Bioventus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bioventus Bundle

Bioventus leverages its strong position in the orthobiologics market, driven by innovative product pipelines and established distribution channels. However, navigating regulatory hurdles and intense competition presents significant challenges that require strategic foresight.

Want the full story behind Bioventus's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bioventus boasts a diverse and clinically differentiated product portfolio, a significant strength. This range includes innovative treatments for osteoarthritis, fracture healing, and various surgical solutions, allowing them to serve a broad spectrum of musculoskeletal conditions. Such diversification reduces their dependence on any single product, offering a more stable revenue stream.

Their focus on clinically proven, minimally invasive treatments resonates strongly with modern healthcare demands. In 2023, Bioventus reported approximately $440 million in revenue, with a substantial portion stemming from their orthobiologics segment, underscoring the market's acceptance of their differentiated offerings.

Bioventus is showing impressive organic growth within its key business areas. For instance, in the first quarter of 2025, even with a reported overall revenue dip because of a divestiture, the company saw a solid 5% organic growth in its core segments like Surgical Solutions and Restorative Therapies. This highlights a strong demand for their main products and successful sales approaches.

The company's performance in specific product lines is particularly noteworthy. Bioventus achieved double-digit organic revenue growth in its Pain Treatments and Surgical Solutions categories. This surge directly contributed to a substantial increase in Adjusted EBITDA during the fourth quarter of 2024, underscoring the financial health and market acceptance of these offerings.

Bioventus demonstrated strong financial improvement, with adjusted earnings per share (EPS) seeing a notable rise in the first quarter of 2025. This uptick is a direct result of the company's successful cost management initiatives and streamlined operational processes.

Looking ahead, Bioventus projects a substantial increase in cash from operations for 2025, nearly doubling the 2024 figures. Furthermore, the company anticipates a reduction in its net leverage, signaling a healthier balance sheet and improved financial flexibility.

The company’s reaffirmation of its 2025 financial guidance for both organic revenue growth and adjusted EBITDA underscores a positive and stable financial outlook. This consistent performance trajectory indicates Bioventus is on a solid path toward enhanced profitability and greater financial resilience.

Strategic Divestitures and Focus on Core

Bioventus' strategic divestitures represent a significant strength, allowing for a sharper focus on its most promising areas. The sale of its Advanced Rehabilitation business, completed in late 2024 and early 2025, is a prime example. While this move impacted reported revenue figures, it’s a calculated step to concentrate resources on higher-growth orthobiologics segments.

This streamlining is crucial for enhancing operational efficiency and resource allocation. By shedding non-core assets, Bioventus can better invest in and develop its key orthobiologics products, which are positioned for stronger market potential. This strategic alignment with their mission of active healing is a key driver for future success.

- Divestiture of Advanced Rehabilitation business: Completed late 2024/early 2025.

- Enhanced focus on core segments: Orthobiologics identified as primary growth drivers.

- Improved resource allocation: Capital and management attention redirected to high-potential areas.

- Strategic alignment: Reinforces commitment to the active healing market.

Strong Analyst Consensus and Market Position

Analysts are overwhelmingly positive on Bioventus, with a consensus 'Strong Buy' rating and a substantial projected stock price increase, reflecting strong confidence in its future. This analyst sentiment is a significant strength, signaling robust faith in the company's strategic direction and operational execution.

Bioventus holds a prominent position within the orthobiologics sector, a market poised for considerable expansion. This growth is driven by demographic shifts, including an aging global population, and a rise in sports-related injuries, both of which increase demand for Bioventus's innovative solutions.

- Analyst Consensus: Predominantly 'Strong Buy' recommendations.

- Price Targets: Significant upside potential projected by analysts.

- Market Position: Key player in the growing orthobiologics market.

- Market Growth Drivers: Aging population and increasing sports injuries.

Bioventus's product line is a significant advantage, offering a wide range of clinically proven treatments for various musculoskeletal issues. Their focus on minimally invasive solutions aligns with current healthcare trends, as evidenced by their substantial revenue contribution from orthobiologics. The company is experiencing strong organic growth, particularly in their Pain Treatments and Surgical Solutions segments, which saw double-digit increases in early 2025.

Strategic divestitures, such as the sale of the Advanced Rehabilitation business in late 2024/early 2025, demonstrate Bioventus's commitment to focusing on high-growth orthobiologics. This allows for improved resource allocation and operational efficiency, strengthening their position in the active healing market.

The company's financial outlook for 2025 is robust, with projected increases in cash from operations and a reduction in net leverage. Analysts are highly optimistic, with a consensus 'Strong Buy' rating and significant upside potential, reflecting confidence in Bioventus's strategic direction and market positioning within the expanding orthobiologics sector.

| Metric | Q1 2025 (Reported) | Full Year 2024 (Estimated/Reported) | Full Year 2025 (Projected) |

|---|---|---|---|

| Organic Revenue Growth (Core Segments) | 5% | N/A | Positive |

| Adjusted EBITDA | N/A | Increased (Q4 2024) | Positive Growth |

| Cash from Operations | N/A | N/A | Nearly Doubled vs. 2024 |

| Net Leverage | N/A | N/A | Reduced |

What is included in the product

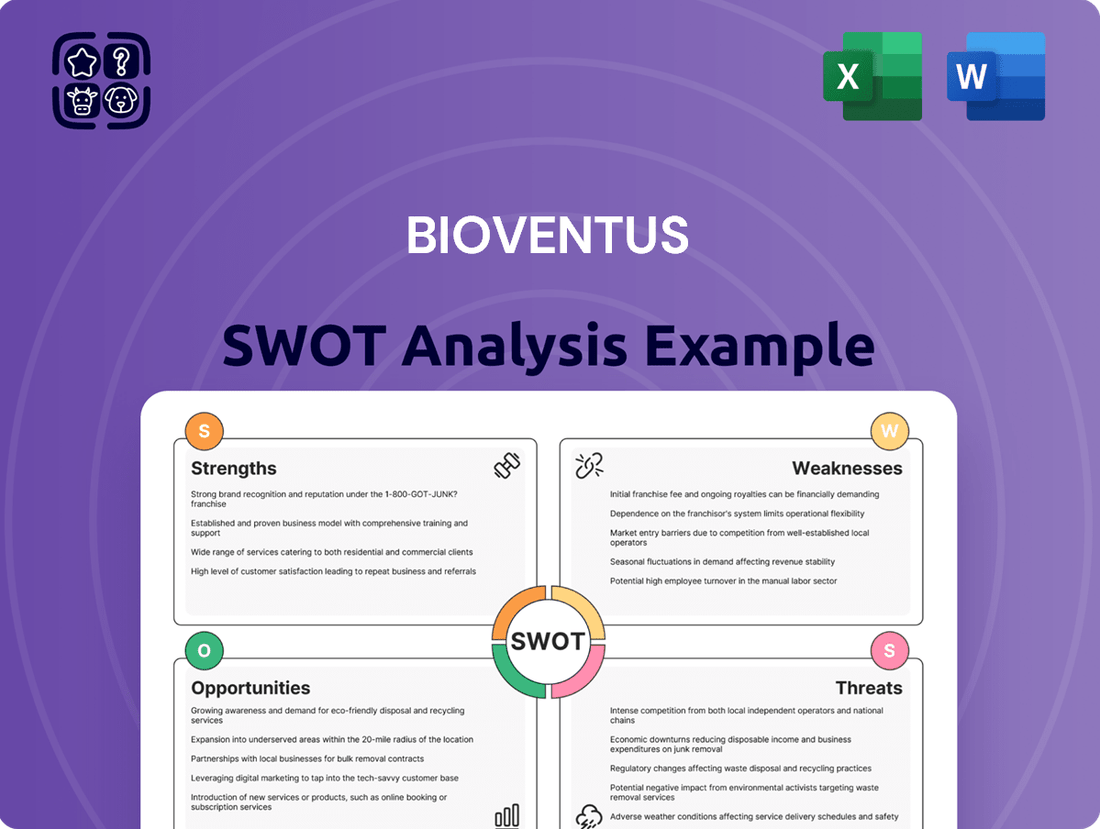

Delivers a strategic overview of Bioventus’s internal and external business factors, mapping its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Bioventus's strategic challenges and opportunities in pain management.

Weaknesses

Bioventus saw its overall revenue drop by 4% in the first quarter of 2025. This dip, despite positive organic growth, stems from the company's strategic decision to sell off its Advanced Rehabilitation business. While this divestiture is a calculated move for future focus, it undeniably creates a short-term drag on reported revenue, which can be viewed as a weakness in its current financial reporting.

The divestiture of Bioventus' Advanced Rehabilitation business in 2023 had a substantial negative impact on its Restorative Therapies segment. This strategic move led to a significant 35% revenue decline within that segment, underscoring a key weakness tied to the reliance on this particular business line.

Bioventus exhibits a high debt-to-equity ratio, a notable weakness that signals increased financial risk. For instance, as of the first quarter of 2024, Bioventus reported a debt-to-equity ratio of approximately 2.6, significantly above the commonly accepted benchmark of 1.0 or 40% of equity.

This elevated leverage means the company relies heavily on borrowed funds, which can strain its ability to manage cash flow and meet its financial obligations, especially during economic downturns. Such a high ratio may also limit Bioventus's flexibility in pursuing new investment opportunities or strategic acquisitions without further increasing its debt burden.

Dependency on Distributor Orders for Pain Treatments

Bioventus's reliance on distributor orders for its pain treatment portfolio presents a notable weakness. For instance, in the first quarter of 2025, revenue growth in this segment experienced a slowdown due to a reduction in distributor purchases. This followed a period of elevated buying activity from distributors at the close of the preceding year.

This pattern highlights a potential vulnerability to the cyclical purchasing behaviors of distributors. Such susceptibility can lead to unpredictable quarterly fluctuations in revenue for Bioventus's pain treatment offerings, making consistent financial performance more challenging to achieve.

- Distributor Purchasing Patterns: The company's revenue is sensitive to when distributors choose to stock up on pain treatment products, leading to uneven sales periods.

- Q1 2025 Impact: A clear example is the Q1 2025 performance, where distributor inventory replenishment in late 2024 caused a dip in subsequent orders.

- Revenue Volatility: This dependency can introduce volatility into the financial results for the pain treatment segment, impacting predictability.

Market Reaction to Q1 2025 Earnings

Despite surpassing earnings per share (EPS) expectations for Q1 2025 and demonstrating organic growth, Bioventus' stock saw a notable downturn. The shares declined in premarket trading and continued to fall following the Q1 earnings call. This negative investor sentiment suggests that factors beyond the reported operational successes, such as the overall revenue contraction or persistent cash flow concerns, are significantly influencing market perception.

The market's reaction highlights a potential disconnect between operational performance and investor confidence. While Bioventus reported an EPS of $0.15, beating the consensus estimate of $0.12, and achieved 2% organic growth, the stock price movement indicated that these positives were overshadowed by other financial pressures. Investors are likely scrutinizing the company's broader financial health, including its ability to generate consistent revenue growth and manage its cash flow effectively, which may be viewed as more critical indicators of long-term value.

- Q1 2025 EPS Beat: Bioventus reported $0.15 EPS, exceeding the $0.12 forecast.

- Organic Growth: The company achieved 2% organic growth in Q1 2025.

- Stock Decline: Shares fell in premarket and post-earnings trading.

- Investor Concerns: Revenue decline and cash flow challenges may be outweighing positive operational metrics.

Bioventus's significant debt load remains a key weakness. With a debt-to-equity ratio around 2.6 in Q1 2024, the company carries substantial financial risk, potentially limiting its ability to invest or manage economic downturns effectively.

| Financial Metric | Value (Q1 2024) | Benchmark/Implication |

|---|---|---|

| Debt-to-Equity Ratio | ~2.6 | Significantly above the typical benchmark of 1.0, indicating high financial leverage and risk. |

Preview the Actual Deliverable

Bioventus SWOT Analysis

This is the actual Bioventus SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It delves into the company's internal strengths and weaknesses, as well as external opportunities and threats. This comprehensive view is crucial for strategic planning.

Opportunities

The global orthobiologics market is on a strong upward trajectory, projected to surpass $10 billion by 2035, growing at a compound annual growth rate of 5.9% starting in 2025. This expansion is fueled by an aging demographic, a rise in sports-related injuries, and greater acceptance of less invasive treatments.

This robust market growth presents a significant opportunity for Bioventus, directly supporting the expansion of its core product offerings and market reach within the regenerative medicine space.

The orthobiologics market is projected to experience substantial growth, fueled by ongoing technological advancements and a global trend favoring regenerative medicine approaches like stem cell therapy and tissue engineering. This expansion is expected to reach an estimated $15.2 billion by 2027, up from $7.8 billion in 2021, representing a compound annual growth rate of 11.8%.

Bioventus, with its focus on active healing, is well-positioned to leverage these innovations. The company can explore opportunities by increasing its investment in research and development or by forming strategic alliances to broaden its portfolio with these forward-looking regenerative therapies.

Bioventus recently expanded its pain treatment portfolio by acquiring the XCELL PRP system via a distribution agreement. This move allows them to tap into the rapidly growing Platelet-Rich Plasma (PRP) market, estimated to reach over $1 billion by 2027, by leveraging their established commercial infrastructure and expertise in hyaluronic acid treatments.

Increased Demand for Minimally Invasive Procedures

There's a significant and growing patient preference for minimally invasive procedures within the orthopedic sector. This trend directly supports Bioventus' strategic direction, as their product portfolio is heavily weighted towards less invasive treatment options.

Bioventus is well-positioned to capitalize on this demand. Their commitment to developing clinically effective, cost-conscious, and minimally invasive solutions aligns perfectly with what patients and healthcare providers are increasingly seeking.

Consider these points regarding the opportunity:

- Growing Market Share: The global minimally invasive orthopedic devices market was valued at approximately $20 billion in 2023 and is projected to grow at a CAGR of over 7% through 2028, according to various market research reports.

- Patient Preference: Studies consistently show patients prefer procedures with shorter recovery times, reduced pain, and smaller incisions, all hallmarks of minimally invasive techniques.

- Bioventus' Portfolio Alignment: Products like their hyaluronic acid joint fluid injections and bone graft substitutes are inherently minimally invasive, fitting seamlessly into this expanding market segment.

Geographic Expansion, Especially in Emerging Markets

While North America currently leads the orthobiologics market, emerging economies, particularly in the Asia-Pacific region, offer substantial growth prospects. This is driven by rising disposable incomes, increased investment in medical research, and a growing prevalence of conditions such as osteoporosis and arthritis. Bioventus, as a global medical technology firm, is well-positioned to capitalize on these opportunities.

For instance, the global orthobiologics market was valued at approximately $10.8 billion in 2023 and is projected to reach $19.3 billion by 2030, growing at a CAGR of 8.7%. Emerging markets are expected to be key drivers of this expansion, with particular focus on countries like China and India where the aging population and increased healthcare spending are significant factors.

- Asia-Pacific Market Growth: The Asia-Pacific orthobiologics market is anticipated to grow at a CAGR of over 9% in the coming years, significantly outpacing established markets.

- Rising Incidence of Orthopedic Conditions: Increased awareness and diagnosis of conditions like osteoarthritis and sports-related injuries in emerging economies fuel demand for advanced treatment solutions.

- Strategic Expansion Potential: Bioventus can leverage its existing product portfolio and technological expertise to establish a stronger foothold in these underserved, high-potential geographic areas.

Bioventus can capitalize on the expanding global orthobiologics market, which is projected to reach $19.3 billion by 2030, with a compound annual growth rate of 8.7%. The company's focus on active healing solutions aligns well with the growing patient preference for minimally invasive procedures, a trend supported by the minimally invasive orthopedic devices market, valued at approximately $20 billion in 2023 and expected to grow over 7% annually through 2028. Furthermore, emerging markets, particularly in the Asia-Pacific region, present significant untapped potential, with this segment of the orthobiologics market anticipated to grow at a CAGR exceeding 9%.

| Opportunity Area | Market Projection (USD) | CAGR | Key Drivers |

|---|---|---|---|

| Global Orthobiologics Market | $19.3 Billion by 2030 | 8.7% | Aging population, sports injuries, regenerative medicine adoption |

| Minimally Invasive Orthopedics | $20 Billion (2023 estimate) | >7% (through 2028) | Patient preference for reduced recovery time and pain |

| Asia-Pacific Orthobiologics | N/A (Growth focus) | >9% | Rising disposable incomes, increased healthcare spending, prevalence of orthopedic conditions |

Threats

The orthobiologics sector, a key area for Bioventus, is crowded with formidable competitors. Companies like Stryker, Zimmer Biomet, and Arthrex are deeply entrenched, offering a wide array of similar products. This crowded landscape means Bioventus must constantly innovate and prove its value to maintain and grow its market share.

This intense rivalry directly impacts Bioventus' pricing power and profitability. For instance, in the competitive bone graft substitute market, price sensitivity can be high, forcing Bioventus to balance innovation costs with market demands. In 2023, the global orthobiologics market was valued at approximately $10.3 billion, with projections indicating continued growth, but also highlighting the significant competitive pressures.

Bioventus operates in the highly regulated medical device sector, facing evolving government oversight. For instance, new guidelines for AI-enabled devices and enhanced cybersecurity mandates present ongoing compliance challenges. Failure to adhere to these regulations can result in significant penalties and hinder market entry, directly impacting product development timelines and costs.

Navigating this complex regulatory environment is crucial for Bioventus to maintain market access and avoid costly delays. In 2023, the FDA issued numerous recalls and warning letters to medical device companies, underscoring the strict enforcement of compliance standards. The cost of regulatory compliance for medical device companies can range from millions to tens of millions of dollars annually, depending on the complexity of their product portfolio and global reach.

Bioventus operates in a market where product recalls are a significant concern, potentially undermining patient trust and leading to substantial financial penalties. For instance, in the broader medical device sector, the average cost of a recall can run into millions of dollars due to manufacturing defects, adverse event reporting, and the logistical nightmare of retrieving and replacing products.

Furthermore, the high cost associated with orthobiologic treatments presents a considerable hurdle. These advanced therapies can be prohibitively expensive for many patients, impacting their accessibility and the rate at which they are adopted by healthcare providers. This financial barrier can directly affect Bioventus's market penetration and revenue growth.

Potential Impact of Macroeconomic Environment and Tariffs

While Bioventus noted in Q1 2025 that tariffs haven't significantly impacted them, a volatile macroeconomic climate remains a potential future threat. Economic slowdowns or shifts in international trade agreements could disrupt their supply chains, influence patient spending on medical devices, and generally affect how the company operates.

For instance, a broad economic contraction in key markets could lead to reduced elective procedure volumes, directly impacting Bioventus's revenue streams. Furthermore, any escalation in trade disputes could introduce new cost pressures or logistical challenges for their product distribution.

- Macroeconomic Uncertainty: Increased global economic volatility could dampen consumer and provider spending on healthcare, impacting Bioventus's sales.

- Tariff Impact: Although currently minimal, future changes in trade policies and tariffs could increase the cost of goods or disrupt supply chains.

- Supply Chain Vulnerability: Global economic instability can expose vulnerabilities in Bioventus's international supply networks, potentially leading to delays or increased costs.

Challenges in Integrating New Businesses/Products

Bioventus faces a significant challenge in its ability to effectively integrate newly acquired businesses, products, or technologies. This integration process, if not managed efficiently and cost-effectively, could introduce operational disruptions and strain the company's financial resources. A poorly executed integration might dilute the focus on Bioventus's core strengths, hindering its overall growth trajectory.

The company's financial performance in recent periods highlights the importance of seamless integration. For instance, while Bioventus reported net sales of $440.8 million for the fiscal year ended September 30, 2023, the costs associated with integrating new ventures can impact profitability if not carefully controlled. Failure to achieve synergistic benefits from acquisitions could lead to increased operational expenses and a drag on earnings per share.

Key considerations for Bioventus in managing this threat include:

- Streamlining post-acquisition processes: Implementing robust systems for financial reporting, supply chain management, and human resources to ensure smooth transitions.

- Synergy realization: Developing clear plans to achieve cost savings and revenue enhancements from acquired entities, with measurable targets and timelines.

- Maintaining operational focus: Ensuring that integration activities do not detract from the performance and strategic direction of existing business segments.

Intense competition within the orthobiologics market, particularly from established players like Stryker and Zimmer Biomet, pressures Bioventus' pricing and profitability. The high cost of advanced orthobiologic treatments also limits patient accessibility and adoption rates, directly impacting Bioventus' market penetration and revenue growth.

Bioventus must navigate evolving regulatory landscapes, with potential penalties for non-compliance and strict enforcement of standards, as evidenced by FDA actions in 2023. Additionally, macroeconomic volatility and potential future trade policy shifts pose risks to supply chains and consumer spending on healthcare, impacting sales and operational costs.

The company also faces challenges in effectively integrating acquisitions, which can lead to operational disruptions and strain financial resources if not managed efficiently. Failure to realize synergistic benefits from these integrations could negatively impact profitability and dilute focus on core business strengths.

SWOT Analysis Data Sources

This Bioventus SWOT analysis is constructed using a robust blend of primary and secondary data, including company financial reports, market research studies, and industry expert interviews to provide a comprehensive and actionable assessment.