Bitfarms Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bitfarms Bundle

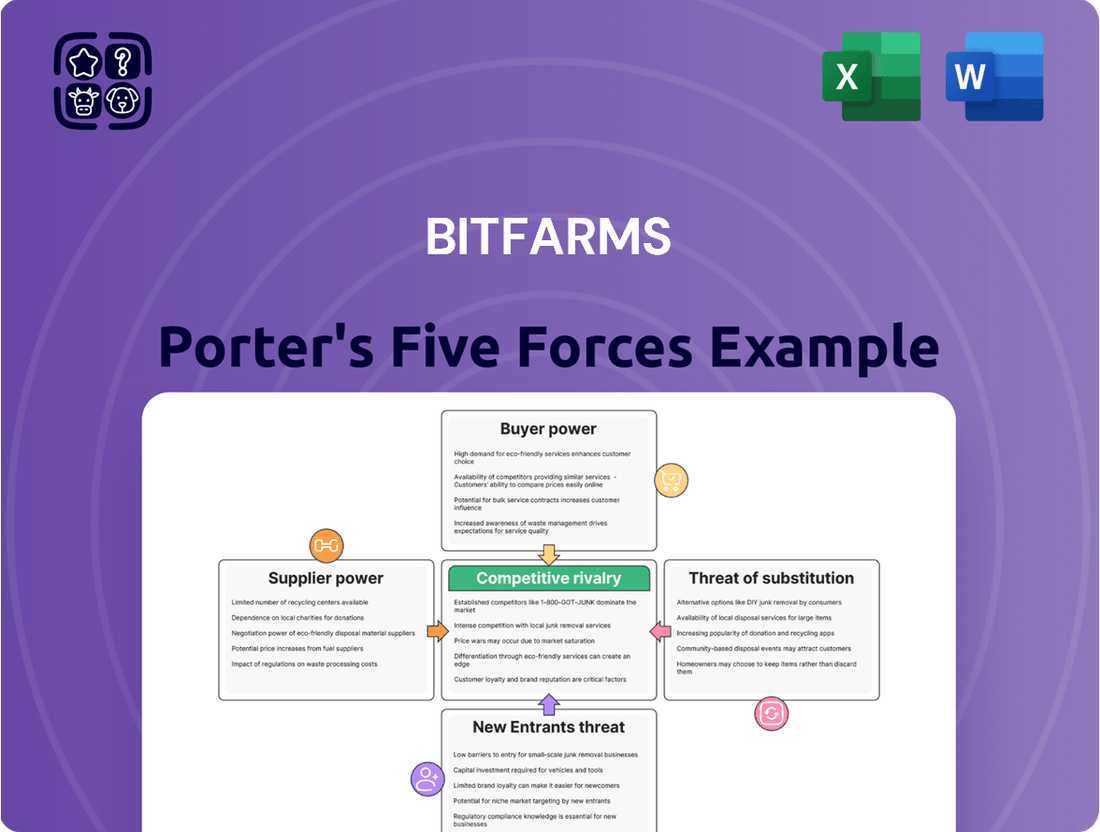

Bitfarms operates in a highly competitive landscape, facing significant pressure from rivals and the constant threat of new entrants disrupting the market. Understanding the intricate interplay of buyer power, supplier leverage, and the availability of substitutes is crucial for navigating this dynamic environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bitfarms’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The market for advanced Bitcoin mining hardware, particularly Application-Specific Integrated Circuits (ASICs), is highly concentrated. Leading manufacturers such as Bitmain, MicroBT, and Canaan dominate this space, giving them considerable leverage.

This limited supplier base means companies like Bitfarms rely heavily on these few producers for the cutting-edge, efficient hardware necessary to stay competitive. The situation is amplified following the 2024 Bitcoin halving, which decreased block rewards, making hardware efficiency even more critical for profitability.

Electricity is the dominant cost for Bitcoin miners, typically representing 75-85% of their total expenses. This makes energy suppliers, from traditional utilities to renewable energy firms, incredibly influential. Their power stems from fluctuating energy prices and the industry's absolute dependence on affordable, consistent power.

Bitfarms' strategy to counter this supplier leverage involves locking in long-term, advantageous power agreements. Securing renewable energy sources is particularly vital for cost stability and environmental, social, and governance (ESG) considerations. For instance, in 2023, Bitfarms reported that approximately 99% of its energy consumption was from hydropower, a significant factor in managing electricity costs.

As Bitcoin mining operations like Bitfarms grow and prioritize efficiency, specialized cooling and data center infrastructure suppliers gain significant leverage. These providers, offering advanced solutions such as immersion cooling, possess unique expertise and face limited competition, potentially commanding higher prices. For instance, the global immersion cooling market is projected to grow substantially, indicating increasing demand for these specialized services.

Limited Alternatives for Key Components

Beyond the main ASIC chips, other critical components for data centers, like specialized networking gear, power distribution units, and cooling systems, can also originate from a limited number of suppliers. This concentration means these suppliers hold significant sway.

The highly specific requirements for high-density computing in cryptocurrency mining often restrict the available vendors for these essential parts. Consequently, these niche suppliers gain considerable bargaining power.

- Concentrated Supplier Base: For critical data center infrastructure beyond ASICs, such as advanced cooling solutions and specialized power management systems, the market often features a few dominant players.

- Technical Specificity: Mining operations demand components engineered for extreme performance and reliability, narrowing the pool of manufacturers capable of meeting these stringent technical specifications.

- Supplier Leverage: This limited choice for essential, yet specialized, hardware grants these suppliers greater leverage in negotiations, potentially impacting Bitfarms' operational costs and equipment procurement timelines.

Labor Market for Skilled Technicians

The operation and maintenance of large-scale data centers, especially those focused on Bitcoin mining and High-Performance Computing (HPC)/AI, demand a workforce possessing specialized skills. This includes expertise in electrical engineering, robust IT infrastructure management, and the intricacies of cryptocurrency mining operations.

A significant shortage of these highly skilled technicians directly translates into increased bargaining power for them. This scarcity can drive up labor costs for companies like Bitfarms, impacting their operational expenses.

- Skilled Technician Shortage: The demand for specialized data center technicians, particularly those with electrical engineering and IT infrastructure backgrounds, is growing rapidly.

- Impact on Wages: Industry reports from 2024 indicate that average salaries for experienced data center technicians have seen a notable increase, reflecting the competitive labor market.

- HPC/AI Demand: The burgeoning field of AI and HPC further intensifies the need for these specialized skills, creating a more challenging recruitment environment.

- Bitfarms' Challenge: Bitfarms, like other operators, must contend with these rising labor costs to secure and retain the talent necessary for efficient data center management.

The bargaining power of suppliers for Bitfarms is substantial, primarily driven by the concentrated market for Bitcoin mining hardware (ASICs) and the critical dependence on electricity. The few dominant ASIC manufacturers, like Bitmain and MicroBT, hold significant leverage due to the technical specificity and high cost of these machines, especially after the 2024 halving intensified the need for efficiency. Energy suppliers also wield considerable power, as electricity constitutes the largest operational expense, making Bitfarms' long-term power agreements, like their reliance on 99% hydropower in 2023, a crucial mitigation strategy.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Bitfarms | 2024 Data/Trends |

|---|---|---|---|

| ASIC Manufacturers | Concentrated market, high R&D costs, technical specialization | High equipment costs, potential supply chain disruptions | Continued dominance of top 3 manufacturers; price stability or increases depending on demand |

| Electricity Providers | Essential input, fluctuating energy prices, regional availability | Significant operational cost, need for stable and affordable power contracts | Increased demand for energy from data centers and AI; pressure on electricity prices in some regions |

| Specialized Data Center Infrastructure | Niche market, unique technical expertise (e.g., immersion cooling) | Higher costs for advanced cooling and infrastructure solutions | Growing market for immersion cooling, indicating increased supplier leverage |

| Skilled Labor (Technicians) | Shortage of specialized skills, high demand from HPC/AI | Rising labor costs, challenges in talent acquisition and retention | Reported salary increases for experienced data center technicians in 2024 |

What is included in the product

This analysis uncovers the competitive landscape for Bitfarms, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and how these forces shape Bitfarms' profitability and strategic positioning.

Bitfarms' Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive forces—perfect for quick strategic decision-making in the volatile crypto mining market.

Customers Bargaining Power

The bargaining power of customers for Bitfarms, primarily the Bitcoin network itself, is effectively zero. The network dictates the rewards through protocol-based block subsidies and transaction fees, which are not negotiable by individual miners.

In 2024, Bitcoin miners like Bitfarms earn rewards determined by the network's design, not by direct negotiation. The halving event in April 2024 reduced the block subsidy from 6.25 BTC to 3.125 BTC, a fundamental change outside any miner's influence.

The bargaining power of customers in the context of Bitcoin mining, particularly for a company like Bitfarms, is largely dictated by the inherent volatility of the cryptocurrency market itself. Essentially, the broader market's demand and sentiment for Bitcoin act as a significant external force, directly influencing the value of Bitfarms' mined product. This means the ultimate price Bitfarms can realize for its mined Bitcoin is not set by Bitfarms, but by the global, decentralized Bitcoin market.

For instance, Bitcoin's price experienced significant fluctuations throughout 2024. While specific daily figures vary, observing the price trends shows how market sentiment can drastically alter the revenue Bitfarms generates from its mining operations. If Bitcoin prices surge, the value of Bitfarms' mined reserves increases, and vice versa. This external price discovery mechanism grants the collective market, acting as a 'customer' for mined Bitcoin, substantial influence over Bitfarms' financial performance.

Miners typically join mining pools to smooth out their income, as the block rewards can be quite unpredictable otherwise. This means that while Bitfarms has its own infrastructure, its participation in these pools places it in a position where the pools, acting as intermediaries, could potentially influence the terms. However, miners retain the flexibility to switch between pools if they find more favorable conditions.

Potential for Direct Bitcoin Acquisition

The potential for direct Bitcoin acquisition significantly influences the bargaining power of customers. Large institutional investors and corporations that might otherwise be customers for Bitcoin can bypass mining companies by acquiring it directly from exchanges or over-the-counter (OTC) desks. This availability of alternative acquisition channels reduces their reliance on any single mining operation, thereby strengthening their negotiating position.

This direct access means that a significant portion of potential Bitcoin buyers, particularly those with substantial capital, are not solely dependent on miners for their supply. For instance, major financial institutions often utilize platforms like Coinbase Institutional or Kraken OTC for large-scale Bitcoin transactions. This direct route offers competitive pricing and immediate settlement, diminishing the leverage individual mining companies hold over these sophisticated buyers.

- Alternative Acquisition Channels: Institutional buyers can source Bitcoin directly from major cryptocurrency exchanges and OTC desks, bypassing mining operations.

- Reduced Dependence on Miners: The availability of direct acquisition methods lessens the dependence of large customers on any single mining company for their Bitcoin needs.

- Competitive Pricing and Efficiency: Direct channels often provide more competitive pricing and efficient transaction processes, further empowering buyers.

Increasing Focus on HPC/AI Services

As Bitfarms expands into High-Performance Computing (HPC) and Artificial Intelligence (AI) data center services, its customer base will evolve to include businesses with substantial computing needs. These clients, typically large corporations, are expected to wield considerable bargaining power. This is largely due to the competitive landscape of cloud computing providers and their demand for favorable pricing, unwavering reliability, and tailored service offerings.

The bargaining power of these new HPC/AI customers is amplified by several factors:

- High Switching Costs for Providers, Low for Customers: While it can be complex for Bitfarms to build out specialized HPC/AI infrastructure, customers can often switch between providers with relative ease if pricing or service levels are not met.

- Price Sensitivity and Volume: Large enterprises requiring significant computing power are highly sensitive to pricing and can negotiate bulk discounts, leveraging their potential volume. For instance, major cloud providers often offer tiered pricing structures that benefit high-usage clients.

- Availability of Alternatives: The market for HPC and AI services is increasingly crowded, with established hyperscalers and other specialized providers offering similar capabilities. This abundance of choice directly empowers customers to demand better terms.

For Bitfarms' core business of Bitcoin mining, customer bargaining power is virtually non-existent. The Bitcoin network itself dictates rewards, and the April 2024 halving reduced block subsidies to 3.125 BTC, a change no miner can influence. While miners can switch mining pools, this offers limited leverage. The true 'customer' for mined Bitcoin is the global market, whose price dictates Bitfarms' revenue, as seen in 2024's price volatility.

As Bitfarms diversifies into HPC and AI services, the bargaining power of its new corporate clients significantly increases. These customers are price-sensitive, can easily switch providers, and have numerous alternatives in a competitive market. For example, major cloud providers offer significant volume discounts, a factor Bitfarms will need to contend with.

| Customer Type | Bargaining Power Factor | Impact on Bitfarms |

|---|---|---|

| Bitcoin Network | Protocol-driven rewards, no negotiation | Zero direct bargaining power; revenue dictated by network design and market price. |

| Global Bitcoin Market | Market sentiment and demand | Significant indirect influence on realized price and revenue. |

| HPC/AI Clients (Large Corporations) | Price sensitivity, ease of switching, availability of alternatives | High bargaining power, demanding competitive pricing and favorable terms. |

What You See Is What You Get

Bitfarms Porter's Five Forces Analysis

This preview showcases the complete Bitfarms Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the cryptocurrency mining industry. You are viewing the exact, professionally formatted document that will be instantly available for download upon purchase, ensuring transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

The Bitcoin mining sector is a crowded space, with a significant number of public and private entities vying for market share. This intense competition means that profitability is often squeezed by the sheer volume of participants.

The network's hashrate, a measure of computing power, has seen consistent growth, reaching new all-time highs throughout 2024. For instance, the average hashrate in early 2024 was significantly higher than in previous years, directly increasing the difficulty of mining and the capital expenditure required to remain competitive.

The 2024 Bitcoin halving drastically cut mining rewards, squeezing profitability for companies like Bitfarms. This event intensified competition, as miners scrambled to upgrade to more power-efficient hardware to maintain margins.

This 'mining arms race' has pushed less efficient operations out, leading to market consolidation and a more concentrated, competitive environment. For instance, by Q1 2024, the average cost of Bitcoin production for many miners increased significantly compared to the pre-halving period.

Access to low-cost energy is a major differentiator in the cryptocurrency mining industry. Bitfarms, for instance, has strategically secured long-term power purchase agreements, often with hydroelectric facilities. In 2024, Bitfarms reported an average cost of electricity of approximately $0.04 per kilowatt-hour, significantly lower than many competitors who might face costs upwards of $0.08 or more per kWh.

This cost advantage directly impacts profitability, especially during periods of declining Bitcoin prices. Companies with cheaper power can continue to operate profitably when others are forced to power down their operations. The global search for such energy advantages is intense, with miners actively seeking locations offering stable, affordable, and increasingly renewable power sources.

Technological Advancements and Efficiency

The constant evolution of ASIC mining hardware, particularly in energy efficiency, significantly intensifies competition. Miners are compelled to invest in the newest models to achieve superior joule per terahash (J/TH) performance, a critical metric for profitability. This necessitates substantial capital outlay and forward-thinking fleet management to mitigate the risk of technological obsolescence.

This drive for efficiency means that companies like Bitfarms must continually assess and upgrade their mining rigs. For instance, the latest generation of ASICs, like the Bitmain Antminer S21, boasts efficiencies around 16-17 J/TH, a marked improvement over older models that might operate at 25-30 J/TH. Failing to adopt these advancements can lead to higher operational costs per bitcoin mined, directly impacting margins.

- Technological Obsolescence: The rapid pace of ASIC development means hardware can become outdated quickly, requiring continuous reinvestment.

- Capital Expenditure: Upgrading to the most efficient hardware demands significant and ongoing financial commitment.

- Efficiency Metrics: Joules per terahash (J/TH) is a primary benchmark, directly influencing operational costs and competitiveness.

- Strategic Fleet Management: Companies must strategically plan hardware acquisition and replacement cycles to maintain an edge.

Diversification into HPC/AI Services

Many Bitcoin miners, including Bitfarms, are actively expanding into high-performance computing (HPC) and AI data center services. This strategic shift aims to offset the inherent volatility of Bitcoin prices and capitalize on their existing robust infrastructure. For instance, by mid-2024, several publicly traded Bitcoin miners had announced significant investments or partnerships focused on HPC/AI, signaling a clear trend in the industry.

This diversification introduces a new competitive arena. Companies are now vying not just for Bitcoin mining rewards but also for lucrative contracts within the burgeoning AI computing sector. The demand for specialized processing power for AI applications is soaring, creating a parallel market where infrastructure efficiency and power availability are key differentiators.

- Increased Competition: The move into HPC/AI intensifies rivalry as traditional tech companies and new entrants also target this high-growth market.

- Infrastructure Leverage: Bitcoin miners with substantial, energy-efficient data center capacity have a distinct advantage in attracting AI workloads.

- Revenue Diversification: Successful entry into HPC/AI can provide more stable and predictable revenue streams compared to Bitcoin mining alone.

The competitive rivalry within Bitcoin mining is fierce, driven by a constant pursuit of efficiency and scale. The 2024 Bitcoin halving significantly reduced block rewards, intensifying the pressure on miners to lower operational costs. Companies like Bitfarms are investing heavily in newer, more energy-efficient ASIC hardware, with the latest models achieving efficiencies around 16-17 J/TH, a crucial factor for profitability in this environment.

Access to cheap, reliable energy remains a key differentiator, with Bitfarms securing power at approximately $0.04 per kWh in 2024. This cost advantage is vital as the network hashrate continues to climb, increasing mining difficulty. Furthermore, the industry is seeing a trend towards diversification into high-performance computing (HPC) and AI data centers, creating a new competitive landscape where infrastructure and power efficiency are paramount.

SSubstitutes Threaten

While Bitcoin is the dominant force, a vast array of alternative cryptocurrencies, often called altcoins, exist. These aim to offer similar functions like storing value or facilitating transactions. For instance, Ethereum's smart contract capabilities offer a different utility, and stablecoins like Tether aim for price stability, acting as a potential substitute for traditional fiat currency in certain digital transactions.

However, Bitcoin's established market capitalization, brand recognition, and network effect present a significant barrier to substitution. As of early 2024, Bitcoin’s market dominance remained substantial, though it has seen fluctuations. This entrenched position means that while altcoins offer alternatives, they haven't yet fully displaced Bitcoin's primary role as the leading digital asset for many investors and users.

Central Bank Digital Currencies (CBDCs) are a growing area of interest for governments worldwide, with many actively exploring or developing their own digital currencies. While these differ fundamentally from decentralized cryptocurrencies like Bitcoin, their potential widespread adoption could lessen the perceived need for private digital currencies. For instance, by mid-2024, over 130 countries were exploring CBDCs, representing significant progress in this area.

For investors looking for a place to store value or make a speculative bet, traditional financial assets like gold, real estate, or stocks can be seen as alternatives to Bitcoin. While Bitcoin is often pitched as digital gold, its wild price swings and unclear regulations might push some investors back to more familiar assets.

In 2024, the price of gold saw a significant surge, reaching all-time highs, which could draw capital away from riskier digital assets. Similarly, the stability of real estate, despite market fluctuations, offers a tangible asset that many find more secure than cryptocurrencies.

The broad appeal of equities, particularly in established companies with consistent dividend payouts, provides a reliable income stream and potential for capital appreciation, acting as a strong substitute for those wary of Bitcoin's speculative nature.

Cloud Computing and AI Infrastructure Providers

As Bitfarms expands into High-Performance Computing (HPC) and Artificial Intelligence (AI) infrastructure, the threat of substitutes is substantial, primarily from dominant cloud computing providers. Companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud offer extensive, scalable computing power and a wide array of pre-built AI services. These established players benefit from massive economies of scale and deep customer relationships, making it challenging for newer entrants like Bitfarms to compete directly on resource availability and pricing for general AI workloads.

Specialized AI infrastructure providers also represent a significant substitute threat. These firms often focus on specific AI hardware accelerators or optimized software stacks, offering tailored solutions that can outperform general-purpose computing for certain AI tasks. For instance, companies developing custom AI chips or highly efficient distributed computing frameworks can present a compelling alternative to generic cloud or Bitfarms' offerings. The market for AI infrastructure is dynamic, with rapid innovation potentially creating new substitute technologies or service models that could disrupt Bitfarms' market entry.

- Cloud Giants' Dominance: AWS, Azure, and Google Cloud collectively held over 65% of the global cloud infrastructure market share in early 2024, according to Synergy Research Group.

- AI Service Integration: These providers offer integrated AI/ML platforms, reducing the need for customers to build their own infrastructure from scratch.

- Specialized Hardware: The rise of AI-specific hardware, like NVIDIA's GPUs and emerging custom AI chips, provides alternatives for organizations prioritizing raw AI processing power.

Direct Investment in Bitcoin vs. Mining Stocks

Investors seeking exposure to Bitcoin's price movements have a significant substitute: direct investment in Bitcoin itself. This bypasses the operational risks and complexities inherent in Bitcoin mining companies like Bitfarms. For instance, in early 2024, Bitcoin's price experienced considerable volatility, presenting an alternative avenue for capital appreciation compared to the fluctuating profitability of mining operations.

This direct investment option acts as a powerful substitute by offering a simpler, albeit different, way to participate in the cryptocurrency market. While Bitfarms aims to capitalize on Bitcoin's price through mining efficiency, direct buyers simply hold the asset. This distinction is crucial when considering investor preferences and risk tolerance.

The availability of direct Bitcoin purchases means that capital which might otherwise flow into mining stocks can be diverted to holding Bitcoin. This can impact the demand for shares in companies like Bitfarms, especially during periods of high retail investor interest in acquiring the cryptocurrency directly.

- Direct Bitcoin Investment: Offers straightforward exposure to Bitcoin's price without the complexities of mining operations.

- Bypasses Operational Risks: Eliminates concerns related to energy costs, hardware failures, and regulatory changes affecting mining.

- Investor Preference: Appeals to investors prioritizing simplicity and direct asset ownership over indirect exposure through a mining company.

- Market Dynamics: Capital allocation to direct Bitcoin purchases can influence the demand for Bitcoin mining stocks.

The threat of substitutes for Bitfarms, particularly in its Bitcoin mining operations, is significant. Investors can directly purchase Bitcoin, bypassing the operational risks and complexities of mining companies. This direct investment offers a simpler route to participate in the cryptocurrency market, potentially diverting capital that might otherwise flow into mining stocks.

Moreover, traditional financial assets like gold and equities serve as alternative stores of value and investment vehicles. Gold's price surge in 2024 to record highs, and the perceived stability of equities, present compelling substitutes for investors wary of Bitcoin's volatility and the regulatory uncertainties surrounding mining operations.

In the High-Performance Computing (HPC) and AI infrastructure space, Bitfarms faces formidable substitutes from established cloud giants like AWS, Microsoft Azure, and Google Cloud. These providers, holding over 65% of the cloud infrastructure market share in early 2024, offer extensive, scalable computing power and integrated AI services, making it difficult for newer entrants to compete on scale and breadth of offerings.

| Substitute Type | Key Characteristics | Market Share/Data (Early 2024) | Impact on Bitfarms |

|---|---|---|---|

| Direct Bitcoin Investment | Simplicity, direct ownership, bypasses operational risk | Significant retail investor participation | Diverts capital from mining stocks |

| Gold | Store of value, tangible asset, historical stability | Record high prices in 2024 | Attracts risk-averse capital |

| Equities | Income generation (dividends), capital appreciation, established markets | Consistent performance in many sectors | Offers alternative investment returns |

| Cloud Computing (AWS, Azure, Google Cloud) | Scalability, broad AI service integration, economies of scale | >65% cloud infrastructure market share | Challenges Bitfarms in AI infrastructure |

Entrants Threaten

The threat of new entrants in Bitcoin mining, specifically concerning the high capital investment for infrastructure and hardware, is significant. Establishing an industrial-scale Bitcoin mining operation demands substantial upfront capital. This includes costs for land acquisition, developing robust power infrastructure, and purchasing specialized ASIC mining hardware, which can run into millions of dollars.

For instance, in 2024, the cost of high-end ASIC miners alone could easily exceed $10,000 per unit, and a large-scale facility would require thousands of these machines. This considerable financial barrier effectively deters many smaller or less capitalized potential entrants from entering the market, thus lowering the immediate threat.

The threat of new entrants into the Bitcoin mining sector, particularly concerning access to cheap and sustainable energy, is significantly dampened by existing infrastructure and long-term agreements. For instance, Bitfarms has secured power purchase agreements (PPAs) that provide them with a competitive edge. New miners would struggle to replicate these advantageous terms, as the most affordable and renewable energy sources are often already contracted.

The regulatory environment for cryptocurrency mining remains a significant hurdle for potential new entrants. This landscape is constantly shifting, with rules varying dramatically from one country or even state to another. For instance, in 2024, several jurisdictions continued to debate or implement new energy consumption standards for mining operations, directly impacting potential profitability and operational feasibility.

New companies entering the space must contend with the inherent risk of sudden policy shifts. These could include new taxes, stricter environmental regulations concerning energy usage, or even complete prohibitions on mining activities. Such unpredictability can deter investment and increase the cost of entry, as businesses must build in contingencies for a wide range of potential regulatory outcomes.

Intense Competition and Declining Profit Margins

The Bitcoin mining sector is already a crowded space, with dominant companies continuously investing in cutting-edge hardware and increasing their operational capacity. This ongoing investment cycle makes it difficult for newcomers to gain a foothold. For instance, in early 2024, the cost of high-end Bitcoin mining machines like the Bitmain Antminer S21 was reported to be around $10,000 to $12,000, a significant upfront investment for any new entrant.

Following the April 2024 Bitcoin halving, which reduced block rewards from 6.25 BTC to 3.125 BTC, profit margins for miners have been significantly compressed. This economic shift means that new entrants must possess substantial scale and operational efficiencies to compete effectively and achieve profitability. Without these advantages, the barrier to entry remains exceptionally high, deterring many potential new competitors.

- High Capital Investment: Acquiring the latest ASIC mining hardware, such as the Antminer S21, can cost upwards of $10,000 per unit, requiring substantial initial capital.

- Operational Efficiency is Key: Post-halving, miners with lower electricity costs and more efficient hardware are better positioned to survive and thrive.

- Economies of Scale: Larger mining operations benefit from bulk purchasing of hardware and electricity, creating a significant advantage over smaller, new entrants.

- Market Saturation: The existing competition from established players like Marathon Digital Holdings and Riot Platforms means new entrants face an uphill battle for market share and profitability.

Technological Expertise and Operational Complexity

The threat of new entrants in Bitcoin mining, particularly concerning technological expertise and operational complexity, is significant. Successfully running a mining operation demands intricate knowledge of specialized hardware, efficient cooling solutions, robust network infrastructure, and stringent cybersecurity measures. For instance, Bitfarms, a major player, invests heavily in optimizing its facilities to maintain competitive energy efficiency, a critical factor in profitability.

Newcomers without this deep technical understanding face a steep learning curve, potentially leading to higher initial costs and operational inefficiencies. This complexity acts as a barrier, as assembling and maintaining the necessary infrastructure, like Bitfarms' large-scale data centers, requires substantial upfront capital and specialized engineering talent. In 2024, the average cost to set up a professional Bitcoin mining operation can range from hundreds of thousands to millions of dollars, depending on scale and technology.

- High Capital Investment: Setting up mining farms involves significant expenditure on Application-Specific Integrated Circuits (ASICs), cooling systems, power infrastructure, and physical security.

- Technical Know-How: Expertise in hardware maintenance, firmware updates, network optimization, and energy management is crucial for efficient operation.

- Operational Scale: Achieving economies of scale, as seen with companies like Bitfarms operating multiple large facilities, is vital for cost competitiveness.

- Energy Procurement: Securing access to low-cost, reliable electricity is paramount, often requiring complex negotiations and infrastructure development.

The threat of new entrants into Bitcoin mining is substantially mitigated by the immense capital required for hardware and infrastructure. For example, in 2024, high-end ASIC miners alone cost over $10,000 per unit, demanding thousands for a large facility.

Furthermore, securing access to cheap, sustainable energy through long-term power purchase agreements, like those held by Bitfarms, presents a significant hurdle for newcomers. The regulatory landscape, with its evolving energy standards and potential policy shifts in 2024, also adds considerable risk and cost to entry.

The market's saturation with established, technologically advanced players, coupled with the economic pressures from the April 2024 halving, means new entrants must possess exceptional scale and efficiency to compete, making the threat of new entrants relatively low.

| Factor | Impact on New Entrants | Example (2024 Data) |

| Capital Investment (Hardware) | Very High Barrier | Antminer S21: ~$10,000 - $12,000 per unit |

| Energy Costs & Procurement | Significant Challenge | Long-term PPAs for low-cost energy are difficult to replicate |

| Regulatory Uncertainty | Increases Risk & Cost | Debates on energy consumption standards impacting operations |

| Technological Expertise | Steep Learning Curve | Requires specialized knowledge in hardware, cooling, and cybersecurity |

| Market Competition & Post-Halving Margins | Compresses Profitability | Reduced block rewards require greater scale and efficiency |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bitfarms is built upon a foundation of publicly available financial statements, investor presentations, and industry-specific market research reports. We also incorporate data from cryptocurrency exchanges, regulatory filings, and news outlets to capture the dynamic nature of the digital asset mining sector.