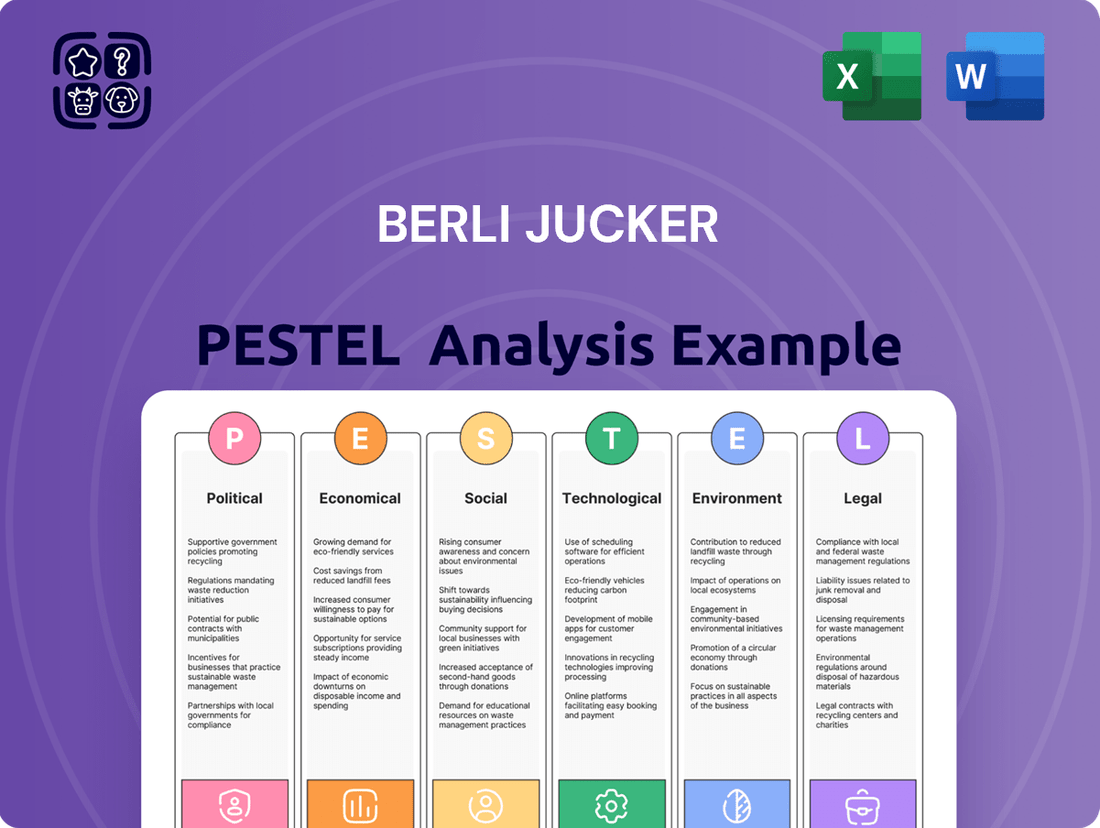

Berli Jucker PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Berli Jucker Bundle

Navigate the complex external forces shaping Berli Jucker's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and evolving social trends present both challenges and opportunities for the company. Gain a strategic advantage by leveraging these expert insights to refine your own market approach. Download the full version now for actionable intelligence.

Political factors

Thailand's political environment has seen recent shifts, and any lingering instability could dampen business confidence and slow down the execution of economic policies. This uncertainty might even affect the 2026 budget planning and overall consumer and business sentiment.

For Berli Jucker, which has significant retail and manufacturing interests, these political developments are crucial. Changes in government spending priorities or policy shifts, particularly those related to economic stimulus, could directly influence their operations and financial performance.

Changes in international trade policies, such as potential US tariffs on goods, could impact Thailand's trade balance and, by extension, Berli Jucker's (BJC) import and export operations. For instance, in 2024, global trade growth was projected to slow, impacting companies with significant international dealings.

As a major player with operations spanning Southeast Asia, BJC leverages regional trade agreements like the ASEAN Free Trade Area (AFTA). However, any alterations to these agreements could disrupt BJC's supply chain efficiency and limit its access to key markets, affecting its overall competitiveness.

Thailand's regulatory landscape, a key political factor for Berli Jucker (BJC), is evolving. The World Bank's 2020 Ease of Doing Business report ranked Thailand 21st globally, indicating a generally favorable environment for business operations, including licensing and permits. This supports BJC's diverse operations across consumer products, packaging, and retail.

However, potential shifts in government policy or increased regulatory scrutiny in specific sectors could impact BJC's cost structure and expansion plans. For instance, changes in food safety regulations or environmental standards could necessitate additional investment in compliance, affecting BJC's profitability and operational efficiency.

Consumer Protection and Food Safety Regulations

Thailand is actively strengthening its consumer protection framework, with new and enhanced laws impacting food labeling, product liability, and online commerce. These developments are designed to bolster consumer rights and guarantee product safety across the board.

Berli Jucker (BJC) must therefore adapt its operational strategies, from manufacturing processes to distribution networks and retail operations, to ensure full compliance with these evolving regulations. This proactive approach is crucial for maintaining consumer trust and market access.

- Increased Scrutiny on Food Labeling: Regulations are mandating clearer and more comprehensive information on food product packaging, potentially impacting BJC's product design and marketing.

- Product Liability Enforcement: Stricter product liability laws mean BJC faces greater accountability for product defects, necessitating robust quality control measures.

- E-commerce Consumer Safeguards: Enhanced protections for online shoppers require BJC to ensure transparency and fairness in its digital sales channels, a growing area for the company.

- Compliance Costs: Adapting to these regulatory changes may incur additional operational and administrative costs for BJC, which need to be factored into financial planning.

Government Economic Stimulus Measures

Government economic stimulus measures, like tax deductions and direct cash injections, significantly impact consumer spending and overall economic activity. For Berli Jucker, particularly its Big C Supercenter retail operations, these initiatives have historically boosted sales. The continuation or modification of these programs in 2024 and 2025 will be a key factor influencing revenue streams within Thailand's modern retail sector.

For instance, Thailand's government has previously implemented measures such as the "We Travel Together" campaign, which subsidized tourism and related spending, indirectly benefiting retail sales. Looking ahead to 2024-2025, any new stimulus packages aimed at boosting domestic consumption could provide a tailwind for Berli Jucker's retail segment.

- Government initiatives directly influence consumer purchasing power.

- Big C Supercenter has historically seen sales uplift from stimulus programs.

- Future stimulus continuation or changes will impact Berli Jucker's revenue.

- Economic support measures are crucial for the modern retail sector's performance.

Political stability in Thailand is a key consideration for Berli Jucker (BJC). While Thailand's Ease of Doing Business ranking was 21st in 2020, any future political instability could affect business confidence and policy implementation, potentially impacting BJC's operations, especially in its retail and manufacturing sectors.

Government economic stimulus packages, such as those seen in 2023 and anticipated for 2024-2025, directly influence consumer spending. For BJC's Big C Supercenter, these programs have historically driven sales, making their continuation or modification a critical factor for revenue in the modern retail segment.

Changes in trade policies and the enforcement of consumer protection laws, including food labeling and product liability, are significant political factors. BJC must adapt to these evolving regulations to maintain consumer trust and market access, potentially incurring compliance costs.

Berli Jucker's reliance on regional trade agreements like AFTA means that any alterations to these pacts could affect supply chain efficiency and market access, impacting its overall competitiveness in Southeast Asia.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Berli Jucker, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A Berli Jucker PESTLE analysis provides a structured framework to identify and mitigate external threats and opportunities, thereby relieving the pain point of uncertainty in strategic decision-making.

Economic factors

Thailand's economy is anticipated to see stable growth through 2024 and into 2025. This growth is largely fueled by increased consumer spending, government investments, and a rebound in tourism. For instance, the Bank of Thailand projected GDP growth of 3.0% for 2024, with expectations of continued positive momentum into 2025.

While consumer spending is on an upward trend, factors like substantial household debt and lower prices for agricultural goods might temper the pace of this growth. Berli Jucker's core businesses, particularly its consumer products and retail operations, are highly sensitive to these shifts in consumer behavior and purchasing power.

Inflation in Thailand is anticipated to stay within the Bank of Thailand's target range, though global economic shifts, particularly the US Federal Reserve's monetary policy, could impact the Thai stock market and the baht's value. For instance, in early 2024, Thailand's inflation rate hovered around 1-2%, well within the central bank's 1-3% target.

Fluctuations in interest rates directly affect Berli Jucker (BJC). Higher rates increase borrowing costs for BJC's operations and capital expenditures, potentially reducing profitability. Conversely, lower rates can make expansion and investment more attractive, influencing BJC's strategic financial planning and overall performance.

High household debt in Thailand, a persistent concern, poses a risk to private consumption recovery, even with government support. For Berli Jucker (BJC), this translates to consumers being more mindful of prices, potentially altering spending habits across its consumer goods and retail segments.

As of early 2024, Thailand's household debt-to-GDP ratio remained elevated, hovering around 80-85%, according to Bank of Thailand reports. This financial pressure on households can directly impact BJC's sales volumes and the effectiveness of its promotional strategies.

Investment Climate and FDI

Political instability can significantly dampen the investment climate, making both domestic and foreign investors hesitant, particularly for projects heavily dependent on government expenditure. This cautious sentiment could affect Berli Jucker's (BJC) strategic expansion initiatives and its ability to secure capital for new undertakings.

Despite ongoing interest in large-scale projects like the Eastern Economic Corridor (EEC), a less predictable political landscape might lead to a more subdued FDI inflow into Thailand.

- Foreign Direct Investment (FDI) in Thailand: In the first half of 2024, Thailand's Board of Investment (BOI) reported a 30% year-on-year increase in FDI applications, reaching THB 380 billion, signaling continued investor interest in key sectors.

- EEC Development: The EEC office reported that as of early 2024, investment applications in the EEC zone reached THB 250 billion, with a focus on advanced industries, though the pace of new project approvals can be influenced by policy continuity.

- Impact on Capital Access: A perceived increase in political risk can lead to higher borrowing costs or a reduced appetite for equity financing, potentially impacting BJC's cost of capital for future growth opportunities.

Regional Economic Dynamics

Berli Jucker's significant footprint across Southeast Asia means its financial health is intrinsically linked to the economic trajectories of nations such as Cambodia, Laos, and Vietnam. These markets are increasingly vital for the company's growth strategy.

The expansion of Big C Supercenter, a key Berli Jucker brand, into these developing economies underscores the critical role of robust regional economic growth and stability. For instance, Vietnam's GDP growth was projected to be around 5.5% to 6.0% in 2024, signaling a positive environment for retail expansion.

- Cambodia's GDP growth was estimated at 6.5% in 2024, offering a fertile ground for retail sector development.

- Laos's economic outlook for 2024 indicated a projected GDP growth of approximately 3.5%, albeit with ongoing fiscal challenges.

- Vietnam's consumer spending has shown resilience, with retail sales of goods and services expected to increase by over 9% in 2024, benefiting companies like Berli Jucker.

Thailand's economy is expected to grow steadily through 2024 and 2025, driven by consumer spending and tourism, with the Bank of Thailand forecasting 3.0% GDP growth for 2024.

However, high household debt, around 80-85% of GDP as of early 2024, could temper consumer spending, directly impacting Berli Jucker's retail and consumer goods segments.

Inflation is projected to remain within the Bank of Thailand's 1-3% target range, as seen in early 2024 figures around 1-2%, but global monetary policies could influence market stability.

Interest rate fluctuations will impact Berli Jucker's borrowing costs and investment decisions, with higher rates increasing operational expenses.

| Economic Indicator | 2024 Projection/Data | Impact on BJC |

|---|---|---|

| Thailand GDP Growth | 3.0% (Bank of Thailand) | Positive for overall market demand |

| Thailand Inflation Rate | 1-2% (early 2024) | Within target, stable consumer prices |

| Household Debt to GDP | 80-85% (early 2024) | Potential dampener on consumer spending |

| Vietnam GDP Growth | 5.5%-6.0% (projection) | Supports BJC's regional expansion |

Preview the Actual Deliverable

Berli Jucker PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Berli Jucker PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, offering valuable strategic insights.

Sociological factors

Thai consumers are increasingly prioritizing their well-being, with a growing emphasis on healthy lifestyles and plant-based eating habits. This shift means a greater demand for products catering to specific health needs, influencing BJC's consumer goods and food divisions. For instance, the market for plant-based alternatives in Thailand saw significant growth, with projections indicating continued expansion through 2025 as consumer awareness rises.

Urbanization continues to reshape consumer habits across Thailand and Southeast Asia, fueling demand for convenient, accessible retail options. This trend directly benefits companies like Berli Jucker, whose extensive network of Big C Supercenters and smaller Big C Mini stores is strategically positioned to capture this growth. In 2023, Thailand's urbanization rate reached approximately 51.6%, with major cities like Bangkok experiencing significant population density increases, creating a fertile ground for modern retail expansion.

Thailand is rapidly transitioning into an aging society, a significant demographic shift driven by falling birth rates and longer lifespans. By 2024, it's projected that over 20% of the population will be aged 60 and above, a trend that will continue to accelerate.

This growing segment of older consumers represents a substantial and influential market, particularly for sectors like healthcare and wellness. Berli Jucker Public Company Limited (BJC) is well-positioned to capitalize on this trend, given its established presence in the healthcare sector, including pharmaceuticals and medical supplies.

The increasing demand for age-appropriate products and services, from pharmaceuticals to specialized food products and home healthcare solutions, presents a clear opportunity for BJC to expand its offerings and market share within this demographic. This aligns with the company’s strategic focus on consumer goods and healthcare.

Digital Adoption and E-commerce Growth

The surge in digital adoption and e-commerce within Thailand is fundamentally reshaping the retail environment. Berli Jucker is strategically expanding its 'out-of-store sales' by leveraging its online platforms and mobile applications to tap into this expanding digital consumer base.

Thailand's e-commerce market is experiencing robust growth, with projections indicating continued expansion. For instance, the market was valued at approximately USD 16 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 12% through 2028. This trend highlights the critical importance of digital channels for retailers like Berli Jucker.

- Digital Penetration: By late 2024, internet penetration in Thailand is expected to exceed 80% of the population, creating a vast online market.

- E-commerce Growth: The Thai e-commerce sector is projected to reach over USD 20 billion by 2025, driven by increased consumer trust and convenience.

- Mobile Commerce: Mobile commerce (m-commerce) accounts for a significant portion of online sales, with over 70% of e-commerce transactions occurring via smartphones.

- Consumer Behavior Shift: Thai consumers are increasingly comfortable making purchases online, influenced by social media marketing and seamless digital payment options.

Cultural and Social Values

Thai cultural values, such as a strong emphasis on community and the observance of traditional celebrations, significantly shape consumer behavior. For instance, major festivals like Lunar New Year and Songkran see increased spending on gifts, food, and household goods, directly impacting sales for companies like Berli Jucker (BJC). BJC strategically aligns its promotional campaigns and product assortments with these key cultural moments to capitalize on heightened consumer demand.

BJC's market approach often reflects an understanding of these social dynamics. In 2023, for example, the Thai retail sector experienced robust growth, partly driven by increased domestic consumption during traditional holidays. BJC's ability to integrate its offerings with these cultural touchstones is a key element in its market penetration and sales performance.

- Community Focus: Thai society's emphasis on collective well-being and family ties influences purchasing decisions, especially for products related to shared celebrations.

- Festival Impact: Major Thai festivals, such as Songkran (Thai New Year) and various Lunar New Year celebrations, are critical periods for retail sales, with consumers often purchasing new items and gifts.

- BJC's Strategy: Berli Jucker (BJC) leverages these cultural events by tailoring product promotions and marketing efforts to align with consumer purchasing patterns during these festive times.

- Market Responsiveness: BJC's success is partly attributed to its responsiveness to evolving social values and its integration of cultural relevance into its business operations.

Thailand's demographic shifts, particularly the move towards an aging society and increasing urbanization, are significant sociological factors impacting consumer behavior. By 2024, over 20% of Thailand's population is projected to be aged 60 and above, creating a growing market for healthcare and wellness products. Simultaneously, urbanization continues, with over half of the population residing in urban areas by 2023, driving demand for convenient retail solutions like those offered by Berli Jucker's Big C stores.

The rising digital adoption further reshapes consumer habits, with internet penetration expected to exceed 80% by late 2024 and the e-commerce market projected to reach over USD 20 billion by 2025. This digital shift necessitates BJC's expansion of online platforms and mobile applications to reach consumers. Furthermore, strong cultural values, including a focus on community and festivals, influence spending patterns, particularly during key celebrations like Songkran and Lunar New Year, which BJC strategically leverages in its marketing.

| Sociological Factor | Trend Description | Impact on BJC | Relevant Data (2024/2025 Projections) |

|---|---|---|---|

| Aging Population | Increasing proportion of elderly consumers | Growth in healthcare, wellness, and specialized food products | Over 20% of population aged 60+ by 2024 |

| Urbanization | Migration to cities and increased urban density | Demand for convenient retail, expansion of Big C network | ~51.6% urbanization rate in Thailand (2023) |

| Digital Adoption | Widespread internet and smartphone use | Growth in e-commerce and mobile commerce (m-commerce) | Internet penetration >80% (late 2024); E-commerce market >USD 20 billion (2025) |

| Cultural Values | Emphasis on community, family, and traditional festivals | Increased spending during holidays; need for culturally relevant marketing | Key festivals drive significant retail sales spikes annually |

Technological factors

Berli Jucker's commitment to digital transformation is evident in its retail and logistics sectors, aiming for greater efficiency and a superior customer journey. This strategic focus is vital for optimizing its complex supply chain and logistics, supporting its wide array of business segments.

In 2024, the company continued to invest in digital solutions, with a significant portion of its capital expenditure directed towards enhancing its e-commerce platforms and warehouse management systems. For instance, its Big C Supercenter chain has seen substantial upgrades to its online ordering and delivery infrastructure, aiming to capture a larger share of the growing online grocery market, which was projected to grow by over 15% in Southeast Asia in 2024.

The optimization of logistics is a key technological driver, with Berli Jucker exploring advanced analytics and automation to streamline inventory management and last-mile delivery. This digital push is expected to yield a 5-10% reduction in operational costs by 2025 through improved route planning and reduced spoilage rates in its food distribution networks.

The rapid expansion of e-commerce in Thailand is a key technological factor influencing Berli Jucker (BJC). To capitalize on this trend, BJC is strategically investing in and broadening its online sales capabilities. This includes enhancing its own website and developing user-friendly mobile applications to reach a wider customer base.

BJC’s objective is to substantially grow its out-of-store revenue streams, with digital platforms playing a crucial role. This omnichannel approach signifies a deliberate pivot towards integrating online and offline retail experiences, aiming to provide customers with seamless purchasing options. For instance, in 2024, the Thai e-commerce market was projected to exceed $20 billion, highlighting the immense potential for BJC’s digital initiatives.

Automation in Berli Jucker's warehousing and logistics operations is a key technological driver. This focus is expected to yield significant cost savings and enhance delivery speed, crucial for maintaining competitiveness in the fast-moving consumer goods sector. For instance, the company has projected substantial annual cost reductions from its new distribution centers, highlighting a strategic investment in technology for greater operational efficiency and optimized supply chain management.

Data Analytics and Personalization

Data analytics is fundamentally reshaping how companies like Berli Jucker (BJC) connect with their customers. By sifting through vast amounts of consumer data, BJC can gain deep insights into purchasing habits, preferences, and even predict future trends. This allows for highly personalized marketing campaigns and product recommendations, making customers feel more understood and valued.

This technological edge is critical in the fast-paced retail and consumer goods markets. BJC can leverage these insights to fine-tune promotions, ensuring they reach the right audience with the right message at the right time. It also plays a vital role in optimizing inventory management, reducing waste, and ensuring popular products are always available.

The ability to personalize experiences is a key driver of customer loyalty. For BJC, this means tailoring everything from loyalty program rewards to in-store or online interactions. Studies in 2024 continue to show that personalized experiences can lead to higher conversion rates and increased customer lifetime value.

- Consumer behavior analysis: BJC uses data analytics to understand purchasing patterns across its diverse product lines, from food and beverages to personal care.

- Personalized promotions: In 2024, retailers leveraging data analytics saw an average increase of 10-15% in campaign effectiveness through targeted offers.

- Inventory optimization: Advanced analytics help BJC predict demand more accurately, reducing stockouts and overstock situations, a critical factor in maintaining profitability.

- Customer loyalty enhancement: By tailoring rewards and communications based on individual customer data, BJC aims to foster stronger, long-term relationships.

Innovation in Manufacturing and Packaging

Technological advancements are significantly reshaping manufacturing and packaging, offering Berli Jucker Public Company Limited (BJC) opportunities to boost product quality, cut expenses, and improve environmental impact. Innovations in automated production lines and smart factory technologies can streamline operations. For instance, the global packaging market is projected to reach USD 1.3 trillion by 2027, indicating substantial growth driven by technological integration.

As a key player in packaging, BJC stands to gain from advancements in materials science and production techniques for glass and aluminum. The adoption of Industry 4.0 principles, such as the Internet of Things (IoT) and artificial intelligence (AI) in manufacturing, can lead to predictive maintenance, reduced waste, and enhanced efficiency. For example, AI-powered quality control systems can identify defects with greater accuracy than traditional methods.

BJC can leverage these technological shifts to:

- Enhance Production Efficiency: Implementing advanced automation and robotics in manufacturing processes can reduce labor costs and increase output.

- Improve Product Quality and Safety: Innovations in packaging materials and designs, such as antimicrobial coatings or smart labels, can extend shelf life and ensure product integrity.

- Drive Sustainability: Adopting eco-friendly packaging materials and optimizing production to minimize waste aligns with growing consumer demand for sustainable products.

- Gain Competitive Advantage: Early adoption of cutting-edge manufacturing and packaging technologies can position BJC as an industry leader, offering superior products and services.

Berli Jucker (BJC) is actively integrating advanced technologies to enhance its retail and logistics operations, focusing on digital transformation for improved efficiency and customer experience. The company's investment in e-commerce platforms and warehouse management systems in 2024 underscores its commitment to capturing the growing online market. For instance, BJC's Big C Supercenter chain has seen significant upgrades to its online infrastructure, aiming to capitalize on the projected 15% growth of the Southeast Asian online grocery market in 2024.

Automation in warehousing and logistics is a key technological driver for BJC, promising cost savings and faster delivery. The company anticipates a 5-10% reduction in operational costs by 2025 through optimized route planning and reduced spoilage. Furthermore, BJC leverages data analytics for deep consumer insights, enabling personalized marketing and better inventory management, which is crucial in the competitive consumer goods sector.

Technological advancements in manufacturing and packaging are also central to BJC's strategy, aiming to boost product quality and reduce costs. The adoption of Industry 4.0 principles, like AI for quality control, is enhancing efficiency and product safety. BJC's focus on eco-friendly packaging and waste reduction aligns with market trends, positioning it for growth in a sector projected to reach USD 1.3 trillion by 2027.

| Technology Focus | BJC Initiatives | Projected Impact/Market Data |

|---|---|---|

| E-commerce & Digital Platforms | Upgrading online ordering, delivery infrastructure, mobile applications | Capture growing online grocery market (SEA projected 15% growth in 2024); Thai e-commerce market >$20 billion in 2024 |

| Automation & Logistics | Streamlining inventory, last-mile delivery, warehouse management | 5-10% reduction in operational costs by 2025; enhanced delivery speed |

| Data Analytics | Consumer behavior analysis, personalized promotions, inventory optimization | 10-15% increase in campaign effectiveness (2024 data); improved customer loyalty |

| Manufacturing & Packaging | Smart factory technologies, AI in quality control, sustainable materials | Boost product quality, cut expenses, improve environmental impact; global packaging market USD 1.3 trillion by 2027 |

Legal factors

Thailand is actively enhancing its consumer protection laws, with new draft acts targeting misleading advertising, product defects, and food safety. These legislative updates also focus on safeguarding online shoppers, reflecting a growing concern for digital commerce integrity. For Berli Jucker (BJC), this means a heightened need to ensure all products and services strictly adhere to these evolving regulations, thereby mitigating risks of penalties and reinforcing consumer confidence.

Thailand's updated food safety and labeling regulations, particularly for pre-packaged goods, are placing a greater onus on manufacturers like Berli Jucker (BJC) to provide consumers with more transparent information. These rules mandate clearer nutritional labels and comprehensive manufacturer details, directly impacting BJC's consumer products division.

Compliance with these evolving Thai regulations is crucial for BJC to maintain consumer trust and avoid penalties. For instance, the Ministry of Public Health's recent amendments to food labeling standards in 2024 aim to enhance consumer understanding of product contents, a move that requires diligent review of BJC's product packaging across its portfolio.

Thailand's Personal Data Protection Act (PDPA) is now in full swing, with regulatory bodies showing a stricter stance on enforcement. Penalties for non-compliance, especially around data breaches and the mandatory appointment of data protection officers, are notably higher, impacting businesses significantly. For instance, in 2023, the PDPC issued guidance on data breach notifications, emphasizing swift reporting to authorities and affected individuals.

Berli Jucker Public Company Limited (BJC), operating extensively in retail and consumer goods, faces direct implications from these PDPA regulations. The company's large customer base necessitates stringent data security protocols and unwavering adherence to PDPA mandates to safeguard sensitive customer information. Failure to comply could lead to substantial fines and reputational damage, impacting consumer trust and market standing.

Product Liability Legislation

Thailand's draft Liability for Defective Goods Act introduces a new framework holding sellers accountable for product defects. This legislation directly affects Berli Jucker (BJC) by necessitating enhanced quality assurance across its manufacturing and distribution operations. BJC must ensure robust product testing and establish clear protocols for managing potential recalls or customer compensation to comply with these updated regulations.

The proposed act categorizes liability based on the type of goods, meaning BJC will need to understand and adhere to specific requirements for each product category it handles. For instance, if BJC's food products are found to have defects, the company could face significant penalties under the new regime. This necessitates a proactive approach to risk management and a thorough review of existing supplier agreements to ensure compliance with the evolving legal landscape.

- Enhanced Quality Control: BJC's manufacturing processes must meet higher standards to prevent defects.

- Product Recall Preparedness: Clear and efficient procedures for product recalls are now critical.

- Consumer Protection Focus: The legislation emphasizes consumer safety, requiring BJC to prioritize this in all product development and distribution.

Competition and Anti-Monopoly Laws

Thailand's Trade Competition Act, enacted to foster a level playing field, strictly prohibits monopolistic practices and agreements that stifle fair competition, ensuring consumers benefit from a wider array of choices and competitive pricing. Berli Jucker Public Company Limited (BJC), given its significant market share in sectors like consumer goods manufacturing and retail, must diligently adhere to these regulations to prevent legal scrutiny and potential penalties.

BJC's operations are therefore shaped by the need to avoid actions that could be construed as anti-competitive. For instance, the Office of Trade Competition Commission (OTCC) actively monitors market dynamics, and any perceived abuse of dominant market positions by large conglomerates like BJC could trigger investigations. As of early 2024, the OTCC has been increasingly active in examining mergers and acquisitions to ensure they do not unduly concentrate market power.

- Regulatory Oversight: BJC must navigate the scrutiny of Thailand's Trade Competition Act, which aims to prevent monopolies and unfair market practices.

- Dominant Position Compliance: The company's significant presence in retail and manufacturing necessitates careful adherence to antitrust laws to avoid legal repercussions.

- Market Dynamics: The Office of Trade Competition Commission's active monitoring of market concentration, particularly concerning mergers and acquisitions, directly impacts BJC's strategic expansion.

- Consumer Welfare: Adherence to competition laws is crucial for BJC to maintain consumer trust and avoid practices that could limit choice or inflate prices.

Thailand's evolving consumer protection laws, including those addressing misleading advertising and product safety, require BJC to maintain stringent product and service compliance. Recent amendments in 2024 to food labeling standards by the Ministry of Public Health mandate clearer nutritional information and manufacturer details, directly impacting BJC's consumer goods division.

The full enforcement of Thailand's Personal Data Protection Act (PDPA) means BJC must prioritize data security, with penalties for breaches, like those outlined in 2023 guidance on breach notifications, being significant. The draft Liability for Defective Goods Act further mandates enhanced quality assurance and recall preparedness for BJC's diverse product lines.

BJC must also navigate Thailand's Trade Competition Act, which prohibits monopolistic practices. The Office of Trade Competition Commission's active scrutiny of market concentration, especially in mergers and acquisitions as observed in early 2024, means BJC needs careful adherence to antitrust laws to avoid investigations and maintain fair market practices.

Environmental factors

Thailand's ban on plastic waste imports, effective January 1, 2025, is a significant environmental policy. This move aims to curb pollution and foster a circular economy, directly influencing businesses reliant on imported plastic materials.

For Berli Jucker (BJC), this ban presents a critical challenge for its packaging division. The company must adapt its supply chain, potentially sourcing more raw materials domestically or exploring alternative, sustainable packaging solutions to comply with the new regulations.

Consumers increasingly favor brands demonstrating genuine commitment to sustainability, a trend that significantly impacts market share. Berli Jucker Public Company Limited (BJC) acknowledges this, highlighting its environmental sustainability efforts in its 2023 annual report. This focus is vital for maintaining and enhancing BJC's brand reputation and appeal to a growing eco-conscious customer base.

Rising energy costs are a significant concern for Berli Jucker (BJC), prompting exploration into renewable energy solutions. For instance, solar rooftop installations are being considered to mitigate operational expenses and lessen the company's environmental impact.

This strategic move aligns with global sustainability objectives, and BJC anticipates long-term cost savings. In Thailand, where BJC operates extensively, the government has set ambitious renewable energy targets, aiming for at least 30% of the country's total electricity generation to come from renewable sources by 2037, creating a supportive policy environment for such initiatives.

Waste Reduction and Recycling Efforts

Berli Jucker Public Company Limited (BJC) is increasingly focusing on waste reduction and recycling initiatives across its broad operational spectrum, extending beyond just plastic. These efforts are crucial for enhancing environmental performance and exploring new revenue streams.

The company recognizes that efficient waste management is not only an environmental imperative but also a strategic business opportunity. By implementing robust systems, BJC aims to minimize its ecological footprint while potentially capitalizing on the value of recycled materials.

- Waste Diversion Targets: BJC is setting ambitious targets for waste diversion from landfills, aiming to recycle or repurpose a significant percentage of its operational waste by 2025.

- Circular Economy Integration: The company is exploring circular economy principles to transform waste into valuable resources, potentially generating revenue from by-products and recycled materials.

- Operational Efficiency Gains: Streamlined waste management processes are expected to lead to cost savings through reduced disposal fees and improved resource utilization.

- Consumer Engagement: BJC is also looking at ways to engage consumers in recycling efforts, particularly within its retail segments, to foster a broader culture of sustainability.

Climate Change and Resource Scarcity

Climate change presents significant long-term risks for Berli Jucker Public Company Limited (BJC), particularly impacting its agriculture-reliant consumer goods segments. Extreme weather events and changing precipitation patterns can disrupt the availability and cost of raw materials, potentially leading to supply chain volatility. For instance, in 2024, Thailand experienced severe drought conditions affecting agricultural yields, a key concern for BJC's food and beverage businesses.

Resource scarcity, exacerbated by climate change, directly threatens BJC's operational efficiency and cost structure. The company's reliance on natural resources for packaging, agricultural inputs, and manufacturing necessitates a proactive approach to sustainable sourcing and water management. By 2025, global water stress is projected to impact regions where BJC sources key ingredients, underscoring the urgency of these adaptations.

- Supply Chain Vulnerability: Climate-induced disruptions in agricultural output directly affect BJC's raw material procurement for products like beverages and packaged foods.

- Resource Management: Increasing water scarcity and the need for sustainable land use are critical considerations for BJC's manufacturing and sourcing strategies.

- Operational Costs: Fluctuations in commodity prices due to climate events and resource constraints can lead to unpredictable increases in operating expenses.

- Consumer Demand Shifts: Growing consumer awareness of environmental issues may influence purchasing decisions, favoring products with demonstrable sustainability credentials.

Thailand's ban on plastic waste imports, effective January 1, 2025, mandates significant shifts for Berli Jucker (BJC) in its packaging operations, pushing for domestic sourcing and sustainable alternatives. Consumer preference for eco-friendly brands is a growing influence, as highlighted in BJC's 2023 report, reinforcing the need for demonstrable sustainability efforts to maintain market appeal. Furthermore, the company is actively pursuing renewable energy, such as solar rooftops, to combat rising energy costs and align with Thailand's 2037 renewable energy targets, aiming for 30% of national electricity generation from these sources.

PESTLE Analysis Data Sources

Our Berli Jucker PESTLE Analysis is meticulously constructed using a blend of publicly available government data, reputable market research reports, and industry-specific publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the company.