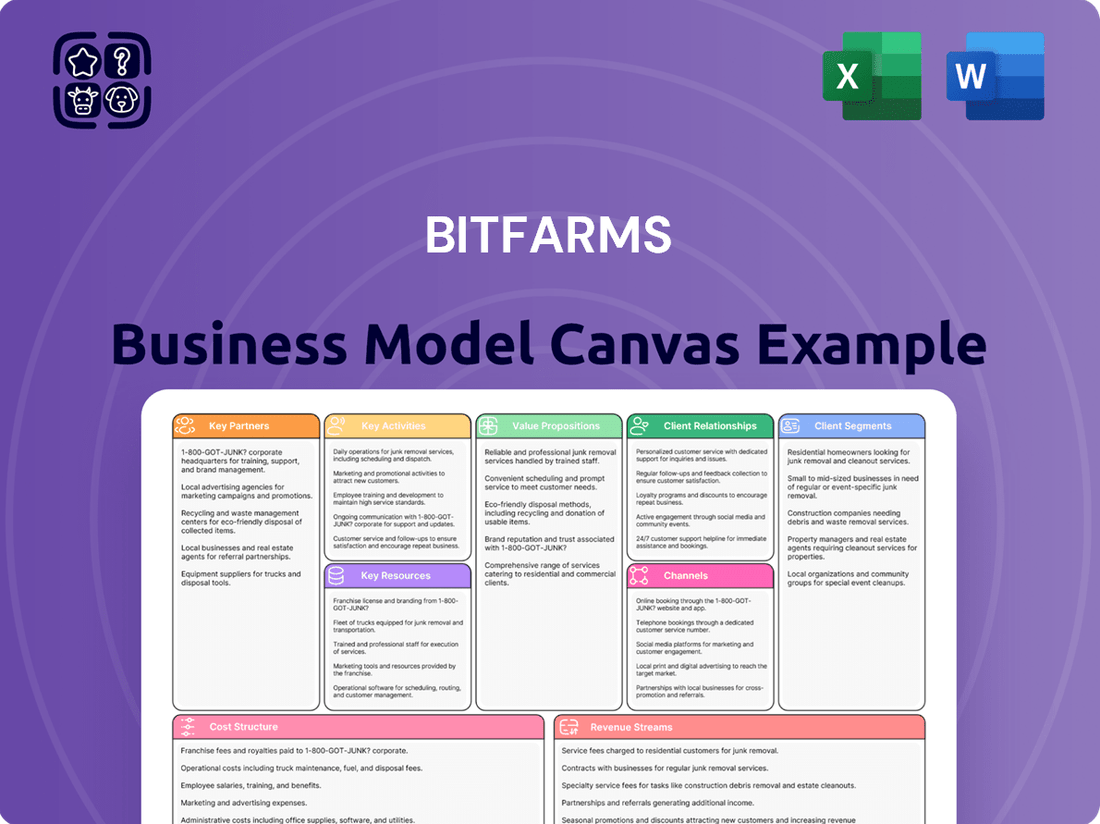

Bitfarms Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bitfarms Bundle

Unlock the full strategic blueprint behind Bitfarms's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Bitfarms prioritizes long-term agreements with energy providers, especially those focused on renewable sources like hydroelectric and solar power. These collaborations are vital for guaranteeing consistent, affordable, and green electricity, a major cost in Bitcoin mining. For instance, in 2023, Bitfarms continued to leverage its strategic energy partnerships, with a significant portion of its energy consumption sourced from hydropower, which generally offers lower and more stable pricing compared to fossil fuels.

Bitfarms' key partnerships with mining hardware manufacturers, such as Bitmain and MicroBT, are crucial for maintaining a competitive edge. These collaborations ensure access to the newest ASIC miners, vital for maximizing hashing power and energy efficiency. For instance, in 2023, Bitfarms continued to deploy next-generation machines, enhancing its operational capabilities.

Bitfarms relies on key partnerships with data center infrastructure providers to construct and operate its large-scale mining farms. These collaborations are essential for securing specialized equipment like high-efficiency cooling systems and robust electrical infrastructure, ensuring optimal performance and reliability. For instance, in 2023, Bitfarms continued to expand its operations, requiring significant investment in these foundational elements.

Financial Institutions and Lenders

Bitfarms' relationships with financial institutions and lenders are foundational for its operational and growth strategies. These partnerships are vital for securing the necessary capital for significant expenditures, such as acquiring mining hardware and funding expansion projects. For instance, in 2024, Bitfarms continued to leverage its banking relationships for various financing needs, including securing credit facilities to support its ongoing capital expenditure programs.

These financial arrangements often take the form of lines of credit, equipment financing, and other debt facilities. A robust relationship with lenders provides Bitfarms with the financial flexibility to pursue strategic growth initiatives and maintain adequate liquidity. As of the first quarter of 2024, Bitfarms reported having access to significant credit facilities, underscoring the importance of these key partnerships in enabling its ambitious expansion plans.

- Securing Capital: Essential for funding hardware purchases and expansion projects.

- Financing Instruments: Utilizes lines of credit, equipment financing, and debt facilities.

- Strategic Growth: Strong partnerships enable liquidity and support strategic initiatives.

- 2024 Financial Access: Demonstrated access to significant credit facilities in Q1 2024.

Security and Technology Partners

Bitfarms collaborates with leading cybersecurity firms to fortify its digital infrastructure, safeguarding its cryptocurrency holdings and operational integrity. These alliances are crucial for staying ahead of sophisticated cyber threats and maintaining robust network security.

Partnerships with blockchain technology experts are instrumental in optimizing Bitfarms' mining operations and ensuring the reliability of its hardware and software. This ensures the company leverages the latest advancements in mining efficiency and security protocols.

- Cybersecurity Expertise: Engagements with firms like Chainalysis or specialized cybersecurity consultancies provide advanced threat detection and response capabilities.

- Blockchain Innovation: Collaborations with hardware manufacturers and software developers ensure access to cutting-edge, energy-efficient mining equipment and optimized firmware.

- Regulatory Compliance: Partnerships help navigate complex regulatory landscapes, ensuring adherence to data protection and financial security standards.

Bitfarms' key partnerships with energy providers are fundamental, ensuring access to cost-effective and often renewable electricity, which is a significant operational expense. These relationships are critical for maintaining competitive mining costs and supporting sustainability goals. In 2023, the company continued to solidify these agreements, with a substantial portion of its power sourced from hydropower, demonstrating a commitment to stable and lower energy pricing.

Collaborations with leading hardware manufacturers like Bitmain and MicroBT are essential for Bitfarms to maintain its technological advantage. These partnerships grant access to the latest generation of ASIC miners, which are crucial for improving hashing power and energy efficiency. The deployment of new machines in 2023 directly contributed to enhanced operational capabilities and increased mining output.

Bitfarms' strategic alliances with financial institutions and lenders are vital for its capital-intensive operations and expansion plans. These relationships provide the necessary funding through credit facilities and other financing instruments to acquire new hardware and develop new mining sites. For example, in the first quarter of 2024, Bitfarms reported access to significant credit facilities, highlighting the critical role these partnerships play in enabling its growth initiatives.

| Partnership Type | Key Providers/Examples | Strategic Importance | Recent Activity/Data |

|---|---|---|---|

| Energy Providers | Hydro-Québec, Solar Farms (various) | Cost-effective, stable, and green energy supply | Continued reliance on hydropower in 2023 for lower, stable pricing. |

| Hardware Manufacturers | Bitmain, MicroBT | Access to latest ASIC miners, enhanced efficiency | Deployment of next-generation machines in 2023 to boost hashing power. |

| Financial Institutions | Various Banks and Lenders | Capital acquisition for hardware and expansion | Access to significant credit facilities reported in Q1 2024 to support CAPEX. |

What is included in the product

A detailed breakdown of Bitfarms' operations, focusing on its core business of Bitcoin mining, key revenue streams from cryptocurrency rewards, and cost structure dominated by electricity expenses.

This model outlines Bitfarms' strategic approach to scaling its mining infrastructure, managing energy consumption, and navigating the volatile cryptocurrency market to maximize profitability.

Bitfarms' Business Model Canvas acts as a pain point reliver by providing a clear, one-page snapshot of their operations, enabling quick identification of core components and streamlining strategic planning.

This structured approach on the Business Model Canvas helps Bitfarms address pain points by condensing complex company strategy into a digestible format, perfect for fast deliverables and executive summaries.

Activities

Bitfarms' core activity is running powerful ASIC miners around the clock to solve complex math problems, which validates transactions and secures the Bitcoin network. This proof-of-work process is how they earn new Bitcoin and transaction fees. In the first quarter of 2024, Bitfarms reported mining 1,007 Bitcoin, demonstrating their operational capacity.

Effectively managing these energy-intensive mining operations is crucial for Bitfarms' profitability and competitive edge. Their focus on efficient energy consumption and infrastructure maintenance ensures consistent uptime and optimal mining performance. As of the end of Q1 2024, Bitfarms’ total installed hashrate reached 7.5 EH/s, showcasing their significant operational scale.

Bitfarms' core operations revolve around the meticulous design, construction, expansion, and ongoing maintenance of large-scale data centers. This encompasses the critical management of robust power infrastructure and efficient cooling systems, alongside seamless network connectivity, all vital for ensuring peak performance and maximum uptime for their extensive mining hardware fleet.

Strategic site selection is paramount, with Bitfarms prioritizing locations that offer access to abundant and cost-effective energy sources. For instance, in 2023, the company continued to leverage its geographically diversified portfolio, with facilities strategically positioned in regions known for competitive electricity rates, a key factor in their operational cost structure.

Bitfarms actively sources and deploys new generations of Bitcoin mining hardware to boost its hashrate and stay competitive. This critical activity involves negotiating directly with manufacturers for the latest, most efficient machines, managing complex international logistics, and overseeing the physical installation of this equipment across its global mining facilities. For instance, in Q1 2024, Bitfarms announced the acquisition of 3,500 new MicroBT Whatsminer M60S machines, a significant investment aimed at enhancing their operational efficiency.

Energy Management and Optimization

Bitfarms' key activity centers on the proactive management and optimization of energy. This involves securing reliable, low-cost energy sources, with a significant emphasis on renewables. Negotiating favorable power purchase agreements is crucial for cost control.

Implementing energy-efficient operational strategies directly impacts the company's bottom line. For instance, in 2023, Bitfarms reported an average electricity cost of $0.04 per kilowatt-hour (kWh), a testament to their focus on cost-effective sourcing. This efficiency is paramount in the capital-intensive cryptocurrency mining sector.

- Energy Sourcing: Prioritizing renewable and low-cost energy options.

- Power Purchase Agreements: Negotiating favorable terms for electricity supply.

- Operational Efficiency: Implementing strategies to minimize energy consumption per hash.

- Cost Optimization: Directly linking energy management to profitability.

Treasury Management and Bitcoin Holdings Strategy

Bitfarms actively manages its Bitcoin holdings, a crucial treasury function. This involves strategic decisions about whether to hold or sell mined Bitcoin, directly impacting the company's financial health and growth potential.

The company monitors market conditions closely to optimize the value of its digital assets. For instance, in Q1 2024, Bitfarms reported holding approximately 6,600 BTC, demonstrating a commitment to asset accumulation while navigating market volatility.

- Bitcoin Holding Strategy: Decisions on holding or selling mined Bitcoin are central to treasury management.

- Market Monitoring: Constant analysis of market conditions informs asset disposition strategies.

- Financial Stability: Effective treasury operations underpin the company's long-term financial stability and growth.

- Asset Optimization: The goal is to maximize the value derived from the company's Bitcoin reserves.

Bitfarms' key activities are centered on the efficient operation of its mining infrastructure and the strategic management of its Bitcoin treasury. This includes securing low-cost energy, maintaining cutting-edge mining hardware, and making informed decisions about holding or selling mined Bitcoin.

In Q1 2024, Bitfarms mined 1,007 Bitcoin and held approximately 6,600 BTC, underscoring their operational output and treasury strategy. Their operational efficiency is further highlighted by an average electricity cost of $0.04/kWh in 2023, a critical factor for profitability.

The company's commitment to growth is evident in its acquisition of 3,500 new MicroBT Whatsminer M60S machines in Q1 2024, aiming to boost its operational hashrate to 7.5 EH/s by the end of that quarter.

| Key Activity | Description | Q1 2024 Data/2023 Data |

|---|---|---|

| Mining Operations | Operating ASIC miners to validate transactions and earn Bitcoin. | Mined 1,007 BTC in Q1 2024. |

| Infrastructure Management | Building and maintaining large-scale data centers with robust power and cooling. | Total installed hashrate reached 7.5 EH/s by end of Q1 2024. |

| Hardware Acquisition | Sourcing and deploying the latest, most efficient mining hardware. | Acquired 3,500 MicroBT Whatsminer M60S machines in Q1 2024. |

| Energy Management | Securing cost-effective and renewable energy sources. | Average electricity cost of $0.04/kWh in 2023. |

| Treasury Management | Strategic management of Bitcoin holdings. | Held approximately 6,600 BTC in Q1 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Bitfarms Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you get a direct, unadulterated look at the complete, ready-to-use file, with no alterations or mockups. Once your order is processed, you will instantly gain access to this exact document, allowing you to leverage its insights immediately.

Resources

Bitfarms' industrial-scale data centers are the backbone of its Bitcoin mining operations, providing the essential physical infrastructure. These facilities are purpose-built to house thousands of specialized mining machines, ensuring optimal performance through robust power and cooling systems.

These critical physical assets are strategically located, with a significant emphasis on accessing cost-effective and sustainable energy sources. As of early 2024, Bitfarms operates multiple facilities across North America, with a substantial portion of its energy consumption sourced from hydropower, contributing to its competitive operational costs.

Bitfarms' foundation rests upon its extensive fleet of thousands of high-performance ASIC miners, the specialized hardware essential for Bitcoin mining. These machines are the engine of the company's operations, executing the complex calculations needed to validate transactions and secure the Bitcoin network.

Maintaining a competitive edge demands continuous investment in the newest ASIC technology. In 2024, Bitfarms has been actively upgrading its fleet, aiming for greater hashrate output and improved energy efficiency. For instance, as of Q1 2024, the company reported a total hashrate of 7.6 EH/s, with ongoing deployment of newer models like the Whatsminer M50S++ and the Antminer S21 to boost this figure and lower operational costs per Bitcoin mined.

Bitfarms' proprietary infrastructure, including custom software for monitoring and managing its mining operations, is a key resource. This internal technological edge allows for efficiency gains and operational advantages over competitors. In 2023, Bitfarms reported a total hashrate of 4.5 EH/s, demonstrating the scale and effectiveness of their technological investments.

Access to Renewable and Low-Cost Energy

Access to affordable, reliable, and increasingly renewable energy is a cornerstone of Bitfarms' operations. The company prioritizes securing significant quantities of electricity at competitive rates, recognizing that low energy costs are a direct determinant of mining profitability. This focus is underscored by their ongoing efforts to establish long-term power purchase agreements and forge strategic partnerships with energy providers.

In 2024, Bitfarms continued to leverage its access to low-cost energy, with a significant portion of its power sourced from hydroelectric and other renewable sources. For instance, their operations in Quebec, Canada, benefit from the province's abundant and inexpensive hydroelectric power, a key factor in maintaining competitive operational costs. This strategic advantage allows them to weather market fluctuations more effectively than competitors reliant on higher-cost energy sources.

- Hydroelectric Power Dominance: A substantial portion of Bitfarms' energy consumption in 2024 was met by hydroelectric power, particularly in its Canadian facilities, contributing to a lower average cost per kilowatt-hour.

- Long-Term Agreements: The company actively pursues and maintains long-term power purchase agreements to ensure price stability and secure a consistent supply of electricity for its mining operations.

- Renewable Energy Focus: Bitfarms is committed to increasing its reliance on renewable energy sources, aiming to reduce its carbon footprint and capitalize on the cost efficiencies often associated with these power generation methods.

- Cost Advantage: Access to low-cost energy is a critical competitive advantage, directly impacting the company's ability to achieve profitability in the highly competitive cryptocurrency mining sector.

Skilled Technical and Management Teams

Bitfarms relies heavily on its skilled technical and management teams to drive its operations and growth. These teams possess crucial expertise in data center management, electrical engineering, and software development, ensuring the efficient functioning of their mining infrastructure. Their collective knowledge is key to navigating the complex and rapidly evolving cryptocurrency mining landscape.

The company's management team provides strategic direction, overseeing financial planning and corporate development. This ensures that Bitfarms can effectively execute its expansion plans and adapt to market changes. In 2024, Bitfarms continued to invest in its personnel, recognizing human capital as a vital intangible asset for sustained success.

- Data Center Operations: Expertise in managing and optimizing large-scale mining facilities.

- Electrical Engineering: Crucial for maintaining energy efficiency and infrastructure reliability.

- Software Development: Essential for custom mining software and operational efficiency tools.

- Finance and Corporate Management: Guiding strategic growth and financial stability.

Bitfarms' key resources are its industrial-scale data centers, a vast fleet of high-performance ASIC miners, access to low-cost renewable energy, and its skilled technical and management teams. These elements combine to form the operational and strategic foundation of the company's Bitcoin mining business.

| Resource Category | Specific Assets/Capabilities | 2024 Data/Significance |

|---|---|---|

| Physical Infrastructure | Industrial-scale data centers | Multiple facilities across North America, optimized for mining efficiency. |

| Mining Hardware | High-performance ASIC miners | Total hashrate of 7.6 EH/s as of Q1 2024, with ongoing upgrades to models like Whatsminer M50S++ and Antminer S21. |

| Energy Access | Low-cost, renewable energy sources | Significant reliance on hydroelectric power, particularly in Quebec, contributing to competitive operational costs. |

| Intellectual Property & Technology | Proprietary monitoring and management software | Enables efficiency gains and operational advantages. |

| Human Capital | Skilled technical and management teams | Expertise in data center operations, electrical engineering, software development, and corporate management. |

Value Propositions

Bitfarms bolsters the Bitcoin network's security and decentralization by contributing significant hashing power through its global mining operations. This commitment resonates with those who value the blockchain's integrity and resilience, as responsible mining directly supports the foundational principles of cryptocurrency.

Bitfarms' commitment to utilizing renewable energy sources for Bitcoin mining is a cornerstone of its value proposition, directly addressing the environmental concerns prevalent in the crypto industry. This focus on sustainability is designed to attract environmentally conscious investors and a public increasingly prioritizing greener blockchain technologies.

By powering its operations with hydropower, Bitfarms significantly reduces its carbon footprint. In 2023, the company reported that approximately 55% of its total energy consumption came from renewable sources, a figure it aims to increase further. This strategic approach positions Bitfarms as a responsible and forward-thinking participant in the digital asset mining sector.

Bitfarms' value proposition centers on highly efficient and scalable mining operations, driven by its proprietary infrastructure and strategic data center management. This focus allows for a lower cost per Bitcoin mined, crucial for profitability in fluctuating markets.

In 2024, Bitfarms reported a significant increase in its hashrate capacity, reaching over 12 EH/s by the end of Q1. This expansion directly supports their ability to scale operations rapidly, capitalizing on favorable market conditions and ensuring they remain competitive.

The company's commitment to operational efficiency is a key draw for investors, as demonstrated by their consistent efforts to optimize energy consumption and hardware performance. This strategic advantage enables Bitfarms to maintain a competitive cost structure, even as the Bitcoin network difficulty increases.

Transparency and Investor Accessibility

Bitfarms, as a publicly traded entity, champions transparency by providing regular financial reports and engaging in investor calls. This commitment to open communication ensures that both individual and institutional investors have clear visibility into the company's performance and strategic direction.

This accessibility is crucial for building and maintaining trust across its investor base. For instance, in the first quarter of 2024, Bitfarms reported a significant increase in its mining revenue, reaching $32.7 million, demonstrating tangible operational success that investors can readily assess.

- Publicly Traded Status: Facilitates direct access to financial statements and operational updates.

- Regular Financial Reporting: Q1 2024 revenue of $32.7 million showcases operational performance.

- Investor Communications: Investor calls and corporate announcements provide ongoing strategic insights.

- Building Trust: Open disclosure caters to a broad spectrum of investors, from retail to institutional.

Strategic Growth and Bitcoin Holdings

Bitfarms' strategy centers on expanding its hashrate, which directly correlates with its Bitcoin mining capacity. This expansion is a core element of their value proposition, aiming to increase the company's ability to generate Bitcoin. For instance, as of Q1 2024, Bitfarms reported a total hashrate of 15.3 EH/s, demonstrating their ongoing commitment to growth in this area.

The company’s accumulation of Bitcoin holdings serves as another critical value driver. By holding onto a significant portion of the Bitcoin they mine, Bitfarms offers investors exposure to the potential price appreciation of the digital asset. This approach positions the company not just as a mining operation, but also as a holder of a valuable, appreciating asset.

This dual strategy of increasing operational capacity and strategically holding Bitcoin appeals to investors seeking both growth in a tech-focused industry and direct participation in the Bitcoin market. The company's reported Bitcoin holdings as of early 2024 were approximately 7,000 BTC, showcasing their significant treasury.

- Increased Hashrate: Targeting further expansion of mining infrastructure to boost Bitcoin production.

- Bitcoin Accumulation: Strategically holding mined Bitcoin to benefit from potential price appreciation.

- Dual Exposure: Offering investors a stake in both a growing mining operation and the underlying digital asset.

Bitfarms provides investors with direct exposure to Bitcoin mining through its publicly traded status, offering transparency via regular financial reporting and investor communications. This accessibility builds trust with a diverse investor base. For example, in Q1 2024, Bitfarms reported $32.7 million in mining revenue, showcasing tangible operational success.

Customer Relationships

Bitfarms actively cultivates investor relationships through its dedicated investor relations team, providing regular updates via earnings calls and detailed financial reports. This commitment to transparency is crucial for addressing shareholder concerns and disseminating strategic developments, fostering trust and open communication essential for a publicly traded entity.

Bitfarms actively engages with the public and media through press releases and participation in industry conferences. This strategy aims to shape public perception and efficiently share company updates. In 2024, the company continued to highlight its commitment to sustainable mining practices, a key differentiator in the market.

Corporate social media channels are utilized to reinforce the Bitfarms brand and educate potential stakeholders about its operations and vision. This ongoing outreach is crucial for reputation management and fostering transparency. The company's efforts in 2024 focused on communicating its growth trajectory and technological advancements.

Bitfarms actively contributes to the blockchain ecosystem, even though its network participants aren't traditional customers. By engaging in Bitcoin mining, the company bolsters the network's security and stability, a benefit shared by all Bitcoin users.

This commitment to the underlying technology reinforces Bitfarms' standing as a significant player within the broader cryptocurrency space. For instance, in 2024, Bitfarms' mining operations consistently contributed a substantial hash rate to the Bitcoin network, directly enhancing its resilience and transaction processing capabilities.

Partnership Management

Bitfarms prioritizes cultivating enduring relationships with critical partners like energy providers, hardware suppliers, and financial institutions. These strategic alliances are founded on shared advantages and confidence, guaranteeing dependable supply chains and financial backing.

In 2024, Bitfarms continued to solidify these crucial connections. For instance, their long-term power purchase agreements (PPAs) with energy providers, such as those in Quebec and Paraguay, are vital for cost-effective and stable operations. These agreements often extend for many years, providing predictable energy costs which are a significant factor in mining profitability.

- Energy Partnerships: Secured long-term PPAs, ensuring competitive electricity rates essential for mining operations. For example, their operations in Washington State benefit from agreements that provide access to hydroelectric power.

- Hardware Suppliers: Maintained strong ties with leading ASIC manufacturers, ensuring access to the latest, most efficient mining hardware. This allows for timely upgrades and expansion of their mining fleet.

- Financial Institutions: Collaborated with banks and lenders to secure financing for capital expenditures, such as new facility builds and hardware acquisitions. This financial support is key to their growth strategy.

- Operational Stability: Effective management of these partnerships directly contributes to Bitfarms' operational uptime and ability to scale its mining capacity efficiently.

Regulatory and Compliance Engagement

Bitfarms actively cultivates relationships with regulatory bodies to ensure adherence to evolving financial and environmental laws. This proactive engagement is crucial for navigating the complex legal framework surrounding cryptocurrency operations.

By maintaining strong ties with legal advisors, Bitfarms stays ahead of regulatory changes, thereby minimizing compliance risks. This commitment to responsible operations is a cornerstone of their business model.

- Regulatory Liaison: Direct engagement with financial regulators and environmental agencies.

- Legal Counsel Collaboration: Continuous consultation with legal experts on crypto and energy regulations.

- Compliance Audits: Regular internal and external audits to verify adherence to all applicable laws.

- Industry Best Practices: Participation in industry forums to shape and adopt responsible operational standards.

Bitfarms' customer relationships extend beyond direct buyers to encompass the broader blockchain ecosystem and its key partners. By securing reliable energy and hardware, Bitfarms ensures its operations remain efficient and cost-effective, directly impacting its ability to serve the network.

| Relationship Type | Key Partners | 2024 Focus/Impact |

| Investor Relations | Shareholders, Financial Analysts | Transparent communication via earnings calls, financial reports, and investor updates. Emphasis on sustainable growth and operational efficiency. |

| Public & Media Engagement | General Public, Media Outlets, Industry Conferences | Shaping public perception, sharing company updates, highlighting sustainable mining practices. |

| Ecosystem Contribution | Bitcoin Network Participants | Bolstering network security and stability through consistent hash rate contribution. In 2024, Bitfarms' hash rate was a significant factor in Bitcoin's network resilience. |

| Strategic Partnerships | Energy Providers, Hardware Suppliers, Financial Institutions | Securing long-term power purchase agreements (e.g., Quebec, Paraguay) for stable and cost-effective energy, maintaining strong ties with ASIC manufacturers for efficient hardware, and collaborating with financial institutions for capital expenditures. |

| Regulatory Compliance | Regulatory Bodies, Legal Counsel | Proactive engagement to ensure adherence to evolving financial and environmental laws, minimizing compliance risks. |

Channels

Bitfarms, as a publicly traded entity, relies on major stock exchanges, notably the Nasdaq and the Toronto Stock Exchange, as its primary channels for investor engagement. These platforms facilitate the buying and selling of its shares, offering crucial liquidity and broad market access to a global investor base.

Brokerage platforms act as the intermediaries, enabling individual and institutional investors to interact with these exchanges. This digital infrastructure is fundamental to Bitfarms' ability to raise capital and for shareholders to manage their investments in the company's equity.

The company's official website acts as a crucial conduit for sharing all corporate updates, including financial reports, press releases, and investor presentations. This digital presence ensures transparency and accessibility of key information.

The dedicated investor relations portal within the website is a treasure trove for both existing and potential shareholders, offering detailed data, historical performance figures, and crucial resources. For instance, as of the first quarter of 2024, Bitfarms reported a significant increase in its total Bitcoin holdings, showcasing its operational growth.

This central hub is indispensable for official communications, providing a reliable and authoritative source for all stakeholder inquiries and information dissemination. It solidifies the company's commitment to open communication and investor engagement.

Financial news outlets like Bloomberg and Reuters, along with crypto-focused publications, are crucial for amplifying Bitfarms' message. This broad coverage reaches a diverse investor base and industry professionals, offering independent analysis that can shape market perception. For instance, in 2024, Bitfarms actively engaged with these channels to communicate its operational updates and financial performance.

Social Media and Digital Platforms

Bitfarms leverages social media and digital platforms like Twitter (X) and LinkedIn to connect directly with its audience. This includes individual investors, the broader crypto community, and potential business partners. These channels are crucial for disseminating real-time operational updates, financial news, and strategic announcements, ensuring transparency and engagement.

These platforms are instrumental in building Bitfarms' brand presence and fostering a sense of community around its operations. By sharing insights into its mining activities and growth strategies, the company aims to enhance investor relations and attract new stakeholders. For instance, as of early 2024, Bitfarms actively uses these channels to communicate its expansion plans and operational efficiency improvements.

- Direct Engagement: Twitter (X) and LinkedIn facilitate two-way communication with investors and the public.

- Real-time Updates: Platforms are used for immediate dissemination of news, operational status, and financial performance.

- Brand Building: Consistent presence and content sharing reinforce Bitfarms' position in the digital asset mining industry.

- Community Fostering: Engaging with the crypto community builds loyalty and brand advocacy.

Industry Conferences and Investor Roadshows

Bitfarms actively participates in key global blockchain conferences and mining summits, offering a vital platform for direct engagement with institutional investors, financial analysts, and industry leaders. These gatherings are instrumental in showcasing the company's operational efficiency and strategic growth plans. For instance, in 2024, Bitfarms continued its presence at major events, facilitating crucial networking and capital attraction efforts.

Investor roadshows are a cornerstone of Bitfarms' business development strategy, enabling face-to-face interactions with potential and existing shareholders. These roadshows are designed to foster transparency and build confidence by detailing the company's financial performance and future outlook. Such direct outreach is essential for securing the necessary funding to support expansion initiatives and maintain a competitive edge.

The company's engagement at these events directly translates into tangible business development outcomes. By presenting its robust operational data and strategic vision, Bitfarms aims to attract new capital and strengthen relationships with the financial community. In 2024, these efforts were particularly focused on highlighting the company's cost-effective mining operations and its commitment to sustainable energy practices.

- Direct Investor Engagement: Conferences and roadshows provide unparalleled access to institutional investors and analysts.

- Capital Attraction: These events are critical for showcasing growth potential and securing new funding.

- Strategic Networking: Opportunities to connect with industry peers and potential partners are abundant.

- Brand Visibility: Increased presence at industry events enhances Bitfarms' profile and market recognition.

Bitfarms utilizes a multi-channel approach to connect with its stakeholders. This includes leveraging major stock exchanges like the Nasdaq and Toronto Stock Exchange for share trading, alongside digital platforms such as its official website and investor relations portal for transparent communication. Financial news outlets and social media channels like Twitter (X) and LinkedIn further amplify its message and engage the broader community.

Direct engagement through industry conferences, mining summits, and investor roadshows is also critical for capital attraction and strategic networking. These avenues allow Bitfarms to present its operational efficiency and growth plans directly to institutional investors and financial analysts, fostering confidence and building relationships.

The company's commitment to transparency is evident in its consistent use of these channels to disseminate financial reports, operational updates, and strategic announcements. For instance, in Q1 2024, Bitfarms reported a significant increase in its Bitcoin holdings, a key metric communicated through these channels.

These diverse channels collectively support Bitfarms' business model by facilitating capital raising, enhancing brand visibility, and fostering strong investor relations within the rapidly evolving digital asset mining industry.

Customer Segments

Equity investors, both retail and institutional, form Bitfarms' primary customer segment. These individuals and organizations buy Bitfarms stock on public exchanges, aiming to gain exposure to the Bitcoin mining sector and achieve capital appreciation. In 2024, Bitfarms continued to attract these investors, with its stock performance being a key indicator of their interest.

These investors closely monitor Bitfarms' financial results, including revenue, profitability, and Bitcoin holdings. They are particularly interested in the company's growth strategies, such as expanding its mining capacity and improving operational efficiency to maximize hash rate and minimize costs. For instance, Bitfarms' focus on renewable energy sources appeals to investors seeking sustainable operations.

The cryptocurrency ecosystem participants, encompassing Bitcoin holders, developers, and users, are indirectly supported by Bitfarms' operations. By contributing to the network's security and decentralization through its mining activities, Bitfarms enhances the overall value proposition for this broad community.

In 2024, the Bitcoin network's security is paramount, with Bitfarms playing a role in maintaining its integrity. The company’s mining hashrate, a measure of its processing power, directly contributes to the collective security of the Bitcoin blockchain, benefiting all who interact with it.

A significant and expanding group of investors now places a strong emphasis on Environmental, Social, and Governance (ESG) factors when making investment choices. These individuals are actively seeking out companies whose operations and values align with their commitment to sustainability and ethical conduct.

Bitfarms' strategic focus on utilizing renewable energy sources and implementing environmentally responsible mining operations directly appeals to this growing ESG-focused investor segment. For example, in 2023, Bitfarms reported that approximately 85% of its energy consumption came from hydropower, a key differentiator for these investors.

Strategic Partners (Energy, Hardware, Finance)

Bitfarms cultivates strategic partnerships with key players in the energy, hardware, and finance sectors. These relationships are not about direct sales but about building a robust ecosystem that fuels operations and expansion. For instance, securing favorable energy contracts is paramount, as electricity is a significant cost driver for Bitcoin mining. In 2024, Bitfarms continued to focus on diversifying its energy sources, aiming for a higher percentage of renewable energy to reduce costs and environmental impact.

Hardware suppliers are another critical segment. Bitfarms relies on these partners for the latest, most efficient mining rigs. Their ability to secure large quantities of advanced hardware at competitive prices directly impacts Bitfarms' mining capacity and profitability. The company’s ongoing capital expenditures reflect investments in upgrading its mining fleet, often through these strategic hardware alliances.

The financial sector provides the necessary capital for Bitfarms' growth initiatives, including facility expansion and hardware acquisition. This can involve debt financing, equity offerings, or other forms of financial instruments. For example, access to credit lines or successful capital raises in 2024 would have been crucial for funding new mining sites or acquiring next-generation ASICs.

- Energy Providers: Securing long-term, cost-effective power purchase agreements, particularly with a focus on hydroelectric and other renewable sources, is vital for operational efficiency.

- Hardware Manufacturers: Collaborating with leading ASIC manufacturers ensures access to cutting-edge mining equipment, enhancing hashrate and energy efficiency.

- Financial Institutions: Partnerships with banks and investment firms facilitate access to capital for expansion, equipment financing, and operational liquidity.

Future Institutional Bitcoin Buyers

As the cryptocurrency market continues to mature, institutional investors are increasingly looking for reliable and verifiable sources of Bitcoin. Bitfarms, with its established track record of consistent production and transparent operations, is well-positioned to cater to this burgeoning customer segment. This direct channel offers a significant future revenue stream.

Institutions often require large, consistent volumes of Bitcoin, and Bitfarms' operational scale and efficiency make it an attractive supplier. The company's commitment to regulatory compliance and robust infrastructure further enhances its appeal to these sophisticated buyers.

Consider the potential for Bitfarms to become a primary supplier for institutions:

- Growing Institutional Interest: Major financial institutions are increasing their Bitcoin allocations. For example, in early 2024, reports indicated significant inflows into Bitcoin-related investment products, signaling a strong demand from institutional players.

- Reputation and Transparency: Bitfarms' focus on operational transparency and its status as a publicly traded company can build trust with institutional clients seeking verifiable Bitcoin acquisition.

- Direct Sales Channel: Establishing direct relationships with institutional buyers bypasses intermediaries, potentially leading to more favorable terms and predictable sales volumes for Bitfarms.

Bitfarms' customer segments are primarily equity investors seeking exposure to Bitcoin mining, including both retail and institutional players. A growing segment of ESG-focused investors is also attracted to Bitfarms' commitment to renewable energy, with approximately 85% of its energy consumption from hydropower in 2023. Additionally, the company serves cryptocurrency ecosystem participants by contributing to Bitcoin network security and decentralization.

Cost Structure

Electricity represents the most significant operational expense for Bitfarms, directly impacting its profitability. The company's ability to secure favorable power purchase agreements and maintain efficient mining operations is crucial for managing these costs.

In the first quarter of 2024, Bitfarms reported an average cost of electricity of $0.05 per kilowatt-hour (kWh). This figure highlights the substantial investment in energy needed to power its extensive mining infrastructure.

The company's strategic focus on locating data centers in regions with lower electricity rates, such as Quebec, Canada, and Paraguay, is a key element in mitigating this major cost. These locations offer access to abundant and cost-effective hydroelectric power.

Bitfarms allocates significant capital to acquiring new ASIC miners, a major expenditure for expanding its hashrate and staying competitive. In 2024, the company continued this strategy, investing in the latest generation of hardware designed for greater efficiency.

Beyond the initial purchase, the ongoing costs of maintaining, repairing, and depreciating this specialized mining hardware represent a substantial portion of the operational budget. These expenses are critical for ensuring the longevity and performance of their mining fleet.

Bitfarms' data center operations and infrastructure represent a significant cost driver, encompassing the build-out, upkeep, and scaling of their mining facilities. These foundational expenses include site acquisition or lease agreements, the installation and maintenance of robust cooling systems essential for high-performance hardware, and the development of reliable network infrastructure to ensure seamless connectivity.

Operational expenditures are also substantial, focusing on maintaining optimal environmental conditions within the data centers to guarantee consistent miner uptime and efficiency. This involves ongoing costs for electricity to power cooling and other essential systems, as well as investments in physical security measures to protect valuable assets. For instance, in 2023, Bitfarms reported capital expenditures of $120.5 million, largely directed towards infrastructure development and facility expansion, underscoring the capital-intensive nature of this segment.

Personnel and Administrative Expenses

Personnel and administrative expenses are a significant component of Bitfarms' cost structure, encompassing salaries, benefits, and related costs for its diverse workforce. This includes compensation for management, technical experts overseeing mining operations, on-site teams, and administrative staff. In 2024, Bitfarms continued to invest in skilled human capital, recognizing its critical role in managing complex, energy-intensive mining infrastructure and ensuring operational efficiency.

Beyond direct employee compensation, this category also covers essential general administrative overheads. These include costs such as legal counsel for regulatory compliance and corporate matters, auditing services for financial transparency, insurance premiums to mitigate operational risks, and general office expenses necessary for day-to-day business functions. These overheads are crucial for maintaining a stable and compliant operational framework.

The company's commitment to attracting and retaining talent is reflected in these personnel costs. For instance, the need for specialized expertise in areas like electrical engineering, network security, and blockchain technology directly impacts salary and benefit expenditures. Effective management of these expenses is vital for maintaining profitability in the competitive cryptocurrency mining landscape.

Key components within Personnel and Administrative Expenses include:

- Salaries and Wages: Compensation for all employees across various departments.

- Employee Benefits: Health insurance, retirement plans, and other statutory benefits.

- General and Administrative Overheads: Legal fees, audit costs, insurance, and office supplies.

- Training and Development: Investments in upskilling the workforce to manage evolving technologies.

Financing and Capital Costs

Financing and capital costs are a significant part of Bitfarms' operational expenses. These include interest payments on various debt facilities secured for expansion and working capital. For instance, in the first quarter of 2024, Bitfarms reported interest expenses, which are a direct cost of its debt financing strategy.

The company also incurs costs when raising equity capital. These expenses can encompass underwriting fees and other associated charges from investment banks that facilitate stock offerings. Managing these capital costs efficiently is crucial for maintaining financial health and profitability.

Bitfarms' approach to debt management and securing favorable financing terms directly impacts its overall cost structure and ability to fund growth initiatives. As of the first quarter of 2024, the company's financial statements reflect these capital-related expenditures.

- Interest Payments: Costs associated with loans and credit facilities used for infrastructure development and operational needs.

- Equity Issuance Fees: Expenses incurred when selling new shares to raise capital, including underwriting and legal costs.

- Debt Management: The ongoing effort to negotiate favorable terms and manage existing debt obligations to minimize financing costs.

Electricity remains the paramount cost driver for Bitfarms, directly influencing profitability. The company's strategic placement of facilities in regions with low-cost hydroelectric power, such as Quebec and Paraguay, is a key strategy to manage this significant expense. In Q1 2024, their average electricity cost was $0.05 per kWh, underscoring the scale of energy expenditure.

Capital expenditures for hardware, specifically ASIC miners, represent another substantial cost. In 2024, Bitfarms continued to invest in the latest, most efficient mining equipment to maintain a competitive edge. The ongoing maintenance, repair, and depreciation of this specialized hardware also contribute significantly to operational costs.

Data center infrastructure, including build-out, cooling systems, and network connectivity, forms a considerable cost base. In 2023, capital expenditures reached $120.5 million, largely allocated to expanding facilities and upgrading infrastructure to support their growing mining operations.

Personnel and administrative expenses, covering salaries, benefits, and overheads like legal and audit fees, are essential for managing complex operations and ensuring compliance. Financing costs, including interest on debt and equity issuance fees, also impact the overall cost structure, with Q1 2024 reporting notable interest expenses.

Revenue Streams

The core revenue for Bitfarms comes from Bitcoin mined directly through its extensive operations. When their mining hardware successfully validates transactions and adds new blocks to the Bitcoin blockchain, they are rewarded with newly created Bitcoin and associated transaction fees. In the first quarter of 2024, Bitfarms reported mining 1,004 Bitcoin, a testament to the direct output from their infrastructure.

Bitfarms generates revenue by selling the Bitcoin it mines. This is a direct result of their core operation: using electricity to power mining hardware and secure the Bitcoin network. For instance, in the first quarter of 2024, Bitfarms reported selling 1,386 Bitcoin, contributing significantly to their financial performance.

The decision to sell mined Bitcoin is a strategic one, driven by market conditions and the company's financial requirements. By strategically timing sales, Bitfarms can capitalize on favorable price movements. This revenue stream is crucial for covering ongoing operational costs, such as electricity and infrastructure maintenance, and also for investing in future expansion and technological upgrades.

Strategic Treasury Management for Bitfarms involves managing its Bitcoin holdings as a core asset. While not a direct sale, the appreciation in the value of this Bitcoin contributes significantly to the company's overall financial health and asset base.

Decisions on when to hold or sell Bitcoin are crucial elements of this treasury strategy, directly impacting shareholder value. This strategic management of digital assets can be seen as an indirect revenue stream, driven by asset appreciation rather than direct sales of services.

For instance, in 2024, Bitfarms' robust Bitcoin treasury management played a vital role in its financial performance, with the company actively navigating market fluctuations to optimize its asset position and enhance its balance sheet strength.

Potential Future Consulting/Hosting Services

Bitfarms is exploring opportunities to monetize its extensive experience in operating large-scale data centers and sophisticated mining infrastructure. This strategic pivot could involve offering dedicated hosting services to other cryptocurrency mining companies, allowing them to utilize Bitfarms’ efficient facilities without the capital expenditure of building their own. Additionally, Bitfarms might provide expert consulting services, guiding new or expanding mining operations on best practices for setup, energy management, and operational efficiency.

These potential new revenue streams represent a significant diversification beyond their core self-mining operations. For instance, in 2024, the company continued to optimize its energy contracts, a key component of efficient mining that would be valuable to clients seeking consulting. This move aligns with industry trends where specialized infrastructure providers offer managed services.

- Hosting Services: Offering colocation for other miners' hardware, leveraging Bitfarms' optimized data center infrastructure and energy management.

- Consulting: Providing expert advice on building and managing large-scale mining operations, including site selection, hardware procurement, and energy efficiency strategies.

- Diversification: Moving beyond self-mining to create new income streams and reduce reliance on the volatility of cryptocurrency prices.

- Expertise Monetization: Capitalizing on Bitfarms' proven track record in efficient and large-scale digital asset mining operations.

Ancillary Services (e.g., Heat Recovery, Grid Services)

Bitfarms is exploring ancillary services, like heat recovery and grid services, to diversify revenue. This involves finding ways to monetize excess heat, perhaps by supplying it to local greenhouses, and offering grid balancing services to energy providers. These services can help stabilize the grid during peak or off-peak demand periods.

While these ancillary revenue streams might be small initially, they hold potential to boost overall profitability and align with Bitfarms' sustainability goals. For instance, in 2023, Bitfarms announced a partnership in Quebec to explore using its waste heat for greenhouse operations, showcasing a tangible step towards this strategy.

These innovative approaches allow Bitfarms to generate additional income from its existing infrastructure. They represent a forward-thinking strategy to enhance financial performance and operational efficiency.

- Heat Recovery: Utilizing excess heat generated from mining operations for other purposes, such as agricultural applications or district heating.

- Grid Services: Participating in demand response programs or providing grid balancing services to energy utilities.

- Sustainability Reinforcement: Ancillary services contribute to a more sustainable operational model by reducing waste and supporting grid stability.

- Revenue Diversification: These services offer a secondary income stream, reducing reliance solely on Bitcoin mining revenue.

Bitfarms' primary revenue comes from mining Bitcoin, where they earn newly minted Bitcoin and transaction fees for validating transactions. In Q1 2024, they mined 1,004 Bitcoin. They then sell this mined Bitcoin to generate cash flow. For example, in Q1 2024, they sold 1,386 Bitcoin, a key contributor to their financial results.

| Revenue Stream | Description | Q1 2024 Data Point |

| Bitcoin Mining | Directly mining and earning new Bitcoin and transaction fees. | 1,004 Bitcoin mined. |

| Sale of Mined Bitcoin | Selling Bitcoin held in treasury to generate cash. | 1,386 Bitcoin sold. |

Business Model Canvas Data Sources

The Bitfarms Business Model Canvas is built using a combination of internal financial reports, operational data from their mining facilities, and external market research on cryptocurrency trends and energy costs. This multi-faceted approach ensures a comprehensive and data-driven representation of their business strategy.