Bitfarms Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bitfarms Bundle

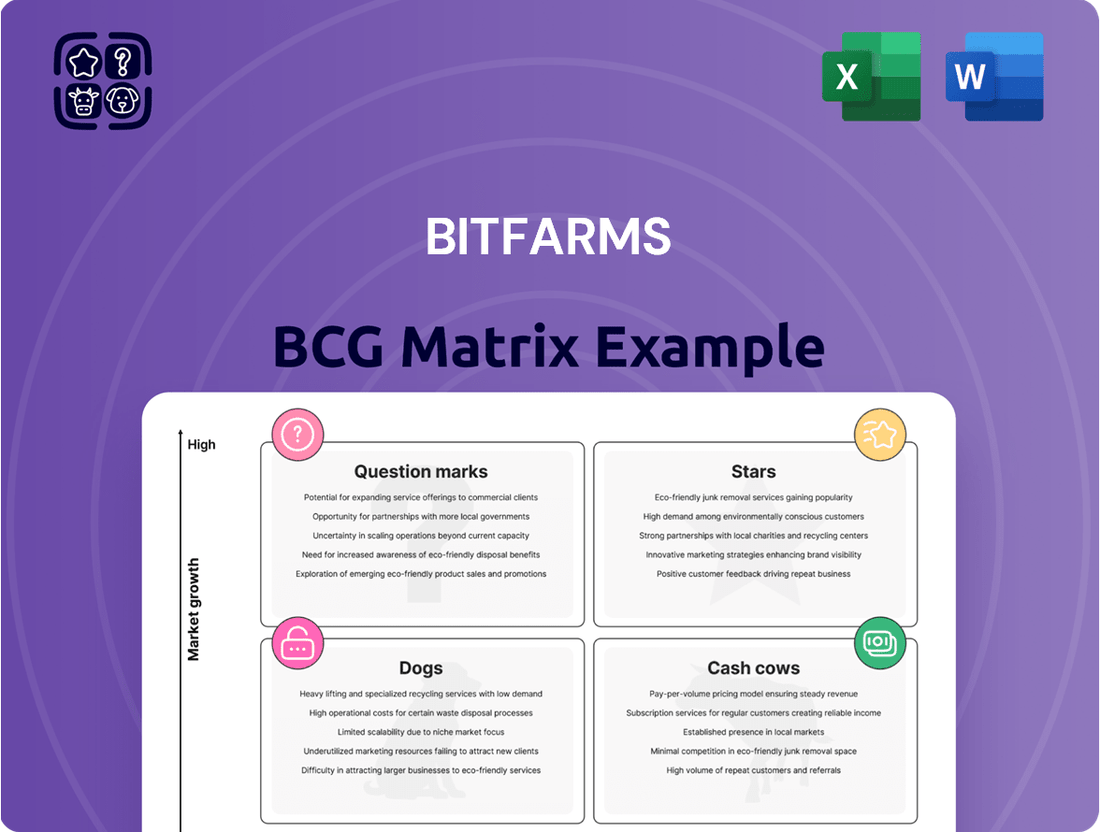

Curious about Bitfarms' position in the competitive cryptocurrency mining landscape? Our BCG Matrix preview offers a glimpse into their product portfolio's potential, highlighting areas of strength and opportunity. Understand where their mining operations might be generating significant returns and where new investments could be crucial for future growth.

Unlock the full strategic potential of Bitfarms' operations by diving into the complete BCG Matrix. This comprehensive report provides a detailed quadrant-by-quadrant analysis, revealing their Stars, Cash Cows, Dogs, and Question Marks. Equip yourself with the data-driven insights needed to make informed decisions and optimize your investment strategy.

Don't miss out on the complete picture! Purchase the full Bitfarms BCG Matrix for actionable insights and a clear roadmap to navigating the volatile crypto market. Gain a competitive edge by understanding exactly where to allocate resources for maximum impact and sustained profitability.

Stars

Bitfarms is making a significant strategic move into High-Performance Computing (HPC) and Artificial Intelligence (AI) infrastructure. This involves a substantial $300 million debt facility secured from Macquarie Group, primarily targeting development at their Panther Creek facility. This investment signals a clear intent to tap into the rapidly expanding AI market.

This pivot leverages Bitfarms' existing strengths, particularly its robust, large-scale energy infrastructure. This is a crucial differentiator in the capital-intensive HPC and AI sector, where reliable and cost-effective power is paramount. The company aims to capitalize on the escalating demand for AI-driven computing power.

Bitfarms is strategically expanding its U.S. footprint, notably in the PJM region, by acquiring assets like Stronghold Digital Mining. This move grants access to cost-effective power and a substantial energy pipeline, enhancing operational efficiency.

This U.S. expansion diversifies Bitfarms' geographical risk and targets increased yields per megawatt. Such a strategy is vital for optimizing both its Bitcoin mining operations and its burgeoning High-Performance Computing (HPC) and Artificial Intelligence (AI) ventures.

Bitfarms boasts an impressive operational hashrate, reaching 19.5 EH/s as of April 2025. This significant computing power places them among the leading Bitcoin miners globally.

Furthermore, their fleet efficiency has seen a notable improvement, now standing at 19 w/TH. This enhanced efficiency is crucial for managing operational expenses, especially in an environment with fluctuating energy costs and Bitcoin prices.

The combination of a high hashrate and superior efficiency directly contributes to Bitfarms' profitability in its core mining operations. These competitive metrics allow them to maintain a strong position within the dynamic cryptocurrency mining sector.

Strategic Partnerships and Validation

Bitfarms' strategic partnerships, such as the one with Macquarie Group for High-Performance Computing (HPC) data center development, are crucial for its growth. These collaborations offer significant third-party validation of its HPC strategy, bringing in essential expertise and accelerating project timelines.

Collaborations with entities like ASG and WWT for infrastructure analysis further bolster Bitfarms' approach. These alliances not only validate the company's strategic direction but also unlock new avenues for future development and market penetration. For instance, in 2023, Bitfarms announced a collaboration with Macquarie Asset Management to explore opportunities in the HPC sector, highlighting the importance of such strategic alliances.

- Macquarie Group Partnership: Focuses on developing HPC data centers, leveraging Macquarie's financial and operational expertise.

- ASG and WWT Collaborations: Provide critical infrastructure analysis and support, enhancing operational efficiency and strategic planning.

- Third-Party Validation: These partnerships serve as strong endorsements of Bitfarms' HPC strategy, increasing investor confidence and market credibility.

- Accelerated Development: Access to specialized knowledge and resources through these alliances speeds up the deployment and scaling of HPC initiatives.

Share Buyback Program

Bitfarms' initiation of a share buyback program in Q1 2025, targeting up to 10% of its public float, is a strategic move. This action suggests management believes the company's stock is undervalued. It also demonstrates a commitment to increasing shareholder value by reducing the number of outstanding shares.

The buyback program is expected to positively impact key financial metrics. By reducing the share count, earnings per share (EPS) will likely increase, making the stock appear more attractive to investors. Furthermore, it helps to offset potential equity dilution from other capital-raising activities.

- Management Confidence: The buyback signals belief in Bitfarms' intrinsic value.

- Shareholder Value: Aims to boost EPS and return capital to shareholders.

- Dilution Control: Counteracts the effects of stock options or future issuances.

- Market Signal: A positive indicator of financial health and future prospects.

Stars in the BCG matrix represent business units with high market share in a high-growth market. Bitfarms' burgeoning High-Performance Computing (HPC) and Artificial Intelligence (AI) infrastructure ventures, supported by a $300 million debt facility from Macquarie Group, fit this description. The company is strategically investing in this rapidly expanding sector, leveraging its existing energy infrastructure as a key competitive advantage.

The company's aggressive expansion into the U.S. market, particularly in the PJM region through acquisitions like Stronghold Digital Mining, further solidifies its position in a high-growth area. This expansion not only diversifies risk but also secures access to cost-effective power, crucial for scaling HPC and AI operations. With an operational hashrate of 19.5 EH/s as of April 2025 and an improved fleet efficiency of 19 w/TH, Bitfarms is demonstrating strong performance in its core business, which can fund and support these new ventures.

| Metric | Value (as of April 2025) | Significance for Stars |

|---|---|---|

| Operational Hashrate | 19.5 EH/s | Indicates a significant market presence in crypto mining, providing a strong foundation. |

| Fleet Efficiency | 19 w/TH | Demonstrates operational excellence, crucial for profitability and reinvestment. |

| HPC/AI Investment | $300 million debt facility | Highlights substantial investment in a high-growth market, positioning it as a Star. |

| U.S. Expansion | Acquisition of Stronghold Digital Mining | Secures cost-effective power and expands footprint in a key growth region. |

What is included in the product

Bitfarms BCG Matrix highlights which mining segments to invest in, hold, or divest based on their market share and growth.

A clear Bitfarms BCG Matrix provides a visual roadmap, alleviating the pain of strategic uncertainty.

Cash Cows

Bitfarms' existing Bitcoin mining operations represent a significant Cash Cow. As of the first quarter of 2024, the company reported a total hashrate of 7.3 EH/s, demonstrating a substantial and established presence in the mining sector. These operations are crucial for generating consistent revenue and cash flow, providing a stable financial bedrock for the company.

While the growth trajectory of the pure Bitcoin mining market may not match the rapid expansion seen in areas like AI, these mature operations are invaluable. They offer a reliable income stream, which is essential for funding new ventures and weathering market volatility. In Q1 2024, Bitfarms mined 1,233 BTC, underscoring the ongoing productivity of these assets.

Bitfarms' vertically integrated infrastructure, encompassing in-house management, electrical engineering, and dedicated repair centers, is a key component of its operations. This self-sufficiency allows for meticulous cost control and enhanced operational efficiency across its mining facilities.

This integrated approach directly translates to optimized resource utilization, a critical factor in the competitive cryptocurrency mining landscape. By managing all aspects of its infrastructure, Bitfarms can potentially achieve higher profit margins on its mining activities.

For instance, in the first quarter of 2024, Bitfarms reported a total hashrate of 8.4 EH/s, with a significant portion powered by their own efficient infrastructure. This operational control is crucial for maintaining competitiveness, especially as energy costs remain a primary expense in mining.

Bitfarms' focus on renewable energy, particularly hydroelectric power, is a significant strength. In 2023, approximately 99% of their energy consumption was sourced from renewables, a testament to their commitment. This strategy not only lowers operational costs but also positions them favorably with investors prioritizing ESG factors.

This reliance on stable, often lower-cost hydroelectric power through long-term contracts provides a competitive edge in the energy-intensive cryptocurrency mining sector. For instance, their average cost of electricity in 2023 was reported to be around $0.04 per kilowatt-hour, significantly below industry averages.

Bitcoin Holdings

Bitfarms' treasury holdings of Bitcoin, valued at $94 million as of April 2025, position this asset as a significant cash cow within its operations. This substantial Bitcoin reserve, a direct result of its mining activities, offers considerable flexibility for liquidity needs or potential capital appreciation.

These holdings are a testament to Bitfarms' successful core business of Bitcoin mining, directly translating operational output into a valuable treasury asset. The $94 million valuation underscores the significance of Bitcoin as a primary driver of the company's financial strength.

- Bitcoin Treasury: $94 million as of April 2025.

- Source: Direct outcome of core mining operations.

- Strategic Value: Can be leveraged for liquidity or value appreciation.

- Market Exposure: Subject to Bitcoin's inherent market volatility.

Low Capex on Current Mining Fleet

Bitfarms' existing mining fleet is a prime example of a cash cow within its business portfolio. With no significant capital expenditures planned for new miner acquisitions in 2025 and 2026, the operational costs for maintaining the current fleet are notably low. This strategic decision frees up substantial capital that can be strategically reallocated to the company's burgeoning high-performance computing (HPC) ventures, which represent the growth engine for Bitfarms.

The existing mining assets continue to be a reliable source of cash generation. For instance, as of the first quarter of 2024, Bitfarms reported a total hashrate of 7.5 EH/s, demonstrating the operational capacity of its fleet. This consistent cash flow from mining operations provides a stable financial foundation, enabling the company to pursue its ambitious growth strategies without relying heavily on external financing for its HPC initiatives.

- Low Capex: No major miner purchases planned for 2025-2026, minimizing capital outlay on the existing fleet.

- Cash Generation: The current mining fleet continues to produce consistent cash flow.

- Capital Reallocation: Freed-up capital is directed towards high-growth HPC initiatives.

- Operational Efficiency: Maintaining the existing fleet requires minimal ongoing investment, maximizing profitability.

Bitfarms' established Bitcoin mining operations are its primary cash cows, consistently generating revenue and cash flow. The company's hashrate reached 8.4 EH/s in Q1 2024, showcasing the scale of these mature assets. These operations provide the financial stability needed to fund new growth areas, like their high-performance computing ventures.

The company's strategic decision to minimize capital expenditures on new mining hardware for 2025 and 2026 further solidifies the existing fleet's role as cash cows. This focus on operational efficiency and low ongoing investment allows for significant capital reallocation to more dynamic growth sectors.

Furthermore, Bitfarms' substantial Bitcoin treasury, valued at $94 million as of April 2025, acts as another significant cash cow. This reserve, a direct result of successful mining, offers financial flexibility and potential for capital appreciation, underscoring the profitability of their core business.

| Metric | Q1 2024 | April 2025 | Significance |

|---|---|---|---|

| Total Hashrate | 8.4 EH/s | N/A | Indicates operational capacity of cash cow assets. |

| Bitcoin Mined | 1,233 BTC | N/A | Direct revenue generation from mining operations. |

| Bitcoin Treasury | N/A | $94 million | Valuable asset generated from mining, providing liquidity. |

| Miner Capex (2025-2026) | Minimal | Minimal | Maximizes cash flow from existing fleet by reducing reinvestment. |

Delivered as Shown

Bitfarms BCG Matrix

The Bitfarms BCG Matrix preview you see is the actual, complete document you will receive upon purchase. This means you get the fully formatted, analysis-ready report without any watermarks or demo content, ensuring immediate usability for your strategic planning.

Dogs

Non-optimized or underperforming mining sites represent Bitfarms' 'Dogs' in the BCG matrix. These are locations struggling with operational inefficiencies or significantly higher energy costs than the company's average, potentially leading to reduced profit margins or even losses. For instance, if a site's cost per kilowatt-hour is substantially above Bitfarms' overall average of approximately $0.04 (as of early 2024), its profitability would be directly impacted.

These underperforming assets tie up valuable capital that could be better deployed elsewhere, hindering overall growth and efficiency. While Bitfarms has not publicly detailed specific underperforming sites, their strategic shift to establish operations in the U.S., particularly in regions with favorable energy costs, implies a potential divestment or optimization of less efficient international locations to improve the company's overall performance.

Outdated mining hardware, characterized by a higher power consumption per terahash, represents Bitfarms' Dogs in the BCG Matrix. This older generation equipment struggles to keep pace with the increasing Bitcoin mining difficulty and the introduction of more efficient ASICs.

In 2023, the average power efficiency of Bitcoin mining hardware continued to improve, with newer models achieving efficiencies below 25 Joules per Terahash (J/TH). Older machines, potentially used by Bitfarms, might operate at efficiencies exceeding 40 J/TH, making them significantly less profitable as electricity costs rise and network difficulty increases.

Operations in high-cost energy regions, such as those Bitfarms may have previously operated in, can be viewed as question marks in the BCG Matrix. These locations, where electricity expenses significantly outweigh revenue potential, directly hinder profitability. For instance, in 2023, Bitfarms reported an average cost of electricity per kilowatt-hour that varied by location, with some areas being considerably more expensive than others, impacting their overall operational efficiency.

Bitfarms' strategic decision to consolidate operations within the United States and actively pursue the acquisition of lower-cost power sources demonstrates a clear move away from these less profitable, high-cost energy environments. This proactive divestment strategy aims to optimize their energy expenditure, a critical factor in the competitive cryptocurrency mining landscape, thereby improving their financial performance and positioning them more favorably for future growth.

Paraguayan Data Center Disposition

Bitfarms' strategic disposition of its 200 MW Yguazu data center in Paraguay, announced in early 2024, can be interpreted through the lens of the BCG Matrix. This sale, while aimed at portfolio rebalancing, indicates that the Yguazu facility, in its prior operational context, may not have fit Bitfarms' long-term strategic objectives. Such divestitures often occur when an asset is underperforming or requires significant capital to meet growth targets, aligning with the characteristics of a 'Dog' in the matrix.

The decision to sell the Paraguayan asset suggests a shift in focus towards more strategically advantageous locations or operational models. For instance, Bitfarms has been actively expanding its operations in North America, particularly in the United States and Canada, aiming for greater energy efficiency and proximity to key markets. The company reported a total hashrate of 7.7 EH/s as of March 2024, with ongoing projects to further increase capacity.

- Strategic Divestment: The sale of the 200 MW Yguazu data center in Paraguay, completed in early 2024, represents a strategic move to optimize Bitfarms' asset portfolio.

- 'Dog' Classification: This asset's disposition suggests it was no longer aligned with the company's optimal long-term strategy, fitting the 'Dog' quadrant of the BCG Matrix due to potential underperformance or strategic misalignment.

- Portfolio Rebalancing: The sale facilitates a rebalancing of Bitfarms' operational footprint, allowing for reallocation of capital and management focus to more promising growth areas.

- Focus on North America: Bitfarms has emphasized expansion in North America, with significant investments in the United States and Canada, aiming for enhanced operational efficiency and market access.

Argentine Operations with Reduced Revenue

Bitfarms' operations in Argentina are currently facing significant headwinds, leading to a notable decline in revenue. The company reported a substantial drop in earnings from this region during the first quarter of 2025. This downturn is largely attributed to operational disruptions, most notably the interruption of electricity supply to its Rio Cuarto facility.

The challenges in Argentina, characterized by reduced revenue generation and operational hurdles, place these operations in a position akin to a 'Dog' within the BCG Matrix. This classification signifies a business segment with low market share and low growth prospects, requiring careful consideration regarding future investment or potential divestment.

- Argentine Revenue Decline: Q1 2025 saw a significant revenue decrease from the company's Argentine operations.

- Operational Halt: The Rio Cuarto facility experienced a halt in electricity supply, directly impacting its productivity.

- Underperformance: These factors collectively indicate underperformance, potentially classifying the segment as a 'Dog'.

- Strategic Review: The current situation necessitates a strategic review of the Argentine business unit's viability.

Bitfarms' 'Dogs' in the BCG matrix represent underperforming assets or operations that consume resources without generating substantial returns. These can include older, less efficient mining hardware or facilities in regions with high operational costs and regulatory uncertainties. For example, if older ASICs have efficiencies above 30 J/TH, they are significantly less profitable than newer models achieving under 25 J/TH, especially with electricity costs hovering around $0.04/kWh in favorable locations.

The strategic divestment of its 200 MW Yguazu data center in Paraguay in early 2024 exemplifies this classification. This move suggests that the facility, in its prior operational state, was not meeting Bitfarms' performance benchmarks or strategic goals, fitting the 'Dog' profile. Such actions are crucial for portfolio optimization, allowing capital to be redirected to more productive ventures, like their expanding North American operations which aim for enhanced efficiency.

The company's operations in Argentina, particularly the Rio Cuarto facility's electricity supply interruptions in Q1 2025, have led to a significant revenue decline in that region. This underperformance, coupled with operational disruptions, firmly places these Argentine operations in the 'Dog' category, indicating low market share and growth prospects that warrant a strategic re-evaluation.

Question Marks

Bitfarms' strategic move into High-Performance Computing (HPC) and Artificial Intelligence (AI) data centers positions it as a Question Mark within its business portfolio. This sector is experiencing explosive growth, with the global AI market alone projected to reach $1.8 trillion by 2030, according to some estimates. Bitfarms' entry, however, is recent, placing it against well-entrenched players with extensive experience and infrastructure.

The company's success in this nascent area depends on its ability to secure significant contracts with major enterprises and consistently provide the high-availability, specialized computing power these clients demand. For context, the demand for AI-specific chips, like those from NVIDIA, saw a substantial surge in 2024, indicating the market's appetite for advanced computing solutions.

Panther Creek Development, while promising with substantial funding, is currently positioned as a Question Mark in Bitfarms' BCG Matrix. This classification stems from the significant execution risks associated with constructing large-scale High-Performance Computing (HPC) data centers, despite favorable conditions like power availability and robust fiber connectivity. The project's success hinges on timely and efficient development to transition it into a Star performer.

Bitfarms is actively exploring potential acquisitions in the U.S. to bolster its High-Performance Computing (HPC) and Artificial Intelligence (AI) initiatives. This strategic move signals a significant pivot towards diversifying its revenue streams beyond traditional Bitcoin mining.

These prospective acquisitions are currently considered question marks within the BCG matrix. Their ultimate contribution to Bitfarms' strategic shift hinges on successful integration and the realization of anticipated synergies and market penetration.

In 2024, Bitfarms reported a substantial increase in its focus on HPC, with significant investments allocated to this segment. The company aims to leverage its existing infrastructure and energy expertise to capture a share of the rapidly growing AI compute market.

Attracting High-Value HPC/AI Counterparties

Attracting high-value High-Performance Computing (HPC) and Artificial Intelligence (AI) counterparties to Bitfarms' new data centers is currently a significant question mark. While the company is building out the necessary infrastructure, the crucial step is securing those lucrative, long-term agreements with major clients. This is paramount for the financial viability and profitability of this expansion. For instance, in 2024, the demand for specialized HPC/AI data center capacity is soaring, with major tech companies actively seeking such resources. Securing even one large contract could significantly de-risk this venture.

The success hinges on Bitfarms' ability to demonstrate its value proposition to these sophisticated clients. This includes not only competitive pricing but also the reliability, scalability, and specialized cooling solutions required for intensive AI workloads. The company's existing expertise in managing large-scale computing operations, primarily for Bitcoin mining, provides a foundation, but the HPC/AI market has distinct demands. As of early 2025, the market for AI-specific data center solutions is experiencing rapid growth, with projections indicating continued expansion throughout the year.

- Infrastructure Development: Bitfarms is investing in new data center facilities to cater to HPC/AI demands.

- Client Acquisition Challenge: The key challenge lies in attracting and securing contracts with high-value HPC/AI counterparties.

- Market Demand: There is substantial and growing demand for specialized HPC/AI data center capacity in 2024 and beyond.

- Value Proposition: Success depends on offering competitive pricing, reliability, scalability, and specialized cooling solutions.

Integration of New HPC/AI Talent and Expertise

Bitfarms is actively bolstering its management with specialized hires in High-Performance Computing (HPC) and Artificial Intelligence (AI), alongside crucial infrastructure roles. This strategic move aims to enhance operational efficiency and explore diversification avenues beyond traditional Bitcoin mining. For instance, as of Q1 2024, Bitfarms reported a significant increase in its computing power, indicating a growing investment in advanced infrastructure.

The company is also actively seeking external partnerships to leverage specialized knowledge in HPC and AI. This collaborative approach is designed to accelerate the integration of these advanced technologies into their existing Bitcoin mining operations. By bringing in external expertise, Bitfarms aims to identify and capitalize on new opportunities, potentially expanding their service offerings.

The effective integration of this new talent and expertise into the existing Bitcoin mining operational framework is a key 'Question Mark' for Bitfarms. Success here will directly impact their diversification strategy. For example, if the new hires can optimize energy consumption through AI-driven insights, it could lead to substantial cost savings, a critical factor in the competitive mining landscape. Their ability to translate HPC capabilities into tangible benefits for the core mining business or new ventures remains a critical variable for future growth.

- Hiring Focus: Bitfarms is bringing in talent with expertise in HPC and AI to its management team.

- External Collaboration: The company is also engaging external partners for specialized knowledge in these advanced fields.

- Strategic Impact: The successful integration of this new talent and expertise is crucial for Bitfarms' diversification strategy.

- Operational Enhancement: This move is expected to improve the efficiency of their existing Bitcoin mining operations.

Bitfarms' expansion into High-Performance Computing (HPC) and Artificial Intelligence (AI) data centers represents a significant strategic pivot, positioning these new ventures as Question Marks in its business portfolio. The company's ability to attract major clients for these specialized services is a critical unknown, given the intense competition and the need for proven reliability. The success of these initiatives hinges on securing lucrative, long-term contracts, a challenge highlighted by the booming demand for AI compute capacity in 2024.

The company's investment in new infrastructure and the hiring of specialized talent are key steps, but the ultimate success of its diversification into HPC/AI remains uncertain. The ability to translate these investments into profitable operations, particularly by securing high-value counterparties, is the primary question mark. As of early 2025, the market for AI data centers is expanding rapidly, presenting both opportunity and significant competitive pressure.

Panther Creek Development, a large-scale HPC data center project, is also a Question Mark due to execution risks, despite favorable site conditions. Bitfarms' potential U.S. acquisitions for its HPC/AI segment are similarly uncertain, their value dependent on successful integration and synergy realization.

| Initiative | BCG Classification | Key Uncertainty | Market Context (2024/2025) |

|---|---|---|---|

| HPC/AI Data Centers | Question Mark | Client acquisition and contract securing | High demand, intense competition |

| Panther Creek Development | Question Mark | Project execution and timely completion | Growing need for specialized infrastructure |

| U.S. Acquisitions (HPC/AI) | Question Mark | Successful integration and synergy realization | Strategic diversification efforts |

BCG Matrix Data Sources

Our Bitfarms BCG Matrix leverages a comprehensive blend of internal financial statements, operational data, and external market research reports to accurately assess business unit performance and market dynamics.