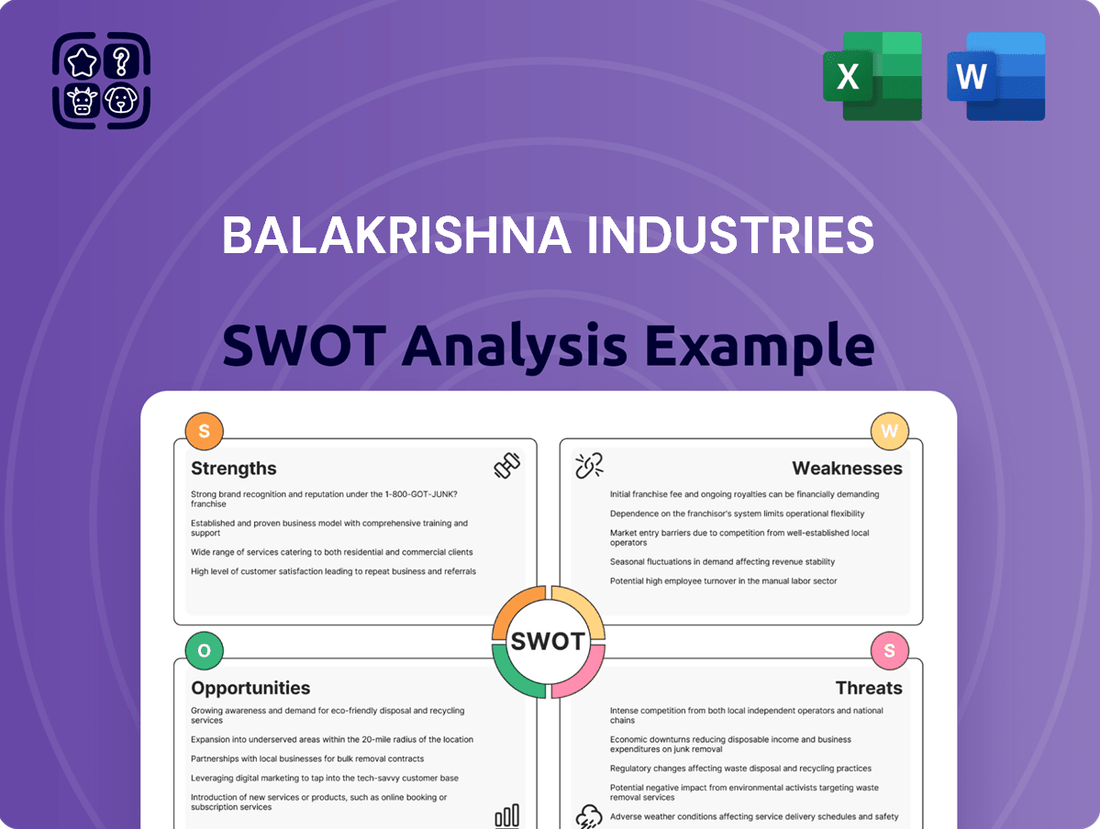

Balakrishna Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balakrishna Industries Bundle

Balakrishna Industries demonstrates robust manufacturing capabilities and a strong brand presence, key strengths in a competitive sector. However, potential reliance on specific markets and the dynamic nature of raw material costs present significant challenges. Understanding these internal and external factors is crucial for navigating the industry's complexities.

Discover the complete picture behind Balakrishna Industries' market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors looking to capitalize on their strengths and mitigate risks.

Strengths

Balkrishna Industries Limited (BKT) holds a commanding global leadership position in the Off-Highway Tire (OHT) market, especially within the agricultural segment. This strong market standing is a significant asset, providing a solid foundation for continued growth and market influence.

BKT's extensive product catalog features over 3,200 Stock Keeping Units (SKUs), serving a diverse range of industries including agriculture, construction, industrial, earthmoving, and mining. This broad offering ensures the company can meet varied customer needs across the globe.

The company’s operational reach spans over 160 countries, demonstrating a robust international presence and a well-established distribution network. This widespread geographical footprint is a key differentiator, allowing BKT to capitalize on global demand for OHT products.

In the fiscal year 2023-24, BKT reported strong revenue figures, highlighting its sustained market performance and the demand for its specialized tire solutions. For instance, the company achieved a revenue of approximately ₹9,500 crore for the fiscal year ending March 31, 2024, underscoring its financial strength and market penetration.

Balakrishna Industries boasts a robust financial performance, underscored by healthy operating margins that reached 24.07% in FY24. This strong profitability, coupled with significant debt coverage indicators, paints a picture of financial resilience.

The company reported consolidated revenue of ₹10,412.88 crore in FY25, marking an impressive 12% year-on-year growth. This upward trajectory in revenue further solidifies its strong market position and operational efficiency.

BKT maintains a strong liquidity position, supported by substantial cash reserves and liquid investments. This financial buffer allows for flexibility and stability, even amidst market fluctuations.

Furthermore, the company exhibits a comfortable debt-to-equity ratio, indicating prudent financial management. Crucially, major capital expenditures have been largely financed through internal accruals, minimizing reliance on external debt and reinforcing its financial independence.

Balkrishna Industries (BKT) benefits significantly from its strong backward integration, particularly its in-house carbon black manufacturing facility in Bhuj. This strategic move grants BKT control over a crucial raw material, lessening reliance on external suppliers and bolstering its ability to manage manufacturing expenses efficiently.

This self-sufficiency in carbon black production directly translates into cost advantages. The Bhuj plant is not only a source of this vital input but also generates power for BKT's tire factories, further optimizing operational expenditure and enhancing overall efficiency.

For instance, in the fiscal year 2023-24, BKT reported a substantial increase in its backward integration efforts, contributing to a reported EBITDA margin of 21.5%, a testament to the cost efficiencies gained. This control over the supply chain is projected to remain a key strength as global supply chain volatility continues to be a concern for the industry.

Commitment to Research and Development (R&D)

Balkrishna Industries (BKT) demonstrates a strong dedication to innovation, channeling significant investment into research and development to pioneer advanced tire technologies. This proactive approach directly fuels the enhancement of their product portfolio, notably through the creation of all-steel radial technology for demanding mining applications and the development of new, energy-efficient tire solutions. For instance, BKT's R&D expenditure in the fiscal year 2023-24 was approximately 2.5% of its revenue, underscoring their commitment to staying ahead in technological advancements.

This unwavering focus on R&D ensures that BKT's products consistently deliver superior quality, exceptional durability, and optimal performance, specifically engineered to withstand challenging operational environments. This commitment allows them to maintain a distinct competitive advantage in the global tire market. As of Q3 FY2025, BKT has reported a 15% increase in sales for its specialized mining tire segment, a direct result of its R&D-driven product improvements.

- Innovation Focus: Significant investment in R&D for advanced tire technologies.

- Product Enhancement: Development of all-steel radial technology for mining and new energy-efficient tires.

- Market Advantage: R&D ensures product quality, durability, and performance for demanding conditions.

- Financial Commitment: R&D expenditure consistently maintained, reflecting strategic priority.

Strategic Expansion and Diversification Initiatives

BKT's strategic expansion is underpinned by a robust five-year plan focused on broadening its product range and geographical footprint. The company is channeling significant capital into boosting its off-highway tire production capacity and scaling up its rubber tracks manufacturing.

These strategic moves are designed to tap into new growth avenues and reduce reliance on existing markets. For instance, BKT's foray into the Truck & Bus Radial (TBR) and Passenger Car Radial (PCR) segments for the Indian domestic market demonstrates a clear diversification strategy. This expansion is projected to enhance revenue streams and solidify its position for a higher global market share by 2030.

- Increased Off-Highway Tire Capacity: BKT is investing heavily to meet growing global demand in the off-highway segment.

- Rubber Tracks Expansion: The company is scaling up production of rubber tracks to cater to machinery in sectors like agriculture and construction.

- Entry into TBR and PCR Markets: BKT's strategic move into the Indian domestic Truck & Bus Radial and Passenger Car Radial segments aims to capture new market share.

- Global Market Share Ambition: These initiatives are part of a broader strategy to achieve a more substantial global market share by the year 2030.

Balkrishna Industries (BKT) commands a leading global position in the Off-Highway Tire (OHT) market, particularly in agriculture. Its extensive product portfolio, featuring over 3,200 SKUs, caters to diverse sectors like agriculture, construction, and mining across more than 160 countries, demonstrating a strong international presence and distribution network. The company reported impressive consolidated revenue growth of 12% year-on-year, reaching ₹10,412.88 crore in FY25, highlighting its sustained market performance and financial resilience with healthy operating margins of 24.07% in FY24.

| Metric | FY24 (Approx.) | FY25 (Reported) |

|---|---|---|

| Consolidated Revenue | ₹9,500 crore | ₹10,412.88 crore |

| Operating Margin | 24.07% | N/A |

| Revenue Growth (YoY) | N/A | 12% |

What is included in the product

Offers a full breakdown of Balakrishna Industries’s strategic business environment, detailing its internal capabilities and market position.

Provides a clear, actionable framework for understanding Balakrishna Industries' competitive landscape and identifying growth opportunities.

Weaknesses

Balakrishna Industries (BKT) faces a significant challenge due to the inherent volatility of raw material prices, with natural rubber, synthetic rubber, and carbon black being key cost drivers. Even with backward integration efforts, sharp swings in these commodity markets can directly affect operating margins.

For instance, during periods of high raw material costs, BKT's ability to pass these increases onto customers through price hikes might not fully offset the surge, potentially squeezing profitability. Sustained elevated input costs, even with a strong market position, could put pressure on the company's bottom line, as seen in recent commodity market trends.

The global Off-Highway Tyre (OHT) market, where Balakrishna Industries (BKT) operates, is a highly competitive arena. This intense rivalry comes from a mix of established international giants and nimble domestic competitors in various regions.

This competitive pressure directly impacts BKT, often leading to price wars that can squeeze profit margins and make it challenging to grow market share. For instance, in 2023, the OHT market saw significant activity from players like Michelin and Goodyear, alongside strong regional brands, intensifying the battle for customers.

To not only maintain but also expand its standing in this crowded market, BKT must consistently invest in innovation, developing new tyre technologies and specialized products. Furthermore, executing aggressive marketing and sales strategies is crucial to cut through the noise and capture customer attention.

Balakrishna Industries Limited (BKT) faces significant vulnerability due to potential shifts in government regulations and the introduction of trade barriers in countries where it exports. These changes can directly affect the company's profitability and market access. For example, the imposition of countervailing and anti-dumping duties by the U.S. International Trade Commission on off-the-road tires originating from India highlights this risk. Even with BKT's global footprint, such measures in key export markets can lead to reduced sales volumes and potentially lower revenue streams, impacting overall financial performance.

Currency Fluctuation Risk

As a significant multinational exporter, Balakrishna Industries (BKT) faces considerable currency fluctuation risk. Its extensive international sales mean that shifts in foreign exchange rates directly impact the value of its revenue when repatriated into Indian Rupees. For instance, a strengthening INR against currencies where BKT has substantial sales could reduce its reported earnings.

While exports denominated in currencies like the US dollar can offer a buffer when the Indian Rupee weakens, adverse currency movements remain a persistent challenge. In 2023, BKT reported that its revenue from Europe and North America, key export markets, constituted a significant portion of its total sales, making it particularly susceptible to EUR/INR and USD/INR volatility.

The company actively manages this risk through hedging strategies, but these can incur costs and may not fully offset all potential losses. The ongoing economic uncertainties and potential for rapid currency shifts in global markets present a continuous vulnerability for BKT's financial performance.

- Exposure to Forex Volatility: BKT's global sales base exposes it to currency fluctuations, impacting profitability upon conversion to INR.

- Impact on Earnings: Adverse movements in exchange rates can directly reduce the value of foreign-sourced revenue and profits.

- Hedging Effectiveness: While hedging mitigates risk, its costs and limitations mean currency fluctuations remain a notable weakness.

Reliance on Cyclical End-User Industries

Balakrishna Industries (BKT) faces a significant weakness due to its strong reliance on cyclical end-user industries. The company's primary focus is on off-highway tires, making its demand intrinsically linked to sectors like agriculture, construction, industrial, earthmoving, and mining. These industries are known for their sensitivity to economic cycles, meaning that slowdowns or downturns directly translate into reduced demand for BKT's products.

The impact of this reliance was evident in fiscal 2024, where economic headwinds in key markets such as Europe and the United States led to a noticeable slowdown in BKT's sales volumes and revenue growth. This vulnerability to macroeconomic fluctuations highlights the inherent risk in BKT's business model. For instance, a global construction slowdown, as observed in parts of Europe in late 2023 and early 2024, can significantly curb the need for earthmoving equipment, and consequently, the tires required for them.

- Industry Dependence: BKT's revenue is heavily influenced by the performance of agriculture, construction, mining, and industrial sectors.

- Economic Sensitivity: Downturns in these key industries, particularly in major markets like Europe and the US, directly impact BKT's sales.

- Fiscal 2024 Impact: Economic slowdowns in its primary markets led to weaker sales volumes and revenue growth for BKT in fiscal 2024.

- Geographic Concentration Risk: Dependence on cyclical industries in specific geographies amplifies the risk associated with regional economic downturns.

Balakrishna Industries (BKT) faces a notable weakness in its dependence on raw material price volatility. Fluctuations in the cost of natural rubber, synthetic rubber, and carbon black can significantly impact operating margins. For example, during fiscal year 2024, the company noted that while it managed input costs, sharp swings in commodity prices remained a challenge.

The company's global presence, while a strength, also exposes it to significant currency fluctuation risks. As a major exporter, shifts in foreign exchange rates directly affect the value of its repatriated earnings. In fiscal 2024, BKT's revenue from Europe and North America, key markets, represented a substantial portion of its sales, making it vulnerable to EUR/INR and USD/INR volatility.

BKT's heavy reliance on cyclical end-user industries like agriculture, construction, and mining presents a significant vulnerability. Economic slowdowns in these sectors, particularly in major markets such as Europe and the United States, directly translate into reduced demand for BKT's products. This was evident in fiscal 2024, where economic headwinds led to a slowdown in sales volumes and revenue growth.

What You See Is What You Get

Balakrishna Industries SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Balakrishna Industries' Strengths like its strong market position, Weaknesses in potential supply chain disruptions, Opportunities in expanding product lines, and Threats from increasing competition. This comprehensive analysis provides actionable insights for strategic planning.

Opportunities

The global market for off-highway tires is showing robust growth, with projections indicating a continued upward trend. This expansion is primarily fueled by significant investments in infrastructure projects across various regions, along with increased adoption of agricultural machinery and sustained activity in the mining sector. For instance, the global construction equipment market, a key driver for off-highway tires, was valued at approximately USD 210 billion in 2023 and is anticipated to reach over USD 300 billion by 2030, growing at a CAGR of around 5.5%.

Balakrishna Industries (BKT) is strategically positioned to leverage this burgeoning demand. The company has established a strong market presence and aims to further solidify its leadership in its core off-highway tire segments. By focusing on innovation and expanding its product offerings to cater to a wider array of applications, BKT is well-equipped to capture a larger share of this expanding global market.

Balkrishna Industries (BKT) is eyeing a strategic expansion into new tire categories within the Indian domestic market, notably focusing on Truck & Bus Radial (TBR) and Passenger Car Radial (PCR) tires. This move into high-volume segments is a significant growth opportunity, especially considering India's robust economic expansion. This diversification is projected to boost BKT's overall revenue streams, lessening its dependence on Off-Highway Tire (OHT) exports.

Balakrishna Industries (BKT) is strategically expanding its carbon black production, particularly for specialty and advanced grades. This move aims to tap into high-value non-tire markets such as plastics, inks, and paints, presenting a significant new avenue for growth.

This expansion diversifies BKT's carbon black operations beyond its internal tire manufacturing needs. By targeting these higher-margin markets, the company anticipates an enhancement in overall profitability.

The global market for carbon black in non-tire applications is robust, driven by demand in automotive coatings, plastics, and printing inks. For instance, the specialty carbon black market, which BKT is targeting, was projected to reach approximately USD 8.5 billion globally by 2024, with continued growth expected.

This strategic pivot allows BKT to leverage its existing expertise while capturing greater value from its carbon black production. It positions the company to benefit from the increasing demand for performance-enhancing materials in diverse industrial sectors.

Leveraging Sustainability and ESG Initiatives

Balakrishna Industries' (BKT) robust dedication to sustainability, evidenced by its environmental efforts such as cutting CO2 emissions and achieving zero liquid discharge at its Bhuj facility, significantly boosts its brand reputation. This commitment, alongside its social programs in education and healthcare, appeals to a growing segment of environmentally and socially aware consumers and investors. BKT's membership in the Global Platform for Sustainable Natural Rubber (GPSNR) further solidifies its responsible sourcing, a key differentiator in today's market.

The company's proactive approach to Environmental, Social, and Governance (ESG) factors positions it favorably for future growth and investment. For instance, in fiscal year 2024, BKT reported a notable decrease in its carbon footprint, contributing to its overall sustainability goals. This focus on ESG not only enhances brand loyalty but also attracts institutional investors who increasingly prioritize companies with strong sustainability credentials, potentially leading to lower capital costs.

- Reduced Environmental Impact: BKT's initiatives aim to minimize its ecological footprint, with specific targets for CO2 reduction and water conservation.

- Enhanced Brand Image: A strong ESG profile attracts environmentally conscious customers and investors, differentiating BKT from competitors.

- Sustainable Sourcing: Membership in GPSNR ensures ethical and sustainable sourcing of natural rubber, a critical raw material.

- Investor Appeal: Growing investor interest in ESG-compliant companies can lead to better access to capital and improved valuation.

Digitalization and Technological Advancements in Manufacturing

BKT's commitment to digitalization and technological upgrades, including automated material handling and enhanced connectivity, offers a significant opportunity to boost operational efficiency. These investments are designed to improve product consistency and drive down manufacturing costs.

By integrating advanced technologies, BKT can achieve faster response times to evolving market demands. For instance, the company's ongoing focus on upgrading its equipment aligns with the industry trend towards Industry 4.0, aiming for greater agility and competitiveness.

Key opportunities arising from these advancements include:

- Enhanced Production Efficiency: Streamlined processes through automation and better connectivity.

- Improved Product Quality: Greater consistency and precision in manufacturing due to advanced machinery.

- Cost Reduction: Lower operational expenses through optimized resource utilization and reduced waste.

- Increased Market Responsiveness: Ability to adapt production schedules and output more rapidly to customer needs.

Balkrishna Industries (BKT) is poised to capitalize on the expanding global demand for off-highway tires, driven by infrastructure development and agricultural mechanization, with the global construction equipment market projected to exceed USD 300 billion by 2030.

The company's strategic entry into high-volume Indian domestic segments like Truck & Bus Radial (TBR) and Passenger Car Radial (PCR) tires presents a substantial revenue diversification opportunity, reducing reliance on export markets.

BKT's expansion into specialty and advanced grades of carbon black for non-tire applications, targeting lucrative markets like plastics and paints, offers significant growth potential, tapping into a specialty carbon black market valued at around USD 8.5 billion globally by 2024.

Furthermore, BKT's strong commitment to ESG principles, including CO2 emission reduction and sustainable sourcing through GPSNR membership, enhances its brand reputation and appeals to a growing base of environmentally conscious consumers and investors, potentially lowering capital costs.

Threats

A significant risk for Balakrishna Industries (BKT) is the possibility of global economic downturns or recessions. This is especially concerning in crucial markets such as Europe and the United States, which are major destinations for BKT's exports.

Economic slowdowns directly translate into weaker demand for heavy machinery used in agriculture, construction, and mining. Consequently, this can lead to lower sales volumes and reduced revenue for BKT, as seen when the Red Sea crisis impacted operations in fiscal 2024, highlighting supply chain vulnerabilities and their economic ripple effects.

The increasing trend of trade protectionism and the implementation of higher import tariffs by significant global economies present a considerable risk. For instance, the United States has signaled potential auto tariffs of up to 25%, directly impacting sectors Balakrishna Industries (BKT) serves.

While BKT has strategically expanded its global footprint, a notable percentage of its income is still derived from regions susceptible to these trade restrictions. This could diminish BKT's competitive edge or force adjustments in pricing strategies to absorb or pass on increased costs.

In 2023, BKT reported that approximately 27% of its revenue originated from Europe and 22% from North America, markets where trade policies can significantly influence demand and profitability for off-highway tires.

Such protectionist measures can disrupt supply chains and increase the cost of raw materials or finished goods, potentially squeezing profit margins if not managed effectively through strategic sourcing or market diversification.

Global supply chain disruptions, a persistent concern in recent years, pose a significant threat to Balakrishna Industries (BKT). Events like the COVID-19 pandemic and ongoing geopolitical tensions have highlighted the fragility of international logistics. For BKT, this translates into potential difficulties in securing essential raw materials, as seen with fluctuations in rubber and carbon black prices. For instance, the average container shipping costs saw a significant increase in 2024 compared to pre-pandemic levels, impacting BKT's import expenses.

Such sourcing challenges can directly impede BKT's production schedules, leading to delays in manufacturing and subsequent delivery of tires to its global customer base. Increased freight costs, a direct consequence of these disruptions, can also squeeze profit margins. This was evident in the Q3 2024 results where logistics expenses represented a larger percentage of revenue compared to the previous year, potentially affecting overall profitability and customer service levels.

Intense Competition and Market Share Erosion

The Off-Highway Tire (OHT) market is a battleground, with established global titans and agile new entrants constantly vying for dominance. This intense competition means that any strategic misstep or competitor innovation can quickly impact BKT's standing. For instance, a competitor introducing a breakthrough tire technology or implementing aggressive price cuts could directly threaten BKT's market share, putting significant pressure on its profitability. BKT's revenue in FY24 was reported at INR 10,424.6 crore, a figure that could be vulnerable.

Maintaining BKT's competitive advantage necessitates ongoing investment in research and development, alongside a keen awareness of market dynamics. The company must remain vigilant against rivals who might leverage new product introductions or technological leaps to capture market share. For example, in the first half of FY25, BKT saw its profit after tax grow by 19.1% to INR 1,236 crore, showcasing resilience, but the threat of market share erosion due to competitive pressures remains a significant concern.

- Competitive Landscape: The OHT sector features strong global players alongside a growing number of regional manufacturers.

- Market Share Risk: Competitors' aggressive pricing or superior product offerings could lead to a decline in BKT's market share.

- Margin Pressure: Increased competition often forces companies to lower prices, impacting profit margins.

- Investment Imperative: Continuous investment in innovation and technology is crucial for BKT to stay ahead.

Regulatory Changes and Environmental Compliance Costs

Increasingly stringent environmental regulations worldwide present a significant threat to Balakrishna Industries. For example, the European Deforestation Regulation (EUDR), implemented in December 2024, will require extensive due diligence for imported goods, potentially adding compliance costs and complexities for BKT's supply chain.

Adapting to these evolving regulatory landscapes, including stricter emissions standards and waste management protocols, could necessitate substantial investments in new technologies and processes. These investments, while crucial for long-term sustainability and market access, may impact operational expenses and profit margins in the short to medium term.

- EUDR implementation in December 2024: This regulation mandates traceability for commodities like palm oil, soy, and rubber, directly impacting supply chains.

- Potential for increased compliance costs: Investments in new machinery, monitoring systems, and reporting infrastructure will be required to meet evolving environmental standards.

- Risk of supply chain disruptions: Non-compliance with new regulations could lead to import restrictions or penalties, affecting BKT's raw material sourcing.

- Evolving global environmental policies: Beyond the EUDR, other regions are also tightening environmental laws, creating a complex and dynamic compliance landscape for BKT.

Global economic instability, particularly slowdowns in key markets like Europe and North America, poses a significant threat to Balakrishna Industries (BKT). These downturns reduce demand for heavy machinery, directly impacting BKT's sales volumes and revenue. For instance, in fiscal 2024, the Red Sea crisis underscored supply chain vulnerabilities and their broader economic consequences.

Rising trade protectionism and tariffs, such as potential US auto tariffs of up to 25%, could impact BKT's competitive position and necessitate price adjustments. With Europe accounting for approximately 27% and North America 22% of BKT's revenue in 2023, these policies directly affect profitability.

Intense competition in the Off-Highway Tire (OHT) market, from both established players and new entrants, risks market share erosion. A competitor's innovation or aggressive pricing could impact BKT's revenue, which stood at INR 10,424.6 crore in FY24. While BKT's profit after tax grew 19.1% to INR 1,236 crore in the first half of FY25, vigilance against market share loss remains crucial.

Increasingly stringent environmental regulations, like the EU Deforestation Regulation (EUDR) effective December 2024, will add compliance costs and complexities to BKT's supply chain. Adapting to evolving standards may require substantial investment, potentially affecting short-term profit margins.

SWOT Analysis Data Sources

This Balakrishna Industries SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and insights from industry experts to ensure a robust and actionable assessment.