Bank of China PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of China Bundle

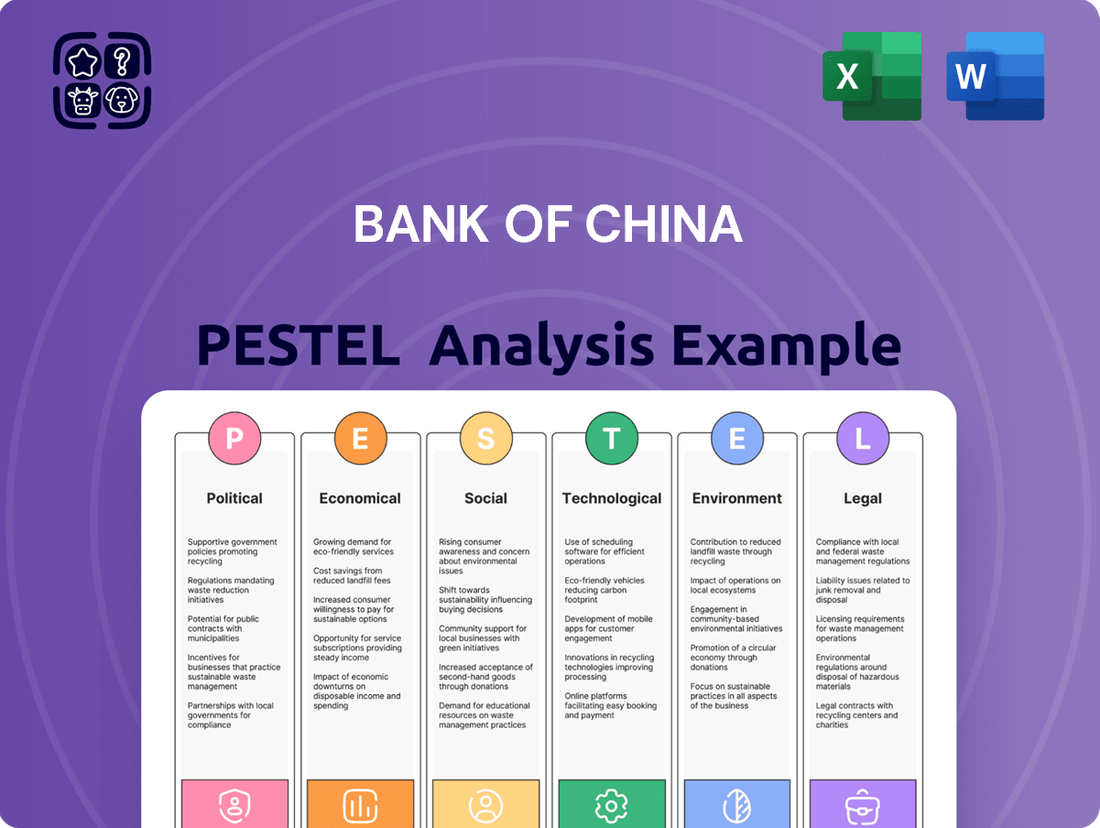

Navigate the complex global landscape impacting Bank of China with our comprehensive PESTLE analysis. Understand the political shifts, economic volatilities, and technological advancements that are shaping its strategic direction. This expert-crafted report provides the critical external intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now and gain a decisive advantage.

Political factors

As a state-controlled entity, Bank of China's strategic direction is intrinsically linked to the Chinese government's economic agenda. This means its lending and investment decisions are often shaped by national priorities, such as supporting key industries or fostering international trade. For instance, in 2023, the Chinese government continued to emphasize financial risk prevention, directly impacting the bank's risk management frameworks and capital allocation strategies.

China's financial sector is undergoing significant reform, with the government introducing new laws and regulations to standardize practices and bolster oversight. For instance, the People's Bank of China (PBOC) has been at the forefront of these efforts, with ongoing initiatives to strengthen capital requirements and risk management frameworks for financial institutions.

These reforms are designed to manage systemic risks and bring domestic financial practices closer to international norms, a crucial step for global integration. Bank of China, like other major financial institutions, must remain agile, adapting its operations to comply with these evolving regulatory landscapes, which often include stricter data reporting and cybersecurity mandates.

Bank of China's vast international footprint means it's significantly exposed to global political shifts. For instance, escalating trade disputes, such as those seen between the US and China in recent years, can directly affect the bank's trade finance volumes. These tensions can lead to increased regulatory scrutiny and operational complexities for the bank's overseas branches.

Belt and Road Initiative (BRI) Support

Bank of China's deep involvement in the Belt and Road Initiative (BRI) positions it as a crucial financial facilitator for China's global trade and investment ambitions. The Chinese government's sustained commitment to BRI projects directly translates into continued opportunities and mandates for the bank.

This strategic alignment means Bank of China is instrumental in channeling funds towards BRI-affiliated countries and projects. For instance, the bank has been active in issuing sustainable development bonds to support these initiatives, with a notable focus on green finance for BRI projects in 2024. This highlights the bank’s role in enabling infrastructure development and economic cooperation across participating nations.

- Facilitating BRI Trade: Bank of China provides essential financial services for trade flows along BRI routes, supporting both Chinese enterprises expanding abroad and foreign businesses engaging with China.

- Investment Enabler: The bank actively finances infrastructure projects, energy ventures, and industrial parks crucial to the BRI's connectivity goals, leveraging its extensive global network.

- Sustainable Finance for BRI: In 2024, Bank of China continued to lead in issuing green and sustainable bonds specifically earmarked for BRI projects, aligning with global ESG trends and China's environmental commitments.

- Government Mandate Alignment: The bank's operations are closely aligned with national policy, ensuring its financial support directly contributes to the strategic objectives of the Belt and Road Initiative.

Anti-Corruption and Governance Directives

The Bank of China, like other state-owned enterprises, is significantly influenced by China's persistent anti-corruption drives and a heightened focus on corporate governance. These initiatives mandate more rigorous internal controls and disciplinary oversight, pushing the bank to prioritize national economic objectives over purely profit-driven strategies. This regulatory environment can also lead to adjustments in employee compensation structures to align with these broader goals.

These directives translate into tangible operational changes for the Bank of China. For instance, the Central Commission for Discipline Inspection (CCDI) continues to be a key player in enforcing accountability. In 2023, the CCDI reported on numerous cases of financial misconduct across various sectors, underscoring the government's commitment to clean governance, which directly impacts financial institutions like the Bank of China.

- Stricter Internal Controls: The bank must implement enhanced compliance procedures and risk management frameworks to adhere to new governance standards.

- Discipline Inspections: Regular audits and inspections by supervisory bodies are becoming more frequent and thorough, demanding greater transparency.

- Alignment with Economic Priorities: Bank of China's lending and investment strategies are increasingly shaped by national development plans, such as those related to green finance or technological innovation.

- Impact on Employee Compensation: Performance metrics may shift to include governance adherence and contribution to national economic goals, potentially affecting bonus structures and salary adjustments.

Bank of China's operations are deeply intertwined with the Chinese government's strategic objectives, particularly evident in its role within the Belt and Road Initiative (BRI). The bank's commitment to BRI projects, including a focus on sustainable finance for these initiatives in 2024, underscores its function as a key financial facilitator for China's global trade and investment agenda.

The government's ongoing emphasis on financial risk prevention, as seen in 2023, directly influences Bank of China's risk management and capital allocation strategies. Furthermore, reforms spearheaded by the People's Bank of China, aiming to bolster oversight and standardize practices, necessitate continuous adaptation from Bank of China to meet evolving regulatory requirements, including those for data reporting and cybersecurity.

China's anti-corruption drives and focus on corporate governance mandate more rigorous internal controls and disciplinary oversight for state-owned enterprises like Bank of China. This means national economic objectives often take precedence over purely profit-driven strategies, with bodies like the Central Commission for Discipline Inspection (CCDI) ensuring accountability, as highlighted by their reports on financial misconduct in 2023.

| Government Initiative | Bank of China's Role/Impact | 2023/2024 Relevance |

|---|---|---|

| Belt and Road Initiative (BRI) | Financing infrastructure, trade facilitation, issuing green bonds for projects | Continued commitment to BRI projects, including sustainable finance in 2024 |

| Financial Risk Prevention | Strengthening risk management frameworks, capital allocation adjustments | Ongoing emphasis in 2023, impacting operational strategies |

| Financial Sector Reform | Adapting to new regulations, enhanced oversight, stricter capital requirements | PBOC-led reforms require agility in compliance and operations |

| Anti-Corruption & Governance | Implementing stricter internal controls, increased transparency, alignment with national goals | CCDI's continued enforcement of accountability impacts governance practices |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Bank of China, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights derived from current trends and data, equipping stakeholders with the knowledge to navigate opportunities and mitigate risks.

This PESTLE analysis of the Bank of China provides a concise, actionable overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

It offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thereby alleviating the pain of sifting through extensive data.

Economic factors

China's economic growth is moderating, with projections for GDP growth around 5% in both 2024 and 2025. This shift from previous high-speed expansion is a significant factor for the Bank of China.

This slowdown, driven by factors like ongoing trade tensions and broader global economic headwinds, directly affects the banking sector. We can expect to see a dampening effect on loan demand as businesses and consumers adjust to a less robust economic environment.

Tighter financial conditions often accompany slower growth, potentially impacting interest margins and the overall profitability of banking operations. The Bank of China will need to navigate these shifts carefully.

The People's Bank of China (PBOC) is actively managing the interest rate environment, aiming to reduce competition among banks for deposits and potentially lowering rates. This policy directly impacts banks' net interest margins (NIMs), which represent the difference between interest income and interest expense. Lowering rates generally compresses these margins.

The pressure on NIMs is evident, with Chinese banks, including the Bank of China, experiencing a significant decline. In 2024, NIMs reached their lowest point in 13 years, a trend that directly squeezes profitability across the sector. This environment necessitates strategic adjustments for banks to maintain healthy financial performance.

Weak credit demand from both Chinese corporations and consumers has significantly slowed loan growth, directly affecting the profitability projections for state-owned banks. This trend, observed throughout 2024, suggests a cautious lending environment.

While analysts anticipate some recovery in credit demand heading into 2025, overall loan growth is still expected to remain considerably more subdued than in prior years. For instance, China's total social financing, a broad measure of credit and liquidity, saw a noticeable deceleration in its year-on-year growth rate during much of 2024.

Real Estate Sector Stability

The stability of China's real estate sector remains a crucial consideration for the Bank of China. While government policies are anticipated to offer some support to housing demand, a complete recovery is not projected until the latter half of 2025, which continues to present a risk to the quality of bank assets.

This ongoing challenge in the property market could impact loan performance and profitability. For instance, in early 2024, developers continued to face liquidity issues, leading to concerns about mortgage defaults and the overall health of the banking system's exposure to real estate.

- Developer Defaults: Continued developer defaults could lead to increased non-performing loans for banks.

- Housing Demand: Policy support might provide a slight uplift, but a significant rebound in housing demand is still some time away.

- Asset Quality: The real estate sector's performance directly influences the asset quality of banks like Bank of China.

- Economic Impact: A prolonged downturn in real estate can have broader implications for China's economic growth and financial stability.

Global Economic Recovery and Trade Dynamics

The global economic recovery continues to be sluggish, with persistent headwinds impacting international trade. Protectionist policies and ongoing policy uncertainty are creating significant challenges for global commerce, directly affecting institutions like the Bank of China. This environment complicates the bank's efforts in facilitating cross-border trade and investment activities.

For the Bank of China, this translates into a more complex operating landscape for its international business segments. The bank's role as a facilitator of global trade finance and investment is directly influenced by these macroeconomic trends. For instance, the World Trade Organization (WTO) has projected that global trade growth might only reach 2.6% in 2024, a slight improvement from previous years but still below historical averages, highlighting the ongoing trade friction.

- Weak Global Growth: Projections for global GDP growth in 2024 hover around 2.7% according to the IMF, indicating a slow and uneven recovery that limits demand for international trade services.

- Protectionist Measures: An increasing number of countries are implementing tariffs and non-tariff barriers, which directly impede the flow of goods and capital, impacting the volume of trade finance transactions.

- Policy Uncertainty: Geopolitical tensions and shifting trade policies create an unpredictable environment, making businesses hesitant to engage in long-term cross-border investments, a key area for the Bank of China.

- Impact on Trade Finance: The slowdown in global trade growth and increased risk perception can lead to reduced demand for trade finance instruments and potentially higher financing costs for businesses.

China's economic growth is moderating, with projections for GDP growth around 5% in both 2024 and 2025, impacting loan demand and potentially squeezing bank profit margins.

The People's Bank of China's policies, including potential interest rate reductions, are already compressing net interest margins, which hit a 13-year low in 2024, forcing strategic adjustments for profitability.

Weak credit demand from corporations and consumers in 2024 signals a cautious lending environment, with only a subdued recovery anticipated for 2025, affecting overall loan growth.

Preview Before You Purchase

Bank of China PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bank of China offers a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain valuable insights into the strategic landscape and potential challenges and opportunities for this major global financial institution.

Sociological factors

Chinese consumers are rapidly embracing digital channels for their banking needs. By the end of 2024, it's projected that over 85% of daily financial transactions in China will be conducted digitally, with mobile banking and payment platforms like Alipay and WeChat Pay leading the way. This shift means Bank of China must prioritize a seamless, intuitive digital experience to attract and retain customers.

China's commitment to inclusive finance is accelerating, with a strong push to bring financial services to previously underserved groups like small and medium-sized enterprises (SMEs) and rural communities. This national agenda is a significant sociological driver, shaping how financial institutions operate and innovate.

As a major state-owned bank, Bank of China is strategically positioned to lead in this area, aligning its operations with the government's priority to broaden financial access. By 2023, the People's Bank of China reported that digital financial inclusion services had reached 1.4 billion people, demonstrating the scale of this societal shift.

China's demographic landscape is rapidly evolving, with a significant increase in its aging population. This trend places a growing emphasis on robust pension finance systems to support a larger cohort of retirees. By 2023, China's population aged 65 and above reached approximately 216.76 million, representing about 15.4% of the total population.

In response to these demographic shifts, Bank of China is actively expanding its pension finance offerings. The bank aims to provide a comprehensive suite of products and services designed to meet the evolving financial needs of China's elderly citizens. This strategic focus also aligns with the nation's broader goals of strengthening its multi-pillar pension system.

Public Trust and Financial Literacy

Public trust is the bedrock of any financial institution, and for state-owned banks like the Bank of China, it's even more critical. Maintaining this trust directly impacts their ability to attract and retain customers, especially in a competitive market. Recent surveys in 2024 indicate that while trust in major Chinese banks remains relatively high, transparency in digital banking services is a growing concern for a significant portion of the population.

Enhancing financial literacy is a key strategy for fostering a stable financial environment. As of early 2025, initiatives by the People's Bank of China and commercial banks are actively promoting financial education. These programs aim to equip citizens with the knowledge to make informed decisions about savings, investments, and credit, which in turn strengthens the banking sector's foundation.

- Public Trust: Surveys in 2024 showed that over 80% of Chinese citizens expressed confidence in major state-owned banks, but a notable segment desired more clarity on data privacy in online transactions.

- Financial Literacy Initiatives: By the end of 2024, over 50 million individuals had participated in government-backed financial literacy programs, with a focus on digital financial tools and consumer protection.

- Transparency in Operations: The Bank of China has been actively increasing its disclosure of financial performance and risk management practices, responding to calls for greater transparency from regulators and the public.

- Client Base Growth: A direct correlation has been observed between improved public perception of transparency and an increase in new account openings, particularly among younger demographics who prioritize digital accessibility and clear communication.

Urbanization and Regional Development

China's continued urbanization, with a significant portion of its population now residing in cities, fuels demand for sophisticated financial services. Initiatives like the Yangtze River Delta integration plan are channeling substantial investment into infrastructure and economic development, creating new avenues for Bank of China's lending and investment products.

These regional development strategies necessitate localized approaches from financial institutions. Bank of China's branch network and product offerings must align with the unique economic profiles and growth trajectories of different urban clusters, from established metropolises to emerging economic zones.

- Urban Population Growth: China's urbanization rate reached 66.16% by the end of 2023, indicating a sustained shift towards urban living and increased demand for financial services in these areas.

- Regional Investment Focus: The Yangtze River Delta region, a key driver of China's economic growth, saw its GDP surpass 30 trillion yuan in 2023, highlighting the financial opportunities in concentrated development areas.

- Financial Needs in Urban Centers: Growing urban populations require diverse financial products, including mortgages, consumer loans, wealth management, and business financing for expanding urban enterprises.

- Bank of China's Role: The bank's ability to tailor financial solutions to the specific needs of rapidly developing urban and regional economies is crucial for its continued market relevance and growth.

Sociological factors significantly shape the banking landscape in China, influencing consumer behavior and institutional strategies. The rapid digital adoption by Chinese consumers, with over 85% of daily financial transactions expected to be digital by the end of 2024, underscores the need for seamless online banking experiences. Simultaneously, the government's push for inclusive finance, which reached 1.4 billion people through digital services by 2023, highlights a societal demand for broader financial access.

China's aging population, with 15.4% of its citizens over 65 by 2023, is creating a growing market for pension finance products, a trend Bank of China is actively addressing. Public trust remains paramount, though concerns about transparency in digital services emerged in 2024 surveys, prompting banks to enhance disclosure. Furthermore, widespread financial literacy initiatives, with over 50 million participants by the end of 2024, are fostering a more informed consumer base.

| Sociological Factor | 2023/2024 Data Point | Implication for Bank of China |

|---|---|---|

| Digital Transaction Adoption | >85% of daily transactions digital by end-2024 | Prioritize user-friendly digital platforms |

| Financial Inclusion Reach | 1.4 billion people served by digital inclusion by 2023 | Expand services to underserved segments |

| Aging Population | 15.4% of population aged 65+ (2023) | Develop robust pension and retirement products |

| Public Trust & Transparency | 80%+ confidence in state banks, but digital transparency concerns (2024) | Increase transparency in online services and data privacy |

| Financial Literacy Programs | >50 million participants by end-2024 | Leverage informed consumers for product uptake |

Technological factors

Bank of China is actively pursuing digital transformation, with a notable focus on integrating fintech. This strategic shift aims to streamline operations and elevate customer engagement across its services.

By embracing advanced technologies, the bank is enhancing its offerings, moving towards a more automated and intelligent banking ecosystem. This digital push is crucial for maintaining competitiveness in the evolving financial landscape.

In 2024, Bank of China continued to invest heavily in digital infrastructure, reportedly allocating significant capital towards fintech development and cybersecurity measures to support its transformation goals.

Bank of China, like other major Chinese financial institutions, is heavily investing in Artificial Intelligence. This adoption spans a wide array of functions, from streamlining internal operations like automated coding and memo generation to enhancing critical areas such as business intelligence, investment analysis, and fraud detection. By 2024, AI-powered tools are expected to significantly boost efficiency and risk management across the banking sector.

The People's Bank of China is a key driver behind this AI integration in digital finance. Their focus is not only on leveraging AI for innovation but also on establishing robust data security protocols. This dual emphasis ensures that advancements in AI within the financial industry are both progressive and secure, a crucial factor for maintaining public trust and financial stability.

As Bank of China continues its digital transformation, cybersecurity and data protection have become critical priorities. The bank is investing heavily in advanced technologies to shield its systems and customer information from evolving threats, reflecting a global trend in financial services.

In 2024, the People's Bank of China (PBOC) has continued to stress the importance of robust cybersecurity for financial institutions, including Bank of China. This emphasis is driven by an increase in sophisticated cyberattacks targeting financial data. Strengthening the financial technology infrastructure is a key directive, necessitating comprehensive measures to protect sensitive customer data and the integrity of financial transactions.

Blockchain Technology for Cross-Border Transactions

Bank of China is actively investigating and integrating blockchain technology, with a particular focus on its application in supply chain financing to boost transparency. This exploration extends to potential uses in cross-border transactions, aiming to streamline international trade processes.

By leveraging blockchain, the bank seeks to significantly reduce instances of fraud and ensure that financial resources are allocated precisely as intended. This initiative directly supports the broader goal of enhancing both efficiency and security within global trade operations.

Globally, the adoption of blockchain in trade finance is gaining momentum. For instance, in 2023, the value of trade finance transactions facilitated by blockchain platforms was estimated to be in the tens of billions of dollars, with projections indicating substantial growth through 2025 as more financial institutions like Bank of China embrace the technology.

- Enhanced Transparency: Blockchain provides an immutable ledger, allowing all parties involved in a transaction to view its progress, reducing information asymmetry.

- Fraud Reduction: The decentralized and cryptographic nature of blockchain makes it highly resistant to tampering, thereby minimizing fraudulent activities.

- Increased Efficiency: Automating processes through smart contracts on a blockchain can significantly speed up cross-border settlements and reduce administrative overhead.

Development of Digital Yuan (e-CNY)

The People's Bank of China is actively pushing for greater adoption of the digital yuan (e-CNY), aiming to broaden its use from domestic retail to international and business-to-business transactions. This initiative is set to significantly impact how financial institutions operate within China.

As a key player in China's financial landscape, the Bank of China is integral to the successful rollout and growth of the e-CNY infrastructure. Its involvement will be critical in developing the necessary systems and facilitating user access.

- Increased Transaction Efficiency: The e-CNY promises faster settlement times for both domestic and cross-border payments.

- Enhanced Financial Inclusion: Digital currency can provide access to financial services for previously unbanked populations.

- Monetary Policy Implementation: The digital yuan could offer the People's Bank of China new tools for managing liquidity and implementing monetary policy.

- Data Analytics Capabilities: The Bank of China can leverage transaction data to gain deeper insights into economic activity and customer behavior.

Bank of China is heavily invested in AI, using it for everything from internal operations to fraud detection, aiming for increased efficiency and better risk management by 2024.

The bank is also exploring blockchain for supply chain finance and cross-border transactions, with global blockchain trade finance projected to grow significantly through 2025.

Furthermore, Bank of China is a key participant in the rollout of the digital yuan (e-CNY), which aims to improve transaction efficiency and financial inclusion.

| Technology Area | Key Initiatives | Expected Impact | 2024/2025 Focus |

|---|---|---|---|

| Artificial Intelligence (AI) | Automated coding, memo generation, business intelligence, investment analysis, fraud detection | Increased operational efficiency, enhanced risk management | Broader AI integration across all business units, advanced analytics for customer insights |

| Blockchain | Supply chain financing, cross-border transactions, smart contracts | Improved transparency, reduced fraud, faster settlements | Piloting blockchain for trade finance, exploring interbank payment solutions |

| Digital Yuan (e-CNY) | Facilitating retail and business-to-business transactions, cross-border payments | Faster transaction speeds, enhanced financial inclusion, new monetary policy tools | Expanding e-CNY pilot programs, developing infrastructure for wider adoption |

| Cybersecurity | Advanced threat detection, data encryption, secure infrastructure | Protection of customer data, system integrity, regulatory compliance | Continuous investment in cutting-edge cybersecurity solutions, proactive threat hunting |

Legal factors

The Bank of China navigates a complex legal landscape heavily influenced by the People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA). These key regulators establish stringent rules for capital adequacy, lending practices, and overall risk management, directly impacting the bank's operational strategies and financial health. For instance, as of late 2024, China's banking sector continues to adapt to evolving prudential requirements aimed at bolstering stability.

China's commitment to combating financial crime is evident in its strengthening of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. These updates introduce more stringent transparency requirements and broaden the scope of predicate offenses, directly impacting how financial institutions operate.

Bank of China, like all financial entities, must navigate these evolving regulations. This includes implementing enhanced compliance protocols to effectively deter and detect illicit financial activities, ensuring adherence to the People's Bank of China's directives, which are increasingly aligned with international standards.

New regulations, such as the Measures for the Data Security Management of Banking and Insurance Institutions, effective December 2024, impose rigorous data classification and protection mandates on financial institutions. Bank of China must meticulously adhere to these evolving data privacy laws to avoid penalties and maintain customer trust.

Cross-Border Financial Regulations

As a global institution, Bank of China navigates a complex web of cross-border financial regulations. These rules govern everything from international capital movements to the intricacies of trade finance, impacting its operations across multiple countries.

Compliance with these diverse legal frameworks is not just a necessity but a critical component of its international business strategy. Failure to adhere can lead to significant penalties and reputational damage.

- Global Regulatory Harmonization Efforts: Bank of China's operations are influenced by ongoing initiatives to harmonize financial regulations internationally, such as Basel III and IV, which set capital adequacy and liquidity standards.

- Sanctions and Anti-Money Laundering (AML) Compliance: The bank must rigorously comply with international sanctions regimes and AML laws in all jurisdictions where it operates, a particularly stringent area given the global reach of financial transactions. For instance, in 2023, global AML fines reached billions of dollars, underscoring the importance of robust compliance programs.

- Data Localization and Privacy Laws: Increasingly, countries are implementing data localization and privacy laws, such as the GDPR in Europe or similar regulations in Asia, which affect how Bank of China handles customer data across borders.

- Trade Finance Regulations: Specific regulations governing international trade finance, including those related to letters of credit, documentary collections, and anti-fraud measures, directly impact the bank's trade services.

Corporate Governance and Compliance Standards

Bank of China, like all major financial institutions, operates under a stringent framework of corporate governance and compliance. This means adhering to evolving standards set by the People's Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC), which are increasingly focused on robust risk prevention and control mechanisms. For instance, in 2023, the CBIRC emphasized stricter capital adequacy ratios and enhanced internal audit functions across the banking sector to bolster financial stability.

These regulations directly impact the bank's operations by mandating alignment with national economic objectives, such as supporting the real economy through targeted lending. Compliance efforts in 2024 and 2025 are expected to intensify in areas like anti-money laundering (AML) and Know Your Customer (KYC) protocols, reflecting global trends and national priorities for financial integrity. The bank's internal compliance framework must therefore be dynamic, adapting to new directives and supervisory expectations.

- Enhanced Regulatory Scrutiny: Expect continued emphasis on capital requirements, liquidity management, and operational resilience from Chinese regulators.

- Risk Management Frameworks: The bank must demonstrate advanced capabilities in identifying, assessing, and mitigating credit, market, and operational risks.

- Alignment with National Policy: Corporate governance must support government initiatives, such as green finance and digital transformation within the financial sector.

- Data Security and Privacy: Increasingly stringent data protection laws require robust compliance measures for customer information and transaction data.

Bank of China operates under a dynamic legal framework shaped by domestic and international regulations. Key Chinese authorities like the PBOC and NFRA dictate stringent capital adequacy and risk management standards. For example, as of late 2024, China's banking sector continues to adapt to evolving prudential requirements aimed at bolstering stability.

The bank must also adhere to increasingly rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, which demand greater transparency and expanded definitions of predicate offenses. Furthermore, new mandates like the Measures for the Data Security Management of Banking and Insurance Institutions (effective December 2024) impose strict data protection obligations.

Globally, Bank of China navigates a complex web of cross-border financial regulations, including sanctions regimes and data privacy laws such as GDPR. Compliance with international standards like Basel III and IV is crucial for its global operations and reputation, especially given that global AML fines reached billions of dollars in 2023.

| Regulatory Area | Key Mandates (2024-2025 Focus) | Impact on Bank of China |

| Capital Adequacy & Liquidity | Adherence to PBOC/NFRA standards, Basel III/IV principles | Influences lending capacity and risk-taking appetite |

| AML/CTF & Sanctions | Enhanced due diligence, transaction monitoring, compliance with international sanctions | Requires robust compliance infrastructure and vigilance against financial crime |

| Data Security & Privacy | Compliance with data localization and privacy laws (e.g., Measures for Data Security Management) | Mandates stringent data protection protocols for customer information |

| Corporate Governance | Alignment with national policy (e.g., green finance), strengthened internal audit | Ensures operations support economic objectives and maintain financial integrity |

Environmental factors

China's commitment to green finance is robust, with the People's Bank of China spearheading efforts to build a comprehensive green financial system. This includes a significant push for green bond issuance and the expansion of green lending programs, aiming to channel capital towards environmentally friendly projects.

Bank of China actively participates in these national green finance initiatives, playing a crucial role in directing substantial funding towards sustainable development and carbon reduction projects. For instance, by the end of 2023, Bank of China had issued over 100 billion yuan in green bonds, with a significant portion of its lending portfolio now allocated to green industries.

Chinese banks, including the Bank of China, are stepping up their efforts in climate risk management. This involves conducting climate stress tests to understand potential impacts on their portfolios. For instance, by 2024, regulators are pushing for more robust disclosure of environmental, social, and governance (ESG) information from financial institutions.

The core objective is to pinpoint and manage financial risks stemming from climate change. This proactive approach is crucial as China aims to transition towards a low-carbon economy. By 2025, enhanced transparency in ESG reporting is expected to become a standard practice, allowing stakeholders to better assess climate-related vulnerabilities.

Bank of China is a key player in promoting sustainability through its financial products. In 2023, the bank issued approximately $10 billion in green and sustainable bonds. This financial backing supports projects aligned with China's ambitious carbon neutrality targets, aiming to reduce emissions by 65% by 2030 compared to 2005 levels.

The bank's provision of sustainability-linked loans incentivizes borrowers to meet environmental, social, and governance (ESG) targets. This strategy directly supports China's national environmental agenda, fostering economic development while prioritizing ecological protection and climate resilience.

ESG Integration into Business Strategy

Chinese banks, including the Bank of China, are increasingly embedding Environmental, Social, and Governance (ESG) principles into their strategic planning. This shift reflects a growing awareness of climate-related risks and opportunities within the financial sector.

This integration goes beyond simply funding green initiatives; it involves a comprehensive evaluation of the environmental footprint across all lending activities. For instance, by the end of 2023, green loans in China’s banking sector saw significant growth, with outstanding balances reaching approximately RMB 33.4 trillion, demonstrating a tangible commitment to environmental finance.

- Green Financing Growth: China's green finance market is expanding rapidly, with green loans and bonds playing a crucial role in funding sustainable projects.

- Portfolio Risk Management: Banks are developing methodologies to assess and manage the environmental risks associated with their existing loan portfolios, moving towards a more holistic approach to sustainability.

- Regulatory Push: The People's Bank of China and other regulators are actively encouraging and guiding financial institutions to enhance their ESG practices and disclosures.

Promoting a 'Beautiful China' Vision

The Chinese government's ambitious 'Beautiful China' initiative, a high-level directive focused on ecological civilization, significantly shapes environmental policy and resource allocation. This vision directly influences the role of green finance in managing environmental risks and directing capital towards sustainable development. For instance, by the end of 2023, outstanding green loans in China reached approximately 32.4 trillion yuan, demonstrating a substantial shift in financial flows.

Bank of China's environmental strategies are intrinsically linked to this national vision, aiming to foster a greener, low-carbon economy. The bank actively supports projects that contribute to pollution control, ecological conservation, and the transition to renewable energy sources. In 2024, the bank committed to increasing its green finance portfolio, aligning with national targets for emissions reduction and environmental protection.

- Green Finance Growth: China's outstanding green loans hit 32.4 trillion yuan by end-2023, reflecting strong government support for sustainable development.

- Bank of China's Commitment: The bank is actively increasing its green finance offerings to support the 'Beautiful China' vision and national carbon reduction goals.

- Sectoral Impact: Environmental strategies are integrated across all sectors, promoting cleaner production and resource efficiency in alignment with national ecological objectives.

China's environmental policies are increasingly driving the financial sector towards sustainability, with a strong push for green finance. Bank of China is actively participating in this transition, aligning its operations with national goals for ecological protection and carbon reduction.

By the end of 2023, China's outstanding green loans reached approximately 32.4 trillion yuan, underscoring the significant growth in this sector. Bank of China itself issued around $10 billion in green and sustainable bonds in 2023, directly supporting projects aimed at achieving national carbon neutrality targets.

The bank is also focusing on managing climate-related financial risks, with regulators encouraging enhanced ESG disclosures by 2024. This proactive approach ensures that environmental factors are integrated into the bank's strategic planning and lending activities.

| Metric | Value (End 2023) | Source/Note |

| China Green Loans Outstanding | 32.4 Trillion Yuan | PBOC Data |

| Bank of China Green/Sustainable Bonds Issued | ~10 Billion USD | Bank of China Reports |

| China's Carbon Reduction Target (by 2030) | 65% reduction vs 2005 | National Climate Goals |

PESTLE Analysis Data Sources

Our Bank of China PESTLE Analysis is built on a robust foundation of data from authoritative sources, including official Chinese government publications, reports from international financial institutions like the IMF and World Bank, and reputable industry-specific research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the bank.