Bioventus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bioventus Bundle

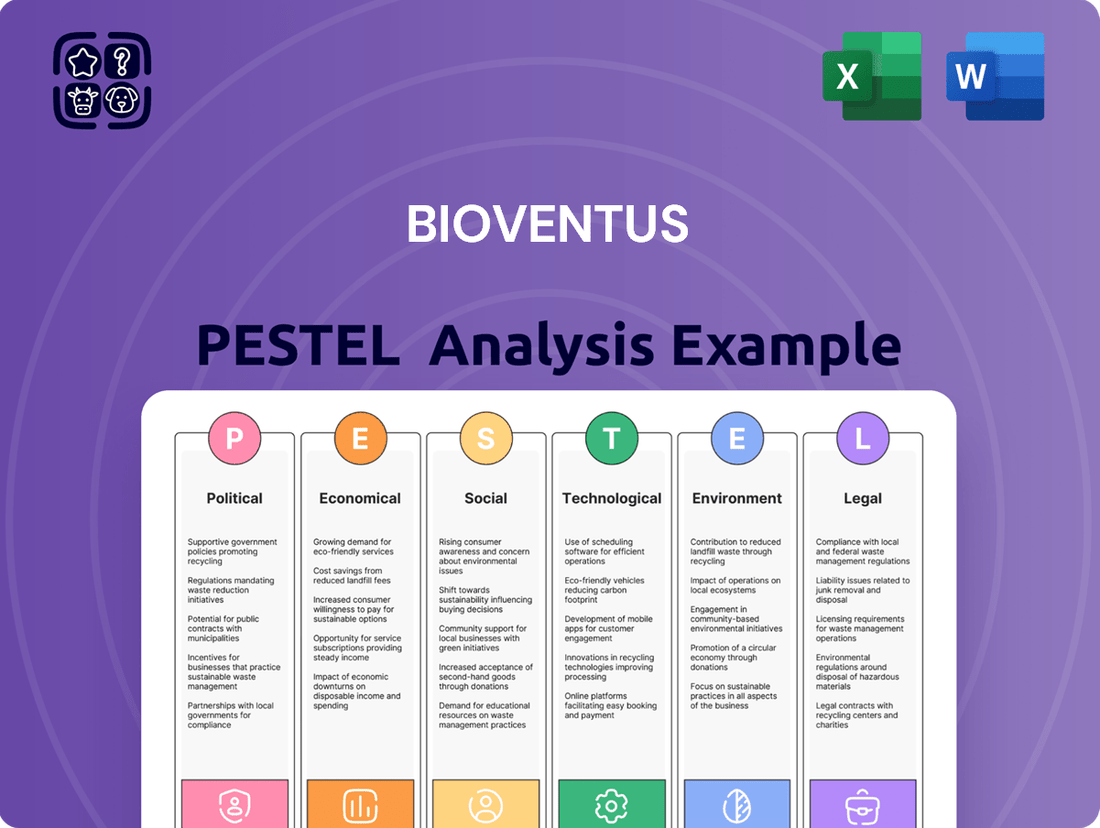

Navigate the complex external landscape impacting Bioventus with our detailed PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and socio-cultural trends are shaping its market. Equip yourself with actionable intelligence to refine your strategy and gain a competitive advantage. Download the full PESTLE analysis now for immediate access to critical insights.

Political factors

Government healthcare policies, especially those concerning reimbursement models and pricing regulations, significantly shape Bioventus's profitability and market access. For instance, changes in Medicare reimbursement rates for procedures utilizing Bioventus's products directly affect revenue streams.

The ongoing shift towards value-based care and bundled payment systems necessitates that companies like Bioventus prove the clinical effectiveness and economic benefits of their offerings to secure favorable reimbursement.

Updates to Medicare and Medicaid reimbursement, with a growing emphasis on quality outcomes, are particularly critical for Bioventus, given its specialization in bone and joint health solutions. In 2024, the Centers for Medicare & Medicaid Services (CMS) proposed updates that could influence payment for certain orthopedic procedures.

Global trade policies, including the imposition of tariffs, can significantly affect Bioventus's supply chain and operational costs. While Bioventus has stated that it does not currently see a material impact from tariffs, broader market concerns about tariffs on medical devices could lead to increased production costs and pricing pressures. For instance, the U.S. International Trade Commission reported that tariffs imposed in recent years have led to higher input costs for many U.S. manufacturers.

Government funding for medical research and development is a significant driver for innovation in the healthcare sector. For instance, in fiscal year 2024, the U.S. National Institutes of Health (NIH) budget was approximately $47.5 billion, supporting a vast array of research projects. This funding directly impacts the pace at which new medical technologies and treatments emerge, which can influence companies like Bioventus.

A potential decrease in such government allocations, perhaps due to shifting budget priorities or economic downturns, could slow down the pipeline of groundbreaking medical advancements. If federal funding for regenerative medicine or orthobiologics research were to be curtailed, it might directly affect the discovery and development of novel products that Bioventus could later commercialize or license.

Regulatory Environment and Approvals

The regulatory landscape, particularly concerning the Food and Drug Administration (FDA) and its international counterparts, directly impacts Bioventus's ability to bring new products to market. For instance, the FDA's approval process for medical devices can be lengthy and rigorous, influencing Bioventus's revenue streams and product launch timelines. In 2023, the FDA continued to emphasize post-market surveillance and cybersecurity for medical devices, adding layers of compliance that companies like Bioventus must navigate.

Emerging regulatory pathways for digital health solutions and AI-powered medical technologies present both opportunities and challenges. While these new frameworks can streamline market access, they also necessitate continuous adaptation to evolving data privacy and algorithm validation standards. Bioventus’s investment in digital health platforms, such as its telehealth offerings, means it must stay abreast of these dynamic compliance requirements to ensure continued market viability.

- FDA Approval Timelines: Delays in FDA approvals for new orthopedic and regenerative medicine products can significantly impact Bioventus's revenue forecasts.

- International Regulations: Navigating varying approval processes in key markets like Europe (CE marking) and Asia is crucial for global expansion and revenue diversification.

- Digital Health Compliance: Adherence to evolving regulations for data security and artificial intelligence in medical devices is paramount for Bioventus's innovative product lines.

- Post-Market Surveillance: Ongoing monitoring and reporting requirements for approved devices add to operational costs and regulatory burden.

Political Stability and International Relations

Bioventus's global reach is significantly influenced by political stability in its key operating regions and the broader landscape of international relations. For instance, the company's presence in North America and Europe, generally stable regions, supports its ongoing operations and strategic growth initiatives.

However, geopolitical tensions or changes in trade policies, such as those impacting cross-border commerce or intellectual property rights, could pose challenges. For example, the ongoing discussions around trade tariffs or the potential for new regulatory frameworks in emerging markets could affect Bioventus's supply chain efficiency and market access, impacting its ability to serve patients and healthcare providers effectively.

- Political Stability: Bioventus operates in markets with varying degrees of political stability; stable environments are crucial for consistent market access and investment.

- International Relations: Favorable international relations facilitate smoother global operations, including supply chain management and market expansion.

- Trade Agreements: Shifts in international trade agreements can directly impact Bioventus's cost of goods, market entry strategies, and overall profitability.

- Regulatory Environment: Evolving political landscapes can lead to changes in healthcare regulations, impacting product approvals, pricing, and market demand.

Government healthcare policies, particularly reimbursement rates and pricing regulations, directly influence Bioventus's revenue. Changes in Medicare and Medicaid policies, such as those proposed by CMS in 2024 for orthopedic procedures, are critical for companies specializing in bone and joint health.

The push towards value-based care requires Bioventus to demonstrate both clinical efficacy and economic benefits to secure favorable reimbursement, a trend reinforced by ongoing healthcare reforms.

Government funding for R&D, like the NIH's substantial budget of approximately $47.5 billion for fiscal year 2024, fuels innovation, impacting Bioventus's pipeline for new medical technologies.

The regulatory environment, including FDA approval processes and international standards for devices and digital health, dictates market access and product launch timelines for Bioventus, with 2023 seeing continued emphasis on post-market surveillance and cybersecurity.

What is included in the product

This Bioventus PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting opportunities and threats derived from current market and regulatory dynamics.

Bioventus' PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during strategic planning.

Economic factors

Healthcare expenditure and budget constraints significantly impact Bioventus. In 2024, many health systems are grappling with inflation and rising labor costs, which can outpace reimbursement rates. This financial pressure often leads to more rigorous scrutiny of medical device costs by value analysis committees, potentially affecting demand for Bioventus's offerings.

For instance, the U.S. Centers for Medicare & Medicaid Services (CMS) projected a 5.1% increase in Medicare hospital spending in 2024, but actual cost inflation, particularly for labor and supplies, has frequently exceeded these projections for providers. This widening gap means hospitals have less discretionary spending, making them more sensitive to the price and demonstrated value of new technologies.

General economic growth and consumer disposable income significantly impact patient access to elective procedures and the demand for medical technologies like those offered by Bioventus. A robust economy, characterized by rising GDP and increased household spending power, often translates to greater patient willingness to invest in treatments aimed at improving active and pain-free lifestyles. For instance, in 2024, global GDP growth is projected to be around 3.2%, providing a generally supportive economic backdrop for discretionary healthcare spending.

Conversely, economic downturns or periods of high inflation can lead to reduced disposable income, potentially dampening demand for non-essential medical treatments. Patients may postpone or forgo elective procedures if they are concerned about job security or facing higher costs for everyday necessities. This sensitivity to economic cycles means that Bioventus's revenue from products like its hyaluronic acid joint injections, often considered elective, could fluctuate with broader economic trends.

Inflationary pressures in 2024 and early 2025 are likely to continue impacting Bioventus's operational expenses, potentially increasing costs for manufacturing inputs and labor. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase in 2023, and while projections vary, persistent inflation could squeeze profit margins.

Rising interest rates present a dual challenge for Bioventus. Higher rates increase the cost of servicing existing debt and make new borrowing more expensive. This is particularly relevant as Bioventus has been actively working to reduce its net leverage, a process that could be complicated by a higher interest rate environment.

Market Size and Growth of Orthobiologics

The orthobiologics market is a significant and expanding sector, fueled by a confluence of demographic and lifestyle trends. An increasing incidence of sports-related injuries, coupled with a global population that is aging, directly translates to a greater demand for treatments that promote healing and regeneration. Furthermore, growing patient and physician preference for less invasive surgical options bolsters the appeal of orthobiologic solutions.

This robust market expansion presents a favorable economic environment for companies like Bioventus. Projections indicate sustained growth, with market research estimating the global orthobiologics market to reach approximately $17.2 billion by 2027, growing at a CAGR of 7.8% from 2022. This upward trajectory suggests ample opportunity for Bioventus to capitalize on increasing demand for its products.

- Growing Demand: The market is driven by rising sports injuries and an aging population.

- Minimally Invasive Trend: Increased preference for less invasive procedures favors orthobiologics.

- Market Value: The global orthobiologics market was valued at approximately $11.1 billion in 2022.

- Projected Growth: Expected to reach $17.2 billion by 2027, with a compound annual growth rate of 7.8%.

Competitive Landscape and Pricing Pressure

The bone and joint health market is highly competitive, with numerous players vying for market share. This intense rivalry often translates into significant pricing pressure, directly impacting Bioventus's revenue streams and profit margins. For instance, in 2023, the global orthopedic devices market, which includes bone and joint solutions, was valued at approximately $55 billion, with projections indicating continued growth but also highlighting the competitive intensity.

To navigate this challenging environment and maintain pricing power, companies like Bioventus must prioritize continuous innovation and product differentiation. This involves not only developing novel treatments and technologies but also effectively communicating their unique value propositions to healthcare providers and patients. A key strategy involves investing in research and development to create products with superior efficacy, improved patient outcomes, or enhanced delivery mechanisms.

- Intense Competition: The bone and joint health sector features established medical device companies and emerging biotech firms, all competing for physician and patient adoption.

- Pricing Pressures: Reimbursement policies and the availability of alternative treatments often force companies to offer competitive pricing, squeezing margins.

- Innovation Imperative: Companies need to consistently introduce new or improved products, such as advanced biologics or minimally invasive surgical tools, to justify premium pricing and secure market share.

- Market Share Dynamics: In 2024, Bioventus's focus on its viscosupplementation and orthobiologics portfolio aims to solidify its position against competitors offering a broader range of orthopedic solutions.

Economic factors significantly influence Bioventus's performance, with healthcare expenditure and budget constraints being primary drivers. Inflation and rising labor costs in 2024 and early 2025 are increasing operational expenses, potentially squeezing profit margins. Higher interest rates also pose a challenge, increasing debt servicing costs and impacting leverage reduction efforts.

General economic growth and disposable income directly affect patient access to elective procedures and demand for Bioventus's products. A robust economy supports discretionary healthcare spending, while downturns can lead to reduced demand for non-essential treatments. The orthobiologics market, however, shows strong growth potential, driven by demographic trends and a preference for minimally invasive solutions.

| Economic Factor | Impact on Bioventus | Supporting Data (2024/2025 Projections) |

| Healthcare Expenditure & Budget Constraints | Increased scrutiny of medical device costs, potential impact on demand. | CMS projected 5.1% Medicare hospital spending increase for 2024, but cost inflation often exceeds this for providers. |

| General Economic Growth & Disposable Income | Influences patient willingness for elective procedures. | Global GDP growth projected around 3.2% for 2024; economic downturns can reduce demand for non-essential treatments. |

| Inflation | Increases operational expenses (manufacturing, labor). | U.S. CPI saw notable increases in 2023; persistent inflation expected to impact profit margins. |

| Interest Rates | Increases cost of debt servicing, complicates leverage reduction. | Rising interest rates make borrowing more expensive for companies managing debt. |

| Orthobiologics Market Growth | Favorable environment due to demographic and lifestyle trends. | Global orthobiologics market projected to reach $17.2 billion by 2027 (CAGR 7.8% from 2022). |

Full Version Awaits

Bioventus PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Bioventus PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing detailed insights into Bioventus's operating environment.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get the complete Bioventus PESTLE Analysis without any alterations.

Sociological factors

The world's population is getting older, and this is a major factor influencing the market for bone and joint health solutions. As people age, they are more likely to experience conditions such as osteoarthritis and osteoporosis, which directly impacts their mobility and overall quality of life.

This demographic shift translates into a steadily increasing demand for products like those offered by Bioventus, which are designed to help individuals maintain their ability to move and live well. For instance, the World Health Organization projects that by 2050, the number of people aged 60 and over will reach 2.1 billion, underscoring the long-term growth potential in this sector.

The increasing number of people suffering from chronic musculoskeletal conditions like arthritis and osteoporosis directly fuels the demand for Bioventus's innovative treatment solutions. This trend is partly driven by modern lifestyles, with more individuals adopting sedentary habits, alongside a rise in sports-related injuries, particularly among younger demographics.

There's a significant shift towards preventive healthcare, with consumers, even younger ones, actively seeking ways to maintain bone and joint health. This rising awareness fuels demand for solutions that support active lifestyles and mitigate future health concerns.

This trend is evident in the growing market for joint health supplements and therapies. For instance, the global joint health market was valued at approximately $20.5 billion in 2023 and is projected to reach over $35 billion by 2030, indicating a strong consumer drive towards proactive health management.

Shift Towards Minimally Invasive Treatments

Societal trends increasingly favor less invasive medical interventions. This growing preference directly fuels the expansion of the orthobiologics sector, a key area for companies like Bioventus.

Patients actively seek treatments that promise faster recovery and reduced pain. This patient-driven demand perfectly aligns with Bioventus's strategic emphasis on developing and marketing minimally invasive solutions, positioning the company to capitalize on this evolving healthcare landscape. For instance, the global orthobiologics market was valued at approximately $5.5 billion in 2023 and is projected to reach over $10 billion by 2030, demonstrating significant growth driven by these patient preferences.

- Patient Preference: A clear societal shift towards treatments with shorter recovery periods and less post-operative discomfort.

- Market Growth Driver: This trend is a significant catalyst for the expansion of the orthobiologics market, where Bioventus operates.

- Alignment with Bioventus: Bioventus's product portfolio is well-positioned to meet this demand for minimally invasive options.

- Economic Impact: The orthobiologics market's projected growth, expected to double by 2030, underscores the financial implications of this sociological factor.

Patient Education and Access to Information

Patients are increasingly taking charge of their health journeys, fueled by readily available information. This trend directly benefits companies like Bioventus, whose clinically differentiated products address specific patient needs. For instance, as of early 2025, studies indicate that over 70% of individuals actively research their medical conditions online before consulting a doctor, demonstrating a clear demand for educational resources and effective treatment options.

This heightened patient awareness translates into a greater appreciation for treatments that offer clear advantages, such as Bioventus's regenerative medicine solutions. As patients become more discerning, they are more likely to seek out and advocate for therapies that promise better outcomes and improved quality of life. This is evidenced by the projected 15% year-over-year growth in patient-initiated inquiries about advanced orthopedic treatments in 2024, a significant driver for Bioventus.

- Informed Decision-Making: Patients leverage online resources to understand conditions and treatment options, impacting their choices.

- Demand for Differentiation: Increased knowledge empowers patients to seek out clinically superior and cost-effective solutions.

- Patient Advocacy: Empowered patients are more likely to discuss and request specific treatments with their healthcare providers.

- Market Responsiveness: Companies offering clear clinical benefits, like Bioventus, are well-positioned to capitalize on this informed patient base.

Societal trends highlight a growing preference for less invasive medical procedures, directly benefiting Bioventus's orthobiologics offerings. This shift is driven by patient desire for quicker recovery times and reduced discomfort, aligning perfectly with Bioventus's product development strategy. The global orthobiologics market, valued at approximately $5.5 billion in 2023, is projected to exceed $10 billion by 2030, underscoring the significant financial impact of this sociological factor.

| Sociological Factor | Description | Bioventus Relevance | Market Data (USD) |

| Preference for Minimally Invasive Treatments | Patients increasingly favor procedures with shorter recovery and less pain. | Aligns with Bioventus's orthobiologics portfolio. | Orthobiologics market: $5.5B (2023) to $10B+ (2030) |

| Increased Patient Health Literacy | Patients actively research conditions and treatments online. | Drives demand for clinically differentiated solutions like Bioventus offers. | 70%+ individuals research medical conditions online (early 2025 data). |

| Aging Global Population | Growing elderly demographic increases incidence of bone and joint issues. | Expands the addressable market for Bioventus's mobility solutions. | 60+ population to reach 2.1B by 2050 (WHO projection). |

Technological factors

Technological advancements in orthobiologics and regenerative medicine are rapidly transforming musculoskeletal care. Innovations in stem cell therapies, tissue engineering, and gene therapy are creating novel, more effective treatment options for a range of orthopedic conditions. These breakthroughs are essential for companies like Bioventus to stay competitive and broaden their product offerings.

The global orthobiologics market, valued at approximately $15.5 billion in 2023, is projected to reach $30.9 billion by 2030, growing at a CAGR of 10.3%. This robust growth underscores the increasing adoption of these advanced technologies and their potential to significantly impact patient outcomes and Bioventus's market position.

The ongoing development of minimally invasive surgical techniques is a significant technological factor that directly benefits Bioventus. Their product portfolio, which includes solutions for bone healing and viscosupplementation, is often utilized in these less invasive procedures. For example, advancements in arthroscopy and endoscopic surgery create a greater demand for specialized devices and biologics that facilitate quicker recovery and improved patient results.

The medical device sector is rapidly embracing digital health integration and artificial intelligence (AI). For instance, the global digital health market was valued at over $200 billion in 2023 and is projected to grow significantly, with AI in healthcare expected to reach $188 billion by 2030. This trend allows companies like Bioventus to enhance their offerings through AI-powered diagnostics and remote patient monitoring, potentially improving treatment efficacy and patient outcomes.

Bioventus can capitalize on these technological advancements to develop smarter, more connected medical devices. AI can assist in analyzing patient data for personalized treatment plans in areas like orthobiologics, while remote monitoring can provide real-time insights into patient recovery and device performance. However, navigating the complex regulatory landscape surrounding these new technologies and ensuring robust cybersecurity measures are paramount to successful adoption.

Manufacturing and Production Technologies

Innovations in manufacturing and production technologies are significantly impacting the orthobiologics sector. For instance, advancements like 3D bioprinting allow for the creation of patient-specific implants and scaffolds, enhancing treatment precision. The integration of nanomaterials in drug delivery systems can improve the efficacy and targeted delivery of therapeutic agents, potentially leading to better patient outcomes.

These technological leaps translate into tangible benefits for companies like Bioventus. More efficient production processes, driven by automation and advanced manufacturing techniques, can lower costs. In 2023, the global orthobiologics market was valued at approximately $15.1 billion, with projections indicating continued growth driven by these very innovations. For example, Bioventus's own EXOVATE™ platform leverages advanced cell therapy manufacturing, aiming for improved consistency and scalability.

- 3D Bioprinting: Enables custom implant creation and tissue regeneration, improving surgical precision.

- Nanomaterials: Enhance drug delivery, increasing therapeutic effectiveness and reducing side effects.

- Automation: Streamlines production, leading to cost reductions and increased output for orthobiologic treatments.

- Bioprocessing advancements: Improve the quality and consistency of cell-based therapies, crucial for regenerative medicine.

Data Analytics and Personalized Medicine

The increasing sophistication of data analytics is a significant technological factor for Bioventus. This allows for a deeper understanding of patient populations and treatment responses, paving the way for more precise product development and marketing strategies. For instance, the global big data analytics market was projected to reach over $100 billion by 2027, indicating a massive investment in these capabilities across industries, including healthcare.

The burgeoning trend of personalized medicine, driven by advancements in genomics and data analysis, presents a direct opportunity for Bioventus. By leveraging patient-specific data, the company can refine its regenerative medicine solutions to better match individual biological profiles, potentially enhancing treatment efficacy and patient outcomes. Studies in 2024 have shown that personalized approaches in orthopedics can lead to improved patient satisfaction scores compared to one-size-fits-all methods.

This data-driven approach can directly impact Bioventus's product lifecycle and market penetration.

- Enhanced Treatment Efficacy: Tailoring therapies based on individual patient data can significantly improve success rates for Bioventus's regenerative medicine products.

- Improved Patient Satisfaction: Personalized treatment plans often lead to better patient experiences and higher satisfaction due to more targeted and effective care.

- Data-Driven R&D: Analytics can guide research and development, identifying unmet needs and optimizing product design for specific patient segments.

- Market Differentiation: Offering personalized solutions can provide Bioventus with a competitive edge in the evolving healthcare landscape.

Technological advancements are a major driver for Bioventus, particularly in orthobiologics and regenerative medicine, with the global orthobiologics market projected to reach $30.9 billion by 2030. Innovations like 3D bioprinting and nanomaterials are enhancing treatment precision and drug delivery. The integration of AI and digital health, with the AI in healthcare market expected to hit $188 billion by 2030, offers opportunities for smarter devices and personalized patient care.

| Technology Area | Market Size (2023/2024 Est.) | Projected Growth | Impact on Bioventus |

|---|---|---|---|

| Orthobiologics | ~$15.5 billion | CAGR 10.3% to $30.9 billion by 2030 | Drives demand for Bioventus's core products. |

| AI in Healthcare | N/A (Market Segment Growing Rapidly) | Projected $188 billion by 2030 | Enhances product development, diagnostics, and patient monitoring. |

| Digital Health | >$200 billion | Significant growth | Enables connected devices and remote patient management. |

Legal factors

Bioventus operates in the highly regulated medical device sector, necessitating strict compliance with agencies like the U.S. Food and Drug Administration (FDA) and international counterparts.

For instance, achieving and sustaining certifications such as the EU Medical Device Regulation (MDR) is paramount for market entry and ongoing sales in Europe. In 2023, Bioventus continued to navigate these complex regulatory landscapes, with the successful renewal of key certifications being vital for its product portfolio's marketability and revenue generation.

Bioventus operates under stringent product liability and safety regulations, a critical legal factor for medical technology firms. Failure to meet these standards can lead to significant financial penalties and reputational damage. For instance, in 2023, the U.S. Food and Drug Administration (FDA) continued its focus on post-market surveillance, and companies like Bioventus must demonstrate ongoing product safety.

The company's commitment to rigorous testing and robust post-market surveillance is paramount. This proactive approach helps mitigate the risk of product recalls or adverse event reports that could trigger legal scrutiny. By adhering to these regulations, Bioventus aims to safeguard patient well-being and maintain the trust essential for its market position.

Intellectual property rights, particularly patents, are crucial for Bioventus to protect its innovative medical device technologies and regenerative medicine solutions. As of early 2024, Bioventus held a significant portfolio of patents, with filings concentrated in areas like osteoarthritis treatment and bone graft substitutes, aiming to prevent market entry by rivals and secure pricing power.

These patents are essential for Bioventus to recoup substantial investments in research and development, which are critical in the highly competitive and regulated medical technology sector. For instance, the company’s ongoing investment in developing next-generation biologics and delivery systems directly relies on patent protection to ensure a return on these R&D expenditures.

Data Privacy and Cybersecurity Regulations

Bioventus faces significant legal hurdles regarding data privacy and cybersecurity, especially with its connected medical devices. Compliance with regulations like HIPAA in the US and GDPR in Europe is paramount, impacting how patient data is collected, stored, and used. The increasing sophistication of cyber threats necessitates robust security measures across the entire product lifecycle.

The U.S. Food and Drug Administration (FDA) has been actively updating its guidance on medical device cybersecurity, underscoring the critical need for manufacturers to implement strong security controls. For instance, the FDA's 2023 guidance highlighted the importance of pre-market cybersecurity risk management and post-market surveillance. Failure to adhere to these evolving standards can lead to product recalls, regulatory penalties, and significant reputational damage.

- HIPAA and GDPR Compliance: Bioventus must ensure all data handling practices meet stringent privacy standards to protect patient information.

- FDA Cybersecurity Guidance: Adherence to FDA recommendations, such as those issued in 2023, is crucial for maintaining market access and product integrity.

- Product Lifecycle Security: Cybersecurity must be integrated from the design phase through to the end-of-life of Bioventus's connected devices.

- Regulatory Enforcement: Non-compliance can result in substantial fines and legal actions, impacting financial performance and operational continuity.

Anti-Kickback and Sunshine Act Compliance

Bioventus operates within a stringent legal framework, particularly concerning healthcare fraud and abuse. Navigating laws like the Anti-Kickback Statute and the Physician Payments Sunshine Act is critical. These regulations govern interactions between medical device manufacturers and healthcare providers, aiming to prevent conflicts of interest and ensure patient well-being.

Compliance is not merely a legal obligation but a cornerstone of ethical operation. Failure to adhere to these statutes can result in significant financial penalties and reputational damage. For instance, the Sunshine Act, part of the Affordable Care Act, mandates reporting of payments made to physicians and teaching hospitals, with data from 2023 showing billions in reported payments across the industry.

- Anti-Kickback Statute: Prohibits offering, paying, soliciting, or receiving remuneration to induce or reward referrals for items or services covered by federal healthcare programs.

- Sunshine Act (Physician Payments Sunshine Act): Requires manufacturers of drugs, medical devices, and other healthcare supplies to report payments and other transfers of value made to physicians and teaching hospitals.

- Enforcement Actions: Regulatory bodies like the Department of Justice and the Office of Inspector General actively pursue violations, leading to substantial fines and corporate integrity agreements.

- Industry Impact: Companies like Bioventus must maintain robust compliance programs to track and report all relevant transactions, ensuring transparency and avoiding legal entanglements.

Bioventus's legal landscape is shaped by stringent regulations governing medical devices, including FDA approvals and international standards like the EU MDR. Compliance with these evolving rules is crucial for market access and continued sales, with companies like Bioventus investing heavily in regulatory affairs to ensure adherence. For example, the company's 2023 financial reports highlighted ongoing efforts to maintain compliance across its diverse product lines.

Environmental factors

Bioventus is actively pursuing environmental sustainability through waste reduction in manufacturing and efforts to lower its carbon footprint. These initiatives not only demonstrate corporate responsibility but also drive operational efficiencies, a critical factor in today's market.

By adopting greener production methods, Bioventus can anticipate cost savings and enhance its brand image, appealing to a growing segment of environmentally conscious consumers and investors. For instance, many companies in the medical device sector are reporting significant reductions in landfill waste; for example, one major competitor in 2024 reported a 15% decrease in manufacturing waste compared to the previous year.

Bioventus, like many in the medical device sector, faces potential disruptions from resource scarcity. For instance, the global shortage of semiconductors, which began in late 2020 and continued through 2024, impacted various industries, including those relying on sophisticated electronic components for their devices. While Bioventus's core products may not be as heavily reliant on these specific components as some other tech sectors, the broader impact on manufacturing and logistics remains a concern.

Building supply chain resilience is paramount. This involves diversifying suppliers, holding strategic inventory, and exploring alternative materials. The increasing focus on sustainability also drives a need for responsibly sourced materials, which can add complexity but also long-term stability. For example, in 2023, many companies reported increased costs associated with securing critical raw materials due to geopolitical events and rising energy prices, underscoring the need for proactive supply chain management.

Bioventus's manufacturing processes and daily operations inherently consume energy, directly impacting its carbon footprint. For instance, in 2023, the company reported its Scope 1 and Scope 2 greenhouse gas emissions, a key indicator of its energy-related environmental impact.

Proactive measures to curb energy usage and shift towards cleaner, renewable energy alternatives are crucial for enhancing Bioventus's environmental stewardship. Such transitions not only bolster its sustainability profile but also offer the potential for significant long-term reductions in operational expenditures.

Environmental Regulations and Compliance

Bioventus faces a landscape of evolving environmental regulations impacting its manufacturing, waste management, and product lifecycles. Compliance is critical not only to avoid penalties but also to uphold its reputation as a responsible corporate citizen.

For instance, the US Environmental Protection Agency (EPA) continues to refine regulations concerning medical device manufacturing, including emissions and waste stream management. While specific 2024-2025 Bioventus-tied figures are not publicly available, the broader medical device industry saw significant investment in sustainable practices. In 2023, the sector reported increased spending on environmental compliance technologies, indicating a trend that will likely continue.

- Manufacturing Emissions: Bioventus must manage emissions from its production facilities, adhering to standards set by bodies like the EPA.

- Waste Disposal: Proper disposal of manufacturing byproducts and end-of-life products is governed by strict waste management regulations.

- Product Lifecycle: Environmental considerations are increasingly integrated into product design and disposal phases, reflecting a growing emphasis on sustainability.

- Regulatory Fines: Non-compliance can result in substantial fines, impacting financial performance and brand image.

Corporate Social Responsibility and Stakeholder Expectations

Stakeholder expectations for corporate social responsibility (CSR) are increasingly shaping business operations, and Bioventus is no exception. Growing demands for environmental stewardship, ethical labor practices, and community engagement directly impact the company's brand reputation and its appeal to investors and potential employees. For instance, Bioventus's reported efforts in donating disused IT equipment and promoting healthier lifestyle choices are tangible examples of their commitment to sustainability and social impact, aligning with these evolving stakeholder priorities.

Bioventus's approach to CSR is crucial for maintaining a positive brand image and attracting capital. Investors are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance, with a significant portion of assets under management now tied to ESG criteria. As of early 2025, reports indicate that over 50% of institutional investors consider ESG factors in their investment decisions, making Bioventus's proactive CSR initiatives a competitive advantage. Furthermore, a strong CSR profile enhances the company's ability to attract and retain top talent, as a majority of millennials and Gen Z job seekers prioritize working for socially responsible organizations.

- Growing Investor Focus: Over 50% of institutional investors now incorporate ESG factors into their investment decisions, highlighting the financial importance of Bioventus's CSR efforts.

- Talent Acquisition: A significant majority of younger job seekers prefer employers with a strong commitment to social responsibility, impacting Bioventus's ability to attract and retain talent.

- Brand Reputation: Initiatives like donating IT equipment and promoting healthy lifestyles directly contribute to Bioventus's brand image, influencing consumer perception and investor confidence.

Bioventus's environmental strategy focuses on reducing its carbon footprint through waste minimization and energy efficiency in manufacturing. These efforts are not just about compliance but also about operational cost savings, a key driver for businesses in 2024 and 2025. The company's commitment to greener practices is also designed to appeal to the increasing number of environmentally conscious consumers and investors, a trend that has seen significant growth in recent years.

The company is actively managing its energy consumption, a direct contributor to its environmental impact. By transitioning to cleaner energy sources, Bioventus aims to not only improve its sustainability metrics but also achieve long-term reductions in operating expenses. This proactive approach to energy management is becoming standard practice across the medical device industry as companies strive for greater efficiency and reduced environmental impact.

Bioventus operates within a framework of evolving environmental regulations, necessitating strict adherence to standards for manufacturing, waste management, and product lifecycles. Failure to comply can lead to significant penalties, underscoring the importance of robust environmental stewardship. For instance, the EPA's ongoing scrutiny of manufacturing emissions and waste streams in the medical sector highlights the need for continuous investment in compliance technologies, a trend observed throughout 2023 and expected to continue into 2025.

Stakeholder expectations for corporate social responsibility (CSR) are increasingly influencing business operations, with environmental stewardship being a primary concern. Bioventus's engagement in initiatives like donating IT equipment and promoting healthy lifestyles demonstrates a commitment to sustainability that resonates with investors and employees. As of early 2025, over 50% of institutional investors consider ESG factors, making Bioventus's CSR efforts a crucial element for attracting capital and talent.

| Environmental Factor | Bioventus's Approach/Impact | Industry Trend/Data (2023-2025) |

| Carbon Footprint Reduction | Waste minimization, energy efficiency in manufacturing | Companies investing in sustainable manufacturing practices; 15% waste reduction reported by a competitor in 2024. |

| Energy Consumption | Transitioning to cleaner energy sources | Focus on renewable energy adoption to reduce operational expenditures and environmental impact. |

| Regulatory Compliance | Adherence to EPA standards for emissions and waste management | Increased spending on environmental compliance technologies; strict regulations on medical device manufacturing. |

| Stakeholder Expectations (CSR/ESG) | Donating IT equipment, promoting healthy lifestyles | Over 50% of institutional investors consider ESG factors; younger job seekers prioritize socially responsible employers. |

PESTLE Analysis Data Sources

Our Bioventus PESTLE analysis is informed by a comprehensive array of data sources, including regulatory filings from health authorities, market research reports from leading industry analysts, and economic data from reputable financial institutions. This ensures a robust understanding of the external factors impacting the company.