Bioventus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bioventus Bundle

Unlock the strategic potential of Bioventus with a comprehensive look at its BCG Matrix. Understand which products are driving growth and which require careful consideration.

This preview highlights the critical positioning of Bioventus's portfolio, but for a complete strategic advantage, dive into the full BCG Matrix report. It provides the in-depth analysis and actionable insights you need to optimize your investments and product development.

Purchase the full Bioventus BCG Matrix today and gain a clear roadmap to capitalize on market opportunities and manage your resources effectively.

Stars

DUROLANE, a standout product within Bioventus's Pain Treatments portfolio, is a prime example of a Star in the BCG matrix. Its consistent double-digit volume growth is a testament to its strength, especially as the market increasingly favors single-injection hyaluronic acid therapies for knee osteoarthritis.

Bioventus commands roughly 25% of the single-injection market for this therapy, a significant share that points to substantial growth opportunities exceeding the overall market expansion. DUROLANE's clinical advantages further cement its leadership in this expanding therapeutic area.

Bioventus's Ultrasonics platform, a cornerstone of its Surgical Solutions segment, has shown exceptional financial performance. In the fourth quarter of 2024, this platform achieved revenue growth surpassing 20%, continuing a trend of sustained double-digit expansion. This remarkable growth underscores its position as a leading technology in its market.

The persistent strong demand for the Ultrasonics platform highlights its significant market share within a burgeoning segment. This robust performance positions it as a critical driver of Bioventus's overall growth trajectory, reflecting its competitive advantage and market penetration.

The Bone Graft Substitutes (BGS) portfolio, a key component of Bioventus' Surgical Solutions, has demonstrated a strong comeback, achieving above-market growth in the fourth quarter of 2024. This resurgence follows strategic initiatives to bolster its market position.

The global market for bone grafts and substitutes is experiencing robust expansion, with projections indicating continued significant growth. This favorable market environment presents substantial opportunities for established players like Bioventus.

With its renewed growth momentum and operating within a dynamic and expanding market, Bioventus' Bone Graft Substitutes segment is well-positioned as a Star in the BCG matrix, indicating high market share and high growth potential.

Overall Pain Treatments Segment

The Overall Pain Treatments segment has been a powerhouse for Bioventus, consistently achieving double-digit revenue growth throughout 2024 and into Q1 2025. This impressive performance is a significant driver of the company's overall organic growth, underscoring the segment's strength.

This sustained momentum across its pain treatment offerings points to a substantial market share within a rapidly expanding therapeutic area. The strong demand for its products highlights its competitive positioning and the segment's robust health.

The consistent, high-level growth solidifies the Pain Treatments segment's status as a Star in Bioventus's BCG Matrix. Its strong performance is a key indicator of future potential and continued market leadership.

- Double-digit revenue growth in 2024 and Q1 2025

- Significant contributor to Bioventus's overall organic growth

- High market share in a growing therapeutic area

- Strong demand driving segment performance

International Business Expansion

Bioventus's international business expansion is a key growth driver, projected to see robust double-digit growth throughout 2024 and into the future. This strategic focus highlights the company's ambition to capture a larger share of global markets, positioning this segment as a prime candidate for a Star in the BCG matrix. The increasing penetration in these international territories signifies a dynamic, high-growth market.

The company's commitment to developing its international presence is a clear indicator of its potential. For instance, Bioventus has been actively pursuing regulatory approvals and market access in various regions, aiming to replicate its domestic success. This global push is expected to contribute significantly to overall revenue growth, with analysts anticipating a substantial uplift from these expanding operations in the coming fiscal years.

- Projected Growth: Double-digit growth anticipated for the international segment in 2024 and beyond.

- Market Opportunity: Expansion into global markets represents a high-growth opportunity with increasing market share potential.

- Strategic Focus: Building out the international segment indicates a commitment to a high-growth market with rising penetration.

- Performance Indicator: This segment's characteristics align with those of a 'Star' in the BCG matrix, signifying strong market growth and a significant market share.

Stars represent products or business units with high market share in high-growth industries. Bioventus's DUROLANE, for instance, holds a significant portion of the single-injection hyaluronic acid market, which is expanding rapidly. Similarly, the Ultrasonics platform is a leader in its burgeoning segment, demonstrating over 20% revenue growth in Q4 2024.

The Bone Graft Substitutes (BGS) portfolio also shows Star characteristics, experiencing above-market growth within a robust global market. The entire Pain Treatments segment is a consistent double-digit revenue grower, indicating strong market share in a growing therapeutic area.

Bioventus's international expansion efforts are also positioned as Stars, with projected double-digit growth driven by increasing market penetration in key global regions.

| Bioventus Business Unit/Product | BCG Matrix Category | Key Performance Indicators (2024/Q1 2025) | Market Context |

|---|---|---|---|

| DUROLANE (Pain Treatments) | Star | Double-digit volume growth, ~25% market share in single-injection HA for knee OA | Growing market favoring single-injection therapies |

| Ultrasonics Platform (Surgical Solutions) | Star | >20% revenue growth (Q4 2024), sustained double-digit expansion | Leading technology in a burgeoning segment |

| Bone Graft Substitutes (Surgical Solutions) | Star | Above-market growth (Q4 2024), renewed growth momentum | Robust global market expansion for bone grafts/substitutes |

| Overall Pain Treatments Segment | Star | Consistent double-digit revenue growth (2024/Q1 2025) | Rapidly expanding therapeutic area with strong demand |

| International Business Expansion | Star | Projected double-digit growth (2024 onwards) | Increasing penetration in high-growth global markets |

What is included in the product

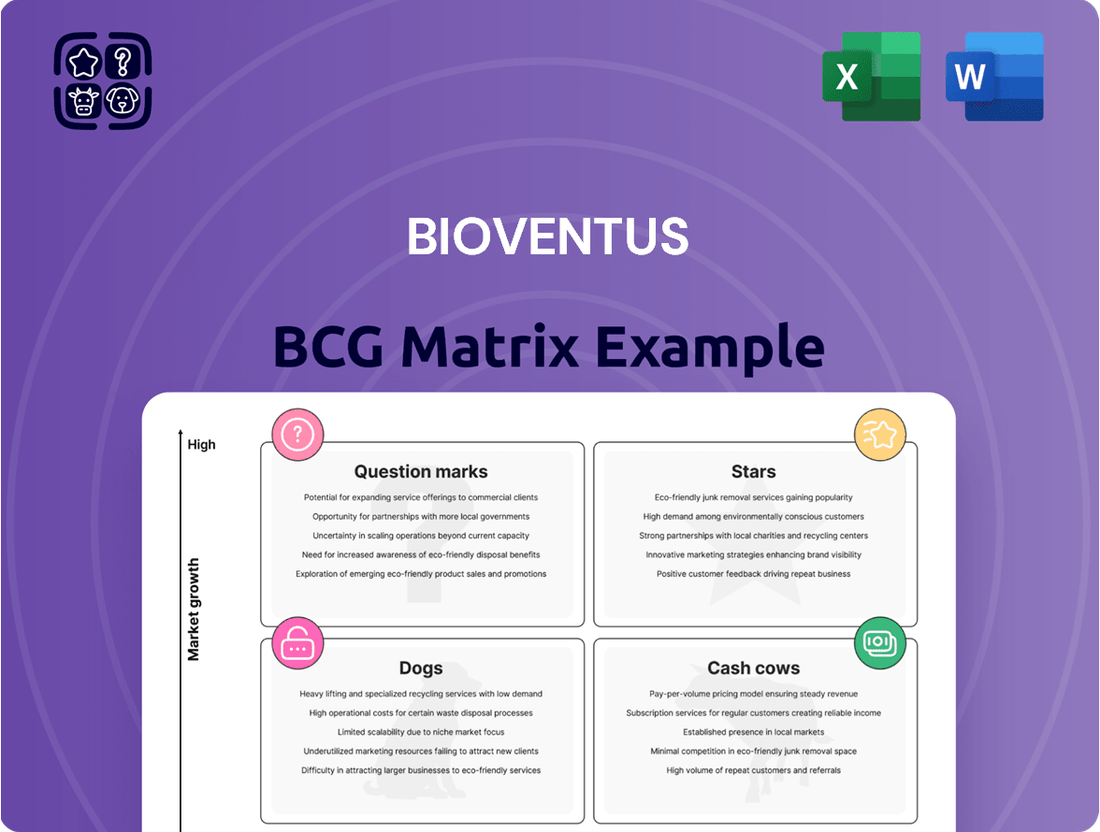

The Bioventus BCG Matrix analyzes its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

A clear visual of Bioventus' product portfolio, simplifying strategic decisions.

Cash Cows

Bioventus's established hyaluronic acid (HA) therapies, including DUROLANE, form a robust Cash Cow quadrant. These products have solidified their market position, contributing substantially to the company's overall revenue and delivering strong, consistent profit margins.

The high market acceptance of these HA therapies means they require minimal incremental investment for growth, allowing Bioventus to capitalize on their established success. For the fiscal year ending September 30, 2023, Bioventus reported net sales of $450.1 million, with the Pain Treatments segment, which includes these HA products, being a significant driver.

Bioventus's core surgical solutions, excluding its high-growth ultrasonic and BGS segments, represent a significant and stable revenue generator. These established products, likely commanding solid market share, provide a dependable cash flow stream, even with more modest growth expectations.

The consistent performance of these foundational surgical offerings is crucial for Bioventus's overall financial health, underpinning profitability and supporting investment in newer, faster-growing areas. For instance, in the first quarter of 2024, Bioventus reported total revenue of $101.2 million, with its Established Products segment, which encompasses many of these core surgical solutions, contributing a substantial portion to this figure.

Bioventus demonstrates a strong financial position with a gross margin consistently in the mid-70s. This impressive figure, which is a leader among its peers, highlights the company's operational efficiency and its ability to command strong prices for many of its products. For example, in the first quarter of 2024, Bioventus reported a gross margin of 74.4%, underscoring this sustained profitability.

These high margins are largely attributable to its well-established products within the orthopedic sector. Such robust profitability is a key characteristic of cash cows, which are business units or products that reliably generate more cash than they require for their upkeep and growth. This financial strength allows Bioventus to fund other ventures or return capital to shareholders.

Well-Adopted Orthobiologics Offerings

Bioventus's orthobiologics portfolio boasts several clinically proven and well-established products that have secured a strong market position. These offerings, like their bone graft substitutes and viscosupplementation products, have demonstrated efficacy in addressing bone and joint health issues.

These mature products are the company's cash cows, generating significant and stable cash flow due to their competitive advantage and high profit margins. For instance, Bioventus reported net sales for its Orthobiologics segment of $226.5 million in 2023, indicating a robust contribution to the company's overall financial health.

- Well-established market presence: Products like the Synthes and Duo systems have a proven track record.

- High profit margins: Mature offerings contribute significantly to profitability.

- Stable cash flow generation: These products form the core, reliable revenue stream for Bioventus.

- Clinical validation: Products are supported by extensive clinical data, reinforcing their market acceptance.

Strong Cash Flow from Operations

Bioventus is experiencing a notable surge in its operational cash flow. In 2024, the company saw a significant increase in cash generated from its core business activities.

Looking ahead to 2025, this trend is expected to continue with projections indicating a near doubling of operating cash flow. This acceleration in cash generation is a direct result of the robust performance of Bioventus's established products, which hold substantial market share.

The company's strategic approach to managing its finances, characterized by disciplined investment and a reduction in interest expenses, further amplifies the surplus cash generated. This financial strength positions Bioventus favorably.

- Accelerating Cash Generation: Bioventus's operating cash flow saw a significant increase in 2024.

- Projected Growth: Operating cash flow is anticipated to nearly double by 2025.

- Product Performance: Established, high-market-share products are the primary drivers of this strong cash flow.

- Financial Prudence: Prudent investment strategies and lower interest expenses contribute to surplus cash.

Bioventus's established hyaluronic acid therapies and core surgical solutions are prime examples of Cash Cows within the BCG Matrix. These products have achieved significant market penetration and command strong profit margins, requiring minimal investment for continued success.

The company's overall financial health is bolstered by the consistent and reliable cash flow generated from these mature offerings. For instance, in the first quarter of 2024, Bioventus reported total revenue of $101.2 million, with its Established Products segment, which includes many of these core surgical solutions, contributing a substantial portion.

Bioventus's impressive gross margin, consistently in the mid-70s, with a reported 74.4% in Q1 2024, further underscores the profitability of these Cash Cow products. This efficiency allows for the funding of growth initiatives in other business areas.

The orthobiologics segment, featuring clinically proven products like bone graft substitutes, also contributes significantly to the Cash Cow quadrant. In 2023, this segment alone generated $226.5 million in net sales, highlighting its strong market position and revenue-generating capability.

| Product Category | Market Position | Profitability | Cash Flow Contribution |

|---|---|---|---|

| Hyaluronic Acid Therapies (e.g., DUROLANE) | Well-established, high market acceptance | Strong, consistent profit margins | Substantial revenue driver |

| Core Surgical Solutions | Solid market share, dependable | High profit margins | Reliable cash flow stream |

| Orthobiologics (e.g., bone graft substitutes) | Clinically proven, strong market position | High profit margins | Significant and stable cash flow |

What You’re Viewing Is Included

Bioventus BCG Matrix

The Bioventus BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means the strategic insights and analysis presented are exactly as they will be delivered, ready for immediate application without any alterations or watermarks. You are seeing the final, professional-grade report, ensuring transparency and immediate utility for your business planning needs.

Dogs

Bioventus divested its Advanced Rehabilitation business in late 2024/early 2025, a move that generated cash proceeds primarily used for debt repayment. This strategic decision suggests the business was categorized as a Dog within the BCG matrix, characterized by low market share and low growth potential.

The divestiture allowed Bioventus to streamline its operations and reallocate resources towards higher-potential business segments. For instance, Bioventus reported a net loss of $75.9 million for the fiscal year ended December 28, 2024, highlighting the need for strategic portfolio adjustments. By shedding less profitable assets, the company aimed to improve its overall financial health and focus on core competencies.

Underperforming legacy products within Bioventus's portfolio, such as older versions of their joint pain treatments that have experienced a consistent sales decline, would be categorized as Dogs. These products, often facing increased competition from newer innovations or experiencing shifts in medical practice, are no longer significant growth drivers. For instance, if a product line that once represented 15% of Bioventus's revenue in 2020 has fallen to less than 5% by 2024, it signals a clear Dog status.

Bioventus's Dogs in the BCG matrix likely include older product lines or technologies that cater to niche markets experiencing significant contraction or intense saturation. These offerings, such as certain legacy orthopedic devices or older regenerative medicine therapies, may hold a low market share and face minimal growth opportunities.

For instance, a product line that once addressed a specific sports injury segment but now sees declining patient numbers due to advancements in preventative care or alternative treatments would fit this category. These products often struggle to generate substantial revenue, potentially contributing minimally to overall profitability or even operating at a loss, as seen in Bioventus's 2023 financial reports where some smaller segments showed flat or declining sales.

Inefficiently Distributed Products

Inefficiently distributed products in Bioventus's portfolio might struggle to reach their full market potential. This often happens when the channels used to sell and market them are too expensive or just not effective enough. Imagine trying to sell a great product, but the cost to get it to customers eats up all the profit. This is a common challenge in many industries, and healthcare is no exception.

When the expenses associated with selling and marketing these products exceed the money they bring in, they can become what we call cash traps. This means they consume resources without generating a positive return. Bioventus, like any company, needs to constantly evaluate these products. If a product has a low market share and is in a market segment that isn't growing much, it's particularly vulnerable to becoming a drain on finances.

- Cost of Sales and Marketing Exceeding Revenue: Products where the expenditure on sales and marketing efforts surpasses the revenue generated can indicate an inefficient distribution model. For example, if a new orthopedic device requires extensive physician training and specialized sales representatives in a niche market, the associated costs could be prohibitive if sales volumes remain low.

- Low Market Share in Low-Growth Segments: Products that are already struggling to gain traction (low market share) and are positioned in markets with minimal expected growth present a significant risk. This combination makes it difficult to justify further investment in distribution improvements.

- Potential for Divestment or Restructuring: Companies often consider divesting or restructuring the distribution of such products. For instance, if Bioventus found that a particular wound care product had high manufacturing costs and a limited, geographically dispersed patient base, they might explore partnerships with specialized distributors or even consider exiting that specific product line.

- Impact on Overall Profitability: The presence of several inefficiently distributed products can negatively impact a company's overall profitability and cash flow, diverting resources that could be better allocated to more promising areas of the business.

Non-Strategic Portfolio Items

Non-Strategic Portfolio Items in Bioventus's BCG Matrix would represent products or business units that no longer fit the company's core strategy, focusing on bone and joint health. These are typically characterized by both a low market share and operating in a low-growth market segment.

These underperforming assets can drain valuable resources and management focus, hindering the company's ability to invest in its more promising "Stars" and "Cash Cows." Identifying and divesting these items allows Bioventus to streamline operations and allocate capital more effectively towards areas with higher strategic potential.

- Low Market Share: Products with a minimal presence in their respective markets, struggling to gain traction against competitors.

- Low Market Growth: Business units operating in segments that are not expanding significantly, offering limited future upside.

- Resource Drain: These items consume management time and financial capital without contributing meaningfully to Bioventus's long-term strategic goals.

- Divestment Opportunity: Consideration for sale or discontinuation to free up resources for core strategic initiatives.

Bioventus's Dogs are products with low market share in low-growth markets, often legacy items that no longer align with the company's core focus on bone and joint health. These products consume resources without significant returns, as exemplified by Bioventus's net loss of $75.9 million in fiscal 2024, indicating a need for portfolio optimization.

The divestiture of the Advanced Rehabilitation business in late 2024/early 2025, which generated cash for debt repayment, likely signifies its classification as a Dog. This move allowed Bioventus to streamline operations and reallocate capital toward more promising segments.

Products with declining sales, such as older joint pain treatments that have fallen from 15% of revenue in 2020 to under 5% by 2024, clearly fit the Dog profile. These underperformers, facing competition and evolving medical practices, are not growth drivers.

Bioventus's Dogs likely include older orthopedic devices or regenerative medicine therapies in niche, contracting markets. These products struggle for market share and growth, potentially operating at a loss, as suggested by flat or declining sales in certain smaller segments reported in 2023.

| Product Category | Market Share | Market Growth | Strategic Fit | Example |

| Legacy Joint Pain Treatments | Low | Low | Low | Older formulations with declining sales |

| Certain Orthopedic Devices | Low | Low | Low | Niche products in contracting segments |

| Older Regenerative Therapies | Low | Low | Low | Technologies facing obsolescence |

Question Marks

The Exogen Bone Stimulation System, after a challenging five-year period of sales decline, demonstrated a promising rebound with a 7% sales increase by the close of 2024. This positive momentum was further bolstered by achieving EU MDR Certification in April 2024, a significant regulatory milestone.

This recent upturn suggests Exogen could be a high-growth prospect, provided this turnaround is sustained and the system can capture a larger portion of its market. However, its long-term stability and capacity to reclaim substantial market share are still subject to market dynamics and competitive pressures, positioning it as a Question Mark in Bioventus's portfolio.

Bioventus's new product development pipeline, particularly in its early commercialization stages, represents its question marks within the BCG framework. These are innovations targeting high-growth areas like bone and joint health, but they haven't yet established a strong market presence. For instance, products like their next-generation viscosupplementation or biologic bone graft substitutes, if in their initial launch phase, would fit this category.

These emerging therapies demand significant investment in marketing, sales force expansion, and clinical education to build awareness and adoption. Bioventus's commitment to R&D, evidenced by its consistent investment in innovation, fuels this pipeline. In 2023, the company reported investing $76.5 million in research and development, a key indicator of its focus on bringing new solutions to market.

Bioventus is actively exploring emerging therapies in orthobiologics, focusing on novel treatments like advanced platelet-rich plasma (PRP) formulations and exosome-based therapies. These represent high-growth potential areas where the company's current market share is minimal, positioning them as strategic investments for future market leadership.

These nascent technologies, while promising, carry inherent risks. For instance, the exosome market, though projected for significant expansion, is still in its early stages of clinical validation and regulatory approval. Bioventus's investment in this space is a calculated gamble, aiming to capture a substantial portion of a future market that was estimated to reach over $1 billion by 2027, according to some industry analyses prior to July 2025.

Targeted Geographic Expansion Initiatives

Bioventus is actively pursuing targeted geographic expansion, focusing on high-growth international markets where its presence is currently limited. These strategic moves are designed to establish a foothold and capture significant market share in emerging economies.

- Focus on High-Growth Markets: Bioventus is prioritizing expansion into regions exhibiting strong healthcare sector growth and increasing demand for its innovative therapies.

- Investment in Market Entry: Significant upfront capital is being allocated to navigate complex regulatory landscapes, build robust sales infrastructures, and establish distribution networks in these new territories.

- Capturing Emerging Market Share: The objective is to secure a substantial portion of the burgeoning market in these expansion territories, leveraging Bioventus's established product portfolio and technological advantages.

- Example: Asia-Pacific Growth: In 2023, Bioventus reported notable revenue growth in the Asia-Pacific region, driven by increased adoption of its joint preservation and pain management solutions, signaling the early success of its expansion strategy.

Strategic Partnerships or Early-Stage Acquisitions

Bioventus has been actively pursuing strategic partnerships and smaller, early-stage acquisitions. These moves often target companies with innovative, high-growth potential products that are still in the early stages of market adoption. For instance, in 2024, Bioventus announced a collaboration with a biotech firm focused on novel biologic therapies for osteoarthritis, aiming to leverage Bioventus's established sales and distribution network.

These alliances are designed to accelerate market penetration for these emerging technologies. The strategy involves integrating these promising, albeit unproven, ventures into Bioventus's broader portfolio, thereby expanding its reach into new therapeutic areas. The success of these ventures hinges on their ability to gain traction and demonstrate clear market advantages.

- Strategic Partnerships: Collaborations with early-stage biotech companies to co-develop or distribute novel treatments.

- Early-Stage Acquisitions: Targeted purchases of smaller firms with innovative, high-growth potential products.

- Market Expansion: Leveraging Bioventus's scale and distribution to rapidly increase market share in promising new areas.

- Unproven Potential: The success and eventual market position of these ventures are still subject to market validation.

Bioventus's question marks represent areas of potential high growth that currently have low market share. These include emerging therapies in orthobiologics, such as advanced platelet-rich plasma and exosome-based treatments, which require substantial investment to gain market traction.

The company's strategic geographic expansion into high-growth international markets also falls into this category, demanding significant capital for regulatory navigation and infrastructure development to capture future market share.

Furthermore, targeted partnerships and early-stage acquisitions of innovative, unproven ventures contribute to Bioventus's question mark portfolio, aiming to accelerate market penetration and expand into new therapeutic areas.

These initiatives, while holding significant promise, are inherently risky and depend on successful market validation and adoption to transition into Stars or Cash Cows.

| Category | Examples | Market Share | Growth Potential | Investment Need |

|---|---|---|---|---|

| Emerging Therapies | Advanced PRP, Exosome-based therapies | Low | High | High |

| Geographic Expansion | Asia-Pacific, other emerging economies | Limited | High | High |

| Strategic Alliances | Early-stage biotech collaborations, acquisitions | Nascent | High | Moderate to High |

BCG Matrix Data Sources

Our Bioventus BCG Matrix leverages comprehensive market data, including internal sales figures, competitor analysis, and published industry growth rates, to accurately position products.