BOK Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BOK Financial Bundle

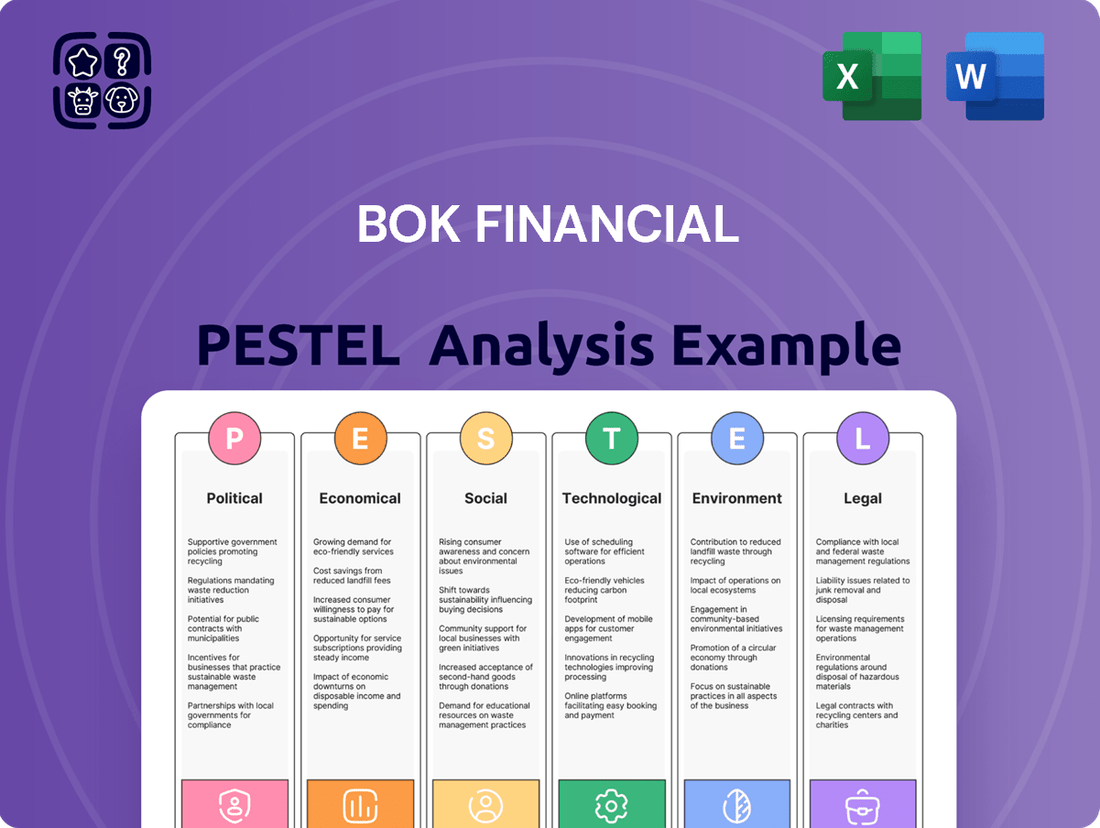

Gain a critical understanding of the external forces shaping BOK Financial's landscape. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Equip yourself with actionable intelligence to anticipate market shifts and refine your strategic approach.

Unlock the full potential of your BOK Financial market strategy. Our comprehensive PESTLE analysis provides expert insights into the macro-environmental influences impacting the bank's operations and future growth. Download the complete report to gain a decisive competitive advantage.

Political factors

BOK Financial operates within a landscape shaped by government policy and regulation, a constant factor for any financial institution. For instance, potential changes to tax policies, such as the expiration or extension of provisions from the Tax Cuts and Jobs Act, could directly affect BOK Financial's bottom line. In 2024, the banking sector continues to navigate evolving capital requirements and consumer protection rules, impacting operational costs and strategic planning.

BOK Financial operates within a heavily regulated environment, facing constant oversight from agencies such as the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC). These bodies possess significant authority over crucial strategic decisions, including mergers, acquisitions, and investment activities, directly impacting BOK Financial's expansion plans and overall growth trajectory.

The FDIC's proposed budget for 2025 suggests a reduction in the number of examiners. However, this comes at a time when the complexity and asset bases of insured financial institutions are consistently increasing. This imbalance could potentially heighten systemic risk within the banking sector, making robust compliance and risk management even more critical for BOK Financial.

Ongoing geopolitical conflicts, particularly in the Middle East and the protracted war between Russia and Ukraine, continue to cast a long shadow over international markets. These events not only disrupt global trade flows and supply chains but also fuel a broader trend toward deglobalization. For instance, the International Monetary Fund (IMF) projected in April 2024 that global growth would slow to 3.2% in 2024, a figure that can be significantly influenced by these persistent geopolitical risks.

Shifts in U.S. trade policy, including the potential for new tariffs or changes to existing trade agreements, introduce a layer of economic uncertainty. These policy adjustments can directly impact BOK Financial's operating environment by affecting the cost of goods, the competitiveness of its clients, and overall market stability. The U.S. trade deficit, for example, remained substantial in early 2024, highlighting the ongoing complexities in international trade relationships.

Consumer Protection Initiatives

Policymakers are indicating a potential recalibration of consumer protection efforts, with some legislative proposals leaning towards a more business-friendly environment. However, this is balanced by ongoing vigilance regarding systemic risks and the rapid evolution of financial technologies.

The National Consumer Law Center (NCLC) is actively campaigning for robust consumer safeguards throughout 2025. Their agenda includes tackling predatory fees, fortifying defenses against financial fraud, and ensuring that artificial intelligence in financial products does not lead to discriminatory practices. For instance, the NCLC has been instrumental in advocating for legislation that caps certain overdraft fees, a move that could impact millions of consumers annually.

- Focus on Fee Regulation: Continued efforts to limit or eliminate abusive fees in financial services.

- Anti-Fraud Measures: Strengthening protections against various forms of financial fraud and scams.

- AI and Non-Discrimination: Ensuring fair and equitable access to financial products, particularly concerning AI-driven decision-making.

Stability of the U.S. Banking System

The Federal Deposit Insurance Corporation (FDIC) remains a cornerstone of U.S. banking system stability. While the system demonstrated resilience through 2024, the FDIC's upcoming 2025 risk review points to potential headwinds. These include persistent interest rate uncertainty and the impact of elevated unrealized losses on securities portfolios, factors that could shape the operating environment for BOK Financial.

The FDIC's proactive approach aims to mitigate systemic risks. However, the review's findings underscore the delicate balance banks must strike. For BOK Financial, navigating these conditions means carefully managing its balance sheet and investment strategies to counter potential market volatility.

- FDIC Deposit Insurance Fund: As of Q1 2024, the DIF stood at $125.6 billion, with a ratio of 1.31% of insured deposits, indicating a robust capital buffer.

- Unrealized Losses: While specific figures for 2025 are pending the FDIC review, unrealized losses on securities held by U.S. banks were reported in the tens of billions in late 2023, a trend that could persist.

- Interest Rate Sensitivity: Banks with longer-duration assets are more exposed to interest rate fluctuations, a key consideration for BOK Financial's portfolio management.

Political stability and government policies significantly influence BOK Financial's operations. Regulatory changes, such as those concerning capital requirements or consumer protection, directly impact compliance costs and strategic flexibility. For instance, the ongoing debate around potential changes to banking regulations in 2024-2025 could necessitate adjustments in BOK Financial's risk management frameworks and operational strategies.

What is included in the product

This BOK Financial PESTLE analysis examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

A concise and actionable summary of the BOK Financial PESTLE analysis, designed to quickly identify and address external threats and opportunities, thereby alleviating strategic planning anxieties.

Economic factors

The Federal Reserve's monetary policy, particularly its stance on interest rates, directly influences BOK Financial's core profitability. When the Fed adjusts its benchmark rates, it ripples through the financial system, affecting how much banks can earn on loans versus what they pay on deposits.

A positively sloped yield curve, where longer-term interest rates exceed shorter-term ones, typically benefits banks like BOK Financial. This scenario allows them to borrow at lower short-term rates and lend at higher long-term rates, widening their net interest margin (NIM).

For BOK Financial, this trend was evident in the first quarter of 2025, with the company reporting continued expansion in its net interest margin, indicating a favorable environment for its lending activities.

Loan growth is a vital economic indicator for financial institutions, directly impacting revenue and balance sheet expansion. BOK Financial experienced a notable acceleration in loan growth during the second quarter of 2025, with expectations set for mid to upper single-digit growth throughout the entire year. This robust expansion suggests a healthy demand for credit and a positive outlook for the bank's lending activities.

Maintaining exceptional credit quality is paramount, especially as economic conditions present potential headwinds for household finances and specific sectors like commercial real estate. BOK Financial's commitment to strong credit underwriting and risk management is essential to navigate these challenges and ensure the long-term stability of its loan portfolio.

Inflationary pressures, especially concerning labor costs, are a significant economic consideration for BOK Financial. While the U.S. economy is projected to see continued positive growth in 2025, this expansion is anticipated to be at a more moderate pace compared to 2024, with ongoing inflation posing a challenge for both consumers and businesses.

Despite these headwinds, robust consumer spending remains a vital pillar, actively supporting overall economic growth. This resilience in consumer behavior is a key factor to monitor as it directly impacts demand for financial services.

Wealth Management Market Trends

The wealth management sector is experiencing a transformation, with clients increasingly favoring digital interactions and a growing appetite for alternative investments. This shift is reshaping how financial institutions like BOK Financial engage with their clientele.

Furthermore, the industry faces a demographic evolution: an aging advisor population coincides with a rising wealth accumulation among younger demographics. This presents a dual challenge and opportunity for BOK Financial to adapt its strategies.

- Digital Adoption: By 2024, it's estimated that over 70% of wealth management clients will prefer digital channels for communication and transactions, a trend expected to continue growing.

- Alternative Investments: The allocation to alternative assets among high-net-worth individuals is projected to reach 25% by 2025, up from approximately 18% in recent years.

- Generational Wealth Transfer: Over the next two decades, trillions of dollars in wealth are expected to transfer to younger generations, who often have different investment priorities and communication preferences.

- Advisor Demographics: The average age of financial advisors continues to rise, with a significant portion nearing retirement, creating a need for succession planning and attracting new talent.

Regional Economic Conditions

BOK Financial's core operations are concentrated in the Southwestern and Midwestern United States. The economic health of these regions, therefore, directly impacts the company's performance. For instance, robust GDP growth in states like Arizona, a key market for BOK Financial, can translate into increased demand for banking services, loans, and insurance products.

Looking at recent data, the Southwestern region, including states like Arizona and Texas where BOK Financial has a significant presence, has shown resilience. Arizona's GDP grew by an estimated 3.1% in 2023, outpacing the national average. This growth is often driven by sectors like technology, healthcare, and tourism, all of which benefit from strong financial services.

The Midwestern states served by BOK Financial also present a mixed but generally positive economic outlook. For example, Oklahoma, the company's home state, saw its GDP increase by approximately 1.8% in 2023. Key industries in these regions, such as energy, agriculture, and manufacturing, are vital to BOK Financial's loan portfolios and deposit bases.

- Southwestern Economic Growth: Arizona's GDP growth of 3.1% in 2023 highlights a strong regional economy favorable for financial institutions.

- Midwestern Stability: Oklahoma's GDP growth of 1.8% in 2023 indicates a steady economic environment in key Midwestern markets for BOK Financial.

- Sectoral Performance: The finance and insurance sectors in these regions are directly influenced by the performance of industries like technology, healthcare, energy, and manufacturing.

- Impact on BOK Financial: Positive regional economic conditions generally lead to higher loan demand, increased investment activity, and a stronger deposit base for BOK Financial.

Economic factors significantly shape BOK Financial's operating environment. The Federal Reserve's monetary policy, particularly interest rate decisions, directly impacts the bank's net interest margin. For instance, BOK Financial reported continued net interest margin expansion in Q1 2025, reflecting a favorable rate environment.

Loan growth is another critical driver, with BOK Financial anticipating mid to upper single-digit growth for 2025, indicating strong credit demand. However, persistent inflation, especially concerning labor costs, presents a challenge, even as consumer spending remains robust, supporting overall economic activity.

The bank's regional concentration in the Southwest and Midwest means that local economic health is paramount. Arizona's GDP growth of 3.1% in 2023 and Oklahoma's 1.8% growth in the same year highlight the varied but generally positive economic landscapes influencing BOK Financial's performance.

| Economic Factor | Impact on BOK Financial | 2023/2025 Data/Outlook |

|---|---|---|

| Federal Reserve Monetary Policy | Net Interest Margin (NIM) | NIM expansion in Q1 2025 |

| Loan Growth | Revenue and Balance Sheet | Mid to upper single-digit growth expected for 2025 |

| Inflation | Operating Costs (Labor) | Moderate growth projected for 2025 with ongoing inflationary pressures |

| Regional GDP Growth (Southwest) | Demand for Services | Arizona GDP grew 3.1% in 2023 |

| Regional GDP Growth (Midwest) | Demand for Services | Oklahoma GDP grew 1.8% in 2023 |

Full Version Awaits

BOK Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This BOK Financial PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It offers a comprehensive overview for strategic planning.

Sociological factors

The aging U.S. workforce, particularly within wealth management, is creating a significant need for a new generation of financial advisors. These younger professionals are expected to be not only technologically adept but also capable of building rapport with a client base that increasingly values digital interaction and immediate access to financial data. By 2025, it's projected that millennials will control a substantial portion of wealth, emphasizing their influence on service delivery.

Millennials and Gen Z, characterized by their digital nativity, demand a frictionless, online-first approach to financial services. They expect intuitive mobile apps, personalized digital advice, and the ability to manage their finances anytime, anywhere. Research from 2024 indicates that over 70% of Gen Z consumers prefer digital channels for banking and financial advice, highlighting a clear shift in client expectations.

The wealth management industry is experiencing a significant push for greater diversity and inclusion. This isn't just about social responsibility; it's a strategic imperative for growth.

Firms that cultivate diverse workforces, especially by bringing in more women and individuals from underrepresented backgrounds, are finding they can connect with a wider range of clients. For instance, in 2024, a significant portion of new wealth was expected to be controlled by women and minority groups, making a diverse advisory team crucial for capturing this market share.

Consumers are demanding more from their banks, expecting slick digital tools for everything from opening accounts to managing investments. This shift means BOK Financial must invest heavily in user-friendly apps and online platforms to stay competitive. For instance, a 2024 survey indicated that over 70% of banking customers prefer digital channels for routine transactions.

Financial Literacy and Education

As financial products grow more intricate, the public's understanding of money matters significantly impacts the demand for specific services and the necessity for clear communication from institutions like BOK Financial. This is crucial for serving a broad range of investors, from novices to seasoned professionals.

Low financial literacy can lead to increased demand for basic banking services and financial education, while higher literacy might drive interest in more complex investment products. For instance, a 2023 FINRA study indicated that only about 69% of Americans could answer three basic financial literacy questions correctly, highlighting a persistent need for accessible educational resources.

- Growing complexity of financial products necessitates enhanced consumer understanding.

- Financial literacy levels directly influence demand for various banking and investment services.

- Institutions like BOK Financial must prioritize clear communication and educational outreach.

- Data suggests a significant portion of the population still requires foundational financial knowledge.

Community Engagement and Corporate Responsibility

BOK Financial actively demonstrates its commitment to corporate responsibility by prioritizing sustainability, ethical practices, and positive community engagement. This focus on being a good corporate citizen directly contributes to a stronger brand image and appeals to a growing segment of socially aware customers and potential employees.

The company's efforts to improve the quality of life in the communities it serves are not just altruistic; they are strategic. For instance, BOK Financial's 2023 community investment initiatives, totaling over $10 million, supported various local programs aimed at economic development and education, directly impacting community well-being and fostering goodwill.

- Community Investment: BOK Financial allocated over $10 million in 2023 to community development and philanthropic efforts.

- Employee Volunteerism: In 2024, BOK Financial employees logged over 15,000 volunteer hours, contributing to local non-profits.

- Sustainability Goals: The company has set targets to reduce its carbon footprint by 20% by 2028, aligning with environmental consciousness.

- Ethical Governance: BOK Financial maintains robust ethical guidelines, reflected in its consistent high scores on corporate governance ratings.

The increasing demand for digital-first financial services, driven by younger demographics like millennials and Gen Z, is reshaping client expectations. Research from 2024 indicates that over 70% of Gen Z prefer digital channels for financial advice, underscoring the need for intuitive mobile platforms. Furthermore, the growing wealth controlled by women and minority groups by 2025 highlights the strategic advantage of a diverse workforce in connecting with these expanding client segments.

Technological factors

The financial services sector is in the midst of a significant digital overhaul, with online and mobile banking platforms taking center stage. BOK Financial is actively participating in this shift, utilizing technology to streamline operations and enhance client service delivery. This digital push not only improves efficiency but also contributes to sustainability by reducing reliance on paper-based processes.

As of late 2024, a significant majority of banking interactions are occurring through digital channels. For instance, mobile banking app usage has seen a substantial increase, with many institutions reporting over 70% of their customer base actively using these platforms for transactions and inquiries. BOK Financial's investment in these digital tools directly supports this trend, enabling them to manage a higher volume of customer interactions with greater efficiency and lower operational costs, a key factor in maintaining competitive pricing and service levels.

Financial institutions like BOK Financial are prime targets for increasingly sophisticated cyberattacks. These threats include ransomware, phishing scams, and vulnerabilities in API integrations, all aiming to steal sensitive customer data. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial stakes involved.

Given BOK Financial's role in managing substantial amounts of sensitive financial information, the pressure to maintain top-tier cybersecurity is immense. Protecting customer data and ensuring the integrity of financial transactions are paramount to retaining client trust and complying with stringent regulatory frameworks like the Gramm-Leach-Bliley Act.

Artificial intelligence and machine learning are significantly reshaping wealth management for institutions like BOK Financial. These technologies are being deployed for enhanced fraud detection, optimizing investment portfolios through advanced analytics, and automating various aspects of client service to improve efficiency and client experience. For instance, in 2024, many financial institutions reported increased investment in AI for personalized client recommendations, aiming to boost engagement and asset growth.

While the potential benefits of AI in driving efficiency and generating deeper insights are substantial, BOK Financial must prioritize responsible implementation. This includes rigorously addressing potential biases within AI algorithms to ensure fair outcomes and maintaining strict compliance with fair lending regulations. The financial sector, in 2025, continues to grapple with the ethical considerations of AI, with regulators emphasizing transparency and accountability in its deployment.

Fintech Partnerships and Competition

The financial technology, or fintech, sector is rapidly evolving, introducing new competitors and partnership opportunities for established institutions like BOK Financial. Fintech firms and robo-advisors are increasingly challenging traditional banking models by offering streamlined digital services, often at lower costs. For instance, the global fintech market was valued at approximately $111.8 billion in 2023 and is projected to grow significantly, reaching an estimated $332.5 billion by 2028, with a compound annual growth rate (CAGR) of 24.3% during that period.

BOK Financial needs to navigate this dynamic environment by considering strategic alliances with fintech innovators or developing its own digital capabilities to remain competitive. These new players frequently boast lower expense ratios and enhanced trading flexibility, attracting a growing segment of the market, particularly younger investors. The rise of robo-advisors, for example, has seen assets under management grow substantially, with some estimates suggesting they could manage over $5 trillion in assets globally by 2027.

- Fintech Market Growth: The global fintech market's projected expansion highlights the increasing influence of technology in financial services.

- Robo-Advisor Impact: Robo-advisors are capturing market share by offering cost-effective and accessible investment management solutions.

- Competitive Pressures: BOK Financial faces pressure to adapt its service offerings and pricing to match the efficiency and flexibility of fintech competitors.

- Strategic Imperatives: Partnerships or internal innovation are crucial for BOK Financial to maintain relevance and attract customers in this evolving landscape.

Data Analytics and Personalized Services

Advanced data analytics are transforming how financial institutions like BOK Financial operate, offering unprecedented insights into market dynamics and customer preferences. This technological shift is crucial for staying competitive in the evolving financial landscape.

By leveraging sophisticated data analytics, BOK Financial can develop highly personalized financial products and services. This tailored approach not only boosts client satisfaction but also significantly improves customer retention rates, a key performance indicator for any financial institution. For instance, in 2024, many leading banks reported a notable increase in customer loyalty when implementing data-driven personalization strategies.

The ability to analyze vast datasets allows for the prediction of client needs and the proactive offering of relevant solutions. This proactive engagement fosters stronger client relationships and can unlock new revenue streams.

- Enhanced Client Understanding: Data analytics provide granular insights into customer financial behavior, enabling BOK Financial to anticipate needs.

- Personalized Product Development: Tailored financial products, from investment portfolios to loan offerings, can be created based on individual client profiles.

- Improved Customer Retention: Personalized service and relevant product offerings directly contribute to higher client satisfaction and reduced churn. In 2024, financial firms with robust data analytics capabilities saw an average of 15% higher retention rates compared to those without.

- Competitive Advantage: Institutions that effectively utilize data analytics gain a significant edge by offering superior, client-centric experiences.

Technological advancements are fundamentally reshaping the financial services industry, pushing institutions like BOK Financial to embrace digital transformation for efficiency and customer engagement. The increasing reliance on mobile banking, with over 70% of customers actively using these platforms in 2024, necessitates robust digital infrastructure. Cybersecurity remains a critical concern, as the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, demanding significant investment in data protection to maintain client trust and regulatory compliance.

Artificial intelligence and machine learning are being integrated to enhance services like fraud detection and personalized investment advice, with many financial institutions increasing AI investment in 2024 for improved client recommendations. The burgeoning fintech sector, projected to reach $332.5 billion by 2028, presents both competitive challenges and partnership opportunities, forcing established players to innovate or risk losing market share. Advanced data analytics are proving invaluable, enabling personalized product development and improving customer retention, with firms leveraging these tools in 2024 seeing an average of 15% higher retention rates.

Legal factors

BOK Financial navigates a stringent regulatory landscape. In 2024, the Federal Reserve continued to emphasize robust capital adequacy, with BOK Financial maintaining strong ratios well above minimum requirements, reflecting a commitment to stability. Adherence to the Bank Secrecy Act and its anti-money laundering (AML) provisions remains paramount, involving significant investment in compliance technology and personnel to detect and prevent illicit financial activities.

Consumer protection laws, such as the Truth in Lending Act and the Fair Credit Reporting Act, dictate how BOK Financial interacts with its customers. Ongoing scrutiny from regulatory bodies like the OCC and CFPB necessitates continuous adaptation of policies and procedures to ensure fair treatment and transparency, especially concerning lending practices and data privacy.

Consumer protection regulations are a significant legal factor for BOK Financial. Laws like those overseen by the Consumer Financial Protection Bureau (CFPB) are designed to safeguard consumers from unfair, deceptive, or abusive practices within the financial services industry. For instance, in 2023, the CFPB continued to focus on areas like unfair billing practices and discriminatory lending, issuing numerous enforcement actions and fines that underscore the importance of robust compliance programs.

BOK Financial must diligently adhere to these consumer protection mandates. This includes ensuring transparency and fairness in fee structures, implementing strong fraud prevention measures, and guaranteeing that technology, particularly in areas like AI-driven lending, is used in a non-discriminatory manner. Failure to comply can result in substantial penalties, reputational damage, and increased regulatory scrutiny, impacting overall business operations and profitability.

The increasing digitization of financial services means BOK Financial must navigate a complex web of data privacy and security laws. Compliance with regulations like the California Consumer Privacy Act (CCPA) and similar state-level initiatives is crucial. Failure to adequately protect sensitive customer data can lead to significant financial penalties, with CCPA fines potentially reaching $7,500 per intentional violation.

Anti-Money Laundering (AML) and Sanctions Compliance

BOK Financial operates within a stringent legal framework, particularly concerning Anti-Money Laundering (AML) and counter-terrorist financing (CFT). These regulations mandate thorough customer due diligence and the reporting of suspicious activities to prevent financial crimes. In 2023, the Financial Crimes Enforcement Network (FinCEN) reported over 3.1 million Suspicious Activity Reports (SARs), underscoring the volume of activity financial institutions must monitor.

The global regulatory landscape for financial crime enforcement is continuously evolving, with increased pressure on institutions to adapt. BOK Financial must remain vigilant in assessing and responding to these shifts. For instance, the European Union's Sixth Anti-Money Laundering Directive (AMLD6), fully transposed by member states in 2021, expanded the scope of predicate offenses for money laundering, impacting cross-border compliance efforts.

- Regulatory Scrutiny: Financial institutions face intense scrutiny regarding AML/CFT compliance, with significant penalties for non-adherence.

- Customer Due Diligence (CDD): Robust Know Your Customer (KYC) processes are essential to identify and verify customer identities and assess risks.

- Suspicious Activity Reporting (SAR): Timely and accurate reporting of suspicious transactions is a critical legal obligation.

- International Cooperation: Global efforts to combat financial crime require adherence to international standards and cooperation with foreign authorities.

Community Reinvestment Act (CRA)

The Community Reinvestment Act (CRA) is a significant legal factor for BOK Financial, as it mandates banks to serve the credit needs of the communities where they operate, including low-income neighborhoods. This legislation aims to combat discriminatory lending and encourage investment in underserved areas.

For BOK Financial, compliance with the CRA directly influences its lending strategies and community development initiatives. The bank's performance under the CRA is assessed periodically, impacting its ability to expand through mergers or acquisitions. For instance, in 2023, regulatory reviews often scrutinize a bank's CRA performance, with specific metrics on loan origination, investment, and service in low- and moderate-income census tracts.

- CRA Mandate: Encourages BOK Financial to provide loans, investments, and services in low- and moderate-income communities.

- Regulatory Scrutiny: BOK Financial's CRA rating influences its growth opportunities, including potential mergers and acquisitions.

- Impact on Operations: The act shapes BOK Financial's lending policies and community outreach programs to meet regulatory expectations.

- 2024/2025 Focus: Expect continued emphasis on measurable community impact and fair lending practices in CRA examinations.

BOK Financial must navigate a complex legal landscape, with consumer protection laws like those enforced by the CFPB being particularly critical. These regulations aim to prevent unfair or deceptive practices, with the CFPB continuing its focus on areas such as unfair billing and discriminatory lending, as evidenced by numerous enforcement actions in 2023. Ensuring transparency in fees and non-discriminatory use of technology like AI in lending are paramount to avoid substantial penalties and reputational damage.

The bank also faces stringent requirements for Anti-Money Laundering (AML) and counter-terrorist financing (CFT). This involves rigorous customer due diligence and the reporting of suspicious activities, a task underscored by FinCEN's report of over 3.1 million Suspicious Activity Reports (SARs) in 2023. Staying abreast of evolving global regulations, such as the EU's AMLD6 which broadened predicate offenses, is essential for effective cross-border compliance.

Furthermore, the Community Reinvestment Act (CRA) mandates BOK Financial to serve credit needs in all communities, including low-income areas, to combat discriminatory lending. The bank's CRA rating, assessed on metrics like loan origination in low- and moderate-income tracts, directly impacts its growth opportunities and strategic decisions, with continued emphasis expected on measurable community impact and fair lending in 2024/2025 examinations.

| Legal Factor | Key Regulations/Focus Areas | 2023/2024/2025 Data/Trends | Impact on BOK Financial |

|---|---|---|---|

| Consumer Protection | CFPB regulations, Truth in Lending Act, Fair Credit Reporting Act | CFPB focus on unfair billing, discriminatory lending; CCPA fines up to $7,500 per intentional violation. | Ensures fair customer interactions, data privacy, and non-discriminatory technology use. |

| AML/CFT | Bank Secrecy Act, FinCEN reporting, AMLD6 | Over 3.1 million SARs reported by FinCEN in 2023; AMLD6 expanded predicate offenses. | Requires robust due diligence, suspicious activity monitoring, and international compliance. |

| Community Reinvestment Act (CRA) | Serving low- and moderate-income communities | Continued emphasis on measurable community impact and fair lending in examinations. | Shapes lending strategies, community investment, and influences M&A opportunities. |

Environmental factors

Financial institutions like BOK Financial are facing growing pressure to actively manage climate-related risks. These risks fall into two main categories: physical risks, such as damage from extreme weather events, and transition risks, which arise from the shift to a lower-carbon economy, impacting industries and investments. For instance, a report from Moody's in early 2024 highlighted that climate-related events could cost the global economy trillions by 2050, a direct concern for financial sector stability.

Integrating robust climate risk management into BOK Financial's core operations is becoming essential. This involves not only identifying potential impacts on their loan portfolios and investments but also developing strategies to mitigate these effects. Furthermore, enhancing climate-related disclosures, perhaps aligning with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD), will be crucial for transparency and investor confidence. As of Q1 2024, many large banks globally have been increasing their climate risk assessment capabilities, with some reporting significant exposure in sectors heavily reliant on fossil fuels.

BOK Financial is actively integrating sustainability into its operations through a comprehensive ESG strategy. This commitment is designed to foster efficiency and cost savings while emphasizing responsible stewardship of natural resources. Such initiatives directly influence operational practices and shape the company's investment decisions, aligning financial goals with environmental and social responsibility.

BOK Financial is actively integrating technology to minimize its environmental footprint, notably by reducing paper consumption and business travel. This strategic approach not only streamlines operations but also aligns with growing demands for corporate environmental stewardship.

The company's commitment extends to tangible reductions in energy use across its physical locations. In 2023, BOK Financial reported a 5% decrease in overall energy consumption compared to 2022, a move supported by investments in energy-efficient building technologies and a significant adoption of hybrid work models, which further curbed commuting-related emissions.

Impact of Extreme Weather Events

Climate change is undeniably increasing the frequency and intensity of extreme weather events. This trend poses significant risks to businesses through potential asset damage, operational interruptions, and a subsequent hit to cash flows.

For BOK Financial, which has a strong presence in the Southwestern and Midwestern United States, these environmental shifts translate into heightened risks. The bank's loan portfolio could be adversely affected by widespread damage from events like severe droughts, floods, or intense storms impacting borrowers' ability to repay loans.

- 2023 saw record-breaking temperatures globally, with the World Meteorological Organization confirming it as the warmest year on record.

- The U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, according to NOAA.

- These events can lead to increased insurance claims and potential defaults on loans secured by property in affected regions.

Green Finance and Sustainable Lending

The financial industry is increasingly prioritizing green finance and sustainable lending. This shift reflects a growing awareness of environmental, social, and governance (ESG) factors in investment decisions and corporate strategy. For BOK Financial, this presents a significant opportunity to innovate and expand its offerings.

BOK Financial can leverage this trend by developing and promoting sustainable lending products and investment vehicles. This aligns with both global environmental objectives and the evolving preferences of investors and clients who are seeking to support environmentally responsible businesses. By doing so, BOK Financial can position itself as a leader in responsible financial practices.

- Market Growth: The global sustainable finance market is projected to reach $50 trillion by 2025, indicating substantial growth potential.

- Investor Demand: In 2024, over 70% of institutional investors reported that ESG factors are material to their investment decisions.

- Regulatory Push: Governments worldwide are implementing policies to encourage green investments, creating a favorable environment for sustainable financial products.

- BOK Financial Opportunity: Offering green bonds, sustainable loans, and ESG-focused investment funds can attract new clients and enhance BOK Financial's reputation.

Environmental factors are increasingly shaping BOK Financial's operational and strategic landscape. The bank is actively addressing climate-related risks, both physical and transitional, by integrating sustainability into its core operations and enhancing climate-related disclosures. This proactive approach is driven by a global recognition of climate change's economic impact, with events like the 28 billion-dollar weather disasters in the U.S. in 2023 underscoring the urgency.

BOK Financial's commitment to environmental stewardship is evident in its efforts to minimize its footprint through technology, reducing paper consumption and business travel, and improving energy efficiency in its buildings. These initiatives not only contribute to cost savings but also align with the growing investor demand for ESG-conscious financial practices, a trend supported by the projected $50 trillion growth in the global sustainable finance market by 2025.

| Environmental Factor | Impact on BOK Financial | Data Point/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased risk to loan portfolios from asset damage and borrower defaults. | 28 billion-dollar weather/climate disasters in the U.S. in 2023. 2023 confirmed as the warmest year on record globally. |

| Shift to Lower-Carbon Economy | Transition risks for investments in carbon-intensive sectors; opportunities in green finance. | Global sustainable finance market projected to reach $50 trillion by 2025. Over 70% of institutional investors consider ESG factors in 2024. |

| Resource Management & Efficiency | Operational cost savings and enhanced corporate reputation. | BOK Financial reported a 5% decrease in energy consumption in 2023 vs. 2022. |

PESTLE Analysis Data Sources

Our BOK Financial PESTLE analysis is meticulously crafted using data from reputable financial institutions, government economic reports, and industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the banking sector.