Bjorn Borg SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bjorn Borg Bundle

Björn Borg's strong brand recognition and loyal customer base are significant strengths, but the company faces intense competition and evolving consumer trends. Understanding these dynamics is crucial for future success.

Want the full story behind Björn Borg's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Björn Borg enjoys significant brand recognition, deeply rooted in the legacy of the tennis icon himself. This heritage is a powerful marketing asset, resonating with consumers who seek a blend of athletic performance and modern fashion. The brand's ability to leverage this history allows it to stand out in a crowded market.

The company has successfully transitioned from its origins in underwear to encompass a broader sports fashion range. This evolution, while maintaining its core identity, allows Björn Borg to attract a wider demographic. In 2023, the Björn Borg Group reported net sales of SEK 754 million, demonstrating continued market presence.

Bjorn Borg's e-commerce and digital presence is a significant strength, evidenced by a robust increase in net sales. In 2024, the company reported a substantial rise in its own e-commerce sales, a trend that continued into Q1 2025 with further growth. This demonstrates a highly effective digital strategy and a strong ability to connect with consumers directly online.

The strategic move to a headless e-commerce platform in 2022 has further amplified these digital capabilities. This upgrade allows for a more integrated and streamlined customer journey across all touchpoints, enhancing the overall online shopping experience and contributing to the brand's direct-to-consumer success.

Björn Borg's strength lies in its diverse product offerings, encompassing underwear, sportswear, swimwear, shoes, and bags, all designed to blend athletic performance with modern fashion. This broad range ensures a wider customer appeal and market penetration.

The company's strategic emphasis on footwear and sports apparel has yielded significant results. In the first quarter of 2025, footwear sales experienced a remarkable 208% increase, while sports apparel saw a healthy 13% growth, highlighting successful expansion in key growth areas.

This strategic diversification is crucial as it mitigates risks by reducing the company's dependence on any single product category, creating a more resilient business model.

Strategic Market Expansion and Distribution Network

Björn Borg is strategically expanding its footprint in promising markets, with Germany demonstrating robust growth in 2024, indicating successful market penetration efforts. This expansion is supported by a diversified distribution strategy that leverages owned retail, direct-to-consumer e-commerce, and partnerships with external retailers and distributors spanning roughly twenty countries. The company's recent move to bring footwear distribution in-house is poised to unlock substantial future growth avenues by providing greater control and efficiency in this key product category.

Commitment to Sustainability

Björn Borg's dedication to sustainability is a significant strength, resonating with today's environmentally conscious market. The brand has set ambitious targets, aiming for a 50% reduction in its carbon footprint by 2030, using a 2020 baseline, and increasing its use of preferred materials. This proactive approach not only bolsters brand image but also attracts a growing segment of consumers who prioritize ethical and eco-friendly purchases.

The company's 2024 sustainability report underscores tangible progress, detailing reductions in Scope 1 and 2 emissions. This commitment is crucial as consumer preferences increasingly lean towards brands demonstrating genuine environmental responsibility.

- Commitment to Sustainability: Björn Borg is actively working to reduce its environmental impact.

- Ambitious Targets: Aims for a 50% carbon footprint reduction by 2030 from a 2020 baseline.

- Increased Use of Preferred Materials: Focus on incorporating more sustainable materials in their products.

- Consumer Appeal: Aligns with growing consumer demand for eco-friendly and ethically sourced goods, enhancing brand reputation.

Björn Borg's brand equity, built on the legacy of the tennis star, remains a cornerstone strength, fostering strong consumer recognition and loyalty. The brand's successful diversification into a broader sports fashion range, extending beyond its underwear origins, has broadened its market appeal. This evolution is supported by robust financial performance, with net sales reaching SEK 754 million in 2023, indicating sustained market relevance.

The company's digital strategy is a key advantage, with significant growth in its direct-to-consumer e-commerce channels continuing into Q1 2025. This digital focus is further enhanced by a headless e-commerce platform implemented in 2022, optimizing the customer experience. The strategic expansion into footwear and sports apparel has proven highly effective, with footwear sales surging by 208% in Q1 2025 and sports apparel growing by 13%.

Björn Borg's commitment to sustainability is a growing strength, with a target to reduce its carbon footprint by 50% by 2030 (from a 2020 baseline) and an increased focus on preferred materials. This aligns with increasing consumer demand for eco-conscious brands, enhancing its market positioning. The brand's international presence is expanding, with Germany showing strong growth in 2024, supported by a multi-channel distribution network.

| Metric | 2023 | Q1 2025 |

|---|---|---|

| Net Sales (SEK million) | 754 | - |

| Footwear Sales Growth | - | +208% |

| Sports Apparel Growth | - | +13% |

What is included in the product

This SWOT analysis outlines Bjorn Borg's internal capabilities, such as brand recognition and product quality, alongside external market opportunities like growing e-commerce and potential expansion into new demographics.

Offers a clear, organized framework to identify and address the brand's competitive challenges and capitalize on market opportunities.

Weaknesses

Björn Borg's gross profit margin saw a concerning drop in the latter half of 2024 and early 2025. This trend indicates that the cost to produce their goods is rising faster than their selling prices, or that they are facing pressure to lower prices, which directly impacts their bottom line.

Specifically, the first quarter of 2025 witnessed a significant decrease, with the gross profit margin falling by 3.4 percentage points to land at 49.9%. This erosion of profitability, despite potential sales increases, warrants close attention to cost management and pricing strategies.

Bjorn Borg's reliance on external partners, as evidenced by the 2024 supply chain disruptions stemming from a former footwear licensee's bankruptcy, presents a significant weakness. While bringing footwear production in-house is a positive step, this past event underscores the inherent vulnerability to the financial health and operational stability of its collaborators.

These disruptions can lead to short-term headwinds, impacting product availability and sales. The company's experience highlights the potential for unforeseen external factors to disrupt production and distribution channels, even with internal integration efforts.

Looking ahead, the ongoing complexities within global supply chains remain a persistent challenge. Bjorn Borg must continue to build resilience to mitigate the impact of potential future disruptions, ensuring consistent product flow and customer satisfaction.

Björn Borg's revenue is heavily concentrated, with Sweden and the Netherlands accounting for a substantial share of its sales. This reliance makes the brand vulnerable to economic fluctuations or changing consumer tastes in these key regions.

While underwear remains a core product, Björn Borg's strong association with this category hinders its evolution into a broader sports fashion brand in the eyes of consumers. This can limit its appeal and market penetration beyond its traditional base.

Challenges in Retail Store Performance

While Bjorn Borg's e-commerce segment is performing well, its physical retail stores faced a sales downturn in the first quarter of 2025. This decline, potentially linked to a reduced store footprint or a broader consumer shift to online shopping, highlights a weakness in their brick-and-mortar operations. The company may need to reassess its physical retail strategy to align with evolving market dynamics.

- Declining Retail Sales: Bjorn Borg's retail stores saw a sales decrease in Q1 2025, contrasting with e-commerce growth.

- Strategic Re-evaluation Needed: This performance gap suggests potential issues with the company's physical store strategy or store count.

- Adapting to Consumer Behavior: The trend underscores the need to adapt to changing consumer preferences, which increasingly favor online purchasing.

Sustainability Performance 'Not Good Enough' in Some Areas

Despite Björn Borg's commitment to sustainability, an independent assessment revealed shortcomings in key areas. The report highlighted that the company's performance is 'Not Good Enough' regarding concrete steps to reduce hazardous chemicals, minimize textile waste, protect biodiversity, and guarantee living wages throughout its supply chain.

This performance gap could negatively affect Björn Borg's brand image, especially with the growing segment of consumers who prioritize ethical and environmentally sound practices. For instance, a 2024 survey found that 68% of consumers consider a brand's sustainability efforts when making purchasing decisions.

- Hazardous Chemical Reduction: Björn Borg needs to implement more robust strategies to phase out harmful chemicals in its production processes.

- Textile Waste Minimization: Efforts to reduce fabric waste during manufacturing and promote circularity in product design require enhancement.

- Biodiversity Protection: The company must strengthen its initiatives to safeguard ecosystems impacted by its material sourcing and production.

- Living Wages: Ensuring fair compensation for all workers across the entire supply chain remains a critical area for improvement.

Björn Borg's increasing cost of goods sold, evident in the 3.4 percentage point drop in gross profit margin to 49.9% in Q1 2025, is a significant weakness. This trend suggests internal cost pressures or competitive pricing challenges that erode profitability. Furthermore, the brand's heavy reliance on Sweden and the Netherlands for revenue makes it susceptible to localized economic downturns or shifts in consumer preferences within these key markets.

The company's physical retail segment experienced a sales decline in early 2025, contrasting with e-commerce growth, indicating a potential misstep in their brick-and-mortar strategy or an inability to adapt quickly enough to evolving consumer shopping habits. Additionally, independent assessments in 2024 highlighted that Björn Borg is falling short on crucial sustainability goals, including reducing hazardous chemicals, minimizing textile waste, protecting biodiversity, and ensuring living wages across its supply chain. This performance gap poses a risk to its brand reputation among increasingly eco-conscious consumers.

| Weakness | Description | Impact | Data Point |

|---|---|---|---|

| Declining Profitability | Erosion of gross profit margin due to rising costs or pricing pressure. | Reduced bottom-line performance. | Gross profit margin fell 3.4 percentage points to 49.9% in Q1 2025. |

| Geographic Concentration | Heavy reliance on sales from Sweden and the Netherlands. | Vulnerability to regional economic shifts. | These two markets constitute a substantial share of total revenue. |

| Physical Retail Underperformance | Sales downturn in brick-and-mortar stores. | Missed revenue opportunities and potential strategic misalignment. | Q1 2025 saw a decrease in physical retail sales. |

| Sustainability Gaps | Shortcomings in reducing hazardous chemicals, waste, protecting biodiversity, and ensuring living wages. | Potential damage to brand image and consumer trust. | Independent assessment in 2024 rated performance as 'Not Good Enough' in key areas. |

Preview the Actual Deliverable

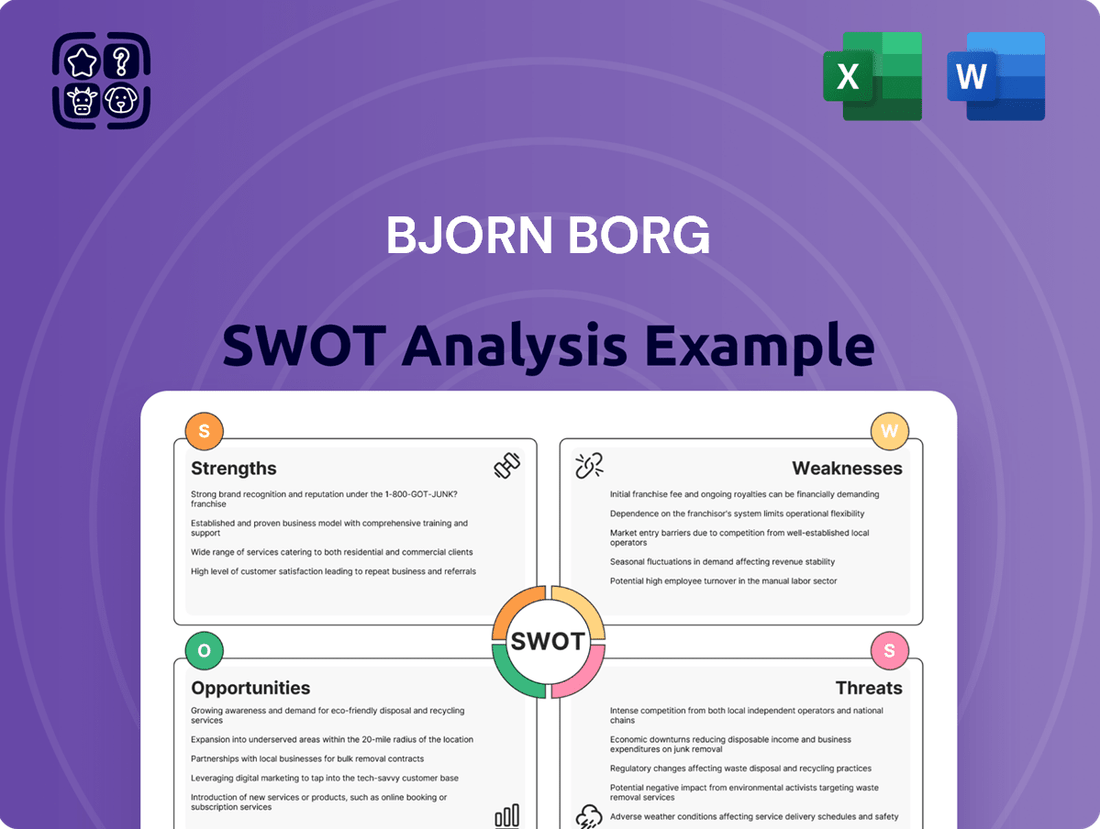

Bjorn Borg SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Bjorn Borg SWOT analysis, providing a clear understanding of its depth and quality. Purchase unlocks the complete, detailed report for your strategic planning needs.

Opportunities

The global sports apparel market is booming, with projections indicating it will reach an estimated $233.5 billion by 2025, a significant increase from previous years. This expansion is fueled by a growing emphasis on health and wellness, alongside the enduring popularity of athleisure wear. Björn Borg can capitalize on this trend by broadening its sportswear and footwear lines, tapping into a vast and receptive consumer base.

The apparel industry's digital transformation, marked by robust e-commerce expansion, presents a prime opportunity for Björn Borg. Global e-commerce sales in apparel were projected to reach over $1.2 trillion in 2024, a figure expected to climb further.

By enhancing its digital infrastructure with AI-driven personalization and virtual try-on technologies, Björn Borg can significantly elevate its customer experience and boost online revenue. The company’s headless e-commerce architecture is a key enabler for agile adoption of these innovations.

Björn Borg has a significant opportunity to grow by entering emerging markets, leveraging its successful hybrid distribution model which combines online sales with physical retail. This expansion could tap into rapidly growing consumer bases eager for established fashion brands.

By forging new alliances with retailers and distributors in regions where its brand presence is currently limited, Björn Borg can unlock substantial market penetration. For instance, continued expansion in Asia, where the apparel market is projected to reach $3.5 trillion by 2027 according to some industry forecasts, presents a prime avenue for increased sales volume and brand recognition.

Enhanced Focus on Sustainable and Ethical Practices

Björn Borg can capitalize on the growing consumer preference for sustainable and ethical fashion by further bolstering its existing initiatives. This presents a significant opportunity to enhance brand loyalty and attract environmentally and socially conscious shoppers, a demographic that is increasingly influencing purchasing decisions.

By improving supply chain transparency, implementing greener dyeing processes, and ensuring fair labor practices, Björn Borg can significantly elevate its brand reputation. For instance, a 2024 report indicated that 60% of consumers are willing to pay more for sustainable products, highlighting the market potential for such commitments.

- Strengthen Sustainability: Increase investment in eco-friendly materials and production methods.

- Enhance Transparency: Provide clear information on sourcing and manufacturing processes.

- Ethical Sourcing: Ensure fair wages and safe working conditions throughout the supply chain.

- Attract Conscious Consumers: Leverage sustainability efforts in marketing to appeal to a growing market segment.

Strategic Collaborations and Product Line Extensions

Strategic collaborations, like the 2024 partnership with esports organization ENCE for athletic wear and merchandise, are key to Bjorn Borg's growth. This move not only diversifies revenue but also taps into the rapidly expanding esports demographic, a market segment showing significant engagement with performance apparel.

Expanding the product line into innovative sports fashion, potentially incorporating smart fabrics or advanced material technologies, presents another avenue for capturing market share. For example, the sports apparel market saw a global growth of approximately 7% in 2023, reaching over $200 billion, indicating strong consumer demand for technologically advanced and stylish activewear.

- New Revenue Streams: Partnerships like the ENCE collaboration can unlock sales channels and customer bases beyond traditional sports.

- Demographic Expansion: Targeting new audiences, such as esports enthusiasts, broadens brand appeal and market penetration.

- Product Innovation: Developing product lines with smart fabrics or new technologies can differentiate Bjorn Borg in a competitive market.

- Market Share Growth: Successful extensions and collaborations can lead to increased sales and a stronger position within the sports fashion industry.

Björn Borg can leverage the expanding global sports apparel market, projected to reach $233.5 billion by 2025, by enhancing its sportswear and footwear offerings. The company can also capitalize on the digital transformation in apparel, with e-commerce sales expected to exceed $1.2 trillion in 2024, by improving its online customer experience with AI and virtual try-on technologies.

Emerging markets offer significant growth potential, particularly in Asia, where the apparel market is anticipated to reach $3.5 trillion by 2027. Furthermore, Björn Borg can attract environmentally conscious consumers, as 60% of consumers are willing to pay more for sustainable products, by strengthening its commitments to eco-friendly materials and ethical sourcing.

Strategic collaborations, such as the 2024 partnership with ENCE, open new revenue streams and tap into the growing esports demographic. Expanding product lines into innovative sports fashion, capitalizing on the sports apparel market's 7% growth in 2023, can further differentiate Björn Borg and increase market share.

| Opportunity | Market Data | Actionable Insight |

| Global Sports Apparel Market Growth | Projected to reach $233.5 billion by 2025 | Expand sportswear and footwear lines to capture wider consumer base. |

| E-commerce Expansion | Apparel e-commerce sales over $1.2 trillion in 2024 | Enhance digital infrastructure with AI personalization and virtual try-on. |

| Emerging Market Entry | Asia apparel market forecast at $3.5 trillion by 2027 | Utilize hybrid distribution model for expansion into new regions. |

| Sustainable Fashion Demand | 60% of consumers willing to pay more for sustainable products | Bolster sustainability initiatives and supply chain transparency. |

| Strategic Collaborations | Esports market engagement with performance apparel | Forge partnerships to access new demographics and revenue streams. |

Threats

The sports fashion arena is incredibly crowded, with global giants and emerging local labels constantly battling for consumer attention and wallet share. This fierce rivalry often forces brands like Bjorn Borg to contend with significant pricing pressures and escalating marketing expenditures just to stay visible. For instance, in 2024, the global sportswear market was valued at approximately $200 billion, with major players like Nike and Adidas commanding substantial portions, making it challenging for mid-tier brands to compete on scale.

Ongoing macroeconomic pressures, including persistent inflation, are a significant threat. For instance, the eurozone experienced an inflation rate of 2.4% in April 2024, a slight decrease from March but still impacting purchasing power. This economic climate can directly curtail consumer spending on non-essential items like fashion apparel and footwear, potentially reducing Björn Borg's sales volumes.

Declining consumer confidence, often a byproduct of economic uncertainty, further exacerbates this threat. In Q1 2024, consumer confidence in key European markets remained subdued, reflecting anxieties about the cost of living and future economic prospects. This hesitancy can lead consumers to postpone or forgo discretionary purchases, directly impacting Björn Borg's revenue streams and potentially squeezing profit margins as demand softens.

Björn Borg faces significant reputational damage risks. Negative press concerning factory working conditions or the use of restricted chemicals could tarnish the brand's image. For instance, in 2023, several apparel brands faced scrutiny over supply chain transparency, with reports highlighting potential labor issues in some manufacturing hubs.

The brand's direct association with the iconic Björn Borg himself presents a unique vulnerability. Any personal scandal or negative public perception surrounding the individual could directly impact the brand's standing. While specific incidents are not publicly detailed, the inherent link means the brand's equity is tied to his public persona.

Supply Chain Disruptions and Rising Costs

Björn Borg, like many in the fashion sector, faces ongoing threats from global supply chain disruptions. These complexities can hinder the timely sourcing of materials and finished goods, directly impacting operational efficiency. For instance, in 2023, shipping costs saw significant fluctuations, with the Drewry World Container Index fluctuating, impacting landed costs for apparel importers.

Elevated transport costs, a persistent issue in recent years, continue to squeeze profit margins. This increase in freight expenses, from ocean shipping to air cargo, directly affects Björn Borg's cost of goods sold. In early 2024, while some shipping rates had eased from pandemic peaks, they remained notably higher than pre-2020 levels, adding pressure to the company's bottom line.

Furthermore, increased inventory expenses pose a challenge. Holding more stock to mitigate potential shortages or delays ties up capital and increases warehousing and management costs. The fashion industry's reliance on seasonal collections means that any disruption can lead to excess or insufficient inventory, both of which are financially detrimental.

- Global supply chain vulnerabilities continue to affect the fashion industry, potentially impacting Björn Borg's product availability.

- Rising transportation costs, a persistent economic factor, directly increase the cost of bringing products to market.

- Higher inventory holding expenses can strain Björn Borg's working capital and operational flexibility.

Rapidly Evolving Fashion Trends and Consumer Preferences

The fashion industry, including sports apparel, is notoriously fickle, with trends shifting at an accelerated pace. For Bjorn Borg, this means a constant challenge to anticipate and respond to evolving consumer tastes in design, color, and material. A failure to keep up can result in significant markdowns on unsold inventory and a perception of being out of touch with current styles, impacting brand desirability.

The speed of these changes necessitates a highly agile supply chain and design process. For instance, in 2024, the athleisure trend continued its dominance, but with a notable shift towards more sustainable materials and bolder, retro-inspired designs. Brands that couldn't pivot quickly to these preferences, perhaps relying on longer production cycles, risked being left with stock that no longer resonated with the target market.

- Trend Volatility: The fashion cycle is shortening, demanding constant adaptation.

- Inventory Risk: Misjudging trends can lead to excess stock and financial losses.

- Brand Relevance: Staying current is crucial for maintaining market position and appeal.

- Innovation Pressure: Continuous investment in new designs and materials is essential for survival.

The intense competition within the sports fashion market, with established global brands and nimble new entrants, presents a significant challenge for Björn Borg. This crowded landscape forces brands to invest heavily in marketing and often leads to price wars, impacting profitability. For example, the global sportswear market was valued at approximately $200 billion in 2024, with major players like Nike and Adidas holding substantial market share, making it difficult for mid-tier brands to compete effectively.

Macroeconomic instability, including persistent inflation and fluctuating consumer confidence, directly affects discretionary spending on fashion items. With inflation rates impacting purchasing power, consumers may reduce spending on non-essential apparel. For instance, eurozone inflation was 2.4% in April 2024, highlighting ongoing economic pressures that can dampen demand for brands like Björn Borg.

Björn Borg also faces risks related to supply chain disruptions and rising transportation costs, which can affect product availability and increase the cost of goods sold. In early 2024, shipping rates remained elevated compared to pre-2020 levels, adding pressure to the company's bottom line. Furthermore, the need to maintain higher inventory levels to counter these disruptions can lead to increased holding costs and tie up valuable capital.

The rapid pace of fashion trends poses a constant threat, requiring Björn Borg to be agile in design and production to remain relevant. Failing to adapt to evolving consumer preferences, such as the growing demand for sustainable materials and retro designs observed in 2024, can result in unsold inventory and a decline in brand appeal.

SWOT Analysis Data Sources

This Bjorn Borg SWOT analysis is built upon a foundation of robust data, including financial performance reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic overview.