Berli Jucker Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Berli Jucker Bundle

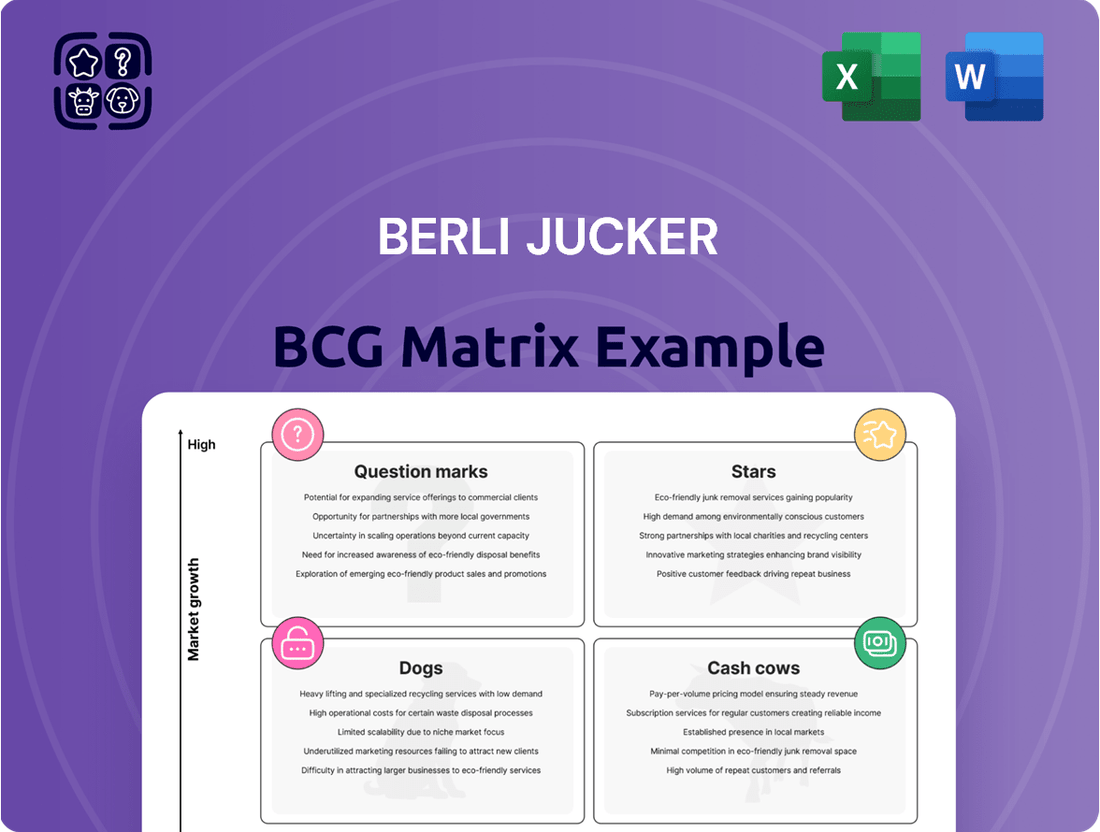

Berli Jucker's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic interplay of market share and growth potential across its diverse product portfolio. Understanding whether its offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making. Purchase the full BCG Matrix to unlock a comprehensive analysis and gain actionable insights for optimizing Berli Jucker's strategic investments and product development.

Stars

Berli Jucker's modern retail arm, spearheaded by Big C Supercenter, is a dominant force in Thailand's retail landscape. This sector is anticipated to expand by a substantial USD 71.7 billion from 2024 to 2029, indicating a fertile ground for growth.

BJC is actively bolstering Big C's presence through the addition of new hypermarkets and supermarkets. The company is targeting mid-single-digit sales growth for this segment in 2025, demonstrating confidence in its expansion strategy.

This aggressive expansion within a high-growth market solidifies Big C's position as a Star within BJC's portfolio. Its performance is crucial for driving the company's overall revenue and market share.

Big C's strategic emphasis on fresh food has paid off, with the retailer consistently capturing a larger slice of the market. This focus is crucial for attracting shoppers and encouraging repeat visits, especially in the rapidly expanding modern retail sector.

In 2024, Big C's fresh food segment saw a notable increase in its market share, contributing directly to higher customer footfall. This success in a high-margin category is a significant driver of Berli Jucker's overall profitability.

Berli Jucker (BJC) is aggressively expanding its online sales, which represented 13.1% of total revenue in Q1 2025. This segment is experiencing robust growth, evidenced by a 49% year-on-year increase in online sales. BJC aims to push this figure into the mid-teens by the end of 2025.

The Thai e-commerce market is booming, providing a fertile ground for BJC's digital ventures. This rapid expansion of online retail in Thailand is a significant tailwind, fueling BJC's strategic investments in its digital channels to capture a greater market share.

Healthcare Division's New Product Launches

Berli Jucker's Healthcare Division is demonstrating strong growth, with its new product launches contributing significantly to a 7.8% sales increase in Q4 2024. This performance was further bolstered by the timely release of government budgets, indicating favorable market conditions.

The broader Thai healthcare market is a key driver for this segment's success. Projections show the private hospital sector alone is expected to expand by 5.6% year-on-year in 2025, underscoring the robust demand for healthcare services and products.

BJC's strategic focus on introducing innovative pharmaceutical products, coupled with its capacity to capitalize on these positive market trends, firmly positions the Healthcare Division as a Star in the BCG matrix. This segment, while a smaller contributor to overall revenue, exhibits high growth potential.

- Healthcare Division Sales Growth: 7.8% increase in Q4 2024.

- Key Growth Drivers: New product launches and government budget releases.

- Thai Healthcare Market Outlook: Private hospital sector projected to grow 5.6% year-on-year in 2025.

- BCG Matrix Classification: Star, due to high growth potential and market tailwinds.

Premium and Innovative Packaging Solutions

Berli Jucker Public Company Limited (BJC) is enhancing its packaging segment by focusing on premium and innovative solutions, targeting growth in specialized markets. This strategy involves introducing products like aluminum bottles and unique glass bottles designed for cosmetics and deodorants. For instance, in 2024, BJC reported significant growth in its packaging segment, with revenue increasing by 12% year-on-year, driven by these value-added offerings.

This strategic pivot into higher-value, niche segments within the packaging industry, which remains a stable yet expanding market, aims to capitalize on emerging consumer demands. BJC's commitment to this area is further underscored by its ongoing investments in modernizing production lines. These upgrades are crucial for meeting the stringent quality and design requirements of premium packaging, supporting an anticipated 15% revenue uplift from these specialized products by the end of 2025.

- Focus on Premium Segments: BJC is actively developing and marketing premium packaging like aluminum and specialized glass bottles for high-end cosmetics and deodorants.

- Market Opportunity Capture: This expansion into niche, higher-value packaging allows BJC to tap into new market segments and increase overall sales volume and value.

- Production Line Investment: The company is investing in upgrading its manufacturing capabilities to support the production of these innovative and premium packaging solutions.

- Growth Trajectory: These strategic moves are designed to bolster BJC's packaging division, contributing to its overall financial performance and market competitiveness.

Big C, BJC's retail powerhouse, is a clear Star. Its dominance in Thailand's retail sector, projected to grow by USD 71.7 billion from 2024-2029, provides a high-growth market. BJC's aggressive expansion of hypermarkets and supermarkets, targeting mid-single-digit sales growth in 2025, reinforces this position.

The strategic focus on fresh food has boosted Big C's market share and customer footfall in 2024, directly impacting BJC's profitability. Furthermore, BJC's online sales, already at 13.1% of total revenue in Q1 2025 with a 49% YoY increase, are a significant growth engine, aiming for mid-teen revenue contribution by year-end.

| BJC Business Segment | BCG Matrix Classification | Key Performance Indicators (2024-2025) | Market Context |

|---|---|---|---|

| Big C (Modern Retail) | Star | Targeting mid-single-digit sales growth (2025). Online sales grew 49% YoY (Q1 2025). | Thai retail market to grow by USD 71.7 billion (2024-2029). |

| Healthcare Division | Star | 7.8% sales increase (Q4 2024). New product launches driving growth. | Thai private hospital sector projected to grow 5.6% YoY (2025). |

| Packaging Segment | Star | 12% YoY revenue increase (2024). Aiming for 15% uplift from specialized products (2025). | Focus on premium, niche markets like aluminum bottles. |

What is included in the product

This BCG Matrix analysis categorizes Berli Jucker's portfolio into Stars, Cash Cows, Question Marks, and Dogs.

It guides strategic decisions on investment, divestment, and resource allocation for each business unit.

A clear visual map of Berli Jucker's portfolio, simplifying strategic decisions.

Instantly identify high-growth Stars and cash-generating Cash Cows for focused investment.

Cash Cows

Berli Jucker's glass packaging division stands as a cornerstone, leveraging its position as Southeast Asia's largest manufacturer. This mature industry, while not experiencing explosive growth, offers a stable revenue stream.

In the fourth quarter of 2024, this segment saw a notable uptick in sales. This growth was fueled by sustained demand from key sectors, particularly beverages and the export market, underscoring its resilience.

The glass packaging business is a classic cash cow for BJC. It reliably generates substantial cash flow, which is crucial for reinvestment in other, higher-growth areas of the company's portfolio.

Berli Jucker's (BJC) aluminum can manufacturing operation stands as a significant Cash Cow. As Thailand's largest producer, it commands a substantial market share in a vital packaging sector.

The segment demonstrated robust performance, with sales climbing 4.2% in Q4 2024, fueled by robust demand from the carbonated soft drink and coffee industries.

With raw material costs remaining stable and the company implementing effective cost-saving measures, this business unit consistently generates strong profits and reliable cash flow for BJC.

Big C Hypermarkets' established stores are quintessential cash cows for Berli Jucker (BJC). These mature retail operations boast a significant market share in prime urban and suburban locations, consistently delivering strong rental income and retail sales. This robust performance solidifies their role as a stable and predictable cash generator for the conglomerate.

For instance, in 2024, BJC continued to emphasize optimizing the performance of its key Big C hypermarkets, recognizing their crucial function in generating consistent cash flow. The company's strategic allocation of resources towards enhancing these established outlets highlights their importance as a reliable income stream, underpinning BJC's overall financial stability.

Core Consumer Products (e.g., Rice Crackers, Bar Soap)

Berli Jucker's core consumer products, such as rice crackers and bar soap, represent significant cash cows within their portfolio. BJC commands the leading market share in Thailand for these categories, particularly within the mid and economy segments. These mature product lines benefit from robust brand loyalty and highly efficient distribution networks.

While the overall Thai FMCG market saw a modest growth of 2.7% in Q1 2025, these established products deliver consistent revenue streams. Their stability is further bolstered by high profit margins, a direct result of their entrenched market position and operational efficiencies.

- Dominant Market Share: BJC holds the largest share in Thailand for rice crackers, bar soap, and tissue in the mid and economy segments.

- Stable Revenue Generation: These mature product lines provide a reliable income source despite moderate overall FMCG market growth.

- High Profit Margins: Established brand loyalty and efficient distribution contribute to strong profitability for these core products.

- Cash Cow Status: Their consistent performance and profitability solidify their position as reliable cash cows for Berli Jucker.

Logistics and Supply Chain Solutions

Berli Jucker's (BJC) Logistics and Supply Chain Solutions segment functions as a robust cash cow. This business benefits from a market projected to expand at a compound annual growth rate (CAGR) between 3.97% and 6.22% from 2025 onwards, indicating sustained demand for these essential services.

Leveraging BJC's extensive operational network and deep internal integration across its varied business units, this segment is well-positioned to maintain a dominant market share within Thailand. Its ability to generate steady revenue streams and enhance the operational efficiency of other BJC divisions solidifies its role as a dependable cash flow generator in a fundamentally important industry.

- Market Growth: Supply chain and logistics market expected to grow at a CAGR of 3.97% to 6.22% from 2025.

- Market Position: Strong position in Thailand due to BJC's extensive network and internal integration.

- Revenue Generation: Consistent revenue contributor, supporting overall business efficiency.

- Industry Importance: Operates in a foundational industry, ensuring reliable cash flow.

Berli Jucker's (BJC) established consumer products, like rice crackers and bar soap, are prime examples of cash cows. These mature product lines benefit from strong brand loyalty and efficient distribution, holding leading market shares in Thailand's mid and economy segments.

Despite moderate overall FMCG market growth, these core products consistently deliver stable revenue streams and high profit margins, reinforcing their role as reliable cash generators for BJC.

The company's logistics and supply chain solutions also function as a robust cash cow, capitalizing on a market projected for steady expansion. Its strong position within Thailand, bolstered by BJC's extensive network, ensures consistent revenue and operational efficiency across the conglomerate.

BJC's Big C hypermarkets represent quintessential cash cows, with established stores in prime locations consistently generating strong rental income and retail sales.

| BJC Business Unit | BCG Category | Key Characteristics | 2024 Performance Indicator |

|---|---|---|---|

| Glass Packaging | Cash Cow | Largest manufacturer in Southeast Asia, stable revenue. | Sales uptick in Q4 2024 driven by beverage and export demand. |

| Aluminum Can Manufacturing | Cash Cow | Thailand's largest producer, commands significant market share. | Sales climbed 4.2% in Q4 2024, strong demand from beverage sector. |

| Big C Hypermarkets | Cash Cow | Mature retail operations, prime locations, strong market share. | Continued optimization of key hypermarkets for consistent cash flow. |

| Core Consumer Products (Rice Crackers, Bar Soap) | Cash Cow | Leading market share in Thailand (mid/economy segments), high brand loyalty. | High profit margins due to entrenched market position and efficiency. |

| Logistics & Supply Chain Solutions | Cash Cow | Benefits from market expansion, leverages BJC's extensive network. | Market projected to grow at a CAGR of 3.97% to 6.22% from 2025. |

What You’re Viewing Is Included

Berli Jucker BCG Matrix

The Berli Jucker BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive strategic analysis ready for immediate application. You can confidently use this preview as a direct representation of the high-quality, actionable insights contained within the final Berli Jucker BCG Matrix report. Once acquired, this document is yours to edit, present, and integrate into your strategic planning processes without any further modifications needed.

Dogs

Within Berli Jucker's diverse retail operations, certain traditional outlets may be experiencing a downturn. These stores, often older or situated in less advantageous locations, are contending with reduced customer visits and stiff competition from modern retail formats and e-commerce. In 2024, this segment of BJC's portfolio likely represents units with low growth prospects and a small share of their local markets.

These underperforming traditional retail outlets could be characterized by stagnant or declining sales, potentially operating at a breakeven point or even incurring net losses. Their contribution to overall profitability might be minimal, and they could be consuming more capital than they generate. This aligns with BJC's broader strategy to streamline operations by divesting or revitalizing such non-core or unprofitable assets.

Berli Jucker's (BJC) international consumer business faced headwinds in late 2024, with sales declining by 8.4% in the fourth quarter. This downturn was largely attributed to the appreciation of the Thai Baht, making BJC's products more expensive for overseas buyers.

Within BJC's portfolio, specific international consumer ventures might be categorized as Dogs if they exhibit a combination of factors. These include consistently negative impacts from currency fluctuations, a low market share in their respective regions, and dim growth prospects for their product lines.

Such underperforming ventures can become a drain on resources, tying up valuable capital without generating commensurate returns. For instance, a venture in a market with a persistent strong local currency against the Baht, coupled with intense competition and stagnant consumer demand, would fit this profile.

Berli Jucker (BJC) operates in the dynamic consumer goods sector, where product lifecycles can be short. Certain niche or older product lines within their portfolio may find it challenging to maintain relevance against shifting consumer tastes and aggressive market competition. This can result in a diminished market share and sluggish growth, potentially turning these items into costly burdens rather than profit drivers.

These underperforming products can become cash traps, demanding resources for upkeep without generating substantial returns. For instance, in 2024, the consumer goods industry saw a significant shift towards sustainable and health-conscious products, leaving many traditional or specialized items with declining appeal. BJC’s strategic approach, which includes consistently launching innovative new consumer products, necessitates a careful evaluation and potential discontinuation of less viable offerings to optimize resource allocation.

Legacy Technical Supply Businesses with Low Demand

Berli Jucker Public Company Limited (BJC) possesses technical supply chain operations alongside its expanding healthcare segment. Certain legacy technical supply businesses within BJC, particularly those in stagnant industrial sectors or facing intense competition with minimal market penetration, could be categorized as Dogs.

These operations may struggle to achieve profitability, potentially only breaking even, or necessitate significant investment simply to retain their current market standing. For instance, if a legacy technical supply unit operates in a sector that experienced a market contraction of 5% in 2024, as some industrial goods sectors did, its viability becomes questionable without strategic intervention.

- Low Market Share: Businesses with a declining or stagnant share in their respective technical supply markets.

- Low Growth Markets: Operations tied to industrial sectors that are not experiencing significant expansion, potentially showing sub-1% annual growth.

- High Maintenance Costs: Units requiring substantial capital expenditure or operational costs to remain competitive or compliant.

- Limited Differentiation: Products or services that offer little unique value proposition against competitors, leading to price-based competition.

Marginalized Private Label Products in Retail

Within Berli Jucker's (BJC) portfolio, certain private label products at Big C might be classified as Dogs in the BCG matrix. These are items that, despite BJC's strategic push for private label growth, haven't captured significant market share or customer interest.

These underperforming private label products represent a challenge. They consume valuable inventory space and capital that could be allocated to more successful offerings. For instance, if a particular line of Big C branded snacks is consistently outsold by national brands and shows minimal sales growth, it fits the Dog profile.

The financial implications are clear: these products tie up resources without generating proportional returns. In 2024, BJC's focus on optimizing its product mix means that such underperformers are prime candidates for review and potential delisting to improve overall inventory turnover and profitability.

- Low Market Share: Products that fail to gain traction against competitors.

- Stagnant or Declining Sales: Consistent poor performance despite marketing support.

- Inventory and Shelf Space Drain: Tying up capital and prime retail real estate.

- Profitability Concerns: Inability to generate adequate returns relative to investment.

Within Berli Jucker's (BJC) extensive product lines, certain niche or older brands might be classified as Dogs. These are products with a low market share in a slow-growing or declining market, offering minimal returns and potentially draining resources. For example, a specific brand of traditional beverage that has seen its market shrink by 3% annually since 2022, while BJC’s overall beverage sales grew by 4% in 2024, would fit this description.

These products often require significant marketing support or inventory management without generating substantial revenue or profit. They represent an inefficient use of capital and shelf space, especially when compared to BJC's more successful brands. The company’s strategy involves a continuous review of its brand portfolio to identify and manage such underperformers.

The challenge with these "Dog" products lies in their inability to generate significant cash flow or market growth. They may only break even or even incur losses, necessitating careful consideration for divestment or revitalization efforts. BJC's commitment to innovation and market leadership means that such legacy products are consistently evaluated against newer, more promising offerings.

In 2024, the consumer goods landscape continued to favor agility and innovation, making it crucial for companies like BJC to prune less effective product lines. Identifying and addressing these "Dogs" is key to optimizing resource allocation and focusing on areas with higher growth potential.

Question Marks

Berli Jucker's (BJC) Big C Mini stores and Pure Pharmacy formats are positioned as potential Stars in its BCG matrix. BJC plans to open 200 new Big C Mini stores and 9 Pure Pharmacy stores in 2025, reflecting significant investment in these growing sectors within Thailand.

While these smaller formats operate in expanding convenience and healthcare retail markets, their current market share is still nascent compared to dominant players. The substantial capital allocation aims to cultivate these ventures into future market leaders, driving growth and profitability for BJC.

Berli Jucker's (BJC) expansion into Hong Kong and Cambodia with 24 Big C stores and 3 Big Mini stores respectively in 2025 positions these ventures as potential Stars in the BCG matrix. These new market entries, while starting with low initial market share, are targeting potentially high-growth retail landscapes in Southeast Asia.

Significant investment will be necessary to build brand recognition and capture market share in these new territories. This strategic move, requiring substantial capital outlay for market penetration, aligns with the characteristics of Stars, which demand investment to maintain their growth trajectory.

Berli Jucker (BJC) has strategically entered the burgeoning beauty and wellness sector in Thailand, a market experiencing robust growth fueled by rising health awareness and a demographic shift towards an older population. This move positions BJC within a high-potential industry, aiming to capitalize on evolving consumer preferences.

As a recent entrant, BJC's current market share in beauty and wellness is naturally low. Significant investment in brand building, product innovation, and extensive marketing campaigns will be crucial to gain traction and elevate its position from a Question Mark to a Star within the BCG framework.

Advanced Medical Device Distribution

Advanced medical device distribution within Berli Jucker (BJC) could be positioned as a question mark in the BCG matrix. The Thai medical device market is expected to expand robustly, with a projected compound annual growth rate of 6.48% between 2024 and 2029.

While BJC's broader healthcare segment demonstrates strength, the specific niche of advanced medical devices, possibly involving new distribution agreements, presents a growth opportunity. These ventures demand significant upfront capital for sales, marketing, and specialized technical assistance to gain traction.

- Market Growth: Thailand's medical device market is forecast to grow at 6.48% CAGR from 2024-2029.

- Strategic Focus: Advanced medical devices represent a high-potential, but investment-heavy, sub-segment.

- Investment Needs: Capturing market share requires substantial investment in sales, marketing, and technical support.

Strategic Investment in Modern Logistics Technologies

Strategic investment in modern logistics technologies aligns with the Thailand logistics market's projected 6% CAGR through 2030, fueled by e-commerce expansion and infrastructure upgrades. BJC's supply chain could target high-growth segments like automated warehousing or specialized last-mile delivery solutions.

These advanced logistics areas, while offering significant future potential, may represent new ventures for BJC, potentially starting with a lower initial market share. This necessitates substantial capital commitment to achieve scalability and competitive positioning.

- Market Growth: Thailand's logistics market is expanding rapidly, with an expected compound annual growth rate exceeding 6% until 2030.

- Investment Focus: BJC should consider investing in cutting-edge logistics technologies such as automation, advanced warehousing, and innovative last-mile delivery.

- Potential Challenges: These technology-driven logistics sectors might initially have a low market share for BJC, requiring considerable investment to grow.

- Strategic Allocation: Such investments would likely place these ventures in the 'Question Marks' category of the BCG matrix, demanding careful resource allocation for future growth.

Berli Jucker's (BJC) ventures into advanced medical device distribution and modern logistics technologies are likely candidates for the Question Mark quadrant in the BCG matrix.

These areas represent high-growth opportunities, with Thailand's medical device market expected to grow at 6.48% CAGR until 2029 and the logistics market projected at over 6% CAGR through 2030. However, BJC's presence in these specific sub-segments may be nascent, requiring significant upfront investment in sales, marketing, and technology to build market share.

The substantial capital allocation needed to establish a strong foothold in these sectors, coupled with their current low market share, places them firmly in the Question Mark category, demanding careful strategic consideration for future development.

| Business Unit | Market Growth | BJC Market Share | Investment Need | BCG Quadrant |

|---|---|---|---|---|

| Advanced Medical Devices | High (6.48% CAGR 2024-2029) | Low (Nascent) | High | Question Mark |

| Modern Logistics Technologies | High (>6% CAGR through 2030) | Low (New Ventures) | High | Question Mark |

BCG Matrix Data Sources

Our Berli Jucker BCG Matrix is built on a robust foundation of financial disclosures, market share data, and industry growth forecasts, ensuring accurate strategic insights.