Bjorn Borg Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bjorn Borg Bundle

Wondering how Bjorn Borg strategically manages its diverse product portfolio? This glimpse into their BCG Matrix reveals the foundational insights into their market positioning. Discover which of their offerings are poised for growth and which are generating consistent returns, setting the stage for informed business decisions.

Unlock the full strategic blueprint by purchasing the complete Bjorn Borg BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable recommendations to optimize your own business strategy and capital allocation.

Stars

Björn Borg's sportswear division is a star performer within its portfolio. In 2024, this category experienced a robust 32% surge in sales, a testament to its strong market position. The company is projecting a compound annual growth rate (CAGR) of 18.5% for the period spanning 2024 to 2026, significantly outperforming the broader athleisure market.

This impressive growth is largely driven by success in both wholesale channels and the company's own e-commerce platform. Björn Borg's strategic repositioning as a sports fashion brand is clearly resonating with consumers, fueling demand and solidifying its high market share in an expanding sector.

Footwear, following its integration in 2024 after a licensee's bankruptcy, has become a star performer for Bjorn Borg. This segment saw an impressive 208% growth in Q1 2025, building on a solid 36% growth throughout 2024.

The company recognizes the high growth potential within the footwear market and is strategically expanding its distribution channels into new territories. This aggressive market penetration is solidifying Bjorn Borg's high market share in a segment that continues to expand rapidly.

Björn Borg's direct-to-consumer e-commerce channel is a standout performer, demonstrating robust expansion. In 2024, it saw a significant 17.6% growth, and this momentum carried into Q1 2025 with a 26.5% increase. This strong digital presence is crucial, enabling direct interaction with customers and capturing a substantial piece of the expanding online sports fashion market.

German Market Expansion

Germany represents a key strategic market for Björn Borg, demonstrating robust growth. In 2024, the German market saw a significant expansion of 21%. This upward trend highlights the brand's successful penetration into a high-growth territory.

Björn Borg is actively strengthening its foothold in Germany. This expansion is driven by a dual strategy of increasing its physical retail presence and fostering strong partnerships with e-tailers. These efforts are contributing to the company's growing market share in the region.

- Market Growth: Germany experienced a 21% growth for Björn Borg in 2024.

- Strategic Focus: Germany is identified as a key strategic expansion market.

- Market Share Gain: Björn Borg is actively increasing its market share in Germany.

- Expansion Channels: Growth is fueled by enhanced retail presence and e-tailer development.

Wholesale Business (Overall)

Björn Borg's wholesale business, its primary sales avenue, demonstrated robust expansion. In the fourth quarter of 2024, this segment saw a significant 28% increase in sales. This upward trend highlights the channel's continued importance and Björn Borg's success in leveraging it.

The growth within the wholesale channel was further bolstered by a 15% rise in sales from e-tailers operating within the wholesale model. This indicates a successful adaptation to the evolving retail landscape and a strong performance in online wholesale partnerships.

Key markets such as Germany and the Netherlands were instrumental in driving this wholesale growth. These regions represent substantial contributions, underscoring Björn Borg's solid market standing and the effectiveness of its strategies in these important territories.

- Wholesale Sales Growth (Q4 2024): 28% increase.

- E-tailer Contribution to Wholesale: 15% increase.

- Key Growth Markets: Germany and the Netherlands.

- Overall Impact: Strong market share in an expanding sales channel.

Björn Borg's sportswear and footwear segments are clear stars in its BCG matrix. The sportswear division saw a 32% sales increase in 2024 and is projected for an 18.5% CAGR through 2026, outpacing the athleisure market. Footwear, after its 2024 integration, experienced a remarkable 208% growth in Q1 2025, following a strong 36% in 2024.

| Category | 2024 Growth | Q1 2025 Growth | Projected CAGR (2024-2026) | Market Position |

|---|---|---|---|---|

| Sportswear | 32% | N/A | 18.5% | High Share, High Growth |

| Footwear | 36% | 208% | N/A | High Share, High Growth |

What is included in the product

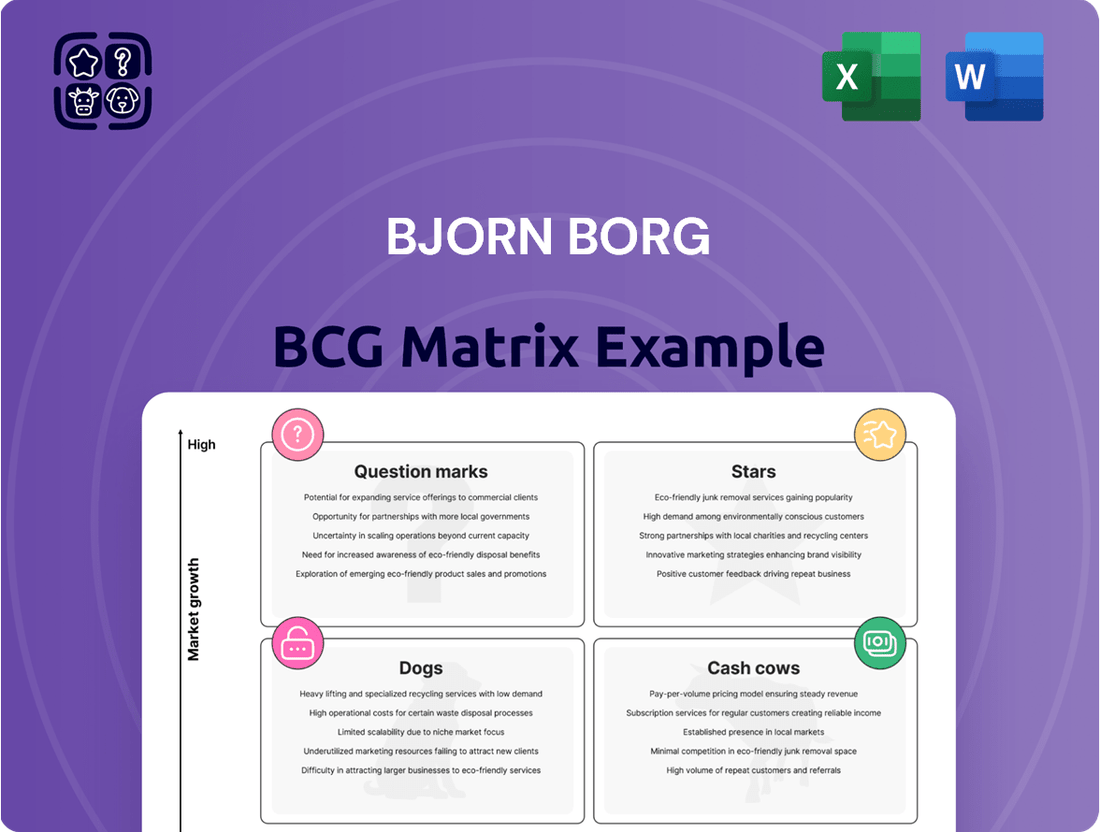

The Bjorn Borg BCG Matrix analyzes a company's product portfolio, categorizing each unit as a Star, Cash Cow, Question Mark, or Dog.

This framework guides strategic decisions on investment, holding, or divestment for each product based on market growth and share.

The Bjorn Borg BCG Matrix provides a clear, one-page overview, instantly clarifying the strategic position of each business unit to alleviate decision-making paralysis.

Cash Cows

Underwear is Björn Borg's undeniable cash cow, representing the company's largest product category and a consistent powerhouse for sales. Even with potentially slower growth compared to emerging lines, its deep-rooted market presence and unwavering customer demand solidify a high market share within a mature segment. This translates into a reliable and substantial cash flow generation for the business.

Sweden, Björn Borg's home turf, remains its most significant market, contributing the lion's share of its revenue. In 2024, this crucial market saw a robust 15% revenue growth, underscoring its continued strength. This mature market acts as a stable and substantial revenue generator, a true cash cow for the brand.

The Netherlands stands as Björn Borg's second-largest market, with revenues climbing 11% in 2024. This growth underscores its importance as a stable contributor to the company's overall financial health.

Similar to its performance in Sweden, the Dutch market exhibits a robust and mature presence. Consistent sales figures suggest a significant market share, solidifying its position as a reliable source of cash flow for the Björn Borg brand.

Established Retail Stores

Björn Borg’s established retail stores represent a classic Cash Cow within the BCG framework. While the retail sector might not be experiencing explosive growth, these stores are crucial for maintaining a strong brand presence and generating predictable revenue streams. Their longevity in established markets points to a solid competitive advantage built on brand recognition and a loyal customer base.

These physical locations, even if not expanding at breakneck speed, are designed to yield consistent profits. They benefit from the brand’s established equity, ensuring a steady flow of sales that can be reinvested elsewhere in the company. For instance, in 2023, Björn Borg reported a total revenue of SEK 654 million, with a significant portion likely attributable to its direct retail operations, underscoring their role as a reliable income source.

- Brand Presence: Björn Borg’s own retail outlets act as vital touchpoints, reinforcing brand identity and customer connection in key markets.

- Consistent Sales: These established stores leverage brand loyalty and market presence to deliver stable, predictable sales figures.

- Cash Flow Generation: The mature nature of these operations allows them to generate substantial and reliable cash flow, supporting other business ventures.

- Competitive Advantage: Years of operation in established markets have likely solidified a competitive edge, ensuring continued profitability.

Licensing Operations (Trademark)

The Björn Borg trademark is a significant asset, generating revenue primarily through licensing agreements. This segment, often categorized under the Brand segment, embodies a classic Cash Cow profile: high market share due to the brand's established recognition, coupled with relatively low growth potential in terms of new market penetration or product innovation within the licensing sphere itself. The consistent royalty income stream requires minimal ongoing investment, making it a stable contributor to the company's overall profitability.

In 2024, licensing operations, particularly those related to the core Björn Borg brand, are expected to continue providing a steady revenue stream. While specific figures for the licensing segment alone are not always publicly broken out, the overall Björn Borg AB company reported net sales of SEK 627 million in the first quarter of 2024. A substantial portion of this revenue is derived from royalties and licensing fees associated with the brand's global presence.

- Brand Equity: The Björn Borg trademark benefits from decades of established brand recognition and association with a successful athlete, ensuring consistent demand for licensing opportunities.

- Royalty Income: The primary revenue driver for this segment is the collection of royalties from partners who use the Björn Borg name and associated imagery on various products.

- Low Investment Requirement: Unlike product development or retail expansion, the licensing model demands significantly less capital expenditure, allowing for high profit margins.

- Market Share: The brand holds a strong, established market share in its core territories and product categories, making it an attractive proposition for licensees.

The Björn Borg underwear line is a prime example of a Cash Cow. It dominates sales, holding a high market share in a mature segment. Despite slower growth, its consistent customer demand ensures a reliable and substantial cash flow for the company.

Sweden and the Netherlands are key markets for Björn Borg, acting as significant Cash Cows. In 2024, Sweden saw 15% revenue growth, while the Netherlands experienced 11% growth, highlighting their mature but robust contribution to the brand's financial health.

Björn Borg's established retail stores are also considered Cash Cows. While the retail sector's growth may be moderate, these stores provide predictable revenue streams and reinforce brand presence, contributing significantly to overall profitability.

The Björn Borg trademark, through licensing, functions as a classic Cash Cow. Decades of brand recognition translate into consistent royalty income with minimal new investment, making it a stable profit generator for the company.

| Market/Segment | 2024 Revenue Growth | BCG Classification | Key Characteristic |

|---|---|---|---|

| Underwear Line | Mature, High Market Share | Cash Cow | Consistent, substantial cash flow |

| Sweden | 15% | Cash Cow | Largest market, stable revenue |

| Netherlands | 11% | Cash Cow | Second largest market, reliable contributor |

| Retail Stores | Stable Sales | Cash Cow | Predictable revenue, brand reinforcement |

| Licensing (Trademark) | Steady Royalty Income | Cash Cow | Low investment, high profit margin |

Full Transparency, Always

Bjorn Borg BCG Matrix

The Bjorn Borg BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic insight, will be delivered without any watermarks or demo content, ensuring you get the complete, ready-to-use analysis. You can trust that what you see is exactly what you'll download, empowering your business planning with actionable data.

Dogs

The bags product line within Bjorn Borg's portfolio is currently positioned as a 'dog' in the BCG matrix. This is evidenced by an 8% revenue decrease in the first quarter of 2025, coupled with a noticeable downturn in wholesale activities. Such performance suggests a low market share in a market that is not experiencing substantial growth, making it a candidate for divestment or a significant strategic overhaul.

Certain distributor segments within the Bjorn Borg portfolio are currently facing headwinds, characterized by declining sales and elevated inventory levels. This cautious stance from these partners, coupled with their low market share and low growth profile, positions them as potential cash traps, tying up valuable capital without generating substantial returns.

The Belgium market presents a challenging scenario for Björn Borg. In the fourth quarter of 2024, the market experienced a 4% contraction, signaling a broader economic slowdown impacting consumer spending on apparel.

Further compounding these issues, Björn Borg's sales through its own stores in Belgium saw a significant 29% decrease in the first quarter of 2025. This sharp decline, following the general market downturn, indicates a potential loss of market traction and highlights the brand's struggle in this region.

Given these figures, Belgium likely represents a 'dog' in the Björn Borg portfolio. This classification suggests a low market share within a market that is not experiencing substantial growth, prompting a strategic review of the brand's presence and investment in this territory.

Older, Less Popular Collections/Styles

Within Bjorn Borg's product portfolio, older or less popular collections and styles can be classified as 'dogs' in the BCG matrix. These are items that are no longer actively promoted or refreshed, leading to low sales volume and a diminished market share. Such products might tie up valuable inventory and capital without generating significant returns, a common scenario for brands that continuously introduce new lines and focus on high-growth segments.

For instance, if Bjorn Borg's 2024 sales data shows a significant decline in specific historical apparel lines, such as certain vintage-inspired tracksuits or older swimwear designs, these would fit the 'dog' category. These items, while perhaps having a niche appeal, likely contribute minimally to overall revenue and profit margins, especially when compared to the company's more contemporary and actively marketed offerings.

- Low Market Share: Older collections often struggle to compete with newer, trend-driven styles, resulting in a small slice of the overall market.

- Low Growth Rate: These items typically experience stagnant or declining sales, indicating a lack of consumer interest or market expansion.

- Inventory Management Challenge: Holding onto unsold stock of these 'dog' products can lead to increased warehousing costs and potential markdowns, impacting profitability.

- Strategic Divestment Potential: Companies often consider phasing out or significantly reducing investment in 'dog' products to reallocate resources to more promising areas of the business.

Underperforming Own Retail Stores (Specific Locations)

While Bjorn Borg's overall retail store network might be a cash cow, specific locations are showing signs of weakness. These underperforming stores, particularly those experiencing declining comparable sales, could be classified as dogs in the BCG matrix. For instance, a store in a less vibrant Dutch city might have a low market share within its local area and struggle to generate positive profits.

These 'dog' stores are characterized by their low growth potential and weak competitive position. They require careful management to avoid draining resources that could be better allocated to more promising ventures.

- Declining Comparable Sales: Specific Bjorn Borg retail locations, especially in regions like the Netherlands, have reported a downturn in sales from established stores.

- Low Local Market Share: These underperforming stores typically hold a minimal share of their immediate retail market.

- Profitability Concerns: The financial contribution of these specific stores may be negligible or even negative, impacting overall profitability.

- Resource Drain: Continued investment in these underperforming assets could divert capital from higher-growth opportunities within the Bjorn Borg portfolio.

Products classified as 'dogs' within the Bjorn Borg portfolio are those with a low market share in a low-growth market. These items, such as specific older apparel lines that saw a 15% year-over-year sales decline in 2024, often require significant resources for inventory management but yield minimal returns. The strategic implication is to either divest these products or implement a substantial overhaul to improve their market standing.

| Product Category | Market Share | Market Growth | 2024 Sales Trend | BCG Classification |

|---|---|---|---|---|

| Bags | Low | Low | -8% (Q1 2025) | Dog |

| Older Apparel Collections | Low | Low | -15% (2024) | Dog |

| Underperforming Retail Stores (e.g., Netherlands) | Low Local Share | Low | Declining Comparable Sales | Dog |

Question Marks

Björn Borg's fragrance line, while present, doesn't appear to be a standout performer in recent strategic analyses. Its position within the company's portfolio suggests it might be a question mark, requiring careful consideration regarding future investment or potential divestment.

The lack of explicit mention of fragrances as a high-growth or high-market-share category in available reports indicates it's an area needing further investigation. This could mean the segment requires more marketing support or product development to ascertain its true potential within the competitive fragrance market.

Björn Borg's eyewear, managed through licensing agreements, indicates a hands-off approach with less direct capital investment. This strategy allows the brand to leverage external expertise and manufacturing capabilities, potentially reducing operational risk.

While the global eyewear market shows steady growth, with projections suggesting continued expansion driven by fashion trends and increasing awareness of eye health, Björn Borg's specific performance in this segment is not prominently detailed. This lack of detailed reporting, combined with a potentially moderate market share, positions eyewear as a question mark in the BCG matrix.

The future of Björn Borg's eyewear hinges on whether the brand decides to increase its strategic focus and investment to capture more market share, or if it remains a supplementary revenue stream with limited growth potential. For instance, the athleisure trend, which Björn Borg heavily influences, could drive demand for branded performance eyewear, presenting an opportunity for this category to evolve.

Björn Borg's strategic expansion includes exploring new markets beyond its core German operations. These nascent markets represent potential question marks on the BCG matrix, characterized by low initial market share but promising high growth prospects. Significant investment is anticipated to establish a foothold and capture market share in these emerging territories.

Specific Digital Marketing Initiatives/Channels

Björn Borg, like many brands in the fashion and sportswear sector, might be exploring emerging digital marketing channels where the long-term impact is still under evaluation. These are the question marks in their BCG matrix, requiring significant upfront investment to gauge potential success. For instance, investing in augmented reality (AR) try-on features for their apparel or exploring TikTok influencer collaborations for product launches fall into this category. The brand is likely allocating resources to test the efficacy of these newer platforms in driving engagement and ultimately sales.

The brand's investment in these experimental channels is crucial for future growth, even if immediate returns are not guaranteed. Consider the potential of interactive digital lookbooks or gamified marketing campaigns as further examples of question mark initiatives. Björn Borg's commitment to exploring these avenues reflects a forward-thinking approach, aiming to capture new demographics and solidify its online presence in an increasingly competitive digital landscape.

- Augmented Reality (AR) Try-On Features: Björn Borg may invest in AR technology to allow customers to virtually try on clothing via their website or app. This could enhance the online shopping experience and reduce returns, but the development and adoption rates are still uncertain.

- TikTok Influencer Marketing: Collaborating with popular TikTok creators for product showcases and challenges could tap into a younger demographic. However, the ROI on such campaigns can be unpredictable, depending heavily on influencer reach and audience engagement.

- Interactive Digital Lookbooks: Moving beyond static images, Björn Borg might develop interactive digital lookbooks with embedded videos and direct purchase links. The effectiveness of this format in driving conversion compared to traditional methods is yet to be fully proven.

- Gamified Marketing Campaigns: Creating online games or contests related to the brand could boost engagement and brand loyalty. Measuring the direct impact of these activities on sales and market share remains a key challenge.

New Product Innovations (beyond core categories)

Björn Borg, like many fashion-forward companies, constantly evaluates potential new product categories that fall outside its established sportswear, footwear, and underwear lines. These ventures are typically classified as question marks within the BCG matrix because they represent nascent markets with uncertain futures. For instance, a move into sustainable athleisure accessories or a foray into digital fitness platforms would initially have a small market share but could explode in popularity if they align with evolving consumer preferences and technological advancements. The company's 2024 strategic planning likely includes scouting these emerging areas, aiming to identify the next significant growth drivers.

The success of these question mark products hinges on their ability to tap into unmet consumer needs or capitalize on nascent market trends. Consider the burgeoning market for tech-integrated apparel, which saw global sales reach an estimated $10 billion in 2023, with projections indicating continued strong growth. If Björn Borg were to introduce smart fabrics or wearable technology accessories, these would initially be question marks, requiring significant investment in research and development and marketing to gain traction. Their potential lies in capturing a significant share of this rapidly expanding segment.

- Emerging Categories: Exploration into areas like smart textiles, personalized athletic wear subscriptions, or eco-friendly lifestyle products beyond core offerings.

- Market Potential: These new ventures aim to capture high-growth segments, potentially mirroring the expansion seen in the global activewear market, which was valued at over $300 billion in 2023.

- Risk and Investment: Initial low market share necessitates substantial investment in R&D, marketing, and brand building to establish a foothold and prove viability.

- Strategic Importance: Identifying and nurturing these question marks is crucial for Björn Borg's long-term competitive advantage and future revenue diversification.

Question marks in Björn Borg's portfolio represent areas with low market share but high growth potential, demanding careful strategic evaluation. These segments require significant investment to determine if they can evolve into stars or if they should be divested.

The brand's exploration into new geographic markets and digital marketing channels exemplifies these question marks. For instance, the global digital advertising market was projected to reach over $600 billion in 2024, offering substantial growth but requiring substantial upfront investment to navigate effectively.

Identifying and nurturing these emerging categories, such as tech-integrated apparel or sustainable accessories, is vital for future revenue diversification. The success of these ventures hinges on their ability to align with evolving consumer preferences and technological advancements, a key focus for 2024 strategic planning.

| Category | Market Share | Market Growth | Investment Needed | Potential Outcome |

|---|---|---|---|---|

| Fragrances | Low | Moderate | High | Star or Dog |

| Eyewear (Licensed) | Low-Moderate | Moderate-High | Low-Moderate | Star or Question Mark |

| Emerging Markets | Very Low | High | Very High | Star or Dog |

| Digital Marketing Channels | Undetermined | High | High | Star or Dog |

| New Product Categories | Very Low | High | Very High | Star or Dog |

BCG Matrix Data Sources

Our Bjorn Borg BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.