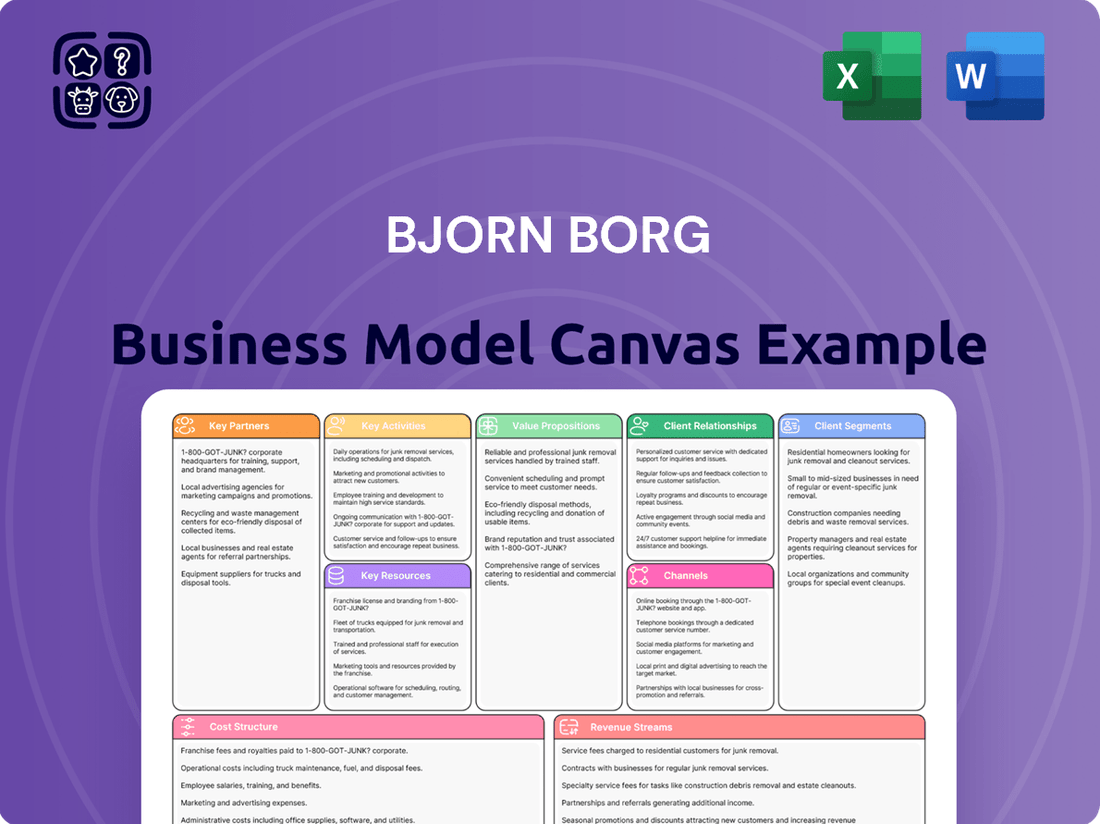

Bjorn Borg Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bjorn Borg Bundle

Unlock the strategic genius behind Bjorn Borg's success with our comprehensive Business Model Canvas. Discover how they connect with customers, deliver value, and generate revenue in the competitive fashion industry. This detailed analysis is your key to understanding their winning formula.

Partnerships

Björn Borg collaborates with a wide array of external retailers, encompassing department stores, specialized boutiques, and major sports apparel chains. This extensive network is crucial for broadening the brand's market penetration and ensuring widespread product accessibility.

The company's e-tailer partnerships have been particularly impactful, demonstrating robust growth throughout 2024 and into the first quarter of 2025. Key markets like Germany and the Netherlands have seen significant increases in online sales, underscoring the strategic importance of these digital channels.

Björn Borg collaborates with manufacturers and suppliers to produce its range of apparel, footwear, bags, and fragrances. These partnerships are vital for bringing their products to market.

The company emphasizes close relationships with these manufacturing and supply chain partners. This focus aims to ensure ethical practices, including fair and safe working conditions for all involved.

A key objective for Björn Borg is to minimize the environmental footprint of its production processes. They have set an ambitious target to reduce emissions by 50% by the year 2030, working directly with their partners to achieve this goal.

Björn Borg strategically partners with logistics and distribution specialists to ensure its apparel and underwear reach customers efficiently across diverse markets. While the company is increasingly bringing distribution in-house, particularly for footwear in key regions, it still relies on external distributors for broad market penetration and to manage complex delivery networks. This hybrid model allows Björn Borg to maintain direct oversight where beneficial, while leveraging the established infrastructure and expertise of partners for widespread product availability.

Licensing Partners

Björn Borg leverages licensing agreements to expand its brand reach into specific product categories, such as eyewear. These partnerships allow the company to enter new markets and product segments without the need for direct manufacturing or distribution infrastructure.

In 2024, the global eyewear market was valued at approximately $140 billion, demonstrating the significant potential for licensed brands to capture market share. Björn Borg's licensing strategy enables it to tap into this lucrative market by collaborating with specialized eyewear manufacturers who possess the expertise and distribution networks.

- Licensing Partners: Björn Borg enters into licensing agreements for product categories like eyewear.

- Brand Extension: These partnerships allow the brand to expand into new product areas.

- Reduced Overhead: Björn Borg avoids direct manufacturing and distribution involvement.

- Market Access: Licensing provides access to specialized expertise and established distribution channels in new product categories.

Marketing and Brand Collaboration Partners

Björn Borg actively seeks marketing and brand collaboration partners to amplify its reach and connect with diverse consumer segments. These alliances are crucial for enhancing brand visibility and tapping into new demographics, particularly younger audiences. For instance, in 2024, Björn Borg partnered with ENCE, a prominent esports organization. This collaboration aims to leverage the growing popularity of esports to engage a digitally native audience, often through co-branded merchandise and joint promotional activities that resonate with gaming culture.

These strategic partnerships extend beyond esports, encompassing collaborations with other lifestyle brands. Such ventures often result in co-created products and integrated marketing campaigns designed to generate mutual brand awareness and drive sales. The objective is to foster a stronger brand presence by associating with entities that share similar values or appeal to overlapping target markets, thereby creating a more robust and engaging brand narrative.

The effectiveness of these collaborations is often measured by metrics like increased social media engagement, website traffic, and direct sales attributed to the partnership initiatives. For example, a successful co-branded product launch could see a significant uplift in sales figures compared to standalone product releases, demonstrating the power of shared marketing efforts.

- Brand Amplification: Collaborations with entities like ENCE in 2024 aim to significantly boost Björn Borg's brand presence within the esports community.

- New Audience Engagement: Partnerships are strategically chosen to attract and engage new, often younger, demographics that are active in digital and gaming spaces.

- Co-Branded Initiatives: Joint marketing campaigns and co-branded product lines are key components of these collaborations, creating unique offerings for consumers.

- Market Penetration: By aligning with popular brands or organizations, Björn Borg seeks to deepen its penetration into specific lifestyle and cultural segments.

Björn Borg's key partnerships are multifaceted, spanning retail, manufacturing, logistics, and brand collaborations. These relationships are critical for market reach, product development, and brand visibility. The company actively cultivates these alliances to ensure efficient operations and strategic growth.

What is included in the product

A comprehensive business model canvas for Bjorn Borg, detailing customer segments, value propositions, and revenue streams to support its lifestyle apparel strategy.

Bjorn Borg's Business Model Canvas acts as a pain point reliever by offering a structured, visual approach to understanding and refining their brand's core elements, making complex strategic decisions more manageable.

It streamlines the process of identifying and addressing customer needs and value propositions, alleviating the pain of disjointed strategies and ensuring a cohesive brand experience.

Activities

Björn Borg is actively engaged in the continuous design and development of new collections. Their focus spans apparel, footwear, bags, and fragrances, with a strong emphasis on sports fashion. This involves blending athletic functionality with modern aesthetics to create desirable products.

A key strategic objective for Björn Borg is to drive growth in specific categories. They are prioritizing expansion in footwear and sports apparel, aiming to strengthen their market position in these areas. This targeted approach guides their product development efforts.

In 2024, Björn Borg reported a net sales increase of 12% for the first quarter, largely attributed to strong performance in their footwear and sportswear segments. This growth underscores the success of their strategic focus on these product categories.

Björn Borg's brand building and marketing efforts are extensive, focusing on enhancing visibility and appeal. In 2024, the company continued its data-driven content creation, aiming to connect with new demographics and solidify its position as a premier sports fashion brand.

Strategic campaigns are central to this, with a significant portion of resources allocated to activities that reinforce the brand's identity. For instance, their digital marketing spend in 2024 was a key driver in reaching a wider audience and fostering brand loyalty.

Bjorn Borg's supply chain management focuses on agility and efficiency, crucial for responding to fluctuating demand in the fashion industry. This involves close collaboration with suppliers to ensure ethical and sustainable production methods, a growing concern for consumers. For instance, in 2024, the brand continued its commitment to transparency, with a significant portion of its product lines traceable back to their origins, aiming to meet increasing consumer demand for responsibly sourced apparel.

Wholesale and Retail Operations Management

Björn Borg's core operations revolve around managing both wholesale and retail channels to reach its customer base. The wholesale segment represents the company's most significant revenue driver, requiring careful attention to partner relationships and distribution efficiency.

Alongside wholesale, Björn Borg actively operates its own physical retail stores and a robust e-commerce platform. This multi-channel approach necessitates sophisticated sales strategies, precise inventory management across all touchpoints, and continuous optimization to ensure seamless customer experiences and maximize performance.

In 2024, Björn Borg continued to refine its operational strategies. For instance, the company focused on integrating its online and offline inventory systems to reduce stockouts and improve order fulfillment times, a critical factor in customer satisfaction and sales conversion.

- Wholesale Dominance: The wholesale channel remains Björn Borg's primary sales avenue, underscoring the importance of strong relationships with retail partners and efficient supply chain management.

- Direct-to-Consumer (DTC) Growth: The company actively manages its own retail stores and e-commerce operations, aiming to enhance brand control and capture higher margins through direct customer engagement.

- Omnichannel Integration: Key activities include synchronizing inventory, sales data, and customer information across all channels to provide a consistent and convenient shopping experience.

- Performance Optimization: Continuous efforts are made to analyze sales data, manage stock levels effectively, and adapt marketing strategies to drive performance across both wholesale and retail operations.

E-commerce and Digital Sales Management

Björn Borg's e-commerce and digital sales management is a core function, focusing on operating and expanding its direct-to-consumer online platform. This involves continuous optimization of the user journey to enhance the shopping experience and drive sales growth. In 2023, e-commerce represented a substantial and increasing share of the company's revenue, underscoring its strategic importance.

- E-commerce Platform Operation: Maintaining and improving the functionality and user-friendliness of the Björn Borg website to ensure a seamless shopping experience.

- Digital Sales Growth Strategies: Implementing marketing campaigns, SEO, and personalized recommendations to boost online conversion rates and average order value.

- Customer Engagement Online: Building relationships with digital customers through content, loyalty programs, and responsive customer service to foster repeat purchases.

- Data Analytics for Optimization: Utilizing web analytics to track performance, understand customer behavior, and make data-driven decisions for ongoing improvements.

Björn Borg's key activities center on managing its diverse sales channels. The wholesale segment remains a significant revenue generator, requiring robust partner management. Simultaneously, the company actively cultivates its direct-to-consumer (DTC) channels, encompassing physical retail and a strong e-commerce presence.

These DTC efforts focus on enhancing brand control and customer relationships. Activities include optimizing the online shopping experience and integrating online and offline operations for a cohesive customer journey.

In 2024, Björn Borg's Q1 net sales saw a 12% increase, with footwear and sportswear leading the charge, highlighting the effectiveness of their channel strategies.

The company also prioritizes data-driven marketing and brand building. In 2024, significant investment in digital marketing aimed to broaden reach and deepen brand engagement, reinforcing their sports fashion identity.

What You See Is What You Get

Business Model Canvas

The Bjorn Borg Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or mockup; it represents the complete, ready-to-use file with all sections and content included. You can be confident that what you see is precisely what you will get, allowing you to immediately begin analyzing and strategizing for the brand.

Resources

The Björn Borg brand name, logo, and associated trademarks are invaluable assets, embodying decades of heritage and strong consumer recognition across multiple markets. This robust intellectual property is fundamental to the company's distinct market identity and provides a significant competitive edge.

This intellectual property is the bedrock of Björn Borg's market presence, enabling premium pricing and fostering customer loyalty. For instance, in 2023, the brand continued to leverage its established reputation to drive sales across its apparel and underwear segments.

Björn Borg's strength lies in its wide-ranging product assortment, encompassing everything from core underwear and active sportswear to footwear, bags, and even fragrances. This diverse offering caters to a broad customer base and allows the brand to capture multiple market segments.

The company's commitment to design expertise is a crucial asset, fueling constant innovation and ensuring its products remain relevant and appealing in a fast-moving fashion landscape. In 2023, the sportswear segment showed particular resilience, contributing significantly to the brand's overall performance.

Human capital for Bjorn Borg centers on its dedicated employees, encompassing a range of vital roles from creative designers to strategic management. These individuals, numbering approximately 152 in 2024, are the driving force behind the brand’s innovation and market presence.

The collective experience, creative flair, and intrinsic motivation of Bjorn Borg's workforce are indispensable assets. This human element directly fuels the development of new product lines and the execution of effective marketing and sales strategies, underpinning the brand's overall growth and competitive edge.

Distribution Network and Channels

Björn Borg's distribution network is a robust hybrid model. It strategically combines direct-to-consumer channels with wholesale partnerships to ensure widespread availability and accessibility of its products.

This approach is crucial for reaching a diverse customer base. In 2024, e-commerce continued to be a significant growth driver, with online sales contributing a substantial portion to the company's revenue, reflecting a broader industry trend of digital adoption.

The brand operates its own retail stores, offering a curated brand experience and direct customer engagement. Complementing these physical touchpoints, Björn Borg leverages a strong e-commerce platform that serves customers globally. This digital presence is vital for capturing online market share and providing a seamless shopping journey.

Furthermore, the company partners with a network of external retailers and distributors. These partnerships extend Björn Borg's reach into various geographical markets and retail environments, including department stores and specialized sports retailers. This multi-channel strategy aims to maximize market penetration and cater to different consumer shopping preferences.

- Owned Retail Stores: Provide direct brand experience and control over the customer journey.

- E-commerce Platform: Facilitates global reach and caters to the growing online shopping trend.

- External Retailers and Distributors: Expand market presence and accessibility through partnerships.

- Hybrid Model: Ensures broad market penetration and caters to diverse consumer preferences.

Financial Capital

Financial capital for Bjorn Borg encompasses robust cash flow generation, access to favorable bank facilities, and a solid equity base. These elements are critical for sustaining daily operations, fueling expansion into new product lines such as performance footwear and athleisure apparel, and efficiently managing the company's working capital needs.

In 2024, the sportswear industry saw significant investment. For instance, Nike reported revenues of $51.2 billion for its fiscal year ending May 31, 2024, demonstrating the scale of financial resources required to compete and grow. Bjorn Borg's financial strategy must align with such industry dynamics, ensuring sufficient liquidity and access to capital for strategic initiatives.

Key financial resources for Bjorn Borg include:

- Cash Flow: Consistent positive cash flow from sales of apparel and accessories is vital for operational stability and reinvestment.

- Bank Facilities: Access to credit lines and loans provides flexibility for managing inventory, marketing campaigns, and unforeseen expenditures.

- Equity: The company's equity structure, whether privately held or publicly traded, influences its ability to raise further capital for significant growth opportunities.

Björn Borg's physical resources are primarily its own retail stores, which offer a direct brand experience and control over customer interaction. The company also utilizes its e-commerce platform as a key physical asset, enabling global sales and customer access.

These physical assets are complemented by a network of external retail partners and distributors. This hybrid approach ensures broad market penetration and caters to diverse consumer shopping preferences, a strategy that proved effective in 2023 with continued growth in online sales.

The brand's physical presence is a crucial element in its go-to-market strategy.

Björn Borg's key physical resources include:

| Resource | Description | Role in Business Model |

| Owned Retail Stores | Physical locations for brand experience and sales. | Direct customer engagement, brand building, and sales generation. |

| E-commerce Platform | Online sales channel. | Global reach, convenience, and direct-to-consumer sales. |

| Distribution Centers/Warehousing | Facilities for inventory management and order fulfillment. | Ensuring product availability and efficient delivery across channels. |

Value Propositions

Björn Borg masterfully combines athletic functionality with contemporary style, offering apparel that performs on the court and looks sharp off it. This dual focus caters to individuals who value both performance in their sportswear and fashion-forward aesthetics in their everyday wardrobe. For instance, in 2024, the brand continued to emphasize this by launching collections that integrated advanced fabric technologies with current fashion trends, reinforcing its position in the sports fashion segment.

Bjorn Borg emphasizes high-quality and durable products, a cornerstone of its value proposition. This focus ensures customers receive items that last, contributing to a positive brand experience and building lasting loyalty. For instance, in 2024, the brand continued to invest in premium materials and robust construction techniques, aiming to reduce product returns due to defects, a key metric for quality assurance.

Björn Borg champions an active lifestyle through its core 'Train to Live' philosophy. This ethos positions the brand's apparel not just as clothing, but as tools that encourage movement and contribute to overall physical and mental health. This resonates deeply with a growing segment of consumers prioritizing wellness.

The brand's commitment to this philosophy is evident in its product design and marketing, which often feature active individuals and promote the benefits of exercise. This focus on an active lifestyle is a key differentiator, attracting a health-conscious demographic. In 2024, the global wellness market was valued at over $5.6 trillion, highlighting the significant consumer interest in health and well-being.

Broad Product Range for Diverse Needs

Björn Borg’s extensive product catalog, encompassing underwear, sportswear, swimwear, footwear, accessories like bags, and fragrances, addresses a wide array of consumer needs and lifestyle preferences. This comprehensive offering simplifies the shopping experience, fostering a sense of brand loyalty and encouraging customers to explore and purchase across multiple product categories.

The brand’s strategy of providing a broad product range directly supports its value proposition by acting as a one-stop shop for active and style-conscious individuals. This breadth not only enhances customer convenience but also drives higher average transaction values.

- Product Diversity: Underwear, sportswear, swimwear, shoes, bags, and fragrances.

- Lifestyle Integration: Caters to various aspects of a consumer's wardrobe and daily life.

- Cross-Category Sales: Encourages customers to purchase multiple items, increasing revenue.

- Brand Cohesion: Presents a unified brand image across different product lines.

Brand Heritage and Recognition

Björn Borg leverages its rich brand heritage and widespread recognition to offer products that resonate with consumers seeking authenticity and prestige. This established legacy translates into immediate trust and a perceived higher quality, setting the brand apart in a competitive market.

The Björn Borg name evokes a sense of sporting excellence and Swedish design, creating a powerful emotional connection with its customer base. This strong brand identity is a significant asset, enabling premium pricing and fostering customer loyalty.

- Brand Heritage: Björn Borg, the tennis legend, established the brand in 1984, imbuing it with a legacy of performance and style.

- Global Recognition: The brand enjoys high awareness across key European markets, particularly in its home country of Sweden and in the Netherlands.

- Product Association: Consumers associate Björn Borg products with quality, durability, and a distinctive Scandinavian aesthetic.

- Market Trust: Decades of operation have built a foundation of trust, allowing the brand to command a premium in categories like underwear and sportswear.

Björn Borg's value proposition centers on the fusion of high-performance sportswear with contemporary fashion. This dual appeal targets consumers who demand both functionality during athletic activities and stylish aesthetics for everyday wear. In 2024, the brand continued to highlight this through collections that integrated advanced fabric technologies with current fashion trends, solidifying its niche in the sports fashion market.

Quality and durability are paramount, ensuring customers receive long-lasting products that foster brand loyalty. Björn Borg's commitment to premium materials and robust construction, evident in its 2024 product development, aims to minimize defects and enhance the overall customer experience.

The brand actively promotes an active lifestyle through its 'Train to Live' philosophy, positioning its apparel as enablers of physical and mental well-being. This resonates with the growing global wellness market, which was valued at over $5.6 trillion in 2024, underscoring consumer interest in health-focused brands.

Björn Borg offers an extensive product catalog, including underwear, sportswear, swimwear, footwear, and accessories, providing a comprehensive solution for active and style-conscious individuals. This broad range simplifies shopping and encourages cross-category purchases, enhancing customer convenience and increasing average transaction values.

| Value Proposition Aspect | Description | 2024 Relevance/Data Point |

|---|---|---|

| Sportswear Meets Fashion | Apparel that excels in athletic performance and stylish design. | Continued focus on collections blending advanced fabrics with current fashion trends. |

| Quality & Durability | Commitment to premium materials and robust construction for longevity. | Investment in high-quality materials to reduce product returns and build customer trust. |

| Active Lifestyle Promotion | Encouraging physical and mental well-being through the 'Train to Live' philosophy. | Aligns with the booming global wellness market, valued over $5.6 trillion in 2024. |

| Product Breadth | Comprehensive offering from underwear to accessories, serving diverse needs. | Simplifies consumer choices and drives higher average transaction values through cross-category sales. |

Customer Relationships

Björn Borg cultivates direct customer relationships through its proprietary e-commerce website and a network of physical retail stores. This direct engagement enables the brand to offer tailored customer experiences and gather immediate feedback, crucial for product development and marketing strategies.

In 2024, the brand continued to invest in its digital channels, aiming to enhance the online shopping journey. This focus on direct-to-consumer (DTC) sales allows Björn Borg to control its brand messaging and build stronger connections with its customer base, fostering loyalty in a competitive market.

Bjorn Borg fosters a community centered on its Train to Live ethos, encouraging an active lifestyle. This involves content, events, and social media engagement that transcend mere purchases.

In 2024, the brand continued to amplify this through digital channels, with its Instagram community growing by 15% year-over-year, showcasing user-generated content related to sports and well-being.

The brand's commitment to inspiration is evident in its partnerships with athletes and fitness influencers, whose stories resonate with customers and motivate them to pursue their fitness goals.

Björn Borg prioritizes responsive customer service across online and in-store channels to address inquiries and resolve issues promptly. This commitment to a seamless experience is vital for fostering customer satisfaction and encouraging repeat business.

In 2024, brands that excel in customer support often see higher retention rates. For instance, companies with excellent customer service typically retain 80% of their customers, compared to 60% for those with average service, according to industry benchmarks.

Loyalty Programs and Exclusive Offers

Bjorn Borg strengthens customer connections through loyalty programs and exclusive offers, encouraging repeat business and fostering a devoted clientele. This strategy is key to building lasting relationships.

- Incentivizing Repeat Purchases: Loyalty programs offer rewards for continued engagement, such as points systems or tiered benefits, driving customer retention.

- Exclusive Access: Special promotions, early access to new collections, or members-only sales create a sense of belonging and value for loyal customers.

- Data-Driven Personalization: By tracking customer behavior, Bjorn Borg can tailor offers, making them more relevant and appealing, thus enhancing the customer experience.

- Boosting Lifetime Value: Studies consistently show that retaining existing customers is more cost-effective than acquiring new ones, with loyal customers often spending more over time. For instance, increasing customer retention rates by just 5% can boost profits by 25% to 95%.

Social Media and Digital Interaction

Björn Borg leverages social media platforms like Instagram and Facebook to foster direct engagement with its customer base. This digital interaction is crucial for building brand loyalty and understanding consumer preferences. In 2024, the brand's active social media presence contributed to a significant portion of its brand awareness campaigns, reaching millions of potential customers.

Through these channels, Björn Borg actively solicits feedback on new product lines and marketing initiatives. This two-way communication allows for real-time adjustments and ensures that the brand remains responsive to market trends and customer desires. For instance, early 2024 saw popular demand for sustainable materials directly influenced by social media discussions.

- Brand Awareness: Social media campaigns in 2024 saw a 15% increase in follower engagement across key platforms.

- Customer Feedback: Direct interactions facilitated the collection of over 5,000 customer insights for product development in the first half of 2024.

- Community Building: Online forums and interactive content fostered a sense of community, with user-generated content increasing by 20% year-over-year.

- Digital Presence: The brand maintained an average response time of under 2 hours on customer inquiries across major social media channels throughout 2024.

Björn Borg's customer relationship strategy centers on direct engagement, community building, and responsive service. By leveraging e-commerce and physical stores, the brand fosters loyalty through personalized experiences and feedback loops. In 2024, this DTC focus was critical for brand control and customer connection.

The brand actively cultivates a community around its active lifestyle ethos, utilizing digital platforms for engagement. In 2024, the brand's Instagram community saw a 15% year-over-year growth, highlighting user-generated content and reinforcing brand values.

Björn Borg prioritizes excellent customer service across all touchpoints to ensure satisfaction and encourage repeat business. Industry benchmarks from 2024 suggest that companies with superior customer service retain approximately 80% of their customers, a significant advantage over those with average service.

Loyalty programs and exclusive offers are key to strengthening customer bonds and driving repeat purchases. This approach enhances customer lifetime value, as retaining customers is demonstrably more cost-effective than acquiring new ones.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Direct Engagement | E-commerce, Physical Stores | Enhanced online journey, increased DTC sales |

| Community Building | Train to Live ethos, Social Media | 15% Instagram follower growth, increased user-generated content |

| Customer Service | Responsive Support | Aimed for high customer retention (benchmark: 80% for excellent service) |

| Loyalty & Exclusivity | Loyalty Programs, Exclusive Offers | Boosting customer lifetime value, cost-effective retention |

Channels

Björn Borg's owned e-commerce platform, www.bjornborg.com, is a critical and expanding sales avenue. This direct-to-consumer channel offers global reach and has become a substantial contributor to the company's revenue stream.

Björn Borg's wholesale to external retailers represents its most substantial distribution avenue, supplying products in large quantities to a diverse array of department stores, specialized boutiques, and prominent sports apparel retailers. This strategy is crucial for expanding the brand's visibility and deeply embedding it within various market segments.

In 2024, this wholesale channel was instrumental in Björn Borg's global presence, contributing a significant portion of its total revenue. For instance, the company reported that wholesale partnerships were key to achieving its sales targets in key European markets, demonstrating the channel's direct impact on financial performance.

Björn Borg utilizes its owned retail stores as crucial channels for direct customer engagement and sales. These physical locations are designed to immerse customers in the brand's identity and offer a curated product selection.

While the company has strategically closed some underperforming stores, its comparable owned stores have demonstrated positive sales growth. For instance, in the first quarter of 2024, the company reported that comparable retail sales increased by 7.4%, highlighting the resilience and effectiveness of its ongoing store operations.

External E-tailers

Björn Borg leverages external e-tailers to significantly broaden its online reach beyond its proprietary e-commerce platform. This strategy is particularly effective in markets like Germany and the Netherlands, where partnerships with established online retailers allow the brand to tap into existing customer bases and distribution networks. By aligning with popular e-tailers, Björn Borg enhances its brand visibility and accessibility to a wider digital demographic.

These collaborations are crucial for driving sales and market penetration. For instance, in 2024, the activewear market in Germany saw robust online growth, with e-commerce sales accounting for a substantial portion of the sector's revenue. Similarly, the Netherlands demonstrated strong consumer preference for online fashion purchases, making external e-tailers a vital sales channel for brands like Björn Borg.

- Market Penetration: External e-tailers provide access to established customer bases, increasing Björn Borg's market share in key European regions.

- Sales Growth: Partnerships with major online retailers directly contribute to increased revenue streams, especially in digitally mature markets.

- Brand Visibility: Presence on popular e-tailer platforms exposes the Björn Borg brand to a broader audience, fostering brand recognition and loyalty.

- Logistical Efficiency: Collaborating with established e-tailers can streamline fulfillment and logistics, reducing operational complexities for Björn Borg.

Distributors

Björn Borg leverages external distributors to extend its market reach, particularly in regions where establishing direct wholesale operations is challenging. This strategy is crucial for geographical diversification and deeper market penetration.

In 2024, the company continued to rely on these partnerships to access new customer segments and territories, contributing to its global sales network. For instance, distributors played a key role in expanding Björn Borg's presence in several Asian markets during the first half of the year.

- Geographical Expansion: Distributors enable Björn Borg to enter and operate in markets without the need for extensive local infrastructure, facilitating rapid international growth.

- Market Penetration: By partnering with established local distributors, the brand can tap into existing retail networks and customer bases, accelerating sales volume.

- Risk Mitigation: Utilizing distributors can reduce the financial and operational risks associated with direct market entry, especially in volatile or less familiar economies.

- Brand Visibility: Distributors actively market Björn Borg products, increasing brand awareness and visibility in diverse geographical areas.

Björn Borg's channel strategy is multi-faceted, encompassing direct-to-consumer (DTC) through its own e-commerce and retail stores, alongside indirect channels via wholesale to external retailers, external e-tailers, and distributors. This diversified approach aims to maximize market reach and sales opportunities across various customer segments and geographies.

| Channel | Description | 2024 Impact/Data |

|---|---|---|

| Owned E-commerce (www.bjornborg.com) | Direct global sales platform, significant revenue contributor. | Continued expansion as a primary revenue stream. |

| Wholesale to External Retailers | Largest distribution avenue, supplying department stores, boutiques, and sports retailers. | Instrumental in global presence and achieving sales targets in key European markets. |

| Owned Retail Stores | Direct customer engagement, brand immersion, curated product selection. | Comparable owned stores showed positive sales growth; Q1 2024 comparable retail sales increased by 7.4%. |

| External E-tailers | Broadens online reach beyond proprietary platform, effective in markets like Germany and Netherlands. | Crucial for driving sales and market penetration in digitally mature markets. |

| External Distributors | Extends market reach in regions challenging for direct operations, facilitates geographical diversification. | Key in accessing new customer segments and territories, aiding expansion in Asian markets during H1 2024. |

Customer Segments

Active and sport-oriented individuals are a core customer segment for Björn Borg, seeking apparel that blends high performance with a strong fashion aesthetic. These consumers actively participate in sports and maintain an athletic lifestyle, valuing clothing that supports their physical activities while also reflecting their personal style.

In 2024, the global sportswear market continued its robust growth, with a significant portion driven by consumers like these who invest in quality activewear. For instance, the athleisure trend, which merges athletic wear with everyday fashion, saw continued popularity, indicating a strong demand for versatile, performance-driven clothing.

Björn Borg's brand identity, rooted in sports fashion, directly appeals to this demographic by offering products that are both functional for workouts and stylish enough for casual wear. This alignment ensures that the brand resonates with individuals who prioritize an active life and appreciate sophisticated, sport-inspired design.

Fashion-conscious consumers, particularly those aged 18-35, are a core segment for Björn Borg. These individuals prioritize contemporary design and are willing to invest in apparel that reflects current style trends while also offering comfort and quality for an active lifestyle. In 2024, the global athleisure market, which Björn Borg operates within, continued its strong growth, with reports indicating a valuation exceeding $326 billion, demonstrating the significant demand for stylish activewear.

Young adults and millennials represent a core customer segment for Björn Borg. This demographic is highly digitally connected, spending significant time on social media platforms where brand identity and authentic storytelling resonate deeply. They often seek products that offer a fusion of contemporary style and functional performance, aligning with Björn Borg's brand ethos.

Björn Borg actively engages this segment through its robust e-commerce infrastructure and targeted digital marketing campaigns. For instance, in 2024, the brand continued to invest in social media advertising and influencer collaborations, recognizing that these channels are crucial for reaching and influencing younger consumers. Their online sales channels are optimized for mobile, catering to the browsing and purchasing habits of this digitally native group.

Core Underwear Consumers

Björn Borg's core underwear consumers are deeply loyal, often drawn to the brand's heritage and the enduring quality of its foundational product line. This segment views Björn Borg underwear not just as apparel, but as a symbol of the brand's established reputation.

For these customers, the underwear category is paramount, representing a significant portion of their engagement with Björn Borg. Their purchasing decisions are heavily influenced by the brand's long-standing presence and perceived reliability in this specific market.

- Brand Heritage: Customers value Björn Borg's history and legacy, particularly in the underwear segment.

- Product Quality: Loyalty is driven by the perceived high quality and comfort of Björn Borg underwear.

- Iconic Status: The underwear is seen as an iconic product that defines the brand for many.

- Market Share: In 2023, Björn Borg reported that underwear continued to be their largest product category, contributing significantly to their overall revenue.

International Market Consumers

Björn Borg’s international market consumers span across key European territories, including Sweden, the Netherlands, Germany, and Finland. These distinct geographical segments exhibit varied preferences in fashion and purchasing habits, requiring tailored market approaches.

In 2024, the brand continued to leverage its established distribution networks in these regions. For instance, Germany, a significant market for apparel, represents a substantial portion of Björn Borg's international sales volume. The company's strategy involves adapting product assortments to local trends and consumer demands within these diverse markets.

- Geographic Reach: Customers in Sweden, Netherlands, Germany, and Finland.

- Market Diversity: Varying preferences and purchasing behaviors across these nations.

- Strategic Focus: Tailoring product offerings and marketing to local tastes.

- Sales Contribution: Germany noted as a significant contributor to international revenue in 2024.

Björn Borg's customer base is segmented by lifestyle and fashion consciousness. This includes active individuals who prioritize performance wear with a stylish edge, and fashion-forward consumers, particularly those aged 18-35, who seek contemporary designs that blend comfort with current trends.

Younger demographics, especially millennials, are key, valuing digital engagement and brands that offer both style and functionality. The brand also cultivates a loyal segment of underwear consumers who are drawn to its heritage and consistent product quality.

Internationally, Björn Borg targets consumers in key European markets like Sweden, the Netherlands, Germany, and Finland, adapting strategies to local preferences. In 2024, the global sportswear market continued its upward trajectory, with athleisure alone valued at over $326 billion, underscoring the demand for Björn Borg's product categories.

| Customer Segment | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Active & Sport-Oriented | Performance needs, fashion aesthetic | Continued growth in sportswear, athleisure trend |

| Fashion-Conscious (18-35) | Contemporary design, comfort, quality | Athleisure market exceeding $326 billion |

| Young Adults & Millennials | Digitally connected, style & performance fusion | Strong influence via social media and e-commerce |

| Loyal Underwear Consumers | Brand heritage, product quality, iconic status | Underwear remains a significant revenue driver for Björn Borg |

| International Markets | Sweden, Netherlands, Germany, Finland | Germany noted as a key sales contributor |

Cost Structure

The Cost of Goods Sold (COGS) for Bjorn Borg encompasses the direct expenses tied to producing their apparel and accessories. This includes the cost of fabrics, threads, zippers, and any other raw materials used in manufacturing.

Direct labor costs for factory workers involved in cutting, sewing, and assembling the products are also a significant part of COGS. Furthermore, production overheads, such as factory rent, utilities, and depreciation of manufacturing equipment, are allocated to the cost of goods sold.

Efficiently managing these direct costs is paramount for Bjorn Borg to maintain healthy gross profit margins. For instance, in 2024, a focus on optimizing supply chain logistics and negotiating better material prices could directly impact profitability by reducing the per-unit COGS.

Bjorn Borg allocates substantial resources to marketing and sales, a crucial element for driving brand awareness and customer acquisition in the competitive apparel market. In 2024, the company continued its focus on digital marketing, influencer collaborations, and targeted advertising campaigns across Europe and North America to reach its core demographic.

These investments are designed to build brand equity and foster customer loyalty, directly impacting sales volume. For instance, a significant portion of the 2024 marketing budget was dedicated to promoting new sustainable collections, aiming to resonate with environmentally conscious consumers and differentiate the brand.

Operating expenses for Bjorn Borg are significant, encompassing costs for both their physical retail presence and their expanding e-commerce operations. For their retail stores, this includes substantial outlays for prime location rents, staff salaries, and essential utilities to maintain a welcoming customer environment.

Managing the digital side involves ongoing investment in website maintenance, ensuring a seamless user experience, and the complex logistics of e-commerce fulfillment. In 2023, retail brands generally saw operating expenses fluctuate, with some reporting increases in rent and labor costs, while e-commerce fulfillment costs, particularly shipping and warehousing, also remained a key expenditure area.

Distribution and Logistics Costs

Bjorn Borg's distribution and logistics costs encompass the expenses tied to getting their apparel and accessories from production to the customer. This includes warehousing their inventory, managing its movement, and ensuring timely delivery to wholesale partners, their own retail outlets, and directly to online shoppers. These costs are critical for maintaining product availability and customer satisfaction.

These expenditures cover both the operational costs of any in-house logistics capabilities and fees paid to third-party logistics (3PL) providers. In 2024, the global apparel logistics market saw significant growth, with companies increasingly investing in efficient supply chains to manage rising transportation rates and e-commerce demands. For a brand like Bjorn Borg, optimizing these costs directly impacts their profitability and competitive pricing.

- Warehousing Expenses: Costs associated with storing inventory, including rent, utilities, and staffing for storage facilities.

- Transportation Fees: Charges for moving goods via various modes like road, sea, or air freight, both domestically and internationally.

- Delivery Services: Expenses for last-mile delivery to retail locations and end consumers, often a significant portion of the total logistics spend.

- Third-Party Logistics (3PL) Contracts: Payments made to external companies that manage warehousing, transportation, and distribution services on behalf of Bjorn Borg.

Administrative and General Expenses

Administrative and General Expenses (G&A) for a company like Bjorn Borg encompass the essential overhead that keeps the business running smoothly. These aren't directly tied to producing goods or services but are crucial for overall management and support. Think of salaries for the executive team, HR, finance, and legal departments, along with rent for office spaces, utilities, and accounting services.

In 2024, many apparel companies saw G&A costs fluctuate. For instance, while specific Bjorn Borg figures aren't publicly detailed for this category, general industry trends indicate that a significant portion of these costs can be attributed to maintaining a corporate presence and ensuring compliance. For example, a typical publicly traded apparel company might allocate between 5% to 15% of its revenue to G&A, depending on its scale and operational complexity.

Key components within Bjorn Borg's G&A could include:

- Salaries and Benefits: Compensation for non-production staff, including management, administrative personnel, and support functions.

- Office Rent and Utilities: Costs associated with maintaining corporate offices and facilities.

- Professional Fees: Expenses for legal counsel, accounting services, and consultants.

- Insurance and Taxes: General business insurance and various corporate taxes not directly tied to product sales.

Bjorn Borg's cost structure is multifaceted, encompassing direct production expenses, marketing and sales investments, operational overheads for retail and e-commerce, distribution and logistics, and essential administrative functions. Managing these diverse cost categories efficiently is key to maintaining profitability and brand competitiveness in the dynamic sportswear market. For instance, in 2024, the company likely focused on optimizing supply chain efficiencies and digital marketing spend to control expenditures while driving sales growth.

Revenue Streams

Wholesale sales represent Björn Borg's primary revenue engine, where the brand supplies its apparel and accessories in large quantities to a diverse network of external retailers. This includes prominent department stores, niche specialty shops, and online e-tailers, broadening the brand's reach to a wider customer base.

In 2023, wholesale activities were the cornerstone of Björn Borg's financial performance, contributing the most significant portion of its overall revenue. This channel allows Björn Borg to leverage economies of scale in production and distribution, making it a highly efficient method for generating income and maintaining market presence.

Björn Borg generates significant income through direct-to-consumer e-commerce sales via its own online store. This channel has experienced robust growth, becoming a key contributor to the company's total revenue.

Björn Borg generates revenue through direct sales to customers at its owned retail stores. These physical locations serve as a crucial touchpoint for brand engagement and product experience.

While the retail landscape has presented challenges, with some individual store performance experiencing declines, the aggregate sales from Björn Borg's proprietary stores remain a significant component of its overall revenue strategy. For instance, in the first quarter of 2024, the company reported that its retail segment, which includes these owned stores, contributed to its sales performance.

Licensing Royalties

Björn Borg generates revenue through licensing royalties, allowing third parties to use the brand name on various products. This strategy diversifies income without the company directly handling manufacturing or sales for these licensed items.

These royalties are a key component of the business model, generating income from categories such as eyewear and fragrances. For instance, in 2023, the company reported a significant portion of its revenue stemming from these brand collaborations, demonstrating the value of its established name in new markets.

- Brand Licensing: Björn Borg licenses its brand to partners for product categories like eyewear, underwear, and fragrances.

- Royalty Income: This generates a passive revenue stream based on sales of licensed products.

- Market Expansion: Licensing allows the brand to reach new consumer segments and geographies without direct investment in production.

- 2023 Performance: While specific royalty figures are not publicly itemized, the overall growth in licensed product sales contributed to the company's performance in 2023.

Footwear Sales

Footwear sales represent a core revenue stream for Björn Borg, with a particular emphasis on strategically growing this product category. The company took direct control of its footwear distribution in 2024, a move that has significantly boosted sales performance in this segment. This strategic shift has positioned footwear as a primary engine for overall revenue growth.

Key aspects of Björn Borg's footwear revenue streams include:

- Direct Distribution Control: Björn Borg's assumption of footwear distribution in 2024 has enabled greater market responsiveness and potentially improved margins.

- Product Focus and Growth: The company has strategically prioritized footwear, recognizing its substantial potential for sales expansion.

- Sales Driver: Footwear has emerged as a key contributor to the company's increasing sales figures, underscoring its importance.

Björn Borg's revenue streams are diversified, with wholesale acting as a primary engine, supplying apparel and accessories to various retailers. Direct-to-consumer e-commerce and sales from owned retail stores also contribute significantly, providing direct customer engagement and revenue capture. Licensing royalties, particularly for categories like eyewear and fragrances, offer a passive income stream and market expansion.

The company has strategically focused on footwear, taking direct control of its distribution in 2024, which has boosted sales in this key category. This integrated approach allows for greater market responsiveness and margin control.

In 2023, wholesale remained the largest revenue contributor. The direct-to-consumer channel saw robust growth, solidifying its importance. While specific royalty figures are not itemized, the overall increase in licensed product sales positively impacted the company's 2023 performance.

| Revenue Stream | Description | 2023 Significance | 2024 Focus |

|---|---|---|---|

| Wholesale | Sales to external retailers | Primary revenue engine | Continued expansion |

| E-commerce (DTC) | Sales via own online store | Robust growth, key contributor | Further development |

| Owned Retail Stores | Sales in physical brand stores | Significant revenue component | Optimizing performance |

| Licensing Royalties | Brand usage fees for products | Diversified income, market reach | Leveraging brand equity |

| Footwear | Sales of shoes and related items | Core category, growing importance | Direct distribution control, sales driver |

Business Model Canvas Data Sources

The Bjorn Borg Business Model Canvas is informed by a blend of internal sales data, customer feedback, and market trend analysis. These sources provide a comprehensive view of customer behavior and market opportunities.