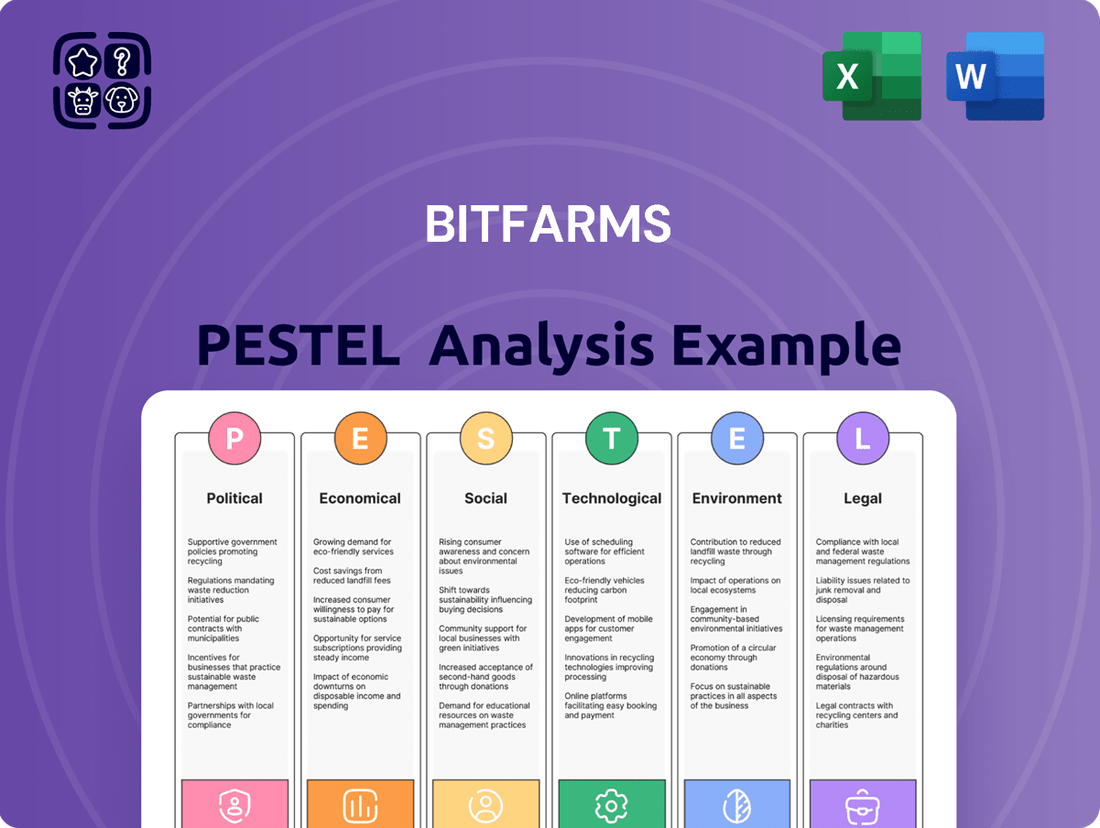

Bitfarms PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bitfarms Bundle

Navigate the complex external forces impacting Bitfarms with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future. Gain a strategic advantage by leveraging these crucial insights. Download the full PESTLE analysis now to unlock actionable intelligence and make informed decisions.

Political factors

Governments globally are intensifying their focus on cryptocurrency mining, with potential regulations targeting energy usage and environmental impact. For Bitfarms, this means adapting operational strategies to comply with varying national policies. For example, in 2023, some regions explored stricter energy efficiency standards for mining operations, which could necessitate investment in newer, less energy-intensive hardware.

Political decisions on energy policy directly influence Bitfarms' operational costs and stability. For instance, regulations like the proposed Clean Cloud Act in the U.S. could mandate specific energy usage or emission standards for crypto miners, potentially increasing expenses or limiting operations. In 2024, discussions around energy grid stability and the role of cryptocurrency mining in demand response programs are ongoing in several jurisdictions where Bitfarms operates.

Global trade relations and the imposition of tariffs on imported mining hardware can significantly affect Bitfarms' capital expenditures and equipment acquisition costs. For example, the U.S. proposed tariffs on imported mining equipment, which could increase operational costs and impact profitability.

Geopolitical stability in operating regions

Bitfarms' operational footprint spans diverse geopolitical landscapes, with data centers strategically located in Canada, the United States, Paraguay, and Argentina. The political stability within these regions is a critical determinant of the company's investment security and operational fluidity. For instance, during 2024, while Canada and the U.S. generally maintained stable political environments conducive to business, certain South American nations experienced shifts in economic policy and regulatory frameworks impacting the digital asset sector.

The regulatory clarity and the specific government stance on cryptocurrency in each operating jurisdiction directly affect Bitfarms' ability to conduct business smoothly. For example, varying approaches to energy consumption for mining operations, taxation of digital assets, and licensing requirements can create operational challenges or opportunities.

- Canada: Generally stable political climate with clear, albeit evolving, regulations for digital asset activities.

- United States: A patchwork of federal and state regulations, with ongoing discussions and potential for new legislation impacting mining operations.

- Paraguay: While offering competitive energy prices, the regulatory environment for cryptocurrency mining is still developing, presenting both opportunities and potential uncertainties.

- Argentina: Navigating a more volatile economic and political landscape, which can influence regulatory consistency and the ease of capital repatriation for foreign investments.

Government incentives for clean energy

Government incentives for clean energy play a crucial role in shaping the operational landscape for companies like Bitfarms. Policies that either encourage or discourage the use of renewable energy sources for industrial activities directly impact a company's cost structure and its ability to maintain a competitive edge.

Bitfarms' reliance on hydroelectric power, for instance, positions it favorably in regions with abundant and affordable renewable energy. However, changes in government subsidies or tax credits for renewable energy generation or consumption can significantly alter this advantage. For example, in 2024, many jurisdictions are reviewing or implementing new clean energy tax credits, such as the Inflation Reduction Act in the United States, which offers substantial incentives for renewable energy projects. These incentives could either bolster Bitfarms' existing strategy or create new opportunities for expansion into regions that previously lacked cost-effective clean energy options.

- Government support for renewable energy projects can lower operational costs for Bitcoin miners.

- Policies influencing the cost and availability of hydroelectric power directly affect Bitfarms' competitive advantage.

- Changes in clean energy incentives, like those seen in the 2024 US Inflation Reduction Act, can impact expansion strategies.

- Regulatory frameworks supporting or restricting renewable energy use are critical for Bitfarms' long-term sustainability.

Political stability across Bitfarms' operating regions, including Canada, the U.S., Paraguay, and Argentina, directly impacts its investment security and operational efficiency. While Canada and the U.S. generally offer stable environments, South American nations can present more volatile economic and regulatory shifts, as observed throughout 2024. Varying governmental stances on cryptocurrency, energy consumption, and taxation create a complex compliance landscape.

What is included in the product

Bitfarms's PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on its operations, identifying potential challenges and strategic advantages in the cryptocurrency mining landscape.

A clear, actionable summary of Bitfarms' PESTLE analysis, highlighting key external factors impacting their operations, serves as a pain point reliver by providing focused insights for strategic decision-making and risk mitigation.

Economic factors

Bitcoin's inherent price volatility directly impacts Bitfarms' financial performance, as the company mines and holds Bitcoin. These price swings can cause significant fluctuations in revenue and profitability. For instance, in Q1 2025, Bitfarms reported a net loss of $36 million, partly reflecting the challenging market conditions and the impact of Bitcoin's price on their operations.

Energy costs are a huge part of Bitfarms' expenses, directly impacting how much profit they make from mining. For instance, in Q1 2024, Bitfarms reported an average cost of electricity of $0.04 per kilowatt-hour, a critical figure for their gross margin.

The company actively seeks out regions with lower energy prices, like the PJM market in the US, to keep their operations cost-effective. This strategy is vital as both cryptocurrency mining and the growing AI sector are driving up demand for electricity, putting pressure on prices.

Inflation and rising interest rates present significant headwinds for Bitfarms. For instance, the US Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a target range of 5.25%-5.50% by July 2023, directly increases Bitfarms' cost of capital. This makes it more expensive to borrow money for new mining equipment or facility expansions, potentially slowing growth.

Furthermore, these macroeconomic factors can dampen investor appetite for riskier assets, including cryptocurrencies, which Bitfarms relies on for revenue. A general economic slowdown, often associated with high inflation and interest rates, can lead to reduced consumer spending and, consequently, lower demand for digital assets, impacting Bitcoin prices and Bitfarms' profitability.

Global economic growth and investment trends

The global economic landscape significantly influences investor sentiment towards digital assets and the broader cryptocurrency sector. As of early 2024, projections for global GDP growth hover around 2.7% to 3.2%, a moderate but steady pace that can foster increased risk appetite among investors. This environment, coupled with persistent inflation concerns in various economies, has fueled a renewed interest in Bitcoin and other cryptocurrencies as potential inflation hedges.

This institutional adoption, a key trend in 2024, directly supports businesses involved in crypto mining, such as Bitfarms. The increasing demand for mining hardware and services is a direct consequence of this growing acceptance. For instance, Bitcoin's market capitalization has seen substantial growth, reaching over $1 trillion again in early 2024, underscoring the expanding investor base and the underlying strength of the crypto market, which benefits mining operations.

- Global GDP growth: Forecasts for 2024 generally range between 2.7% and 3.2%, indicating a stable but not booming global economy.

- Institutional Investment: Major financial institutions are increasingly allocating capital to digital assets, with Bitcoin ETFs seeing significant inflows in early 2024.

- Inflationary Pressures: Ongoing inflation concerns in developed economies continue to drive interest in alternative assets like Bitcoin.

- Market Capitalization: Bitcoin's market cap has surpassed $1 trillion in early 2024, reflecting robust investor confidence and market maturity.

Competition within the mining industry

The Bitcoin mining sector is intensely competitive, with companies constantly vying for increased hashrate and operational efficiency. Bitfarms, like its peers, needs to invest in cutting-edge mining hardware and refine its processes to reduce the cost per Bitcoin mined and maintain its market position.

This competitive landscape means that factors like energy costs and hardware obsolescence are critical. For instance, Bitfarms reported in Q1 2024 that its cost of revenue per Bitcoin was $7,730, a figure directly impacted by the efficiency of its mining fleet and electricity prices.

- Hardware Advancement: The rapid development of more powerful and energy-efficient ASICs (Application-Specific Integrated Circuits) necessitates continuous hardware upgrades to stay competitive.

- Energy Cost Management: Access to low-cost, reliable electricity is a primary differentiator, directly affecting the profitability of mining operations.

- Operational Efficiency: Optimizing cooling systems, network connectivity, and facility management are crucial for maximizing uptime and mining output.

- Market Hashrate Growth: The overall Bitcoin network hashrate is a benchmark; miners must increase their own hashrate to maintain their share of block rewards. As of mid-2024, the Bitcoin network hashrate has consistently trended upwards, exceeding 600 EH/s.

Economic factors significantly shape Bitfarms' operational landscape, primarily through Bitcoin's price volatility and the cost of energy. For instance, in Q1 2025, Bitfarms reported a net loss of $36 million, highlighting the direct impact of market conditions on its revenue and profitability.

Energy costs remain a critical expense, with Q1 2024 electricity costs averaging $0.04 per kilowatt-hour, directly influencing gross margins. Bitfarms' strategic sourcing of low-cost energy, such as in the PJM market, is vital amidst rising demand from both crypto mining and AI, which pressures electricity prices.

Macroeconomic conditions, including inflation and interest rates, also pose challenges. The US federal funds rate reaching 5.25%-5.50% by July 2023 increased Bitfarms' cost of capital, potentially slowing expansion. Furthermore, a stable global GDP growth forecast of 2.7%-3.2% for 2024, alongside persistent inflation, has driven renewed investor interest in Bitcoin as an inflation hedge, boosting its market capitalization above $1 trillion in early 2024.

| Economic Factor | Impact on Bitfarms | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Bitcoin Price Volatility | Directly affects revenue and profitability. | Q1 2025 Net Loss: $36 million, partly due to market conditions. |

| Energy Costs | Major operational expense, impacting gross margin. | Q1 2024 Avg. Electricity Cost: $0.04/kWh. Strategic sourcing in low-cost regions (e.g., PJM). |

| Interest Rates & Inflation | Increases cost of capital, may dampen investor risk appetite. | US Federal Funds Rate: 5.25%-5.50% (as of July 2023). |

| Global Economic Growth | Influences investor sentiment and demand for digital assets. | Global GDP Growth Forecast 2024: 2.7%-3.2%. Bitcoin Market Cap: >$1 trillion (early 2024). |

Preview Before You Purchase

Bitfarms PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bitfarms PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed examination of the external forces shaping the cryptocurrency mining industry and Bitfarms' position within it.

The content and structure shown in the preview is the same document you’ll download after payment. This includes in-depth analysis of market trends, regulatory landscapes, and technological advancements relevant to Bitfarms' growth and sustainability.

Sociological factors

Public sentiment regarding cryptocurrencies significantly shapes regulatory approaches and the overall acceptance of Bitcoin mining. Negative perceptions, particularly concerning environmental sustainability and links to illegal activities, can fuel public demand for more stringent regulations. This heightened scrutiny directly impacts the social license for companies like Bitfarms to operate, potentially affecting their ability to secure financing and expand operations.

The increasing focus on Environmental, Social, and Governance (ESG) factors significantly impacts investment decisions. For Bitfarms, a commitment to using 99% renewable energy sources, as reported in early 2024, positions it favorably with ESG-conscious investors, potentially attracting substantial capital. Conversely, any missteps in social responsibility or governance could lead to divestment, impacting the company's valuation and access to funding.

Large-scale Bitcoin mining operations, like those run by Bitfarms, can sometimes create local friction. Concerns often revolve around noise pollution from cooling systems, which can lead to community opposition and even legal challenges. For instance, in some areas, residents have voiced complaints about the constant hum of mining equipment, impacting their quality of life.

Maintaining strong community ties is therefore crucial for Bitfarms to operate without interruption. Positive engagement can mitigate potential conflicts and foster a more cooperative environment. In 2023, Bitfarms reported community engagement initiatives in several of its locations, aiming to address local concerns proactively.

Digital literacy and adoption rates

The increasing global adoption of cryptocurrencies, fueled by a desire for financial inclusion and a hedge against inflation, directly reflects rising digital literacy and a growing acceptance of digital assets. This trend is crucial for companies like Bitfarms, as it underpins the demand and potential stability of Bitcoin, the primary asset they mine. For instance, by early 2024, global crypto ownership was estimated to be over 420 million people, a significant jump from previous years.

This growing digital fluency translates into a larger potential user base and investor pool for cryptocurrencies, which in turn can positively impact the economics of Bitcoin mining. As more individuals and institutions become comfortable with digital transactions and asset management, the network effect of Bitcoin strengthens, potentially leading to increased transaction fees and a more robust market. Reports from 2024 indicated a steady rise in the number of active crypto wallets, suggesting a deepening engagement with the digital asset ecosystem.

Key indicators of this trend include:

- Growing Global Crypto Ownership: Estimated to exceed 420 million individuals by early 2024.

- Increased Digital Asset Acceptance: Driven by financial inclusion and inflation hedging needs.

- Rising Active Wallet Numbers: Indicating deeper engagement with the digital asset ecosystem throughout 2024.

- Enhanced Network Effect: A larger, more digitally literate user base strengthens Bitcoin's underlying value proposition.

Workforce availability and skills

Bitfarms' operations, particularly its industrial-scale Bitcoin mining and High-Performance Computing (HPC) facilities, demand a highly specialized workforce. This includes expertise in areas such as electrical engineering for power management, data center operations for maintaining optimal conditions, and increasingly, AI and machine learning skills to enhance efficiency. The availability of this talent pool in its key operating regions, such as North America and South America, directly influences Bitfarms' capacity for expansion and effective facility management.

In 2024, the global demand for skilled data center professionals is projected to remain robust. For instance, reports from industry analysis firms indicate a persistent shortage in specialized IT infrastructure roles, which can translate to higher recruitment costs and longer lead times for Bitfarms. The company's strategic location choices are therefore critical, needing to align with regions that have a strong existing talent pipeline or robust educational programs in relevant technical fields.

- Skilled Labor Demand: The complexity of managing large-scale mining hardware and associated infrastructure necessitates a workforce proficient in electrical engineering, network administration, and cooling system maintenance.

- AI Integration: As Bitfarms explores HPC applications, the need for professionals with AI and data science backgrounds will grow, impacting talent acquisition strategies.

- Geographic Talent Pools: Bitfarms' ability to scale is directly tied to the availability of skilled labor in its chosen operational geographies, influencing site selection and expansion plans.

Societal attitudes toward digital currencies and their environmental impact are crucial for Bitfarms' public image and regulatory navigation. Growing skepticism about energy consumption, often highlighted in media reports throughout 2024, can pressure governments to enact stricter mining regulations. This public discourse directly affects Bitfarms' social license to operate and its ability to secure favorable financing.

The increasing emphasis on Environmental, Social, and Governance (ESG) principles influences investor confidence and capital allocation. Bitfarms' reported commitment to 99% renewable energy sources in early 2024 positions it well with ESG-focused investors, potentially attracting significant investment. Conversely, any perceived lapses in social responsibility or governance could deter investment, impacting the company's market valuation.

Community relations are vital for operational continuity, as local opposition to mining operations, often due to noise pollution from cooling systems, can lead to disruptions. Bitfarms' proactive community engagement initiatives in 2023 aimed to mitigate such conflicts. The increasing global adoption of cryptocurrencies, with over 420 million owners by early 2024, reflects rising digital literacy and acceptance, underpinning demand for Bitcoin mining services.

Technological factors

The relentless evolution of Application-Specific Integrated Circuits (ASICs) directly impacts mining efficiency and profitability. Bitfarms must continually invest in and deploy the newest ASIC models to stay competitive.

Newer ASIC generations boast substantially higher hashrates and reduced energy consumption. For instance, Bitfarms reported in Q1 2024 that its fleet had an average efficiency of 30.3 J/TH, a testament to the ongoing hardware upgrades.

Developments in blockchain scalability, particularly Layer 2 solutions like the Lightning Network, are significantly increasing Bitcoin's transaction capacity. The Lightning Network, for instance, has seen substantial growth, with its capacity reaching over 5,700 BTC by mid-2024, demonstrating a tangible improvement in transaction throughput and cost reduction.

These advancements, while directly enhancing Bitcoin's usability, indirectly influence the mining sector by potentially altering network demand and transaction fee structures. Increased efficiency could lead to more microtransactions, potentially boosting overall network activity and the revenue streams available to miners like Bitfarms, even if individual transaction fees decrease.

Bitfarms, operating as a significant data center provider, is acutely exposed to evolving cybersecurity threats. These range from cryptojacking, which hijacks computing power for illicit cryptocurrency mining, to more advanced persistent threats targeting its critical infrastructure. Protecting its proprietary systems and ensuring data integrity are paramount for operational continuity and maintaining the trust of its investors.

In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial stakes involved. For Bitfarms, a breach could lead to significant financial losses, reputational damage, and regulatory penalties, underscoring the need for continuous investment in advanced cybersecurity solutions to safeguard its operations and client data.

Infrastructure and data center innovation

Infrastructure and data center innovation is crucial for crypto miners like Bitfarms. Optimizing data center design with advanced cooling systems, such as hydrocooling and liquid-cooled rigs, is key to maintaining energy efficiency and ensuring continuous operation, especially under heavy computational loads. Bitfarms' strategy of developing its own infrastructure allows for the seamless integration of these cutting-edge technologies, directly boosting performance and reducing operational costs.

For instance, in 2024, Bitfarms reported significant improvements in its energy efficiency metrics, partly attributed to these infrastructure upgrades. The company's ongoing investment in proprietary data center solutions, including enhanced cooling, underpins its ability to manage the high energy demands of Bitcoin mining effectively. This focus on innovation in their physical infrastructure is a direct response to the evolving needs of the digital asset mining sector.

- Energy Efficiency: Advanced cooling systems can reduce energy consumption by up to 40% compared to traditional air cooling methods.

- Operational Uptime: Liquid cooling and optimized airflow minimize hardware overheating, leading to increased uptime and reduced maintenance.

- Scalability: Innovative data center designs facilitate easier scaling of mining operations to accommodate growing demand and new hardware deployments.

- Cost Reduction: Lower energy bills and reduced hardware failure rates translate to significant operational cost savings for miners.

Integration of High-Performance Computing (HPC) and AI

Bitfarms is strategically expanding into High-Performance Computing (HPC) and AI data centers, a move that capitalizes on its robust energy infrastructure and U.S. holdings. This technological pivot is designed to unlock new revenue streams and create sustained value well beyond its core Bitcoin mining operations.

This diversification is a significant growth vector, with the global HPC market projected to reach $67.1 billion by 2027, according to some industry forecasts. Bitfarms' existing energy assets, particularly its access to low-cost hydroelectric power, provide a competitive advantage in the power-intensive HPC and AI sectors.

The company's strategic focus includes:

- Developing specialized data centers for AI workloads

- Leveraging existing energy infrastructure for cost-effective operations

- Expanding its U.S. footprint to serve the growing demand for HPC services

- Diversifying revenue streams beyond cryptocurrency mining

The continuous advancement in ASIC technology is critical for Bitfarms' competitiveness, with newer models offering superior hashrates and energy efficiency. By Q1 2024, Bitfarms reported an average fleet efficiency of 30.3 J/TH, reflecting ongoing hardware upgrades.

Innovations in blockchain, such as Layer 2 scaling solutions like the Lightning Network, are enhancing transaction capacity. By mid-2024, the Lightning Network's capacity exceeded 5,700 BTC, improving transaction throughput and potentially impacting mining revenue streams through increased network activity.

Bitfarms faces significant cybersecurity risks, with global cybercrime costs projected to reach $10.5 trillion annually by 2025. Protecting its infrastructure and data is vital to prevent financial losses and reputational damage.

The company's investment in data center infrastructure, including advanced cooling systems, is crucial for operational efficiency and uptime. These upgrades directly support Bitfarms' ability to manage the high energy demands of mining and its expansion into HPC and AI data centers.

Legal factors

Evolving tax regulations on cryptocurrency income and capital gains directly impact Bitfarms' financial obligations and profitability. The increasing scrutiny on digital assets means Bitfarms must remain agile in adapting to varying global tax frameworks.

New rules, such as the requirement for crypto brokers to file 1099 forms for customer sales and gains starting in 2025, signal a more stringent reporting environment. This broader market shift towards greater transparency in crypto transactions will likely influence how Bitfarms manages its own tax liabilities and compliance efforts.

As a publicly traded entity, Bitfarms operates under stringent federal securities laws and financial reporting standards. These regulations dictate how the company must disclose its financial performance and operational activities to investors and regulatory bodies.

The company's current situation includes class action lawsuits alleging issues with internal controls and the classification of cash flows. Such legal challenges can necessitate a restatement of financial statements, potentially affecting investor confidence and market valuation.

The intensifying global focus on Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, while primarily targeting cryptocurrency exchanges, casts a significant shadow over the entire crypto sector, including mining operations like Bitfarms. These measures are designed to bolster transparency and deter illicit financial flows, creating a more scrutinized operational landscape for all participants.

For Bitfarms, this translates into a need to ensure robust compliance frameworks are in place, even if not directly handling customer transactions in the same way an exchange does. Failure to adapt to these evolving regulatory expectations could impact banking relationships and overall market perception, potentially affecting access to capital and operational stability in the 2024-2025 period.

Environmental regulations and reporting

Governments globally are increasingly scrutinizing the environmental impact of cryptocurrency mining. Legislation like the proposed Clean Cloud Act in the U.S. aims to mandate disclosures on energy consumption and carbon emissions for large-scale mining operations. This trend signifies a growing legal landscape where compliance with environmental reporting standards is becoming a critical factor for companies like Bitfarms.

Bitfarms must navigate these evolving regulations, which include potential penalties for non-compliance. For instance, failure to meet reporting requirements could lead to fines or operational restrictions. As of early 2024, the specifics of enforcement and the precise thresholds for reporting under such acts are still being defined, making proactive engagement and robust data management essential.

- Mandatory Disclosure: Legislation is emerging that requires crypto miners to report electricity usage and carbon footprint data.

- Compliance Risk: Non-adherence to environmental regulations can result in significant penalties for mining companies.

- Evolving Landscape: The legal framework surrounding crypto mining's environmental impact is still developing, necessitating continuous monitoring.

- Operational Impact: Future regulations could influence where and how Bitfarms operates its mining facilities.

International legal frameworks for digital assets

The global digital asset sector operates within a patchwork of national regulations rather than unified international laws. This lack of harmonization presents significant hurdles for companies like Bitfarms, which maintain operations across multiple jurisdictions. For instance, the U.S. Securities and Exchange Commission (SEC) has been actively pursuing enforcement actions against crypto firms, while other nations have adopted more permissive stances, creating uneven playing fields.

Bitfarms faces the ongoing challenge of adapting its operations to diverse and sometimes conflicting legal requirements in countries such as Canada, the United States, Paraguay, and Argentina. These differences can impact everything from how digital assets are classified and traded to the specific compliance protocols required for mining operations. For example, Canadian securities regulators have imposed stricter rules on crypto exchanges compared to some of their international counterparts.

- Regulatory Divergence: Disparate legal interpretations of digital assets across nations necessitate constant monitoring and adaptation by global players.

- Compliance Burden: Operating in multiple jurisdictions with varying rules increases the complexity and cost of legal and regulatory compliance for companies like Bitfarms.

- Enforcement Actions: Aggressive enforcement by bodies like the U.S. SEC can create uncertainty and potential liabilities for digital asset businesses.

The legal landscape for cryptocurrency mining is rapidly evolving, with new regulations impacting Bitfarms' operations and financial obligations. For instance, the U.S. is moving towards greater transparency in digital asset transactions, with new reporting requirements for crypto transactions set to take effect in 2025, directly influencing compliance needs.

Bitfarms is also navigating class action lawsuits, with allegations concerning internal controls and cash flow classifications impacting its financial reporting and investor confidence. These legal challenges underscore the importance of robust governance and accurate financial disclosures. Furthermore, increased global focus on Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, while primarily aimed at exchanges, creates a more scrutinized environment for all crypto sector participants, including miners, potentially affecting banking relationships and capital access.

Environmental regulations are also a significant legal factor, with proposed legislation like the Clean Cloud Act in the U.S. mandating disclosures on energy consumption and carbon emissions for large mining operations. Bitfarms must proactively manage its environmental footprint and reporting to avoid penalties, with the specifics of enforcement still being defined in early 2024.

The company operates within a fragmented global regulatory framework, with differing legal interpretations of digital assets across jurisdictions like Canada, the U.S., Paraguay, and Argentina. This regulatory divergence, exemplified by the U.S. SEC's enforcement actions, creates a complex compliance burden and necessitates continuous adaptation to varying legal requirements.

Environmental factors

Bitcoin mining's substantial energy demand and resulting carbon footprint are major environmental considerations for companies like Bitfarms. The industry's electricity consumption is a focal point for regulators and the public alike.

The environmental impact is stark: a single Bitcoin transaction can emit as much carbon as a car driving over 1,600 kilometers. For 2024, the estimated annual electricity consumption of the Bitcoin network was around 130-150 terawatt-hours (TWh), with a significant portion of this energy potentially derived from non-renewable sources, contributing to a substantial carbon footprint.

Bitfarms strategically leverages predominantly hydro-electric power and secures long-term power purchase agreements, underscoring its commitment to sustainable Bitcoin mining operations. This focus on renewable energy infrastructure is central to its environmental strategy and brand identity, aiming to differentiate itself in a sector often scrutinized for its energy consumption.

The rapid pace of technological advancement in specialized mining hardware leads to a significant generation of electronic waste (e-waste). As newer, more efficient machines emerge, older models become obsolete quickly. This presents a substantial environmental challenge for companies like Bitfarms.

Managing and minimizing this e-waste is critical for the Bitcoin mining industry. Responsible disposal and recycling practices are essential to mitigate the environmental impact. Globally, e-waste generation is a growing concern, with estimates suggesting over 50 million metric tons were produced in 2023 alone, a figure projected to rise.

Water usage for cooling systems

Large-scale data centers, like those operated by Bitfarms for Bitcoin mining, consume significant amounts of water, primarily for cooling systems. Hydrocooling, while efficient, can be a notable water user, especially in areas where water resources are already strained.

This environmental factor is increasingly important, particularly in 2024 and 2025, as global awareness of water scarcity grows. Companies are under pressure to demonstrate responsible water management practices.

- Water Intensity: Bitcoin mining operations can be water-intensive, with some estimates suggesting that the energy required to mine Bitcoin can necessitate substantial water usage for cooling.

- Regional Impact: The impact of water usage is magnified in regions experiencing drought or with limited freshwater availability, potentially leading to regulatory scrutiny or operational challenges for miners.

- Technological Solutions: Innovations in cooling technology, such as air cooling or immersion cooling, are being explored to reduce reliance on water-intensive methods, a trend likely to accelerate in the coming years.

Local environmental impact (noise, heat)

Bitcoin mining operations, such as those run by Bitfarms, can significantly impact local environments through noise pollution generated by cooling systems and the dissipation of heat. These localized effects have led to community concerns and regulatory scrutiny.

For instance, in 2023, a lawsuit was filed in Quebec, Canada, against a cryptocurrency mining operation citing excessive noise, highlighting the real-world consequences of these environmental factors. Such issues can result in operational disruptions and increased compliance costs for mining companies.

- Noise Pollution: Large-scale mining farms utilize numerous high-speed fans for cooling, creating a constant hum that can be disruptive to nearby residential areas.

- Heat Dissipation: The significant heat generated by mining hardware requires robust cooling solutions, which can lead to elevated ambient temperatures in the immediate vicinity of the facility.

- Community Relations: Negative environmental impacts can strain relationships with local communities, potentially leading to public opposition and demands for stricter regulations or even facility closures.

The environmental impact of Bitcoin mining, particularly its energy consumption and carbon footprint, remains a critical factor for Bitfarms. The network's estimated 130-150 TWh annual consumption in 2024, with a portion from non-renewables, highlights this challenge. Bitfarms' strategy of utilizing hydroelectric power and securing long-term power agreements directly addresses these concerns, aiming for sustainable operations.

PESTLE Analysis Data Sources

Our Bitfarms PESTLE Analysis is constructed using a comprehensive blend of data from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.