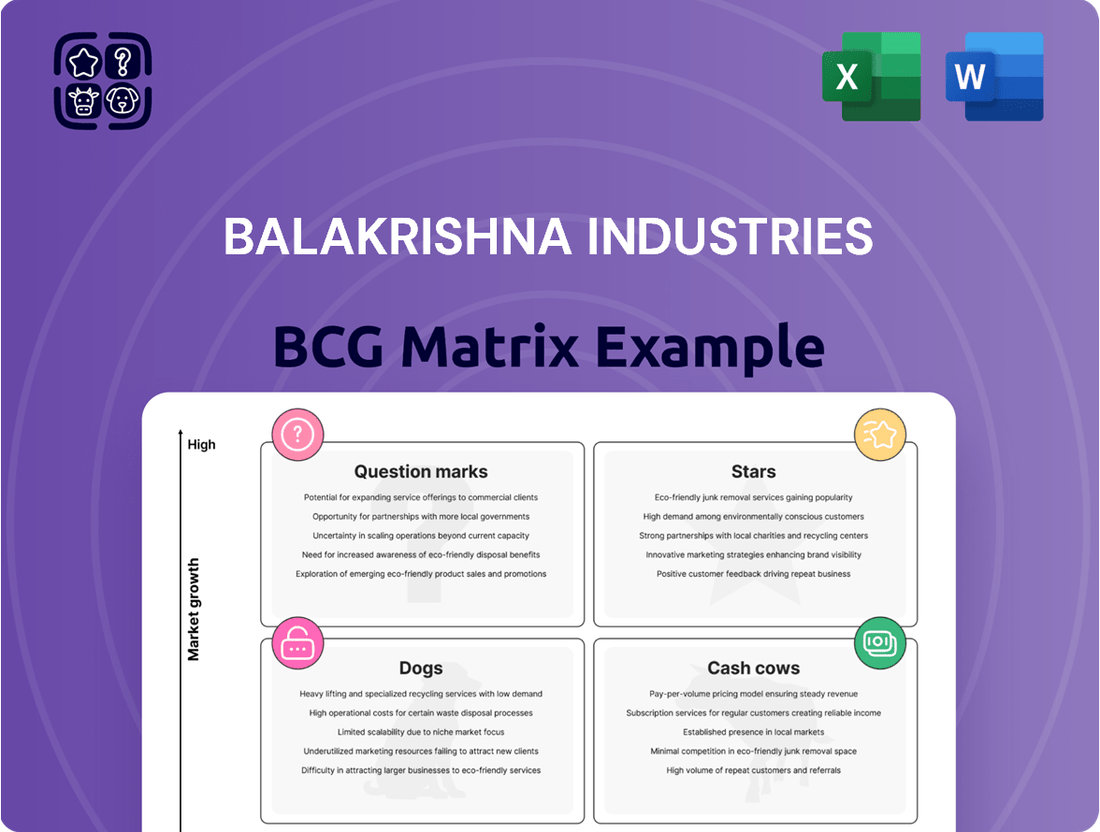

Balakrishna Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balakrishna Industries Bundle

Balakrishna Industries' product portfolio paints a compelling picture of market dynamics, with some offerings clearly leading the pack and others requiring careful consideration. Understanding which segments are fueling growth and which might be holding the company back is crucial for strategic planning.

This preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks, but to truly grasp the nuances and unlock actionable insights, you need the full picture. Don't just guess where your investments should go; know it.

Purchase the complete Balakrishna Industries BCG Matrix to receive a detailed breakdown of each product's position, enabling you to make informed decisions about resource allocation and future product development. Gain the clarity needed to navigate their market with confidence and secure a competitive edge.

Stars

Balkrishna Industries' advanced agricultural radial tires, like the AGRIMAX PROCROP and AGRIMAX SPARGO SB, are positioned as Stars in the BCG matrix. These tires are designed for the increasing demand in agriculture for machinery that is both high-performing and gentle on the soil. BKT's strong existing market share in this segment further solidifies their Star status.

The agricultural sector's ongoing mechanization fuels the demand for these specialized tires. For instance, the global agricultural tires market was valued at approximately USD 7.8 billion in 2023 and is projected to grow significantly. BKT's innovative tire technology directly addresses the need for improved efficiency and reduced soil compaction, key factors for modern farming practices.

Large Mining and Earthmoving Radial Tires are a clear Star in Balakrishna Industries' BCG Matrix. The company's focus on expanding its range of all-steel radial tires, especially those up to 57 inches, for demanding mining and earthmoving applications highlights this. This segment is thriving due to robust global mining and construction activity, fueled by infrastructure projects and the ongoing need for mineral resources.

BKT's commitment, including strategic investments and proprietary technology in this high-value market, positions these tires for significant market share growth. For instance, in 2023, the global construction equipment market was valued at approximately $220 billion, with mining equipment representing a substantial portion, and this sector is projected to continue its upward trajectory.

BKT's high-performance construction tires are engineered for exceptional durability and output in the toughest job sites. These advanced solutions are crucial for the booming global construction sector, particularly in emerging markets experiencing rapid development.

The market for robust Off-The-Highway (OHT) tires is experiencing substantial growth, driven by increased infrastructure spending worldwide. For instance, the global construction equipment market was valued at approximately USD 210 billion in 2023 and is projected to grow significantly in the coming years.

BKT's strong market position, bolstered by consistent investment in research and development for its construction tire range, positions it for continued expansion. This segment represents a significant star in the BCG matrix, exhibiting both high market share and high growth potential.

Specialized Forestry Tires

Specialized forestry tires represent a niche but growing segment for BKT, demanding extreme durability and unique traction. As mechanization increases in forestry and the demand for sustainable timber rises, this market is poised for continued expansion. BKT's focus on providing customized, high-quality solutions allows it to secure a strong foothold in this specialized area.

BKT's forestry tire offerings are designed to withstand the rigorous conditions of logging and timber harvesting. These tires are crucial for operational efficiency and safety in challenging terrains.

- Market Growth: The global forestry tire market is projected to grow, driven by increased demand for wood products and advancements in logging technology.

- BKT's Position: BKT has established itself as a key player by offering robust and reliable tires specifically engineered for forestry applications, contributing to its strong market presence.

- Technological Advancements: Continuous innovation in tire design, focusing on puncture resistance and enhanced grip, further solidifies BKT's competitive edge in this segment.

Off-Highway Radial Tires for Emerging Markets

Balakrishna Industries Limited (BKT) positions its Off-Highway Radial Tires for Emerging Markets as a Star in the BCG matrix. This strategic classification is driven by the significant growth potential and BKT's strong market position in these key regions.

The company's comprehensive range of radial off-highway tires is specifically tailored for the needs of rapidly developing economies, focusing heavily on Asia-Pacific and the Americas. These markets are experiencing robust expansion, fueled by substantial investments in infrastructure projects and increasing agricultural mechanization.

BKT's success in these Star segments is underpinned by its dedicated export strategy and a well-established distribution network. This allows the company to effectively penetrate and capture considerable market share in these dynamic and high-growth environments.

- Market Growth: Emerging markets in Asia-Pacific and the Americas are showing high growth rates, with some agricultural regions seeing double-digit percentage increases in machinery adoption annually.

- BKT's Position: BKT has secured a leading market share in specific off-highway radial tire segments within these emerging economies, often outperforming competitors due to product specialization.

- Investment Drivers: Infrastructure development, such as new road construction and mining operations, alongside the drive for greater agricultural efficiency, are primary catalysts for demand.

- Export Focus: BKT's global export sales constituted over 85% of its revenue in FY2023, with emerging markets representing a substantial and growing portion of this figure.

Balkrishna Industries' advanced agricultural radial tires, like the AGRIMAX PROCROP and AGRIMAX SPARGO SB, are positioned as Stars due to their strong market share and the high growth in agricultural mechanization. These tires cater to the increasing demand for high-performing, soil-friendly machinery, with the global agricultural tires market valued at approximately USD 7.8 billion in 2023.

Large Mining and Earthmoving Radial Tires are also Stars, driven by robust global mining and construction activity. BKT's expansion in all-steel radial tires up to 57 inches, catering to demanding applications, solidifies this. The construction equipment market, a significant part of which is mining equipment, was valued at roughly $220 billion in 2023.

BKT's high-performance construction tires are Stars, meeting the needs of the booming global construction sector, especially in developing regions. The demand for Off-The-Highway (OHT) tires is surging due to infrastructure spending, with the global construction equipment market valued at approximately USD 210 billion in 2023.

Specialized forestry tires represent a growing niche Star for BKT, demanding extreme durability and unique traction. The increasing mechanization in forestry and demand for sustainable timber are fueling market expansion. BKT's tailored, high-quality solutions are crucial for operational efficiency in challenging terrains.

Off-Highway Radial Tires for Emerging Markets are classified as Stars due to significant growth potential and BKT's strong position, particularly in Asia-Pacific and the Americas. These markets are expanding rapidly due to infrastructure investments and agricultural mechanization, with BKT's global exports exceeding 85% of revenue in FY2023.

| Product Category | BCG Matrix Classification | Key Growth Drivers | BKT's Market Position | Relevant Market Data (2023/2024 Estimates) |

|---|---|---|---|---|

| Agricultural Radial Tires | Star | Agricultural mechanization, demand for soil-friendly tech | Strong existing market share, innovative product lines | Global agricultural tires market: ~USD 7.8 billion |

| Large Mining & Earthmoving Radial Tires | Star | Global mining & construction activity, infrastructure projects | Expanding range of all-steel radial tires (up to 57 inches) | Global construction equipment market (incl. mining): ~USD 220 billion |

| Construction Tires (OHT) | Star | Infrastructure spending, rapid development in emerging markets | Strong market position, consistent R&D investment | Global construction equipment market: ~USD 210 billion |

| Specialized Forestry Tires | Star | Forestry mechanization, demand for sustainable timber | Key player with robust, reliable tires for logging | Growing global forestry tire market |

| Off-Highway Radial Tires (Emerging Markets) | Star | Infrastructure development, agricultural mechanization in APAC & Americas | Leading market share in specific segments within these economies | BKT's global exports: >85% of revenue (FY2023); significant growth in emerging markets |

What is included in the product

This BCG Matrix analysis for Balkrishna Industries clarifies which product segments are market leaders and which require strategic focus or divestment.

Balakrishna Industries' BCG Matrix offers a clear, actionable overview of its business units, relieving the pain of strategic uncertainty.

Cash Cows

Established agricultural bias tires represent a significant Cash Cow for Balakrishna Industries (BKT). Despite a market trend towards radial tires, BKT's bias tire offerings for conventional farming remain a cornerstone, enjoying widespread adoption and brand loyalty.

This segment, though mature with low growth, provides a steady stream of high cash flow. BKT benefits from strong brand equity, a robust distribution network, and deep market penetration in this area.

The minimal investment needed for these low-growth products allows BKT to efficiently extract profits, reinforcing their Cash Cow status. For instance, in the fiscal year ending March 2024, BKT reported a robust revenue, with a substantial portion likely attributable to these foundational agricultural products.

BKT's core industrial OHT portfolio acts as a solid Cash Cow within their business. These tires are essential for factory and material handling equipment, ensuring consistent demand from replacement needs and ongoing industrial operations.

This segment, while not growing rapidly, offers predictable revenue streams. For example, in 2023, BKT reported a robust performance in their Industrial segment, contributing significantly to their overall financial health, with a notable increase in sales volume for these foundational products.

BKT's strong market position and efficient manufacturing processes in this product category translate into healthy profit margins. This allows them to generate reliable cash flow, which can then be reinvested into other growth areas of the company.

Standard construction equipment tires represent a significant Cash Cow for Balakrishna Industries (BKT). These are the workhorse tires, found on excavators, loaders, and other everyday construction machinery. BKT has built a strong and lasting reputation in this segment, meaning they have a substantial and consistent share of the market.

This segment of the construction market is quite mature. Demand for these tires is steady, not experiencing rapid growth but remaining reliably high. Think of it like the demand for basic building materials; it's always there because construction is always happening, even if it’s not booming. In 2023, the global construction equipment tire market was valued at approximately USD 6.5 billion and is projected to grow at a modest CAGR of around 3.5% through 2030, highlighting its stable nature.

BKT's competitive edge in this area is clear. They’ve invested in efficient manufacturing and strong distribution networks, allowing them to offer quality products at competitive prices. This leads to consistent profitability and a dependable stream of cash for the company. Their strong brand recognition in this segment also commands pricing power, further boosting profit margins.

Replacement Market OHT Sales in Europe

BKT's aftermarket sales of off-highway tires in Europe represent a significant Cash Cow. This mature market, accounting for close to half of BKT's total export turnover, benefits from consistent replacement demand across agricultural, industrial, and construction sectors. The strong brand loyalty within Europe means BKT can rely on steady revenue streams with minimal need for extensive promotional spending.

Key aspects of this Cash Cow include:

- Dominant European Market Share: Europe is BKT's largest export market, underscoring its strength in this region.

- Consistent Replacement Demand: The ongoing need to replace tires on established fleets of machinery ensures predictable sales.

- High Revenue Generation: The sheer volume and consistent nature of European sales contribute substantially to BKT's overall profitability.

- Reduced Investment Needs: Mature market status and brand recognition allow for lower marketing and sales expenditures, maximizing profit margins.

Mature Earthmoving Tire Lines

Certain mature and well-entrenched earthmoving tire product lines, particularly those for standard equipment and applications, function as cash cows for Balakrishna Industries. While newer, larger mining tires might be considered Stars, the existing portfolio in stable earthmoving operations provides reliable cash flow. These products benefit from established customer relationships and predictable replacement cycles in a market segment that, while large, may experience slower growth compared to emerging niches. For instance, in 2024, the earthmoving segment continued to be a significant contributor to the company's revenue, reflecting the consistent demand for these established product lines.

These cash cow products are crucial for funding Balakrishna Industries' investments in growth areas. They represent a stable income stream, allowing the company to allocate resources effectively. The predictability of demand in the standard earthmoving sector underpins the cash cow status of these tire lines.

- Stable Revenue Generation: Mature earthmoving tire lines consistently generate predictable revenue due to established market presence and demand.

- Funding Growth Initiatives: Profits from these cash cows are reinvested into developing new products, such as those for emerging mining applications.

- Market Share Dominance: Balakrishna Industries holds a strong position in the standard earthmoving tire market, ensuring continued sales.

- Operational Efficiency: These product lines benefit from optimized manufacturing processes, contributing to healthy profit margins.

Balakrishna Industries' (BKT) established agricultural bias tires are a prime example of a Cash Cow. This segment, though mature, provides a steady and substantial cash flow due to strong brand loyalty and deep market penetration. BKT's robust distribution network further solidifies its position in this foundational product line. In fiscal year 2024, BKT reported strong overall revenue, with these bias tires continuing to be a significant contributor.

BKT's standard construction equipment tires also function as a Cash Cow. These are essential for everyday construction machinery and benefit from consistent replacement demand. The global construction equipment tire market, valued around USD 6.5 billion in 2023, is projected for modest growth, indicating the stability of this segment. BKT's efficient manufacturing and strong brand recognition ensure healthy profit margins and reliable cash generation from these tires.

The aftermarket sales of off-highway tires in Europe represent another significant Cash Cow for BKT. Europe, BKT's largest export market, consistently drives revenue through replacement demand across various sectors. The high brand loyalty in this mature market allows for reduced marketing expenditure, maximizing profit extraction. This segment's contribution to BKT's export turnover is substantial, underscoring its Cash Cow status.

Mature earthmoving tire product lines, especially for standard equipment, serve as Cash Cows for BKT, funding investments in growth areas like larger mining tires. These lines benefit from established customer relationships and predictable replacement cycles in a stable market. The earthmoving segment remained a significant revenue driver for BKT in 2024, highlighting the consistent demand for these established products.

| Cash Cow Segment | Market Maturity | Growth Rate | Cash Flow Generation | Investment Needs |

|---|---|---|---|---|

| Established Agricultural Bias Tires | Mature | Low | High, Steady | Low |

| Standard Construction Equipment Tires | Mature | Modest | High, Predictable | Low |

| European Aftermarket Off-Highway Tires | Mature | Low | High, Consistent | Very Low |

| Standard Earthmoving Tires | Mature | Low | High, Reliable | Low |

Preview = Final Product

Balakrishna Industries BCG Matrix

The Balakrishna Industries BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive document, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a ready-to-use analysis for your business planning needs.

Dogs

Specific Stock Keeping Units (SKUs) of older bias tires designed for niche applications or outdated machinery models are likely to be found in the Dogs quadrant of the BCG matrix. These tires often have a very low market share within a shrinking segment of the off-highway tire (OHT) market.

Products in this category generate minimal revenue and can lead to disproportionately high inventory or maintenance expenses. For instance, Balakrishna Industries, a major OHT manufacturer, might have certain bias tire SKUs that have seen demand significantly decrease due to technological advancements or shifts in the industries they serve.

These underperforming SKUs could be candidates for divestment or discontinuation to free up resources. In 2024, companies like Balakrishna Industries are increasingly focusing on high-performance radial tires, further marginalizing the demand for older bias tire technologies.

The financial burden of holding obsolete inventory for these niche bias tires can outweigh the small returns they generate, making them a clear liability in the company's product portfolio.

Within Balakrishna Industries (BKT), certain highly specialized, low-volume legacy products might fall into the Dogs category. These are typically tires for equipment that's no longer in mainstream production or for niche industrial uses with declining demand. For example, tires designed for older, specialized agricultural machinery or specific legacy construction equipment could fit this description.

These products often have a very small market share and minimal growth prospects, meaning they don't contribute significantly to BKT's overall revenue or future strategy. While they might still have a loyal, albeit small, customer base, their low volume means they consume resources—like manufacturing capacity and inventory management—without generating substantial returns for the company.

In 2023, BKT's overall growth was strong, with reported revenues reaching approximately €1.3 billion. However, within this strong performance, it's plausible that a small percentage of revenue derived from these legacy segments showed flat or negative growth, a hallmark of the Dogs quadrant in the BCG matrix. These products are not aligned with BKT's strategic push into high-growth segments like radial tires for agriculture and construction or their investments in advanced tire technologies.

Other High Technology (OHT) segments where BKT possesses a minor market share often fall into the Dogs category. Here, the company contends with intense, undifferentiated competition primarily driven by price. If BKT cannot differentiate itself through superior quality or brand recognition to justify higher pricing, these segments may struggle to achieve profitability, potentially operating at break-even or incurring losses.

These competitive Dog segments typically exhibit limited growth potential. The effort required to gain traction and generate meaningful returns can be disproportionately high, diverting resources from more promising business areas. For instance, in 2024, while the overall specialty tire market showed resilience, certain niche OHT applications saw price wars intensify, impacting margins for all players, including BKT.

Underperforming Small-Scale OEM Partnerships

Small-scale Original Equipment Manufacturer (OEM) partnerships that have not grown or consistently delivered substantial tire volumes can be categorized as Dogs in Balakrishna Industries' (BKT) portfolio. These are ventures where BKT’s market share for specific equipment tires is low, and the overall market segment for that equipment is stagnant or declining. Such partnerships can become cash traps, consuming valuable resources without offering significant strategic or financial returns. For instance, if BKT's supply to a niche agricultural equipment manufacturer, representing less than 1% of BKT's total revenue in 2024, is tied to an equipment segment that saw only a 0.5% growth in the same year, it highlights a potential Dog scenario.

Resources allocated to these underperforming OEMs, such as dedicated sales efforts or specialized product development, would be better redeployed to more promising areas of BKT's business. The lack of growth in these partnerships suggests a limited future potential, making continued investment a strategic misstep.

- Low Market Share: BKT’s position within the specific equipment segment is marginal.

- Stagnant Market Segment: The overall demand for the equipment these tires serve is not increasing.

- Resource Drain: Continued investment yields minimal strategic or financial benefits.

- Potential Divestment: Consideration may be given to divesting or deprioritizing these partnerships.

Certain Legacy Lawn and Garden Tire Lines

Certain legacy lawn and garden tire lines from Balakrishna Industries (BKT) could be considered potential Dogs in the BCG matrix. This is particularly true if these specific product lines operate in very low-growth or even declining market segments within the broader lawn and garden sector. BKT's market share in these niche areas might be limited, hindering their ability to gain significant traction or achieve economies of scale.

These legacy products may not receive the same level of investment in research and development or the same marketing push as BKT's more strategically important Off-Highway Tire (OHT) segments. This lack of focus can lead to stagnation, with minimal profitability and a reduced capacity to adapt to evolving market demands. For instance, if a particular tire size or tread pattern designed for older equipment has seen a sharp decline in new equipment sales, it would fit the Dog profile.

- Market Share: Potentially low in specific, aging lawn and garden sub-segments.

- Market Growth: Operates in very low-growth or declining sectors.

- Profitability: Likely minimal due to low volume and lack of competitive advantage.

- Strategic Focus: Receives less R&D and marketing investment compared to core segments.

Products categorized as Dogs within Balakrishna Industries (BKT) represent those with a low market share in slow-growing or declining segments. These are often older tire technologies or specialized items for niche applications facing reduced demand. For example, certain bias tires for outdated agricultural machinery or specific legacy construction equipment fit this profile. These products generate minimal revenue and can consume resources without offering significant returns, potentially leading to divestment.

In 2023, BKT reported strong overall growth, but it's probable that a small portion of its revenue came from these legacy segments, showing flat or negative growth. This is typical of Dogs, which don't align with BKT's strategic focus on high-growth radial tires and advanced technologies. The financial burden of holding obsolete inventory for these niche tires can outweigh their small returns, making them a liability.

Intense, undifferentiated competition in some Other High Technology (OHT) segments can also place BKT products in the Dogs category if differentiation through quality or brand is lacking. In 2024, price wars in certain niche OHT applications intensified, impacting margins for all players, including BKT, further marginalizing older tire technologies.

Small OEM partnerships with stagnant demand for specific equipment tires also represent potential Dogs. If BKT's supply to a niche agricultural equipment manufacturer, for instance, represents less than 1% of total revenue in 2024 and is tied to a segment with only 0.5% growth, it highlights a Dog scenario. Resources spent here would be better allocated to more promising business areas.

| BKT Product Category (Example) | Market Share | Market Growth | Profitability | Strategic Implication |

| Legacy Bias Tires (Niche Applications) | Low | Declining | Low/Negative | Divestment/Discontinuation |

| Specialized OEM Tires (Stagnant Segments) | Low | Stagnant | Minimal | Resource Reallocation |

| Certain OHT Segments (Price Wars) | Low to Moderate | Slow | Marginal | Focus on Differentiation/Exit |

Question Marks

Balkrishna Industries (BKT) has recently ventured into the Indian Truck and Bus Radial (TBR) tire market, marking a significant move into a new segment. This entry positions the TBR segment as a Question Mark within BKT's product portfolio, characterized by its high growth potential in India.

Despite the promising growth outlook, BKT currently holds a negligible market share in this segment. The Indian TBR market is highly competitive, with established players dominating sales.

To elevate this segment from a Question Mark to a potential Star, BKT will need to make substantial investments. These investments are crucial for ramping up production capacity and driving market adoption of its TBR products.

Industry reports from 2023 indicated the Indian commercial vehicle tire market was valued at approximately INR 35,000 crore, with the TBR segment showing robust growth. BKT's strategic entry aims to capture a portion of this expanding market, though significant challenges remain in building brand recognition and distribution networks.

The planned launch of Passenger Car Radial (PCR) tires in India firmly places this segment within the Question Mark category for Balkrishna Industries (BKT). This initiative taps into a large and growing consumer base, indicating significant potential for high growth.

Currently, BKT holds virtually no market share in the Indian PCR tire segment, necessitating substantial capital infusion. Investments will be critical for building brand recognition, establishing a robust distribution network, and scaling up production capabilities to compete effectively.

The Indian automotive market is dynamic; passenger car sales in India reached approximately 3.89 million units in 2023, signaling a strong demand for related products like PCR tires. BKT’s entry into this market is a strategic move to capitalize on this growth, though it carries inherent risks due to the lack of established presence.

Successfully navigating this market will require BKT to execute a well-defined strategy to gain traction and market share, with the ultimate goal of transforming this Question Mark into a Star performer within their product portfolio.

Balakrishna Industries' (BKT) foray into rubber tracks represents a classic Question Mark in the BCG matrix. While the dedicated production facility set to open by late 2026 signals a serious commitment, the segment is still in its nascent stages of commercialization and market penetration.

The demand for rubber tracks is indeed on the rise in specific off-highway sectors, driven by factors like improved traction and reduced ground pressure in applications such as construction and agriculture. However, BKT faces the challenge of scaling production efficiently and building brand recognition in a competitive landscape where established players already hold significant market share.

Significant capital investment will be crucial for BKT to not only meet the growing demand but also to establish a strong foothold. Without substantial investment in advanced manufacturing capabilities and aggressive market development strategies, it will be difficult for the rubber tracks division to transition from a Question Mark to a Star performer within BKT's product portfolio.

Advanced/Specialty Carbon Black for Non-Tire Use

Balakrishna Industries' (BKT) expansion into advanced and specialty carbon black for non-tire applications is a prime example of a Question Mark in its BCG Matrix. This strategic move aims to leverage its carbon black production capabilities beyond its core tire manufacturing, targeting high-growth external markets. The success hinges on BKT's ability to establish a strong foothold and gain market share in these competitive specialty segments.

The global specialty carbon black market is projected to reach significant figures. For instance, in 2024, the market was estimated to be valued at approximately USD 8.5 billion and is expected to grow at a compound annual growth rate (CAGR) of around 6% through 2030. This growth is driven by demand from industries like plastics, coatings, inks, and batteries, all of which require high-performance carbon black grades.

- Market Potential: The non-tire carbon black market offers substantial growth opportunities, particularly for specialty grades used in advanced applications.

- Investment Required: BKT will need to invest in research and development, production capacity, and marketing to compete effectively in these new segments.

- Competitive Landscape: Established global players dominate the specialty carbon black market, posing a significant challenge for BKT's entry.

- Strategic Importance: Diversifying into non-tire applications can reduce BKT's reliance on the cyclical automotive and tire industries, enhancing overall business resilience.

Very Large All Steel Radial Mining Tires (New Extensions)

The introduction of very large, all-steel radial mining tires, such as those with 57-inch diameters, positions BKT's new extensions within the mining tire market. While the broader mining tire segment is typically a Star in the BCG matrix due to consistent demand and market share for established players, these ultra-large specialized tires represent a nascent but promising area.

BKT's strategic investment in this niche reflects an ambition to capture future market leadership. The company is actively building its presence and market share in these high-specification tire sizes, which cater to a growing but very specific segment of the mining industry. This segment is characterized by significant capital investment requirements for both manufacturers and end-users.

- Market Position: These ultra-large tires are likely in the Question Mark or developing Star phase of the BCG matrix for BKT, given the investment and focus on gaining share in a specialized, growing niche.

- Investment Rationale: BKT's expansion into these larger sizes signifies a strategic bet on the increasing demand for high-performance tires in heavy-duty mining operations, aiming to establish a strong foothold before competitors fully capitalize.

- Competitive Landscape: While the overall mining tire market is competitive, this ultra-large segment might have fewer dominant players, offering BKT an opportunity to carve out significant market share.

- Growth Potential: The mining sector's ongoing need for efficient and durable equipment, particularly in large-scale operations, underpins the growth potential for these specialized tire extensions.

Balkrishna Industries' (BKT) foray into the Indian Truck and Bus Radial (TBR) tire market and the planned launch of Passenger Car Radial (PCR) tires in India both represent significant Question Marks. These segments are characterized by high growth potential but currently hold negligible market share for BKT, necessitating substantial investment to build brand recognition and scale production. The Indian TBR market was valued at approximately INR 35,000 crore in 2023, while passenger car sales reached about 3.89 million units in the same year, highlighting the opportunities BKT aims to capture.

The company's expansion into rubber tracks and advanced specialty carbon black also falls into the Question Mark category. While demand for rubber tracks is rising in specific sectors like construction and agriculture, and the global specialty carbon black market is projected to reach USD 8.5 billion in 2024 with a 6% CAGR, BKT faces challenges in scaling production and competing against established players. Significant capital investment in advanced manufacturing and market development is crucial for these ventures to transition from Question Marks to potential Stars.

Similarly, BKT's introduction of ultra-large, all-steel radial mining tires (e.g., 57-inch diameter) positions these specialized products as Question Marks within the broader, typically Star, mining tire segment. This niche requires substantial capital for both manufacturers and end-users. BKT's strategic investment aims to establish a strong foothold in this growing, high-specification area, potentially carving out market share before competitors fully capitalize.

| Segment | BCG Category | Market Growth | BKT Market Share | Investment Need |

|---|---|---|---|---|

| Indian TBR Tires | Question Mark | High | Negligible | Substantial |

| Indian PCR Tires | Question Mark | High | Negligible | Substantial |

| Rubber Tracks | Question Mark | Rising | Low | Substantial |

| Specialty Carbon Black | Question Mark | High (Global: 6% CAGR) | Low | Substantial |

| Ultra-Large Mining Tires | Question Mark (Niche) | Growing | Developing | High |

BCG Matrix Data Sources

Our Balakrishna Industries BCG Matrix draws from official company filings, industry growth reports, and market share data to provide a comprehensive view. This analysis is further enriched by expert commentary and competitor benchmarking for strategic clarity.