BOK Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BOK Financial Bundle

Curious about BOK Financial's strategic product positioning? This glimpse into their BCG Matrix reveals the potential of their offerings, but it's just the tip of the iceberg.

Unlock the full strategic advantage by purchasing the complete BOK Financial BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, and discover actionable insights to drive smarter investment decisions.

Stars

BOK Financial's wealth management division is a star performer. In the second quarter of 2025, the company saw its fiduciary and asset management revenue climb to new quarterly peaks. This strong showing is underpinned by a consistent upward trend in assets under management or administration (AUMA), which reached an impressive $117.9 billion.

This segment's growth trajectory is remarkable, boasting an approximate 8% compounded annual growth rate over the past ten years. This sustained expansion highlights BOK Financial's ability to cater to the increasing demand for tailored and tech-forward financial services, solidifying its position as a key player in a dynamic market.

BOK Financial has strategically bolstered its commercial banking operations, with a keen eye on high-growth markets like Texas. This deliberate investment has fueled significant expansion in their Commercial & Industrial (C&I) loan portfolio.

In Texas alone, BOK Financial achieved an impressive 9.8% year-over-year increase in C&I loans. This demonstrates a successful strategy of targeting and capturing market share in economically vibrant regions.

The Southwestern United States, recognized as a dynamic hub for commercial banking, presents a prime opportunity for BOK Financial to further solidify its presence and drive continued growth.

BOK Financial is strategically entering the mortgage finance and warehouse lending space with a planned launch between September and October 2025. This move targets a high-growth market, anticipating a significant uptick in mortgage origination activity.

The Mortgage Bankers Association projects total mortgage origination volume to reach $2.3 trillion in 2025, a substantial rise from an estimated $1.79 trillion in 2024. This expansion allows BOK Financial to tap into this expanding market.

The new division is designed to connect with a broad network of independent mortgage originators. By doing so, BOK Financial aims to leverage the increasing demand within the housing sector, positioning itself to capture a larger share of this market.

Core C&I Loan Portfolio Expansion

BOK Financial's core Commercial & Industrial (C&I) loan portfolio is a significant growth engine. In 2024, this segment saw an impressive 8.1% year-over-year expansion.

This expansion is attributed to strategic investments in both talent and sales support tools. The company has focused on building robust pipelines and effectively utilizing its liquidity to fuel this growth.

- Core C&I Loan Portfolio Expansion: BOK Financial achieved 8.1% year-over-year growth in its C&I loan portfolio in 2024.

- Drivers of Growth: Investments in personnel and sales enablement tools have been key factors.

- Future Outlook: Strong pipelines and liquidity position BOK Financial for continued robust loan growth through 2025.

Digital Transformation in Client Experience

The financial sector's digital evolution is accelerating, driven by client expectations for intuitive, AI-powered interactions. BOK Financial is actively investing in technology to elevate customer journeys and operational efficiency across its offerings, including wealth management.

These technological advancements are crucial for BOK Financial to secure a stronger market position as the industry shifts. Companies that effectively embed artificial intelligence into their workflows are poised to achieve a significant competitive advantage.

- Client Expectations: 75% of consumers expect personalized experiences from financial institutions.

- AI Adoption: By 2026, 80% of financial services firms are projected to use AI for customer service.

- BOK Financial's Focus: Investments in digital platforms aim to improve client onboarding and digital self-service capabilities.

- Market Impact: Enhanced digital experiences are key differentiators in attracting and retaining clients in 2024.

BOK Financial's wealth management division is a star performer, with fiduciary and asset management revenue reaching new quarterly peaks in Q2 2025. This growth is fueled by a consistent increase in assets under management or administration (AUMA), which stood at $117.9 billion.

The company's core Commercial & Industrial (C&I) loan portfolio is also a star, experiencing an 8.1% year-over-year expansion in 2024, driven by strategic investments in talent and sales support. This robust growth is further supported by strong pipelines and a solid liquidity position, setting the stage for continued expansion through 2025.

BOK Financial's strategic entry into mortgage finance and warehouse lending, planned for late 2025, positions it to capitalize on the projected 2025 mortgage origination volume of $2.3 trillion. This move taps into a high-growth market, anticipating significant activity within the housing sector.

| Business Unit | Market Share | Growth Rate (YoY) | Future Potential |

|---|---|---|---|

| Wealth Management | Strong | ~8% CAGR (10-year) | High, driven by AUMA growth |

| Commercial & Industrial Loans | Growing | 8.1% (2024) | High, supported by strategic investments |

| Mortgage Finance & Warehouse Lending | Emerging | Projected $2.3T origination (2025) | High, targeting expanding housing sector |

What is included in the product

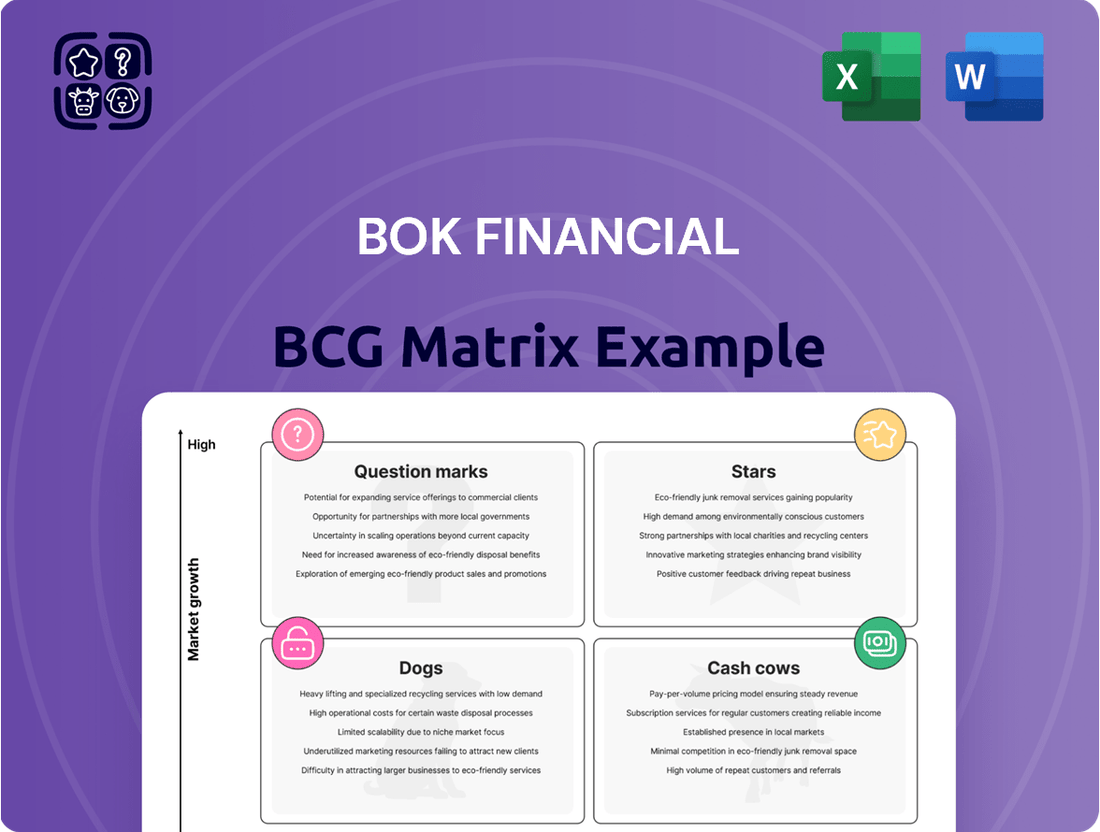

Highlights which units to invest in, hold, or divest based on market growth and share.

Clear visualization of BOK Financial's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs for strategic focus.

Cash Cows

BOK Financial's established commercial banking operations represent a significant cash cow. This segment is a bedrock of the company, consistently delivering a substantial portion of its net interest income. In 2024, commercial banking continued to be a primary driver of profitability.

As a market leader in its operating regions, BOK Financial's commercial banking boasts a high market share. This strong position allows it to generate significant cash flow, which is crucial for funding other growth initiatives within the company. The segment's robust lending activities and deep client relationships provide a stable revenue stream in a mature market.

BOK Financial's Investment and Trust Services are a prime example of a Cash Cow within its BCG Matrix. This segment, encompassing fiduciary and asset management, contributes a substantial portion to the company's overall revenue, highlighting its importance as a fee-based income generator.

As of the first quarter of 2024, BOK Financial reported non-interest income, which includes its investment and trust services, at $260 million. This mature business line provides a stable and consistent cash flow, benefiting from an established market presence that minimizes the need for significant promotional investments.

BOK Financial's core consumer banking deposit base functions as a significant cash cow. While not experiencing rapid growth in new product uptake, this division provides a substantial and dependable source of funds.

These deposits are vital for financing the company's lending operations and ensuring robust liquidity. In 2023, BOK Financial reported total deposits of $46.4 billion, underscoring the scale of this stable funding source.

Established customer relationships within this segment foster consistent, low-cost funding, a hallmark of a healthy cash cow. This stability allows BOK Financial to allocate resources to higher-growth areas.

Mortgage Servicing Rights Portfolio

BOK Financial's mortgage servicing rights (MSRs) portfolio represents a significant cash cow. These rights generate consistent, recurring revenue, providing a stable income stream that helps offset fluctuations in mortgage origination activity. In 2023, BOK Financial saw an increase in its mortgage servicing revenue, partly due to strategic MSR acquisitions, underscoring the segment's role as a reliable cash generator.

- Recurring Revenue: MSRs provide a predictable income stream through servicing fees.

- 2023 Growth: Mortgage servicing revenue saw an increase in 2023, bolstered by MSR purchases.

- Stability: This segment acts as a buffer against the cyclical nature of mortgage origination.

- Cash Generation: MSRs are a consistent source of cash for BOK Financial.

Electronic Funds Transfer Network (TransFund)

BOK Financial's TransFund operates as an established electronic funds transfer network, a core service within its regional financial offerings.

This mature infrastructure consistently generates fee income, reflecting its high market adoption and foundational role.

TransFund provides a steady, predictable revenue stream for BOK Financial, requiring minimal investment in aggressive market expansion.

- TransFund's Role: A mature, foundational service within BOK Financial's portfolio.

- Revenue Generation: Consistent fee income from facilitating electronic transactions.

- Market Position: High market adoption, signifying a stable and reliable business segment.

- Strategic Focus: Minimal need for aggressive expansion, emphasizing steady cash flow.

BOK Financial's established commercial banking operations continue to be a significant cash cow, consistently driving profitability. This segment benefits from a high market share in its operating regions, enabling substantial cash flow generation. The robust lending activities and deep client relationships provide a stable revenue stream, vital for funding other growth initiatives.

Investment and Trust Services also represent a prime cash cow, contributing substantially to BOK Financial's revenue through fee-based income. As of Q1 2024, non-interest income, including these services, reached $260 million. This mature business line offers stable and consistent cash flow with minimal need for significant promotional investments due to its established market presence.

The core consumer banking deposit base serves as another significant cash cow, providing a dependable source of funds for lending operations and ensuring liquidity. With total deposits reaching $46.4 billion in 2023, these established customer relationships foster low-cost funding, allowing resource allocation to higher-growth areas.

BOK Financial's mortgage servicing rights (MSRs) portfolio is a key cash cow, generating recurring revenue and acting as a buffer against origination fluctuations. Mortgage servicing revenue saw an increase in 2023, partly due to strategic MSR acquisitions, highlighting its role as a consistent cash generator.

TransFund, an established electronic funds transfer network, also functions as a cash cow by consistently generating fee income through its high market adoption. This mature infrastructure requires minimal investment for aggressive expansion, ensuring a steady, predictable revenue stream.

| Segment | BCG Category | 2023 Data Point | 2024 Data Point (Q1) | Key Characteristic |

|---|---|---|---|---|

| Commercial Banking | Cash Cow | Primary driver of profitability | Continued primary driver of profitability | High market share, stable revenue |

| Investment & Trust Services | Cash Cow | Substantial revenue contribution | Non-interest income $260 million | Fee-based income, established market |

| Consumer Banking Deposits | Cash Cow | Total Deposits $46.4 billion | N/A | Low-cost funding, stable liquidity |

| Mortgage Servicing Rights (MSRs) | Cash Cow | Increased mortgage servicing revenue | N/A | Recurring revenue, stable income |

| TransFund | Cash Cow | Consistent fee income | N/A | Mature infrastructure, high adoption |

What You See Is What You Get

BOK Financial BCG Matrix

The BOK Financial BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present; you'll get the complete, analysis-ready report designed for strategic decision-making. The file is prepared for immediate use, allowing you to seamlessly integrate its insights into your business planning and presentations. You can be confident that what you see is precisely what you will download, ensuring a transparent and valuable transaction.

Dogs

BOK Financial's energy loan portfolio saw a significant drop, falling 12.1% from the previous quarter and 16.9% compared to the same period last year as of Q1 2025. This contraction, from a historically strong segment, signals a shrinking part of their overall lending business.

The continued decline in this sector, without compensatory growth elsewhere, positions the energy loan portfolio as a potential 'dog' within BOK Financial's business portfolio. Such a classification necessitates strategic evaluation, potentially leading to careful management or even divestiture to optimize the company's overall financial health.

BOK Financial's healthcare loan portfolio experienced a 4.5% contraction in the first quarter of 2025 compared to the prior quarter. This decline signals a potential softening in the bank's engagement with this particular lending sector.

If this downward trend continues and the market conditions for healthcare loans remain unfavorable, this segment could be classified as a 'dog' within the BCG matrix. Such a classification would necessitate a thorough strategic evaluation to mitigate any ongoing negative impact on overall financial performance.

Regional banks, including BOK Financial, are navigating increasing challenges with commercial real estate (CRE) loans, as delinquency rates have been on the rise throughout the banking industry. For instance, by the end of Q1 2024, the delinquency rate for CRE loans held by US banks had climbed to 7.1%, up from 5.4% a year prior.

While BOK Financial generally boasts robust credit quality, certain CRE loan segments, particularly those in struggling sub-markets or experiencing higher delinquency, could become cash traps. These segments might immobilize capital without yielding adequate returns, signaling a need for strategic divestment or restructuring.

Outdated Legacy IT Systems

Outdated legacy IT systems represent a significant challenge for many financial institutions, including regional banks. Despite substantial investments in digital transformation, these older systems can act as a bottleneck, increasing operational expenses and slowing down innovation. For BOK Financial, if specific internal systems are inefficient, hinder data utilization, or impede digital initiatives, they are essentially consuming valuable resources without contributing to a competitive edge. These are prime candidates for modernization or outright replacement to streamline operations and enhance capabilities.

The cost of maintaining legacy systems can be substantial. For instance, a 2024 report indicated that financial services firms spend an average of 60% of their IT budget on maintaining existing systems, often leaving less for new development and innovation. This highlights the financial drain that outdated technology can impose.

- Legacy systems can lead to increased operational costs due to higher maintenance and support needs.

- Inefficient data utilization from legacy systems hampers advanced analytics and personalized customer experiences.

- Modernizing or replacing outdated IT infrastructure is crucial for maintaining competitiveness in the digital age.

- A significant portion of IT budgets in the financial sector is allocated to maintaining legacy systems, limiting investment in new technologies.

Segments with Rising Operational Costs

BOK Financial's rising operational costs, especially personnel expenses, highlight areas that might be considered 'dogs' in a BCG Matrix analysis. These segments, if not generating sufficient revenue to offset increased spending, can drag down overall profitability.

Personnel expenses alone increased from $393.7 million in the first half of 2024 to $428.9 million in the first half of 2025. This nearly 9% jump indicates a significant investment in human capital, which needs to be carefully monitored against the performance of the business units that utilize this workforce.

- Rising Personnel Costs: A 9% increase in personnel expenses from H1 2024 to H1 2025 signifies a major cost driver.

- Potential 'Dog' Segments: Business units or processes where these increased costs aren't matched by proportional revenue growth are prime candidates for being classified as 'dogs.'

- Impact on Profitability: Such segments can dilute overall company profits and require strategic cost-containment measures.

- Need for Strategic Review: Identifying and addressing these high-cost, low-return areas is crucial for optimizing financial performance.

BOK Financial's energy loan portfolio, down 16.9% year-over-year as of Q1 2025, and its contracting healthcare loan segment, down 4.5% sequentially in Q1 2025, both exhibit characteristics of 'dogs' in the BCG matrix. These areas are experiencing declining market share or growth, requiring careful strategic consideration to avoid becoming a drag on overall performance.

Similarly, certain commercial real estate (CRE) loan segments, especially those with rising delinquency rates—which reached 7.1% for US banks by end of Q1 2024—could be classified as dogs if they become cash traps. Outdated legacy IT systems, consuming an average of 60% of IT budgets in financial services as of a 2024 report, also represent potential dogs due to high maintenance costs and limited innovation output.

The substantial increase in BOK Financial's personnel expenses, rising nearly 9% from the first half of 2024 to the first half of 2025, points to another area needing scrutiny. If specific business units or processes benefiting from this increased workforce do not demonstrate proportional revenue growth, they too could be categorized as dogs, necessitating strategic cost management or restructuring.

| BCG Category | BOK Financial Segment Examples | Key Indicators | Strategic Implication |

|---|---|---|---|

| Dogs | Energy Loans | 16.9% YoY decline (Q1 2025) | Evaluate for divestment or careful management to free up capital. |

| Dogs | Healthcare Loans | 4.5% sequential decline (Q1 2025) | Assess market viability and potential for turnaround or exit. |

| Dogs | Underperforming CRE Loans | Rising delinquency rates (e.g., 7.1% for US banks in Q1 2024) | Requires restructuring, sale, or write-downs to mitigate risk. |

| Dogs | Legacy IT Systems | High maintenance costs (60% of IT budgets in financial services, 2024) | Prioritize modernization or replacement to improve efficiency and competitiveness. |

| Dogs | High-Cost, Low-Return Business Units | 9% increase in personnel expenses (H1 2024 to H1 2025) without proportional revenue growth | Implement cost controls or reallocate resources to more profitable areas. |

Question Marks

BOK Financial's new digital banking products, especially those incorporating AI for client interaction and operational efficiency, fit the question mark category within the BCG Matrix. These are in markets experiencing rapid growth, but BOKF currently holds a small slice of that market.

Significant capital infusion is necessary for these digital offerings to capture greater market share and ascend to star status. Without this investment, they risk declining into the dog quadrant, representing underperforming assets.

For instance, as of Q1 2024, the digital banking sector saw continued expansion, with fintech investments reaching $12.2 billion globally in the first quarter, according to KPMG. BOK Financial's new products are entering this dynamic environment, aiming to carve out a niche.

BOK Financial's expansion into new geographic markets, like Austin and San Antonio, places it in the "Question Marks" category of the BCG Matrix. These are areas with high growth potential, but BOKF is still establishing its presence and building market share. For instance, in 2023, BOK Financial reported a net interest income of $1.8 billion, reflecting its overall operational scale, but specific contributions from these newer markets are still developing.

BOK Financial's specialized consumer lending initiatives, while aiming for high-growth segments, represent potential question marks within its BCG Matrix. These targeted efforts, which saw a 2.4% sequential increase in Q1 2025, require significant investment in marketing and product differentiation to gain traction against established competitors.

Advanced API-driven Commercial Treasury Services

BOK Financial's advanced API-driven commercial treasury services are positioned within a rapidly expanding market driven by the demand for real-time payments and integrated treasury solutions. This segment of commercial banking is experiencing significant growth, with projections indicating a continued upward trend as businesses increasingly prioritize digital transformation and operational efficiency. For instance, the global API management market, which underpins these services, was valued at approximately $4.4 billion in 2023 and is expected to reach $15.2 billion by 2028, showcasing the substantial growth potential.

Given this market dynamism, BOK Financial's investment in new, advanced API-driven treasury solutions places them in a high-growth category. However, as a newer entrant or innovator in this specific space, their initial market share is likely to be low. This scenario necessitates substantial investment in technology development, client acquisition, and service enhancement to effectively compete against established players and capture a meaningful portion of this burgeoning market. The bank's strategic focus on these services aligns with broader industry trends, but the path to market leadership will require sustained capital allocation and a robust go-to-market strategy.

- Market Growth: The commercial banking sector is seeing accelerated adoption of real-time payments and API-embedded treasury services, a trend that fuels fee income for financial institutions.

- BOK Financial's Position: Developing and rolling out advanced API-driven treasury solutions places BOK Financial in a high-growth market segment.

- Market Share Dynamics: Initial market share for these advanced offerings is likely to be low, requiring significant investment to build competitive strength.

- Investment Needs: Competing effectively in this evolving landscape demands heavy investment in technology and client engagement.

Strategic Acquisitions for Capability Enhancement

In the dynamic wealth management sector, major players are actively acquiring smaller firms to bolster their expertise in areas such as private credit and alternative data analytics. For BOK Financial, if they were to pursue similar strategic acquisitions to expand into these high-growth, specialized markets where their current footprint is minimal, the newly acquired capabilities or niche markets would likely be classified as question marks within the BCG matrix.

These question marks represent areas with high market growth potential but currently low market share for BOK Financial. Significant investment and careful integration would be crucial post-acquisition to nurture these nascent capabilities and transform them into potential stars. For instance, a strategic acquisition in the alternative data analysis space could cost anywhere from tens of millions to hundreds of millions of dollars, depending on the target's existing technology, client base, and intellectual property.

- Acquisition Target: A firm specializing in alternative data analytics for investment strategies.

- Market Growth: The market for alternative data in finance is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 20% leading up to 2025.

- BOK Financial's Position: Currently has a limited presence in this specialized niche.

- Investment Need: Requires substantial post-acquisition investment in technology, talent, and integration to achieve competitive market share.

BOK Financial's strategic ventures into emerging fintech partnerships, particularly those leveraging blockchain for enhanced transaction security and efficiency, represent question marks. These partnerships operate in a high-growth sector, but BOKF is still establishing its market presence and influence within this nascent ecosystem.

Significant investment in technology integration and client adoption strategies is vital for these partnerships to gain substantial market share and evolve into strongholds. Without this focused capital allocation, they risk becoming underutilized assets.

For instance, the global blockchain in financial services market was valued at approximately $1.8 billion in 2023 and is projected to reach $10.3 billion by 2028, demonstrating the considerable expansion potential BOK Financial is targeting.

| BOK Financial Venture | Market Growth | BOK Financial's Current Share | Investment Requirement |

| Fintech Partnerships (Blockchain) | High (e.g., $1.8B in 2023, projected $10.3B by 2028) | Low | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial statements, detailed market research reports, and internal performance metrics to accurately assess business unit positioning.