Berli Jucker SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Berli Jucker Bundle

Berli Jucker's strategic position is shaped by its strong brand recognition and extensive distribution network, but also faces challenges from intense market competition. Understanding these dynamics is crucial for anyone looking to invest or strategize in this sector.

Want the full story behind Berli Jucker's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Berli Jucker's strength lies in its remarkably diversified business portfolio, spanning consumer products, packaging, healthcare, modern retail, and supply chain logistics. This broad engagement creates a resilient revenue stream, significantly reducing dependency on any single market segment. For example, in 2023, the company reported impressive growth across its various divisions, with its modern retail arm, Big C Supercenter, continuing to be a major revenue driver, alongside robust contributions from its packaging and healthcare operations.

Berli Jucker's Big C Supercenter chain holds a commanding position as a premier modern retailer in Thailand, with a robust and expanding footprint across Southeast Asia. This strong market presence is a key strength, underpinning its competitive advantage.

Big C's strategic growth initiatives are poised to further solidify its market leadership. The company's ambitious expansion plans, which include opening new hypermarkets and smaller Big C Mini stores, alongside a comprehensive renovation program for existing outlets through 2025, are designed to boost customer engagement and drive sales. For instance, the company has earmarked significant capital for these upgrades, aiming to enhance the shopping experience and attract a wider customer base.

A core element of Big C's strategy involves a concentrated focus on fresh food offerings and the development of its private label product lines. This approach is crucial for differentiating itself from competitors and capturing a larger share of consumer spending, particularly as consumer preferences increasingly lean towards quality and value-driven private label options. This focus is expected to be a significant driver of continued growth and increased customer traffic in the coming years.

Berli Jucker Public Company Limited (BJC) has been actively pursuing strategies to boost its profitability and streamline operations. This dedication is evident in their financial performance, with recent reports showing an uptick in gross profit margins across several business units.

These margin improvements are largely attributed to a more favorable product mix, successful negotiation of lower raw material costs, and a concerted effort to reduce selling, general, and administrative (SG&A) expenses. For instance, BJC reported a notable increase in its gross profit margin in its consumer products segment during the first half of 2024.

This strategic focus on operational efficiency is a key strength, paving the way for sustained core profit growth. Analysts project this trend to continue, with positive contributions to the company's bottom line expected throughout 2025, driven by these ongoing cost management initiatives.

Robust Supply Chain and Logistics Capabilities

Berli Jucker Public Company Limited (BJC) boasts a robust supply chain and logistics network, a crucial asset for its extensive consumer goods and retail businesses. This infrastructure ensures efficient product distribution and smooth retail operations across its diverse portfolio.

BJC is strategically investing in technology to bolster its supply chain. For instance, in 2023, the company continued its digital transformation initiatives, focusing on enhancing traceability and transparency. This includes implementing advanced analytics for optimizing inventory management and route planning, aiming to reduce operational costs and waste.

- Enhanced Distribution Efficiency: BJC's logistics capabilities allow for timely delivery of a wide range of products, from food and beverages to personal care items, supporting its extensive retail footprint.

- Technological Integration: Investments in supply chain technology, including data analytics and automation, are designed to improve forecasting accuracy and reduce lead times.

- Resilience and Sustainability: The focus on supply chain resilience helps mitigate risks from potential disruptions, while efforts to reduce waste contribute to the company's sustainability goals.

Commitment to Sustainability and ESG Initiatives

Berli Jucker's core philosophy centers on becoming 'Your Trusted Partner for Sustainable Better Living,' embedding sustainability deeply into its operations. This commitment is underscored by ambitious Environmental, Social, and Governance (ESG) targets, including a goal to achieve Net Zero Greenhouse Gas (GHG) Emissions by 2050. The company is actively expanding its renewable energy projects and championing circular packaging solutions, demonstrating a proactive approach to environmental stewardship.

This dedication to sustainability resonates with increasing stakeholder expectations and positively impacts brand reputation, making Berli Jucker an attractive prospect for investors prioritizing socially responsible enterprises. For instance, in 2023, the company reported a 15% increase in the use of recycled materials in its packaging, a tangible step towards its circular economy goals.

- Net Zero GHG Emissions target by 2050

- Expansion of renewable energy projects

- Promotion of circular packaging solutions

- Alignment with growing stakeholder demand for ESG

Berli Jucker's diversified business model is a significant strength, encompassing consumer products, packaging, healthcare, and modern retail, which provides a stable revenue base. The company's modern retail arm, Big C Supercenter, is a market leader in Thailand and is expanding across Southeast Asia. BJC's focus on enhancing its private label offerings and fresh food selection at Big C is a key differentiator and growth driver.

Operational efficiency is another core strength, with BJC demonstrating improvements in gross profit margins through a better product mix and cost management. For example, BJC reported a notable increase in its gross profit margin in its consumer products segment during the first half of 2024. These efforts are expected to continue driving sustained profit growth through 2025.

BJC possesses a robust supply chain and logistics network, crucial for its extensive operations. The company is actively investing in technology to enhance its supply chain, including advanced analytics for inventory and route optimization. This technological integration aims to improve forecasting accuracy and reduce operational costs.

The company's commitment to sustainability, with a Net Zero GHG Emissions target by 2050 and initiatives in renewable energy and circular packaging, aligns with growing stakeholder expectations. In 2023, BJC reported a 15% increase in the use of recycled materials in its packaging, showcasing tangible progress towards its environmental goals.

| Business Segment | Key Strengths | Recent Performance Highlight (2023/H1 2024) |

|---|---|---|

| Modern Retail (Big C) | Market leadership in Thailand, expanding SEA presence, focus on fresh food and private labels. | Continued revenue driver, ambitious expansion and renovation plans through 2025. |

| Consumer Products | Diversified portfolio, improved gross profit margins. | Notable increase in gross profit margin in H1 2024 due to favorable product mix and cost management. |

| Packaging & Healthcare | Strong contributions to revenue, growing market share. | Robust contributions alongside retail and consumer segments. |

| Supply Chain & Logistics | Efficient distribution network, technological investment. | Digital transformation initiatives for enhanced traceability and optimized inventory management. |

| Sustainability | ESG commitment, Net Zero target, circular economy focus. | 15% increase in recycled material usage in packaging in 2023. |

What is included in the product

Delivers a strategic overview of Berli Jucker’s internal and external business factors, highlighting its strengths in distribution, weaknesses in brand recognition, opportunities in emerging markets, and threats from intense competition.

Offers a clear, actionable framework to identify and address Berli Jucker's strategic challenges.

Weaknesses

Berli Jucker's (BJC) reliance on Thai consumer spending presents a notable weakness, especially given that a substantial portion of its revenue, particularly from its Big C supermarket chain, is directly linked to domestic purchasing power. This makes the company vulnerable to fluctuations in the Thai economy.

The ongoing economic recovery in Thailand, coupled with persistent high household debt, could significantly dampen consumer spending. This directly impacts Big C's ability to achieve same-store sales growth and, consequently, BJC's overall retail segment revenue. For instance, while Thailand's GDP growth was projected around 2.5-3.5% for 2024, a slowdown in consumer sentiment could still hinder retail performance.

Berli Jucker (BJC) operates in intensely competitive retail and consumer product markets, especially in Thailand. Global and regional players are numerous, creating a challenging environment. This fierce rivalry, particularly within hypermarkets, often results in price wars, squeezing BJC's profit margins and making market share growth difficult without significant investment in unique offerings or aggressive marketing.

Berli Jucker Public Company Limited (BJC), with its extensive manufacturing operations, particularly in packaging, faces significant challenges due to the fluctuating prices of key raw materials. For instance, the cost of natural gas, soda ash, and aluminum can experience sharp increases, directly impacting BJC's production expenses.

While BJC employs strategies like price lock agreements and supplier diversification to mitigate these risks, unforeseen surges in raw material costs can still strain profitability. If these increased expenses cannot be fully passed on to consumers through price adjustments, it directly affects the company's bottom line.

Operational Challenges in Healthcare and Technical Supply Chain

The healthcare and technical supply chain segment, despite its growth prospects, has faced operational hurdles. A significant challenge noted in 2024 was the impact of delayed government budget allocations, which directly affected the sales of medical devices.

While a rebound is expected as these budgets are disbursed, the segment's financial performance remains susceptible to governmental policies and spending patterns. This sensitivity can introduce a degree of unpredictability into the revenue streams for this sector.

- Government Budget Delays: Hindered medical device sales in 2024 due to delayed allocations.

- Policy Sensitivity: Performance is closely tied to government spending and policy shifts.

- Revenue Unpredictability: Government fiscal actions can introduce variability in revenue streams.

Exposure to Foreign Exchange Fluctuations

Berli Jucker Public Company Limited (BJC) faces significant exposure to foreign exchange fluctuations due to its substantial international operations. Key markets like Vietnam and Hong Kong mean that currency movements can directly impact its financial reporting.

For example, a strengthening Thai Baht can reduce the reported value of sales generated in foreign currencies when those earnings are translated back into Baht. This was evident in recent financial periods, where such currency shifts have demonstrably affected BJC's consolidated revenue and overall profitability.

- International Presence: BJC operates in countries including Vietnam and Hong Kong, making it susceptible to currency volatility.

- Baht Strength Impact: A stronger Thai Baht can diminish the reported value of international sales when converted, negatively affecting consolidated financial results.

- Profitability Concerns: These currency swings can directly impact BJC's overall profitability, creating an element of unpredictability in financial performance.

Berli Jucker's (BJC) heavy reliance on the Thai consumer market makes it vulnerable to economic downturns and shifts in domestic spending patterns. This concentration risk is particularly evident in its Big C supermarket operations, which are directly tied to local purchasing power. For instance, while Thailand's GDP growth was projected around 2.5-3.5% for 2024, a slowdown in consumer sentiment could still hinder retail performance.

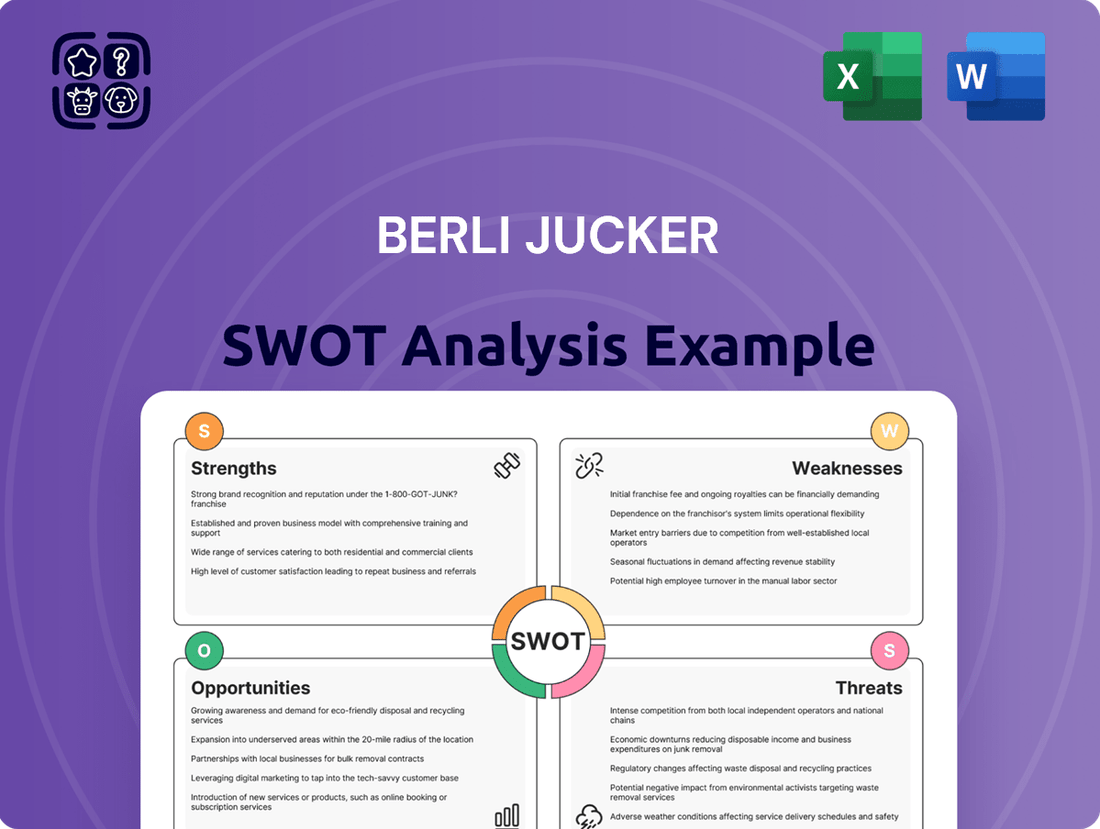

Preview Before You Purchase

Berli Jucker SWOT Analysis

The preview below is taken directly from the full Berli Jucker SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of its Strengths, Weaknesses, Opportunities, and Threats.

This is a real excerpt from the complete Berli Jucker SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific strategic needs.

You’re viewing a live preview of the actual Berli Jucker SWOT analysis file. The complete version becomes available after checkout, offering a detailed strategic roadmap.

Opportunities

Berli Jucker (BJC) has a clear path to growth by expanding its Big C retail presence. This includes adding more Big C Supercenters and smaller Big C Mini stores, not just in Thailand but also across promising Southeast Asian countries like Cambodia, Laos, and Vietnam.

The company's strategy to open new hypermarkets and convenience stores, alongside upgrading existing locations, is designed to boost its market share and connect with a wider range of consumers. For instance, BJC announced plans in early 2024 to invest significantly in store network expansion and modernization, aiming to capture a larger portion of the rapidly growing retail market in these regions.

The healthcare sector in Thailand and the broader Southeast Asian region is experiencing robust expansion, creating a significant growth avenue for Berli Jucker (BJC). This surge is fueled by rising consumer demand for pharmaceuticals and advanced medical devices, indicating a favorable market environment for BJC's offerings.

BJC is well-positioned to capitalize on this trend through strategic new product introductions. Coupled with expectations of renewed government spending on healthcare infrastructure and supplies in 2024/2025, BJC’s healthcare and technical supply chain is poised for substantial sales growth and improved gross profit margins, thereby increasing its contribution to the company's overall financial performance.

Berli Jucker can capitalize on the expanding e-commerce landscape in Thailand, a trend that saw significant acceleration in 2024. By investing further in its digital infrastructure and online sales platforms, BJC can tap into a growing consumer base that prefers the convenience of online shopping.

Leveraging Big Data analytics presents a key opportunity for BJC to gain deeper insights into customer preferences and purchasing patterns. This data-driven approach can inform more targeted marketing campaigns and the development of personalized product assortments, enhancing customer engagement and loyalty in the competitive digital space.

Digital transformation extends beyond sales to operational efficiencies. BJC has the chance to implement advanced digital tools for inventory management, supply chain optimization, and customer service, ultimately reducing costs and improving overall business performance throughout 2025.

Product Innovation and Diversification in Consumer and Packaging

Berli Jucker Public Company Limited (BJC) has a significant opportunity to innovate and diversify within its consumer and packaging divisions. This includes launching premium and specialized packaging, as well as developing new personal care and snack items. For example, by the end of 2024, the global flexible packaging market was projected to reach over $130 billion, indicating strong demand for advanced solutions.

Expanding product lines and targeting new customer bases, particularly in the food and cosmetics packaging arenas, presents a clear path to increased sales and improved profitability. BJC's existing strengths in distribution and brand recognition provide a solid foundation for these ventures. In 2023, BJC reported a notable increase in its consumer segment revenue, driven by strong performance in its food and beverage categories, underscoring the potential for further growth through product expansion.

- Launch premium and specialized packaging solutions to capture higher-value market segments.

- Introduce new personal care and snack products to broaden consumer appeal and market share.

- Target the food and cosmetics packaging sectors to leverage growing industry demand.

- Expand product portfolios to enhance sales volume and optimize profit margins.

Strategic Acquisitions and Partnerships

Berli Jucker Public Company Limited (BJC) can significantly bolster its market standing and geographical footprint through targeted acquisitions and strategic alliances. These moves are crucial for expanding into untapped territories or integrating businesses that offer synergistic benefits. For instance, BJC's successful acquisition and rebranding of AbouThai to Big C in Hong Kong demonstrates a viable strategy for market penetration and growth.

Exploring further strategic acquisitions presents a clear opportunity for BJC to accelerate its expansion. By identifying and integrating companies in new markets or adjacent business sectors, BJC can quickly gain market share and diversify its revenue streams. This approach allows for faster entry and establishment compared to organic growth alone.

Partnerships offer another avenue for BJC to leverage external expertise and resources. Collaborating with established players in new regions or complementary industries can facilitate market access, share development costs, and mitigate risks. Such alliances can be particularly effective in navigating complex regulatory environments or building brand recognition in unfamiliar markets.

- Acquisition of complementary businesses: BJC could target companies in areas like consumer goods manufacturing or retail logistics to enhance its existing portfolio.

- Geographic expansion through M&A: Acquiring local players in Southeast Asian countries where BJC has a presence, or entering new markets like Vietnam or the Philippines, could be strategic.

- Joint ventures for market entry: Partnering with local entities in markets with high growth potential but significant entry barriers could de-risk expansion efforts.

- Technology integration partnerships: Collaborating with tech firms to enhance BJC's e-commerce capabilities and supply chain efficiency could be a key differentiator.

Berli Jucker (BJC) is poised to benefit from the burgeoning e-commerce sector in Thailand, which saw significant acceleration in 2024. Enhancing its digital infrastructure and online platforms will allow BJC to tap into a growing segment of consumers who prefer online shopping convenience.

Leveraging Big Data analytics offers BJC a chance to gain deeper insights into customer preferences, enabling more targeted marketing and personalized product offerings to boost engagement and loyalty.

Digital transformation can also improve operational efficiencies through advanced tools for inventory management and supply chain optimization, reducing costs and enhancing overall business performance throughout 2025.

Threats

A significant threat to Berli Jucker (BJC) is a prolonged economic downturn in Thailand and the wider Southeast Asian market. This slowdown directly impacts consumer spending power, a crucial driver for BJC's diverse product portfolio.

Rising household debt levels, persistent inflation, and global economic instability are key factors that could curb consumer demand for BJC's goods. For instance, Thailand's household debt to GDP ratio remained elevated, approaching 90% in early 2024, which can constrain discretionary spending.

This reduced purchasing power translates into lower retail sales volumes and weaker demand for consumer products, directly challenging BJC's revenue streams and profit margins. The company's reliance on consumer markets makes it particularly vulnerable to these macroeconomic headwinds.

The rapid ascent of digital-first retailers and e-commerce platforms presents a formidable challenge to established brick-and-mortar operations such as Big C. Consumers are increasingly shifting their preferences towards the convenience of online shopping, a trend that accelerated significantly in recent years. For instance, global e-commerce sales are projected to reach over $7 trillion by the end of 2025, underscoring the scale of this digital migration.

If Berli Jucker Public Company Limited (BJC) fails to adequately invest in and adapt its digital strategies, it faces a substantial risk of ceding valuable market share to more agile and digitally native competitors. This could impact Big C's revenue streams and overall market position if its online presence and customer experience lag behind industry benchmarks.

Geopolitical tensions and economic instability, such as those seen in the ongoing conflicts in Eastern Europe and the Middle East, can severely disrupt global supply chains. This directly impacts Berli Jucker (BJC) by affecting the availability and pricing of essential raw materials and finished products. For instance, disruptions in shipping routes, like those experienced in the Red Sea in early 2024, led to increased freight costs and delivery delays for many companies, a challenge BJC likely navigated.

These supply chain vulnerabilities can significantly inflate BJC's operating expenses due to higher logistics and material costs. Furthermore, product shortages stemming from these disruptions can hinder BJC's capacity to satisfy consumer demand, ultimately pressuring profit margins. The International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure susceptible to downward revision based on the persistence of such supply chain issues.

Regulatory Changes and Increased Compliance Costs

Berli Jucker (BJC) faces potential headwinds from evolving regulatory landscapes across its diverse operating regions. Changes in Thai and international laws concerning consumer goods, packaging, and labor could significantly increase compliance burdens and associated costs. For example, stricter environmental regulations, such as those targeting plastic usage or emissions, might require substantial capital outlays for process upgrades or the adoption of new sustainable materials, impacting profitability.

The company must remain agile to adapt to these shifts. For instance, the Thai government's ongoing focus on environmental sustainability, as seen in initiatives like the Extended Producer Responsibility (EPR) scheme for packaging, could necessitate BJC to invest in collection and recycling infrastructure. Such regulatory adjustments, while aimed at broader societal benefits, directly translate into operational expenses and strategic planning considerations for BJC.

- Increased operational expenses due to new environmental mandates, potentially impacting margins.

- Need for significant investment in compliance infrastructure and process re-engineering.

- Risk of penalties or market access limitations if regulatory requirements are not met promptly.

- Adaptation to evolving consumer product safety and labeling standards across different markets.

Currency Fluctuations and Geopolitical Risks

Currency fluctuations present a significant challenge for Berli Jucker (BJC), impacting not only its direct sales but also the costs of imported goods and the burden of servicing foreign-denominated debt. For instance, a stronger Thai Baht against currencies like the Vietnamese Dong or Cambodian Riel could increase BJC's import expenses for raw materials or finished goods sourced from these regions, thereby squeezing profit margins. The company's international operations, which contribute a notable portion to its revenue, are directly exposed to these exchange rate volatilities, making profitability unpredictable.

Geopolitical risks, particularly those affecting the Southeast Asian region, add another layer of uncertainty. Tensions or instability could disrupt established supply chains, leading to delays and increased logistics costs for BJC. Furthermore, such events can dampen consumer sentiment, reducing demand for BJC's products across its key markets. For example, any significant political unrest in Vietnam or Thailand, where BJC has substantial operations, could directly hinder its ability to conduct business and execute strategic expansion initiatives.

- Currency Volatility Impact: Significant Baht appreciation against regional currencies could raise import costs for BJC, potentially impacting its gross margins.

- Debt Servicing: Fluctuations in exchange rates can alter the real cost of servicing BJC's foreign currency-denominated debt.

- Geopolitical Disruption: Regional instability could interrupt BJC's supply chains and distribution networks, affecting product availability.

- Consumer Confidence: Geopolitical events often lead to reduced consumer spending, directly impacting BJC's sales volumes.

Intensifying competition from both local players and international brands poses a significant threat to Berli Jucker (BJC). As more companies enter the market with aggressive pricing and innovative product offerings, BJC faces pressure on its market share and pricing power. For instance, the fast-moving consumer goods (FMCG) sector in Southeast Asia is highly dynamic, with new entrants constantly vying for consumer attention.

The company's reliance on traditional retail channels, particularly its Big C supermarket chain, makes it vulnerable to the rapid expansion of e-commerce platforms and discount retailers. These channels often offer lower overheads and can pass those savings onto consumers, creating a price disadvantage for BJC. For example, the growth of online grocery delivery services in Thailand has accelerated, capturing a segment of the market that values convenience and competitive pricing.

The threat of counterfeit products entering the market also impacts BJC, potentially damaging brand reputation and eroding consumer trust. Ensuring product authenticity across its extensive distribution network requires continuous vigilance and investment in supply chain integrity. This challenge is particularly relevant in markets where regulatory enforcement can be inconsistent, allowing illicit goods to proliferate.

BJC must also contend with changing consumer preferences and the demand for healthier, more sustainable products. Failure to adapt its product portfolio to these evolving tastes could lead to a decline in sales volume. For example, a growing segment of consumers in Thailand is actively seeking out organic and plant-based options, a trend that BJC needs to address proactively to maintain its relevance.

| Threat Category | Specific Challenge | Potential Impact on BJC | Example/Data Point |

|---|---|---|---|

| Competition | Increased market saturation and aggressive pricing by rivals | Erosion of market share, reduced pricing power, pressure on margins | Growth of discount retailers and private label brands in Thai grocery sector |

| E-commerce Shift | Growing consumer preference for online shopping and digital-first retailers | Loss of foot traffic and sales to online competitors, need for significant digital investment | Projected continued growth in Southeast Asian e-commerce, exceeding $200 billion by 2025 |

| Counterfeit Goods | Proliferation of fake products impacting brand image and sales | Damage to brand reputation, loss of consumer trust, reduced sales revenue | Ongoing challenges in combating counterfeit pharmaceuticals and consumer goods in emerging markets |

| Changing Consumer Preferences | Demand for healthier, sustainable, and ethically sourced products | Risk of product obsolescence, need for portfolio diversification and R&D investment | Rising consumer interest in plant-based diets and eco-friendly packaging in the region |

SWOT Analysis Data Sources

This Berli Jucker SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market research reports, and expert industry insights to provide a data-driven and accurate strategic overview.