Balakrishna Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balakrishna Industries Bundle

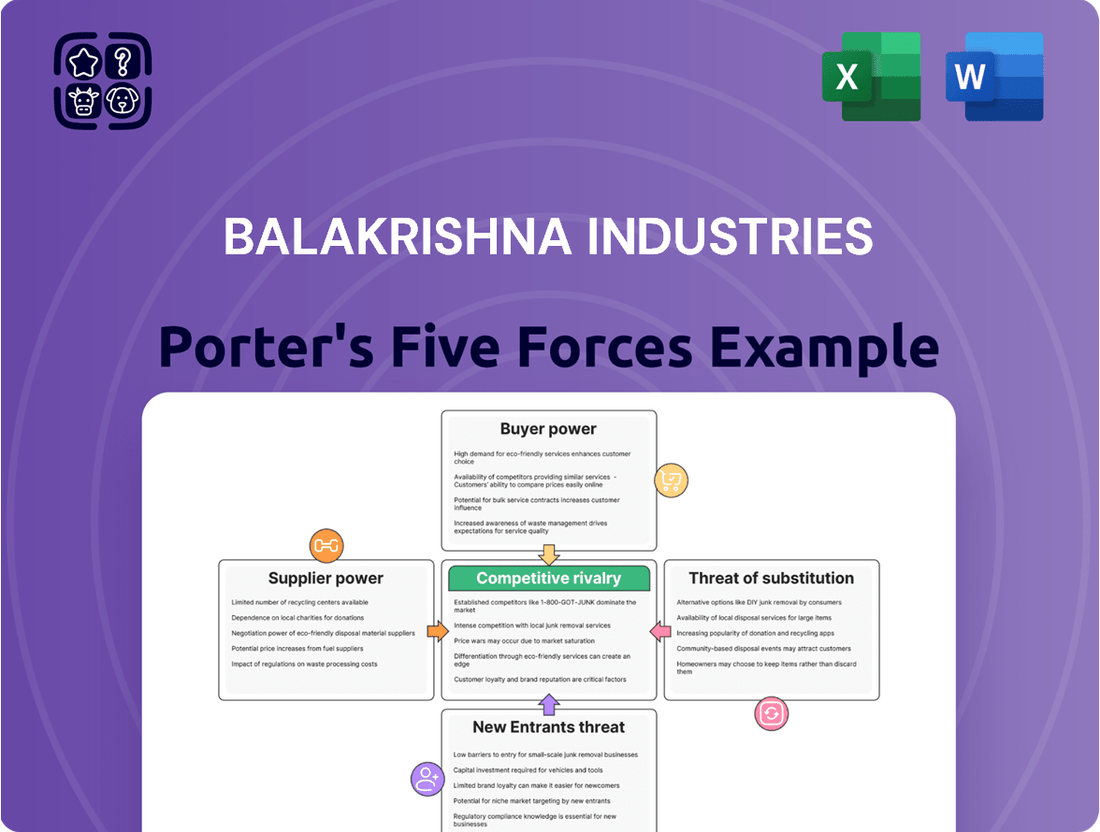

Balakrishna Industries operates in a dynamic market, facing moderate threats from new entrants and the availability of substitutes. The bargaining power of buyers is significant, especially for large original equipment manufacturers. While suppliers hold some leverage due to specialized components, intense competition among them limits their overall influence.

The competitive rivalry within the agricultural and construction equipment sector is substantial, pressuring Balakrishna Industries to innovate and maintain cost-effectiveness. Understanding these forces is crucial for strategic planning and identifying competitive advantages.

The complete report reveals the real forces shaping Balakrishna Industries’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Balakrishna Industries (BKT) faces a significant bargaining power from its raw material suppliers, particularly for natural rubber and carbon black. The limited number of key suppliers for these essential inputs means BKT has less leverage in negotiating prices and terms, potentially impacting its cost of goods sold and profit margins. For instance, in 2024, the global natural rubber market experienced price volatility due to weather patterns affecting supply in major producing regions, directly influencing BKT's procurement costs.

The reliance on a concentrated supplier base for critical materials like synthetic rubber and various chemicals also grants these suppliers considerable influence. Fluctuations in global commodity prices, such as crude oil which is a precursor for carbon black, directly translate into higher input costs for BKT. This dependency highlights the supplier's ability to dictate terms, especially when demand for these materials is high, as observed in early 2024 with increased industrial activity globally.

The availability of substitutes for key inputs like rubber and carbon black can significantly dilute supplier bargaining power. While core materials are standard, alternative grades or even sustainable sourcing options provide BKT with flexibility. For instance, the emergence of bio-based rubber alternatives in 2024 offers manufacturers a potential hedge against traditional rubber price volatility.

Switching suppliers for essential raw materials presents significant hurdles for BKT. These include the costs associated with re-tooling manufacturing equipment, implementing new quality control protocols, and rigorous material testing to ensure performance standards are met. For example, a shift in rubber compound suppliers could necessitate recalibrating vulcanization processes, a time-consuming and expensive undertaking.

This difficulty in switching suppliers inherently strengthens the bargaining power of BKT's existing material providers. Particularly for specialized grades of carbon black or synthetic rubber, which are critical for producing BKT's high-performance off-highway tires, suppliers can command higher prices or more favorable terms. In 2023, BKT's raw material costs represented a substantial portion of its overall production expenses, highlighting the impact of supplier pricing on profitability.

Importance of Supplier's Input to BKT's Product

The bargaining power of suppliers for Balkrishna Industries (BKT) is significant due to the critical nature of their inputs. The quality and consistent availability of raw materials like natural rubber, synthetic rubber, carbon black, and various chemicals directly impact the performance, durability, and ultimately, the cost-effectiveness of BKT's off-highway tires. These tires are engineered for demanding applications, meaning any compromise in material quality can severely affect product integrity and customer satisfaction.

Suppliers who can offer superior grades of these materials, or those with proprietary formulations, hold considerable leverage. For instance, specialized synthetic rubber compounds that enhance wear resistance or fuel efficiency provide these suppliers with a distinct advantage. BKT's reliance on these specific material properties to maintain its competitive edge in niche markets strengthens the suppliers' negotiating position, potentially leading to higher input costs.

- Critical Raw Materials: Natural rubber, synthetic rubber, carbon black, and chemicals are essential for tire manufacturing, with quality directly affecting product performance.

- Supplier Leverage: Suppliers of high-quality or specialized materials have increased bargaining power due to BKT's need for superior product attributes.

- Impact on BKT: Material quality influences tire durability, performance in demanding conditions, and overall cost-effectiveness, making reliable suppliers indispensable.

- Market Dependence: BKT's focus on specialized off-highway tires means dependence on suppliers who can consistently meet stringent material specifications.

Threat of Forward Integration by Suppliers

The threat of forward integration by raw material suppliers poses a significant challenge to Balakrishna Industries. If these suppliers were to move into tire manufacturing themselves, they would directly compete, significantly amplifying their bargaining power and potentially dictating terms more forcefully. This scenario is more probable for suppliers of specialized materials rather than generic commodities, particularly if the tire industry demonstrates robust profitability.

For instance, a major synthetic rubber producer might explore establishing its own tire production facilities if market analysis indicates substantial returns. Such a move would transform a key supplier into a formidable rival, capable of leveraging its upstream control to gain market share. This strategic shift could disrupt Balakrishna Industries' supply chain and pricing stability.

- Supplier Integration Risk: Suppliers integrating forward into tire manufacturing directly compete with Balakrishna Industries, increasing supplier leverage.

- Specialty vs. Commodity: The likelihood of forward integration is higher for suppliers of specialized materials than for broad commodity providers.

- Market Attractiveness: Suppliers are more likely to pursue forward integration if the tire manufacturing market offers attractive profit margins.

- Competitive Landscape Impact: Supplier integration can intensify competition and alter the power dynamics within the tire industry.

Balakrishna Industries (BKT) faces considerable supplier bargaining power, particularly for key inputs like natural rubber and carbon black. The limited number of suppliers for these critical materials means BKT has less influence in price negotiations, impacting its cost of goods. For example, in 2024, natural rubber prices saw volatility due to supply disruptions in Southeast Asia, directly affecting BKT's procurement expenses.

The reliance on a concentrated supplier base for specialized synthetic rubber and carbon black grades grants these providers significant leverage. Global commodity price fluctuations, such as those in crude oil affecting carbon black, directly translate to higher input costs for BKT. This dependency allows suppliers to dictate terms, especially during periods of high industrial demand, as seen in early 2024.

| Input Material | Key Suppliers | 2024 Impact/Consideration |

| Natural Rubber | Limited global producers | Price volatility due to weather; increased procurement costs. |

| Carbon Black | Few major manufacturers | Subject to crude oil price fluctuations; higher input costs. |

| Specialty Chemicals | Niche suppliers | Proprietary formulations give leverage; potential for premium pricing. |

What is included in the product

This analysis of Balakrishna Industries reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and how these forces shape the company's profitability.

Instantly visualize Balakrishna Industries' competitive landscape with a clear, actionable summary of all five forces, simplifying complex strategic pressures for swift decision-making.

Customers Bargaining Power

Balkrishna Industries (BKT) serves a broad customer base, including Original Equipment Manufacturers (OEMs) in agriculture, construction, and industry, alongside global aftermarket distributors. While the aftermarket is important, the concentration of major OEM clients, who buy in large volumes, can significantly amplify their negotiation leverage.

For instance, a substantial portion of BKT's revenue often comes from a relatively small number of large OEMs. This dependence means that if these key customers were to demand lower prices or more favorable terms, BKT might find it challenging to refuse, especially if alternative suppliers are readily available.

For Original Equipment Manufacturers (OEMs), the bargaining power of customers is significantly constrained by high switching costs. Changing tire suppliers requires rigorous and time-consuming testing, along with extensive qualification procedures. In 2024, for instance, a major agricultural equipment manufacturer might spend upwards of $250,000 and six months on validating a new tire supplier to ensure compatibility and performance standards are met. This investment in re-engineering and validation makes OEMs hesitant to switch, thereby reducing their bargaining leverage.

In the aftermarket segment, while the physical act of changing tires is straightforward, brand switching is influenced by more than just ease of replacement. Factors like established brand loyalty, the reach and efficiency of distribution networks, and customer perception of tire performance play a crucial role. For example, a farmer accustomed to a specific tire brand's durability in challenging terrain might be reluctant to switch even if a competitor offers a slightly lower price, demonstrating a form of customer stickiness that limits their bargaining power.

Balkrishna Industries (BKT) significantly limits customer bargaining power through its strong product differentiation in the off-highway tire market. The company offers a vast range of tires specifically engineered for demanding applications in agriculture, construction, and mining, rather than competing in the more commoditized automotive sector.

This specialization means customers seeking optimal performance and durability for their specific heavy-duty equipment have fewer alternatives. For instance, BKT's development of advanced technologies like Very High Flexion (VF) and Improved Flexion (IF) tires for agricultural machinery allows tractors to carry heavier loads at lower pressures, enhancing soil protection and fuel efficiency. These specialized features mean customers are less likely to substitute BKT tires with generic offerings, as they would compromise on critical operational performance.

Customers' Price Sensitivity

Customers in sectors such as agriculture, construction, and mining often scrutinize the total cost of owning tires, factoring in aspects like their lifespan and how they impact fuel consumption. For instance, a farmer looking at a tractor tire isn't just considering the initial purchase price but also how many seasons it will last and if it contributes to better fuel economy. This cost-consciousness directly influences their bargaining power.

Balakrishna Industries (BKT) can mitigate this customer sensitivity by highlighting the long-term value proposition of its products. When BKT offers tires that are known for their durability and superior performance, they can reduce the overall operating expenses for their customers. This means that even if BKT tires have a slightly higher upfront cost, their extended lifespan and efficiency can justify the price, thereby lessening the customer's inclination to haggle over price.

- Cost-Conscious Segments: Agriculture, construction, and mining are key BKT markets where total cost of ownership is paramount.

- Value Proposition: BKT's focus on tire longevity and fuel efficiency directly addresses customer concerns about operating costs.

- Premium Pricing Potential: By delivering high-performance, durable tires, BKT can command a premium, reducing price sensitivity.

- Reduced Bargaining Power: When customers perceive greater value and lower long-term costs, their ability to demand lower prices diminishes.

Threat of Backward Integration by Customers

The threat of customers, particularly large Original Equipment Manufacturers (OEMs), integrating backward into tire production for Balakrishna Industries (BKT) is generally considered low. This is primarily due to the significant capital investment required, the specialized technological expertise needed, and the complex manufacturing processes involved in creating off-highway tires. These barriers make it impractical and uneconomical for most customers to establish their own tire manufacturing capabilities.

For instance, setting up a modern tire plant involves hundreds of millions of dollars in initial outlay and ongoing operational costs. The technological know-how for compound formulation, tread design, and curing processes is highly specialized. Furthermore, achieving the consistent quality and scale of production that BKT offers would be a substantial undertaking for any individual OEM.

- High Capital Intensity: Establishing a tire manufacturing facility requires substantial upfront investment, often exceeding hundreds of millions of dollars.

- Specialized Technology and Expertise: Tire production involves proprietary rubber compounds, intricate mold designs, and precise curing techniques that are difficult to replicate.

- Complex Manufacturing Processes: From mixing raw materials to final vulcanization, tire manufacturing is a multi-stage, technically demanding operation.

- Economies of Scale: BKT benefits from economies of scale in raw material purchasing and production, which would be challenging for individual customers to match.

The bargaining power of customers for Balkrishna Industries (BKT) is moderately high, primarily driven by the concentration of major Original Equipment Manufacturers (OEMs) in their client base. These large customers purchase in significant volumes, giving them leverage to negotiate pricing and terms. For instance, a substantial portion of BKT's revenue often derives from a limited number of key OEMs, making their demands difficult to refuse, especially if alternative suppliers exist.

However, this power is somewhat constrained by high switching costs for OEMs. The extensive testing and qualification processes required to change tire suppliers can cost hundreds of thousands of dollars and take many months, deterring OEMs from making frequent changes. In the aftermarket, brand loyalty and distribution network strength also limit customer power.

BKT's product differentiation through specialized, high-performance tires for demanding off-highway applications further reduces customer bargaining power. Features like VF and IF tire technology offer tangible operational benefits, making customers less inclined to substitute for generic options. While customers are cost-conscious and consider total cost of ownership, BKT can mitigate this by emphasizing the long-term value and durability of its products.

| Customer Segment | Key Bargaining Factors | BKT's Mitigating Factors |

|---|---|---|

| OEMs (Agriculture, Construction, Mining) | Volume purchasing, potential for backward integration (low), negotiation on price and terms | High switching costs for OEMs (testing, qualification), product differentiation, specialized technology |

| Aftermarket Distributors & End-Users | Price sensitivity, brand switching (limited by loyalty/performance perception) | Brand loyalty, distribution network reach, perceived product quality and durability, total cost of ownership value |

Same Document Delivered

Balakrishna Industries Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Balakrishna Industries meticulously dissects the competitive landscape, revealing significant bargaining power of both buyers and suppliers within the off-highway tire market. It further evaluates the threat of new entrants and the intensity of existing rivalry, highlighting the industry's mature nature and capital-intensive barriers to entry. The analysis also thoroughly examines the threat of substitute products, concluding with strategic implications for Balakrishna Industries to navigate these forces effectively.

Rivalry Among Competitors

The global off-highway tire market where Balkrishna Industries (BKT) operates is intensely competitive. Major multinational corporations such as Bridgestone, Michelin, Goodyear, and Continental are significant players, bringing substantial resources and established brand recognition. These giants compete across various segments, from agriculture to construction, often leveraging advanced technology and extensive distribution networks.

Beyond these global behemoths, BKT also contends with numerous specialized and regional niche brands. These competitors, while smaller in scale, often possess deep expertise in specific product categories or geographic markets. This diversity means BKT must constantly adapt its strategies to counter the varied strengths of its rivals, whether it's technological innovation, cost efficiency, or localized market penetration.

For instance, in the agricultural tire segment, a key area for BKT, the competitive landscape includes companies known for specific innovations or regional dominance. Michelin's advancements in radial tire technology and Goodyear's long-standing presence in North America are examples of how different competitors offer distinct advantages. This broad spectrum of competition necessitates continuous evaluation of market dynamics and strategic positioning for BKT.

The off-highway tire market is demonstrating stable, albeit not explosive, growth. This is largely fueled by ongoing mechanization in agriculture and significant infrastructure development projects, especially in emerging economies. For instance, the global off-highway tire market was valued at approximately $28.5 billion in 2023 and is projected to reach around $37.2 billion by 2030, indicating a compound annual growth rate (CAGR) of about 3.9%.

A growing market generally tends to soften competitive rivalry. When the overall pie is expanding, companies can often achieve their growth targets by capturing new demand rather than by aggressively fighting for existing market share. This dynamic can lead to a less cutthroat environment, allowing for more focus on innovation and operational efficiency rather than purely price-based competition.

Balakrishna Industries (BKT) carves out a niche by focusing on specialty off-highway tires designed for harsh environments, highlighting their durability and performance. This specialization sets them apart in a competitive landscape.

However, rivals aren't standing still; they are also pouring significant resources into research and development. Innovations in advanced tread patterns, the use of eco-friendly materials, and the integration of smart tire technology are constant across the industry.

This intense R&D activity means continuous product evolution and sustained competitive pressure. For instance, in 2024, several major tire manufacturers announced new lines featuring enhanced wear resistance and improved fuel efficiency, directly challenging BKT's performance claims.

The rapid pace of technological advancement and product improvement among competitors necessitates BKT's ongoing commitment to innovation to maintain its differentiated position.

High Fixed Costs and Exit Barriers

The tire manufacturing sector, including companies like Balakrishna Industries, is characterized by substantial capital requirements. Significant investments in sophisticated plant and machinery, alongside ongoing research and development, create high fixed costs. For instance, establishing a new tire manufacturing facility can easily run into hundreds of millions of dollars, making it a highly capital-intensive industry.

These high fixed costs, coupled with substantial exit barriers such as specialized equipment that is difficult to repurpose and long-term supplier contracts, can lock companies into the industry. When demand softens, firms may be compelled to compete fiercely on price to ensure their expensive facilities operate at higher utilization rates, thus spreading those fixed costs over more units. This can lead to intense price wars, even when profitability is challenged.

- High Capital Investment: Setting up a tire plant requires substantial upfront investment in land, buildings, specialized machinery, and technology.

- Economies of Scale: Larger production volumes are necessary to achieve cost efficiencies, making it difficult for smaller players to compete.

- Exit Barriers: Specialized assets and contractual obligations make it costly and difficult for companies to leave the industry.

- Capacity Utilization Pressure: Companies strive to maintain high production levels to offset fixed costs, potentially leading to price competition.

Brand Identity and Customer Loyalty

Balakrishna Industries (BKT) has cultivated a robust global brand identity, a significant factor in its competitive landscape. The company exports its products to over 160 countries, underscoring its international reach and brand recognition. This strong presence is built upon a reputation for quality and a consistent drive for innovation, which are crucial for standing out in the tire manufacturing sector.

While BKT benefits from established customer loyalty, particularly among users in performance-critical applications where tire reliability is paramount, this loyalty is not absolute. The tire market is intensely competitive, with rivals constantly pushing for market share. Therefore, BKT must maintain its commitment to continuous innovation and offer competitive pricing to both retain its existing customer base and attract new ones. This dynamic ensures that brand identity alone is not enough to guarantee sustained market leadership.

In 2024, the global tire market continued to see intense competition, with major players investing heavily in research and development. For instance, Michelin announced significant R&D spending for 2024 focusing on sustainable materials and smart tire technologies. BKT's ability to match or exceed these efforts, coupled with strategic pricing, will be key to navigating this rivalry.

- Brand Reach: BKT exports to over 160 countries, showcasing a broad international footprint.

- Key Differentiators: Commitment to quality and continuous innovation are central to BKT's brand.

- Customer Loyalty Drivers: Loyalty is strongest in performance-critical applications but requires ongoing support.

- Competitive Imperatives: Continuous innovation and competitive pricing are vital for customer retention and acquisition.

Competitive rivalry within the off-highway tire sector, where Balkrishna Industries (BKT) operates, remains a significant force. Major global players like Bridgestone, Michelin, and Goodyear possess substantial resources and well-established brands, intensifying competition across agriculture and construction segments. BKT must navigate this landscape by focusing on its specialization in durable, high-performance tires for demanding conditions, a strategy that helps differentiate it from broader market offerings.

The intense R&D efforts across the industry, with companies like Michelin investing heavily in areas such as sustainable materials and smart tire technology in 2024, mean that BKT faces constant pressure to innovate. This technological race, coupled with high capital requirements for manufacturing and significant exit barriers, can lead to price-based competition as firms strive to maintain capacity utilization. For instance, the global off-highway tire market, valued at approximately $28.5 billion in 2023, is expected to grow, but this expansion doesn't necessarily ease the rivalry among established and emerging competitors.

| Key Competitors | Key Strengths | 2024 R&D Focus Examples |

| Bridgestone | Global presence, extensive product range | Advanced material science |

| Michelin | Technological innovation, brand reputation | Sustainable materials, smart tires |

| Goodyear | Strong North American presence, diverse portfolio | Performance enhancement |

| Continental | Automotive and industrial expertise | Digitalization, safety technologies |

SSubstitutes Threaten

Alternative mobility solutions, such as track systems for agricultural and construction machinery, pose a threat of substitution for off-highway tires. These tracks can offer advantages like reduced ground pressure, which is crucial for certain applications to minimize soil compaction. However, the adoption of track systems is tempered by their inherent drawbacks, including significantly higher initial purchase costs and increased maintenance requirements compared to traditional tire setups.

For large and expensive off-highway tires, retreading and repair services present a significant threat of substitution. These services offer a more budget-friendly alternative to buying brand new tires, effectively giving existing tire casings a longer life. This directly impacts Balakrishna Industries Limited (BKT) by potentially reducing the demand for new tire sales in the aftermarket segment.

The cost savings provided by retreading can be substantial. For instance, a retreaded tire can cost anywhere from 30% to 50% less than a new tire, making it an attractive option for fleet operators looking to manage expenses. This price differential directly influences BKT's aftermarket revenue streams, as customers may opt for the cheaper, refurbished option rather than a full replacement.

Future advancements in vehicle technology, like lighter materials or novel propulsion systems, could indeed impact the demand for certain types of heavy-duty tires. For instance, the rise of electric vehicles (EVs) might necessitate tires designed for higher torque and potentially different weight distribution, altering specifications for off-highway applications. However, the core requirement for robust traction and significant load-bearing capacity in sectors like mining and construction, where Balakrishna Industries (BKT) is strong, is unlikely to disappear. In 2024, the global off-highway tire market was valued at approximately $28 billion, underscoring the enduring need for these specialized products.

Material Substitutes for Tires

The threat of material substitutes for tires, particularly for companies like Balkrishna Industries (BKT), is generally considered low in the current market. While there aren't direct, widely adopted material substitutes that completely replace the function of rubber in traditional tires, ongoing innovation in materials science presents a potential future challenge. For instance, advancements could introduce new composite materials that offer comparable or superior performance characteristics, potentially impacting the demand for conventional rubber tires.

The automotive industry is constantly exploring alternative materials. While a full tire replacement is unlikely in the short term, developments in areas like advanced polymers or composite structures could offer new avenues. For example, research into self-healing materials or those with enhanced durability could eventually lead to tire-like products with different base compositions.

BKT, a major player in off-highway tires, relies heavily on natural and synthetic rubber. The cost of these raw materials significantly influences BKT's profitability. In 2023, rubber prices saw fluctuations, with natural rubber prices averaging around $1,500 to $1,800 per metric ton, influenced by factors like weather and global demand.

- Limited Direct Substitutes: Currently, no single material effectively replaces the complex blend of rubber, reinforcing agents, and other components that constitute a modern tire across all its functions.

- Material Science Advancements: Ongoing research into advanced polymers, composites, and even bio-based materials could eventually lead to materials that offer comparable or improved tire performance, potentially altering the competitive landscape.

- Focus on Performance and Sustainability: Future substitutes will likely be evaluated not only on cost but also on performance metrics like grip, durability, fuel efficiency, and environmental impact, areas where BKT is actively innovating.

- Raw Material Cost Sensitivity: BKT's profitability is closely tied to the cost of natural and synthetic rubber, making significant shifts in material technology a factor to monitor for long-term strategic planning.

Cost-Performance Trade-offs of Substitutes

The threat of substitutes for Balakrishna Industries' off-highway tires is moderate. Key performance factors for these specialized tires, such as extreme durability, superior traction in challenging terrain, high load-bearing capacity, and extended longevity, are difficult for substitutes to match. Any alternative would need to provide comparable or better performance at a competitive total cost of ownership, a significant hurdle considering the intricate engineering involved in their production.

For instance, while general-purpose tires might seem like a substitute, they often fall short in critical off-highway applications. In 2024, the off-highway tire market is valued at billions, with specialized tires commanding a premium due to their engineered resilience. Companies like Balakrishna Industries invest heavily in R&D to meet these demanding specifications.

- Durability: Off-highway tires must withstand extreme conditions, from sharp rocks to heavy impacts, a trait not easily replicated by standard tires.

- Traction: Mud, sand, and uneven surfaces require specialized tread patterns and compounds that general tires lack.

- Load Capacity: These tires often support immense weights, demanding robust construction beyond typical tire capabilities.

- Longevity: The total cost of ownership is critical; longer-lasting specialized tires often prove more economical than frequent replacements of inferior alternatives.

The threat of substitutes for Balakrishna Industries (BKT) off-highway tires is moderate. While direct material substitutes are limited, alternative mobility solutions like track systems and the practice of tire retreading present more significant challenges. These alternatives can offer cost savings or specific performance benefits, directly impacting BKT's demand for new tires, particularly in the aftermarket segment.

Retreading, for example, can cost 30% to 50% less than a new tire, making it a financially attractive option for fleet operators. The global off-highway tire market was valued at approximately $28 billion in 2024, highlighting the substantial market BKT operates within, where cost-effectiveness is a key consideration for customers.

| Substitute Type | Key Advantages | Potential Impact on BKT |

| Track Systems | Reduced ground pressure, improved traction in specific conditions | Lower demand for tires in niche applications where tracks are preferred |

| Tire Retreading/Repair | Significant cost savings (30-50% less than new tires) | Reduced aftermarket sales volume for new tires |

| Advanced Materials (Future) | Potential for enhanced durability, lighter weight, improved sustainability | Long-term risk of market disruption if performance and cost are competitive |

Entrants Threaten

Entering the off-highway tire manufacturing sector presents a formidable challenge due to immense capital requirements. Establishing advanced production facilities, acquiring specialized machinery, and investing in crucial research and development necessitates significant financial outlay. For instance, BKT, a key player, has allocated substantial capital expenditure towards expansion initiatives, underscoring the high entry barriers that deter new competitors.

Balakrishna Industries faces a significant barrier to entry due to the immense R&D, specialized engineering, and proprietary technologies required for high-performance off-highway tires. Developing advanced rubber compounds, innovative tread patterns, and robust tire construction demands a deep knowledge base that new players struggle to replicate.

Established players like Balakrishna Industries (BKT) possess extensive global distribution networks, reaching over 160 countries through strong relationships with original equipment manufacturers (OEMs) and aftermarket dealers. This established infrastructure presents a significant barrier for new entrants.

New companies would struggle to replicate BKT's market access, requiring substantial investment and time to build comparable distribution channels and secure trusted partnerships. Gaining traction against incumbents with entrenched supply chains and customer loyalty is a formidable challenge.

Brand Loyalty and Reputation

Brand loyalty represents a significant barrier for new entrants looking to challenge Balakrishna Industries (BKT). BKT has cultivated a powerful reputation over decades, deeply rooted in the exceptional quality, unwavering durability, and robust performance of its tires, particularly in challenging off-highway environments. This hard-won trust means potential new players face an uphill battle in gaining market traction.

Establishing comparable brand recognition and fostering customer loyalty in a sector where reliability is not just preferred but absolutely critical, would demand substantial time and considerable financial investment from any newcomer. Consider the tire industry's long lead times for product development and market penetration; it's not a space where quick wins are common.

For instance, BKT's commitment to research and development, evidenced by its continuous product innovation and extensive testing, underpins its strong brand equity. This focus ensures their offerings meet the stringent demands of sectors like agriculture, construction, and mining. New entrants must not only match this technical prowess but also effectively communicate their value proposition to a discerning customer base already satisfied with BKT's proven track record.

- Brand Equity: BKT's decades-long focus on quality and durability has cemented its reputation, making it difficult for new entrants to gain immediate trust.

- Customer Loyalty: In off-highway applications, reliability is paramount, leading to strong customer loyalty towards established brands like BKT.

- Investment Required: New competitors would need significant capital and time to build brand recognition and achieve the same level of market acceptance as BKT.

- Market Inertia: Existing customer relationships and satisfaction with BKT's performance create inertia, slowing down the adoption of new brands.

Regulatory Hurdles and Environmental Standards

The tire industry faces significant regulatory hurdles and evolving environmental standards, acting as a strong deterrent to new entrants. Companies looking to enter this market must invest heavily in ensuring compliance with diverse global regulations, including stringent safety certifications and quality benchmarks. For instance, the European Union's Tyre Labelling Regulation requires tires to be classified based on fuel efficiency, wet grip, and external rolling noise, a complex standard to meet from inception.

These compliance requirements translate into substantial upfront costs and extended timelines for market entry. New players must dedicate resources to research and development, manufacturing processes, and testing to meet these rigorous demands. In 2024, the ongoing push for sustainability in manufacturing, particularly concerning material sourcing and end-of-life tire management, further elevates these barriers. Companies like Balakrishna Industries have already established robust systems to manage these complexities.

- Global Regulatory Complexity: Navigating diverse international standards for tire safety, emissions, and materials requires significant investment and expertise.

- Environmental Compliance Costs: Meeting stringent environmental regulations, such as those related to recycled content or chemical usage, adds considerable expense to production.

- Certification Processes: Obtaining necessary certifications for product safety and quality can be time-consuming and costly, delaying market entry.

- Evolving Standards: The continuous updating of environmental and safety regulations necessitates ongoing adaptation and investment from all industry players.

The threat of new entrants for Balakrishna Industries (BKT) is considerably low, primarily due to the substantial capital investment required to establish advanced manufacturing facilities and secure specialized machinery. The off-highway tire sector demands significant upfront funding for research and development, as well as the creation of sophisticated production lines, making it a high-barrier industry for newcomers.

New entrants would also face immense challenges in replicating BKT's established global distribution networks and the strong relationships it has cultivated with original equipment manufacturers (OEMs) and aftermarket dealers. Building a comparable market presence, which often takes years of dedicated effort and strategic partnerships, is a formidable obstacle for any aspiring competitor.

Furthermore, BKT's decades of brand building have fostered significant customer loyalty, particularly in applications where tire durability and performance are critical. Overcoming this ingrained trust and brand equity requires new players to invest heavily in marketing and product quality to even begin competing effectively against an incumbent with a proven track record.

The complex regulatory landscape, encompassing diverse international safety certifications and evolving environmental standards, adds another layer of difficulty for potential entrants. Meeting these stringent requirements necessitates considerable investment in compliance and ongoing adaptation, further solidifying BKT's position in the market.

Porter's Five Forces Analysis Data Sources

Our Balakrishna Industries Porter's Five Forces analysis is built upon a robust foundation of data, including the company's annual reports, industry-specific market research from firms like CRISIL and IMARC, and government economic data.