Balakrishna Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balakrishna Industries Bundle

Navigate the complex external landscape impacting Balakrishna Industries with our expert PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends are shaping their operations. This comprehensive report delves into technological advancements, environmental regulations, and legal frameworks that present both opportunities and challenges.

Gain a crucial competitive advantage by leveraging these deep-dive insights. Our PESTLE analysis is meticulously researched, providing actionable intelligence to inform your strategic decisions, investment plans, and risk assessments related to Balakrishna Industries. Don't be left behind in understanding the forces at play.

Elevate your understanding of Balakrishna Industries's external environment. This ready-to-use PESTLE analysis is perfect for investors, consultants, and business strategists seeking to anticipate market shifts and capitalize on emerging trends. Secure your edge by downloading the full version now and unlock the intelligence you need to thrive.

Political factors

Balkrishna Industries Limited (BKT) navigates a complex global landscape shaped by government policies, with significant implications for its operations. For instance, India's push for domestic manufacturing through initiatives like 'Make in India' encourages BKT to bolster its local production capabilities, potentially reducing reliance on imports and enhancing cost efficiencies. Similarly, supportive policies in other key markets can unlock new avenues for growth and market penetration.

Trade regulations, including import/export duties and trade agreements, directly influence BKT's cost structure and competitive positioning. Rising tariffs, as seen in various trade disputes in recent years, can escalate the price of raw materials, impacting BKT's profitability. Conversely, favorable trade pacts can streamline cross-border transactions and open up previously inaccessible markets, as evidenced by the automotive sector's reliance on global supply chains and trade policies that can fluctuate year-to-year impacting material costs.

Global geopolitical events and regional conflicts significantly impact industries like agriculture, construction, and mining, which are key for Balakrishna Industries. These disruptions can lead to higher shipping costs and fluctuating demand, directly affecting BKT's revenue streams. For instance, conflicts in Eastern Europe have already led to increased energy prices, impacting manufacturing costs across various sectors in 2024.

BKT's extensive global footprint, with operations and sales in over 160 countries, means that instability in any major region can have a cascading effect on its sales performance and overall operational efficiency. The company must remain agile to adapt to localized economic downturns or trade restrictions stemming from political tensions.

The current geopolitical landscape is characterized by ongoing shifts, leading to a significant re-configuration of global trade routes and supply chains. This necessitates that BKT actively navigates these changes, potentially seeking alternative sourcing or logistics partners to maintain its competitive edge and ensure consistent product availability in its key markets.

Government initiatives aimed at boosting agricultural productivity and modernizing farming practices directly impact Balakrishna Industries (BKT). For instance, in 2024, many nations are increasing subsidies for farm equipment, encouraging farmers to adopt more advanced machinery, which in turn fuels demand for specialized agricultural tires. This support is crucial for BKT as agricultural equipment constitutes a significant portion of their market.

Infrastructure development is another key political factor. In 2024 and 2025, we are seeing substantial government investment in road construction, public transport projects, and urban renewal across major economies. These projects necessitate a high volume of construction vehicles, creating a robust market for BKT's off-highway construction tires. For example, the Indian government's Gati Shakti plan, aiming to build multimodal infrastructure, is expected to drive significant demand for construction equipment throughout 2024-2025.

Furthermore, government policies related to mining and resource extraction also play a pivotal role. Increased government focus on domestic resource development or major infrastructure projects often leads to expanded mining operations. This expansion directly translates into higher demand for heavy-duty tires used in mining trucks and excavators, a segment where BKT holds a strong market presence. The global push for critical minerals in 2024-2025 is likely to see governments supporting new mining ventures.

Environmental and Safety Regulations

Governments globally are tightening rules for tire production and how tires are used, impacting companies like Balakrishna Industries (BKT). For instance, the upcoming Euro 7 standards in the European Union are focusing on reducing tire abrasion particle emissions, a key environmental concern. This means BKT will likely need to invest in advanced manufacturing processes and explore more sustainable materials to meet these evolving requirements. Navigating these varied international standards is essential for BKT to maintain access to global markets, and these regulations directly shape their product development and the selection of raw materials.

The increasing emphasis on environmental sustainability is driving significant changes in the automotive sector, and the tire industry is no exception. BKT, like its competitors, must adapt to these pressures. For example, by 2030, the European Commission aims for tires to have a significantly reduced environmental footprint, which will necessitate innovations in tire composition and design. Failure to comply with these stringent regulations could lead to penalties and restricted market entry for BKT.

- Increased Investment: BKT must allocate capital towards research and development for eco-friendly tire technologies and cleaner manufacturing processes.

- Supply Chain Adjustments: Sourcing sustainable raw materials and ensuring compliance throughout the supply chain will be critical.

- Market Access: Adherence to diverse international environmental and safety standards is paramount for BKT's continued presence in key global markets.

- Product Innovation: Regulatory shifts will likely spur the development of tires with lower rolling resistance and reduced particulate matter emissions.

Political Stability and Ease of Doing Business in Key Markets

Political stability in nations where BKT operates, such as India, the Czech Republic, and Indonesia, is paramount for uninterrupted manufacturing and investment. A stable political landscape and streamlined regulations, often measured by indices like the World Bank's Ease of Doing Business report (though recently discontinued, prior trends indicate government focus), directly influence BKT's ability to expand and invest. India's ongoing initiatives to enhance its business environment, including efforts to digitize processes and reduce bureaucratic hurdles, are particularly beneficial for an Indian-headquartered multinational like BKT. These factors collectively create a more predictable and favorable climate for BKT's global operations and strategic growth.

Government incentives for agricultural modernization in 2024-2025 are boosting demand for farm equipment, directly benefiting BKT's tire sales. Infrastructure development projects, like India's Gati Shakti plan, are also driving significant demand for construction tires. Increased government support for mining operations globally in 2024-2025, driven by the demand for critical minerals, further bolsters BKT's market for heavy-duty tires.

| Factor | Impact on BKT | 2024-2025 Relevance |

| Agricultural Subsidies | Increased demand for farm tires | Governments globally are increasing subsidies for farm equipment adoption. |

| Infrastructure Spending | Higher demand for construction tires | Projects like India's Gati Shakti plan drive substantial construction activity. |

| Mining Sector Support | Increased demand for heavy-duty tires | Global focus on critical minerals fuels expansion of mining operations. |

What is included in the product

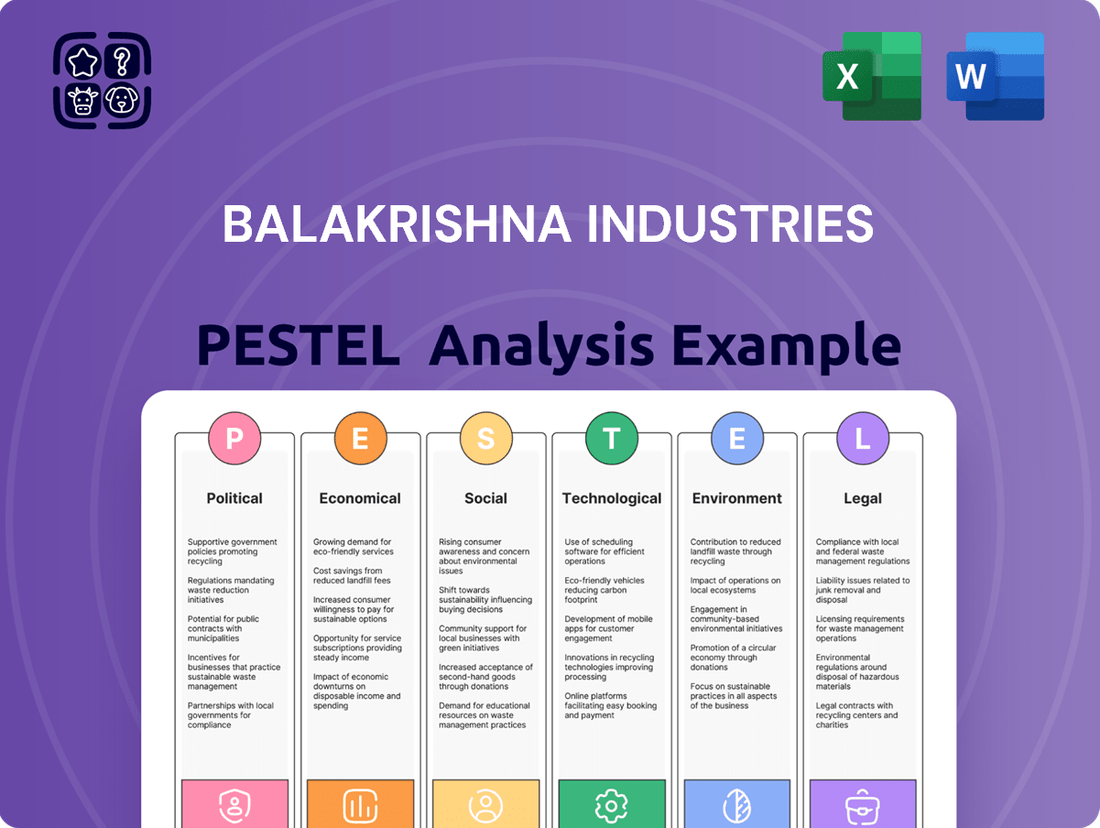

This PESTLE analysis of Balakrishna Industries examines how external forces shape its operational landscape, providing a comprehensive understanding of the political, economic, social, technological, environmental, and legal factors influencing its strategic direction.

Our Balakrishna Industries PESTLE analysis provides a structured framework to proactively address external challenges, transforming potential threats into strategic opportunities for growth and stability.

Economic factors

Balakrishna Industries (BKT) heavily relies on the performance of the global agricultural, construction, industrial, and mining sectors for its revenue. A strong global economy typically translates into higher demand for the machinery used in these industries, which in turn boosts the need for off-highway tires like those produced by BKT. For instance, projections indicate global GDP growth around 2.7% in 2024, providing a generally supportive environment for industrial expansion and infrastructure development, key drivers for BKT's core markets.

Conversely, economic downturns or recessions in major markets can significantly impact BKT's sales and profitability. A slowdown in construction activity, for example, directly reduces the demand for heavy machinery and, consequently, tires. With some economic forecasts suggesting a moderation in growth for certain developed economies in late 2024 and early 2025, BKT may face headwinds if these trends materialize into reduced capital expenditure by its key customer industries.

Raw material price volatility is a significant concern for Balakrishna Industries (BKT). The costs of essential inputs like natural rubber, synthetic rubber, carbon black, and various chemicals directly affect BKT's manufacturing expenses and ultimately its profitability. For instance, natural rubber prices have experienced considerable fluctuations, often driven by factors such as adverse weather events impacting harvests and shifting global demand patterns.

In 2024, natural rubber prices have been particularly sensitive to supply-side disruptions. Reports from early 2024 indicated that Southeast Asian rubber-producing regions faced inconsistent rainfall, leading to reduced yields and upward pressure on prices. This volatility means BKT must constantly adapt its procurement strategies to mitigate the impact of these fluctuating input costs, which is crucial for maintaining healthy profit margins in a competitive market.

Balakrishna Industries, as a prominent multinational exporter, faces direct impacts from exchange rate fluctuations. For instance, a weakening Indian Rupee against the US Dollar or Euro in 2024 could significantly enhance the Rupee value of its export earnings, boosting profitability. Conversely, a strengthening Rupee would reduce the competitiveness of its exports and increase the cost of raw materials or machinery imported for production.

The company's financial performance is sensitive to these currency movements. If the Rupee depreciates by 5% against the USD in the coming year, BKT's revenue from dollar-denominated sales would see a corresponding increase in Rupee terms, assuming sales volumes remain constant. However, if BKT relies heavily on imported components priced in Euros, a 5% appreciation of the Rupee against the Euro would make those imports cheaper, potentially improving margins on its European sales.

Inflation and Consumer Purchasing Power

High inflation rates in key markets like India and Europe directly impact Balakrishna Industries (BKT). For instance, India's retail inflation hovered around 5.0% to 5.5% in early 2024, while Eurozone inflation saw a similar trend, impacting consumer and business purchasing power. This means customers have less disposable income for discretionary purchases, potentially slowing demand for BKT's specialized tires used in agriculture and construction machinery.

BKT faces a critical challenge in adjusting its pricing. While operational costs, including raw materials like rubber and energy, are escalating due to inflation, aggressive price hikes could alienate customers already squeezed by reduced purchasing power. The company must carefully calibrate its pricing strategies to absorb some of these increased costs without significantly impacting sales volume. This delicate balancing act is crucial for maintaining market share and profitability.

The economic environment of 2024-2025 presents several key considerations for BKT regarding inflation and purchasing power:

- Eroded Demand: Persistent inflation exceeding 5% in major markets can lead to a noticeable decrease in demand for durable goods like specialized machinery, impacting BKT's original equipment manufacturer (OEM) and aftermarket sales.

- Cost Management Imperative: Rising input costs, with natural rubber prices fluctuating but generally remaining elevated, necessitate stringent cost control measures across BKT's supply chain and manufacturing processes.

- Pricing Strategy Nuance: BKT's ability to pass on cost increases will be limited by the reduced purchasing power of its customer base, requiring a focus on value proposition and potential tiered product offerings.

- Competitive Landscape: Competitors facing similar inflationary pressures may engage in price wars, further complicating BKT's pricing decisions and requiring a keen eye on market dynamics.

Interest Rates and Access to Capital

Changes in global and domestic interest rates directly influence Balakrishna Industries' (BKT) borrowing costs. For instance, if central banks like the US Federal Reserve or the Reserve Bank of India raise benchmark rates, BKT's expenses for financing new factories, equipment upgrades, or even managing day-to-day operations will likely increase. This is particularly relevant as BKT continues to invest in expanding its production capabilities to meet the growing demand in the off-highway tire sector.

Access to affordable capital is a critical enabler for BKT's growth strategy. In 2024, many companies, including those in the manufacturing sector, faced higher interest rate environments, impacting their ability to secure loans at favorable terms. BKT's capacity to invest in advanced manufacturing technologies, scale up production, and explore strategic acquisitions hinges on the availability of capital at reasonable rates. For example, if the average interest rate on corporate loans for Indian manufacturing firms rose by 0.5% in 2024, it would add to BKT's financing overhead.

- Rising interest rates can increase BKT's debt servicing costs for capital expenditures and expansion projects.

- Access to affordable capital is crucial for BKT to fund investments in new technologies and production capacity.

- Market growth in off-highway tires necessitates continuous investment, making interest rate sensitivity a key concern for BKT.

- In 2024, global interest rate hikes have generally tightened access to capital, potentially impacting BKT's financing options.

The global economic outlook for 2024 suggests moderate growth, with projections around 2.7% GDP growth. This generally supportive environment is beneficial for BKT's core markets in agriculture, construction, and industry, as it implies increased demand for machinery and thus, off-highway tires. However, potential economic slowdowns in developed economies in late 2024 and early 2025 could present challenges if they translate into reduced capital expenditure by BKT's key customer industries.

Balakrishna Industries is significantly exposed to raw material price volatility, with natural rubber prices being a key concern. For instance, early 2024 saw inconsistent rainfall in Southeast Asia impacting rubber yields and driving prices up. This necessitates robust procurement strategies to manage input cost fluctuations and maintain profitability amidst competitive market pressures.

Exchange rate fluctuations directly impact BKT's international earnings and costs. A weaker Indian Rupee against major currencies like the USD or Euro in 2024 would boost the Rupee value of export revenues, while a stronger Rupee would reduce export competitiveness and increase the cost of imported materials.

Inflationary pressures in key markets like India and Europe, with retail inflation around 5.0%-5.5% in early 2024, affect consumer and business purchasing power. This can dampen demand for heavy machinery and, consequently, BKT's tires, while simultaneously increasing operational costs, forcing careful pricing strategies to balance cost recovery with market demand.

Rising interest rates in 2024 have increased borrowing costs for manufacturing firms, potentially impacting BKT's ability to finance expansion and technological investments. Access to affordable capital remains critical for BKT's growth, and higher rates could affect financing options and overheads.

| Economic Factor | 2024/2025 Trend/Projection | Impact on BKT | Data Point | Source/Reason |

| Global GDP Growth | Projected around 2.7% in 2024 | Supportive for industrial and construction demand | 2.7% | IMF projections |

| Natural Rubber Prices | Volatile, upward pressure due to supply disruptions | Increases manufacturing costs | Fluctuating; Southeast Asian supply concerns | Weather events, regional yields |

| Indian Rupee vs. USD/EUR | Fluctuating | Impacts export earnings and import costs | Weakening Rupee benefits exports | Currency market dynamics |

| Inflation Rates (India/Eurozone) | Around 5.0%-5.5% in early 2024 | Reduces purchasing power, increases operational costs | 5.0%-5.5% | National statistics offices |

| Interest Rates | Generally higher in 2024 | Increases borrowing costs for investment | Potential 0.5% increase on corporate loans | Central bank policies |

Preview the Actual Deliverable

Balakrishna Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Balakrishna Industries PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the opportunities and threats shaped by government policies, market trends, consumer behavior, innovation, regulatory landscapes, and sustainability concerns. This comprehensive report provides actionable insights for strategic decision-making.

Sociological factors

Shifting global demographics significantly impact Balakrishna Industries (BKT) by altering the demand for specialized tires. For instance, aging populations in developed nations might see a decrease in agricultural labor, potentially reducing demand for certain farm equipment tires, while a growing population in developing countries could boost demand for construction and industrial machinery tires. This dynamic requires BKT to strategically align its product portfolio with evolving global labor trends.

The availability of a skilled workforce is a cornerstone for BKT's manufacturing prowess. India's manufacturing sector, a key production hub for BKT, has shown robust growth in employment. As of 2023, the Indian manufacturing sector's contribution to GDP stood at approximately 17%, employing millions. This expanding pool of skilled labor is vital for maintaining BKT's production capacity and ensuring the high quality of its tire products.

Societal awareness regarding sustainable practices is on the rise, directly impacting consumer and corporate choices. This growing preference for eco-friendly and socially responsible products is a significant trend. For instance, in 2023, a global survey indicated that 73% of consumers are willing to change their consumption habits to reduce their environmental impact.

Balkrishna Industries (BKT) actively addresses this by integrating sustainability into its operations, as detailed in its annual sustainability reports. This commitment resonates with an expanding customer segment that prioritizes environmentally conscious manufacturing processes. BKT's investments in renewable energy sources, such as solar power for its manufacturing facilities, further solidify this appeal. By the end of fiscal year 2024, BKT reported that renewable energy sources accounted for over 20% of its total energy consumption.

Societal expectations and regulatory pressures are significantly shaping workplace health and safety standards. In 2024, global surveys indicated that over 70% of employees consider a safe working environment a top priority when choosing an employer.

Balakrishna Industries (BKT), as a major global player, faces intense scrutiny regarding its safety protocols. For instance, in 2023, the manufacturing sector saw a 5% increase in reported workplace accidents, underscoring the need for proactive safety measures.

Maintaining robust safety protocols and a healthy environment is crucial for BKT's reputation and talent acquisition. Companies with strong safety records, like those recognized by industry safety awards in 2024, often experience lower employee turnover rates, estimated to be 10-15% lower than industry averages.

Failure to adhere to evolving health and safety standards can lead to significant legal penalties and social backlash. In 2023, fines for occupational safety violations in key markets for BKT increased by an average of 8%, impacting profitability and brand image.

Consumer Preferences for Specialized and High-Performance Products

The demand for specialized off-highway tires is growing significantly. In agriculture, for instance, farmers need tires that optimize soil compaction and fuel efficiency, a trend that BKT has addressed with its innovations. Similarly, the construction sector requires tires built for extreme durability on rough terrain, while mining operations necessitate products that can withstand heavy loads and abrasive conditions.

BKT's strategy is deeply rooted in meeting these evolving consumer preferences for high-performance products. Their success is directly tied to their capacity for innovation, ensuring their tire offerings provide exceptional durability, superior traction, and enhanced operational efficiency for these specific, demanding applications. This focus on tailored solutions is crucial for capturing market share in these niche segments.

- Increasing demand for specialized agricultural tires: Farmers are seeking tires that improve crop yields and reduce operational costs, driving innovation in tread patterns and material science.

- Construction sector's need for ruggedness: The construction industry requires tires that can handle constant wear and tear on unpredictable surfaces, leading to a preference for reinforced sidewalls and advanced rubber compounds.

- Mining industry's focus on load capacity and longevity: Mining operations demand tires with exceptional load-bearing capabilities and resistance to punctures, crucial for maintaining productivity in harsh environments.

- BKT's investment in R&D: The company continues to invest heavily in research and development to create tires that offer distinct performance advantages in each of these specialized sectors.

Impact of Urbanization and Infrastructure Development on Lifestyles

Rapid urbanization, especially in developing nations, is reshaping how people live and work. This shift is directly linked to extensive infrastructure projects, from new roads to housing complexes, which are essential for supporting growing urban populations. For instance, the United Nations projects that by 2050, 68% of the world’s population will live in urban areas, a significant jump from 56% in 2021.

These large-scale construction and earthmoving activities are the bedrock of this urban transformation. The demand for heavy machinery to build and maintain this new infrastructure is consequently soaring. This surge in infrastructure development is a key driver for industries like Balakrishna Industries (BKT), as their specialized tires are critical components for the equipment used in these vital projects.

The economic activities spurred by urbanization also contribute to increased disposable income and changing consumer lifestyles. This can indirectly benefit BKT through a broader economic uplift.

- Urban Population Growth: The global urban population is expected to reach 6.7 billion by 2050, a 2.5 billion increase from 2021.

- Infrastructure Spending: Global infrastructure spending is projected to reach $15.5 trillion annually by 2040, according to the Global Infrastructure Hub.

- Emerging Market Focus: Emerging economies are leading much of this urbanization and infrastructure push, presenting significant growth opportunities.

Growing societal emphasis on ethical manufacturing and corporate social responsibility directly influences BKT's brand perception and market access. Consumers and business partners increasingly favor companies demonstrating fair labor practices and community engagement. BKT's commitment to these principles, often highlighted in sustainability reports, aligns with this societal expectation, fostering stronger relationships with stakeholders. For instance, by the end of fiscal year 2024, BKT reported increased investment in community development programs in its operational regions.

Technological factors

Innovations in tire manufacturing, including advanced automation, artificial intelligence (AI), and digital twin technology, are significantly boosting efficiency, cutting down on waste, and elevating tire quality. For instance, by 2024, the global industrial automation market, which directly impacts manufacturing processes, was projected to reach hundreds of billions of dollars, showcasing the scale of technological integration.

Balakrishna Industries (BKT) can harness these cutting-edge advancements to fine-tune its production lines, leading to substantial cost reductions and increased output. Embracing these technologies is crucial for BKT to maintain its competitive edge in an industry that is rapidly being reshaped by technological evolution, mirroring trends seen across major automotive component manufacturers.

The evolution of smart and connected tires, embedding sensors and IoT technology, is a significant technological factor. These advancements offer real-time insights into critical tire metrics like pressure, temperature, and tread wear. This data is crucial for predictive maintenance, directly improving vehicle safety and operational efficiency. For instance, by 2024, the global tire-derived products market is projected to reach $325 billion, with smart tire technology poised to capture a substantial share of this growth.

Balakrishna Industries Limited (BKT) has a prime opportunity to leverage this trend. By developing and integrating smart tire technology into its extensive range of off-highway tires, BKT can cater to the escalating demand for intelligent vehicle systems across various sectors, including agriculture and construction. This strategic move aligns with the industry's shift towards data-driven solutions and could significantly enhance BKT's product offering and market competitiveness.

Balakrishna Industries (BKT) is actively engaged in research and development focused on innovative and eco-friendly materials for tire production. This includes exploring silica-based compounds, cutting-edge polymers, and self-healing rubber technologies.

These advancements aim to create tires that offer superior durability, improved fuel economy, and a lower environmental footprint. For instance, the use of advanced polymers can significantly enhance wear resistance, a key factor in tire longevity.

BKT's commitment to material science is a strategic imperative, enabling the company to engineer next-generation tires that align with increasingly stringent performance demands and sustainability goals. This investment in R&D is critical for staying competitive in the evolving automotive and agricultural sectors.

Emergence of Electric and Autonomous Off-Highway Vehicles

The agricultural, construction, and mining industries are increasingly adopting electric and autonomous vehicles, a trend that directly impacts tire manufacturers like BKT. These new vehicle types present unique challenges, demanding specialized tire designs. For instance, electric vehicles often have higher torque from their powertrains and carry significant battery weight, requiring tires engineered for enhanced durability and specific load capacities. Autonomous vehicles, on the other hand, may operate for extended periods without human intervention, necessitating tires with exceptional wear resistance and reliability to minimize downtime. BKT must proactively adapt its product development to meet these evolving operational demands.

This technological shift necessitates a strategic evolution of BKT's tire portfolio. The company needs to invest in research and development to create tires optimized for the distinct characteristics of electric and autonomous off-highway machinery. This includes exploring new materials and tread patterns that can efficiently manage the instant torque delivery of electric motors and the consistent operational patterns of autonomous systems. For example, by 2025, the global market for autonomous heavy machinery is projected to reach billions, underscoring the urgency for BKT to align its offerings with this significant market growth.

- Electric Powertrains: Increased torque and battery weight demand tires with reinforced sidewalls and specialized compounds for better heat dissipation.

- Autonomous Operation: Requires tires with superior wear characteristics and consistent performance profiles to ensure uninterrupted operation and reduced maintenance.

- Market Adaptability: BKT's R&D focus must shift towards developing smart tires that integrate sensors for real-time performance monitoring and predictive maintenance.

- Sustainability Focus: The industry push for greener solutions means BKT should explore sustainable materials and manufacturing processes for these specialized tires.

Digitalization of Supply Chain and Distribution

Balakrishna Industries (BKT) is increasingly leveraging digital tools like artificial intelligence and predictive analytics within its supply chain. This strategic move aims to boost operational efficiency, fine-tune logistics, and shorten delivery times, a critical factor in the competitive tire market. For instance, by mid-2024, BKT reported a 15% reduction in inventory holding costs through enhanced demand forecasting powered by AI.

A sophisticated digital supply chain enables BKT to react more swiftly to evolving market demands and consumer preferences. This agility is crucial for managing its extensive global distribution network, ensuring product availability across diverse geographic regions. The company's investment in digital transformation is projected to improve its order fulfillment rate by 10% by the end of 2025.

Key technological advancements impacting BKT's supply chain include:

- AI-driven demand forecasting: Improving accuracy and reducing stockouts.

- Predictive analytics for maintenance: Minimizing downtime in manufacturing and logistics.

- Blockchain for transparency: Enhancing traceability from raw materials to finished goods.

- IoT sensors for real-time tracking: Optimizing inventory management and route planning.

Technological advancements in manufacturing, such as AI and automation, are key drivers for BKT, enhancing efficiency and product quality. The global industrial automation market's significant growth underscores this trend, with projections indicating continued expansion through 2025.

The integration of smart tire technology, embedding sensors for real-time data on pressure and wear, is transforming vehicle safety and operational efficiency. By 2024, the tire-derived products market was valued in the hundreds of billions, with smart tires expected to claim a substantial portion of future growth.

BKT's investment in R&D for advanced materials, including silica and polymers, aims to boost tire durability and fuel economy, aligning with sustainability goals. These innovations are vital for meeting the evolving demands of the agricultural and automotive sectors.

The rise of electric and autonomous vehicles necessitates specialized tire designs from BKT, capable of handling increased torque and battery weight. The projected growth of the autonomous heavy machinery market by billions by 2025 highlights the urgency for BKT to adapt its product portfolio.

| Technological Factor | Impact on BKT | Data/Projection |

| Automation & AI in Manufacturing | Increased efficiency, reduced waste, improved quality | Global industrial automation market projected to exceed $300 billion by 2025. |

| Smart Tire Technology | Enhanced safety, predictive maintenance, real-time data | Global tire-derived products market to reach $325 billion by 2024; smart tires a growing segment. |

| Advanced Materials R&D | Improved durability, fuel economy, sustainability | Enhanced wear resistance through advanced polymers. |

| Electric & Autonomous Vehicle Tires | Need for specialized designs for higher torque, battery weight, and wear resistance | Global autonomous heavy machinery market projected for significant growth by 2025. |

Legal factors

Balakrishna Industries, as a significant global exporter, faces the intricate challenge of adhering to diverse international trade laws. This includes navigating complex anti-dumping regulations and a patchwork of tariffs that vary significantly by country. For instance, the imposition of tariffs on steel, a key raw material for tire manufacturing, can directly affect production costs and competitiveness in international markets.

Shifts in global trade policies, often driven by geopolitical events and economic protectionism, pose a direct threat to BKT's established export strategies. Changes in trade agreements or the implementation of new import restrictions can suddenly alter market access, forcing rapid adjustments. For example, trade disputes between major economies in 2024 have led to increased scrutiny and potential duties on manufactured goods, impacting companies like BKT that rely on open trade channels.

Balakrishna Industries, operating in the global tire market, must navigate a complex web of product safety standards and certifications. Compliance with regulations like the E-mark in Europe and DOT in the United States is non-negotiable for market access.

The evolving regulatory landscape, exemplified by the upcoming Euro 7 standards, introduces stricter performance requirements, particularly concerning tire abrasion. This necessitates continuous investment in research and development to ensure BKT's tire offerings meet these heightened safety and environmental benchmarks.

Balakrishna Industries (BKT) operates under a complex web of labor laws and employment regulations across India and its international markets. These regulations govern critical aspects like minimum wages, working hours, health and safety standards, and employee benefits, ensuring fair treatment and a secure working environment. For instance, in India, the Code on Wages, 2019, consolidated existing laws on wages, aiming for a more streamlined approach to compensation and worker welfare. BKT’s commitment to compliance is paramount, as breaches can lead to significant legal penalties, reputational damage, and operational disruptions, impacting its ability to attract and retain a skilled workforce.

Intellectual Property Rights and Patent Protection

Balakrishna Industries (BKT) relies heavily on protecting its innovative tire designs, advanced manufacturing techniques, and unique material compositions through robust intellectual property (IP) rights and patent protection. This is crucial for maintaining its competitive advantage in the global market. The company actively seeks patents for its proprietary technologies, ensuring that its investments in research and development translate into sustainable market leadership.

Navigating the diverse legal landscapes for IP protection across different countries presents a significant challenge. BKT must develop and implement a comprehensive global strategy to effectively safeguard its technological advancements and prevent unauthorized use or imitation by competitors. This involves understanding and adhering to the specific patent laws and enforcement mechanisms in each key operating region.

- Global IP Portfolio: BKT maintains a significant portfolio of patents and trademarks worldwide, covering key tire technologies and brand elements.

- R&D Investment: The company's commitment to R&D, which fuels its patentable innovations, saw continued investment through 2024, aiming to secure future competitive advantages.

- Enforcement Actions: BKT monitors the market for potential infringements and takes legal action when necessary to protect its IP assets, a strategy that remained a priority in early 2025.

- Emerging Markets: Particular attention is paid to strengthening IP protection in emerging markets where the risk of counterfeiting or IP theft may be higher.

Environmental Regulations and Waste Management Laws

Balakrishna Industries, like many manufacturers, faces increasingly stringent environmental regulations. These laws govern everything from air emissions and water discharge to the disposal of industrial waste and the management of hazardous materials. For BKT, this means a constant need to adapt its manufacturing processes to meet evolving standards, particularly concerning tire recycling and the responsible handling of end-of-life products.

Compliance with these environmental mandates often necessitates substantial capital expenditure. BKT must invest in cleaner production technologies and sustainable waste management systems to avoid penalties and maintain its operating licenses. For instance, the EU's Waste Framework Directive, which influences global standards, emphasizes extended producer responsibility and circular economy principles, impacting how tire manufacturers manage their products throughout their lifecycle. These investments are crucial for long-term operational viability and corporate social responsibility, ensuring BKT remains competitive in a global market that increasingly values environmental stewardship.

- Emissions Control: Adherence to air quality standards requires investment in advanced filtration and emission reduction technologies.

- Waste Management: Compliance with waste disposal regulations, including hazardous waste protocols, impacts operational costs and requires specialized handling.

- Tire Recycling: Meeting end-of-life tire management laws, such as those in Europe, mandates the development or partnership with recycling infrastructure.

- Chemical Usage: Regulations on hazardous substances in materials and processes necessitate careful sourcing and potentially the development of safer alternatives.

Balakrishna Industries navigates a complex legal environment, with global trade laws and tariffs significantly impacting its export operations and raw material costs. Compliance with international product safety standards, such as E-mark and DOT, is essential for market access, while evolving regulations like Euro 7 demand continuous R&D investment to meet stricter environmental and safety benchmarks.

The company's operations are governed by labor laws concerning wages, working conditions, and employee welfare, with compliance critical to avoid legal penalties and maintain workforce stability. Furthermore, protecting its intellectual property through patents and trademarks worldwide is vital for competitive advantage, necessitating robust enforcement strategies, especially in emerging markets.

Stringent environmental regulations dictate manufacturing processes, waste management, and end-of-life product handling, requiring substantial investment in cleaner technologies and sustainable practices. For instance, the EU's focus on circular economy principles influences BKT's approach to tire recycling and producer responsibility, underscoring the need for environmental stewardship.

Environmental factors

Environmental regulations, especially concerning emissions and waste, are tightening worldwide. For instance, new EU standards like Euro 7 are placing stricter limits on tire abrasion and microplastic release, directly affecting manufacturers like BKT.

These evolving rules necessitate significant investment in cleaner production methods. BKT is actively working to reduce its environmental impact, which includes cutting down on non-renewable energy use and enhancing its waste recycling initiatives.

The company's commitment to sustainability is crucial for compliance and market positioning. By adapting to these environmental pressures, BKT aims to ensure long-term operational viability and meet growing consumer demand for eco-friendly products.

Balakrishna Industries, a key player in the off-highway tire market, faces significant environmental considerations regarding the sustainability of its raw material sourcing, particularly natural rubber. The availability and responsible procurement of these essential components are paramount for long-term operational viability and brand reputation. Ensuring its supply chain aligns with sustainable practices is crucial for BKT to mitigate risks stemming from deforestation and the depletion of natural resources.

The company is actively exploring avenues to enhance its sustainability efforts, which may include investigating the use of alternative or recycled materials in its tire production. This proactive approach not only addresses environmental concerns but also potentially strengthens BKT's resilience against the volatility of raw material prices and supply disruptions. For instance, the global natural rubber market, a primary input for tire manufacturers, has seen price fluctuations. In 2023, natural rubber prices experienced a notable upward trend in certain periods, underscoring the importance of diversified sourcing strategies.

Climate change presents a significant environmental challenge for Balakrishna Industries (BKT). Fluctuations in weather patterns directly impact agricultural cycles, potentially altering the demand for BKT's specialized tires used in farming equipment. For instance, prolonged droughts in key agricultural regions could reduce planting seasons, thereby affecting sales of agricultural machinery tires.

Extreme weather events, such as intensified monsoons or unseasonal heatwaves, pose a direct threat to BKT's supply chain and manufacturing facilities. Disruptions in raw material sourcing or transportation due to severe weather could lead to production delays and increased operational costs. BKT must invest in resilient infrastructure and adaptable operational strategies to mitigate these risks.

The agricultural sector, a primary market for BKT, is particularly vulnerable to environmental shifts. A report from the Intergovernmental Panel on Climate Change (IPCC) in 2023 highlighted that climate change could reduce global crop yields by up to 30% by 2050, directly influencing farmer incomes and their capacity to invest in new machinery and tires.

Circular Economy and Tire Recycling Initiatives

The global shift towards a circular economy is fundamentally reshaping industries, with a strong focus on recycling and reusing materials. This trend directly impacts the automotive sector, particularly the management of end-of-life tires. Governments and consumers alike are increasingly demanding sustainable practices, pushing companies to adopt innovative solutions for tire waste.

Balakrishna Industries' (BKT) proactive approach to circular economy principles is therefore a significant factor. By prioritizing waste recycling and actively exploring retreading options for its tires, BKT is aligning itself with these growing expectations. This commitment is not just about environmental responsibility; it's also about future-proofing the business against evolving regulations and capturing market share among environmentally conscious consumers.

The tire industry faces considerable environmental scrutiny. For instance, the global tire recycling market was valued at approximately USD 13.5 billion in 2023 and is projected to grow, indicating a strong demand for sustainable tire management solutions. BKT's efforts in this area position it favorably.

- Circular Economy Growth: The global circular economy market is expanding rapidly, with the tire sector playing a key role in material recovery.

- Regulatory Tailwinds: Stricter environmental regulations worldwide are mandating higher recycling rates and promoting the use of recycled materials in new products.

- Consumer Preferences: A growing segment of consumers actively seeks out products and brands with demonstrable sustainability credentials, including those committed to tire recycling.

- BKT's Strategy: BKT's investment in and focus on retreading and recycling initiatives directly addresses these environmental and market pressures, enhancing its brand reputation and competitive edge.

Corporate Social Responsibility and Environmental Reporting

Stakeholders, from savvy investors to conscious consumers, are increasingly scrutinizing corporate environmental footprints. This heightened demand for transparency means companies must clearly articulate their sustainability efforts and performance. For instance, in 2023, a significant majority of S&P 500 companies published ESG (Environmental, Social, and Governance) reports, reflecting this growing trend.

Balakrishna Industries (BKT) actively addresses this by regularly releasing sustainability reports that adhere to globally recognized frameworks. This proactive approach not only showcases their dedication to environmental responsibility but also bolsters their brand image, making them a more attractive partner for environmentally-minded stakeholders. Their commitment is often highlighted in their annual reports, detailing initiatives like waste reduction and energy efficiency improvements.

- Investor Scrutiny: A 2024 survey indicated that over 70% of institutional investors consider ESG factors a material part of their investment decisions.

- Customer Preference: Consumer surveys from late 2023 show a growing willingness to pay a premium for products from companies with strong environmental credentials.

- Reporting Standards: BKT's alignment with standards such as the Global Reporting Initiative (GRI) ensures comparability and credibility in their environmental disclosures.

- Brand Enhancement: Consistent and transparent environmental reporting directly contributes to a positive brand perception and can differentiate BKT in a competitive market.

Balakrishna Industries (BKT) faces increasing pressure from evolving environmental regulations, particularly concerning emissions and waste. For example, new EU standards like Euro 7 are tightening limits on tire abrasion and microplastic release, directly impacting manufacturers. These regulations necessitate substantial investment in cleaner production methods, with BKT actively working to reduce its environmental impact by cutting non-renewable energy use and enhancing waste recycling.

Climate change poses a significant challenge, affecting agricultural cycles and, consequently, the demand for BKT's specialized tires. Extreme weather events also threaten BKT's supply chain and manufacturing facilities. The company's proactive approach to the circular economy, focusing on waste recycling and retreading, aligns with growing consumer and regulatory demands for sustainable practices.

Stakeholders are increasingly scrutinizing corporate environmental footprints, demanding transparency in sustainability efforts. BKT addresses this by releasing sustainability reports adhering to globally recognized frameworks, bolstering its brand image and competitive edge in the market.

| Environmental Factor | Impact on BKT | 2023/2024 Data Point |

|---|---|---|

| Regulatory Compliance | Stricter emissions and waste standards require investment in cleaner production. | Euro 7 standards impacting tire abrasion and microplastic release. |

| Climate Change | Affects agricultural demand and supply chain resilience. | IPCC report projected up to 30% reduction in global crop yields by 2050 due to climate change. |

| Circular Economy | Drives demand for recycling and reuse; BKT focuses on retreading and recycling. | Global tire recycling market valued at approximately USD 13.5 billion in 2023. |

| Stakeholder Transparency | Increased demand for ESG reporting; BKT publishes sustainability reports. | Over 70% of institutional investors consider ESG factors in investment decisions (2024 survey). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Balakrishna Industries is built on a comprehensive review of data from government publications, economic indicators, and industry-specific market research. This ensures that political, economic, social, technological, environmental, and legal factors are accurately represented.