Bank of China Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of China Bundle

The Bank of China faces moderate bargaining power from its buyers, as switching costs for retail customers are relatively low, though corporate clients may have more entrenched relationships. Intense rivalry among domestic and international banks, coupled with the looming threat of new entrants leveraging digital technologies, significantly shapes its competitive landscape.

The complete report reveals the real forces shaping Bank of China’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Bank of China's primary suppliers are its capital sources, such as depositors and lenders. As a state-owned enterprise, its access to funding from the People's Bank of China and other state entities can mitigate the influence of other capital providers.

In 2024, the global financial landscape continued to emphasize the importance of diverse funding streams for major banks. For instance, while state backing provides a stable foundation, attracting substantial corporate and institutional deposits in competitive markets necessitates offering attractive interest rates and robust financial services.

Technology and infrastructure providers hold considerable sway over banks like Bank of China. These suppliers furnish essential software, hardware, and cybersecurity, forming the backbone of modern banking operations. For instance, in 2024, the global IT spending by financial services firms was projected to reach over $300 billion, highlighting the sheer volume of these critical purchases.

Specialized vendors, particularly those dealing in advanced areas like artificial intelligence or blockchain, can wield significant bargaining power. The high costs associated with switching these sophisticated systems, coupled with their integral role in Bank of China's digital transformation and global operations, mean that these tech providers are not easily replaced. This dependence can translate into more favorable terms for the suppliers.

Skilled employees, especially those in specialized fields like investment banking, risk management, and data analytics, are vital suppliers of expertise for the Bank of China. The intense global competition for top financial talent means these professionals hold significant bargaining power. For instance, in 2023, the average salary for a senior risk manager in major financial hubs like Hong Kong and Singapore could exceed $150,000 annually, reflecting this demand.

This leverage allows skilled individuals to command competitive compensation packages and robust career advancement paths. To secure the necessary human capital to achieve its strategic goals, Bank of China must actively invest in attractive remuneration and development programs, ensuring it remains an employer of choice in the financial sector.

Regulatory and Compliance Services

Bank of China, as a globally operating state-owned entity, faces extensive regulatory oversight. This reliance on external expertise for compliance means suppliers of regulatory and compliance services, including legal and auditing firms, hold considerable sway. Their specialized knowledge is crucial for navigating intricate international financial regulations, making their services indispensable.

The bargaining power of these suppliers is amplified by the critical nature of their work. Failure to comply with regulations can result in severe penalties and reputational damage for Bank of China. For instance, in 2024, financial institutions globally faced increased scrutiny and fines related to anti-money laundering (AML) and know-your-customer (KYC) regulations, underscoring the importance of expert compliance services.

- Specialized Expertise: Suppliers possess unique knowledge of complex global financial regulations.

- Critical Functionality: Compliance services are essential for operational legality and risk mitigation.

- High Switching Costs: Changing providers can be costly and time-consuming due to the need for re-establishing trust and understanding of internal processes.

- Limited Substitutes: Few entities can offer the same depth of specialized regulatory guidance.

Payment Network and Clearing System Providers

Payment network and clearing system providers wield significant bargaining power over banks like the Bank of China. These entities, including SWIFT and various domestic clearing houses, offer critical infrastructure for international and domestic transactions, making their services essential for the Bank of China's operations. Their indispensability means that any changes in fees or service availability directly affect the bank's cost structure and operational efficiency.

The global payment system is highly concentrated, with a few key players dominating. For instance, SWIFT, the Society for Worldwide Interbank Financial Telecommunication, serves as a vital messaging network for over 11,000 financial institutions in more than 200 countries. This widespread adoption underscores the dependence of major banks on such networks for facilitating cross-border payments, a core function for institutions like the Bank of China involved in international trade and investment.

- Essential Infrastructure: Providers of global payment networks and clearing systems are fundamental to a bank's ability to process transactions, especially in international trade.

- Limited Alternatives: While some alternatives exist, the established networks often offer unparalleled reach and integration, limiting a bank's ability to switch easily.

- Cost Impact: Increased fees or service disruptions from these providers directly translate to higher operating costs and potential inefficiencies for the Bank of China.

The bargaining power of suppliers for Bank of China is moderate, influenced by the critical nature of their services and the availability of alternatives. While state backing offers a degree of insulation, the bank must still manage relationships with technology providers, skilled labor, and regulatory consultants.

In 2024, the demand for specialized financial talent remained high, with banks like Bank of China competing for expertise in areas such as AI and cybersecurity. This competition grants significant leverage to skilled professionals, necessitating competitive compensation and development opportunities to attract and retain them.

Furthermore, the reliance on global payment networks like SWIFT highlights the supplier power in this sector. With SWIFT connecting thousands of financial institutions worldwide, its indispensability for international transactions positions it as a key supplier with considerable influence over transaction costs and operational efficiency for entities like Bank of China.

| Supplier Category | Bargaining Power Factor | 2024 Relevance/Example |

|---|---|---|

| Capital Sources (Depositors/Lenders) | Moderate (State backing mitigates) | Global interest rate hikes in 2024 influenced deposit rates, requiring competitive offerings. |

| Technology & Infrastructure Providers | High (Specialized, high switching costs) | Financial services IT spending projected over $300 billion globally in 2024, showing dependence. |

| Skilled Employees (e.g., Risk Managers) | High (Intense competition for talent) | Senior risk manager salaries in major hubs exceeded $150,000 annually in 2023. |

| Regulatory & Compliance Services | High (Specialized knowledge, critical function) | Increased fines for AML/KYC non-compliance in 2024 underscored the value of expert services. |

| Payment Networks (e.g., SWIFT) | High (Essential infrastructure, limited alternatives) | SWIFT connects over 11,000 institutions, vital for Bank of China's international operations. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Bank of China's position in the global financial services industry.

Instantly assess competitive intensity across all five forces, empowering swift strategic adjustments for the Bank of China.

Customers Bargaining Power

Individual retail customers at Bank of China typically have low bargaining power. This is because most banking products are standard, and each customer's individual transactions are relatively small. For instance, in 2023, the average retail deposit balance for many large banks remained in the tens of thousands of yuan, highlighting the limited individual leverage.

While switching banks for basic accounts might seem easy, factors like convenience, the established trust in a state-owned institution like Bank of China, and the availability of a wide range of integrated services often make customers hesitant to move. This stickiness, even if not a direct financial cost, reduces their effective bargaining power.

However, the sheer size of Bank of China's retail customer base, which numbered in the hundreds of millions by the end of 2023, gives them collective leverage. If widespread dissatisfaction arises, this large group can exert influence through coordinated actions, such as mass account closures or negative publicity, impacting the bank's reputation and profitability.

Large corporations, state-owned enterprises, and institutional clients hold substantial sway due to the sheer volume and complexity of their financial dealings with the Bank of China. These sophisticated entities, often possessing dedicated finance teams, can effectively negotiate for better pricing, bespoke financial solutions, and specialized service. For instance, in 2023, the Bank of China reported significant revenue from its corporate banking segment, underscoring the importance of these high-value relationships.

Government entities, as significant clients for Bank of China, wield considerable bargaining power. As a state-owned institution, Bank of China is deeply intertwined with national economic strategies, meaning government agencies often dictate terms for services, especially in areas like public finance management or infrastructure project financing. For instance, in 2024, government-backed initiatives often require specific pricing structures or preferential treatment, directly impacting the bank's profitability on these accounts.

Small and Medium-sized Enterprises (SMEs)

Small and Medium-sized Enterprises (SMEs) present a varied landscape for the Bank of China, with their bargaining power differing significantly. While a single SME might not wield substantial influence, their collective economic contribution, especially in driving job creation and innovation, often garners attention. For instance, in 2024, SMEs continued to be a cornerstone of China's economic development, contributing a substantial portion to GDP and employment, which incentivizes policy support and can translate into more favorable banking terms.

The Bank of China, like other major financial institutions, actively seeks to serve the SME sector. This competitive environment, where multiple banks vie for SME clients, can empower these businesses, particularly when negotiating loan conditions, interest rates, and service fees. However, this power is often tempered by the SMEs' inherent reliance on external financing, making them sensitive to the overall availability and cost of credit.

- Diverse Bargaining Power: Individual SMEs have limited leverage, but their aggregate economic impact can increase their collective bargaining strength.

- Government Support & Competition: Policies aimed at supporting SMEs and inter-bank competition can lead to better terms for these businesses.

- Reliance vs. Influence: While SMEs need bank financing, their crucial role in the economy grants them some negotiation power, particularly on loan terms.

- SME Contribution: In 2024, SMEs remained vital for China's economic growth, underscoring their importance to banks.

Global Trade and Investment Clients

Global trade and investment clients, such as multinational corporations and cross-border investors, possess substantial bargaining power. These entities, often dealing with high-value transactions and requiring intricate financial solutions, can negotiate for favorable foreign exchange rates, trade finance terms, and investment banking services. For instance, in 2024, the total value of global trade in goods and services reached trillions of dollars, highlighting the scale of these clients' operations and their leverage.

Bank of China’s specialized expertise in servicing these sophisticated clients is a critical competitive advantage. However, this also means the bank must consistently meet the elevated expectations of these demanding customers. The sheer volume of international transactions, estimated to be in the hundreds of trillions annually in recent years, underscores the significant financial influence these clients wield.

- High Transaction Values: Clients engaging in global trade and investment often handle substantial sums, giving them leverage in negotiations.

- Demand for Specialized Services: The complexity of international finance requires tailored solutions, which clients can demand from providers.

- Competitive Market: The presence of multiple financial institutions offering similar services intensifies competition, further empowering clients.

- Global Reach: The international footprint of these clients allows them to switch between financial providers based on terms and conditions.

The bargaining power of customers for Bank of China varies significantly across different segments. While individual retail customers generally have low leverage due to the standardized nature of products and small transaction sizes, large corporate clients and government entities wield considerable influence. This is driven by the volume and complexity of their business, as well as strategic importance.

| Customer Segment | Bargaining Power | Key Factors |

| Retail Customers | Low | Standardized products, small transaction volumes, convenience, trust. |

| Large Corporations & SOEs | High | High transaction volumes, complex financial needs, dedicated finance teams, bespoke solutions. |

| Government Entities | High | Strategic importance, public finance management, infrastructure financing, policy influence. |

| SMEs | Moderate | Collective economic contribution, competition among banks, reliance on financing. |

| Global Trade & Investment Clients | High | High-value transactions, intricate financial solutions, international reach, specialized service demand. |

Preview Before You Purchase

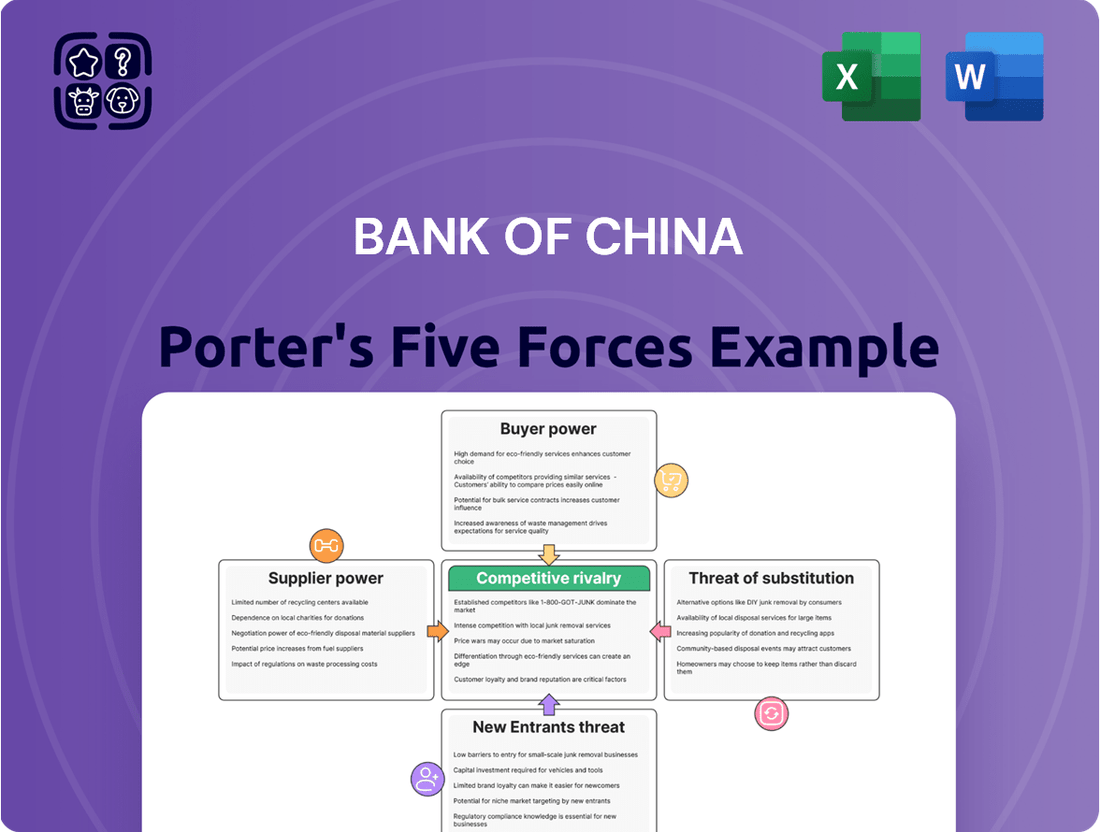

Bank of China Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of the Bank of China, detailing its competitive landscape and strategic positioning. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, containing an in-depth examination of industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitute products. Rest assured, there are no placeholders or generic content; you are viewing the complete, ready-to-use analysis that will be instantly available for your use.

Rivalry Among Competitors

The competitive rivalry among state-owned banks, including Bank of China, is significant. These giants, while aligned with national goals, fiercely compete for market dominance in high-value areas such as corporate lending, international trade finance, and wealth management.

This rivalry often plays out through enhanced service quality, advancements in digital banking, and unique product offerings rather than overt price reductions. Implicit state coordination and regulatory frameworks tend to moderate aggressive pricing strategies, shifting the competitive battleground to innovation and customer experience.

In 2024, the combined assets of China's five largest state-owned commercial banks, which include Bank of China, exceeded 100 trillion RMB, underscoring their substantial market presence and the scale of their competitive endeavors.

Beyond the dominant state-owned 'Big Four,' Bank of China faces intensifying competition from a dynamic landscape of joint-stock commercial banks and a multitude of city commercial banks. These entities often demonstrate greater operational flexibility and a more aggressive approach to capturing market share, particularly within specialized segments.

These agile competitors are frequently at the forefront of technological adoption and innovative service delivery. For instance, many joint-stock banks have been quick to roll out advanced digital banking platforms and personalized financial products, directly challenging the traditional customer relationships of larger institutions. This rapid innovation allows them to effectively target specific customer demographics or geographic areas where Bank of China's presence might be less concentrated, thereby fragmenting the market and increasing overall competitive intensity.

Foreign banks, while holding a smaller portion of the overall Chinese market, significantly intensify competition, especially in specialized segments like investment banking and wealth management. For instance, in 2023, foreign banks' share of total assets in China's banking sector remained modest, yet their influence in areas catering to high-net-worth individuals and cross-border financial activities is notable, pushing domestic players like Bank of China to innovate.

These international institutions frequently introduce global best practices, cutting-edge financial products, and advanced risk management frameworks. This influx compels Bank of China to continually refine its international service offerings and bolster its overall competitiveness to meet evolving client expectations and global standards.

Disruption from Fintech Companies

Fintech companies are significantly intensifying competitive rivalry for Bank of China. While not licensed banks, they provide services that directly challenge traditional banking offerings, including mobile payments, online lending, and digital wealth management. For instance, Ant Group's Alipay and Tencent's WeChat Pay have captured a substantial share of China's digital payment market, forcing established banks to adapt rapidly.

These fintech giants leverage vast user bases and cutting-edge technology to offer seamless and often lower-cost financial solutions. This competitive pressure necessitates that Bank of China accelerates its digital transformation initiatives. The bank must invest heavily in new technologies and cultivate its own digital financial ecosystems to maintain customer loyalty and market relevance in this evolving landscape.

- Fintech Market Share: By the end of 2023, digital payment transaction volumes in China handled by non-bank entities, primarily fintech platforms, exceeded trillions of yuan, demonstrating their significant market penetration.

- Digital Investment: Bank of China has publicly committed billions of dollars towards its digital infrastructure upgrades and the development of new fintech-driven products and services through 2025.

- Customer Adoption: Surveys in early 2024 indicated that over 70% of Chinese consumers now prefer mobile payment solutions, a trend largely driven by fintech innovation.

- Competitive Response: Bank of China's own digital banking app saw a 25% increase in active users in 2023, reflecting its efforts to counter fintech competition.

Regulatory Environment and Policy Influence

The regulatory environment in China significantly shapes the competitive landscape for banks like Bank of China. Government policies aimed at financial stability, such as capital adequacy requirements and lending restrictions, directly impact how banks operate and compete. For instance, in 2023, China's banking sector saw continued regulatory focus on risk management and asset quality, influencing lending growth and profitability across all institutions.

Policies that support specific industries or national economic goals, like those favoring green finance or technological innovation, can create distinct competitive advantages or disadvantages. Bank of China, as a state-owned enterprise, is often a key instrument in implementing these national priorities. This alignment can offer preferential access to certain markets or funding, but it also means adhering to directives that might not align with purely commercial objectives, thereby influencing its strategic flexibility compared to privately held competitors.

- Government Influence: China's financial sector is heavily guided by state policies, impacting competitive dynamics.

- Policy Impact: Regulations on financial stability, industry support, and digitalization are key drivers of competition.

- State-Owned Advantage/Constraint: Bank of China's state ownership aligns it with national goals, providing strategic advantages but also imposing operational constraints.

Competitive rivalry for Bank of China is intense, stemming from both domestic and international players, including agile joint-stock banks and influential fintech firms. These competitors often drive innovation in digital services and specialized financial products, forcing Bank of China to adapt. For example, by early 2024, over 70% of Chinese consumers preferred mobile payments, a trend largely fueled by fintech companies.

Foreign banks, though smaller in market share, add pressure in niche areas like investment banking. Bank of China's response includes significant digital transformation investments, with billions committed through 2025 to enhance its technological infrastructure and offerings. This strategic push aims to maintain customer relevance and market position against these varied competitive forces.

| Competitor Type | Key Competitive Actions | Impact on Bank of China | 2023/2024 Data Point |

|---|---|---|---|

| State-Owned Banks | Market dominance, corporate lending, international finance | Significant rivalry, implicit coordination moderates price wars | Combined assets > 100 trillion RMB |

| Joint-Stock & City Commercial Banks | Operational flexibility, digital banking, specialized segments | Intensifying competition, market share capture | Rapid adoption of digital platforms |

| Foreign Banks | Global best practices, investment banking, wealth management | Pressure to innovate international offerings | Modest asset share, but high influence in niches |

| Fintech Companies | Mobile payments, online lending, digital wealth management | Direct challenge to traditional services, customer base erosion | >70% consumer preference for mobile payments (early 2024) |

SSubstitutes Threaten

Digital payment platforms and e-wallets, such as Alipay and WeChat Pay, present a significant threat of substitution for traditional banking services. These platforms have captured a substantial portion of daily transactions in China, with WeChat Pay alone processing billions of transactions daily. Their user-friendly interfaces and integrated functionalities, from peer-to-peer transfers to wealth management, directly compete with core banking offerings.

Large corporations increasingly bypass traditional banking channels by accessing capital directly through bond issuances and equity offerings. In 2024, global bond issuance reached trillions of dollars, demonstrating this trend. This disintermediation directly competes with commercial banks like Bank of China for lending business, particularly for well-established entities.

Investment banks and securities firms play a crucial role in facilitating these direct capital market accesses, offering alternatives to bank loans. While Bank of China's own investment banking division can capture some of this activity, the underlying shift for large borrowers to manage their own financing needs represents a significant substitution threat to its core lending operations.

Peer-to-peer (P2P) lending and crowdfunding platforms, while significantly scaled back in China due to regulatory actions, historically offered a viable substitute for traditional bank financing. These platforms provided alternative avenues for small businesses and individuals who found it challenging to access credit from conventional banking channels.

Despite a reduction in their overall market presence, the fundamental principle of direct lending and community-based funding persists. This underlying concept continues to represent a potential alternative for specific financing requirements, thereby challenging the Bank of China's traditional dominance in lending.

Non-Bank Financial Institutions (NBFIs)

The threat of substitutes for Bank of China is significant due to a wide array of Non-Bank Financial Institutions (NBFIs). These include asset management companies, insurance firms, trust companies, and securities brokers, all offering financial products that can directly compete with traditional bank deposits and investment offerings. For example, wealth management products from these NBFIs can often present more attractive returns or features compared to standard bank savings accounts.

Bank of China must therefore remain agile and continuously innovate its product portfolio to effectively compete. The sheer diversity of NBFIs means that Bank of China faces competition across various customer segments and financial needs. In 2023, the total assets managed by Chinese NBFIs saw substantial growth, indicating their increasing market presence and ability to draw capital away from traditional banking channels.

- Asset Management Companies: Offer diversified investment portfolios, often with higher risk-adjusted returns than simple bank deposits.

- Insurance Firms: Provide savings-linked insurance products that combine investment and protection, appealing to risk-averse customers.

- Securities Brokers: Facilitate direct investment in capital markets, allowing customers to bypass banks for equity and bond trading.

- Trust Companies: Manage wealth and assets through specialized trust structures, catering to high-net-worth individuals seeking bespoke financial solutions.

Central Bank Digital Currencies (CBDCs) and Stablecoins

Central Bank Digital Currencies (CBDCs), such as China's e-CNY, represent a significant threat of substitution for traditional commercial bank deposits and payment services. The e-CNY pilot programs have seen substantial growth, with over 264 million individual accounts registered by the end of 2023, indicating a potential shift in how consumers and businesses conduct transactions.

While CBDCs are expected to work alongside the existing financial infrastructure, their direct functionality could diminish the reliance on commercial bank accounts for everyday payments and savings. This could impact fee income and customer relationships for banks. Furthermore, the increasing development and potential widespread adoption of private stablecoins, pegged to fiat currencies, offer another avenue for value transfer that bypasses traditional banking channels.

The threat intensifies as these digital alternatives become more user-friendly and gain regulatory clarity. For instance, by mid-2024, several major cities in China have expanded e-CNY usage to cover public transportation and utility payments, demonstrating a growing integration into daily life.

- CBDC Adoption: China's e-CNY has seen significant user growth, reaching over 264 million individual accounts by the end of 2023.

- Payment Service Substitution: CBDCs could reduce reliance on commercial bank accounts for everyday transactions, impacting fee revenue.

- Stablecoin Potential: Widely adopted stablecoins offer alternative value transfer mechanisms, posing a long-term substitutive threat to traditional banking services.

The threat of substitutes for Bank of China is substantial, driven by evolving digital payment ecosystems and direct access to capital markets. Digital platforms like Alipay and WeChat Pay handle billions of daily transactions, offering seamless payment and wealth management features that directly compete with traditional banking services. Furthermore, large corporations increasingly bypass banks by issuing bonds and equities, a trend evidenced by trillions in global bond issuance in 2024, directly impacting commercial lending.

Non-Bank Financial Institutions (NBFIs), including asset managers and insurance firms, also pose a significant threat by offering competitive investment products, with total assets managed by Chinese NBFIs growing substantially in 2023. Central Bank Digital Currencies (CBDCs), like China's e-CNY, are another potent substitute, with over 264 million individual accounts by end-2023, potentially reducing reliance on commercial bank accounts for payments and savings.

| Substitute Category | Examples | Impact on Bank of China | Key Data Point (2023/2024) |

| Digital Payment Platforms | Alipay, WeChat Pay | Reduced transaction volume and fee income | WeChat Pay: Billions of daily transactions |

| Direct Capital Markets | Bond Issuance, Equity Offerings | Loss of corporate lending business | Global Bond Issuance: Trillions of dollars (2024) |

| Non-Bank Financial Institutions (NBFIs) | Asset Managers, Insurance Firms | Competition for deposits and investments | Chinese NBFI Assets: Substantial growth (2023) |

| Central Bank Digital Currencies (CBDCs) | e-CNY | Reduced reliance on bank accounts for payments | e-CNY Accounts: 264 million+ individuals (end-2023) |

Entrants Threaten

The threat of new entrants into China's banking sector is significantly dampened by high regulatory barriers and substantial capital requirements. Aspiring banks face stringent licensing processes, demanding capital adequacy ratios, and intricate compliance mandates. For instance, in 2024, the China Banking and Insurance Regulatory Commission (CBIRC) continued to enforce rigorous capital requirements, with major banks maintaining core tier-1 capital ratios well above the regulatory minimums, often exceeding 10%.

These formidable entry hurdles make it exceedingly challenging for new domestic or international players to gain a foothold and compete effectively with established institutions like Bank of China. The sheer scale of capital needed to meet regulatory demands and build a competitive infrastructure deters many potential entrants, thereby protecting incumbent banks from disruptive competition.

Established banks, including Bank of China, leverage significant economies of scale, with extensive branch networks and deeply entrenched customer bases. In 2023, Bank of China operated over 10,000 domestic outlets, a scale that new entrants would find incredibly costly to match. This existing infrastructure creates a substantial barrier, as replicating such reach and operational efficiency requires massive upfront capital investment, putting new players at a distinct cost disadvantage.

Bank of China's status as a state-owned enterprise significantly bolsters its brand recognition and customer trust, especially in China where stability is highly valued. New entrants face a steep uphill battle to replicate this entrenched confidence, which typically demands extensive and sustained marketing investments alongside a proven history of reliable service delivery.

Technological and Data Capabilities

The threat of new entrants in banking, particularly those leveraging technology, is tempered by the massive investments already made by established players like Bank of China. While fintechs can be nimble, they face the daunting task of replicating the extensive IT infrastructure, advanced data analytics, and robust cybersecurity that incumbents have built over years. For instance, as of 2024, major banks continue to allocate significant portions of their operating budgets to technology upgrades, aiming to enhance customer experience and operational efficiency.

New digital-first entrants would need to not only develop sophisticated technological platforms but also amass comparable datasets to offer personalized services and effectively manage the inherent risks in financial operations. Building this level of data capability and technological maturity from scratch represents a substantial barrier.

- Significant IT Investment: Established banks like Bank of China have made multi-billion dollar investments in IT systems, creating a high initial cost for new entrants.

- Data Accumulation Challenge: New players must acquire vast amounts of customer data to match the personalized service capabilities of incumbents.

- Cybersecurity Demands: The need for advanced cybersecurity infrastructure to protect sensitive financial data presents a considerable hurdle for emerging fintechs.

Government Support and Strategic Importance

As a state-owned enterprise, Bank of China (BOC) enjoys significant government backing, which acts as a substantial barrier to new entrants. This support can manifest as favorable regulatory treatment, preferential access to capital, and alignment with national economic strategies. For instance, in 2023, BOC played a key role in facilitating cross-border RMB transactions, a strategic priority for China. New entrants, lacking this deep-rooted government affiliation, struggle to replicate the scale and influence BOC wields.

The strategic importance of BOC to the Chinese economy further deters new competition. Its role in supporting key industries and implementing monetary policy creates an environment where new players find it exceptionally difficult to gain traction. In 2024, BOC continued its focus on supporting green finance initiatives, a sector heavily influenced by government directives. This inherent advantage makes it challenging for any new financial institution to compete on a level playing field.

- Government backing provides implicit guarantees and access to favorable funding.

- BOC's alignment with national development goals creates strategic advantages.

- New entrants lack the established relationships and policy support enjoyed by BOC.

- The state-owned nature of BOC creates an uneven playing field, limiting the threat of new entrants.

The threat of new entrants into Bank of China's market is low due to substantial capital requirements and stringent regulatory oversight, with new banks needing to meet high capital adequacy ratios as enforced by regulators in 2024. Established players like Bank of China benefit from massive economies of scale, operating extensive branch networks that are prohibitively expensive for newcomers to replicate, with Bank of China having over 10,000 domestic outlets in 2023. Furthermore, Bank of China's state-owned status fosters deep customer trust and brand recognition, a difficult advantage for new entrants to build without significant and sustained investment.

| Barrier | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | High minimum capital to operate | Deters new players due to substantial upfront investment | Major banks maintained CET1 ratios >10% in 2024 |

| Economies of Scale | Cost advantages from large-scale operations | Makes it difficult for new entrants to match pricing and efficiency | Bank of China had >10,000 domestic outlets in 2023 |

| Brand Loyalty & Trust | Customer preference for established, reliable institutions | Requires significant marketing and time to build comparable trust | State-owned status enhances perceived stability |

| Regulatory Hurdles | Complex licensing and compliance procedures | Increases time-to-market and operational costs for new entrants | Ongoing stringent licensing by CBIRC |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank of China is built upon a foundation of comprehensive data, including the bank's official annual reports, investor relations disclosures, and filings with regulatory bodies like the China Banking and Insurance Regulatory Commission (CBIRC).