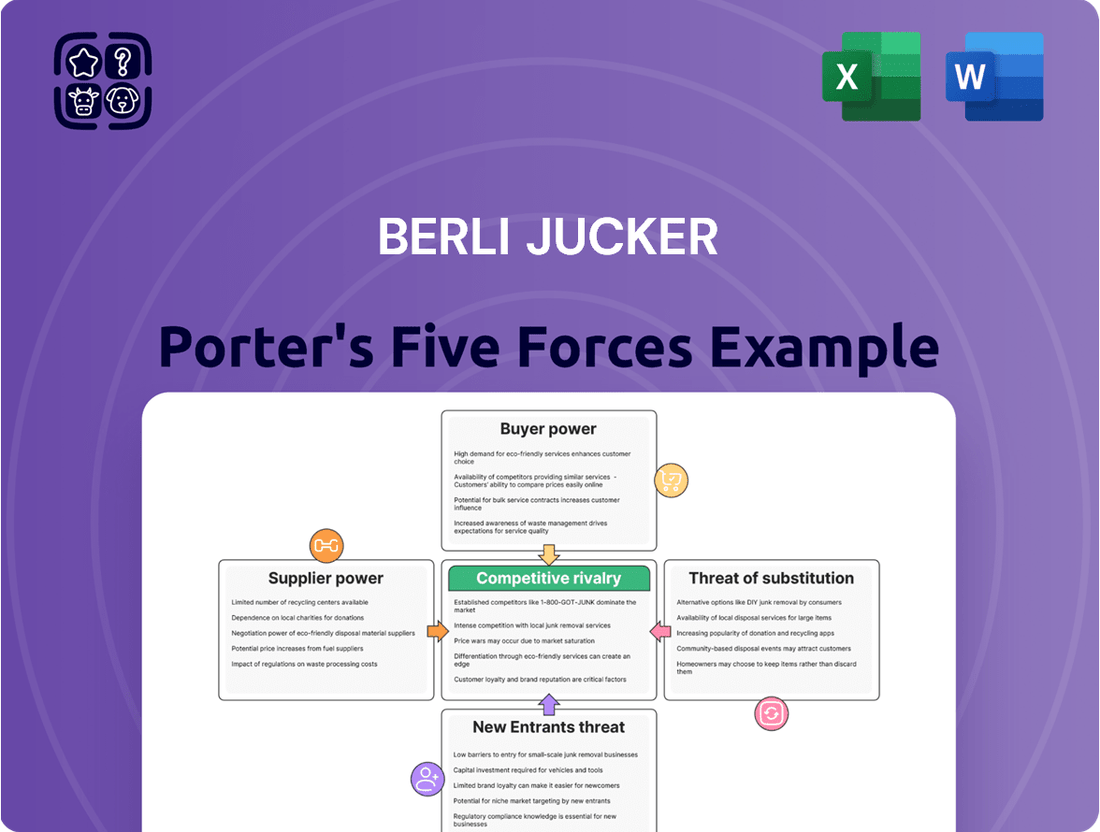

Berli Jucker Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Berli Jucker Bundle

Berli Jucker operates within a dynamic market, facing moderate buyer power due to product differentiation and brand loyalty, while supplier power is somewhat limited by a diverse supplier base. The threat of new entrants is present but mitigated by capital requirements and established distribution networks.

The complete report reveals the real forces shaping Berli Jucker’s industry—from the intensity of rivalry to the threat of substitutes. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Berli Jucker's (BJC) diverse operations, spanning consumer goods, packaging, healthcare, and retail, mean supplier power varies greatly by segment. For instance, in its packaging division, if only a handful of companies supply specialized resins or films, those suppliers gain significant leverage. This concentration is a key factor; in 2024, global supply chain disruptions highlighted how reliance on a few specialized input providers can amplify supplier bargaining power, potentially impacting BJC's cost of goods sold.

The cost and complexity BJC faces when changing suppliers directly impact how much power those suppliers hold. For example, in their consumer products and packaging manufacturing, finding new sources for specialized materials or machinery could mean substantial expenses for retooling equipment, recalibrating quality checks, or obtaining new industry certifications. This complexity naturally strengthens the supplier’s position.

Suppliers might integrate forward into Berli Jucker's (BJC) operations, for instance, a key ingredient provider could begin manufacturing finished consumer goods. This would directly challenge BJC by introducing new competition from entities that previously supplied them. In 2024, the consumer goods sector saw increased M&A activity, suggesting a willingness for companies to expand their value chain.

Importance of Supplier's Input to BJC's Cost/Quality

The bargaining power of suppliers significantly influences Berli Jucker Company's (BJC) cost structure and product quality. When a supplier's input is critical for BJC's final product, especially if there are few alternative suppliers, that supplier gains considerable leverage. For example, if a unique ingredient is essential for the premium quality of BJC's consumer goods or the efficacy of its healthcare products, and this ingredient is difficult to source elsewhere, the supplier's power increases.

BJC actively works to mitigate this by managing its raw material costs. A key example is their focus on soda ash, a vital component in glass packaging. By strategically managing the procurement of such materials, BJC seeks to ensure cost stability and maintain the quality standards that consumers expect.

- Criticality of Inputs: The more essential a supplier's product or service is to BJC's production process or final product quality, the greater the supplier's bargaining power.

- Availability of Alternatives: If BJC has limited options for sourcing a particular component or raw material, suppliers of that item gain more power.

- BJC's Cost Management Focus: BJC's efforts to control raw material expenses, such as for soda ash used in packaging, directly address supplier power by seeking stable pricing.

- Impact on Profitability: High supplier power can lead to increased input costs, potentially squeezing BJC's profit margins if these costs cannot be passed on to consumers.

Availability of Substitute Inputs

The availability of substitute raw materials or components significantly diminishes supplier power. When Berli Jucker (BJC) can readily source alternative inputs, it lessens its reliance on any single supplier, thereby strengthening its negotiating position.

BJC's strategic focus on diversifying its sourcing, including partnerships with local small and medium-sized enterprises (SMEs), directly addresses this factor. This approach not only reduces dependency on a narrow supplier base but also provides flexibility in the face of fluctuating prices and potential supply disruptions.

- Reduced Dependency: By identifying and cultivating relationships with multiple suppliers, BJC mitigates the risk of being held hostage by the pricing or supply decisions of a single entity.

- Cost Mitigation: Access to substitute inputs allows BJC to switch to more cost-effective options when existing suppliers increase their prices, directly impacting profitability. For instance, if a key packaging material supplier raises prices by 5% in 2024, BJC’s ability to find a comparable substitute at a 2% increase would save significant costs.

- Supply Chain Resilience: Diversified sourcing enhances BJC's overall supply chain resilience, ensuring operational continuity even if one supplier faces production issues or goes out of business.

The bargaining power of suppliers for Berli Jucker (BJC) is a critical factor influencing its operational costs and profitability. When BJC relies on specialized inputs with few alternatives, suppliers gain significant leverage. For example, in 2024, disruptions in global supply chains underscored the impact of supplier concentration, particularly for specialized resins in the packaging sector, potentially increasing BJC's cost of goods sold.

The difficulty and expense BJC faces in switching suppliers, such as retooling equipment or obtaining new certifications for specialized packaging materials, directly amplify supplier power. Furthermore, if suppliers integrate forward into BJC's value chain, such as a key ingredient provider entering the finished consumer goods market, it introduces direct competition, a trend observed with increased M&A in the consumer goods sector in 2024.

| Factor | Impact on BJC | Example Scenario (2024) |

| Criticality of Inputs | Higher power for suppliers of essential components | Unique ingredient for premium consumer goods or healthcare products |

| Availability of Alternatives | Lower power for suppliers with many substitutes | BJC diversifying sourcing to local SMEs to reduce dependency |

| Switching Costs | Higher power for suppliers with high BJC switching costs | Significant expenses for retooling machinery for new packaging materials |

| Supplier Integration | Increased competition from suppliers | Ingredient supplier entering finished consumer goods market |

What is included in the product

This analysis delves into the competitive intensity, buyer and supplier power, threat of new entrants, and substitute products impacting Berli Jucker's market position.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Berli Jucker's market landscape.

Customers Bargaining Power

Berli Jucker's (BJC) customer base displays a spectrum of price sensitivity. In its prominent modern retail arm, Big C Supercenters, consumers often prioritize value, particularly for everyday necessities, making them quite responsive to price changes. This is a critical factor for BJC's consumer goods segment.

However, BJC also serves business clients in sectors like packaging and healthcare, where price sensitivity can be influenced by factors beyond just the unit cost, such as product quality, reliability, and long-term supply agreements. For instance, in 2023, Big C's revenue reached approximately THB 145 billion, underscoring the significant volume of transactions where price plays a key role in consumer purchasing decisions.

The bargaining power of customers is a key factor in Berli Jucker's (BJC) operating environment. This power is largely shaped by buyer concentration and the volume of their purchases. For instance, in BJC's business-to-business segments like healthcare or supply chain solutions, large institutional clients can exert considerable influence due to the sheer volume of their orders, potentially negotiating more favorable terms.

Conversely, BJC's retail operations, exemplified by its Big C supermarket chain, cater to a broad and dispersed consumer base. This wide distribution of individual customers generally dilutes the bargaining power of any single buyer, as their individual purchase volumes are relatively small compared to the overall sales of the business. In 2024, Big C continued to serve millions of customers across Thailand, underscoring the fragmented nature of its retail buyer base.

The bargaining power of customers for Berli Jucker is significantly influenced by the wide availability of substitute products and retailers in Thailand. Consumers can readily shift their spending to numerous supermarkets, hypermarkets, convenience stores, and burgeoning e-commerce platforms, all vying for market share. This abundance of choice means customers can easily compare prices and offerings, putting pressure on Berli Jucker to remain competitive.

In 2024, Thailand's retail sector saw continued growth in online sales, with e-commerce penetration reaching approximately 15% of total retail sales, according to various industry reports. This digital shift further amplifies customer bargaining power, as online channels often facilitate easier price comparisons and access to a broader range of products, including those offered by Berli Jucker's competitors.

Buyer Information and Transparency

Increased transparency, fueled by digital platforms and price comparison tools, significantly boosts customer bargaining power. This readily available information allows buyers to make more informed purchasing decisions, putting pressure on retailers to offer competitive pricing and compelling value propositions. For Berli Jucker (BJC), particularly its modern retail segment like Big C, this trend necessitates constant adaptation of pricing and promotional strategies to maintain market relevance and customer loyalty.

In 2024, the digital landscape continued to empower consumers. For instance, online marketplaces and review sites provide extensive product information and price comparisons, directly influencing purchasing behavior. Big C, as a major player in Thailand's retail sector, must therefore remain agile, leveraging data analytics to understand consumer price sensitivity and tailor promotions effectively. This proactive approach is crucial for navigating an increasingly transparent and competitive market environment.

The bargaining power of customers is amplified by:

- Widespread access to price comparison websites and apps.

- Availability of detailed product reviews and ratings from other consumers.

- Increased ease of switching between retailers due to online convenience.

- Greater brand awareness and knowledge of product alternatives.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Berli Jucker (BJC) is generally low across its diverse operations. While large corporate clients in sectors like packaging or healthcare might possess the resources to produce their own raw materials or components, thereby reducing their dependence on BJC, this is not a widespread concern for the majority of their customer base.

For instance, in the consumer goods sector, individual consumers obviously cannot backward integrate. Even for BJC's business-to-business clients, the capital investment and expertise required for backward integration are often prohibitive, especially given BJC's established scale and efficiency in supplying various inputs. BJC's 2024 performance, showing robust revenue growth across its segments, indicates that customers continue to find value in BJC's offerings rather than pursuing self-sufficiency.

- Low Threat: Large business customers in BJC's packaging or healthcare segments could theoretically integrate backward, but this is uncommon due to high costs and complexity.

- Minimal Impact: For the vast majority of BJC's diverse customer base, the ability or inclination to backward integrate is negligible.

- BJC's Strengths: BJC's scale, efficiency, and established supply chains make it difficult for most customers to profitably produce their own inputs.

- Market Validation: BJC's continued revenue growth in 2024 suggests customers are not actively seeking to replace BJC's products with their own production.

Berli Jucker's (BJC) customers exhibit varying degrees of bargaining power, influenced by their concentration and purchase volume. Large institutional clients in BJC's B2B segments, like healthcare or packaging, can negotiate favorable terms due to significant order sizes. In contrast, BJC's retail arm, Big C, serves a highly fragmented customer base, where individual buyer power is diluted by small transaction volumes. In 2024, Big C continued to serve millions of customers across Thailand, highlighting this dispersed buyer landscape.

The availability of substitutes and ease of switching retailers significantly amplifies customer bargaining power for BJC. With numerous supermarkets, hypermarkets, and e-commerce platforms readily accessible in Thailand, consumers can easily compare prices and offerings. This competitive environment necessitates that BJC maintains aggressive pricing and promotional strategies to retain market share and customer loyalty.

Digitalization further empowers BJC's customers, with widespread access to price comparison tools and product reviews. This increased transparency allows buyers to make more informed decisions, pressuring retailers to offer competitive pricing. In 2024, e-commerce penetration in Thailand reached approximately 15% of total retail sales, a trend that intensifies customer bargaining power by facilitating easier price comparisons and broader product access.

The threat of backward integration by BJC's customers is generally low. While some large corporate clients in specialized sectors might possess the resources for self-production, the substantial capital investment and expertise required make this an uncommon strategy. BJC's continued revenue growth in 2024, demonstrating strong performance across its diverse segments, indicates that customers find continued value in BJC's offerings.

Preview the Actual Deliverable

Berli Jucker Porter's Five Forces Analysis

This preview showcases the complete Berli Jucker Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately upon purchase. This ensures transparency and that you gain full access to this comprehensive strategic tool without any alterations or missing sections.

Rivalry Among Competitors

Berli Jucker faces significant competitive rivalry across its core business segments in Thailand and Southeast Asia, notably in modern retail, consumer products, and packaging.

The Thai modern retail landscape is particularly fierce, with established giants like Central Group and The Mall Group wielding substantial market share and brand loyalty. In 2024, the retail sector in Thailand continues to see aggressive expansion and promotional activities from these key players, impacting Berli Jucker's market penetration and pricing power.

Furthermore, the burgeoning e-commerce sector, with platforms like Shopee and Lazada, introduces an additional layer of competition, forcing traditional retailers like Berli Jucker to adapt their strategies and invest in omnichannel capabilities to remain relevant and capture evolving consumer preferences.

The Thai retail market is experiencing robust growth, with projections indicating continued expansion driven by rising e-commerce adoption and a rebound in tourism. For instance, the Thai e-commerce market alone was valued at approximately USD 21.7 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 12.5% through 2028, according to Statista. This overall market expansion, however, doesn't automatically translate to uniform success for every player.

Despite the favorable industry growth, intense competition within the Thai retail landscape can temper individual company growth rates. Berli Jucker (BJC) is actively pursuing strategies to capitalize on this market expansion, including the aggressive rollout of its Big C Mini convenience store format and ongoing renovations of its larger Big C hypermarket and supermarket outlets. These initiatives aim to secure a larger share of the growing consumer spending.

In the fast-moving consumer goods and retail sectors, truly setting products apart can be a tough game, often pushing companies into competing primarily on price. Berli Jucker Public Company Limited (BJC) tries to stand out with its broad range of products, including its own brands and fresh food selections at its Big C supermarkets. However, because it's generally easy for customers to switch between brands or retailers without much hassle or expense, the competition remains quite intense.

Exit Barriers

High exit barriers significantly influence competitive rivalry within industries. When companies have substantial investments in fixed assets, like manufacturing plants or extensive retail store networks, they face considerable difficulty and cost in leaving the market. This reluctance to exit can intensify competition as firms are compelled to remain and fight for market share, even in less favorable conditions. For Berli Jucker (BJC), its vast infrastructure, spanning diverse segments from consumer goods manufacturing to retail operations, represents significant sunk costs. This deep investment makes exiting certain business lines or the market itself a financially daunting prospect, thereby contributing to sustained, and at times heightened, competitive pressures.

- BJC's extensive fixed assets in manufacturing and its broad retail presence act as major exit barriers.

- These substantial sunk costs discourage companies from leaving the market, thereby sustaining intense rivalry.

- In 2023, BJC reported total assets of approximately THB 175 billion, illustrating the scale of its infrastructure.

Strategic Commitments of Competitors

Competitors in Thailand's retail and consumer goods landscape are demonstrating substantial strategic commitments. These often involve significant capital allocation towards digital transformation initiatives, aiming to enhance online presence and customer engagement. Many are also aggressively pursuing omnichannel strategies, seamlessly integrating physical and digital sales channels. For instance, data from 2024 indicates that major players have increased their IT spending by an average of 15% year-over-year to bolster these capabilities.

These industry-wide commitments create a challenging environment for Berli Jucker (BJC). BJC's own strategic directives, such as planned store expansions and a heightened emphasis on categories like fresh food, are direct reactions to this intense competitive pressure. The company's 2024 financial reports highlight a 10% increase in capital expenditure dedicated to store modernization and supply chain improvements, reflecting the need to keep pace with rivals.

- Digital Transformation Investments: Competitors are channeling resources into e-commerce platforms, mobile apps, and data analytics to better understand and serve customers.

- Omnichannel Integration: A key focus is on providing a consistent brand experience across online stores, physical retail locations, and social commerce channels.

- New Store Formats: Retailers are experimenting with smaller, more localized stores and specialized formats to cater to evolving consumer preferences and urban density.

- BJC's Response: BJC's strategy of expanding its Big C supermarket chain and strengthening its fresh food offerings directly addresses the need to compete on convenience, variety, and value in a rapidly changing market.

Berli Jucker (BJC) operates in a highly competitive environment, particularly within Thailand's modern retail and consumer goods sectors. Established players like Central Group and The Mall Group exert significant influence, driving aggressive expansion and promotional activities that impact BJC's market share and pricing flexibility. The rapid growth of e-commerce, exemplified by platforms like Shopee and Lazada, further intensifies this rivalry, compelling BJC to invest in omnichannel strategies to remain competitive.

The Thai retail market's projected growth, with the e-commerce segment alone valued at approximately USD 21.7 billion in 2023 and expected to grow at a CAGR of 12.5% through 2028, presents opportunities. However, this expansion is matched by intense competition, necessitating strategic responses from BJC, such as the expansion of its Big C Mini convenience stores and store renovations. The ease with which consumers can switch brands and retailers means competition often centers on price, making differentiation through product range and value crucial for BJC.

| Competitor | Market Segment | 2024 Strategic Focus |

|---|---|---|

| Central Group | Modern Retail, Department Stores, Food | Aggressive expansion, Digital integration, Loyalty programs |

| The Mall Group | Department Stores, Malls, Food | Premiumization, Experiential retail, E-commerce development |

| Shopee/Lazada | E-commerce | User acquisition, Logistics improvement, Diverse product offerings |

| Local Convenience Stores | Convenience Retail | Store network expansion, Private label development, Localized assortments |

SSubstitutes Threaten

The threat of substitutes for Berli Jucker (BJC) is quite varied across its different business segments. In the consumer goods sector, customers have a wide array of choices, from established competitor brands to more affordable generic options, significantly impacting BJC's pricing power and market share in these areas.

For BJC's packaging division, the threat from substitutes is particularly notable. While BJC offers glass and aluminum packaging, alternatives like flexible packaging, which is experiencing robust growth in Southeast Asia, present a significant challenge. For example, the flexible packaging market in Southeast Asia was valued at approximately USD 3.5 billion in 2023 and is projected to see a compound annual growth rate of over 5% through 2028, driven by demand for convenience and sustainability.

Customers and businesses constantly weigh the benefits against the costs when looking at alternative products or services. For example, while sustainable packaging solutions are becoming more popular, their higher initial cost compared to conventional plastics can be a significant hurdle for many companies, impacting their purchasing decisions.

In 2024, the global market for sustainable packaging materials, while growing, still faces this price-performance challenge. Reports indicate that while consumer demand for eco-friendly options is up, the actual adoption rate is often tied to whether the cost premium is justifiable by perceived performance benefits or regulatory pressures. For instance, some biodegradable plastics can cost 10-30% more than traditional polyethylene, a factor Berli Jucker must consider.

Buyer propensity to substitute is a key factor in the threat of substitutes. This willingness to switch is shaped by how easy it is to find alternatives, how attached customers are to existing brands, and how aware they are of other options. For instance, in 2024, the increasing digital literacy and widespread internet access mean consumers are more readily exposed to and can easily compare substitute products and services.

In the retail landscape, the surge in e-commerce and direct-to-consumer (DTC) channels presents highly convenient substitutes for traditional brick-and-mortar retail. This shift means buyers can often find comparable or even better products online with just a few clicks, bypassing the need to visit physical stores. For example, online marketplaces offering a vast array of goods directly from manufacturers or specialized sellers provide a compelling alternative to established retail chains.

Technological Advancements in Substitutes

Technological advancements are significantly boosting the appeal of substitute products for Berli Jucker. For instance, innovations in biodegradable and compostable packaging materials are making them more competitive against conventional plastics and paper, directly impacting BJC’s core packaging business.

These advancements not only improve the performance of substitutes but also often reduce their cost, making them a more viable alternative for consumers and businesses alike. For example, the development of advanced recycling technologies for plastics can lower the effective cost of using recycled content, thus strengthening the competitive position of plastic packaging substitutes.

- Eco-friendly packaging materials: Innovations in plant-based plastics and recycled content are making alternatives more cost-effective and performance-comparable.

- Digitalization in supply chains: Technologies enabling direct-to-consumer models or reduced packaging needs are emerging.

- E-commerce packaging solutions: Lightweight, durable, and customizable packaging designed specifically for online retail are gaining traction, potentially displacing traditional bulk packaging.

Regulatory and Social Pressures Favoring Substitutes

Increasing regulatory and social pressures are significantly influencing the threat of substitutes for Berli Jucker (BJC). For instance, in 2024, many regions saw heightened scrutiny on single-use plastics, pushing consumers and businesses towards reusable or biodegradable alternatives. This trend directly impacts BJC's packaging divisions and consumer goods, where eco-friendly options are gaining traction.

BJC's strategic response, including its investments in sustainability initiatives, is a direct acknowledgment of these evolving market dynamics. The company's commitment to reducing its environmental footprint, evident in its 2024 sustainability reports, aims to mitigate the impact of these substitute threats by offering consumers more responsible choices within its product portfolio.

- Growing Demand for Sustainable Packaging: Consumers increasingly prefer products with minimal environmental impact, driving demand for compostable or recyclable packaging.

- Government Regulations: Policies like plastic bans or extended producer responsibility schemes in key markets directly favor alternative materials.

- Consumer Awareness: Heightened public awareness regarding environmental issues encourages a shift towards brands perceived as more sustainable.

- Technological Advancements: Innovations in material science are making eco-friendly substitutes more viable and cost-competitive.

The threat of substitutes for Berli Jucker (BJC) is significant, particularly in its packaging and consumer goods segments. For instance, the rise of flexible packaging, projected to grow at over 5% annually in Southeast Asia through 2028, directly challenges BJC's traditional glass and aluminum offerings. Furthermore, the increasing consumer preference for sustainable options, driven by regulatory pressures and heightened awareness, pushes demand towards biodegradable and compostable materials, which can have a cost premium of 10-30% over conventional plastics in 2024.

| Segment | Key Substitutes | Market Trend/Data (2024) | Impact on BJC |

|---|---|---|---|

| Packaging | Flexible packaging, biodegradable plastics, recycled content | Southeast Asia flexible packaging market valued at ~USD 3.5 billion in 2023, growing over 5% annually. Biodegradable plastics can cost 10-30% more. | Pressure on pricing and market share for traditional packaging. Need to innovate in sustainable materials. |

| Consumer Goods | Private label brands, competitor brands, direct-to-consumer (DTC) channels | E-commerce growth provides easy access to a wide array of comparable products. | Reduced brand loyalty and pricing power. Increased competition from online retailers. |

Entrants Threaten

The capital needed to enter Berli Jucker's (BJC) various markets differs greatly. For instance, setting up a large retail operation akin to Big C demands a massive upfront investment. This includes securing prime real estate, building modern stores, stocking vast amounts of inventory, and establishing efficient supply chains.

Similarly, manufacturing plants for packaging materials, a key area for BJC, also require significant initial capital outlay. These investments in machinery, technology, and infrastructure act as substantial hurdles for potential new competitors looking to enter these sectors.

In 2024, the average cost to establish a new supermarket in Thailand could range from tens of millions to over a hundred million US dollars, depending on size and location, illustrating the scale of capital commitment.

Berli Jucker Public Company Limited (BJC) benefits significantly from economies of scale across its diverse operations, including manufacturing, distribution, and retail. In 2024, BJC's substantial production volumes allow for lower per-unit costs, a formidable barrier for any new competitor seeking to enter the market. This scale extends to its vast distribution network, encompassing numerous large-scale distribution centers, which translate into significant logistical efficiencies and cost savings that are challenging for newcomers to match in the short term.

New companies often struggle to get their products onto store shelves or into the hands of consumers. This is particularly true in markets like consumer goods and modern retail where shelf space and established logistics are crucial. For instance, in 2024, securing prime placement in major supermarket chains can involve significant slotting fees and marketing commitments, making it tough for newcomers.

Berli Jucker, or BJC, has a distinct advantage here. Their extensive Big C Supercenter network acts as a powerful internal distribution channel, allowing them to bypass many of the barriers new entrants face. This existing infrastructure, built over years, provides a significant competitive moat.

Brand Identity and Customer Loyalty

Berli Jucker Public Company Limited (BJC), especially with its prominent Big C Supercenter brand, has cultivated a deeply entrenched brand identity and significant customer loyalty within Thailand's retail sector. This strong connection makes it challenging for new players to gain traction.

New entrants face the considerable hurdle of investing heavily in marketing and promotional activities to even begin matching BJC's established brand recognition and customer base. For instance, in 2023, the Thai retail market continued to see intense competition, with established players like Big C leveraging their brand equity to maintain market share.

- Brand Equity: Big C's long-standing presence and consistent service have fostered trust and preference among Thai consumers, a difficult asset for newcomers to replicate.

- Customer Loyalty Programs: BJC's loyalty programs, such as those offered at Big C, incentivize repeat purchases and create a barrier to switching for existing customers.

- Marketing Investment: A new entrant would likely need to allocate a substantial portion of its initial capital to marketing campaigns to build awareness and persuade consumers to try their offerings.

- Perceived Value: Beyond just price, Big C's brand is associated with quality, variety, and a positive shopping experience, elements that are hard to convey and prove quickly to new customers.

Government Policy and Regulations

Government policies and regulations significantly influence the threat of new entrants in Thailand's retail sector, where Berli Jucker operates. While Thailand has policies aimed at encouraging foreign investment, these are often balanced by intricate regulatory frameworks that can act as substantial barriers. For instance, licensing requirements, import duties, and adherence to local product standards can increase the initial cost and complexity for potential new competitors, thereby limiting new market entry.

Navigating these regulatory landscapes requires significant investment in legal counsel and compliance, which can be prohibitive for smaller or less experienced players. In 2024, the Thai government continued to emphasize consumer protection and fair trade practices, which translates into stricter oversight of retail operations. This means any new entrant must demonstrate robust compliance with these evolving standards, adding another layer of difficulty.

- Licensing Hurdles: Obtaining necessary retail licenses in Thailand can be a lengthy and complex process, involving multiple government agencies.

- Import Regulations: Tariffs and specific import regulations on goods, especially for foreign-owned retail businesses, can impact cost structures and product availability.

- Compliance Costs: Adhering to Thai labor laws, food safety standards (for grocery retail), and environmental regulations adds to the operational expenses for new entrants.

- Foreign Ownership Limits: While foreign investment is permitted, certain retail sub-sectors may still have restrictions on foreign ownership percentages, requiring joint ventures or specific partnership structures.

The threat of new entrants for Berli Jucker (BJC) is generally moderate to low across its key business segments. High capital requirements for retail and manufacturing operations, coupled with BJC's strong brand equity and established distribution networks, create significant barriers to entry. Government regulations and compliance costs further deter potential new competitors.

In 2024, the substantial investment required to establish a large retail footprint, potentially exceeding $100 million USD for a supermarket, alongside the need for extensive marketing to match BJC's brand recognition, presents a formidable challenge for newcomers. These factors collectively limit the ease with which new players can effectively challenge BJC's market position.

| Barrier to Entry | Impact on New Entrants | BJC's Advantage |

|---|---|---|

| Capital Requirements | High initial investment for retail and manufacturing. | Economies of scale in production and distribution. |

| Brand Equity & Loyalty | Difficult to build comparable brand recognition and trust. | Long-standing presence and customer loyalty programs. |

| Distribution & Shelf Space | Securing prime retail placement and logistics is costly. | Extensive Big C network acts as an internal distribution channel. |

| Regulatory Environment | Complex licensing, compliance, and potential ownership limits. | Established expertise in navigating Thai regulations. |

Porter's Five Forces Analysis Data Sources

Our Berli Jucker Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Berli Jucker's annual reports, investor presentations, and public financial filings. We also incorporate insights from reputable industry research reports, market intelligence platforms, and news archives to provide a thorough understanding of the competitive landscape.