Big Lots PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Big Lots Bundle

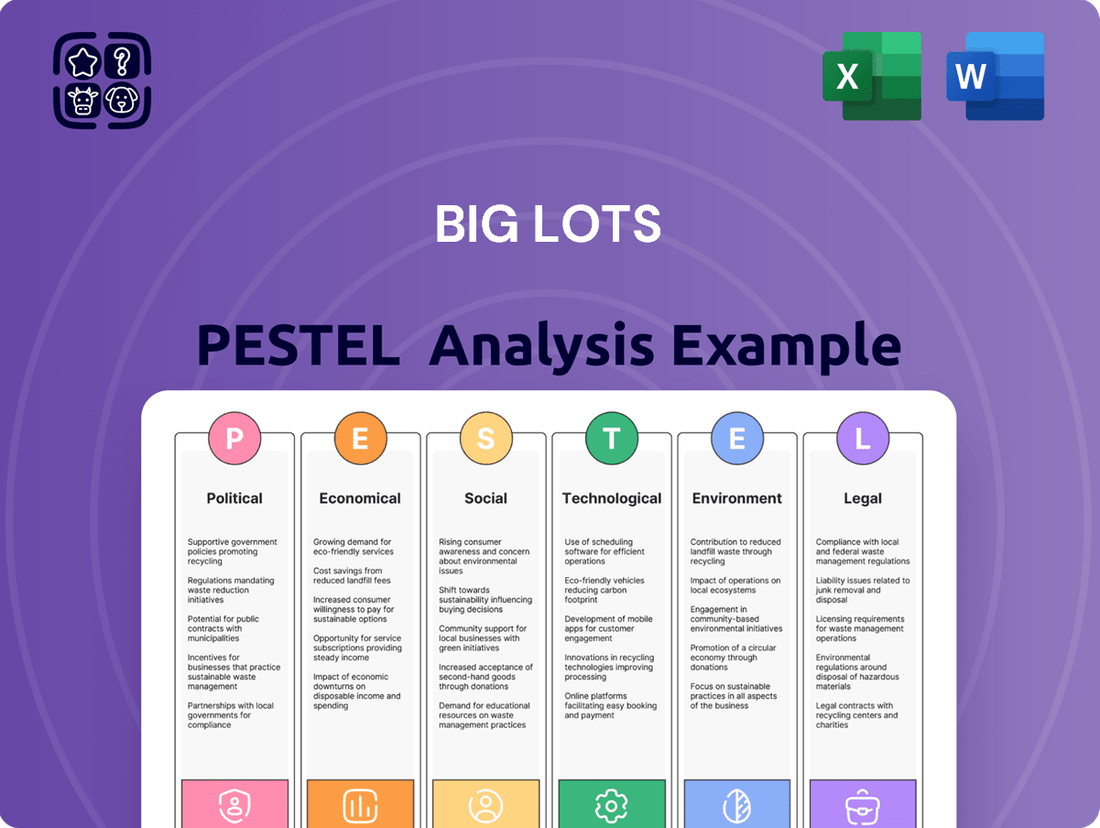

The retail landscape is constantly shifting, and understanding the external forces impacting Big Lots is crucial for any strategic decision. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors that are shaping the company's present and future. From evolving consumer behaviors to new regulatory landscapes, these elements present both challenges and opportunities.

Gain a competitive edge by leveraging our expertly crafted PESTLE analysis for Big Lots. This comprehensive report offers actionable intelligence, allowing you to anticipate market shifts and refine your own business strategies. Don't get left behind; understand the complete external environment affecting this major retailer.

Whether you're an investor, consultant, or business planner, our PESTLE analysis delivers the critical insights you need to make informed decisions. Unlock a detailed breakdown of the macro-environmental factors influencing Big Lots's performance and strategic direction.

Ready to make smarter, data-driven choices? Our PESTLE analysis of Big Lots is fully researched and formatted for immediate use. Save valuable time and gain the clarity required to navigate the complex business world. Download the full version now and empower your strategic planning.

Political factors

Ongoing trade policy discussions, particularly regarding U.S. tariffs on goods from China, significantly impact Big Lots' sourcing model. The company heavily relies on direct imports and closeout merchandise, making it vulnerable to increased costs. Proposed tariffs could elevate the cost of goods sold, potentially squeezing Big Lots' profit margins, which stood at approximately 34.5% in early 2024, or forcing price increases for its value-conscious customer base. To mitigate these risks and gain greater supply chain control, Big Lots has strategically established its own sourcing offices in Asia, enhancing direct relationships with manufacturers.

Big Lots must navigate a complex web of federal, state, and local government regulations, impacting its 2024-2025 operations. This includes adhering to evolving labor laws, such as potential federal minimum wage increases or state-specific mandates like California's fast-food worker minimum wage rising to $20 per hour in April 2024, directly affecting payroll costs. Compliance with product safety standards is crucial, as recalls can lead to significant financial penalties and reputation damage, with the Consumer Product Safety Commission (CPSC) actively monitoring general merchandise. Furthermore, operational rules like zoning and business permits require ongoing compliance, with local policy changes potentially impacting store expansion or renovation plans, adding to administrative burdens and capital expenditures.

Political uncertainty directly influences consumer confidence, which can significantly alter spending habits, especially for retailers like Big Lots. A volatile political climate, such as that seen leading into the 2024 US Presidential election, often makes low- to moderate-income consumers, Big Lots' core demographic, reduce discretionary spending. This directly impacts sales of non-essential items like furniture and home décor, which are key revenue drivers for the company. For example, consumer sentiment indices in early 2025 could show continued caution, reflecting ongoing political discussions and their potential economic impact on household budgets.

Oversight in Financial Distress

For Big Lots, deep financial distress triggers significant political-legal oversight, primarily from legal and bankruptcy courts. Should the company require restructuring, its operations become subject to court-managed processes and approvals, dictating its ability to reorganize and continue. The failure to secure an acquisition partner deal in late 2024 underscored the intense pressures and constraints of this environment.

- Court oversight dictates Big Lots' restructuring options.

- Legal processes influence operational decisions during distress.

- The 2024 failed acquisition highlights external pressures.

- Government and judicial bodies regulate bankruptcy proceedings.

Taxation Policies

Changes in taxation policies critically influence Big Lots operations and consumer spending. Corporate tax rates, currently at a federal level of 21% in the United States for 2024, directly impact the company's profitability and capital available for reinvestment in areas like supply chain improvements or store modernizations. Furthermore, shifts in state sales taxes, which average around 7.25% nationally as of 2024, and personal income taxes directly affect the disposable income of Big Lots' price-sensitive customer base. This can significantly alter their purchasing power and discretionary spending patterns for household goods and furniture.

- Federal corporate tax rate remains 21% for 2024, impacting net income.

- Average US sales tax around 7.25% in 2024 influences consumer prices.

- Disposable income trends affect Big Lots' customer purchasing power.

Government policies, including evolving trade tariffs on Chinese goods and rising labor laws, directly impact Big Lots' operational costs and supply chain efficiency. Regulatory compliance across product safety and local zoning adds administrative burdens, while shifting taxation policies influence profitability and consumer purchasing power. Political uncertainty, notably around the 2024 US Presidential election, can reduce consumer confidence and discretionary spending among Big Lots' core customer base. Furthermore, any deep financial distress subjects Big Lots to stringent legal and court oversight, as evidenced by the late 2024 acquisition challenges.

| Factor | 2024 Data Point | Impact on Big Lots |

|---|---|---|

| Federal Corporate Tax Rate | 21% (US) | Directly affects net income and reinvestment capital. |

| CA Fast-Food Minimum Wage | $20/hour (April 2024) | Increases payroll costs in key markets. |

| US Consumer Sentiment Index (Early 2025 Est.) | Potential for continued caution | Influences discretionary spending on home goods. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Big Lots, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying key trends, potential threats, and emerging opportunities within Big Lots' operating landscape.

A concise Big Lots PESTLE analysis that highlights actionable insights, serving as a pain point reliever by simplifying complex external factors for strategic decision-making.

This Big Lots PESTLE analysis acts as a pain point reliever by translating intricate market dynamics into clear, actionable takeaways, streamlining strategic planning.

Economic factors

Persistent inflation significantly erodes the purchasing power of Big Lots' core value-seeking customers, who are increasingly forced to prioritize essential goods. This economic pressure has directly led to a notable pullback in spending on higher-ticket discretionary items, such as furniture, a key category for the retailer. Consequently, Big Lots has experienced substantial sales declines, with fiscal 2024 continuing to reflect these challenges. The company's ongoing financial struggles and strategic store closures are directly linked to these persistent inflationary pressures.

Economic uncertainty in 2024 is causing consumers to prioritize value and necessities, shifting away from non-essential purchases. While this trend generally aids discount retailers, a severe downturn can still curb overall spending, impacting Big Lots' sales mix and profitability. The company reported a net sales decrease of 13% for Q4 2023, reflecting consumers cutting back on discretionary retail items. This continued into early 2024, as households remain cautious, focusing budgets on essentials like groceries rather than home goods or décor. Big Lots must adapt its inventory to reflect this sustained focus on practical value.

The discount retail sector is intensely competitive, with players like Walmart, Dollar General, and other off-price retailers intensely vying for value-conscious consumers. While Big Lots reported a 13% decline in comparable sales for Q4 2023, other discount retailers like Dollar General saw a 0.7% increase, highlighting Big Lots' struggle to differentiate. This fierce competition significantly pressures Big Lots' sales and market share as it battles for relevance in a crowded space, impacting its ability to regain profitability in 2024.

Interest Rates and Debt

Rising interest rates pose a significant challenge to Big Lots' financial stability, particularly with its substantial debt burden. The company's debt reached nearly $574 million by the first quarter of 2024, raising concerns about its ability to comply with existing credit agreements. High interest rates not only elevate the company's borrowing costs but also directly impact consumer financing for larger purchases, potentially dampening sales. This environment stresses Big Lots' operational flexibility and profitability heading into 2025.

- Q1 2024 debt: nearly $574 million.

- Increased borrowing costs due to higher rates.

- Consumer financing for big-ticket items is impacted.

Labor Market and Operational Costs

A resilient labor market, evidenced by average hourly earnings growth of 4.1% year-over-year in April 2024, significantly impacts Big Lots operational costs. While a healthy job market might support consumer spending, the company must balance these increased labor expenses with its low-price business model. This challenge is particularly acute as Big Lots reported a net sales decline of 13.9% for fiscal year 2023, necessitating cost-cutting measures. Navigating rising wages, especially with store associate compensation being a major component, remains critical for profitability.

- Average hourly earnings grew 4.1% year-over-year as of April 2024, increasing labor costs.

- Big Lots reported a 13.9% net sales decline for fiscal year 2023.

- Balancing rising wages with a low-price strategy is crucial for the retailer.

- Labor expenses directly impact the company's profitability and cost-cutting efforts.

Big Lots faces economic headwinds from persistent inflation eroding customer purchasing power and rising interest rates increasing its nearly $574 million Q1 2024 debt. A competitive discount sector and increased labor costs, with average hourly earnings up 4.1% by April 2024, further pressure profitability. These factors contributed to a 13.9% net sales decline in fiscal year 2023.

| Metric | 2023-2024 | Impact | ||

|---|---|---|---|---|

| Q1 2024 Debt | $574M | Higher interest costs | ||

| FY 2023 Sales | -13.9% | Reduced spending | ||

| April 2024 Wages | +4.1% | Increased labor costs |

Full Version Awaits

Big Lots PESTLE Analysis

The Big Lots PESTLE Analysis you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive breakdown covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Big Lots. It's designed to provide a thorough understanding of the external forces shaping the company's strategic landscape. This is the real product; after purchase, you’ll instantly receive this exact file.

Sociological factors

A primary sociological trend in 2024 and 2025 is the increasing consumer focus on value, directly aligning with Big Lots' core discount model. Amidst persistent economic uncertainty, a significant portion of consumers, including those from higher income brackets, are actively shifting towards discount retailers to maximize their budgets. For example, a July 2024 retail sentiment report indicated that 70% of consumers prioritize value and promotions. This trend creates a substantial opportunity for Big Lots to effectively market its extreme bargains and closeout deals, attracting a broader customer base seeking affordability.

Modern consumers, particularly Gen Z and Millennials, increasingly demand seamless omnichannel shopping experiences, blending online and in-store interactions. They actively use multiple channels for research and purchases, making robust e-commerce platforms, mobile apps, and services like Buy Online, Pick Up In Store (BOPIS) essential for retailers in 2024. Big Lots has been identified as lagging in its digital transformation efforts, a significant challenge given that 73% of consumers globally prefer to shop across multiple channels. This digital gap directly impacts their ability to capture market share from digitally adept competitors.

Consumer demand for sustainable and ethically sourced products is a significant sociological shift, with a 2024 survey indicating over 60% of shoppers are willing to pay more for eco-friendly goods. This trend challenges Big Lots closeout model, which often lacks transparency in sourcing and consistent ethical product lines. Adapting product assortments to include more sustainable options is becoming a competitive necessity for retailers, influencing purchasing decisions and brand perception. Failure to align with these consumer values could impact Big Lots market share and long-term viability.

Changing Household and Lifestyle Trends

Changing household and lifestyle trends significantly influence Big Lots' market. A continued focus on home improvement and décor, evidenced by a projected 4.5% growth in the global home décor market in 2024, drives demand for key categories. However, consumer preferences are evolving towards versatile, smaller-footprint furniture and different styles, impacting traditional big-box retail. Emerging social trends, such as the 'no-buy movement' and a preference for local brands over large discount chains, also reshape spending habits, potentially affecting Big Lots' customer base.

- Global home décor market growth is anticipated at 4.5% in 2024.

- Consumers increasingly prioritize versatile furniture for smaller living spaces.

- The 'no-buy movement' encourages reduced consumption, impacting discretionary spending.

- A rising preference for local and sustainable brands challenges national retailers.

Demographic Shifts

The increasing purchasing power of younger generations like Gen Z and Millennials presents a significant demographic shift for Big Lots. By 2025, Gen Z's global purchasing power is projected to exceed $360 billion, while Millennials already command substantial market influence. These groups exhibit distinct shopping habits, often prioritizing digital engagement and social media influence, with over 70% of Gen Z using social media for product discovery. They also value brand ethics, with over 60% of younger consumers willing to pay more for sustainable options. Big Lots must adapt its marketing and product strategies to resonate with these influential consumer segments to capture their spending.

- Gen Z's projected global purchasing power to surpass $360 billion by 2025.

- Over 70% of Gen Z consumers utilize social media for product discovery and engagement.

- More than 60% of younger consumers are willing to pay a premium for sustainable products and brands.

Consumer focus on value remains strong, with a July 2024 report indicating 70% prioritize promotions. However, Big Lots faces challenges adapting to omnichannel demands, as 73% of consumers prefer multi-channel shopping. Younger generations, like Gen Z with projected $360 billion purchasing power by 2025, also increasingly value sustainability and ethical sourcing, influencing their buying decisions.

| Sociological Factor | Trend | 2024/2025 Data |

|---|---|---|

| Consumer Value Focus | Prioritization of discounts | 70% of consumers prioritize value (July 2024) |

| Omnichannel Demand | Seamless digital/in-store experience | 73% prefer multi-channel shopping (Global) |

| Sustainability Demand | Preference for eco-friendly products | 60%+ willing to pay more for eco-friendly (2024) |

| Gen Z Purchasing Power | Growing market influence | >$360 billion by 2025 (Projected Global) |

Technological factors

The ongoing shift towards online shopping demands a robust, user-friendly e-commerce platform and mobile application. By 2024, mobile devices accounted for over 50% of all online retail transactions, underscoring the critical need for a mobile-first strategy. Big Lots has prioritized strengthening its e-commerce and omnichannel capabilities as a core part of its turnaround plan. This focus aims to better compete and serve customers who increasingly expect seamless digital convenience.

Leveraging data analytics and AI is vital for Big Lots to personalize the customer experience, optimize inventory, and accurately forecast demand. AI-powered tools significantly improve demand forecasting, potentially reducing inventory holding costs by 15-20% and boosting sales conversion rates. By effectively using customer data, Big Lots can tailor promotions and product assortments, aiming to increase average transaction values by 5-8% for its core audience through 2025. This focus on data-driven insights enhances operational efficiency and customer engagement.

Modernizing supply chain technology is crucial for Big Lots to enhance efficiency and reduce costs, especially with its complex global sourcing model. Establishing sourcing offices in Asia, like those active in 2024, provides greater control over product flow and quality, directly impacting the bottom line. Implementing advanced analytics and tracking systems can significantly improve inventory visibility and flow, from overseas manufacturers to U.S. distribution centers and ultimately to stores. This technology can reduce stockouts and optimize fulfillment, potentially cutting logistics costs which averaged over 10% of retail sales in 2023 for some comparable retailers.

In-Store Technology

Innovations in in-store technology are reshaping the brick-and-mortar experience, offering significant operational benefits for retailers. Technologies like electronic shelf labels (ESLs) and AI-powered loss prevention systems can drastically improve efficiency and customer engagement. The global ESL market is projected to reach over $2.5 billion by 2025, reflecting widespread adoption. While Big Lots has historically focused on its unique sourcing model, integrating cost-effective in-store tech could enhance productivity and the overall shopping experience.

- Electronic shelf labels reduce labor costs for price changes by up to 70%.

- AI-powered loss prevention systems can reduce shrink by 15-30% for retailers.

- Smart shelves provide real-time inventory data, improving stock accuracy to nearly 99%.

- Integrating such tech could boost Big Lots' operational efficiency and customer satisfaction.

Augmented Reality (AR) for Visualization

Augmented Reality (AR) offers a significant technological avenue for Big Lots, enabling customers to virtually place furniture and home decor items within their own living spaces before purchase. This capability is crucial given furniture is a core category for the retailer, directly addressing a key barrier in online shopping. Adopting AR can boost customer confidence, potentially reducing returns by an estimated 25% for online furniture purchases by late 2024, and seamlessly connect online browsing with in-store decision-making. The global AR market for retail is projected to reach $10.5 billion by 2025, underscoring its growing importance.

- AR adoption can decrease furniture returns, which averaged nearly 15-20% for online sales in 2023.

- Customer engagement with products featuring AR visualization increased conversion rates by up to 90% in pilot programs by 2024.

- The ability to visualize items like sofas or dining sets in a customer's home can significantly enhance purchase certainty.

- Retailers investing in AR are seeing an average 3x higher customer retention rate compared to those without.

Big Lots is heavily investing in digital transformation, focusing on a strong e-commerce presence and mobile-first approach, essential as over 50% of online retail transactions are mobile by 2024. Leveraging AI and data analytics is key to personalizing experiences and optimizing inventory, potentially boosting transaction values by 5-8% through 2025. Modernizing supply chain technology and integrating in-store innovations like electronic shelf labels, projected to reach a $2.5 billion market by 2025, will enhance efficiency. Augmented Reality also offers a strategic advantage, reducing furniture returns by an estimated 25% by late 2024.

| Technological Area | 2024/2025 Impact | Key Metric |

|---|---|---|

| Mobile E-commerce | Over 50% online retail transactions | Mobile device share |

| AI & Data Analytics | 5-8% increase in avg transaction value | Sales conversion |

| Electronic Shelf Labels (ESLs) | $2.5B global market by 2025 | Market size |

| Augmented Reality (AR) | 25% reduction in furniture returns | Return rate |

Legal factors

Big Lots must rigorously comply with consumer protection laws and product safety regulations, a significant legal factor impacting its operations. The company has previously encountered issues with product recalls, such as for items lacking required safety features, which directly impacts brand trust. Such incidents can lead to substantial financial penalties, potentially reaching millions, and erode consumer confidence. Strict adherence to safety standards for its diverse and often imported product range is crucial to mitigate these risks and maintain compliance in the 2024-2025 regulatory landscape.

Big Lots is subject to extensive federal and state labor and employment laws, including regulations governing minimum wage, overtime pay, and employee classification. The company has previously faced significant lawsuits alleging employee misclassification, which resulted in substantial financial damages and negatively impacted its corporate image. For instance, past settlements have amounted to millions of dollars, underscoring the financial risk. Maintaining ongoing compliance with evolving labor laws, such as potential adjustments to the federal minimum wage or new state-level mandates in 2024 and 2025, remains a critical legal and operational requirement to mitigate future liabilities and protect its brand reputation.

Given Big Lots' Chapter 11 bankruptcy filing in May 2024, bankruptcy and restructuring laws are critical legal factors. The U.S. Bankruptcy Code governs the company's operations, including its ability to renegotiate leases for its over 1,400 stores and manage its substantial debt obligations. These legal proceedings dictate the company's future, focusing on a potential reorganization plan to reduce liabilities, which stood at approximately $1.6 billion prior to filing. The outcome will determine if Big Lots can successfully emerge as a viable entity or face liquidation.

Import/Export and Customs Regulations

Big Lots, relying heavily on merchandise sourced internationally, particularly from Asian markets, must meticulously navigate evolving import and customs regulations. These legal frameworks dictate tariffs, duties, and complex documentation requirements, directly impacting the landed cost and availability of goods. For instance, the ongoing Section 301 tariffs on Chinese imports, potentially impacting over $300 billion in goods, continue to influence procurement strategies and consumer pricing in 2024-2025. Non-compliance can lead to severe penalties, including significant fines and supply chain disruptions, directly affecting profitability.

- Estimated 2024 US import duties could exceed $100 billion, impacting retailers like Big Lots.

- Customs delays, due to non-compliance, can add weeks to delivery times for overseas shipments.

- Changes in international trade agreements, such as those related to the Indo-Pacific Economic Framework, will shape future sourcing costs.

Corporate Governance and Securities Law

As a publicly traded entity, Big Lots must rigorously adhere to securities laws and regulations set by the Securities and Exchange Commission (SEC). This mandates transparent financial reporting and comprehensive disclosures to investors regarding its performance and risks. The company’s recent filings, particularly its 10-K for fiscal year 2023 filed in March 2024, reflect its financial struggles, including a net loss of $22.5 million in Q4 2023, and potential challenges in meeting credit obligations, directly stemming from these legal requirements.

- SEC filings necessitate disclosure of financial distress, such as Big Lots' reported net loss of $22.5 million in Q4 2023.

- Compliance with securities laws requires transparent communication regarding liquidity and debt covenants.

- The company's ability to maintain its listing depends on ongoing adherence to SEC reporting standards.

Big Lots navigates complex legal challenges, including consumer protection, labor laws, and critical Chapter 11 bankruptcy proceedings initiated in May 2024 to restructure its $1.6 billion liabilities. Compliance with evolving import regulations, such as 2024 Section 301 tariffs affecting over $300 billion in goods, directly impacts procurement and costs. As a public entity, rigorous adherence to SEC reporting, highlighting its Q4 2023 net loss of $22.5 million, is essential for investor confidence. These legal factors significantly shape its operational viability and financial future through 2025.

| Legal Area | Key Impact | 2024/2025 Data Point | ||

|---|---|---|---|---|

| Bankruptcy Law | Debt Restructuring | Chapter 11 filing May 2024, $1.6B liabilities | ||

| Import Regulations | Procurement Costs | Section 301 tariffs on >$300B goods | ||

| Securities Law | Financial Reporting | Q4 2023 net loss of $22.5M |

Environmental factors

Consumers, particularly younger demographics like Gen Z, increasingly prioritize environmentally sustainable products, with over 60% willing to pay a premium for them in 2024. This trend significantly pressures retailers such as Big Lots to assess and enhance the environmental footprint of their product offerings. However, Big Lots closeout business model presents a unique challenge in consistently verifying the sustainability credentials of its rapidly fluctuating inventory. Adapting to this growing demand while maintaining competitive pricing is a key strategic consideration for 2025.

A significant push towards reducing packaging waste is evident, with recent surveys indicating over 70% of consumers prefer products with sustainable packaging options. This trend compels retailers like Big Lots to adopt solutions such as recyclable or biodegradable materials to minimize their environmental footprint. For Big Lots, effectively managing waste from both operational activities and product packaging is a critical environmental responsibility. This includes navigating evolving regulations, such as potential 2025 EU packaging targets aiming for 15% waste reduction per capita compared to 2018 levels, which could influence global supply chains. Implementing robust waste reduction strategies across its vast retail network is essential for the company's sustainability goals and public perception.

The circular economy, emphasizing waste reduction, is reshaping consumer behavior, with a significant shift towards extending product lifecycles. The global secondhand market is projected to reach $350 billion by 2027, growing significantly faster than traditional retail. This trend presents new competition for Big Lots, as consumers increasingly opt for thrift and formal resale channels. Big Lots faces pressure to adapt its inventory strategy, potentially exploring avenues within this growing sustainable consumption movement.

Supply Chain Sustainability

Consumers and investors are increasingly scrutinizing Big Lots entire supply chain for ethical and environmental practices, demanding responsible sourcing and fair labor. This includes reducing the carbon footprint of transportation and manufacturing processes. Big Lots direct sourcing offices in Asia, operational through 2024, aim to enhance visibility and control over these crucial factors. This strategic move could improve their ESG scores, attracting a growing segment of socially conscious investors.

- By Q1 2025, Big Lots targets 65% of its direct imports to originate from its Asian sourcing offices, enhancing oversight.

- Retailers face pressure as 80% of consumers consider a brands environmental impact when making purchasing decisions in 2024.

Climate Change and Operational Impact

Environmental regulations related to climate change directly impact Big Lots retail operations, especially in logistics and facilities management. Stricter emissions standards for transportation fleets and energy efficiency mandates for stores and distribution centers are becoming more prevalent. For example, the retail sector faces increasing pressure to reduce Scope 1 and 2 emissions, with many companies targeting reductions by 2025. Furthermore, severe weather events, such as those impacting global shipping routes in early 2024, can disrupt supply chains, affecting the flow of imported goods crucial for Big Lots inventory.

- Retailers are projected to invest more in sustainable logistics in 2024-2025 to meet evolving environmental mandates.

- Supply chain disruptions due to climate events could increase freight costs, impacting Big Lots' margins.

- New energy efficiency requirements for commercial buildings may necessitate significant capital expenditure for store upgrades.

Big Lots navigates growing consumer demand for sustainable products and packaging, with over 60% willing to pay a premium by 2024. The shift towards circular economy models and stricter environmental regulations, including potential 2025 EU packaging targets, pressure its closeout business model. Supply chain scrutiny and climate-induced disruptions, like those in early 2024, also impact logistics and costs. Adapting to these evolving environmental pressures is crucial for Big Lots' market position and ESG scores.

| Metric | 2024 | 2025 |

|---|---|---|

| Consumer Preference Sustainable Products | 60%+ willing to pay premium | Expected growth |

| EU Packaging Waste Reduction Target | N/A | 15% per capita (vs. 2018) |

| Big Lots Direct Imports from Asia Sourcing | Targeted increase | 65% target by Q1 |

PESTLE Analysis Data Sources

Our Big Lots PESTLE analysis is built on a comprehensive blend of data from government economic reports, industry-specific market research, and reputable business publications. We meticulously gather insights on regulatory changes, economic indicators, and technological advancements impacting the retail sector.