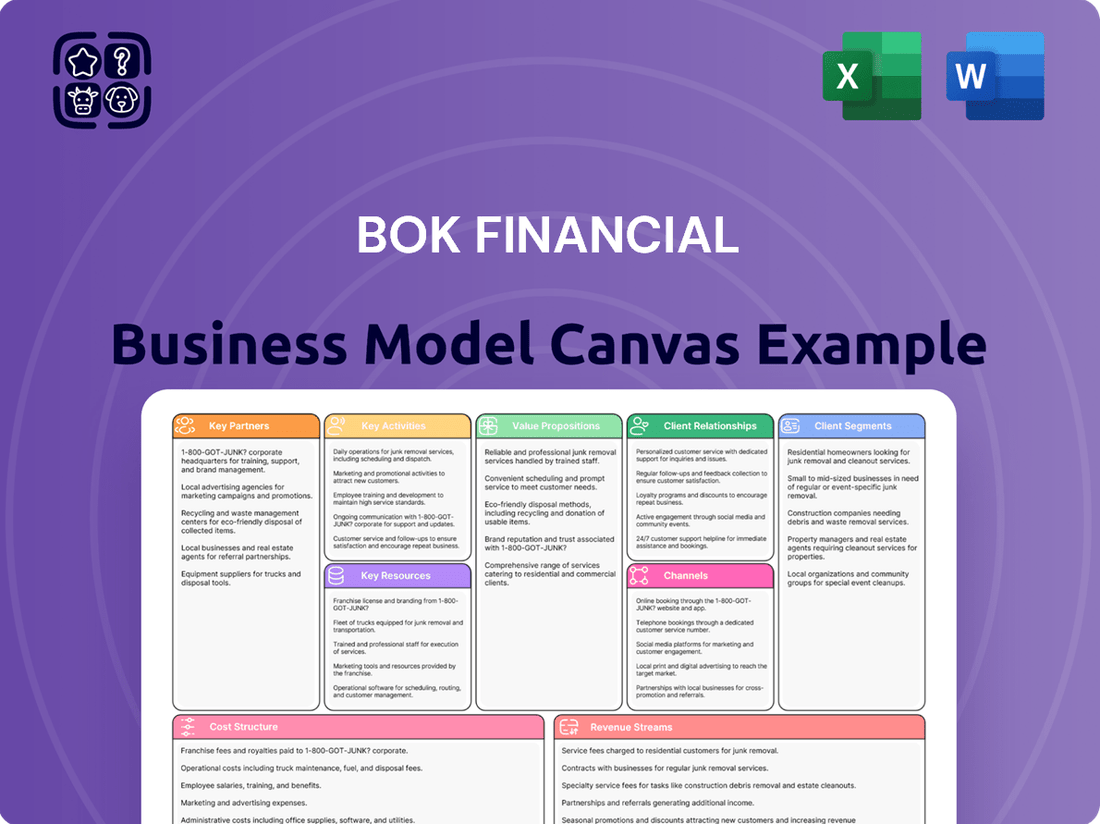

BOK Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BOK Financial Bundle

Unlock the strategic blueprint behind BOK Financial's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear view of their competitive advantage. Ideal for anyone looking to understand a thriving financial institution's operational framework.

Partnerships

BOK Financial heavily relies on technology and software providers to power its digital banking, cybersecurity, and internal operations. These partnerships are vital for delivering a smooth customer experience and maintaining efficient back-office functions. For instance, in 2023, BOK Financial continued to invest in its digital transformation, which would necessitate ongoing collaborations with providers of core banking systems and advanced data analytics tools to stay competitive.

BOK Financial actively engages with key regulatory bodies like the Federal Reserve and the Office of the Comptroller of the Currency to ensure full compliance with banking laws and consumer protection standards. These collaborations are crucial for navigating evolving financial regulations, with the bank investing significantly in compliance technology and personnel to meet stringent requirements, such as those related to the Bank Secrecy Act and anti-money laundering (AML) protocols, thereby safeguarding its operational integrity.

BOK Financial collaborates with insurance underwriters and brokers to offer a wide array of insurance products. This partnership is crucial for expanding their service offerings beyond traditional banking, providing clients with a more holistic financial planning experience.

These strategic alliances enable BOK Financial to access specialized knowledge in risk assessment and policy administration. For instance, in 2024, the insurance sector saw continued growth in demand for integrated financial solutions, making these partnerships particularly valuable for customer retention and acquisition.

Mortgage Origination and Servicing Partners

BOK Financial leverages partnerships with third-party originators and servicers to streamline its mortgage operations. These collaborations are crucial for managing the complexities of the mortgage pipeline and ensuring efficient loan servicing.

These relationships allow BOK Financial to optimize risk management and enhance scalability within the capital-intensive mortgage sector. By working with specialized partners, the bank can access expertise and resources that support its growth objectives.

For instance, in 2024, the U.S. mortgage industry saw significant activity. While specific BOK Financial partnership data isn't publicly detailed, the broader market indicates the importance of such alliances. The Mortgage Bankers Association reported that mortgage origination volumes, while fluctuating, remained a key indicator of industry health.

- Third-Party Originators (TPOs): BOK Financial may engage TPOs to expand its reach and origination capacity without directly investing in a larger in-house origination force.

- Loan Servicing Partners: Outsourcing loan servicing to specialized firms can reduce operational costs and improve efficiency in managing customer accounts, payments, and collections.

- Secondary Market Investors: Partnerships with entities that purchase mortgages in the secondary market provide BOK Financial with liquidity, enabling it to originate more loans.

- Risk Mitigation: Collaborations can include agreements for risk-sharing or the sale of loans with specific risk profiles, thereby managing BOK Financial's overall exposure.

Community Organizations and Local Businesses

BOK Financial actively cultivates key partnerships with a diverse array of community organizations, non-profits, and local businesses. These collaborations are fundamental to deepening community engagement and actively contributing to regional economic growth.

These strategic alliances often manifest through sponsorships of local events and initiatives, the co-creation of financial literacy programs aimed at underserved populations, and joint ventures that address specific community needs. For instance, in 2024, BOK Financial continued its commitment to financial education through partnerships with organizations like Junior Achievement, reaching thousands of students across its markets.

- Community Engagement: Partnerships enhance BOK Financial's local presence and brand reputation by demonstrating a tangible commitment to the well-being of the communities it serves.

- Economic Development: Collaborations with small businesses and non-profits stimulate local economies through shared resources and joint projects.

- Financial Literacy: Joint programs with community groups aim to improve financial knowledge and access to banking services for a broader segment of the population.

- Brand Reputation: These alliances reinforce BOK Financial's image as a responsible corporate citizen invested in the prosperity of its operating regions.

BOK Financial's key partnerships are foundational to its operational success and market reach. These include vital collaborations with technology providers for digital infrastructure and cybersecurity, regulatory bodies for compliance, and insurance partners to broaden financial product offerings. Additionally, strategic alliances in the mortgage sector with originators and servicers, alongside deep community engagement through local organizations, underscore its multifaceted approach to growth and service delivery.

| Partnership Type | Key Function | Impact | 2024 Relevance/Data Point |

|---|---|---|---|

| Technology Providers | Digital banking, cybersecurity, core operations | Enhanced customer experience, operational efficiency | Continued investment in digital transformation, critical for competitive edge. |

| Regulatory Bodies (e.g., Federal Reserve) | Ensuring compliance with banking laws | Operational integrity, risk mitigation | Significant investment in compliance technology to meet evolving regulations. |

| Insurance Underwriters/Brokers | Offering insurance products | Expanded service offerings, holistic financial planning | Growth in demand for integrated financial solutions in 2024. |

| Mortgage Originators/Servicers | Streamlining mortgage operations | Optimized risk management, scalability | U.S. mortgage industry saw significant activity in 2024, highlighting the importance of these alliances. |

| Community Organizations | Deepening community engagement, economic growth | Enhanced local presence, financial literacy improvement | Partnerships with groups like Junior Achievement reached thousands of students in 2024. |

What is included in the product

This Business Model Canvas provides a structured overview of BOK Financial's strategy, detailing its customer segments, value propositions, and revenue streams.

It offers a clear, actionable framework for understanding BOK Financial's operations and competitive positioning, suitable for strategic planning and stakeholder communication.

BOK Financial's Business Model Canvas offers a structured approach to pinpoint and address customer pain points, transforming abstract challenges into actionable business strategies.

It provides a clear, visual framework to diagnose and alleviate the specific financial and operational struggles faced by their target clientele.

Activities

Commercial and consumer banking operations are the engine of BOK Financial, encompassing the critical tasks of accepting deposits and originating various types of loans, from commercial and real estate to individual consumer credit. These activities directly fuel the bank's interest income and are the bedrock of its service offerings to a broad client base.

In 2024, BOK Financial's commitment to these core functions is evident. The bank actively manages a diverse portfolio of loans, aiming for efficient processing and robust risk management to ensure profitability and stability. This operational focus is key to delivering essential financial services and maintaining a strong market presence.

BOK Financial's Investment and Trust Services Management involves actively managing investment portfolios and offering wealth management advice. This includes crucial tasks like asset allocation and security selection, ensuring client assets are strategically grown and protected. In 2024, the company continued to emphasize its fiduciary responsibilities, a cornerstone of trust administration for both individuals and institutions.

These core activities are designed to generate significant fee income for BOK Financial. By catering to clients who require sophisticated financial planning and asset preservation strategies, the business segment solidifies its role in the company's overall revenue generation. This focus on high-value services attracts and retains a discerning client base.

BOK Financial's mortgage origination and servicing activities encompass the complete lifecycle of mortgage lending. This includes guiding customers through the application, underwriting, and closing processes for new loans, and then managing these loans post-closing. In 2024, the company continued to focus on streamlining these operations to enhance efficiency and customer experience.

The servicing aspect involves crucial tasks such as collecting monthly payments, managing property tax and insurance escrows, and addressing customer inquiries. This ongoing relationship management is vital for maintaining customer loyalty and ensuring consistent revenue streams. BOK Financial's commitment to effective servicing directly impacts its profitability and market reputation.

Financial Advisory and Brokerage Services

BOK Financial's Financial Advisory and Brokerage Services are central to its value proposition, offering expert guidance to help clients navigate complex financial landscapes and achieve their objectives. This includes personalized retirement planning, strategic college savings advice, and broad investment management. These services are designed to foster strong, long-term client relationships and generate significant fee-based income.

These activities are crucial for building trust and loyalty, directly impacting customer retention and the expansion of BOK Financial's client base. By providing tailored financial solutions, the company positions itself as a trusted partner in its clients' financial journeys.

- Expert Financial Advice: Offering personalized strategies for wealth accumulation and preservation.

- Investment Strategies: Developing and implementing diversified investment plans tailored to individual risk tolerance and goals.

- Brokerage Services: Facilitating the buying and selling of securities to execute investment strategies.

- Client Relationship Building: Fostering deep, lasting relationships through consistent, high-quality service and advice.

Risk Management and Regulatory Compliance

BOK Financial actively manages financial, operational, and reputational risks through continuous monitoring and mitigation strategies. This is a crucial activity for maintaining stability and customer trust in the banking sector.

Adherence to banking laws and regulations is paramount. For instance, in 2024, the financial industry faced evolving compliance landscapes, requiring significant investment in technology and personnel to ensure adherence to directives like those from the Consumer Financial Protection Bureau (CFPB).

- Risk Mitigation: Implementing robust internal controls and conducting regular audits are key to identifying and addressing potential vulnerabilities across all operational areas.

- Regulatory Adherence: Staying current with and complying with all applicable banking laws, including capital requirements and anti-money laundering (AML) regulations, is non-negotiable.

- Policy Enforcement: Ensuring all internal policies are consistently applied and updated reflects a commitment to sound governance and operational integrity.

- Reputational Safeguarding: Proactive risk management directly contributes to maintaining BOK Financial's reputation as a trustworthy and reliable financial partner.

BOK Financial's core banking operations, including deposit-taking and loan origination, are fundamental to its revenue generation. In 2024, the bank continued to focus on managing its loan portfolio, which includes commercial, real estate, and consumer loans, aiming for profitable growth and efficient risk management.

Investment and Trust Services involve managing client assets and providing wealth management advice. This segment is crucial for generating fee income, with a strong emphasis in 2024 on fiduciary responsibilities and strategic asset allocation for both individual and institutional clients.

Mortgage origination and servicing are key activities, covering the entire loan lifecycle from application to post-closing management. In 2024, BOK Financial aimed to enhance operational efficiency and customer experience within these processes, ensuring consistent revenue streams through effective servicing.

Financial Advisory and Brokerage Services offer expert guidance on financial planning and investment management, fostering long-term client relationships. These services are vital for fee-based income and client retention, with a focus in 2024 on personalized strategies for wealth accumulation and preservation.

Risk management and regulatory adherence are paramount, involving continuous monitoring and mitigation of financial, operational, and reputational risks. In 2024, compliance with evolving banking laws, such as those influenced by the CFPB, required significant investment in technology and personnel.

| Key Activity | 2024 Focus | Revenue Impact | Client Benefit |

|---|---|---|---|

| Core Banking | Loan portfolio management, deposit growth | Net Interest Income | Access to credit, secure savings |

| Investment & Trust | Asset management, wealth advice | Fee Income | Wealth growth, financial security |

| Mortgage Services | Streamlined origination, efficient servicing | Fee Income, Net Interest Income | Homeownership, financial stability |

| Advisory & Brokerage | Personalized financial planning, investment execution | Fee Income | Achieving financial goals, informed decisions |

| Risk Management | Compliance, internal controls | Stability, Reputation | Trust, safety of funds |

Full Document Unlocks After Purchase

Business Model Canvas

The BOK Financial Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive business model analysis you'll gain access to. Once your order is complete, you will download this same, fully detailed canvas, ready for your strategic planning and decision-making.

Resources

BOK Financial’s robust capital base and ample liquidity are the bedrock of its operations, enabling it to confidently extend credit and manage daily financial flows. As of Q1 2024, BOK Financial reported a Common Equity Tier 1 (CET1) capital ratio of 12.5%, comfortably exceeding regulatory requirements and underscoring its financial strength.

This strong capital position, bolstered by retained earnings and diverse funding avenues, allows BOK Financial to not only meet customer withdrawal needs consistently but also to weather economic downturns. Its liquidity coverage ratio (LCR) stood at a healthy 115% at the end of 2023, signifying its capacity to manage short-term obligations effectively.

BOK Financial's human capital, encompassing seasoned bankers, financial advisors, trust officers, IT specialists, and risk managers, forms the bedrock of its operations. These skilled employees are the engine behind exceptional service delivery, fostering innovation, and guiding critical strategic choices.

The company recognizes that investing in its people through robust talent development programs and retention strategies is paramount for achieving and sustaining long-term success. For instance, in 2024, BOK Financial reported a significant focus on employee training and development, with a substantial portion of its operating expenses dedicated to human capital enhancement.

BOK Financial's technology infrastructure is the backbone of its operations, encompassing robust and secure IT systems. This includes their core banking software, which handles essential financial transactions, and their user-friendly online and mobile banking platforms that allow customers to manage their accounts conveniently. These digital channels are crucial for delivering services efficiently and enhancing the overall customer experience.

Data analytics tools are also a key resource, enabling BOK Financial to gain insights into customer behavior and market trends. Coupled with strong cybersecurity defenses, these platforms are vital for protecting sensitive information and maintaining trust in an increasingly digital financial landscape. Continuous investment in these areas is paramount for staying competitive.

In 2024, the financial services industry saw significant investment in digital transformation. For instance, a report indicated that global spending on digital banking technology was projected to reach over $70 billion, highlighting the critical nature of these platforms for institutions like BOK Financial to maintain their competitive edge and meet evolving customer expectations.

Branch Network and Physical Presence

BOK Financial maintains a strategic network of physical branches, recognizing their continued importance even with the growth of digital banking. This physical presence is crucial for fostering in-person customer relationships and providing accessible banking services, particularly for segments that prefer or require face-to-face interactions.

These branches enhance brand visibility within local communities and serve as hubs for localized service delivery. As of the first quarter of 2024, BOK Financial operated approximately 120 full-service banking centers across its operating footprint, demonstrating a commitment to a tangible, community-focused approach.

- Tangible Presence: Physical branches offer a concrete point of contact, building trust and facilitating deeper customer engagement.

- Customer Access: They cater to customers who value in-person service for transactions, advice, and problem resolution.

- Brand Visibility: Branches act as visible landmarks, reinforcing brand recognition and community presence.

- Localized Service: The physical footprint enables tailored service delivery that resonates with the specific needs of local markets.

Brand Reputation and Customer Trust

BOK Financial’s brand reputation and customer trust are foundational. In 2024, trust in financial institutions remains paramount, influencing customer acquisition and retention. A strong reputation acts as a significant draw for new clients and solidifies relationships with existing ones, directly impacting market share and profitability.

This intangible asset is cultivated through consistent reliability and ethical operations. For BOK Financial, this means transparent dealings and dependable service delivery. In the competitive banking landscape of 2024, where customer loyalty can be fleeting, a well-earned reputation is a powerful differentiator.

- Customer Acquisition: A positive brand image reduces the cost of acquiring new customers.

- Customer Retention: Trust fosters loyalty, leading to lower churn rates.

- Competitive Advantage: A strong reputation sets BOK Financial apart in a crowded market.

- Risk Mitigation: Public confidence helps navigate economic uncertainties and regulatory scrutiny.

BOK Financial's intellectual property, including proprietary algorithms for risk assessment and customer relationship management, provides a significant competitive edge. These internal knowledge assets drive efficiency and innovation. The bank actively protects its intellectual property through patents and copyrights, ensuring its unique methodologies remain exclusive.

Furthermore, BOK Financial leverages its extensive data analytics capabilities, transforming raw data into actionable insights. This data-driven approach informs strategic decisions, from product development to market expansion. In 2024, the bank continued to invest in advanced analytics platforms to better understand customer needs and predict market shifts.

The bank's commitment to research and development is evident in its continuous refinement of financial products and services. This focus on innovation, supported by its intellectual capital, allows BOK Financial to adapt to evolving industry trends and maintain its market position.

Value Propositions

BOK Financial provides a full spectrum of financial services, encompassing banking, investments, trusts, mortgages, wealth management, brokerage, and insurance. This integrated approach simplifies financial management for clients with diverse needs, offering a convenient, one-stop solution.

In 2024, BOK Financial continued to emphasize this comprehensive model, aiming to deepen client relationships by offering tailored solutions across various financial disciplines. This strategy supports their goal of becoming a primary financial partner for individuals and businesses alike.

BOK Financial distinguishes itself by offering personalized service and expert guidance, particularly for its commercial and high-net-worth clientele. This client-centric approach ensures that financial solutions are meticulously crafted to align with specific individual or business objectives.

The bank's commitment to dedicated relationship management means clients benefit from consistent access to experienced financial professionals. These experts provide invaluable insights and ongoing support, a crucial element for navigating complex financial landscapes.

BOK Financial's strength lies in its deep roots across the Southwestern and Midwestern United States. This regional specialization means they truly grasp the unique economic currents, industry trends, and community priorities within these areas. For instance, in 2024, the bank continued to be a significant lender to agricultural businesses in the Midwest, a sector vital to that region's economy.

This localized knowledge translates into financial solutions that are not just generic but tailored to the specific needs of businesses and individuals operating within these geographic contexts. Customers experience the advantage of partnering with an institution that understands their local landscape, fostering more effective and responsive financial strategies.

Security and Stability of a Reputable Institution

BOK Financial, as an established financial holding company, provides a strong sense of security and stability for its clients' deposits and investments. This is underpinned by rigorous risk management protocols and adherence to strict regulatory oversight, offering clients peace of mind when entrusting their assets. For instance, as of the first quarter of 2024, BOK Financial reported total assets of $48.4 billion, demonstrating its substantial financial footing and capacity to absorb potential market fluctuations.

The trust clients place in BOK Financial's stability is a significant competitive advantage. This institutional resilience is crucial in an economic climate where reliability is paramount. In 2023, BOK Financial’s net income was $1.06 billion, reflecting consistent profitability and a sound operational framework that supports its long-term stability.

- Depositor Confidence: BOK Financial's reputation as a reputable institution instills confidence in depositors, assuring them of the safety of their funds.

- Investment Security: Clients investing with BOK Financial benefit from the stability of a well-managed financial entity, reducing perceived investment risk.

- Robust Risk Management: The company's commitment to strong risk management practices is a core component of its stable operational model.

- Regulatory Compliance: Adherence to regulatory requirements further solidifies BOK Financial's standing as a secure and stable financial partner.

Convenient Access Through Multi-Channel Banking

BOK Financial offers customers convenient access to its banking services through a robust multi-channel strategy. This includes physical branches, a comprehensive online banking platform, intuitive mobile applications, and a widespread ATM network, ensuring clients can manage their finances flexibly and efficiently.

This commitment to diverse access points caters to a broad range of customer preferences, from those who prefer in-person interactions to digital-first users. For instance, as of early 2024, BOK Financial reported a significant increase in digital transaction volumes, highlighting the growing reliance on its online and mobile platforms.

- Branch Network: BOK Financial maintains a physical presence to support traditional banking needs.

- Digital Platforms: Online banking and mobile apps provide 24/7 account management and transaction capabilities.

- ATM Accessibility: An extensive ATM network offers convenient cash access and basic banking services.

- Customer Preference: This multi-channel approach ensures service availability aligns with varied customer interaction styles.

BOK Financial's value proposition centers on its comprehensive, integrated financial services, offering clients a single point of contact for banking, investments, trusts, mortgages, wealth management, and insurance. This holistic approach simplifies financial management, especially for those with diverse and evolving needs. In 2024, the bank continued to refine this model, aiming to become a primary financial partner through tailored solutions across its service spectrum.

Customer Relationships

For their commercial, institutional, and high-net-worth clients, BOK Financial often assigns dedicated relationship managers or private bankers. These professionals are key to building trust and understanding client-specific financial needs.

These dedicated managers offer personalized service, acting as the primary point of contact for clients. This approach is designed to foster strong, long-term relationships by ensuring clients feel understood and supported through complex financial situations.

BOK Financial cultivates deep client connections through personalized advisory services within its wealth management, investment, and trust divisions. These relationships are nurtured through consistent financial guidance and strategic planning, including regular check-ins and performance assessments.

The bank actively adapts financial strategies to align with clients' evolving circumstances and aspirations, ensuring the advisory remains relevant and impactful. For instance, in 2024, BOK Financial reported a significant increase in assets under management for its wealth advisory services, reflecting client trust in their tailored approach.

For a significant portion of BOK Financial's customer base, particularly those in the consumer and small business segments, digital self-service platforms are the primary touchpoint. These online banking portals and mobile applications facilitate convenient self-management of accounts and basic transactions.

These digital channels are crucial for efficiency and accessibility, handling everyday banking needs for millions. In 2023, BOK Financial reported that over 70% of its customer transactions occurred through digital channels, highlighting the dominance of these platforms.

Customer Service and Support Centers

BOK Financial maintains a robust customer service infrastructure, featuring both call centers and online support channels. These resources are designed to assist clients with a wide range of needs, from general inquiries and technical troubleshooting to specific transaction support.

The bank's commitment to efficient support is evident in its efforts to ensure clients can quickly resolve issues and access necessary information. This focus on responsiveness is a key driver in maintaining high levels of customer satisfaction and loyalty within its diverse client base.

In 2024, BOK Financial reported significant investments in enhancing its digital customer service capabilities, aiming to reduce average call handling times by 15% and increase first-contact resolution rates by 10% through AI-powered tools and expanded self-service options.

- Dedicated Call Centers: Offer personalized assistance for complex issues.

- Online Support: Includes FAQs, chatbots, and secure messaging for quick query resolution.

- Transaction Support: Facilitates smooth processing and troubleshooting for all banking activities.

- Customer Satisfaction Focus: Continuous improvement initiatives to ensure a positive client experience.

Community Engagement and Local Presence

BOK Financial actively engages with its communities through sponsorships and participation in local events, fostering stronger customer relationships and demonstrating a commitment to the regions it serves. This localized strategy builds goodwill and a sense of shared values.

In 2024, BOK Financial continued its tradition of community investment. For instance, their support for local initiatives, such as the Tulsa Arts Commission and various youth sports leagues across their footprint, underscores this commitment. This deepens customer loyalty and reinforces the bank's role as a community partner.

- Community Investment: BOK Financial's dedication to local presence is evident in its consistent support for community events and educational programs.

- Strengthened Ties: By participating in local activities, the bank enhances its connection with customers and the broader community.

- Reinforced Commitment: This localized approach builds goodwill and highlights BOK Financial's dedication to the regions where it operates.

- Sense of Belonging: The bank fosters a sense of shared values and belonging through its active community engagement.

BOK Financial employs a multi-faceted approach to customer relationships, blending personalized service for high-value clients with efficient digital solutions for the broader base. Dedicated relationship managers and private bankers foster trust and tailor financial strategies for commercial, institutional, and high-net-worth individuals, ensuring their evolving needs are met. For everyday banking, digital platforms and robust customer support channels provide accessibility and convenience, handling millions of transactions annually.

| Relationship Channel | Client Segment | Key Features | 2023/2024 Data Point |

|---|---|---|---|

| Dedicated Relationship Managers/Private Bankers | Commercial, Institutional, High-Net-Worth | Personalized advisory, primary point of contact, tailored strategies | Significant increase in assets under management for wealth advisory services (2024) |

| Digital Self-Service Platforms (Online/Mobile) | Consumer, Small Business | Account management, transactions, accessibility | Over 70% of customer transactions via digital channels (2023) |

| Customer Service Infrastructure (Call Centers, Online Support) | All Segments | Inquiries, technical support, transaction assistance, issue resolution | Investment in AI tools to reduce call handling times by 15% (2024) |

Channels

BOK Financial maintains a physical branch network predominantly in the Southwestern and Midwestern United States, offering a crucial avenue for customer interaction and service delivery.

These branches are vital for facilitating in-person banking needs, from routine transactions to more complex services like loan applications and financial consultations, fostering direct relationships with clients.

As of the first quarter of 2024, BOK Financial reported approximately 200 banking locations, underscoring their commitment to a physical presence that supports community engagement and accessibility.

BOK Financial's online banking platforms serve as a cornerstone for customer interaction, offering comprehensive portals for account management, bill payments, fund transfers, and statement access. These digital hubs are designed for 24/7 availability, providing unparalleled convenience for a broad spectrum of banking needs.

In 2024, the shift towards digital channels continued to accelerate. BOK Financial reported that a significant majority of its retail transactions were conducted through its online and mobile platforms, highlighting the critical role these channels play in customer engagement and operational efficiency.

BOK Financial's mobile banking applications offer customers convenient, on-the-go access to essential banking services such as mobile check deposits, balance inquiries, and payment capabilities. These dedicated apps are designed for tech-savvy individuals who value immediate access to their financial data and prioritize ultimate convenience.

The shift towards mobile banking is undeniable. In 2024, a significant majority of banking transactions are expected to be conducted via mobile devices, reflecting a growing preference for digital channels among consumers seeking efficiency and ease of use for their everyday financial needs.

ATMs (Automated Teller Machines)

ATMs function as a crucial channel for BOK Financial, offering customers convenient 24/7 access to essential banking services like cash withdrawals, deposits, and balance inquiries. This self-service network significantly extends the bank's reach, providing accessibility beyond traditional branch hours and physical locations. In 2024, BOK Financial operated a substantial ATM network, facilitating millions of transactions annually, underscoring their role as a primary touchpoint for everyday customer needs.

- Convenience: Provides round-the-clock access to basic banking.

- Reach: Extends service availability beyond branch hours and locations.

- Efficiency: Serves as a cost-effective channel for high-volume transactions.

- Customer Engagement: Offers a direct, self-service interaction point for daily banking.

Direct Sales Teams and Relationship Managers

BOK Financial leverages direct sales teams and dedicated relationship managers to serve its commercial, institutional, and high-net-worth clients. These teams are instrumental in building and maintaining strong client relationships, offering personalized financial solutions and continuous support. This direct approach is vital for securing and retaining valuable customer segments, driving significant revenue. In 2024, BOK Financial reported that its commercial banking segment, heavily reliant on these direct relationships, saw continued growth in loan demand and deposit balances, contributing to the bank's overall profitability.

These professionals act as the primary point of contact, proactively identifying client needs and delivering bespoke financial products and services. Their expertise in areas like treasury management, commercial lending, and wealth management ensures that high-value clients receive comprehensive and integrated solutions. This focus on personalized service fosters loyalty and deepens client engagement, which is a cornerstone of BOK Financial's strategy for acquiring and retaining its most important customer base.

- Client Acquisition: Direct engagement allows for targeted outreach and tailored pitches to attract high-value commercial, institutional, and high-net-worth individuals.

- Relationship Deepening: Dedicated relationship managers provide ongoing support and proactive advice, fostering long-term loyalty and increasing share of wallet.

- Revenue Generation: This channel is a significant contributor to revenue, as these clients typically have larger transaction volumes and require more sophisticated financial products.

- Market Penetration: Direct sales teams enable BOK Financial to effectively penetrate specific market segments and build a strong presence within them.

BOK Financial's channels are multifaceted, encompassing a robust physical branch network, extensive digital platforms, and a dedicated direct sales force. This combination ensures broad accessibility and tailored service for diverse customer segments. The bank actively balances traditional banking methods with cutting-edge digital solutions to meet evolving customer expectations.

The strategic deployment of these channels is crucial for BOK Financial's customer engagement and operational efficiency. By offering multiple avenues for interaction, the bank caters to both convenience-seeking digital users and those who prefer personal, in-person service.

In 2024, BOK Financial's digital channels, particularly mobile banking, continued to see increased adoption, with a majority of retail transactions occurring online. This trend highlights the growing importance of these platforms in the bank's overall strategy.

The direct sales channel remains vital for BOK Financial's commercial and high-net-worth clients, driving significant revenue through personalized service and sophisticated financial solutions.

| Channel | Description | Key Benefits | 2024 Data/Focus |

|---|---|---|---|

| Physical Branches | Network of locations for in-person banking. | Direct customer interaction, complex services, community engagement. | Approx. 200 locations; focus on community presence. |

| Online Banking | Comprehensive web portals for account management. | 24/7 access, account management, bill pay, transfers. | Majority of retail transactions; high customer engagement. |

| Mobile Banking | Dedicated apps for on-the-go financial services. | Convenience, mobile check deposit, balance inquiries, payments. | Significant majority of transactions; growing preference for digital. |

| ATMs | Self-service machines for essential banking. | 24/7 cash access, deposits, balance inquiries; extended reach. | Substantial network facilitating millions of transactions annually. |

| Direct Sales Teams | Relationship managers for commercial and high-net-worth clients. | Personalized solutions, relationship building, tailored financial products. | Drove growth in commercial segment loan demand and deposits. |

Customer Segments

Individuals and households form the bedrock of BOK Financial's consumer banking operations. This segment encompasses a wide array of customers, from those just starting out with checking and savings accounts to established families managing mortgages and credit card needs. They are drawn to BOK Financial for its emphasis on convenience, readily accessible services, and competitive pricing on essential financial products.

In 2024, the demand for digital banking solutions continued to surge among this demographic, with a significant portion of transactions occurring through mobile apps and online platforms. BOK Financial's focus on user-friendly digital interfaces directly addresses this trend, aiming to provide seamless access to personal loans, credit cards, and basic banking services, catering to diverse financial goals from everyday spending to long-term wealth building.

Small to Medium-sized Businesses (SMBs) are a cornerstone for BOK Financial, demanding a suite of essential banking services. This includes business checking and savings accounts, commercial loans, and flexible lines of credit to manage operational needs and expansion. They also rely on treasury management services for efficient cash handling and merchant services for payment processing.

SMBs often seek personalized financial guidance to navigate cash flow challenges and fuel their growth strategies. In 2024, SMBs continued to be a significant driver of economic activity, with many actively seeking capital for investment and operational resilience. For instance, data from the Small Business Administration (SBA) indicated robust demand for SBA-backed loans throughout the year, highlighting the sector's need for accessible financing.

Large corporations, public entities, and non-profits represent a key customer segment for BOK Financial, seeking intricate commercial lending, advanced treasury management, and comprehensive investment banking services. These clients often require specialized trust and asset management solutions, demanding a high degree of financial acumen and robust operational capabilities from their banking partners.

The relationships with these sophisticated entities are typically highly customized, reflecting their unique financial structures and strategic objectives. For instance, BOK Financial's commitment to providing tailored solutions was evident in its support for various large-scale infrastructure projects and corporate financings throughout 2024, demonstrating its capacity to handle complex financial needs.

High-Net-Worth Individuals and Families

High-net-worth individuals and families are key clients for BOK Financial, leveraging a comprehensive suite of services including wealth management, private banking, and trust services. They expect highly personalized advice and sophisticated financial strategies tailored to their unique needs, with discretion being a critical factor. Building enduring, trust-based relationships is fundamental to serving this segment effectively.

This demographic often seeks expert guidance in investment advisory and estate planning to preserve and grow their wealth across generations. For instance, in 2024, the global wealth management market continued to see strong demand from HNWIs, with assets under management projected to grow significantly. BOK Financial's ability to offer integrated solutions, from daily banking to complex trust administration, caters directly to their multifaceted financial lives.

- Wealth Management Services: Offering tailored investment portfolios and financial planning.

- Private Banking: Providing dedicated banking and credit solutions.

- Trust and Estate Planning: Facilitating wealth transfer and asset protection.

- Personalized Advice: Delivering sophisticated strategies with a focus on discretion.

Mortgage Borrowers

Mortgage borrowers are individuals and families looking to finance a home purchase or refinance an existing mortgage. Their primary concerns revolve around securing competitive interest rates and finding loan products that align with their financial situations. In 2024, the average 30-year fixed mortgage rate fluctuated, impacting borrower decisions significantly.

This segment prioritizes a streamlined and efficient application process, seeking lenders who offer clear communication and quick turnaround times. They are often comparing offers from multiple institutions to ensure they are getting the best terms available.

- Competitive Interest Rates: A key driver for borrowers, influencing affordability and long-term cost.

- Flexible Loan Options: Seeking products like adjustable-rate mortgages (ARMs) or FHA loans to meet specific needs.

- Efficient Processing: Valuing speed and simplicity in mortgage application and closing procedures.

- Homeownership Goals: Driven by the aspiration to own property, whether for the first time or as an upgrade.

BOK Financial serves a diverse customer base, including individuals and households seeking everyday banking and lending solutions. Small to medium-sized businesses rely on the bank for essential services like commercial loans and treasury management. Large corporations, public entities, and non-profits engage BOK Financial for complex commercial lending and investment banking, while high-net-worth individuals utilize wealth management and private banking services.

Cost Structure

Employee salaries and benefits represent a substantial cost for BOK Financial, reflecting the company's reliance on its extensive workforce. This includes compensation for a diverse team, from customer-facing branch staff to highly specialized financial analysts and executive leadership.

In 2024, BOK Financial's total compensation and benefits expense was a significant driver of its operating costs. For instance, in the first quarter of 2024, salaries, wages, and benefits accounted for a considerable portion of their non-interest expense, demonstrating human capital as a primary investment.

BOK Financial's technology infrastructure and software costs are significant, encompassing the maintenance and upgrades of IT systems, robust cybersecurity measures, and the development of digital platforms. These expenses are vital for ensuring operational efficiency and maintaining a competitive edge in the financial sector.

Ongoing costs include substantial investments in data centers, network infrastructure, cloud services, and specialized financial software licenses. For instance, in 2024, the banking industry globally saw IT spending increase, with a significant portion allocated to digital transformation initiatives and cybersecurity, reflecting the critical nature of these investments for institutions like BOK Financial.

Branch Operations and Real Estate Costs represent a substantial expense for BOK Financial, encompassing rent or mortgage payments, utilities, maintenance, security, and property taxes across its extensive geographical footprint. These physical locations are crucial for customer interaction and service delivery, but they also represent a significant investment. For instance, in 2023, the banking industry generally saw continued pressure on operating expenses, with real estate and branch-related costs remaining a key area of focus for efficiency improvements.

Marketing and Advertising Expenses

BOK Financial incurs significant costs to promote its diverse financial services, aiming to attract new customers and cultivate strong brand recognition. These expenses encompass a wide range of activities, from broad advertising campaigns and strategic sponsorships to targeted public relations initiatives and robust digital marketing efforts. For instance, in 2024, financial institutions like BOK Financial continued to invest heavily in digital channels, with digital advertising spend across the financial services sector projected to see substantial growth, reflecting the shift in consumer behavior.

These marketing and advertising expenditures are crucial for BOK Financial's customer acquisition strategy and overall market share expansion. The effectiveness of these investments directly impacts the bank's ability to reach its target audience and differentiate itself in a competitive landscape. In 2023, BOK Financial reported that its non-interest expense, which includes marketing, increased by 4.2% to $1.7 billion, highlighting the ongoing commitment to customer growth and brand building.

- Advertising Campaigns: Investment in traditional and digital advertising platforms to reach a broad audience.

- Sponsorships and Partnerships: Funding events and collaborations to enhance brand visibility and community engagement.

- Public Relations: Efforts to manage media relations and shape public perception of the bank.

- Digital Marketing: Online advertising, social media engagement, content marketing, and search engine optimization to attract and retain customers digitally.

Regulatory Compliance and Legal Fees

BOK Financial operates in a heavily regulated sector, necessitating significant spending on regulatory compliance and legal fees. These costs are essential for adhering to banking laws, meeting reporting mandates, undergoing audits, and securing legal advice. For instance, in 2023, financial institutions globally saw a rise in compliance costs, with many reporting that these expenses represented a considerable portion of their operating budget.

These expenditures are not optional; they are fundamental to maintaining operational integrity and avoiding costly penalties. Failing to comply can lead to severe financial repercussions and reputational damage. Therefore, BOK Financial views compliance as a non-negotiable cost of doing business, crucial for its long-term stability and trustworthiness.

- Regulatory Compliance: BOK Financial invests heavily in systems and personnel to ensure adherence to all banking regulations and reporting requirements.

- Legal Counsel: Significant funds are allocated to legal services for advice on complex financial regulations, contract reviews, and potential litigation.

- Audit Expenses: Costs associated with internal and external audits are substantial, ensuring transparency and accountability in financial operations.

- Risk Management: Proactive risk management, often driven by regulatory demands, incurs costs for technology, training, and specialized staff.

BOK Financial's cost structure is heavily influenced by its workforce, technology investments, physical presence, marketing efforts, and regulatory obligations. Employee compensation and benefits are a primary expense, reflecting the need for skilled personnel across various banking functions. Significant outlays are also directed towards maintaining and upgrading its technology infrastructure, ensuring cybersecurity, and developing digital platforms to stay competitive.

The bank's extensive branch network incurs substantial real estate and operational costs, including rent, utilities, and maintenance. Marketing and advertising expenses are crucial for customer acquisition and brand building, with a notable shift towards digital channels. Furthermore, adherence to stringent banking regulations requires considerable investment in compliance, legal counsel, and risk management systems.

| Cost Category | Description | 2024 Impact/Focus |

| Employee Salaries & Benefits | Compensation for diverse workforce, from front-line staff to executives. | A significant driver of operating costs; human capital is a primary investment. |

| Technology Infrastructure | IT systems, cybersecurity, digital platforms, data centers, cloud services. | Essential for operational efficiency and competitive edge; industry-wide IT spending increased in 2024. |

| Branch Operations & Real Estate | Rent, utilities, maintenance, security for physical locations. | Key area for efficiency improvements; represents a significant investment in customer interaction. |

| Marketing & Advertising | Digital marketing, advertising campaigns, sponsorships, public relations. | Crucial for customer acquisition and brand differentiation; digital ad spend growing in financial services. |

| Regulatory Compliance & Legal | Adherence to banking laws, reporting, audits, legal advice, risk management. | Non-negotiable cost for operational integrity and avoiding penalties; a considerable portion of operating budgets. |

Revenue Streams

Net Interest Income is BOK Financial's main revenue engine. It's the profit made from the difference between what the bank earns on loans and investments and what it pays out on customer deposits and other borrowings. This core banking activity is fundamental to their business model.

For instance, in the first quarter of 2024, BOK Financial reported net interest income of $514 million. This demonstrates the significant contribution of their lending and deposit-taking operations to their overall financial performance.

BOK Financial generates substantial revenue through service charges and fees, a key component of its non-interest income. These include fees for account maintenance, overdrafts, and various transaction types, alongside charges for treasury management services. In 2024, such fees are expected to remain a critical driver of profitability, often correlating directly with customer engagement and transaction volumes.

BOK Financial generates significant revenue from investment management and trust services. These fees come from expertly managing client investment portfolios, handling trust administration, and offering tailored wealth management advice. These services are often structured as asset-based fees, meaning a percentage of the assets under management, or as fixed fees for specific, specialized services.

This revenue stream demonstrates resilience, being less susceptible to the direct impact of interest rate fluctuations compared to traditional lending. For instance, in the first quarter of 2024, BOK Financial reported a substantial contribution from its wealth management segment, underscoring the stability and importance of these fee-based income sources in its overall business model.

Mortgage Banking Income

BOK Financial generates revenue from its mortgage banking activities through several key avenues. These include origination fees charged when new mortgages are created, ongoing loan servicing fees for managing existing mortgages, and profits realized from selling these originated loans into the secondary market. This revenue stream is inherently sensitive to fluctuations in interest rates and the overall health of the housing market, making it a dynamic component of their income.

The mortgage banking income stream is multifaceted, capturing various fees associated with the entire mortgage lifecycle. This includes points charged at closing, appraisal fees, title insurance fees, and other administrative charges. For instance, in 2024, BOK Financial, like many in the industry, likely experienced shifts in mortgage origination volumes influenced by the prevailing interest rate environment.

- Origination Fees: Income earned from processing and closing new mortgage loans.

- Loan Servicing Fees: Recurring revenue from managing existing mortgage portfolios, including payment collection and escrow administration.

- Secondary Market Sales: Gains derived from selling originated mortgages to investors, often securitized into mortgage-backed securities.

Brokerage and Insurance Commissions

BOK Financial generates income through brokerage commissions by facilitating securities transactions for its clients. This involves earning a fee each time a client buys or sells stocks, bonds, or other investment instruments.

Commissions from insurance product sales also form a significant part of this revenue stream. BOK Financial earns money by selling various insurance policies, such as life, disability, or property and casualty insurance, to its customer base.

These earnings are primarily transactional, meaning they are realized at the point of sale or execution of a trade. However, some insurance products may also provide recurring commission-based revenue over time.

- Brokerage Commissions: Income from facilitating client trades in securities.

- Insurance Commissions: Revenue from selling various insurance products like life, disability, and property/casualty.

- Revenue Type: Primarily transactional, with some recurring commission potential from insurance.

BOK Financial also generates revenue from its corporate and commercial banking services, which include a range of lending and treasury management solutions. These services cater to businesses, providing them with capital for growth and tools to manage their finances efficiently.

In the first quarter of 2024, BOK Financial reported commercial and industrial loans totaling $25.6 billion. This highlights the significant volume of lending activity that underpins this revenue stream.

The bank's treasury management services, which offer businesses solutions for cash flow, payments, and liquidity, are a key fee-based revenue contributor. These services are crucial for businesses and often lead to stable, recurring income for the bank.

| Revenue Stream | Description | 2024 Data/Context |

| Corporate & Commercial Banking | Lending to businesses, treasury management services. | C&I loans of $25.6 billion in Q1 2024. |

| Treasury Management | Fee-based services for business cash management. | Critical for business operations, drives recurring income. |

Business Model Canvas Data Sources

The BOK Financial Business Model Canvas is constructed using a blend of proprietary financial data, extensive market research reports, and internal strategic planning documents. These diverse sources ensure a comprehensive and accurate representation of the bank's operational and strategic framework.