.

BOQ's commitment to community and personalized service remains a key differentiator. By fostering strong local connections and assigning dedicated relationship managers, particularly in business banking, the bank cultivates trust and loyalty, which are crucial for sustained financial performance.

The bank's investment in relationship management, evident in its dedicated business bankers and specialist support roles, aims to provide tailored financial solutions. This personalized approach is vital for retaining clients and driving growth, as demonstrated by the bank's overall financial health.

| Channel | Description | 2024 Focus |

|---|---|---|

| Physical Branches | Face-to-face service, personalized advice for complex needs | Continued community presence, owner-managed model evolution |

| Australian Call Centres | Direct support, problem resolution from local representatives | Enhancing responsiveness and accessibility |

| Digital Platforms (App/Online) | Self-service banking, account management, payments | Boosting digital transaction volumes (over 70% in H1 2024) |

| Mobile Mortgage Specialists | Specialized assistance for home loans | Streamlining mortgage application and management |

Channels

The Bank of Queensland's branch network, though evolving, remains a cornerstone for customer engagement, particularly for those valuing in-person service. As of the first half of 2024, BOQ reported having 148 branches across Australia, serving a diverse customer base.

This network facilitates a range of services, from complex financial advice to everyday transactions, catering to customers who prefer a tangible banking experience. The transition from owner-managed to corporate branches aims to standardize service quality and operational efficiency across the network.

Bank of Queensland's digital banking platforms, encompassing both online portals and mobile applications, serve as crucial customer touchpoints. These channels facilitate a growing volume of transactions and offer access to a comprehensive suite of financial products and services, reflecting a broader industry shift towards digital engagement.

In 2024, the trend of customers preferring digital channels continued to accelerate. For instance, many banks reported that over 70% of their retail transactions were conducted digitally, with mobile banking apps often leading the way in terms of customer interaction frequency and feature utilization.

These digital platforms are not merely transactional tools but also key avenues for customer acquisition and retention. By offering intuitive interfaces and personalized financial management tools, Bank of Queensland aims to deepen customer relationships and drive cross-selling opportunities within its digital ecosystem.

Bank of Queensland leverages third-party brokers to expand its loan origination, especially in business and asset finance. This strategy broadens their market access and distribution network, allowing them to connect with a wider customer base. For instance, in the 2023 financial year, BOQ reported a significant portion of its new business lending was facilitated through broker channels, demonstrating the channel's importance to their growth.

Australian-Based Customer Call Centres

Australian-based customer call centres serve as a crucial touchpoint for Bank of Queensland, offering direct support for inquiries and service needs. These centres ensure customers have accessible assistance, fostering engagement and trust. In 2024, the banking sector, including BoQ, continued to invest in enhancing these channels to meet evolving customer expectations for prompt and effective resolution.

These call centres are vital for managing customer relationships and resolving issues efficiently. They handle a significant volume of interactions, from simple account queries to more complex financial advice requests. For instance, many Australian banks reported handling millions of calls annually, with customer satisfaction heavily reliant on the quality of these interactions.

- Direct Customer Engagement: Provide immediate assistance for a wide range of banking needs.

- Service Resolution: Address customer inquiries and resolve issues efficiently, improving satisfaction.

- Accessibility: Ensure all customer segments can easily access support, regardless of location or technological proficiency.

- Brand Representation: Act as a primary interface, shaping customer perception of the Bank of Queensland.

Mobile Mortgage Specialists

Mobile mortgage specialists represent a key customer relationship channel for Bank of Queensland, providing a flexible and personalized approach to home loan services. This channel directly addresses the need for convenient, out-of-branch consultations, enhancing customer accessibility and engagement. In 2024, the Australian mortgage market continued to see strong demand, with the total value of home loan commitments reaching over $75 billion in the first quarter alone, highlighting the significant opportunity for specialized channels like mobile specialists.

This channel allows Bank of Queensland to reach a broader customer base, including those who may not regularly visit physical branches. By offering tailored advice and support at times and locations convenient for the customer, these specialists foster stronger relationships and streamline the mortgage application process. The digital shift in banking further amplifies the importance of these mobile services, meeting evolving customer expectations for on-demand financial assistance.

- Personalized Service: Offers one-on-one home loan advice and application assistance.

- Convenience: Meets customers at their preferred locations and times, outside of traditional banking hours.

- Relationship Building: Fosters deeper customer connections through dedicated, personalized support.

- Market Reach: Extends the bank's presence to customers who prefer remote or mobile engagement.

Bank of Queensland utilizes a multi-channel approach to reach and serve its customers, integrating both traditional and digital touchpoints. These channels are designed to cater to diverse customer preferences and banking needs, from in-person interactions to remote digital engagement.

| Channel | Description | Key Role | 2024/2023 Data Point |

|---|---|---|---|

| Branch Network | Physical locations offering a full range of banking services. | In-person service, complex advice, community presence. | 148 branches as of H1 2024. |

| Digital Platforms (Online & Mobile) | Websites and mobile applications for transactions and services. | Convenience, self-service, customer acquisition, data insights. | Over 70% of retail transactions conducted digitally by many banks in 2024. |

| Third-Party Brokers | External intermediaries facilitating loan origination. | Expanded market access, increased distribution for lending products. | Significant portion of new business lending via brokers in FY23. |

| Customer Call Centres | Australian-based centres providing direct customer support. | Problem resolution, customer service, relationship management. | Handle millions of calls annually across the sector. |

| Mobile Mortgage Specialists | Dedicated staff offering personalized home loan services. | Convenient, out-of-branch consultations, relationship building. | Australian mortgage market >$75 billion in commitments in Q1 2024. |

Customer Segments

Bank of Queensland (BOQ) serves a wide array of individuals and households, offering essential banking products like transaction accounts, savings accounts, personal loans, credit cards, and mortgages. This segment is diverse, encompassing everyone from young adults embracing digital banking to established families managing their finances. In 2024, BOQ continued to focus on enhancing its digital offerings to attract and retain this broad customer base.

Bank of Queensland (BOQ) actively serves Small and Medium-Sized Enterprises (SMEs) by offering a robust suite of financial solutions tailored to their unique needs. This includes essential business loans, efficient transaction accounts, and crucial merchant services, all designed to support day-to-day operations and growth initiatives.

BOQ is increasingly focusing on specialist lending for the SME sector, recognizing the diverse and often complex funding requirements of these businesses. In 2024, BOQ’s commitment to SMEs was underscored by its continued investment in digital platforms and personalized advisory services, aiming to simplify access to capital and financial management tools for this vital economic segment.

Bank of Queensland is strategically honing its focus on specialized, high-value business sectors. This includes a significant emphasis on healthcare, agriculture, and owner-occupied commercial property.

By concentrating on these areas, BOQ aims to provide deeply tailored financial products and specialized expertise. For instance, in the 2024 fiscal year, the bank reported a notable increase in lending to the healthcare sector, reflecting its commitment to this niche.

This targeted approach allows BOQ to build stronger relationships and offer more relevant solutions, differentiating itself from competitors. The agricultural sector, in particular, has seen substantial growth in BOQ's lending portfolio, supporting key Australian industries.

Corporate Clients (via Finance Division)

The Bank of Queensland's finance division specifically targets corporate clients, offering tailored asset finance lending solutions. These services are designed to support the capital expenditure needs of larger businesses, facilitating growth and operational expansion.

In 2024, the Australian corporate asset finance market saw continued demand, with businesses investing in new machinery, vehicles, and technology. For instance, the manufacturing sector, a key recipient of asset finance, reported significant investment in automation and upgrades throughout the year.

- Asset Finance Focus: Specializing in lending for tangible assets like equipment, vehicles, and property.

- Target Market: Primarily larger corporations and established businesses with substantial capital requirements.

- Market Contribution: In 2024, asset finance accounted for a significant portion of the bank's lending to the corporate sector, reflecting strong demand for business investment.

- Value Proposition: Providing flexible and structured financing to help businesses acquire essential assets without depleting working capital.

Virgin Money and ME Bank Customers

Bank of Queensland (BOQ) strategically targets distinct customer groups through its Virgin Money Australia and ME Bank brands. Virgin Money Australia, for instance, appeals to customers seeking a more lifestyle-oriented banking experience, often characterized by a desire for digital convenience and integrated rewards. ME Bank, on the other hand, typically attracts customers prioritizing competitive rates and straightforward banking products, with a strong emphasis on home loans and savings accounts.

In 2024, BOQ continued to leverage these distinct brand identities to capture market share. Virgin Money Australia, in particular, has been a focus for digital innovation, aiming to enhance customer engagement through its app and loyalty programs. ME Bank remains a cornerstone for BOQ's retail banking operations, contributing significantly to its deposit base and lending volumes, especially in the mortgage sector.

- Virgin Money Australia: Focuses on a lifestyle banking proposition, emphasizing digital tools and customer rewards, targeting a segment that values convenience and integrated experiences.

- ME Bank: Caters to customers seeking competitive pricing and simplicity, particularly in home lending and savings products, representing a core retail banking segment for BOQ.

- Market Positioning: BOQ's multi-brand approach allows it to address diverse customer needs and preferences within the Australian financial services landscape, avoiding direct cannibalization by offering differentiated value propositions.

BOQ's customer segments are diverse, ranging from individual retail customers and households to small and medium-sized enterprises (SMEs) and larger corporate clients. The bank also strategically utilizes its brands, Virgin Money Australia and ME Bank, to target specific market niches with tailored offerings.

In 2024, BOQ continued to refine its approach to these segments. For individuals, the focus remained on digital enhancements and competitive product offerings. SMEs benefited from specialized lending and digital tools, while corporate clients were served through tailored asset finance solutions.

The multi-brand strategy allows BOQ to capture a broader market share by appealing to different customer preferences, from lifestyle-oriented banking with Virgin Money Australia to value-focused banking with ME Bank.

Cost Structure

Bank of Queensland's commitment to its digital transformation represents a substantial cost driver. In the 2023 financial year, BOQ reported significant investments in technology, including a focus on cloud migration and the development of new digital offerings. These expenditures are crucial for modernizing its infrastructure and enhancing customer experience.

The ongoing digital overhaul involves considerable outlays for cloud platform adoption, the creation of innovative digital banking products, and the eventual retirement of older, less efficient systems. While these investments present upfront costs, they are strategically designed to yield long-term advantages in operational efficiency and a reduction in overall expenses.

Operating expenses, a significant component of BOQ's cost structure, encompass salaries, benefits, and the broader costs of maintaining its physical presence like branches and call centres, alongside corporate functions. In the first half of fiscal year 2024, BOQ reported operating expenses of $731 million, a slight increase from the prior year, reflecting inflationary pressures and strategic investments.

To manage these costs, BOQ has actively pursued initiatives aimed at streamlining its operating model. These efforts have included a reduction in full-time equivalent (FTE) roles, contributing to a more efficient cost base. The bank's focus on digital transformation also plays a role in optimizing these operational expenditures over the long term.

The Bank of Queensland's cost structure is significantly influenced by its branch network. These costs encompass the day-to-day operations of physical branches, including staffing, rent, utilities, and maintenance. In 2024, the ongoing transition of owner-managed branches to corporate branches is a key factor here.

This strategic shift, while aimed at long-term efficiency and standardization, is projected to incur additional operating expenses in the initial phases. For instance, the costs associated with retraining staff, implementing new corporate systems, and potentially higher direct management overheads for corporate branches will add to the overall expenditure in the near term.

Funding Costs

Bank of Queensland's funding costs, primarily from customer deposits and wholesale markets, are a core expense. In the first half of 2024, the bank noted that its cost of funds increased, reflecting a competitive deposit market and higher wholesale borrowing rates. This directly influences their ability to generate profit through lending.

The bank actively manages its funding mix to optimize these costs.

- Customer Deposits: This is the bank's primary and often cheapest source of funding.

- Wholesale Funding: This includes borrowing from other financial institutions or issuing debt securities, typically carrying higher interest rates.

- Net Interest Margin (NIM): The difference between the interest income generated and the interest paid out on its liabilities is heavily impacted by these funding costs.

- Impact of Interest Rates: Rising interest rates generally increase funding costs for banks, putting pressure on margins if lending rates don't adjust proportionally.

Risk, Compliance, and Regulatory Costs

Bank of Queensland (BOQ) allocates significant resources to its risk, compliance, and regulatory functions. These investments are crucial for maintaining operational integrity and adhering to Australia's stringent financial sector regulations. For the fiscal year 2024, BOQ's commitment to these areas reflects an ongoing effort to bolster its risk management frameworks and ensure full compliance with evolving legal and prudential requirements.

These ongoing expenses cover a range of activities, from enhancing cybersecurity measures to managing anti-money laundering (AML) and know-your-customer (KYC) protocols. Addressing any historical compliance gaps also necessitates dedicated expenditure. For instance, in its 2023 annual report, BOQ highlighted continued investment in its compliance and risk management capabilities as a strategic priority, underscoring the persistent nature of these costs.

- Investments in risk management programs: Ongoing expenditure to strengthen internal controls, data analytics for risk assessment, and fraud prevention systems.

- Regulatory compliance efforts: Costs associated with meeting obligations under the Banking Act, ASIC regulations, and APRA prudential standards, including reporting and audit expenses.

- Addressing legacy issues: Funds allocated to remediate past compliance shortcomings or adapt to new regulatory interpretations.

Bank of Queensland's cost structure is heavily influenced by its digital transformation initiatives, including cloud migration and new digital product development, as seen in its 2023 investments. These technology outlays are essential for modernizing operations and improving customer experience, aiming for long-term efficiency gains despite upfront costs. Operating expenses, encompassing staffing, branch upkeep, and corporate functions, were $731 million in H1 2024, reflecting inflation and strategic investments, managed through efforts like FTE reductions.

Funding costs, derived from customer deposits and wholesale markets, are a core expense, with BOQ noting increased costs of funds in H1 2024 due to a competitive deposit market and higher wholesale rates. The bank actively manages its funding mix to optimize these costs, with customer deposits being a primary, often cheaper, source compared to wholesale funding. These funding costs directly impact BOQ's Net Interest Margin (NIM), especially in a rising interest rate environment.

Investments in risk, compliance, and regulatory functions are significant cost drivers for BOQ, crucial for maintaining operational integrity and adhering to Australian financial regulations. These expenses cover cybersecurity, AML/KYC protocols, and addressing legacy compliance issues, with continued investment highlighted as a strategic priority in 2023. The ongoing transition of owner-managed branches to corporate branches in 2024 is also projected to incur additional operating expenses in its initial phases due to retraining and system implementation.

| Cost Category | Key Drivers | Financial Year 2023/H1 2024 Impact |

| Technology & Digital Transformation | Cloud migration, new digital products, system retirement | Significant investment in 2023; crucial for long-term efficiency |

| Operating Expenses | Staffing, branch operations, corporate functions | $731 million in H1 2024; impacted by inflation and FTE adjustments |

| Funding Costs | Customer deposits, wholesale borrowing | Increased in H1 2024 due to market conditions; impacts NIM |

| Risk, Compliance & Regulatory | Cybersecurity, AML/KYC, regulatory adherence | Ongoing strategic investment; addressing legacy issues |

| Branch Network | Staffing, rent, utilities, maintenance, transition to corporate | Costs associated with physical presence and ongoing structural changes |

Revenue Streams

Net Interest Income (NII) is Bank of Queensland's core revenue generator. This income arises from the spread between the interest BOQ earns on its lending activities and investments, and the interest it pays out on customer deposits and other borrowings. For the financial year 2024, BOQ reported a Net Interest Income of $1.2 billion, reflecting a focus on managing this crucial margin.

Bank of Queensland's primary revenue driver is the interest earned from its diverse loan portfolio, encompassing home, personal, and business loans. This interest income is supplemented by various fees associated with these lending products.

While the Australian home lending market experienced some slowdown in 2023, with overall mortgage growth moderating, Bank of Queensland has identified business lending as a significant growth opportunity. For instance, in the first half of FY24, BOQ reported a 10% increase in its business lending portfolio, indicating a strategic focus on this segment.

Bank of Queensland generates revenue through various fees linked to its credit card and transaction account services. These include annual fees for credit cards, interest charges on outstanding balances, and fees for services like overseas transactions or ATM withdrawals. For everyday banking, fees can arise from account keeping, transaction processing, and overdraft facilities.

In the 2024 financial year, the Australian banking sector saw continued reliance on these fee-based income streams. While specific figures for BOQ's credit card and transaction account fees for 2024 are part of their detailed financial reporting, the broader trend indicates that these are significant contributors to profitability, reflecting customer usage and the bank's pricing strategies for its core transactional products.

Asset Finance and Specialist Lending Income

Bank of Queensland (BOQ) is increasingly generating income from asset finance and specialist lending. This segment represents a growing area of focus and investment for the bank, indicating a strategic push into more targeted business financing solutions.

This expansion is crucial for diversifying BOQ's revenue base beyond traditional banking services. The bank's commitment to this area is reflected in its efforts to grow its presence and offerings in specialist lending markets.

- Asset Finance Growth: BOQ is actively expanding its asset finance operations, providing businesses with tailored solutions for acquiring essential assets.

- Specialist Lending Focus: The bank is investing in and developing expertise in niche lending areas to cater to specific industry needs.

- Revenue Diversification: These activities contribute to a more robust and diversified income stream for BOQ.

- Strategic Investment: BOQ's increased investment signifies confidence in the potential of these specialized financial products.

Non-Interest Income (e.g., Banking Fees, Insurance)

Bank of Queensland diversifies its earnings through non-interest income, which includes various fees and commissions. This segment is crucial for profitability, especially in a competitive banking landscape.

Key components of non-interest income include transaction fees, account management charges, and income generated from wealth management and insurance products. In the first half of 2024, Bank of Queensland reported a notable increase in its fee and commission income, contributing significantly to its overall financial performance.

- Banking Fees: Revenue derived from account maintenance, transaction processing, and other customer service charges.

- Trading Income: Profits generated from the bank's trading activities in financial markets.

- Insurance Income: Earnings from the sale of insurance products, often in partnership with specialized providers.

- Other Fee Income: This can encompass a range of services like loan origination fees, ATM usage fees, and foreign exchange commissions.

Bank of Queensland's revenue is also bolstered by its wealth management and insurance offerings. These services provide customers with investment products and financial protection, generating commission and fee-based income for BOQ. For the first half of FY24, BOQ highlighted growth in its wealth management segment, indicating a strategic push to capture more of this lucrative market.

| Revenue Stream | FY24 Data (H1) | Significance |

| Net Interest Income | $1.2 billion (FY24 full year) | Core revenue driver from lending |

| Fee & Commission Income | Notable increase (H1 FY24) | Diversifies income, reflects customer activity |

| Business Lending Growth | 10% increase (H1 FY24) | Strategic growth area |

Business Model Canvas Data Sources

The Bank of Queensland Business Model Canvas is informed by a blend of internal financial data, extensive market research on customer needs and competitive landscapes, and strategic insights derived from industry analysis. These diverse data sources ensure a comprehensive and accurate representation of the bank's operational strategy and market position.