Bioventus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bioventus Bundle

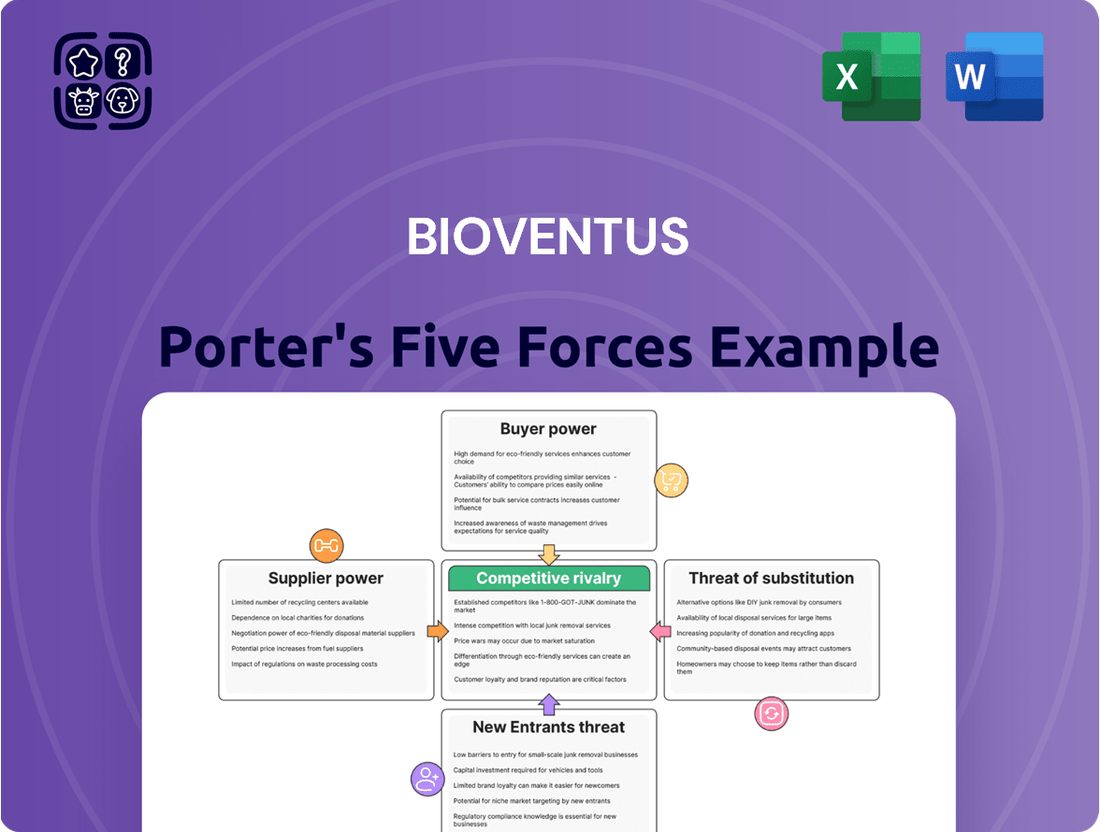

Bioventus operates in a dynamic market shaped by several key forces, including the bargaining power of buyers and the threat of substitute products. Understanding these pressures is crucial for navigating the competitive landscape.

The complete report reveals the real forces shaping Bioventus’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

In the medical technology sector, especially for niche areas like orthobiologics, the number of suppliers for crucial components or raw materials can be quite restricted. This concentration means that if Bioventus relies on a small group of specialized providers for unique biomaterials or essential manufacturing techniques, those suppliers gain considerable leverage.

For instance, if a particular collagen source or a proprietary cell culture medium is vital for Bioventus's product efficacy and only a handful of companies produce it, these suppliers can dictate terms. This limited supplier base for critical inputs directly amplifies their bargaining power, potentially impacting Bioventus's cost of goods sold and production continuity.

Switching suppliers in the medical device sector, particularly for companies like Bioventus, involves significant hurdles. These include rigorous regulatory approvals, extensive validation procedures, and the potential need to re-engineer existing products to accommodate new components or materials. These complexities directly translate into high switching costs.

For Bioventus, these elevated switching costs strengthen the bargaining power of its current suppliers. If a supplier's product is deeply integrated into Bioventus's offerings and meets all regulatory standards, changing to a new supplier would be a costly and time-consuming endeavor, potentially impacting production timelines and product performance.

If suppliers provide highly differentiated or proprietary components, technologies, or services that are critical to Bioventus's unique product offerings, their bargaining power is elevated. This is especially true if these inputs are not easily replicated or sourced from other vendors. For example, if a key supplier for Bioventus's regenerative medicine products offers a patented cell-culture medium or a specialized delivery system that is integral to the product's efficacy and cannot be easily substituted, that supplier holds significant leverage.

Threat of Forward Integration by Suppliers

Suppliers might integrate forward into Bioventus's business if they possess the capacity and motivation to compete directly. This would increase their bargaining power, as Bioventus would likely seek to preserve favorable supplier relationships.

For instance, a key component supplier for Bioventus's regenerative medicine products could potentially develop its own finished products. This scenario would shift the competitive landscape, making Bioventus more reliant on maintaining positive terms with this now-competitor.

The threat of forward integration is particularly relevant in industries with high R&D costs or specialized manufacturing capabilities, where suppliers might have unique insights or assets that could be leveraged for direct market entry.

Consider the supplier of advanced biomaterials used in Bioventus's joint pain treatments. If this supplier has the technological know-how and distribution channels, they could launch their own branded therapies, directly challenging Bioventus.

Importance of Bioventus to the Supplier

The bargaining power of suppliers to Bioventus is influenced by how crucial Bioventus is to their business. If Bioventus constitutes a small fraction of a supplier's total sales, that supplier holds more leverage. For instance, if a key component supplier generates 95% of its revenue from other clients, the loss of Bioventus as a customer would be inconsequential, allowing the supplier to dictate terms more forcefully.

Conversely, if Bioventus represents a substantial portion of a supplier's revenue, the supplier's bargaining power diminishes. For example, if Bioventus accounts for a significant percentage of a raw material provider's income, that provider would be more inclined to offer favorable pricing and terms to retain Bioventus's business, thereby reducing their own leverage.

- Supplier Dependence: If Bioventus is a minor client for a supplier, the supplier's bargaining power increases as they have less to lose by imposing stricter conditions.

- Bioventus's Impact: Conversely, if Bioventus is a major customer for a supplier, the supplier's bargaining power is weakened, as they are more dependent on Bioventus's continued patronage.

- Market Concentration: The availability of alternative suppliers also plays a role; a concentrated supplier market benefits suppliers, while a fragmented one benefits Bioventus.

The bargaining power of suppliers to Bioventus is significant due to the specialized nature of orthobiologics components. A limited number of suppliers for critical biomaterials and proprietary technologies means these providers can dictate terms, impacting Bioventus's costs and production. High switching costs, stemming from regulatory hurdles and product re-engineering, further solidify supplier leverage.

Suppliers who offer differentiated or patented inputs essential for Bioventus's unique product efficacy hold considerable power, especially if alternatives are scarce. The threat of forward integration by suppliers, where they might develop competing finished products, also strengthens their position.

Supplier leverage is amplified when Bioventus represents a small portion of their sales, giving suppliers less incentive to accommodate Bioventus's needs. Conversely, if Bioventus is a major client, the supplier's power is reduced as they are more reliant on maintaining the relationship.

| Factor | Impact on Bioventus | Example Scenario | Data Point (Illustrative) |

|---|---|---|---|

| Supplier Concentration | High Leverage | Bioventus relies on a single supplier for a patented growth factor. | Estimated 3 key suppliers for critical orthobiologic raw materials. |

| Switching Costs | High Leverage | Changing a primary cell culture medium requires extensive FDA re-validation. | Estimated 12-18 months for regulatory approval of new material suppliers. |

| Supplier Differentiation | High Leverage | A supplier provides a proprietary scaffold technology integral to product performance. | Bioventus's top 5 products utilize components from specialized, often single-source, suppliers. |

| Bioventus's Customer Importance | Low Leverage | Bioventus is a small client for a supplier focused on larger pharmaceutical companies. | Bioventus's annual spend with key suppliers represents <10% of supplier revenue. |

What is included in the product

This analysis identifies the intensity of competition within the musculoskeletal health market, assessing the threat of new entrants, the bargaining power of suppliers and buyers, and the availability of substitute products for Bioventus.

Instantly identify competitive pressures and opportunities within the pain management market, enabling Bioventus to strategically navigate threats and capitalize on growth areas.

Customers Bargaining Power

Customers in the healthcare sector, including major hospital systems, clinics, and government payers like Medicare and Medicaid, are exhibiting heightened price sensitivity. This trend is fueled by ongoing initiatives to manage and reduce overall healthcare spending, alongside a significant pivot towards value-based care models. For instance, in 2024, many hospital systems reported increased pressure to demonstrate cost-effectiveness for all purchased medical devices and treatments, directly impacting their purchasing decisions and negotiations with suppliers like Bioventus.

Large hospital networks and Group Purchasing Organizations (GPOs) represent a significant customer segment for Bioventus, and their substantial purchase volumes grant them considerable bargaining power. For instance, in 2023, GPOs were estimated to represent over 80% of hospital purchasing volume for many medical products, a trend that has continued to solidify.

This concentrated purchasing power allows these entities to negotiate more aggressive pricing and favorable contract terms, directly impacting Bioventus's revenue streams and profit margins. Their ability to consolidate demand from multiple healthcare providers means they can wield considerable influence over suppliers like Bioventus, seeking volume discounts and preferential treatment.

The availability of numerous alternative treatments for bone and joint health significantly empowers customers. These alternatives, whether from direct competitors or even traditional methods, offer Bioventus's customers more choices, directly impacting the company's pricing power.

When customers can easily switch to a different product or therapy, their bargaining power against Bioventus escalates. For instance, the market for non-surgical joint pain management is diverse, with treatments ranging from physical therapy and exercise to other regenerative medicine options, potentially limiting Bioventus's ability to command premium pricing.

Customer Information and Transparency

As healthcare data becomes more accessible, customers like hospitals and physicians can readily compare the efficacy and cost of different orthobiologics. This increased transparency empowers them to negotiate better pricing and terms with suppliers like Bioventus.

For instance, in 2024, the rise of real-world evidence platforms allows for direct comparison of patient outcomes and cost per procedure across various regenerative medicine products. This means a hospital can easily see if a competitor's product offers similar or better results at a lower price point, directly impacting their purchasing leverage.

- Increased Data Accessibility: Healthcare data transparency is on the rise, enabling informed comparisons.

- Cost-Effectiveness Scrutiny: Customers can easily evaluate the financial benefits of different orthobiologics.

- Negotiating Power: Enhanced information allows customers to secure more favorable terms.

- Real-World Evidence: Platforms in 2024 facilitate direct comparison of product performance and cost.

Threat of Backward Integration by Customers

While the threat of customers backward integrating into orthobiologic production is generally low for Bioventus, it's not entirely absent. Large, well-funded hospital systems or integrated healthcare networks could theoretically develop their own solutions, bypassing suppliers like Bioventus. This is especially true if they perceive significant cost savings or a strategic advantage in controlling their supply chain for key medical products.

The primary deterrents to this kind of backward integration are the substantial research and development expenses and the complex regulatory pathways required for medical device and biologic approval. For instance, bringing a new orthobiologic product to market can cost tens of millions of dollars and take several years, a significant undertaking for even large healthcare organizations. Despite these high barriers, the mere possibility of such integration, however remote, can exert subtle pressure on Bioventus during price negotiations and contract discussions.

- Low Likelihood: High R&D and regulatory costs make direct production by customers a minimal threat.

- Potential Influence: The theoretical possibility of integration can still impact customer bargaining power.

- Strategic Considerations: Large healthcare networks might explore this if cost savings or supply chain control are paramount.

The bargaining power of customers is a significant force for Bioventus, driven by increasing price sensitivity and the availability of alternatives. Large hospital systems and Group Purchasing Organizations (GPOs) wield considerable influence due to their substantial purchasing volumes, often negotiating aggressive pricing. For example, GPOs in 2023 represented over 80% of hospital purchasing volume for many medical products, a trend that continued into 2024.

Customers are empowered by greater transparency in healthcare data, allowing them to compare the cost-effectiveness and real-world efficacy of various orthobiologics. Platforms in 2024 facilitate these comparisons, enabling buyers to leverage this information for better terms. While backward integration by customers is a low threat due to high R&D and regulatory costs, the potential for it can still influence negotiations.

| Factor | Impact on Bioventus | Evidence/Data Point (2023-2024) |

|---|---|---|

| Customer Concentration (GPOs/Large Hospitals) | High Bargaining Power | GPOs accounted for >80% of hospital purchasing volume in 2023. |

| Availability of Alternatives | Limits Pricing Power | Diverse non-surgical pain management options exist. |

| Data Transparency & Real-World Evidence | Increases Customer Leverage | Real-world evidence platforms in 2024 allow direct cost-efficacy comparisons. |

| Backward Integration Threat | Low, but potentially influences negotiations | High R&D ($ tens of millions) and regulatory hurdles deter integration. |

What You See Is What You Get

Bioventus Porter's Five Forces Analysis

This preview showcases the comprehensive Bioventus Porter's Five Forces Analysis, detailing the competitive landscape of the orthobiologics market. You are viewing the exact document you will receive immediately after purchase, providing a thorough examination of the industry's bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of existing rivalry.

Rivalry Among Competitors

The orthobiologics market is quite crowded, featuring a mix of smaller, specialized local and regional companies alongside big, well-known medical device manufacturers. This fragmentation means Bioventus is up against a wide array of competitors, each with their own strengths and market focus.

Key players like Orthofix, Medtronic, Zimmer Biomet, and Stryker are significant rivals. For instance, in 2023, Medtronic reported revenues of $23.4 billion, showcasing its substantial resources and market presence, which directly impacts the competitive landscape Bioventus navigates.

The global orthobiologics market is experiencing robust expansion, with projections indicating a compound annual growth rate (CAGR) between 5.2% and 6.7% from 2025 onward. This growth, while generally positive, doesn't eliminate intense competition.

Companies within this expanding sector will continue to vie aggressively for market share, leveraging innovation and strategic partnerships to capture a larger portion of the increasing demand for regenerative medicine solutions.

Bioventus thrives on offering clinically distinct, cost-effective, and minimally invasive treatments. This focus on innovation allows them to stand out. For instance, their DUROLANE for osteoarthritis and the XCELL PRP system exemplify this strategy.

The company's ability to consistently introduce unique products is key to staying ahead and avoiding price wars. In 2023, Bioventus reported revenue of $448.8 million, underscoring the market's reception to their differentiated offerings.

Exit Barriers

Bioventus faces significant competitive rivalry partly due to high exit barriers. These barriers, such as substantial investments in specialized manufacturing facilities and ongoing research and development for regenerative medicine technologies, make it difficult and costly for companies to leave the market. For instance, Bioventus’s commitment to developing advanced biologic therapies requires long-term capital allocation and specialized expertise, locking in players even during periods of lower profitability.

The presence of these exit barriers means that even if Bioventus or its competitors experience declining revenues or margins, they are compelled to remain active in the market. This persistence can lead to sustained, intense competition. Companies might engage in aggressive pricing strategies or increased marketing efforts to maintain market share, rather than exiting, which can put pressure on overall industry profitability and further fuel rivalry.

Consider the impact of long-term supply agreements and regulatory approvals for their product lines. These create further inertia, as terminating such commitments or abandoning the regulatory pathways for their innovations would incur significant penalties or sunk costs. This situation is common in the medical device and biopharmaceutical sectors where Bioventus operates, contributing to a landscape where established players are reluctant to withdraw, thereby intensifying the competitive dynamic.

- Specialized Assets: Bioventus operates in a sector requiring highly specific manufacturing capabilities for biologics, which are not easily repurposed or sold.

- R&D Investments: Significant and ongoing investment in developing new regenerative medicine products represents a substantial sunk cost for all players.

- Long-Term Contracts: Agreements with healthcare providers and distributors create obligations that are costly to break.

- Regulatory Hurdles: The lengthy and expensive process of obtaining and maintaining regulatory approvals for medical products acts as a substantial barrier to entry and exit.

Industry Concentration and Market Share

While the market for Bioventus's products can appear fragmented, the competitive landscape is significantly shaped by a few major players. These established companies often boast strong brand recognition and well-developed distribution networks, which can create a formidable barrier for smaller competitors.

Bioventus faces intense rivalry from these larger entities. For instance, in the orthobiologics segment, competitors like Arthrex and Stryker have substantial market presence. Bioventus's success hinges on its ability to differentiate its offerings and effectively compete for market share against these giants.

- Intensified Competition: The presence of major players with strong brand recognition and extensive distribution networks significantly intensifies competition for Bioventus.

- Market Share Dynamics: Bioventus's capacity to maintain or expand its market share against these established competitors is a critical measure of the competitive rivalry it faces.

- Key Competitors: In specific segments, companies like Arthrex and Stryker represent significant competitive threats due to their established market positions.

- Strategic Importance: Effectively navigating this competitive rivalry is crucial for Bioventus's sustained growth and profitability in the market.

Bioventus operates in a highly competitive orthobiologics market, facing rivalry from both specialized firms and large medical device manufacturers. This intense competition is fueled by high exit barriers, including significant R&D investments and specialized manufacturing needs, which keep players engaged even during challenging periods. For example, the substantial capital required for regenerative medicine technologies makes market exits costly, thereby sustaining rivalry.

Key competitors like Medtronic, Zimmer Biomet, Stryker, and Arthrex possess considerable market presence and resources, intensifying Bioventus's challenge to gain and maintain market share. In 2023, Medtronic's revenue of $23.4 billion highlights the scale of these larger rivals, while Bioventus reported $448.8 million in revenue, indicating the need for differentiation.

The orthobiologics market's projected growth, with a CAGR between 5.2% and 6.7% from 2025, attracts continued aggressive competition. Companies will leverage innovation and strategic alliances to capture this expanding demand, making Bioventus's focus on clinically distinct and cost-effective solutions, such as DUROLANE and XCELL PRP, crucial for its competitive strategy.

| Competitor | 2023 Revenue (Approx.) | Market Segment Focus |

| Medtronic | $23.4 billion | Spine, Biologics, Extremities |

| Zimmer Biomet | $1.7 billion (HVT segment) | Knee, Hip, Extremities, Spine |

| Stryker | $21.8 billion | Orthopaedics, MedSurg, Neurotechnology |

| Arthrex | $4.5 billion | Arthroscopy, Sports Medicine |

| Bioventus | $448.8 million | Orthopaedics, Wound Care |

SSubstitutes Threaten

Patients and healthcare providers have a range of established treatments for bone and joint issues. These include physical therapy, pain management drugs, standard surgical procedures, and lifestyle changes. These options, while not identical biological replacements, address the same patient needs, presenting a competitive challenge to Bioventus.

The threat of substitutes for Bioventus's orthobiologic products hinges significantly on the perceived efficacy and cost-effectiveness of alternative treatments. If other therapies, such as traditional physical therapy or less invasive surgical procedures, can achieve comparable or better patient outcomes at a lower price point, then patients and healthcare payers are more likely to choose these substitutes. This can directly reduce the demand for Bioventus's offerings.

For instance, consider the market for osteoarthritis knee pain. While Bioventus offers viscosupplementation products, the growing adoption of advanced physical therapy protocols and the increasing availability of less invasive surgical options present a tangible threat. In 2024, the global physical therapy market was projected to reach over $100 billion, indicating a substantial and accessible alternative for patients seeking pain relief and functional improvement.

Technological advancements in adjacent fields pose a significant threat of substitutes for Bioventus. For instance, the development of more effective pharmaceutical pain management solutions could lessen the demand for orthobiologic treatments. Similarly, innovations in non-invasive rehabilitation technologies or even advancements in preventative health strategies might reduce the overall need for Bioventus' product offerings.

Patient and Physician Acceptance of Substitutes

The willingness of patients and physicians to adopt alternative treatments significantly impacts the threat of substitutes for Bioventus's products. If patients show a strong preference for less invasive procedures or treatments they are already familiar with, this can increase the appeal of substitutes, even if Bioventus offers superior outcomes. For example, a patient's comfort level with traditional physical therapy versus an injectable regenerative medicine treatment can be a deciding factor.

Physician prescription habits are equally critical. Doctors may be more inclined to prescribe treatments they have extensive experience with or that are covered by existing insurance protocols. In 2024, the adoption rate of novel regenerative therapies can be slower in markets where established, albeit less effective, treatment pathways are deeply ingrained in clinical practice. This inertia can create a substantial barrier for Bioventus's innovations when competing against more conventional alternatives.

The perceived advantages of substitutes, such as lower upfront costs or simpler administration, can also sway decisions. While Bioventus's products might offer long-term benefits, the immediate cost-effectiveness of a substitute can be a powerful driver for both patients and healthcare providers. This is particularly relevant in healthcare systems facing budget constraints.

- Patient preference for familiar, less invasive treatments can elevate the threat of substitutes.

- Physician comfort and experience with existing therapies influence prescription patterns, potentially favoring substitutes.

- Cost-effectiveness of alternatives, even if less advanced, can drive adoption in budget-conscious environments.

Regulatory and Reimbursement Landscape for Substitutes

Changes in healthcare regulations and reimbursement policies significantly impact the attractiveness of substitute treatments for orthobiologics. For instance, if government payers or private insurers broaden coverage for less invasive or more traditional therapies, it could diminish the market share of Bioventus's specialized products.

Favorable reimbursement for emerging alternative therapies, such as advanced physical therapy protocols or novel regenerative medicine techniques outside of current orthobiologic classifications, could also shift market dynamics. This could lead to a decrease in demand for existing orthobiologic solutions if these alternatives prove to be more cost-effective or equally efficacious.

In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to evaluate coverage for various medical procedures and devices. Any adjustments to reimbursement rates for procedures utilizing non-orthobiologic treatments, or the introduction of new codes for alternative therapies, directly influence the competitive landscape.

The threat of substitutes is heightened by:

- Shifting Reimbursement Policies: Alterations in how payers cover procedures involving alternative therapies can make them more or less competitive against orthobiologics.

- Emergence of Cost-Effective Alternatives: The development and adoption of therapies that offer similar clinical outcomes at a lower cost pose a significant threat.

- Regulatory Approval of New Treatments: Approval of new, non-orthobiologic treatments by regulatory bodies like the FDA could introduce direct substitutes into the market.

The threat of substitutes for Bioventus's orthobiologic products is substantial, driven by a range of established and emerging alternatives. These substitutes address similar patient needs, often with varying degrees of efficacy, cost, and invasiveness. The global physical therapy market, projected to exceed $100 billion in 2024, exemplifies the scale of these alternatives.

Patient and physician preferences play a critical role, with a tendency towards familiar, less invasive, or more cost-effective treatments influencing adoption. Reimbursement policies also significantly shape the competitive landscape, making alternatives more or less attractive depending on payer coverage. For example, any favorable adjustments in CMS reimbursement for non-orthobiologic therapies in 2024 directly impact Bioventus's market position.

| Substitute Category | 2024 Market Projection (USD Billion) | Key Competitive Factors |

|---|---|---|

| Physical Therapy | >100 | Familiarity, Non-invasiveness, Cost-effectiveness |

| Pain Management Drugs | N/A (Broad category) | Accessibility, Immediate Relief, Potential Side Effects |

| Standard Surgical Procedures | N/A (Procedure-specific) | Established Efficacy, Potential for Higher Cost/Downtime |

| Preventative Health Strategies | N/A (Growing segment) | Long-term Health Focus, Reduced Need for Intervention |

Entrants Threaten

Entering the medical technology and orthobiologics sector, where Bioventus operates, demands immense capital. Companies need significant funding for groundbreaking research and development, rigorous clinical trials that can cost millions, establishing state-of-the-art manufacturing facilities, and building a robust sales and marketing network. For instance, bringing a new medical device to market can easily exceed $100 million in development costs alone.

Stringent regulatory hurdles significantly deter new entrants in the orthobiologics market. Companies like Bioventus must navigate complex approval pathways from bodies such as the U.S. Food and Drug Administration (FDA) and the UK's Medicines and Healthcare products Regulatory Agency (MHRA). These processes are not only lengthy, often taking years, but also incur substantial costs, estimated to be in the tens of millions of dollars for novel medical devices, making it a formidable barrier for smaller, less capitalized competitors.

Bioventus, a global medical technology company, has cultivated a strong brand reputation and deep-seated relationships with physicians and healthcare systems. This established trust is a formidable barrier for new entrants. For instance, in 2023, Bioventus reported net sales of $432.5 million, underscoring its significant market presence and the substantial investment required to even approach such figures.

Access to Distribution Channels

Securing effective distribution channels and sales networks is paramount for any new entrant aiming to penetrate the healthcare market, especially in specialized areas like regenerative medicine where Bioventus operates. Established companies often possess deep-rooted relationships and extensive infrastructure, making it a significant hurdle for newcomers to gain comparable access to hospitals, clinics, and key opinion leaders.

For instance, Bioventus's established sales force and distribution agreements provide a significant advantage. In 2023, the company reported a net sales increase of 10% year-over-year, reaching $451.9 million, partly driven by its ability to effectively reach its target customer base through these existing channels.

- Established Networks: Bioventus leverages its long-standing relationships with healthcare providers, making it difficult for new entrants to replicate this level of market penetration.

- Sales Force Efficiency: A skilled and experienced sales team, already familiar with the product portfolio and customer needs, is a substantial barrier to entry.

- Logistical Infrastructure: The costs and complexities associated with building a comparable distribution and logistics network are considerable for new players.

Proprietary Technology and Intellectual Property

Bioventus's focus on clinically differentiated treatments highlights its reliance on proprietary technology and intellectual property. This creates a significant barrier for new entrants. Developing comparable or superior products would necessitate substantial investment in research and development, alongside the risk of patent infringement litigation. For instance, Bioventus's hyaluronic acid viscosupplementation products, like DUROLANE, are protected by patents, making it difficult for competitors to replicate their efficacy and market position without extensive legal and financial hurdles.

The threat of new entrants is therefore moderated by the high cost and complexity associated with replicating Bioventus's innovation pipeline. New companies would need to secure substantial funding and navigate a complex regulatory landscape, in addition to overcoming the intellectual property protections already in place. This barrier is particularly relevant in the regenerative medicine and orthobiologics sectors where Bioventus operates, as these fields often involve intricate scientific processes and extensive clinical validation.

- Proprietary Technology: Bioventus's product portfolio, including its EXOVATE™ and other regenerative medicine solutions, is built upon unique technological platforms.

- Intellectual Property: The company holds numerous patents covering its core technologies and product formulations, safeguarding its market position.

- R&D Investment: New entrants would require significant capital for R&D to develop comparable products, estimated to be in the tens or hundreds of millions of dollars for novel therapeutic development.

- Patent Infringement Risk: The threat of costly patent infringement lawsuits deters potential competitors from entering markets with established IP.

The threat of new entrants into Bioventus's market is significantly low due to the substantial capital required for research, development, and regulatory approvals, often exceeding $100 million for new medical devices. Furthermore, the rigorous FDA and MHRA approval processes, costing tens of millions, create a formidable barrier. Bioventus's established brand reputation, physician relationships, and extensive distribution networks, supported by $451.9 million in net sales in 2023, make it difficult for newcomers to gain traction.

| Barrier | Description | Estimated Cost/Time |

|---|---|---|

| Capital Requirements | Funding for R&D, clinical trials, manufacturing, sales & marketing | >$100 million for new medical devices |

| Regulatory Hurdles | FDA/MHRA approvals for medical technology | Tens of millions of dollars, years of process |

| Brand Reputation & Relationships | Established trust with physicians and healthcare systems | Years of investment and consistent performance |

| Distribution & Sales Networks | Access to hospitals, clinics, and key opinion leaders | Significant infrastructure and relationship building |

| Intellectual Property | Patented technologies and proprietary formulations | Substantial R&D investment, risk of litigation |

Porter's Five Forces Analysis Data Sources

Our Bioventus Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial statements, investor relations disclosures, and market research reports from leading industry analysts.